You can now easily invest in the PSE stock market inside GCash using GStocks PH.

Disclaimer: This post aims to educate and not to give financial advice. Investments have different risks, and it is up to the investor to do due diligence and make decisions regarding his money.

It’s a really long time coming. At first, GCash launched GInvest, which focused on mutual funds. Eventually, their wealth management products also began increasing. Now with GCrypto and the upcoming GStocks Global, GCash could provide lots of different investment products to all of their users. Even those who haven’t created their stock market brokerage accounts. It hasn’t been done before and I’m excited to see what other types of products we will be able to see in the wealth management space in the future.

What is GStocks PH?

GStocks PH is a product from inside GCash that enables a user to buy and sell stocks from the local stock exchange. In this implementation, they partnered with AB Capital Securities to provide the trading experience from inside GCash itself.

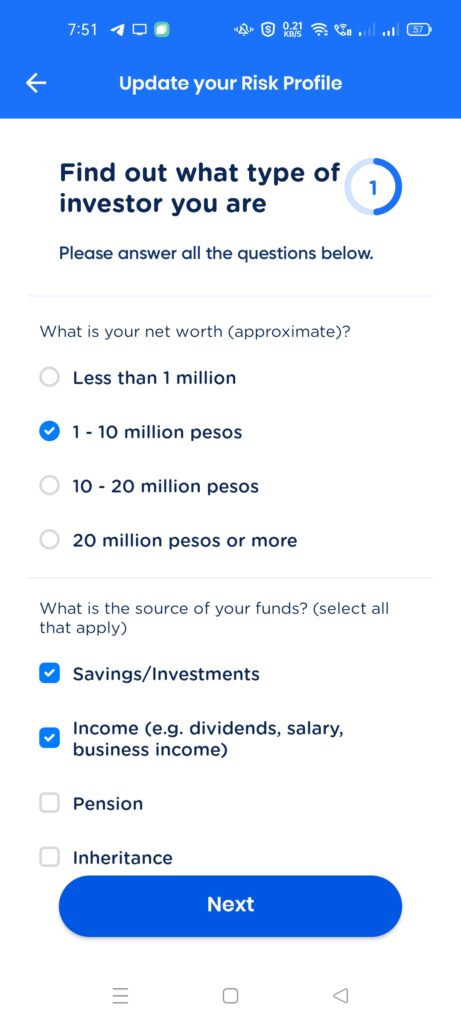

Getting your Risk Profile

You will need to take a questionnaire to be able to acquire your risk appetite. The results of this questionnaire will determine your risk appetite and GCash will be recommending you some investments depending on this appetite.

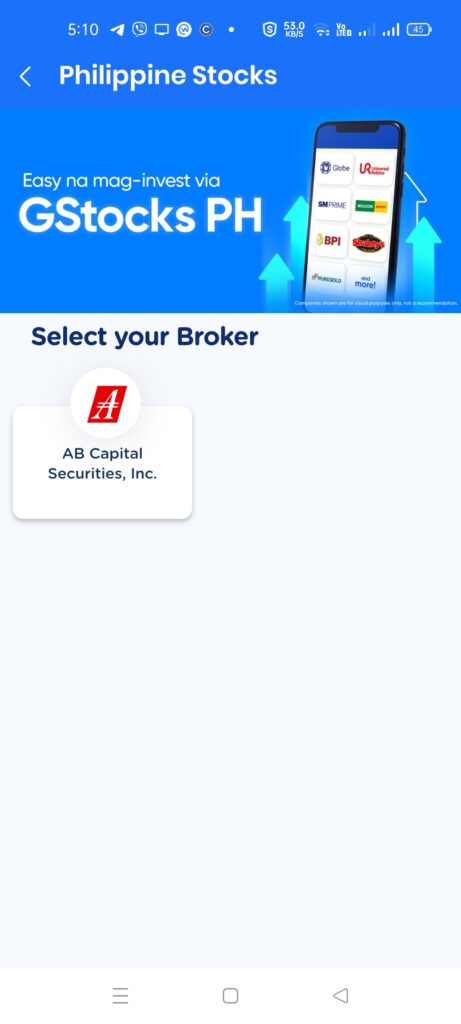

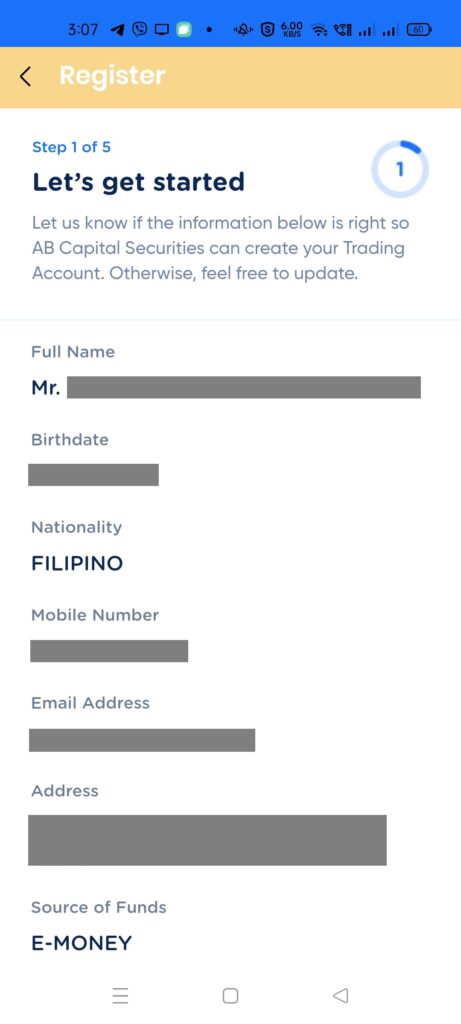

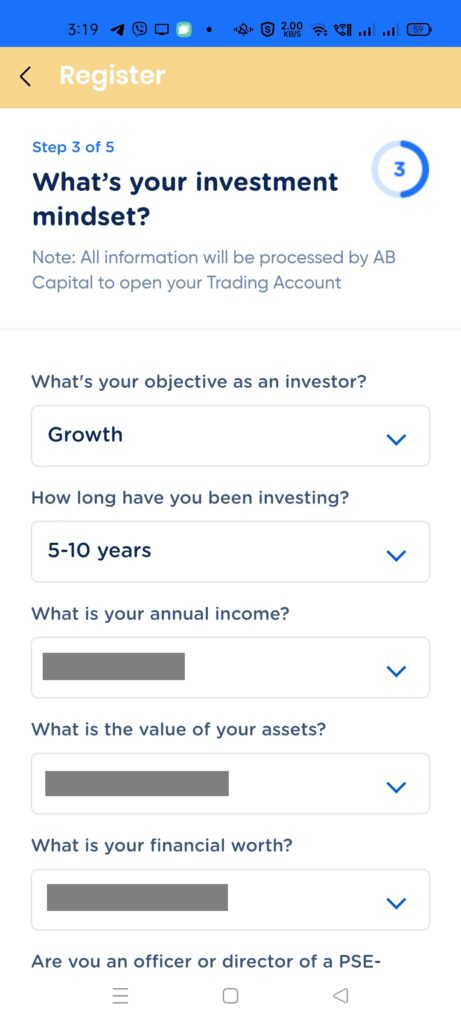

How do I register for an account in GStocks PH?

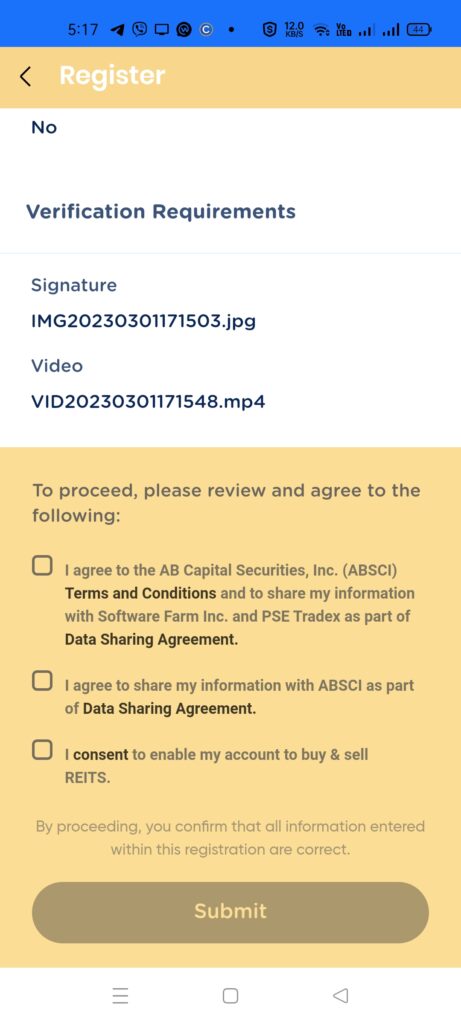

Registering an account is easy, you need to click the GStocks PH icon from inside GInvest. Then once inside, click on AB Capital Securities and start the process of creating an account. Most of the heavy lifting has already been done for you as your registered data is used in creating the account.

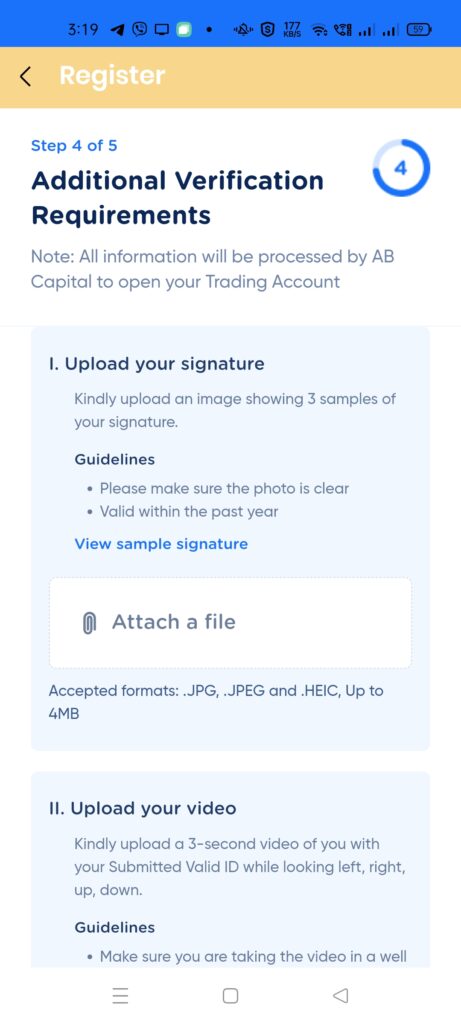

Probably the most hassle part is taking a selfie video (with a submitted valid ID) and the personal signature picture as you need to upload those separately in your application.

Once registration is done, you need to wait at most 7 banking days for your account to be processed and activated. You will be receiving an email that you can now open your account.

How do I top-up my funds in GStocks PH?

Before you can buy any stocks you first need to top-up your funds inside your AB Capital account. Take note that topping up funds take 1 business day to be processed.

From the AB Capital main page, click on the Top Up button. Input your top-up amount and confirm the payment.

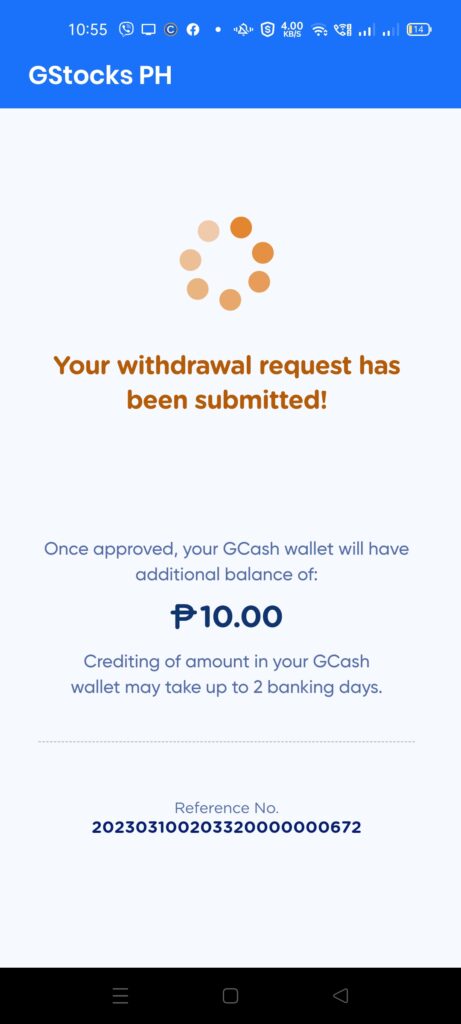

How do I withdraw my funds in GStocks PH?

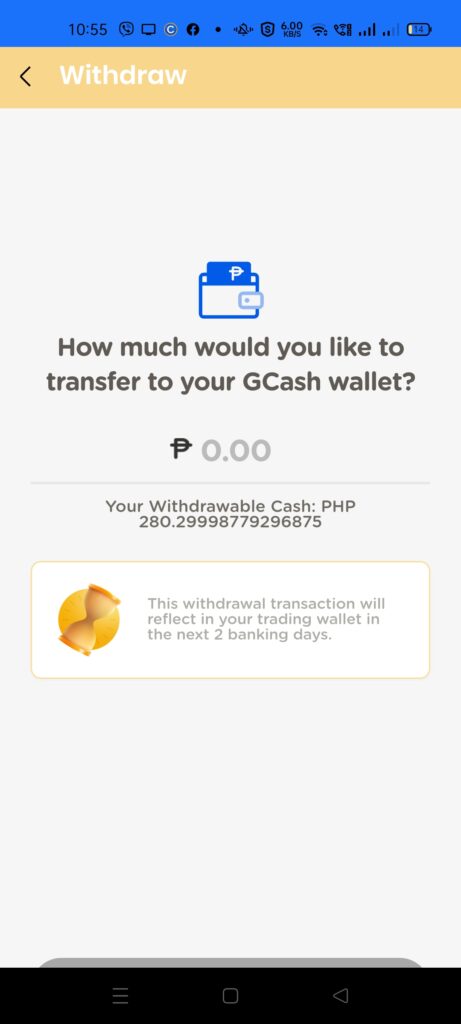

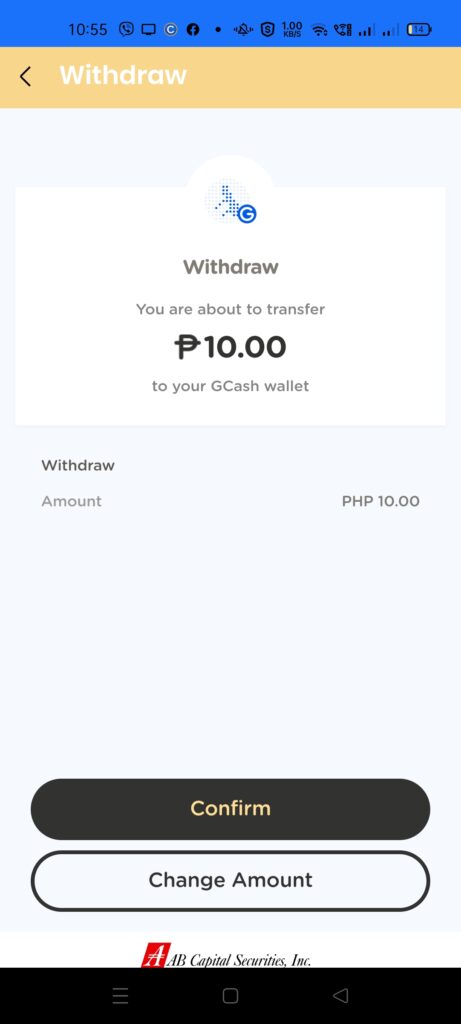

Similarly, you can also withdraw your funds from your account wallet. In this case, it takes 2 banking days to be processed.

From the AB Capital main page, click on the Withdraw button. Input your desired amount and confirm the withdrawal request.

How to buy or sell stocks in GStocks PH?

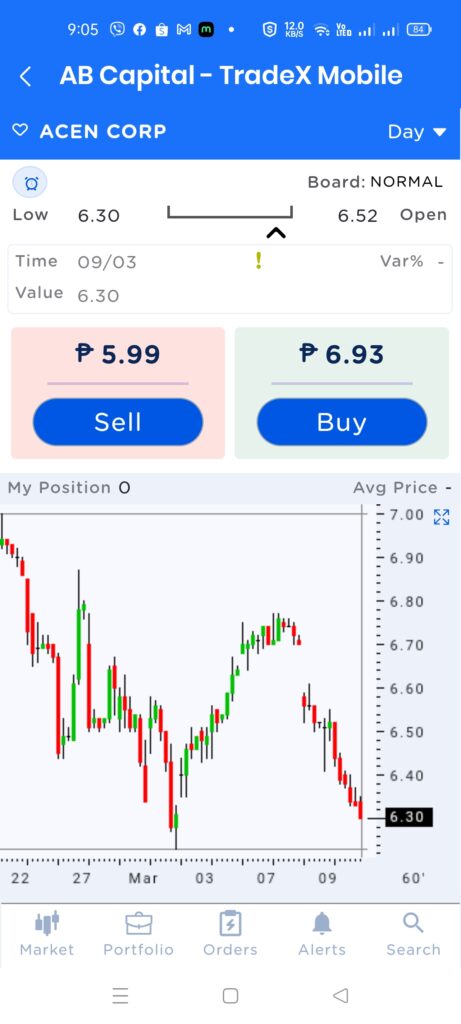

Once your account is created and your wallet is funded, you can now go inside the trading platform. The first thing you see in the trading platform is the list of different Top 30 stocks. At the bottom, you can cycle through different features like checking your orders, and your portfolio.

Once inside the AB Capital page, you can check out the different stocks and click on each to see its individual chart and also to buy or sell it. The price of the stock varies during the course of a day, and when buying, don’t try to overplan it as you are a stock investor and not a stock trader. Stock traders actively check the charts and find ways to gain when the market is open.

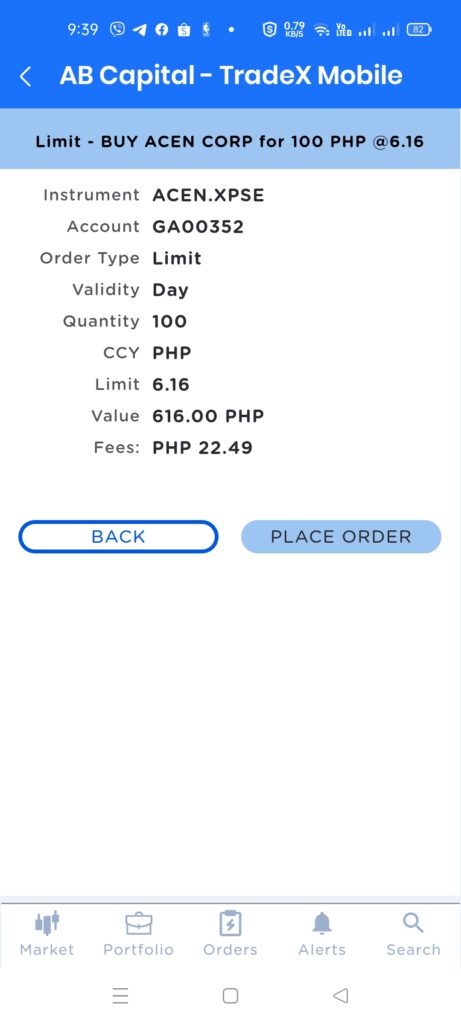

When you click on Buy, you are then taken to a page where you can specify the quantity and the price you are buying the stock. I recommend you buy it at a price closest to the one quoted to you as the sale finalizes immediately that way.

Once your order is placed, you will be able to see on the Orders page the status of that particular order. The system will eventually inform you via the alerts page that it is finished.

For selling, it works in a similar way. Any proceeds will immediately go to your account balance.

Other Questions

Can I cancel my buy or sell order on the trading platform?

You can cancel the order as long as it is not yet fulfilled, however, you cannot cancel around 15 minutes before the trading hours start (9:15-9:30 AM) and a few minutes before the end (2:48-2:50 PM).

Is there a fee to use the platform?

No, using GStocks PH is completely free. However, take note that in selling stocks you should also consider the taxes included.

Summary

We talked about how stocks work in our little primer and how we can put this into action by creating a GStocks PH account. We delved into the details of registering as well as the how-tos of top-ups, withdrawals, and how to buy and sell stocks in lots using the platform.

Related Posts

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services: