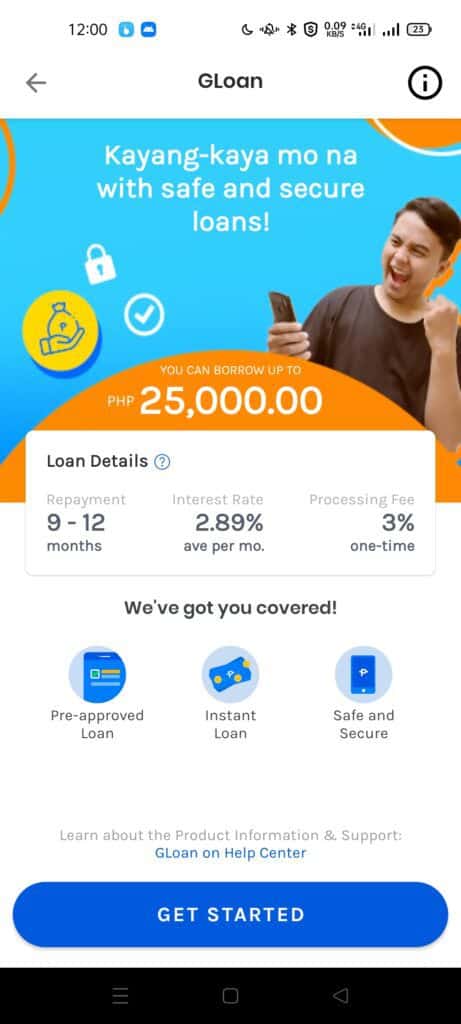

GLoan is an easy way of getting cash loans withdrawable via ATM from GCash.

The operator of GCash, Mynt is actually composed of two subsidiaries — GCash and Fuse Lending. The GCash company handles the e-wallet and everything under it, while Fuse Lending handles loan products. Before turning it over to CIMB, GCredit was also handled by Fuse Lending.

A lot of requests when GCredit was launched was whether users could encash the loan. GCredit is a virtual loan so it was only applicable to GCash products like Pay QR, Pay Bills, and Online Payments.

There was a gap that needed to be filled, and GLoan was then created to do so.

What is GLoan?

GLoan is a personal loan that you can get in your GCash balance. This in turn you can use in any GCash service, including withdrawal or cash out, bank transfer, or sending money to another person among others.

As this is a loan, you will also need to pay for it monthly. The main requirement is having a high enough GScore, and a good credit history similar to GCredit.

How much can I avail with GLoan and what are the terms?

The general terms of the loan depend on your GScore. There are two types of GLoan: the normal GLoan, and the Sakto Loan.

The normal GLoan terms are:

- The minimum amount is Php 1000 and the maximum is Php 125000

- The loan duration can vary from 5, 6, 9, 12, 15, 18, and 24 months

- The add-on interest rate is 1.59-6.57% per month

- There is a 3% fee outright when you get the loan

GLoan Sakto Loan terms are:

- The minimum amount is Php 100 to Php 500

- The loan duration is 14 days or 30 days

- No interest

- There is a fee of Php 6.5 to Php 75, depending on the amount

How can I avail of a GCash Sakto Loan?

You can only avail of this loan currently via a text message from GCash. This is mainly for users who follow a certain set of criteria — these criteria are only known to GCash for now.

How high of a GScore do you need to activate GLoan?

Unfortunately, this is not publicly known. But according to the help article, you need to both have a good GScore and a good credit history to unlock GLoan.

Can I withdraw or cash out my GLoan?

Yes, you will need to go through cash-out via partners or your GCash Card. Take note that there are charges for cash-outs as well as via ATM. You can also transfer the funds to any bank account via Bank Transfer.

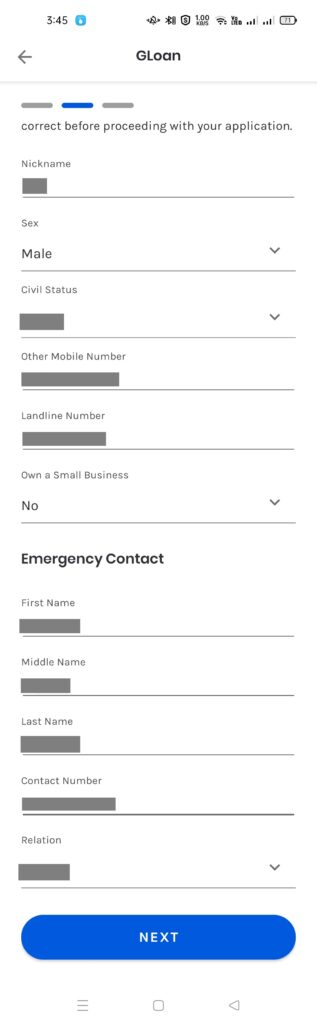

How do I avail of GLoan?

