This post explains the different BPI cash-in channels you can tap into in the GCash app.

It’s now easy to set up a BPI cash-in channel from within GCash. This is useful for transferring funds easily from your bank account to GCash. Aside from UnionBank and CIMB (GSave), BPI is one of few bank-related cash-in options without any fees included.

What are the benefits of setting BPI cash-in?

Along with UnionBank, Payoneer, Paypal, and other remittance channels, there are no charges for cashing in, unlike transferring from any bank app to GCash through Instapay. Also, they do not contribute to the Php 8000 offline cash-in limit.

Also, once you link your BPI account and put in funds in GFund or in GInsure, it unlocks the Php 500k balance limit.

Unlocking Higher Account Limits

You can unlock higher limits by linking your BPI/UnionBank or your Payoneer account/s and utilizing either GSave or GInvest / GInsure with a Php 100 deposit or investment.

Once you do so, you will be able to unlock:

- A bigger wallet limit – Php 500,000 maximum

- Higher incoming limits – you will be able to receive up to Php 500,000 in your wallet and daily cash-ins have no limitations

- Higher outgoing limits – withdrawals will have no limitations per month, and you can withdraw up to Php 10,000 per day

You will be receiving an SMS informing you of the increased limits.

Take note that once you’ve unlinked all of your BPI/UnionBank/Payoneer accounts, the limits will revert back to what it was before.

What are the Limitations of BPI Cash In?

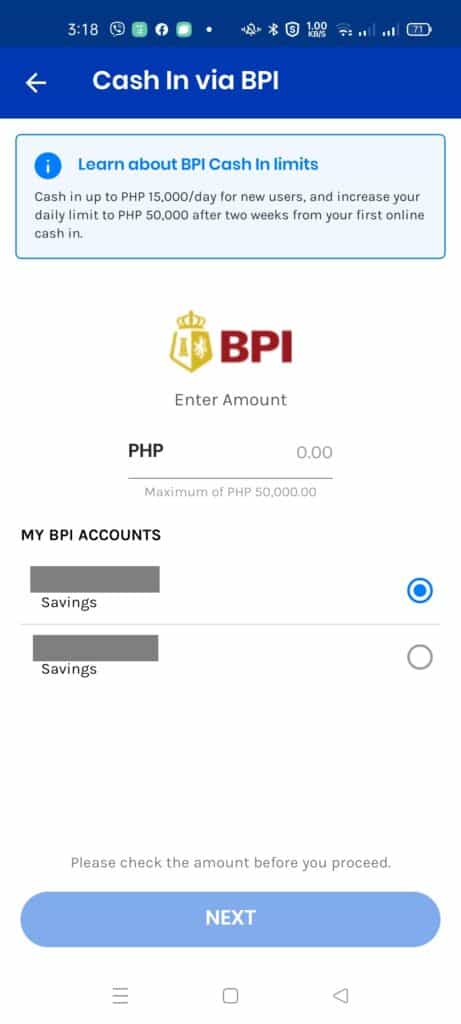

Once you’ve linked your account, the maximum cash-in daily limit is Php 15000. This will eventually reach Php 50000 after a few weeks.

Unfortunately, Php 50000 is the daily limit for BPI in general, so that is also the maximum cash-in for GCash, and this also applies in the actual BPI account including online and ATM withdrawals.

