Here are 7 tips on positively increasing your GScore for higher limits on your GCredit, GLoans, and GGives.

As an advocate of GCash and digital wallets in general, I’m also subscribed to Facebook groups related to these topics. More often than not the topic of GScore comes up.

Specifically, many are wondering why their GScore keeps going down despite their efforts of using the GCash app.

As I said in my other post about GScore and GCredit, GScore uses GCash transaction data to record behaviors that we GCash users have as we use the app. In turn, these behaviors are what GCash uses to quantify a credit score.

With this in mind, I’ve decided to list down what habits GScore seems to reward and penalize.

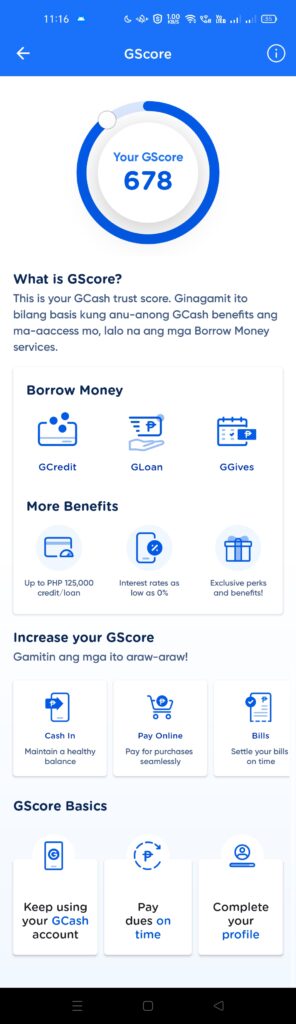

Here is a sample of my own GScore:

Given this information, the tips I’ll be sharing come from what I’ve been doing so far. Please take note though, these are my own thoughts and opinions on the matter, and should not be considered as actual parts of GScore rules.

These are proven in my case because I’ve been doing these tips for a while now and in sharing these I hope you will be able to see the same results. Anyway, here goes:

1. Have a healthy GCash balance at all times.

Many GCash users only use the app as a transaction passthrough app — meaning, they cash in small amounts and use all of it in a single feature like Buy Load; or transfer all of it via Bank Transfer.

Having a healthy GCash balance proves you can repay your loans more often and also makes you more likely to use other features like Pay Bills or Pay QR which is rewarded by GScore.

Many bank savings accounts have penalties if you go below a certain amount average per month. Think of your GCash balance in the same way. The higher the average amount in a month, the higher your GScore can potentially go.

Personally, I have Php 100-500 as my balance at all times. It’s also helpful to have some money in my wallet since I also have an auto-debit with GSave every week. Also, you are more likely to use your GCash when you have a positive balance.

2. Use your GCash app regularly.

Many users complain that they use so and so features regularly, but “regularly” can mean differently depending on the person.

Let’s put it into more concrete terms. How regularly do you use the app? Two times a week? Three times? GCash can detect how often you log into the app. So if you use the app every day, you will definitely be eligible for a higher GScore.

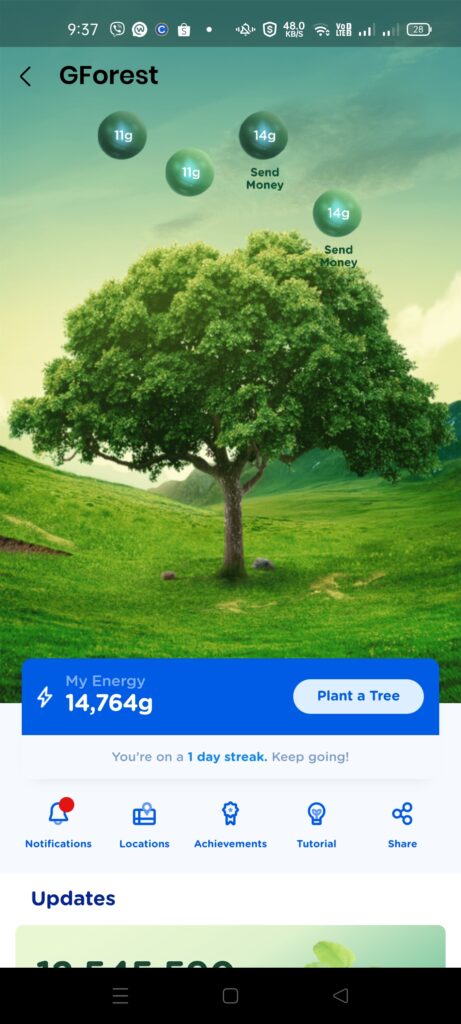

Think of it this way, if you log in every day to get GCash Forest energy points, it definitely contributes to your total score. Consistency is key.

3. Save and Invest regularly.

Do you use GSave and GInvest? How often do you deposit or invest? Generally, if you use these financial services, you are better off, since it means you have better money habits than the majority of GCash users.

This is also connected to Tip #1 (Having a healthy balance) — if you put your money into more valued services than just spending or withdrawing it all away, then all the better your credit standing becomes.

I suggest setting an auto-debit for GSave, even a small amount every week will do. Putting money into GInvest regularly, on top of GSave would also be definitely better for your score.

4. Use as many features and services as you can.

If you use your GCash regularly, then it most likely won’t be limited to just a single feature, like Buy Load for example. You would also be paying your bills, or using it to buy from merchants online and via QR code. GLife has made it easy to find products and services that are purchasable by GCash.

Let me emphasize: Make GCash Forest Energy Points matter to you.

If you log into GCash every day to check your tree (you should keep the streak going), you would naturally be doing more activities that generate more energy points.

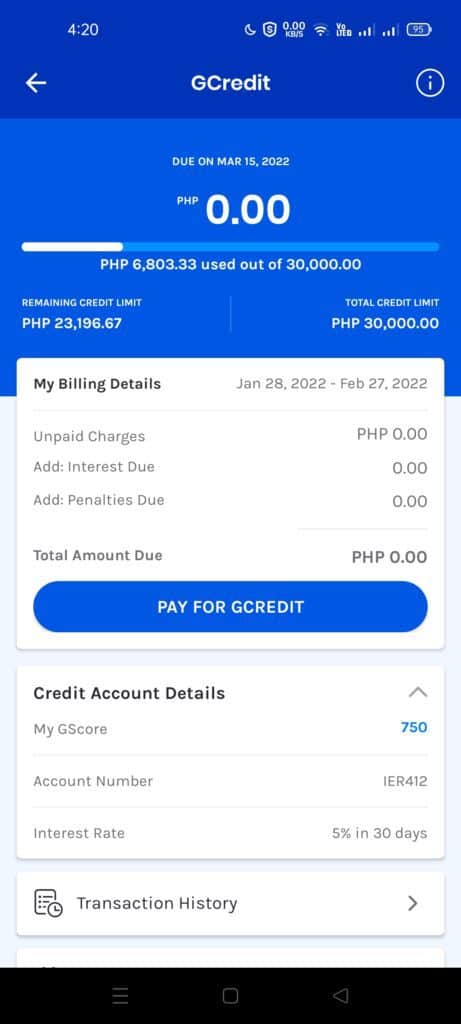

5. Use and pay off your GCredit, GLoan, and GGives on time, every time.

GScore is a measure of how bankable a person is. As a result, it also tracks loan usage and repayment. You should use GCredit and show that you know how to use it. This also applies to GLoan and GGives.

Pay your dues as soon as you can, and avoid penalties. You will definitely be rewarded with a higher score as a result.

6. Link your Bank Accounts.

As you use the GCash app, you would eventually notice that cashing in is definitely easier when you have a bank account or debit card linked. You would not need to go to a 7-11 or a remittance center to cash in.

Likewise, cash-out is definitely easier when you can Bank Transfer to the bank you are linked to since you can transfer to your bank and withdraw using your ATM card for that bank.

Alternatively, you can also use a GCash Card for cash-out as you can use it in any ATM anywhere.

Bank Transfers are also a good indicator that you use the GCash app regularly. If you use debit card cash-in in conjunction with the bank transfer cash-out method I mentioned above, then you are better off, since you will definitely be using your GCash app more often.

7. Pay most if not all of your bills using GCash.

I’ve explained in Tip #4 (Use GCash services) that we should use Pay Bills more often. For example, if our transaction data shows that we paid a lot of different utilities, then it means that we have a good financial capacity in general.

One of my theories is GScore does not only track the number of billers we pay in the app but also the type. For example, if we show that we use GCash Pay Bills to pay for our car insurance — it also infers that we have a car. This can also translate to a higher ability to pay off debts.

Why am I not unlocking my GCredit limits?

It takes time and consistency. You may see your GScore go down, but the key is not to be discouraged. Eventually, you will also be able to achieve higher GCredit limits.

Summary

I explained some observations I had regarding GScore and I summarized them into seven tips.

Basically, if we need to have a better GScore, we need to trust GCash and use it every day. I know that sometimes it is hard for this trust to come along sometimes with GCash and all of its numerous issues, but give it a chance and GCash will reward you for that trust.

The tips I mentioned above are only my thoughts on the matter and there is a chance I may be wrong with my assumptions compared with the actual GScore rules.

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

i have xperiance a gcash dereasing

Even after following these tips?

mine any transaction i did my gscore is not increasing :/

How consistent were you? GScore rewards consistent use of the app. Did you try to do it everyday? At least getting energy points for gcash forest?

Bro i do it everyday and my gscore still the same..

How high is your GScore?

This is true..

Thank you sa tips.

Gcredit is unreliable. I spent 30 minutes in-store waiting…because repeated attempts only came out with “System is busy, try again later”..I just gave up left the store and went home…that was a hassle.

Sorry to hear that, unfortunately, GCash goes through downtimes sometimes. Just like having the risk of your credit card being declined, I would suggest anyone have at least some balance in their GCash or have an alternative way of paying via cash.

I used my GCash regularly and by regularly I mean up to 3 times a day. I’m using it to pay all of my bills, I pay via QR, I send money, I cash in through linked bank outs, sometime I even send load to my nephew, I’m using GSave and I deposit 3 times a month. Yet, my GScore is moving so slow and now just noticed that it went down a bit.

May I ask why you are tracking your GScore? Are you trying to unlock your GCredit? Suggest you don’t try to make it a big deal and just keep on using your GCash app.

I am using my gcash like 5 times or more a day , but instead of increasing my gscore ; it decrease

Di lang yan sa quantity, pati sa quality ng transactions. For example, anong klaseng transactions ba ginagawa mo? Buy load lang ba? Or Send Money? Try various types of transactions. Also, di mo dapat papansinin ang GScore, basta gamit lang palagi dapat.

naka 2months trasac lang ako naka 10k limit kagad ako ginagamit kolang sya using paybills tapos more on my AUB AND RCBC Credit card lang hassle kasi pumunta banko lalo na pag natapat ng monday tapos wla ka naman ibang check ipapasok or cash kaya madalas gcash ginagamit ko gulat ako 500 kagad gscore ko tapos may 10k limit kagad

That’s makes their scoring system unpredictable, may higher GScore ako sayo pero 2k lang na approved saken.

Their algorithm is quite unpredictable. I have been using GCash regularly but my credit limit was only 2k even with a high GScore, unlike my friends who don’t use GCash that often got approved with 10k, other got 5k credit limit. And I got higher GScore than them. Quite unfair.

Chinecheck din yata nila ang credit score sa banks at mataas gscore pag nagbabayad ka ng credit card using gcash

I think this is because they turned off graduation. Your score as of application dictates the credit limit you’ll get, so if you applied when you had a relatively low score, it’s possible that you’ll get a lower CL compared to your friends if they applied once they reached a higher score bracket.

Malaking pera na ang napamcash in ko at send money.. walang increase.sa.gscore ko

Di lang po cash in at send money nakasalalay ang gscore, behavior ito as a whole in using the gcash app. Kung ginagamit mo gsave, ginvest at yung ibang mga gamit ng app mas tataas gscore mo.