It only takes a few minutes to set up:

Availing of GLoan in GCash

- From the main GCash page, go to “Borrow” and click on GLoan.

- Click the button and click Next on the intro pages. Once in the loan selection screen, select your terms if applicable. Take note that the terms may vary depending on your GScore.

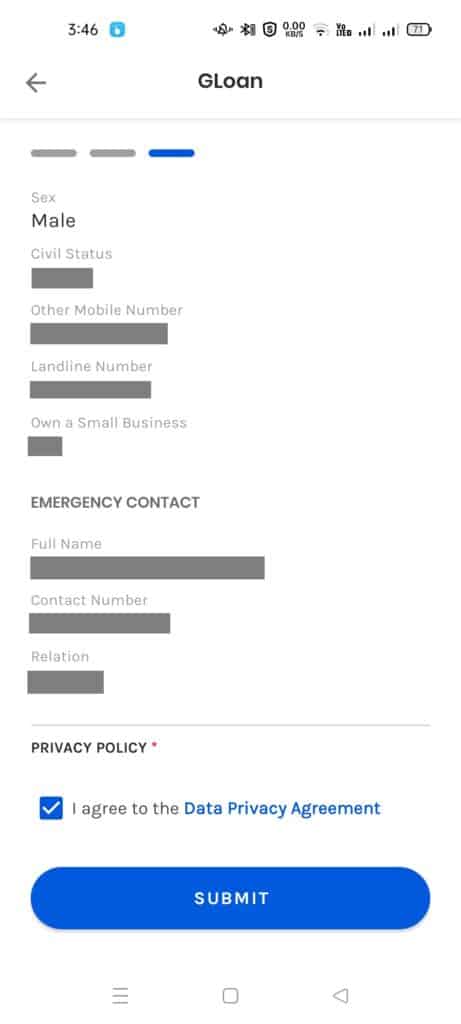

- Confirm your loan term selection and input some of your KYC information to finish the registration.

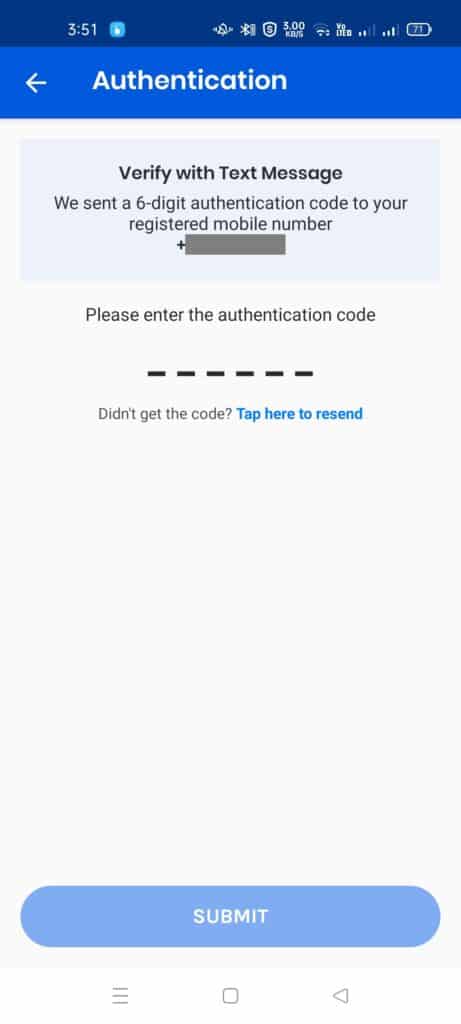

- Confirm that you will be going through your application by inputting an SMS OTP.

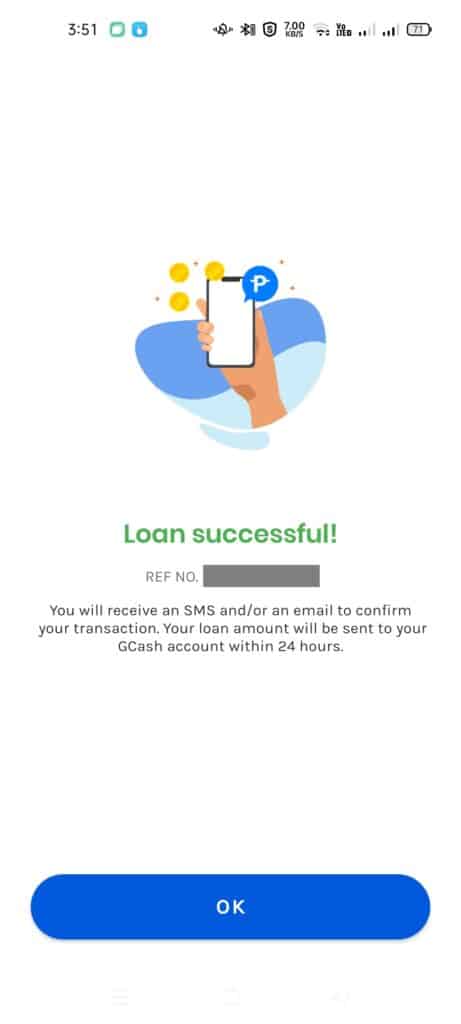

- Once done, you will receive your GLoan in your GCash account.

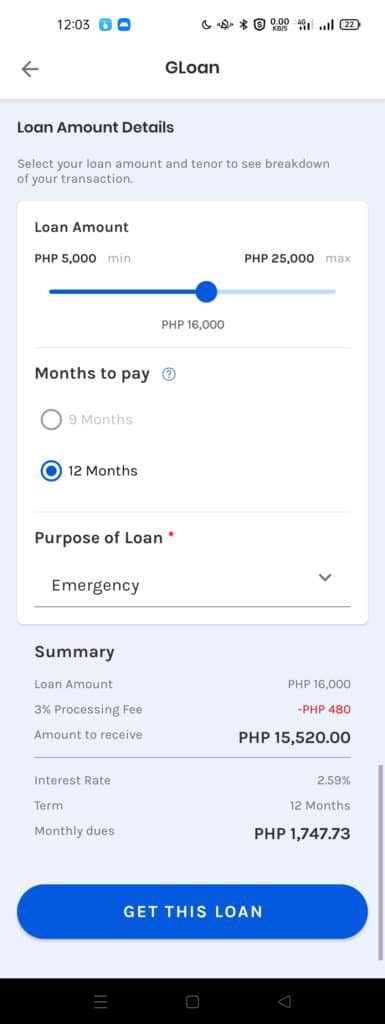

Can you provide a sample computation of the dues and interests included?

The loan has an add-on rate monthly, meaning it takes into account the principal and computes using the full amount, including the 3% processing fee outright.

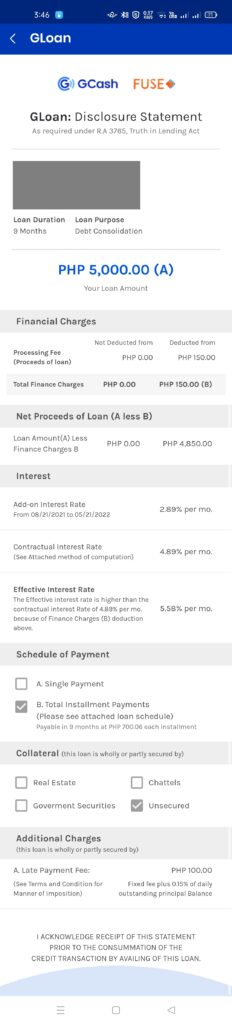

In my example above, I picked Php 5000 to borrow with an add-on rate of 2.89% and a loan term of 9 months.

Given:

Amount to Borrow = Php 5000

Add-on Rate (monthly) = 0.0289

Loan term = 9 months

Amount Borrowed Per month = 5000 / 9 months = 555.56

Amount Borrowed with Add-on Rate = 5000 * 0.0289 = 144.50

Monthly Due = 555.56 + 144.50 = 700.06However, you will not be receiving the full Php 5000, but only Php 4850, as there is a 3% processing fee when you start — even though the computation is for the full amount.

What do the penalties look like?

Looking at the disclosure statement:

The penalty is a fixed fee of Php 100, and 0.15% of the daily outstanding principal balance. For example, using the same example above and I wasn’t able to pay for the second month:

Given:

Monthly due = 700.06 (check the previous example above)

This is the second month, so there has already been a first payment of 700.06.

Daily Outstanding Principal Balance (DOPB) = 5000-700.06 = 4299.94

Fixed penalty = 100

Variable penalty = DOPB * 0.015 = 64.50

Total penalties = 100 + 64.50 = 164.50

This also means that the more payments you've settled, the lesser the variable penalties you will incur.

Take note the variable penalty is incurred every unpaid day.

What do “contractual interest rate” and “effective interest rate” mean in the disclosure statement?

These two interest rates take into account the principal getting smaller every month. As we are already using an add-on rate (which only takes account of the full principal per month), these are put in here as part of due diligence. For simplicity’s sake, we can focus on using the add-on rate only.

However, for completeness’ sake:

The contractual interest rate computes the interest payable based on the remaining balance per repayment.

The effective interest rate is the true interest rate you are paying based on the outstanding loan amount calculated after each principal repayment is deducted from your outstanding loan. In this case, it takes into account the actual loan amount you are getting, with the processing fee deducted.

Other Questions

What’s the difference between GCredit and GLoan?

GCredit is virtual money only, and can only be used with payments (web pay, bills, GLife, and QR). GLoan is an actual money loan you can use not only with payments but with all of the services GCash offers, including withdrawal via ATM.

What’s the difference between GGives and GLoan?

GGives allow you to pay for an item in installments, while GLoan is an actual money loan. The main similarity between them is they need to have a high enough GScore to activate.

How many GLoans can I avail? Does it affect my GCredit?

You can avail of GLoan multiple times, but only one at a time. As long as a GLoan is active, you will need to pay in full before you can avail of another. This is different from GCredit. Additionally, you can avail of both GCredit and GLoan at the same time.

However, if you lapse in payment on either one, your GScore will most likely decrease and it will make it harder to avail of subsequent loans once you’ve paid up as your GScore gets lower and lower.

Why isn’t GLoan available for me?

Either your GLoan is not yet available for your account, or the GCash account you are using is not your main one. Only one instance of a loan product can be active for a user, even though he has multiple accounts.

How do I repay my GLoan?

You can pay your GLoan in the GCash app itself. Otherwise, GLoan will also deduct via auto-debit once your due has passed. The auto-debit works similarly to GCredit where GCash informs you about the auto-debit by SMS before doing it later in the day.

You can pay partially or in full as long as you pay before your due date.

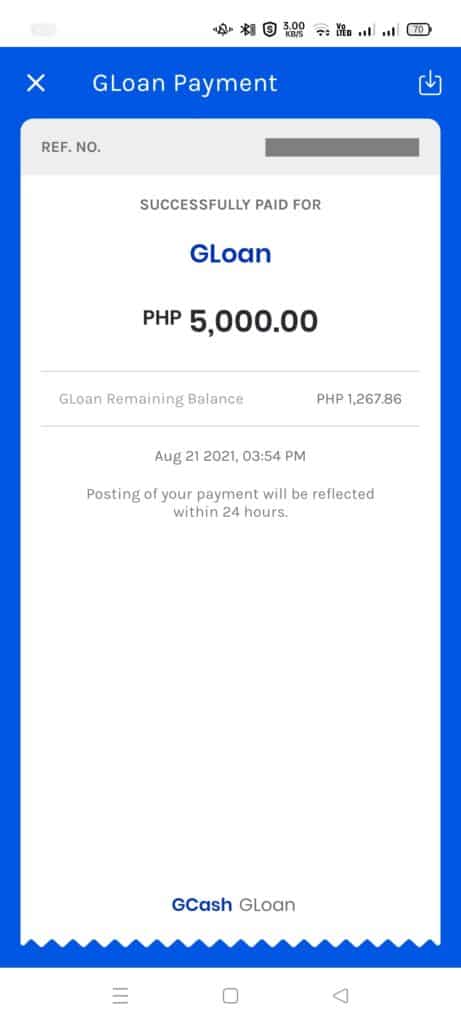

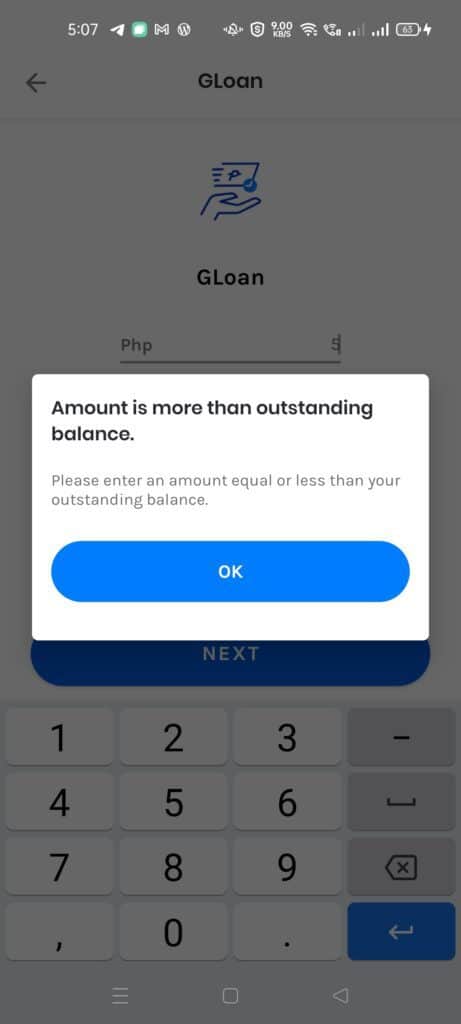

Can I pay the loan in full, in advance?

Yes, you can, however, you will still need to pay for the interest due as a whole. For example, my loan amount was Php 5000, and I tried to pay Php 5000 (even after deducting the 3% fee) and I still had Php 1267.86 left payable. Also, you can’t pay more than the balance.

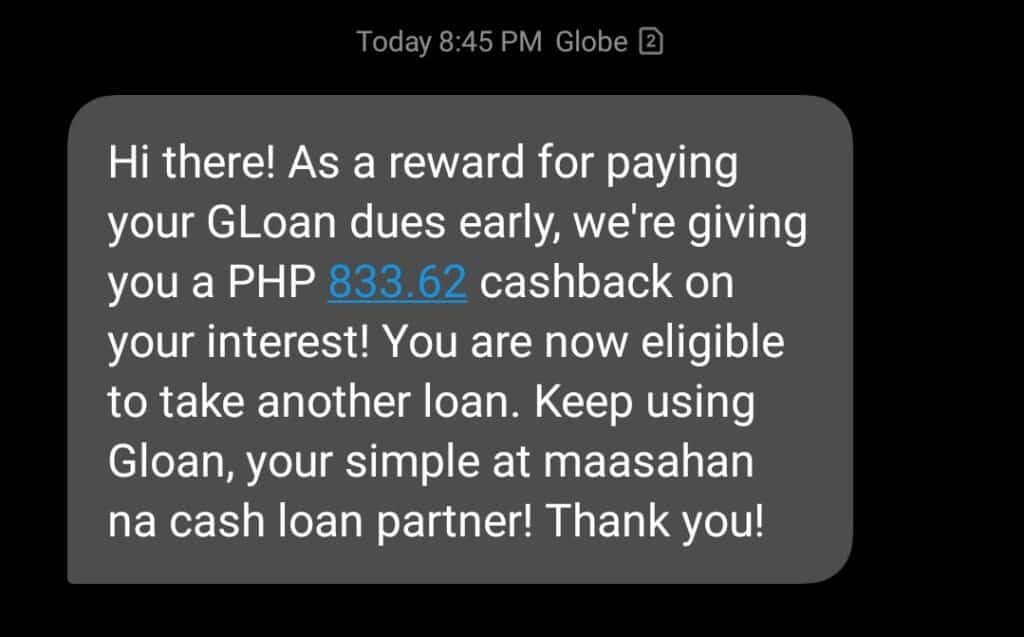

You can get rebates in the form of unused interest if you pay in advance. For example, if you availed of a 12-month loan and you paid in full after only 3 months, you will have a rebate of the 6-month interest amounts you did not use.

How do I know how much I need to pay in advance for my GLoan if I need to pay in full?

You can see the remaining balance once you’ve made the payment. You can also check the Loan Documents to see your Payment Schedule.

You can also check your GLoan transaction history, or you can pay extra — if it goes over, it will result in an error.

Can I avail of another after paying my current GLoan in advance?

You will also be able to avail of another GLoan once you’ve paid off one in full. You just need to wait 2-3 days for it to activate again. As far as I know, this is how it happens.

Some reported not getting it again until after a few months. Perhaps this is due to a recalculation of GScore. To disclose, my GScore is currently maxed out at 750.

My GLoan didn’t push through or I didn’t receive any funds. What should I do?

You need to wait for it for a few minutes. If it doesn’t come even after 24 hours, then you will need to file a support ticket.

Summary

We described how to avail of a GLoan in GCash. A GLoan is an actual loan you can get and then use with any GCash service. This is a loan, and hence this needs to be paid monthly which usually means an auto-debit from your GCash balance.

Availing of this loan is straightforward. This also has better terms than other loan apps available in Google Play, as long as you have a high enough GScore and you have a good credit history.

Some related posts are:

- GScore – the credit score of GCash for its users

- GCredit – allows you to buy using credit

- GGives – allows to you buy in monthly installments

- GInsure – allows you to buy insurance from within GCash

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

How high should Gscore be (yung minimum) to avail Gloan? Do you know?

No one knows. However if you have GCredit, most likely you also have GLoan.

5000

500+

Hi, would you know upon payment of full amount, how soon can I re-apply for a new Gloan? Thank you!

After48 hours.

sure po ba na 48hrs ? or depende parin ? sana may sumagot

depende parin po talaga kase in my case, meron ding right after full payment ko, avail nadin sya agad2. meron din na after 2 days and may after 4 days din po. meron din na nag full payment ako exactly due date then yung next na amount na pwedeng i loan ko is mas mababa na po and naka depende parin talaga sa Gscore.

Hi, would you know if after paying the full amount, can I apply for another Gloan on the same month?

Thanks in advance for your feedback.

as far as i know once a loan is fully paid, you are free to get another one

How many days before you can reapply for your next gloan after paying your first loan in full amount. Did you receive an sms right away that you can avail the loan again?

No, it took some time rin for me. Around a month or so.

Ask ko po sana kasi nag advance payment na po ako sa gloan ko, pero walang message sa akin ang gloan na tapos na ako sa Loan ko po. Ano po ba ang gagawin ko,. Nag payment po ako ngayon ng 520 for month of june 8 then nag payment po ako ulit ng 1040 na para sa. Natitira kung 2 months para tapos na po.. pero wala akong confirmation na narecieve basta ang message po sa akin continue pay You have successfully paid P1040.00 for your Gloan with transaction number #3004556470999. Continue to pay for your loans conveniently with GCash!

Hintayin mo lang makukuha mo rin gusto mo. Kung wala pa rin after a few days, magreach out ka na sa GCash Support.

Yes, after 48hours.

Thank u

Thank you for your informative post. I just got GCREDIT approved, hoping I can get GLOAN as well.

I already pay my full balance and its been 48hrs now but still cant apply a new loan. Theres no available yet? How long will I wait?

Did you pay the whole loan, without ending the term itself (6 months, etc)? I think you need to end the term before you can take a new loan

nkapg reloanka po after 48 hrs?

Did you get the reloan asap?

No, probably a few weeks after pa siya nagtext na puwede na ulit.

I’m curious lang po. Did it take 1 month before sila nagmessage before you can take another loan?

Yes po, around 1 month for me

Have you already applied for a new loan? I am curious also how long it will take before I can reapply again. Thanks in advance

sakin po it took 3days only. i double check the full amount to paid,sa unang loan ko po dti kaya pala tumagal ako ng reloan dhil di ko lam may balance pko na .08 haha kya pla 10days na pero di pren mkareloan. after i paid the .08 within 3 days okay na. its my 3rd time now

Hello po gano na po kalaki ang pwede nyong maloan sa gLoan

depende sa gscore mo

1 day lang naka pag loan ulit ako

i have a 600+ Gscore , and using all the description for highrer Gscore gain.

Still cant avail the Gloan… sad

-_-

Gloan apply

yes po, basahin niyo yung nasa post kung paano

Pag po ba nagbayad agad ng gloan ksama sa computation ung interest ng 9months? Khit wLa pa 1 month nabayadan na po pa explain please 😥

Pag binayaran mo yung full loan, kasama yung interest na sinet niyo — kung 9 months ito, kasama ito doon. Di po siya kagaya ng credit card na bumabawas ang interes kada bayad niyo.

Hello po. Pano nila kinocompute ung cashback once fully paid na ung loan? Just availed Gloan for emergency – 9 months term. Planning to pay it in full by the end of December or January 2022. Yun po bang triny nyo was it paid in less than a month? Thanks po!

Yes, tried to pay it in full parang two months palang out of 9. Di ko rin alam paano nacompute ang cashback, nakita ko lang nakacredit na sa account ko.

Hello once you have paid in full , (paid full 9 months) on 2nd month palang. Eligible na ba ulit for new gloan?

You need to wait for the SMS na puwede na ulit magloan.

How soon did you get the cashback after paying it off?

A few weeks after I paid it off – I paid it off the second month (out of 9 months)

magkano po cashback narecieve nyo

mga 800 pesos

is there any hidden charges po ba? lets say computed po ang loan, for example 2800 per month for 12 months… fix na po ba un ang babayaran? or as I said mo may other hidden charges? Maraming Salamat po

Walang hidden charges kasi may mga terms na kailangan mong i-accept bago ibibigay ang loan. Kung anong nakalagay doon, yun yung susundin na terms.

hello, medyo naguluhan na ako dito, and unfortunately wala nako copy nung mga terms. I just paid my 6th month installment so may 3 months pa ako, napansin ko lang 12k kasi yung principal ko so 12k divided by 9 months is 1333.33 pero ang nakalagay sa due ko is 1455.87 plus yung monthly na 224.26 which pag kinalculate ko is 1.86% nung 12k, so I am paying 1680.13 monthly tapos napansin ko din hindi nagmamatch yung remaining balance dun kapag naless na yung current payment..let’s say after nung first payment ko ng december last year ng 1680.13 may remaining balance daw na 10906.85 eh 12k less 1680.13 is 10319.87 na lang dapat. so far wala naman akong late payment and wala din naman ako nakikita na additional na fees, basta yung 1455.87 at 224.26 monthly, yan lang nakalagay so 1680.13 lagi, pero yun nga every month until etong last payment ko last may 25, 2022, lagi hindi match yung remaining balance less yung current payment. Nagsubmit ako ng ticket, sana maexplain nila.

Magkano po naging cashback nyo? planning to pay my loam in advance. 9 months 10k terms nung akin

800 something pesos… i think yun yung interest na dapat ibabayad ko pero dahil maaga kaya sinoli

Grabe po pala gloan, i forgot to pay my monthly due kahapon, P905.00. Now na babayaran ko naging 1,977- laki ng late charges 😭😭😂. Isang araw lng na late

Sa pagkakaalam ko po, kya po ganyan, dahil isinama na rin nila s billing ung next month mo, kya prang ngdoble cya. Pro in actual eto po yung:

Current Month Amortization + Late Charge/Fees + Next Billing Cyle (Month)

Kya parang ang laki ng Total Amt na babyaran nyo after lang ng 1 day late.

Sa pagkakaalam ko po, kya po ganyan, dahil isinama na rin nila s billing ung next month mo, kya prang ngdoble cya. Pro in actual eto po yung:

Current Month Amortization + Late Charge/Fees + Next Billing Cyle (Month)

Kya parang ang laki ng Total Amt na babyaran nyo after lang ng 1 day late.

Grabe po pala gloan, i forgot to pay my monthly due kahapon, P905.00. Now na babayaran ko naging 1,977- laki ng late charges 😭😭😂. Isang araw lng na late

I received an email from gcash na after 48 hours ay pwedi nang mag loan ulit. Is that true? Kasi yong iba sa mga comments ay hindi parin daw.

In my case, may SMS na nagsabi na puwede na ulit. You can try accessing GLoans again.

dapat mo pang mghintay na pwd na mkapagloan ilit?

aug 10 nkaloan ako ng 1k by august 25. monthy payment ko 196.70. may nakita akong mga 866 na balance. ngbabasakaling makapagloan ulit. aftrr may nkita akong another almost another 196. pg sept 10 starting day sa monthly duedate ko akala ko full payment yun pala may .09 pang remaining. aftr 24 hrs. d pa din mkapagreloan. aftr paying noong sept 10. my nakitang for oct 10 . pero zero lng naman ang balance

Pag fully paid na, sandali lang para makapagloan ulit. Pero kailangang hintayin muna na magreflect sa GCash side.

sure po ba na 48hrs ? or depende parin ? sana may sumagot

As long as nakabayad kayo nang tama mabibigyan po ulit kayo ng GLoan

I’m a first time gloan user- Can I pay my gloan with my gcredit ? Thanks

You can’t pay a loan with another loan

Good Pm.. salamat sa sasagot po..I availed 15k,payable 9 months.. 1st month ko po January na magbayad .if bayaran ko po this january.hm po rebate?? babalik ba ung unearned interest mismo??thank you

Yeah kung ano yung natitirang babayaran mo dapat na interes, ibabalik yun sa iyo

Can. I loan

Sundan mo lang po yung nasa post

Hi,

First offer po is 10k. last week i think.

Nung mag loan na sana ako today, amount was changed to 2k nlang po.

Idk po why 🙁

Baka nag-adjust GScore mo? Di ko rin sure kung paano nangyari yan.

how many gscore can avail gloan po?

Hi po sigurado eh, di siya public info

Hi, ask ko lang po, nakapag loan ako sa GLoan, pero hind pa ko eligible sa Gcredit? My worries now is if mg full payment ako, baka hindi n ko makareloan ulit since nasa 400 palang ung Gcredit ko.

Basta makafull payment ka, makakareloan ka ulit. Pagkaalam ko magkaiba ang GCredit at GLoan requirements. Ako nga wla akong GGives kahit na mataas ang GScore ko (750)

Hi, thanks sa gumawa ng blog na to 🙂 nasagot lahat ng tanong ko :)anyway, I applied for GLoan nun March 12, 1k un binigay na amount payable for 5 months. binayaran ko na po sya agad in full kasama interest nun March 18. 🙂 sana makatanggap ulit ako ng offer. 🙂

Hi, ask ko lang po, nakapag loan ako sa GLoan, pero hind pa ko eligible sa Gcredit? My worries now is if mg full payment ako, baka hindi n ko makareloan ulit since nasa 400 palang ung Gcredit ko.

Magkahiwalay po yun na product. Parehas sila tumitingin sa GScore niyo po pero di ibig sabihin pag enabled isa enabled rin yung kabila.

Hello, how recent yung 2-3 days lang ang hihintayin to reapply for GLoan? Marami kasi akong nababasa na umaabot pa ng buwan bago makapagloan ulit.

In my experience after a few days meron na ulit. Baka po nagkaroon ng issue with repayment? Di rin po kasi clear anong nangyari sa GScore nung mga balak magreapply na users.

How updated na pwede ka na makapag reloanafter 2-3 days after you pay it full? Some says na it takes months pa daw eh.

Speaking from experience ganun po kasi nangyari sa akin

Hello ask ko lng about sa Gloan, nag loan kase ako 11k in 9months (Nov9,2022) then na fully payment in advance ko na siya in this april 18 (in 5months) and today is april 21 na pero wala parin ako narereceive na sms or email from Gcash to avail ulet..

Ang question ko lng is need ko pa ba hintayin yung due-date (May9) nya? or automatic na dpat may marereceive akong sms or email at hintayin ko lng eto?

Thanks..

Ako po automatic nung pagbayad ko nang buo, pero after a few days. Sa inyo po baka kailangan ng konting hintay pa.

Hi! I just want to ask po kung saan ko po pwede makita yung Gloan remaining balance ko? Hindi din po kasi ako naka receive ng amortization schedule from gcash.

Wala po sa GLoan sa ngayon. Sa GGives meron, kaya sa palagay ko may update na mangyayari na mapaparehas sila.

Hi,

Can I ask po kung saan pwede makita ang remaining balance ko sa gloan? Or yung amortization schedule? Hindi po kasi ako nakatanggap ng email

Check niyo po galing gl***@*********ng.com yung email dapat

hello first loan ko sa gloan is 25k. tapos nag fully paid ako after months , then nag reloan po ako ulit pero yung offer is only 5 thousand.., paano nangyari, anybody has experienced like mine?

Ang makakasabi lang po ay si GCash kung bakit bumababa ang offer. Baka po bumaba rin ang GScore niyo.

I got a text message me from g cash na eligible na daw po ako for a personal cash loan worth up to 50k kaso may previous loan pa ako.

Di naman kaya siya scam? May hinihingi ba sa yo?

Hindi po scam nakarecieve din ako kaso may gloan pa ko that time now waiting po ako sana same as yours in 3days ahead makaloan ulit

Meron din ako nareceive na offer na 50k. Ngaun nag fully paid na ako…sa experience mo nkapgloan ka ulit within 2-3 days?

magreloan ako n paid ko n ung dati tas ngayun ok n relaon pero d ako mkpag push tyrough s reloan error tas after an hour ok n but ididnot recievds any funs ta my due n agad ako how come? d rin ako nkareceved n succesfull ang reloan

I-end pa po ba yung month term daw before mag advance payment para makareapply ulit agad?

ilang months bago mo nakuha ang cashback?

Days lang, around 1 week siguro

Akin isang buwan na wala parin 😑

Hi! Pag nag pay po ba full in advance, may notification din kung magkano yung expected cashback po? Planning on getting a loan pa lang din kasi hahahahaha thank youuu

Yes, magttext kung ano yung details ng cashback

How many days before i can claim my gloan?

What do you mean? You should be able to get it immediately once you apply for it.

I got scammed. somebody got my account details and voila i now got a GLoan to pay somebody’s item. Thankfully its only 1k and i just want to pay it full and bail out and close down my account. Please help me how to pay that Gloan fully, asap. thanks

Can’t you raise that case to support? You just need proof that your account got compromised.

pano pag my late payments before.. then nagbayad ng full in advance, pwede pa din ba makareloan? and magkano ung usual na inooffer pag reloan?

Yes, puwede naman. Di natin alam kung magkano ang next amount ng reloan.

Hello. May nakapagtry na ba dito na magadvance payment (i.e. paid the remaininh balance in full for 6 months) and reapply afterwards? How long bago kayo nakaavail ulit ng GLoan? And tumaas ba credit limit?

Hello. Ask ko lang po, kung nag-apply ka sa loan ilang minutes, hours or days bago po maconfirm o pumasok sa account mo ung loan?

Almost instant basta naapprove dapat

Good afternoon,

Ask ko lang po pag nag increase ang Gloan , nag iincrease din ba ang GCredit?

Depends pa rin sa GScore, di rin natin alam paano niya binibigay ang mga increase.

How to Increased Gloan ? I already paid in full payment my 1st Gloan but on my 2nd Gloan same Amount parin

Basta tuloy tuloy lang paggamit

After mag apply sa gloan wala pading nag rereflect sa account 24 hrs na nakalipas and update if approved ba or hindi

Hintayin lang po, minsan tumatagal bago siya iapprove

Nagpalit ako ng number sa gcash ko and nafully paid ko ng maaga ang GLoan balance ko, yung cashback koba automatic magsesend sa new registered number sa gcash ko ?

Kung saan po nakaassign ang GLoan dun mapupunta yung rebate