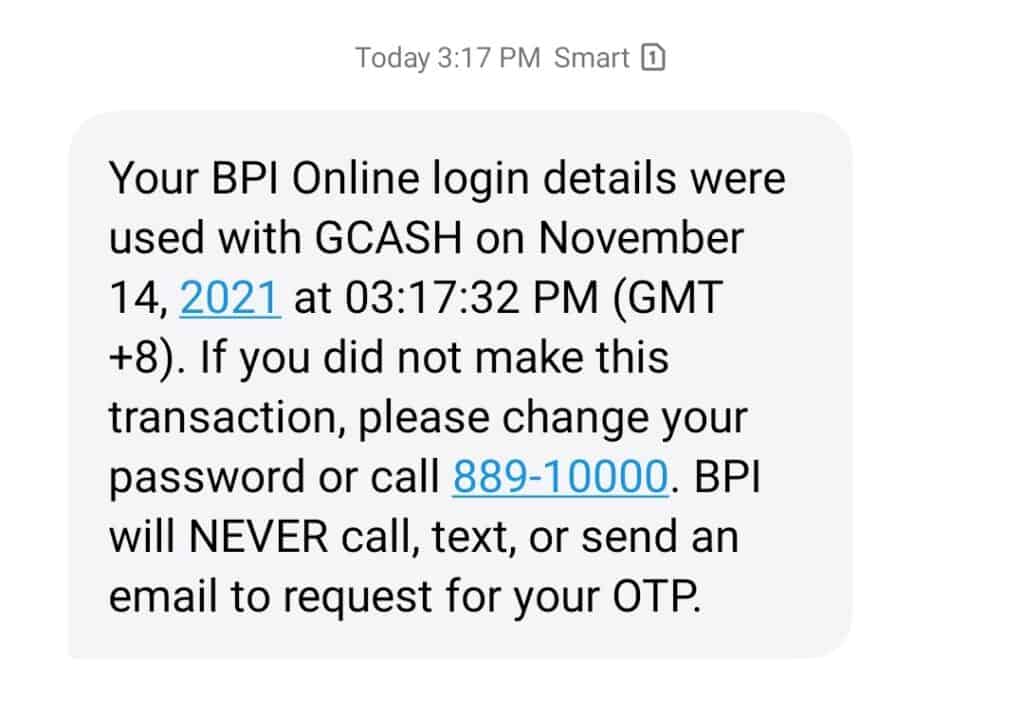

Any change in the password for BPI Online also affects the GCash-linked account. You also need to re-link your account in GCash.

Starting Oct 2, 2023, there will be a Php 5 charge every time you cash in using BPI.

How do I link my BPI account with GCash?

You should first have an active BPI Online account. If you don’t have one, it is also easy to create an account as you don’t need to go to a BPI branch anymore.

Creating a BPI Online Account

Prerequisites are:

- You should have an existing BPI deposit account, loan account, and/or credit card to enroll in BPI Online.

- You should first make sure that your official mobile number set with BPI is updated as any OTPs (one-time-passwords) would be sent to this number.

- You can update this by calling the BPI support hotline (+632-889-10000) or 1-800-188-89100 for domestic toll-free PLDT calls.

Creating an account in BPI Online

- Visit BPI Online or download the BPI Mobile app.

- Click on “Register Now.”

- Select your preferred product type (deposit, credit card, loan).

- Enter your account number, customer number, or loan account number.

- Input your date of birth.

- Create your username and password.

- Type your email address.

- Read the Terms and Conditions. Click “Submit.”

- Enter your One-Time-PIN. Click “Submit.”

- Confirm the email sent to the email address entered.

Linking your BPI Online Account into GCash

Linking BPI to GCash

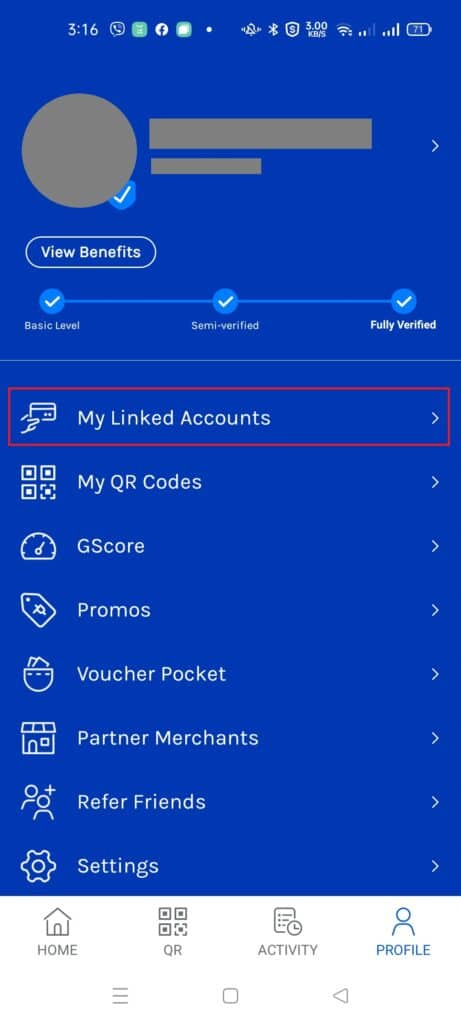

- In your GCash app, go to the Profile page, and select My Linked Accounts.

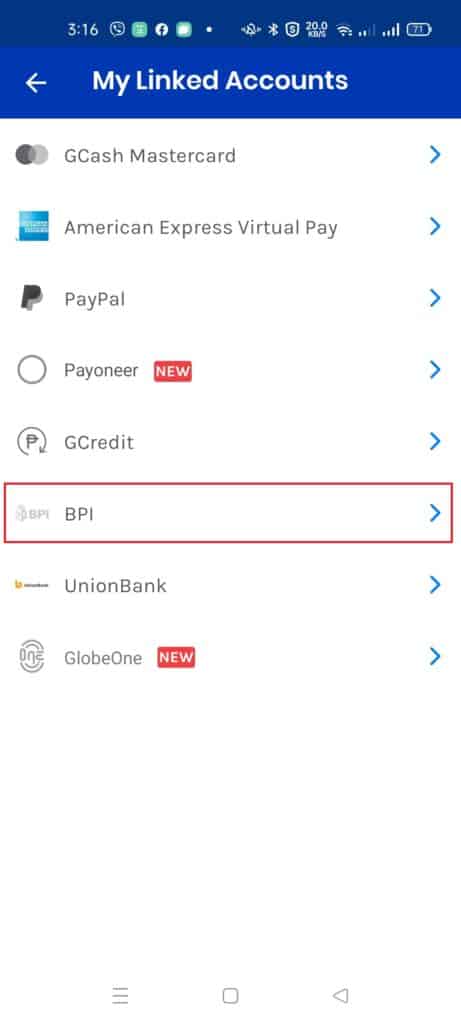

- Under the My Linked Account page, click on BPI.

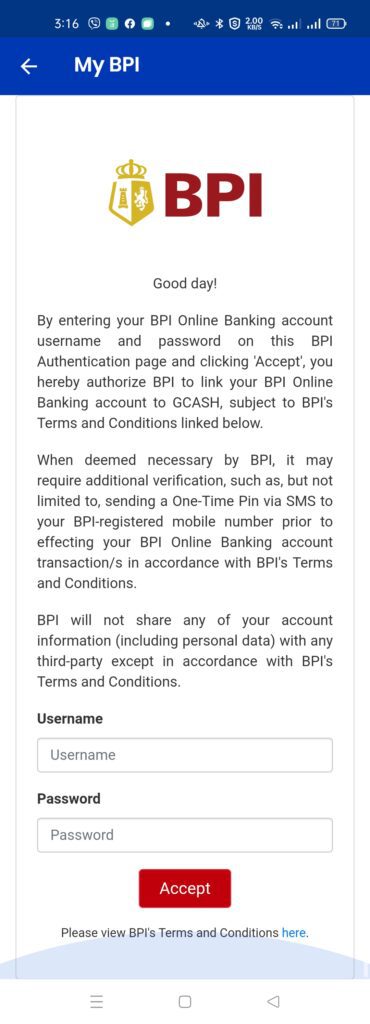

- On the My BPI page, input your username and password for your BPI Online account. You will need to input the OTP after.

- Once done, you will see a success page and also an SMS that you linked your account.

How do I cash in using BPI after linking in GCash?

Cashing in from BPI to GCash

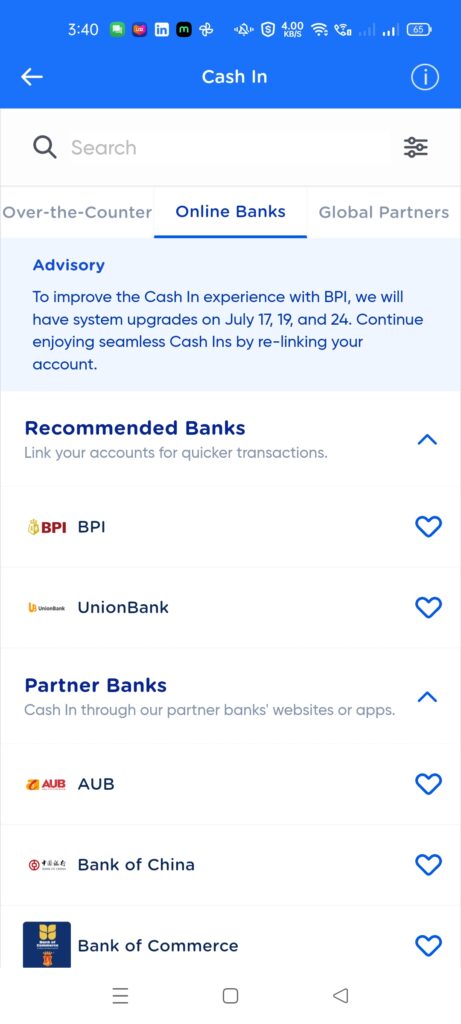

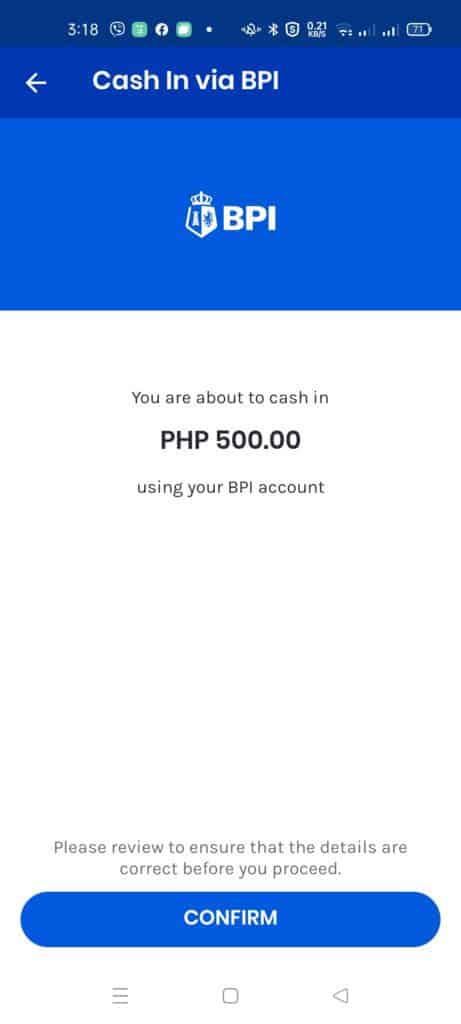

- In the GCash app, click on Cash-In.

- Once on the cash-in page, click on BPI under My Linked Accounts.

- On the BPI cash-in page, enter the amount you are cashing in and select the account you are withdrawing from.

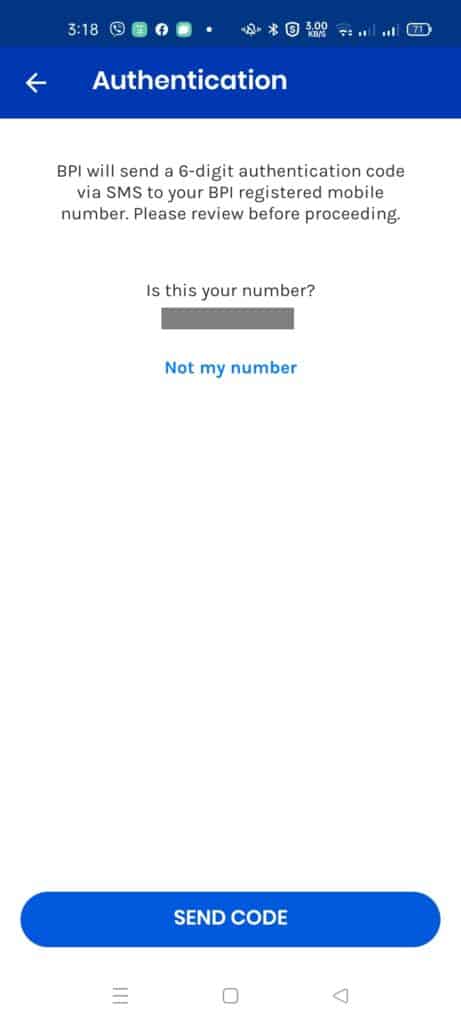

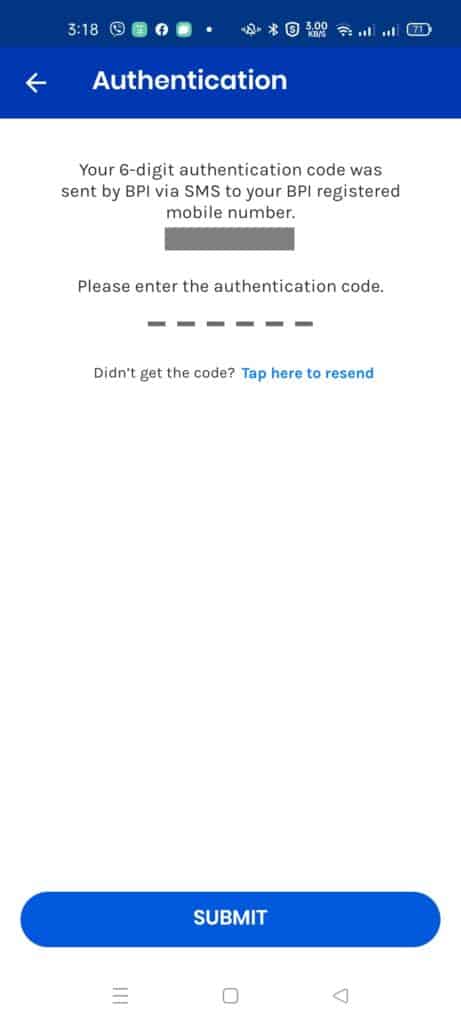

- Confirm the number you are receiving the OTP from, and input the OTP you’ve received from that number.

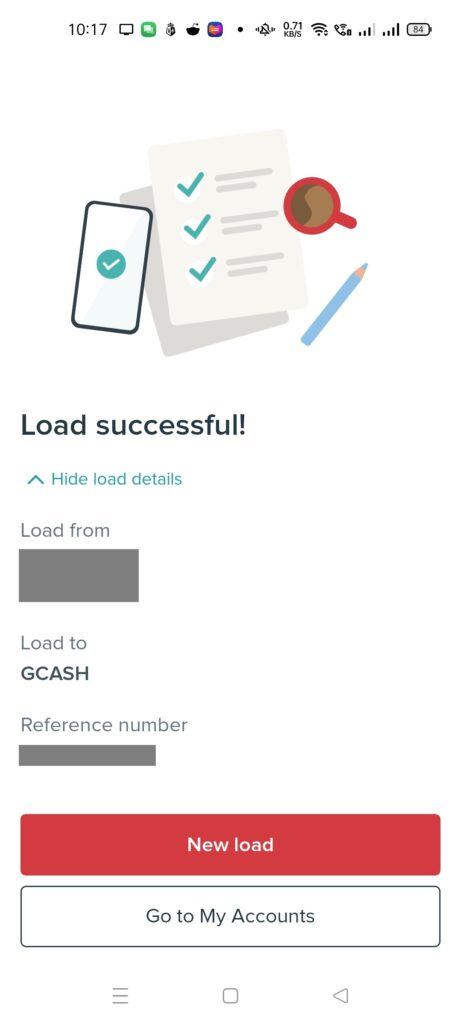

- Cash-in should succeed and you will be receiving an SMS.

Other Questions

Can I transfer from BPI Online to my GCash without fees?

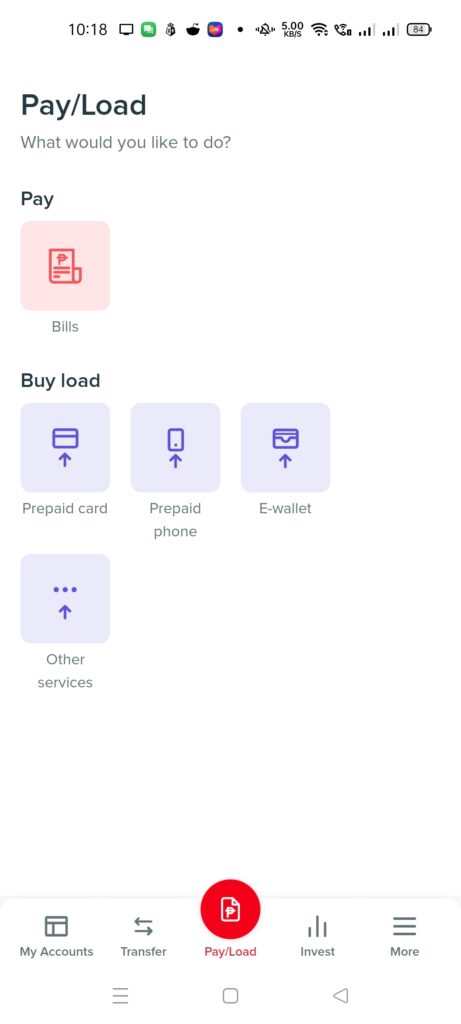

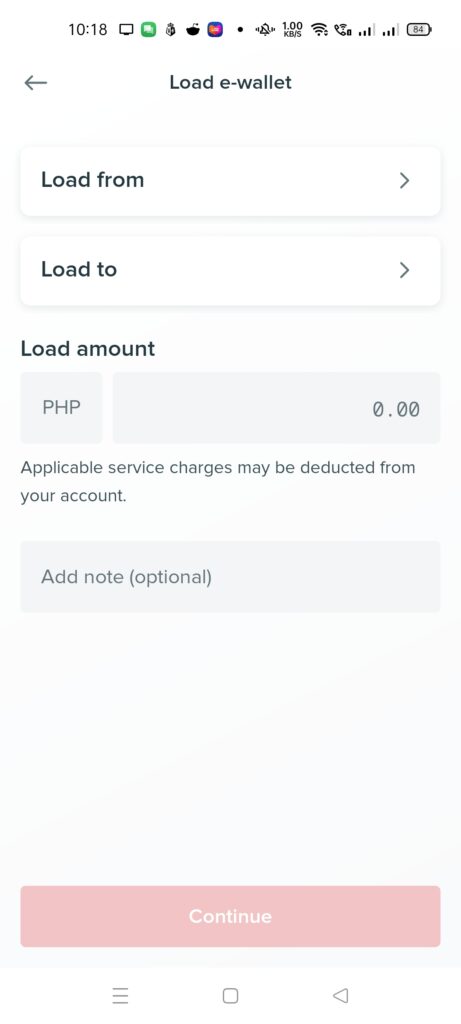

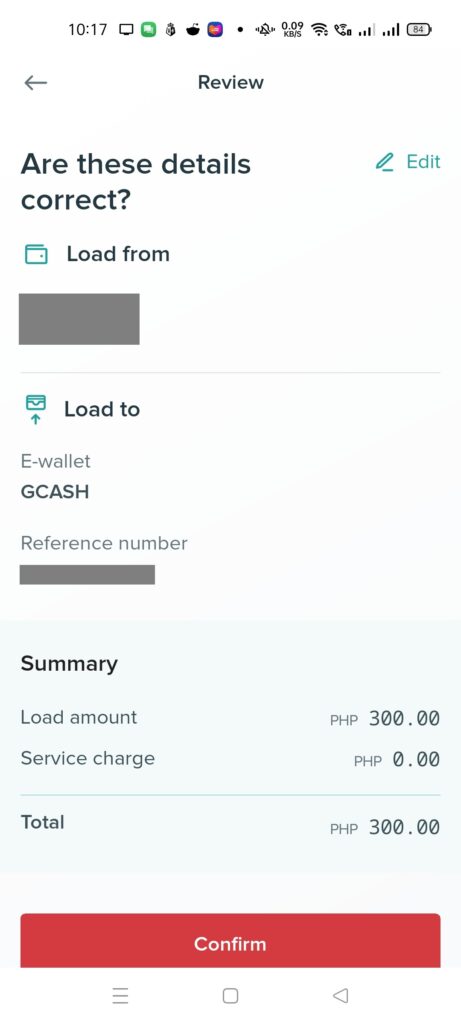

Yes, for now, you can send funds without fees via the “Load E-Wallet” option in BPI Online. This is different from the “Send to bank” option which usually has fees due to Instapay (Php 25).

Sending funds to your GCash via BPI Load E-Wallet

- From the BPI Online page or app, click on Pay/Load > Buy load > Load E-Wallet.

- Fill up the form with your account, input “GCash” under “load to” and your GCash number under “Reference Number”.

- Confirm the transfer.

Is this different from MySaveUp by BPI in GSave?

Yes, you can also create a new savings account in the GSave marketplace using either your BPI Online account credentials or your GCash KYC profile.

Can I link my BPI Online account with multiple GCash accounts?

Yes, as long as you can receive the OTP from the mobile number set in your BPI account. This is helpful with dual SIM phones as you can also have two GCash accounts on that phone.

Do I need to be verified to link my BPI Online account with GCash?

Yes, you need to be fully verified to do so.

How do I resolve the “Invalid User ID and/or Password” during linking?

You should first try to log into your BPI Online account first to confirm your User ID and password. If this doesn’t work, try resetting your password in BPI Online, confirm your access in BPI Online, and then link in GCash.

Is there a limited number of attempts to link your BPI Online account with GCash?

You can only attempt to link three times. After three times, you will be locked out of your BPI Online account as well. You will need to reset your password in BPI Online first before linking again with GCash.

My BPI account was deducted, but the funds were not reflected in my GCash wallet.

Any issues with cash-in will be resolved within 2 days, without needing to file a support ticket. You will be receiving an SMS once your funds go through.

Can I send money from my BPI Online account directly to my GCash account instead?

Yes, you can do so as “Transfer to another bank” in your BPI app, however, you will need to pay a Php 25 Instapay transfer fee.

How do I unlink my BPI account?

You can unlink by clicking on BPI on the My Linked Accounts page under your profile.

Summary

Cashing in using online resources (e.g., BPI, UnionBank, Payoneer, Paypal, Remittance) has no fees and does not contribute to the offline cash-in limit. Linking your BPI Online account is easy in GCash, you just need your username and password.

I have a new e-commerce site where you can buy some e-books here: GCR Prime

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services: