Traditional banking has been here for a very long time. And now, as we go through the digital age, banking has transformed because of the speed at which information can be transferred.

However, this speed has never translated easily with our fellow Filipinos. Many of our countrymen are not Internet savvy and don’t even have a credit card or a savings account to start with.

GCash has now offered financial services to the unbanked masses through multiple trailblazing products, from GSave to GInvest, to GCredit. One of the most known ones is GSave.

What is GSave?

GSave is a feature in the GCash app that allows you to create and access savings accounts within the GCash app itself.

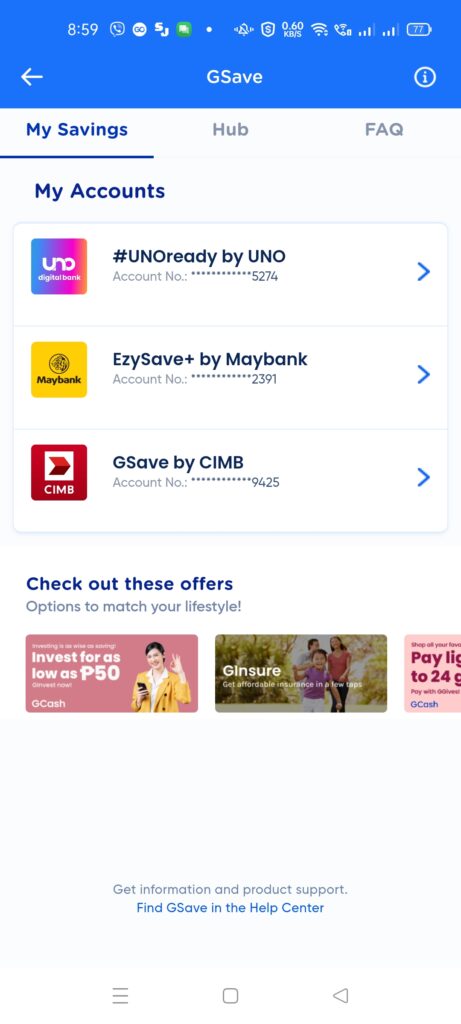

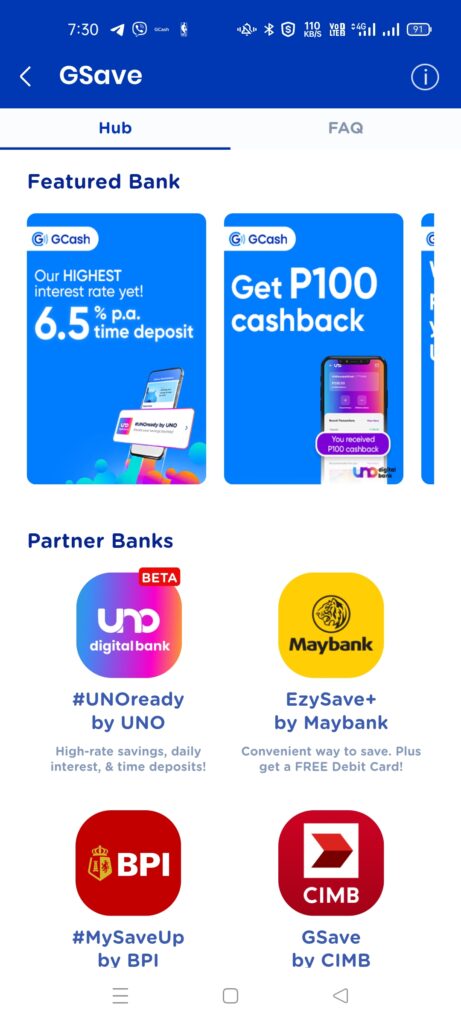

Previously, it only offered a single savings account from CIMB, but now it has upgraded to a GSave Marketplace. This marketplace aims to offer different savings products from different banks.

Having a savings account integrated into GCash enables you to deposit and withdraw your funds at any time.

What requirements do I need to avail of an account?

GSave accounts need you to be Fully Verified. You will be able to open accounts without the need to submit documents or IDs as they leverage the Know-Your-Customer (KYC) information you shared when you verified your account.

How safe are the savings accounts in GSave?

GSave Marketplace is safe because these are savings accounts, as such, deposits are also insured by PDIC by default.

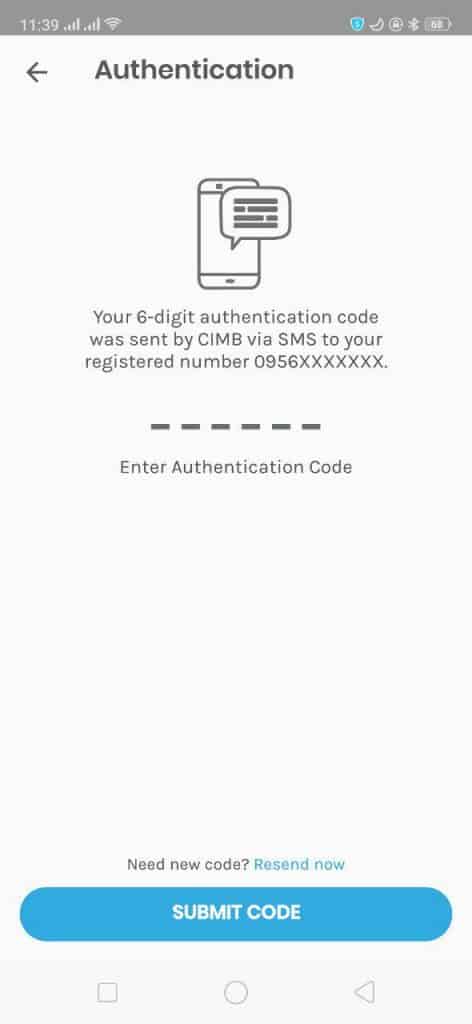

Also, before you can withdraw any money from your account, you will need to go through an OTP challenge.

The only problem you may encounter is if the service itself goes into maintenance — this would effectively freeze your funds until the maintenance is over.

Is there a service charge? How about maintaining balance and min-max deposit amounts?

- There is no service charge.

- There is also no maintaining balance, and no required balance to start earning interest.

- The minimum deposit and withdrawal amount are Php 0.01.

- The maximum withdrawal amount per day is Php 50,000.

- The maximum deposit amount in total is Php 100,000.

- Take note that GCash also has cash-in and cash-out limits for Fully Verified users (100k for both per month).

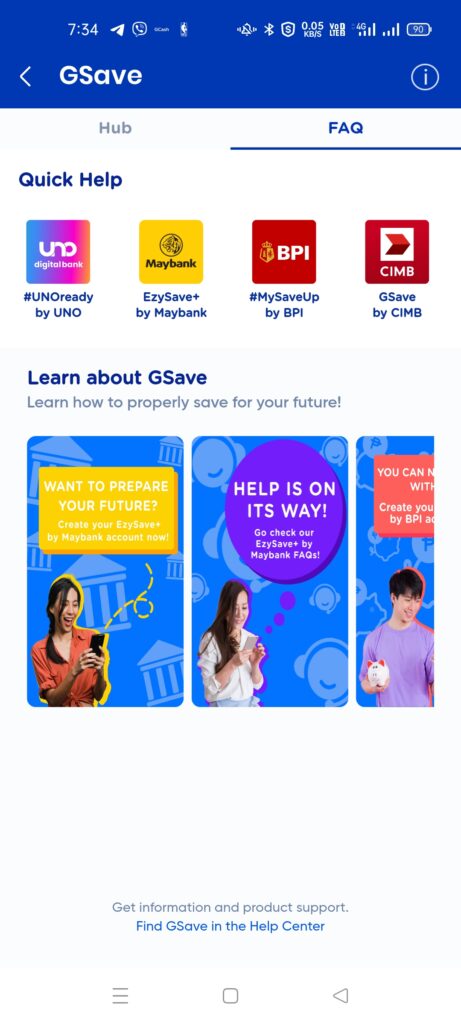

What are the banks currently in GSave Marketplace?

Since GSave is now a marketplace, we can expect that as time passes there would be more and more choices available. Currently, there are these offerings:

- GSave by CIMB

- #MySaveUp by BPI

- EzySave+ by Maybank

- UnoReady by Uno

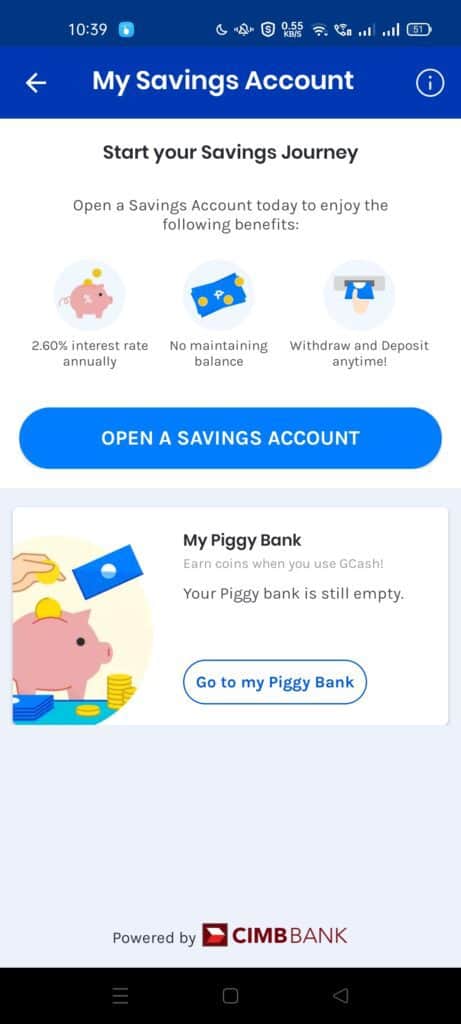

What is GSave by CIMB?

GSave by CIMB is the original GSave product. It is powered by CIMB, one of the few digital-only banks in the Philippines.

What are the interest rates for GSave by CIMB in comparison with other banks?

GSave currently provides an annual interest rate of around 2%, which is on par with some other digital banks. Previously CIMB offered higher interest to the tune of 4% per annum but has since tempered down their rates.

Is GSave by CIMB different from the CIMB GSave Plus account?

Yes, because once you reach Php 100,000, you cannot deposit into the GSave account anymore in the app. If you need to deposit more than the limit, you need to have the account converted to a “GSave Plus” account.

This will allow you to deposit more, and as a result, you can use the high-interest rate better as the amount grows even bigger.

How do I create a GSave by CIMB account?

You need to be a Fully Verified user, you should be a non-US Filipino citizen, and should be more than 18 years old.

Creating a GSave by CIMB Account

- Go into GSave Marketplace by clicking on GSave.

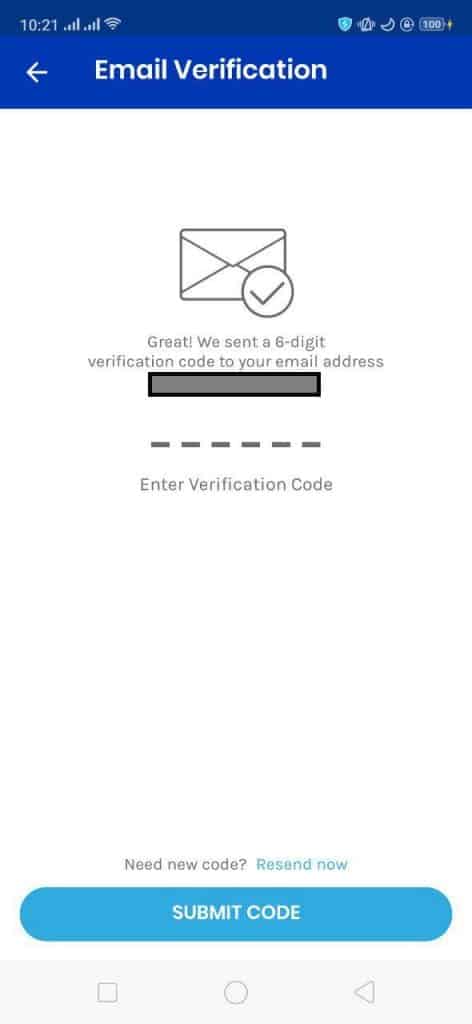

- The first step is to verify your email by clicking on GSave by CIMB and opening a savings account.

- This will prompt you to have your email verified first to proceed.

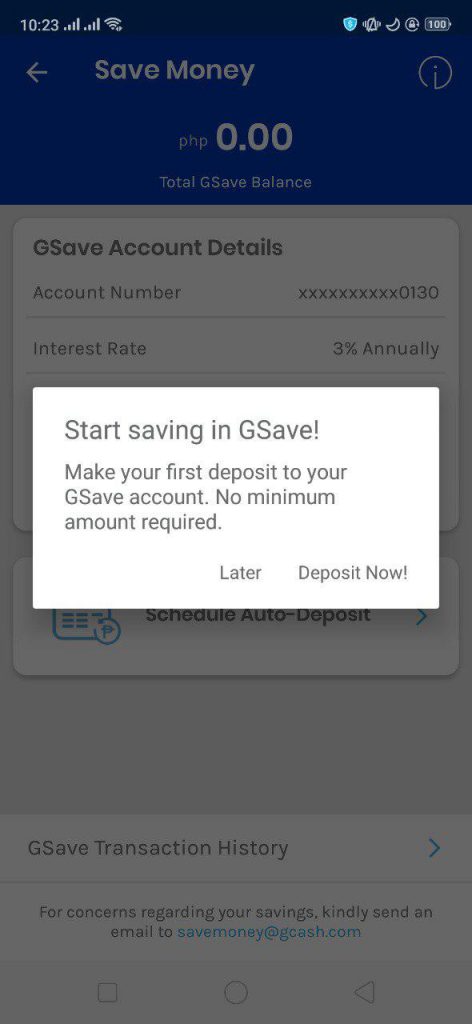

- Click on GSave by CIMB, you can now deposit any amount from your wallet to your GSave account.

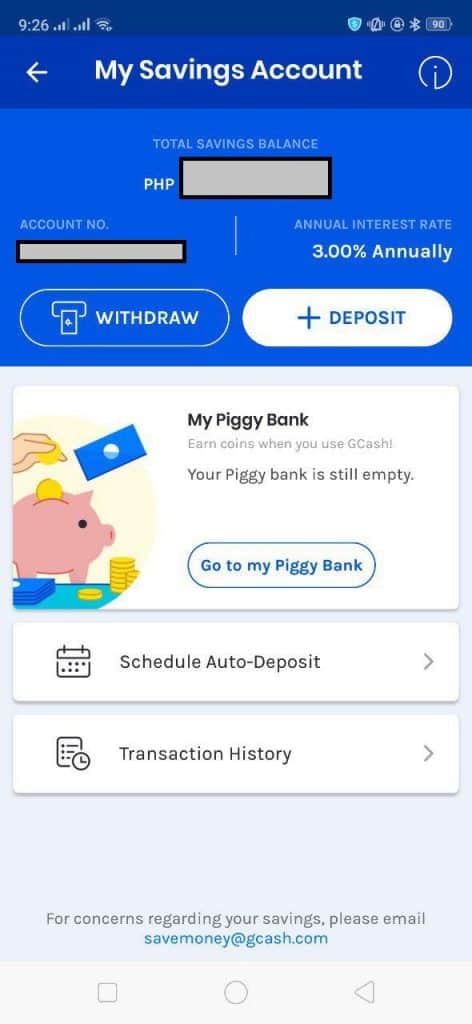

- From the main GSave page, you can make a deposit, make a withdrawal, schedule an auto-deposit, and see your transaction history.

How do I make a deposit in GSave by CIMB?

Making a deposit in GSave by CIMB

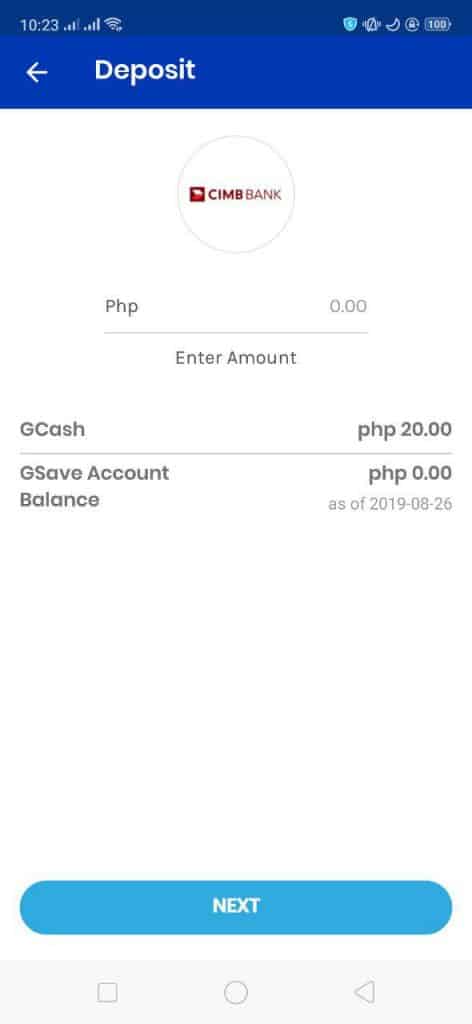

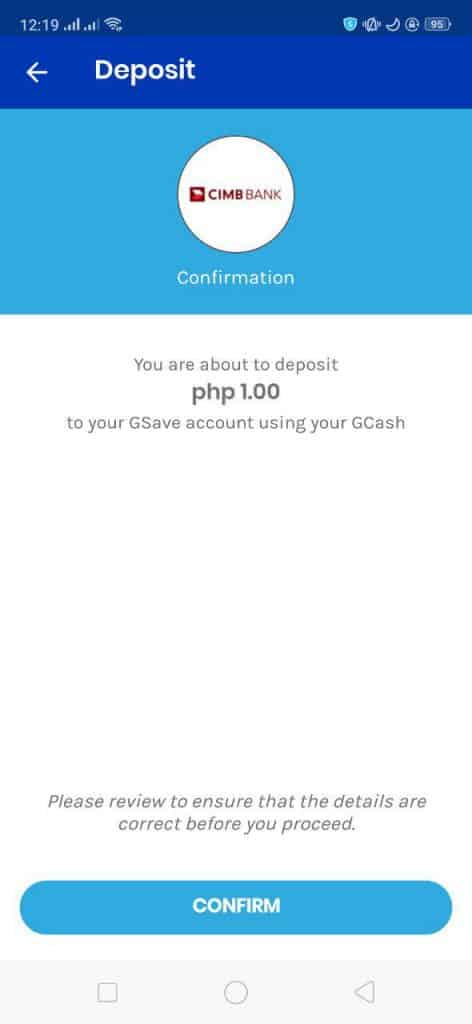

- Click on the “Make a Deposit” button to go to a deposit screen.

- Choose any amount, then you need to confirm the amount to be deposited. You will receive an SMS for a successful deposit.

How do I withdraw my funds in GSave by CIMB?

Withdrawing funds in GSave by CIMB

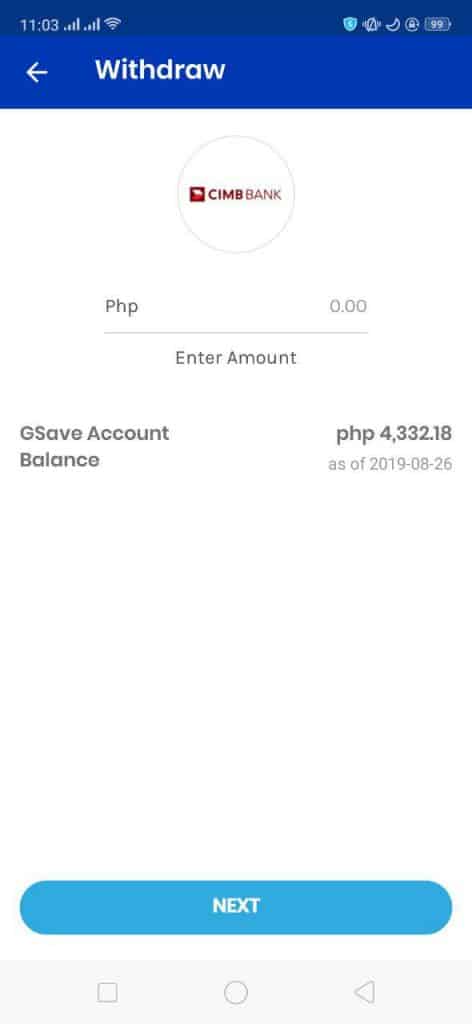

- Click on the “Withdraw Funds” button and you will go to a similar screen with Deposit.

- Input the amount to withdraw and confirm the withdrawal amount.

- With withdrawals, there is always an OTP confirmation included.

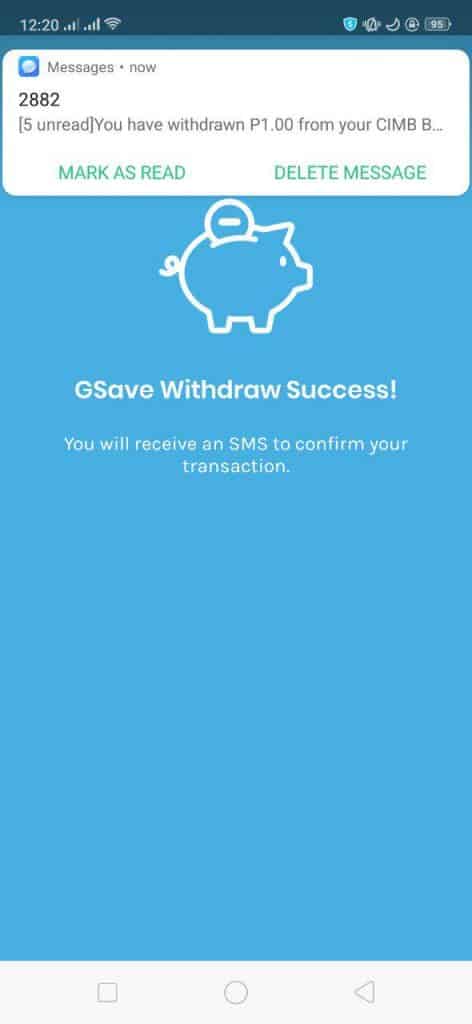

- Similarly, you will receive an SMS for a successful withdrawal.

How do I set an auto-deposit schedule in GSave by CIMB?

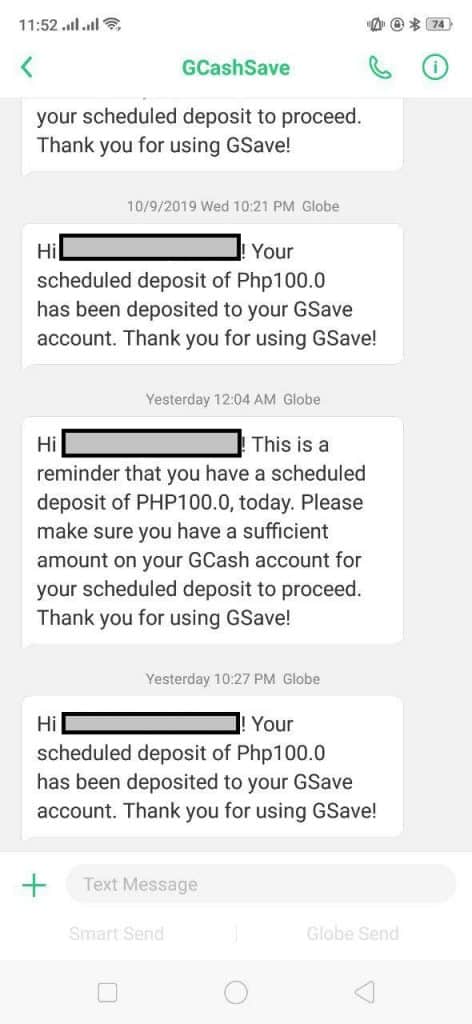

Auto-deposit allows you to make deposits on a set schedule. You can set it daily, weekly, or monthly. This is useful for paydays when you need to set aside an amount.

Setting up an auto-deposit schedule in GSave by CIMB

- Click on the “Schedule Auto-Deposit” button from the GSave by CIMB main menu page.

- Choose an amount to be debited and the duration it will take.

- Afterward, you will also receive an SMS with your selected preferences.

How can I check my Transaction History in GSave by CIMB?

You can also check the transaction history to get real-time historical data. You can also download it for your records.

Click on the “Transaction History” button and it will go to the history page.

You can see your recent transactions, even the interest incurred as well as the taxes here. You can also download the transaction report if you need to. Here is a sample:

Other Questions

How is GSave different from GInvest?

GSave is a savings account, while GInvest is an investment vehicle. Savings accounts are managed by banks (CIMB) while GInvest is managed by a mutual funds company (ATRAM) currently.

When you deposit or withdraw in GSave, you should get your money immediately. When you invest or redeem in GInvest, it usually takes a while because there is a need to buy or sell shares in the market.

Another difference is that GSave has usually a fixed amount of interest, while GInvest earnings can fluctuate depending on the mutual fund you invested in.

Does GSave affect GScore?

GSave does affect GScore positively. As you deposit more and withdraw less, GCash will see that you can be entitled to more credit. As a result, it will be a positive influence on GScore — even better if you also use the auto-debit feature.

Can you generate EPs for GForest using GSave?

GSave can now earn GCash Forest energy points (EPs) for depositing/withdrawing funds. You can earn up to 131g EP per transaction.

Can I have multiple GSave accounts?

Yes. With multiple GCash accounts, you can also have different GSave accounts for each GCash one by using a different email address for each GCash account.

However, if you have an existing CIMB account and the mobile number and email address are the same as in your GCash account, it will notify you that you cannot use GSave. The workaround for this is to use a different email address to be able to create a new GSave account.

You can change your email address in the GCash app via the sidebar, by clicking your Personal Profile and changing your email address under your profile.

Summary

First, we talked about GSave and how it fits into the GCash ecosystem. GSave makes creating savings account easy because you do not need to sign forms or provide IDs. It also provides the highest interest rate for savings currently in the country.

We also walked through creating a GSave account, and also how to deposit, withdraw, set up a scheduled deposit, and look through the transaction history.

I have a new e-commerce site where you can buy some e-books here: GCR Prime

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

This is very informative! Thank you very much. I do have a question. I know that there is a withdrawal charge for gcash using the gcash mastercard to withdraw in atms. I am trying to bypass that. Is it possible that I deposit money into the Gsave (cimb) and make atm withdrawal from there, so I could avoid the 20php withdrawal charge?

Yeah, you can do that. Actually that is similar to Bank Transfer. You can bypass the fee by transferring to any bank account and withdrawing from your specific bank ATM.

how to avail

I already changed my email address but it’s still not letting me use gsave. Still getting the message “sorry, you are unable to deposit as of the moment”

I also contacted gcash support and was told “please be informed that users in GSave will have their accounts expired unless they link their account to the CIMB App. Account expiry disables a user’s capability to deposit on Save Money but allows to do Withdrawal transaction. You may reach out to CIMB Bank Philippines for all concerns regarding account linking and upgrade via the CIMB App. CIMB Bank is our partner for Save Money and will help you resolve your concern about being able to use the CIMB App. If you already link this with the CIMB app and still unable to do deposit transactions, please reply on this email so we can do further checking”

Lastly i downloaded the CIMB app but when signing up i get a message that says my mobile number is already registered. I tried to log on using my gcash log in info but also unable to.

Thanks gor the help

What I know about this is once you created a GSave account, you will also be receiving an SMS from CIMB with your credentials. I think the sender is “CIMB” and username and password in the message.

You can look for it. If you can’t find it, then the next step should be to contact CIMB support.

what will i do if my mobile in gsave is lost

It’s tied to your GCash account so better try to replace SIM or transfer account

Good Atfer im jayson i using Gcash, i want to use the Save Money but there is something wrong pop up the words Oops! Your account details is already being used for another CIMB savings account. i use this CIMB before but my phone is lost and i cant open my gcash app because the number i used is lost also. can you help me how can i use the save money at Gcas. i already retrive my CIMB Bank apps and i change my new number also.

It would be better to contact CIMB support instead of GCash as this is mainly related to CIMB.

Good day im mark jun abon i using gcash and i try to use the save money i try to deposit 2,000 but there is something wrong pop up the words oops! please try again later if the error persist, contact us as help.gcash.com and and thats why my balance in gcash is deducted but i dont receive balance in save money i have still zero balance

Better contact GCash support. I’m sorry but GCR cannot provide customer support.

Hi thank you for ths informative post uve got. I have a concern. When depositing in gcash, not in gsave, there is a limit of 8k and when it exceeds, there will be a 2% interest. Now, if I withdraw from gsave with the amount of 8k, thus it will be deposited in gcash wallet. Will there be an interest regarding that Id be exceeding the limit?

ex.

Cebuana cash in 8k – Gcash Wallet = 2% deduction of the total amount = assumed i receive 7900 due to 2%

Gsave withdraw 8k – Gcash Wallet – as I exceed, will there be a charge?

Thanks hehe i dont know if ths s clear to you. But i really hope it is. Thankssss

Regarding the 8k+2%, the 2% is not actually an interest, but a fee. And that only happens for over-the-counter cash ins (like 7-11, palawan, puregold, etc). GSave is not included in this because this is considered as a deposit/withdrawal. So any operation in gsave is free.

I love gcash forest your the best.

I have already GSave Account and upgraded my account already but no Sms message on my username and password….

You can contact cimb support —

For PLDT, Smart, and Talk n Text subscribers, you may call #2462 (#CIMB) or (+632) 8924-2462 on your phone

For Globe and TM subscribers, you may call us on our landline: +632-8924-2462. Telco charges apply.

I lost 10,000 pesos from using GSave… is it really GSave? or GScam? send me back my money and please respond to my goddamn ticket #48981874

Sorry this is not GCash Support. Is there no reply yet?