For some people, there is really a need for sending or receiving money via remittance outlets or pawnshops like Palawan Express Pera Padala, Cebuana Lhuillier, Tambunting, and Villarica.

It is the bread and butter of OFWs and the majority of people who don’t have any bank accounts. And unfortunately, they don’t really have a proper alternative.

However, the fees they charge are expensive. Each amount sent has a corresponding service fee. Here are a couple of examples:

Think about it, every 100 has a 3 or 6 peso fee, which is in short 3 or 6% of the whole amount. Then of course you also have to wait in line just to remit and claim the money. So much energy and resources are wasted.

For the common blue-collar worker, even the act of going to the pawnshop will eat up his time, and his time has an equivalent amount of money. Ultimately he would be spending a big chunk of his money just to send or receive money using traditional remittance.

The Power of Digital Wallets

This is where the usefulness of digital wallets can be easily seen. Cashing in and sending money is free or has a minimal fee, given both the sender and the receiver are using the digital wallet. The only thing needed is a cellphone, which a majority of Filipinos have, no matter how rich or poor he is.

But an effect of this is you need to use the platform of the digital wallet you’ve chosen. You need to use the money for the services supported by that particular wallet. For example, in GCash you would have the advantage of a lot of merchants supporting GCash QR payments.

Does cashing in over-the-counter have fees in GCash?

For 7-11 cash-ins, there is a 1% fee of the total cash-in amount. For example, if you cash in Php 1000, the fee will be Php 10, and the total amount of Php 990 will be credited or added to your balance. This fee always comes first as it is a 7-11 collected fee.

GCash cash-in for partner outlets is free for the first Php 8000 per month. When the amount goes over the Php 8000 limit, it will incur a 2% fee. This limit refreshes every first day of the month.

For example: Today, you cashed in Php 7000. There is no fee since it is still below the Php 8000 limit. The next day, you cashed in Php 2500. Since you went over the limit, there is a fee included with the cash-in but only for the amount over the limit. The cash-in that has the fee applied is the amount over 8000 this month: Php 8000 - Php 7000 = Php 1000 Then we subtract from the amount you are cashing in: Php 2500 - Php 1000 = Php 1500 The fee is 2% of the amount. Php 1500 * 0.02 = Php 30 So the total cash-in with the fee would be: Php 2500 - Php 30 = Php 2470 Any later cash-ins for this month will have a 2% fee after this.

If you are cashing in 7-11, and you’ve exceeded the Php 8000 limit, the 1% fee goes first (7-11 fee), then the 2% goes after (GCash fee).

For example, if you are cashing in Php 1000 in 7-11 after exceeding the Php 8000 limit, the cash-in fee for 7-11 applies first: Php 1000 - Php 10 (1% of Php 1000) = Php 990 Afterwards, the 2% fee from GCash applies: Php 990 - Php 19.80 (2% of Php 990) = Php 970.20 The net cash-in amount is Php 970.20.

Once you are near the limit, you will receive a notification in your Inbox informing you of the charges once you go past the limit.

Please take note that this is only for manual cash-ins — remittances and bank cash-ins are not included.

If you want to know how to circumvent this fee, you can refer to my fees page to see alternative solutions.

Over-the-Counter GCash Cash Ins

I explained how cash-in and cash-out work more comprehensively in this post. For our post, we will focus more on the cash-in services of over-the-counter channels.

There are four types of over-the-counter cash-in — machine cash-in, over-the-counter, and generate barcode.

Machine Cash-in

The machine cash-in method is basically cashing in using an ATM-like machine. There are mainly two companies that cater to this method – which is Pay&Go, TouchPay and eTap. I’ve discussed this in-depth in this post.

Over-the-Counter Method

This method consists of two parts:

- Cashing in GCash Pera Outlet

- Manual Cash-In with Partners

When going through GCash Pera Outlet, the sari-sari store partner does the cash-in for you. They will be asking for your GCash number, name, and a valid ID.

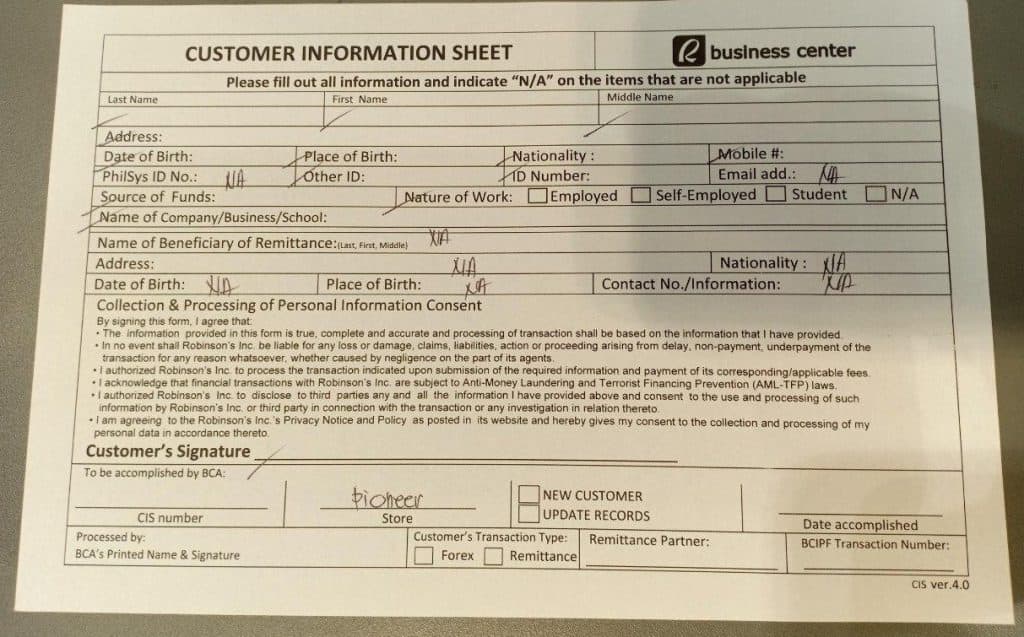

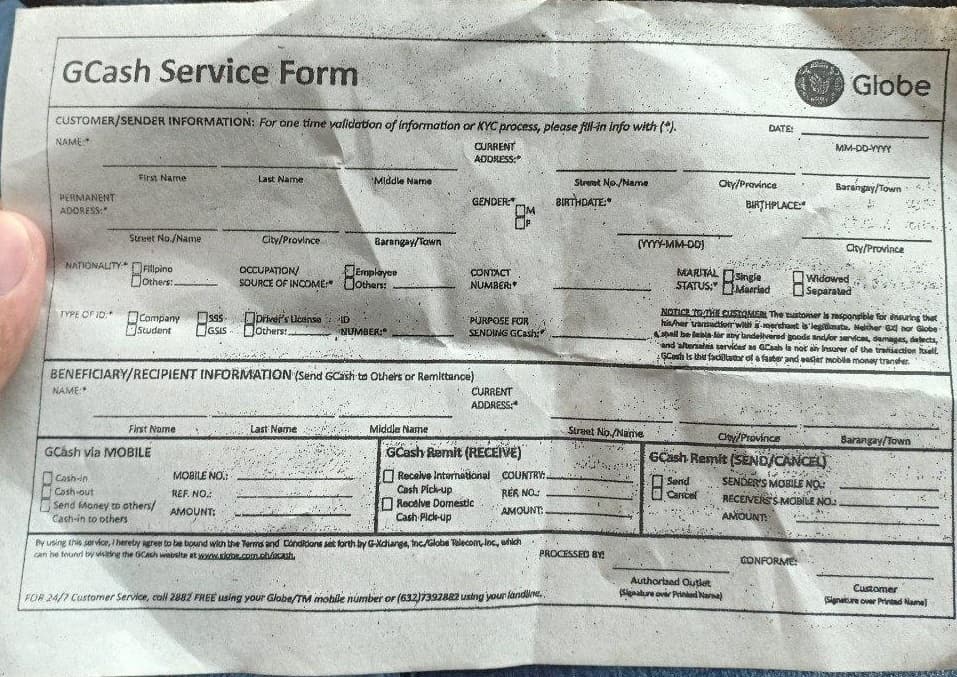

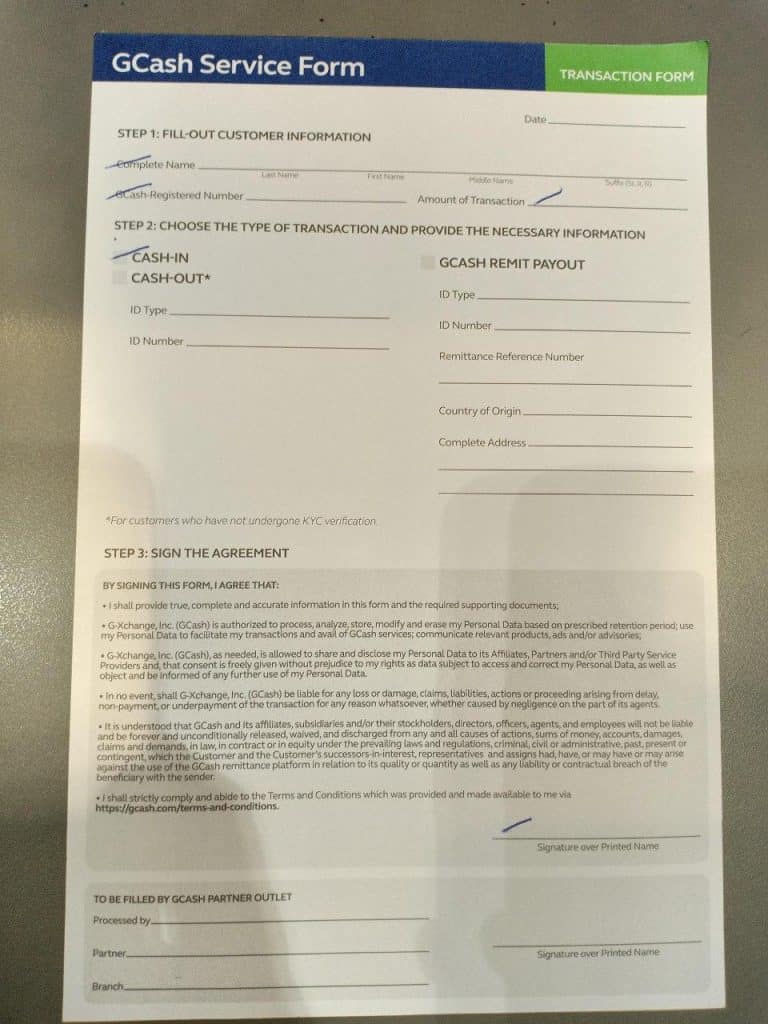

For some partners, you will also need to fill up a form and show a valid ID. You will also need to register to their system if you are a first-time user. This applies for any OTC partner outlet like Palawan Pawnshop Pera Padala, Tambunting, Villarica, Cebuana Lhuillier, and Robinson’s.

Here are some examples of some forms:

For GCash verification and for receiving GCash Padala, you would need a valid ID from this list:

- UMID

- Driver’s License

- SSS ID

- Passport

- Phil Postal ID

- PRC ID

- Pag-IBIG ID

- Philsys / ePhilID

- Alien Certificate of Registration (ACR) – if you are a foreign national

- Student ID, Birth Certificate – if you are a minor, and applying for GCash JR

If you don’t have an ID from this list, you need to file a Help Support ticket to help in your verification.

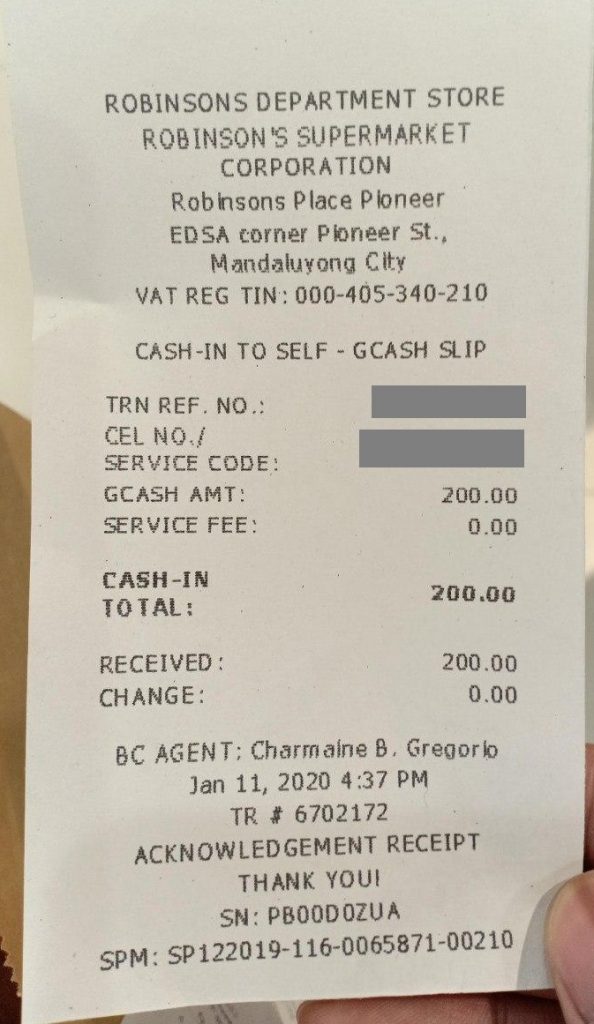

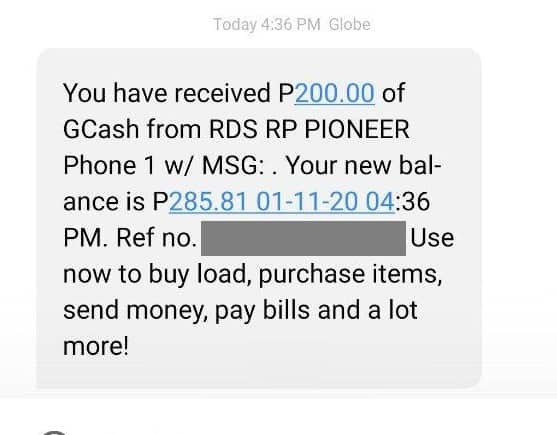

After processing the transaction, you would also receive an acknowledgment receipt, as well as an SMS notification.

Some shops that are using the over-the-counter cash-in method are:

- Alfamart

- All Day Supermarket

- Cebuana Lhuillier

- Digipay Agents

- Easy Day Shop

- ECPay

- Ever Supermarket

- Family Mart

- Gaisano Grand Malls

- iBayad

- Lawson

- LBC Express

- Mercury Drug

- Palawan Pawnshop

- Pera Hub

- Petron

- Posible

- RD Pawnshop

- Robinson’s Department Store

- Robinson’s Supermarket

- Seaoil

- Villarica

- VIP Payment Center

- Watson’s

You can check out the Over the Counter section of the GCash Cash In page to find out more.

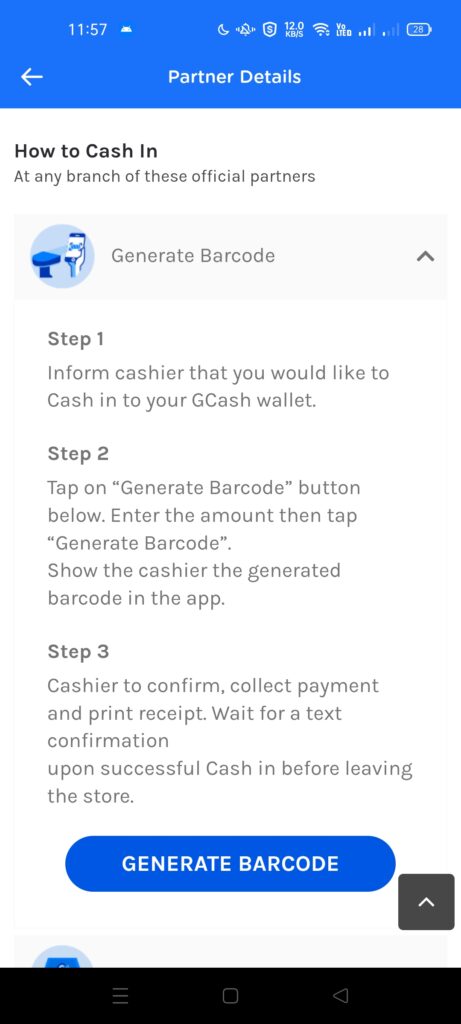

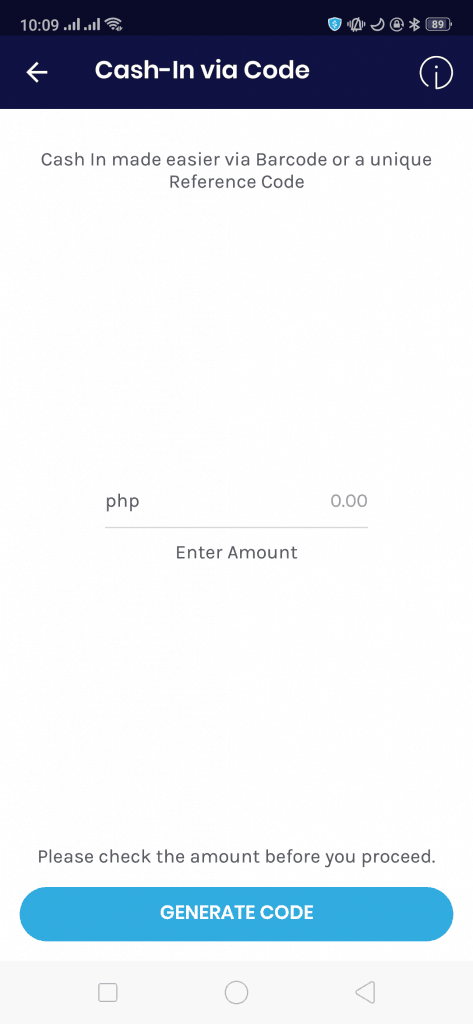

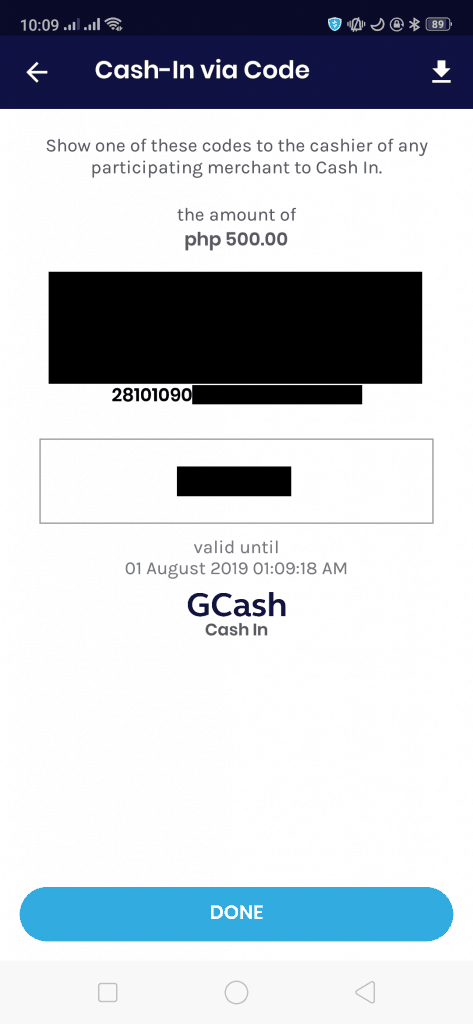

Generate Barcode Method

Not all partners have this available. This involves showing the generated barcode from the GCash app. You can set the cash-in amount even before you leave home since the validity of the cash-in is 3 hours.

You just need to show the barcode or the number code to the shop that supports it. Here are some merchants that support Generate Barcode:

- Bayad Center

- ExpressPay

- Jaro Pawnshop

- Ministop

- Puregold

- Savemore

- SM Department Store

- SM Hypermarket

- SM Supermarket

- Tambunting

- TrueMoney

- Waltermart

For 7-Eleven, you can use the Cliqq kiosk machine to cash in. You need to put in the amount and the GCash mobile number to generate the cash-in barcode slip. After you get the slip from the machine, you need to queue up at the cashier to pay.

Please Take note that for 7-Eleven, there is a 1% fee when cashing in.

What if I don’t get the cash-in from 7-11?

For a really quick resolution, you can call up ECPay support and not GCash. You need to have the receipt with you as they will verify the transaction using the details in the receipt.

Are there alternatives to cashing in without fees?

I’ve collected a list of methods on how to cash in without fees.

What are the limits for cashing in?

For Fully Verified GCash users, there is a limit of Php 100,000 per month. Once you’ve reached this, you cannot cash in until the 1st day of the succeeding month.

Unlocking Higher Account Limits

You can unlock higher limits by linking your BPI/UnionBank or your Payoneer account/s and utilizing either GSave or GInvest / GInsure with a Php 100 deposit or investment.

Once you do so, you will be able to unlock:

- A bigger wallet limit – Php 500,000 maximum

- Higher incoming limits – you will be able to receive up to Php 500,000 in your wallet and daily cash-ins have no limitations

- Higher outgoing limits – withdrawals will have no limitations per month, and you can withdraw up to Php 10,000 per day

You will be receiving an SMS informing you of the increased limits.

Take note that once you’ve unlinked all of your BPI/UnionBank/Payoneer accounts, the limits will revert back to what it was before.

Summary

I described the process of cashing-in over-the-counter. There are three methods to this — over the counter, machine, and generate barcode.

Manual cash-in means filling out some forms and having them processed. Machine cash-in uses automated machines to process your cash-in. Generate barcode is for some of the partners that have scanners for easy cash-in.

Related Posts

I have a new e-commerce site where you can buy some e-books here: GCR Prime

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services: