GScore is a built-in credit score in GCash, and GCredit is a revolving credit line in GCash.

Think about the people that don’t have access to credit. They are the ones who fall prey to loan sharks and other predatory lenders. They get bogged down by paperwork and bureaucracy in government. They get refused by big corporate lenders and banks.

What if we could help them by giving them a way to borrow money safely, without collateral as long as they provide 1 official ID? In GCash you only need to be Fully Verified to access financial services.

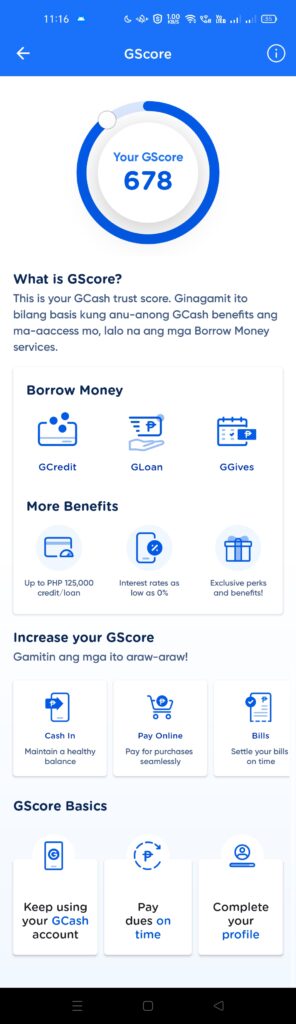

What is GScore?

GScore is a type of credit scoring that uses your GCash user data as a measure of your credit history. The higher the score, the more financially worthy you are considered to be.

In China, with a better Zhima Credit score, they can forego deposits with renting stuff like bicycles, or they can provide better loan rates for apartments or cars. Bad credit can mean more identification is needed for financial transactions. In the US, your FICO score determines your mortgage payments, your loan terms, and your credit card standing.

Here in the Philippines, we currently don’t have a nationwide centralized scoring system, however, we do have a credit bureau. Nonetheless, GCash created its own credit scoring system, using user behavior through transaction data as its source for scoring.

How does GScore work?

In the GCash app, your historical transaction data will be the source from which your GScore will derive. You can increase or decrease your GScore by the habits you practice regularly.

This may look like we’re giving up privacy to get credit but this is all voluntary. You can choose to ignore GScore in the app altogether. However, if you do decide to opt in you can get access to better deals and lending options in-app.

How can I make my GScore higher?

The algorithm GScore uses puts more weight on the quality of your transactions, meaning cashing in an amount and then simply cashing it out will not move the needle. Your GScore may increase or decrease depending on usage. If you are practicing good financial behavior in using GCash, then the GScore algorithm will reward you with a higher score.

Here are some simple tips to make your GScore go up:

- Keeping a healthy, positive balance; don’t leave your GCash wallet empty

- Linking a bank account then doing cash in and cash out via bank transfer

- Investing in GFunds by putting in money regularly

- Depositing money in your GSave account regularly, and using different GSave partners

- Using varied GCash features like Send Money, Buy Load, Pay Bills, and Pay QR regularly

- Using GCredit, GLoan, and GGives, and also paying off your loans without incurring penalties

- Use GCash regularly; you should be using it enough that GForest Energy Points matter to you

- Buying GInsure products and paying your dues diligently

- Checking out GLife stores and purchasing products

How often does your GScore readjust?

It is unclear when GScore readjusts, but we do know it does so regularly and seemingly looks at your transaction history data weekly. Do not get discouraged by a lowering GScore. Even if your GScore lowers, your credit limit will likely still remain the same as long as you keep using your GCredit.

What is GCredit?

GCredit is a line of credit provided by GCash, and it is tied to your current GScore. The higher the GScore, the higher the credit limit you can have.

GCredit is the one way we can utilize our GScore. Basically, it’s a revolving line of credit but with daily interest.

This is in line with GCash’s mission to provide financial services to people who are traditionally not covered by these. The truth is that Filipinos have the least credit card usage in the ASEAN region.

Can I cash out my GCredit?

You cannot cash out your GCredit. However, given a big enough GScore, you can be qualified to cash out a loan using GLoan. This is a feature where you are given a cash loan with terms depending on your GScore.

Can I use GCredit and transfer it to my bank?

No. If you would like to avail of a cash loan to transfer to a bank account, you can opt for GLoan.

Can I use GCredit and transfer it to another person via Send Money?

No, GCredit is only for personal use. If you would like to avail of a cash loan to send to someone else, you can opt for GLoan.

Can I borrow in GCredit via installment?

No, however, you can avail of GGives, which provides you with a pay-later installment method for GCash.

How do I get GCredit?

You need to be fully verified in the GCash app. Once you get to a high enough GScore, you will receive a notification that you can activate GCredit. The actual GScore that will unlock GCredit is not disclosed by GCash.

GCredit terms will depend on your GScore. There have been anecdotes from users that they were given big terms immediately, but for others, they were given smaller terms then these increased gradually from continued use.

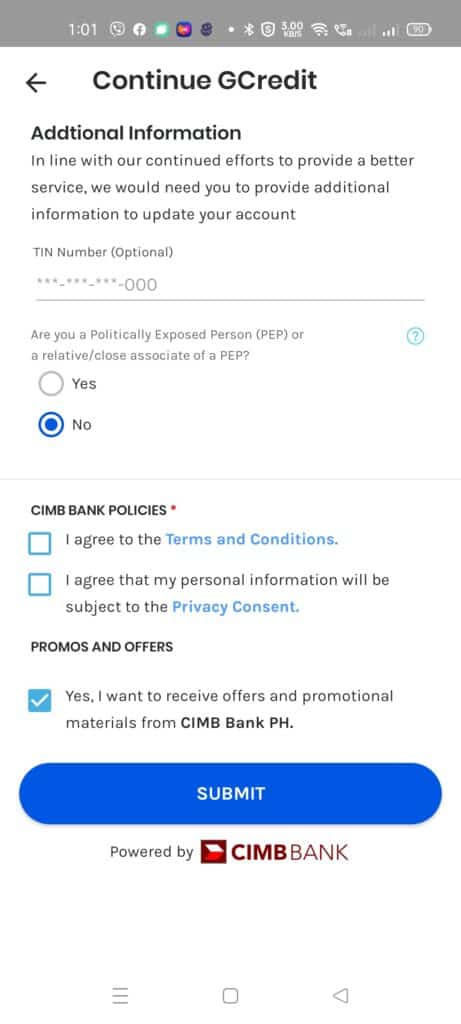

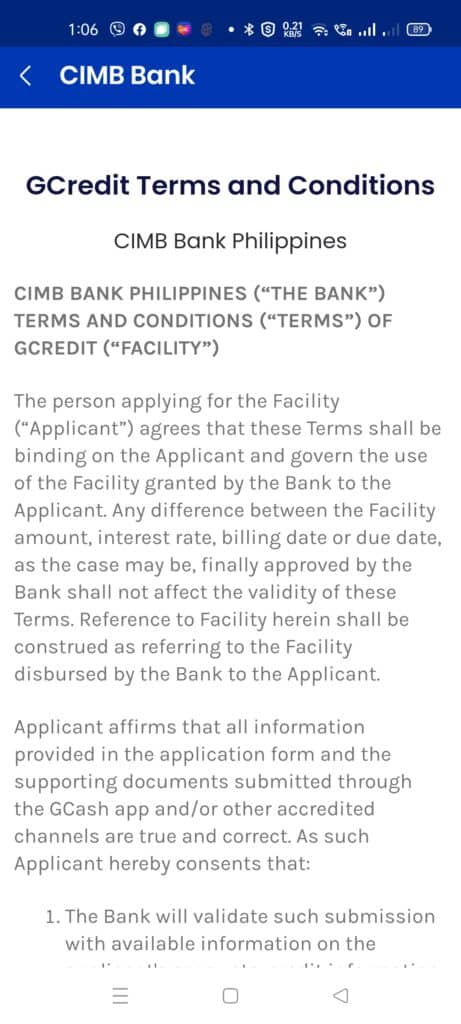

Opting in to GCredit

GCredit is powered by CIMB Bank. This is why some promos with CIMB Bank are also tied up with having GCredit enabled. As such, you need to opt into agreements as CIMB is a third-party provider of GCredit.

Can I not use my GCredit?

You can opt not to activate GCredit. You will not incur any fees or penalties if you do so.

Can I cancel my GCredit?

You can have your GCredit terminated via GCash Support.

I have multiple GCash accounts. Does this also mean I have multiple GCredit accounts as well?

No, your GCredit is only tied to your main account.

Does GCredit have an annual fee?

There is no fee when using GCredit, aside from the interest and fees.

How do I unlock a GCredit of 30000?

In my opinion, I’ve personally achieved Php 30,000 GCredit by being able to hold on to a max 750 GScore for almost a year.

However, this may differ from your experience. I recommend you keep on using your GCash on as many features as you can.

How high is the interest rate?

If you let your GCredit accrue for a month, the total is by default 5% on top of the principal amount. GCredit also compounds daily instead of monthly.

What does daily compounding mean?

It means that the interest rate is computed per day, instead of per month. If you paid your GCredit sooner, you would pay a lower amount in total than if you paid a month after.

This also means that if you used GCredit today and paid it off today, there is actually no interest incurred.

Can I use the full amount again if I paid my GCredit earlier?

Yes. Another advantage of paying it off early aside from the lower interest payment is you can use your full credit again even before your due date (revolving credit).

For example, you have a Php 3000 GCredit. You used it to pay for your groceries amounting to Php 1500 today. If you pay it off the next day, then your GCredit returns to Php 3000, and you can borrow the full amount again.

Do you have a sample interest computation for GCredit?

If you used GCredit to pay 500 pesos to a merchant, and you plan to pay it off the week after. How much interest in total do you have to pay?

Given: Principal = 500 Interest = 5% = 0.05 Days Interest Incurred = 7 days / 30 days Formula is: Total Amount Due = Principal x (1 + (Interest x Days Interest Incurred)) So the total amount due after 7 days is: 500 x (1 + (0.05) x 7/30) = 505.83 What if you'd paid it later, for example after the full month? 500 x (1 + (0.05) x 30/30) = 525.00

The total amount to pay is 505.83. If you paid it after a month, you would have paid around 25 pesos more.

Keep in mind that the interest rate is based on the default 5% rate. A higher GScore can also mean a lower interest rate. Please check your GCredit page.

How long is the Repayment Period for GCredit?

You have a total of 46 days to pay your loan without penalties. The billing period is 30 days. Your due date is 16 days after the last day of the billing period. This is called the billing date.

So to summarize the definition of dates on the Manage GCredit page:

- The billing period is the date from when you started your GCredit usage and count 30 days from that date

- The billing date is the first day after the billing period

- The due date is the 16th day after the billing period

Your billing period and your due date both depend on the day you signed up for GCredit. Please take note that the loan has a daily interest.

So for the example below, you have your billing period from July 28 to August 27. Your due date is 16 days after August 27, which is Sept. 13.

The very last day to pay your dues will be on September 13. If you pay after September 13, then you will need to pay the penalty fee on top of your dues.

Why can’t I see the interest incurred on the Manage GCredit page during the billing period?

The interest due when you use GCredit is not reflected in the Manage GCredit page until the billing period ends. Understandably this confuses most first-time GCredit users. You will only see the interest due on this page when you’ve received your Statement of Account on the billing date itself.

This is why it’s so important to pay your GCredit off as early as you can since you can only see the total interest due when you receive your statement.

What is the Minimum Amount Due in GCredit?

As GCredit uses revolving credit, you have the option to pay only the minimum amount due. As long as you pay this amount, you won’t have penalties and your GCredit won’t be disabled.

The downsides are you would not be able to access your full GCredit amount (only the amount you paid for is replenished), and the unpaid amount will incur interest that would roll over next month (5% prorated daily).

The computation of the minimum amount due is:

Minimum Amount Due = 10% of the Unpaid Charges + Full Interest of the Month + Penalties (if applicable)The unpaid charge is the amount you need to pay to make the GCredit balance zero. For example, if your GCredit is Php 10000 and you used Php 5000 of it, that is the unpaid charge. Fifteen percent of Php 5000 is Php 750 in this case.

The full interest is the interest incurred when you used your GCredit this month. This differs depending on if you paid early or not. Otherwise, it’s 5% prorated daily.

Penalties are applicable if you failed to pay on time previously.

What does the GCredit Statement of Account look like?

The statement of account is sent to your email after your billing period (at your billing date). For example, for the billing period above (July 28 – Aug 27), you would be receiving the statement on Aug 28. You would then have 16 days to pay your dues (September 13 from the example above).

For the screenshots below, I used my own statement as an example:

What happens if I don’t pay my GCredit dues?

You will incur penalties depending on how long you went on without paying your dues. Here is a list of the penalties corresponding to the number of days late (meaning after the due date):

- 1-30 days late = Php 200

- 31-60 days late = Php 500

- 61-90 days late = Php 900

- 91 days and later = Php 1500

So it is best to pay and settle as early as possible. If you are not able to pay after 3 months, your GCredit will be deactivated or revoked and your GScore will crash as well.

If you don’t pay your dues, GCredit will automatically debit your GCash balance. Any attempts to cash in or deposit will not be effective as the payment will take priority. GCredit will also be disabled until you’ve paid off your remaining dues.

If you’ve been delinquent for a while, you may receive a notice letter as well. Since your GScore also goes down, your GCredit will eventually become deactivated or revoked when it goes down enough.

Why did my GCredit amount decrease?

Some factors that may affect your GCredit include:

- You don’t use GCredit at all.

- You failed to maintain the proper GScore for your GCredit limit.

- Your GCredit is not maximized for your actual need of it. An example is if you have Php 10000 GCredit, but you only use Php 1000 per month, then it may also cause your GCredit to go down.

Where can I use GCredit in the GCash app?

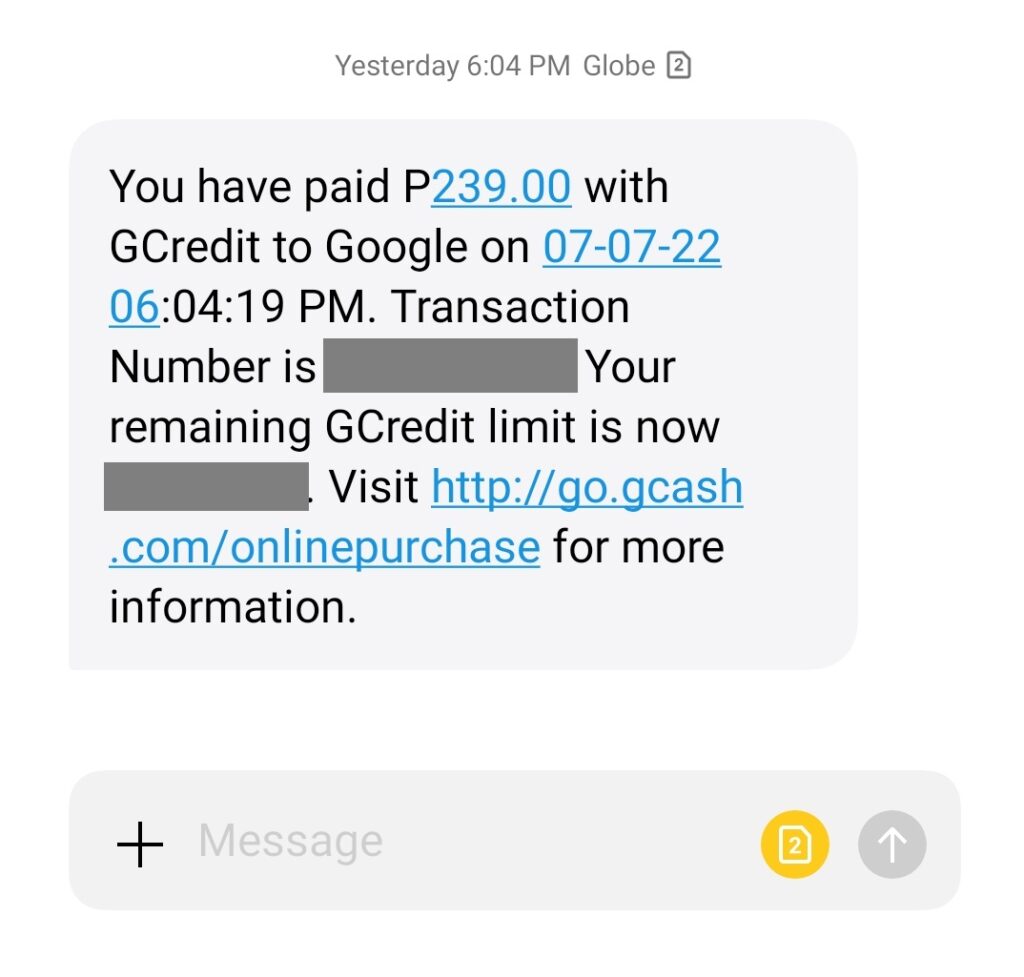

You can use GCredit to pay merchants or bills in the GCash app. You can also pay on web pay/online payment merchants using GCredit. Additionally, you can also use GCredit with GLife merchants and with Alipay+ partners like Google, FoodPanda, and Apple Store.

Can I use GCredit in Lazada?

No, once you link your GCash account in Lazada, any payment will draw directly from your wallet balance. You can instead use LazPayLater for paying using credit.

Can I use GCredit in foodpanda?

No, you can only pay using your GCash balance.

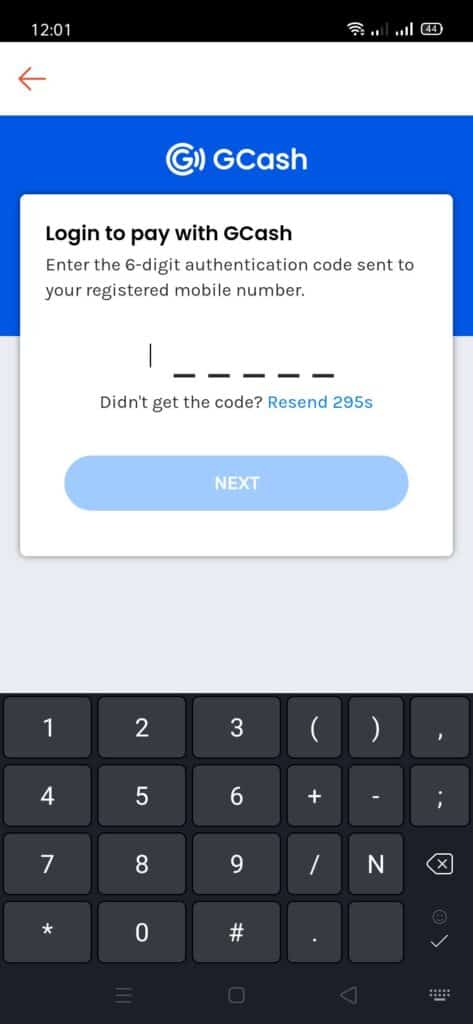

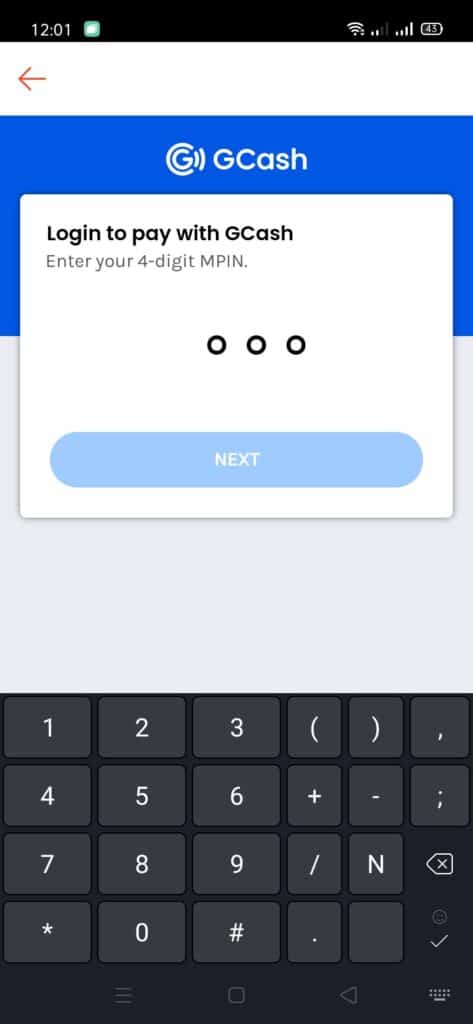

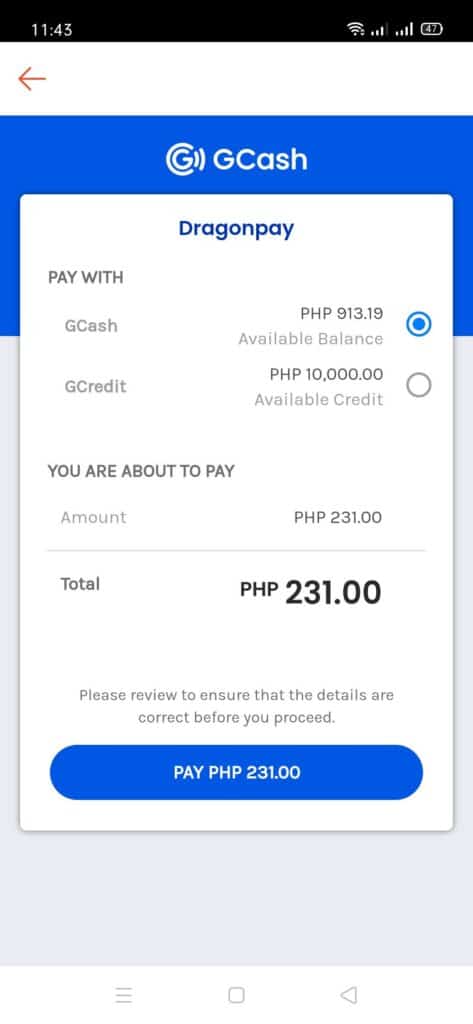

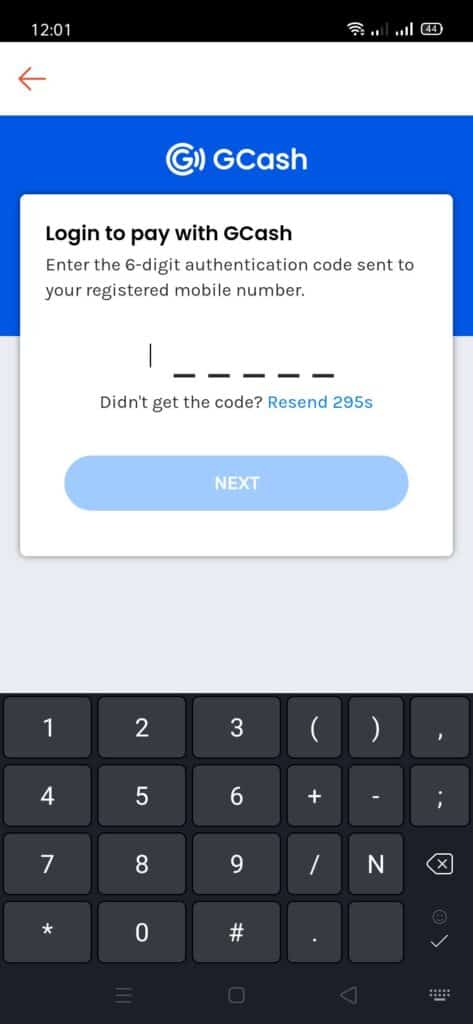

How do I pay with GCredit via Online Webpay?

You will be able to select GCredit as a payment mode while paying with most web pay merchants.

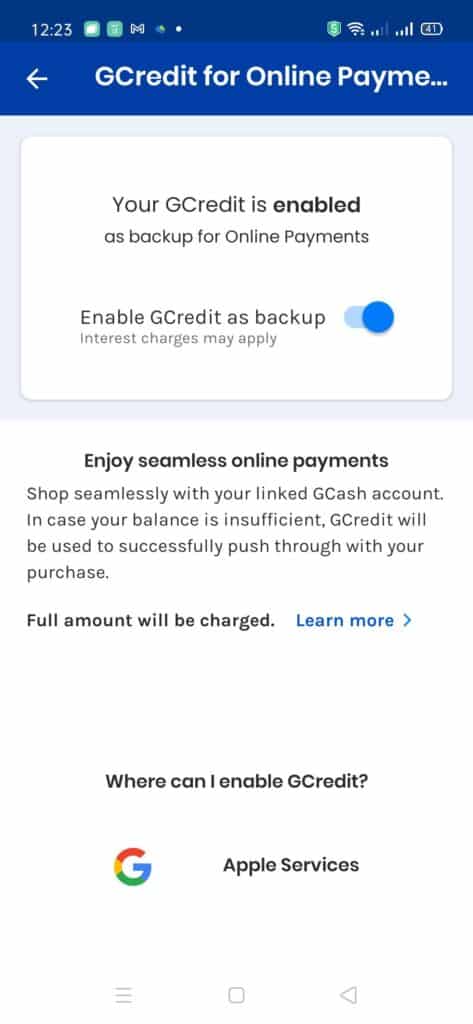

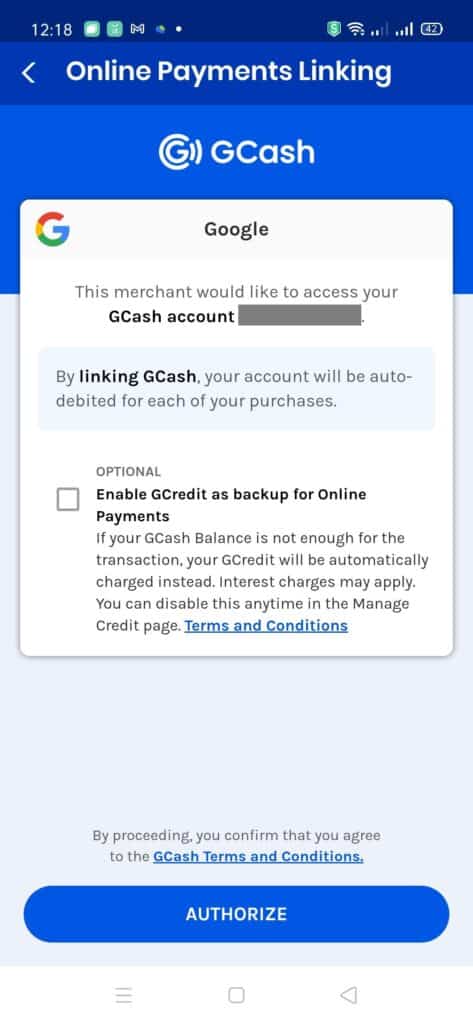

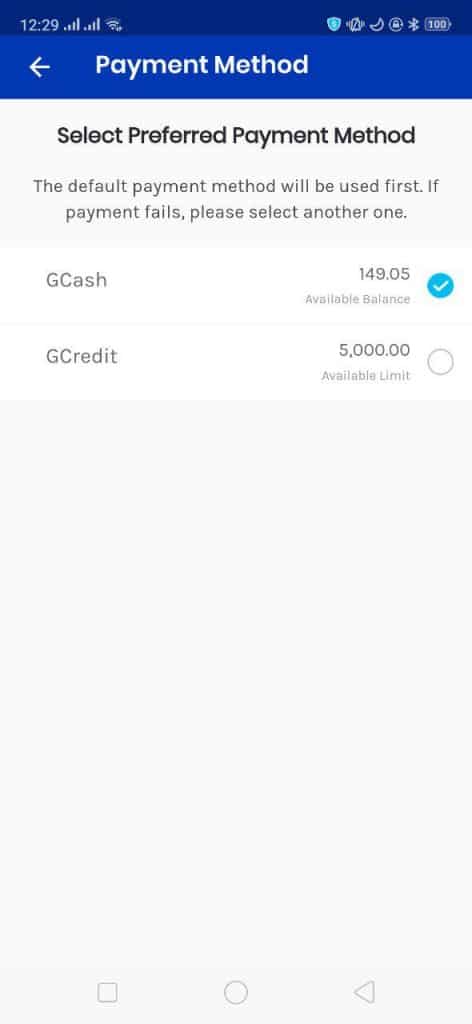

How do I enable backup payments via GCredit?

You can also enable GCredit as a backup payment method in case your balance is not enough to pay for a subscription. This works with online merchants with GCredit enabled.

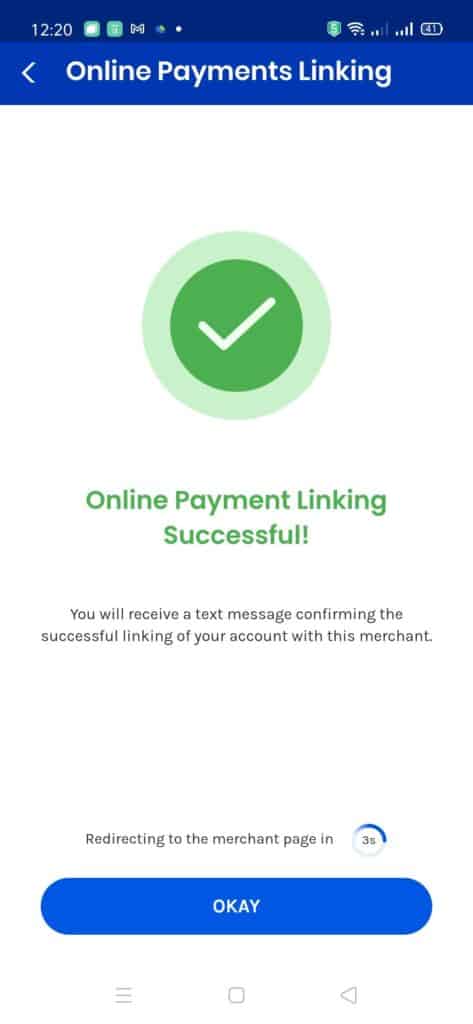

How can I link my GCash with Google Play and use GCredit to pay for subscriptions?

As you can use your GCredit as a backup to pay for online payments, you can also use this to pay for your Google Play subscriptions. You just need to link your GCash with your Google Play account.

To disable this function, you can always tick on the “Enable GCredit as backup” in the Online Payment Settings of the Manage GCredit dashboard.

Why can’t I use my GCredit in my payments?

You need to update your details with CIMB Bank (please see Opting into GCredit section above).

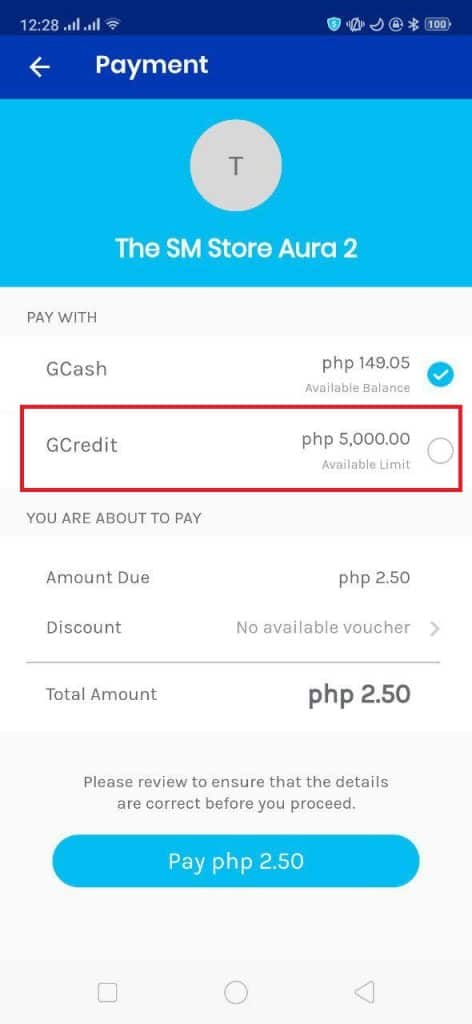

How do I pay via Scan QR / Generate Code?

For Scan QR, you just need to select GCredit as your method of payment once you reach the confirm payment page.

For Generate QR Code, you need to select it below the QR Code itself.

Can I use GCredit for payments in 7-11 / 7-Eleven?

No, you can only use your balance.

What merchants support GCredit?

Most merchants have this enabled across any payment method (scan-to-pay, online payments, GLife).

How do I pay my bills using GCredit?

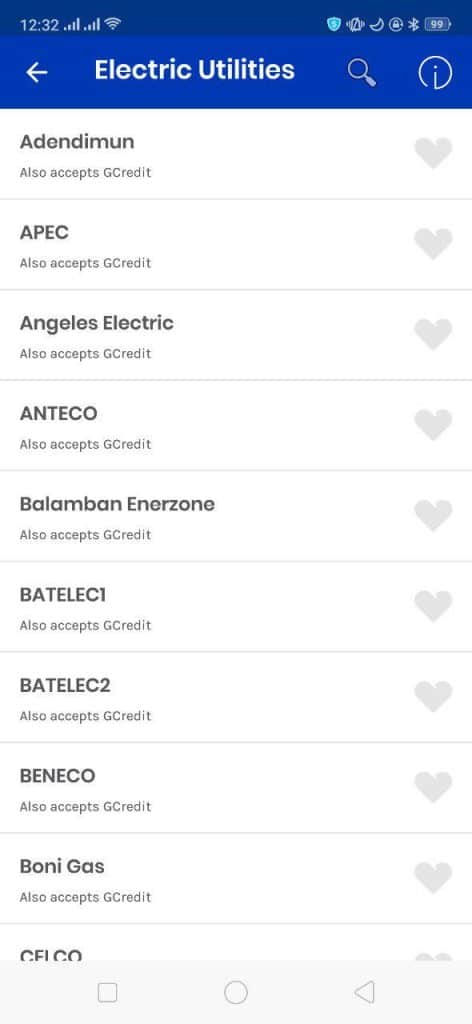

You can see “Also accepts GCredit” on the biller itself. For example, here are the billers under Electric Utilities:

When GCredit is down or under maintenance, the “also accepts GCredit” line disappears. You cannot use GCredit with government billers and with third-party loan companies.

These are biller categories in the app that support GCredit:

- Electric Utilities

- Water Utilities

- Cable/Internet

- Telecoms

- Insurance

- Real Estate

- Healthcare

- Schools

- Transportation

Can I use GCredit to pay for Home Credit or credit cards?

No, as you cannot use debt to pay for more debt.

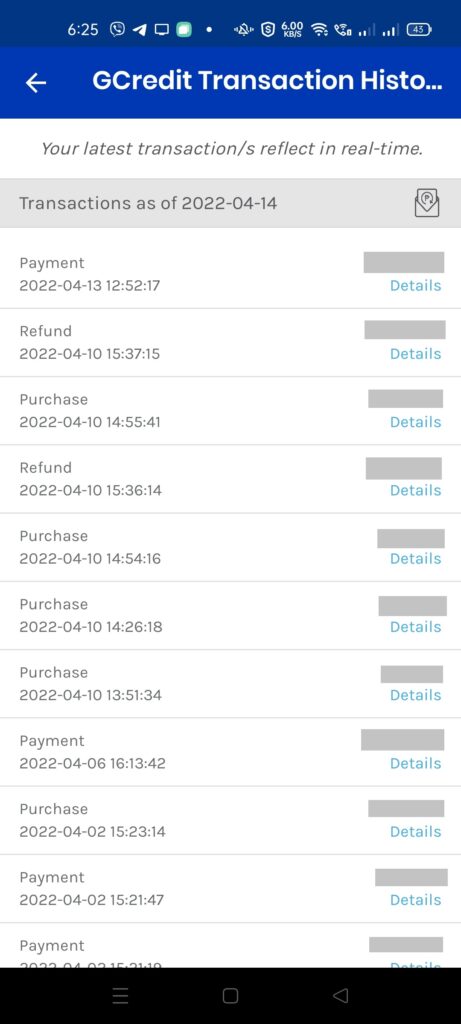

How do I check my transactions using GCredit?

You can use the Transaction History in the GCredit dashboard. This is real-time, so you can check immediately after your transactions.

You can also request an email with your transactions on the same page.

Can I still use my GCredit even if my GScore goes down?

Yes, until you reach a certain amount. If your GScore passes this amount limit or you remain inactive for a long time, your GCredit will be deactivated.

How do I reinstate my GCredit if I got deactivated?

You can file a ticket in the Help Center and request reactivation. Although, one of the requirements is a high enough GScore to be able to use GCredit again.

Why can’t I see the GCredit option when paying via QR or via pay bill?

When there is no GCredit option, either the merchant/biller doesn’t support GCredit payments, or GCredit is under maintenance in the meantime.

Can I use GLoan and GGives with GCredit?

Yes, you can all use them together. Also, using GCredit regularly also fuels your GScore to enable GLoan and GGives. Once you have them, you need to take care of them as these are all tied up to your credit score.

Summary

We talked about GScore and how it represents your creditworthiness as you use the GCash ecosystem. You can increase this by the quality of your transactions in GCash, not only by quantity — at the very least, you need to use GCash so much that GCash Forest matters to you.

The GCash app can provide a corresponding GCredit amount depending on your individual GScore.

GCredit is a safe way of providing credit to those who traditionally have no credit cards and no savings account, without leaning on high-interest lenders. Its main difference with credit cards is the daily compounding, compared to monthly credit cards. This makes it more flexible as you can pay it off early.

Another huge difference for GCredit is you need to pay it off fully before being able to use it the following billing period. It will also automatically debit your GCash balance once you have missed your payments.

Related Topics

- GScore – Tips on how to increase your GScore

- GLoan – How to avail of cash loans in GCash

- GGives – How to avail of the installment method in GCash

- GInsure – Buying cheap insurance within GCash

- GInsure Bill Protect – Buying protection for paying bills

I have a new e-commerce site where you can buy some e-books here: GCR Prime

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

What happen to my Gscore I pay on time and also I use Gcash Everday. From 633 Gscore to 578 Gscore please help me. Thank you!

I’ve written a post to help you with tips to increase GScore — 7 Proven Tips to Increase Your GScore

I have a gcredit but it doesnt appear whenever I pay.

Starting last week GCcredit has been under maintenance, even until now. Let’s wait until it’s available again.

There may be maintenance going on that’s why it doesn’t appear.

hi , my gscore is now over 400 , but it still doesn’t unlock the gcredit

It will eventually unlock. Just keep on using the app.

Mine also i already paid my bill but gcredit doesn’t appear

Having a gscore of 400 DOES NOT GUARANTEE UNLOCKING OF GCREDIT.

In my experience my GCredit unlocked at that level and I also talked with others who experienced the same. I suggest you keep on using your GCash, it will unlock as long as you keep on using it. It isn’t actually a switch that toggles when you reach 400 but more of a higher probability of unlocking it. The actual rules are known only to Mynt/GCash.

indeed. 419 but still cant use gcredit

mine got unlocked with 460 gscore

Thanks for this. Very informative and helpful.

Thanks for the infos. much better than the answers from the agents of the customer service. hehehe

Regarding the update of the gscore, is there a specific day when it updates?

Actually I don’t know the exact day, but it seems to do so weekly.

Some Government BillPay does not accept GCredit and Only Gcash.. Why? e.g MMDA. Also What is the Highest possible Gscore a person can have? WHat is the Minimum Gscore to have a 30,000 limit?

For government billers they specifically don’t allow payment via credit.

Highest possible is around 800+.

I can’t really say what the minimum gscore is to get that amount. Perhaps 800? Currently I’m at 750 and 10k.

where and how do u use your gcredit?

It’s basically credit built into GCash. I think you would best learn more by reading the post itself.

Very helpful information here, thank you very much. I unlocked my Gcredit when it reached around 531. But note that I did not try to unlock it when it was below that score. Just happened to be curious and hit the button if it will unlock that time…

I recently received a text message from Gcredit notifying me of an increase gcredit limit. Now, on the app theres this red notification dot in the manage account icon. However, there is nothing to do about it once i’ve gone inside the app. And the red notif dot still remained as well as my credit limit remained the same.

I don’t know what to do regarding that – maybe you can wait it out. But if it’s still like that after a couple of days, then it’s better to file a support ticket.

Same with mine. I received a notification that my limit has been increased. But there’s no option to somehow activate it. The red dot is still there in ‘manage credit’. Filed a ticket but no reply yet.

What happens, if i did not use my gcredit? does it lowered my gscore? Does it close ny Gcredit? Does using gcredit also increases my Gscore?

Yes, I’ve found that using GCredit also contributes to GScore as long as you use consistently and also pay on time.

The G score is not realistic I have cash in over 75k peso an the score is going down

I also buy load for my self an friends

I do bank tranfers

The score system is not well designed

Did you try using GSave and GInvest? I’ve found that the best way to make your GScore up is to use these consistently. And also, how often do you use the app? You said you cash-in over 75k, but is it in a single transaction? GScore seem to like consistent transactions more than the one time big time ones.

Hi can i ask, How bout i use gcash everyday and each week i cashin and transact different Bills. But my gscore remains 354. Its almost 2 weeks

Perhaps it’s because you use GCash transactionally (in and out). You may need to use value added services like GSave and GInvest to show that you have good financial habits.

Pls remove my gcredit, i dont want to use it…hiw to deactivate it?

Once you’ve activated it, you cannot deactivate. You can just choose not to use it.

do i still need to pay the gcredit balance even if i didn’t use the given amount? i received 1000 which is I can’t use because i’m residing abroad and i don’t want to use it either. any possible way to get rid of it?

If you do not use it then you don’t need to pay anything. You also can’t get rid of it once it’s there.

I have 2 gcash accounts by 2 different mobile numbers. Both are in my name. Both are fully verified. I have for sometime been using gcredit via one gcash account now with 2000 gcredit limit using my mobile phone. The 2nd gcash account recently got unlocked with 1000 gcredit limit. Can I be using the recent gcredit at merchant partners too? I would love to be using them both.

Yup, as far as I know you can use both GCredit accounts without any penalty.

I’m also stuck at Gscore of 750 and GCredit of P10K since October 2019. It didn’t move since then. I’m using GCash almost everyday.

Im exceeded credit limit but theres a bal. On my gcash wallet when can i use it,, actually i always cash in/ cash out on my account,,can i request an increase on my credit limit

Actually you can temporarily increase your limit this ECQ. You just need to contact support to have it approved.

Hi, at 750 GScore, how much is your Credit Limit? Does it help increasing my GScore if I have lots of GSavings and GInvest but less transactions in Paybills and Pay QR?

10k GCredit is unlocked at around 600 GScore. Right now 750 is the ceiling. I don’t think you can go higher at the moment.

What if i only paid the total purchases and i don’t want to pay the interest and penalties is there a possibility that interest and penalties occur interest or charges?

Do you mean you don’t want to pay for the interest? Then you should pay your gcredit the same day you used it.

Hi GCR, how much GCredit does a GScore of 750 have?

Right now based on experience, it’s 10k

hello, i activated my gcredit and it gave me P2000.00 worth of credit limit. what if i dont use it all? does is still apply to charges?

No, if you don’t use it, there are no charges.

Hi, How much gscore did you have to activate gcredit with 2K worth? 🙂

I’m not really sure, mine just jumped from 1k to 5k then to 10k. I suggest you just keep on making your GScore go up.

Gscore went to 400 already but I cant activate gcredit yet? I also haven’t recieved any text message from gcash, does this mean I’m not eligible??

Sometimes it takes time. Don’t worry, it will unlock sooner or later.

thank you 🙂

Gscore already in 410 since last week but still cant unlock gcredit. Whyy? 😢

I suggest you keep on using it, don’t worry, it will unlock soon. The actual rules to unlock are not really publicly shared by GCash, I just shared what I experienced, which was a GCredit unlock around a GScore of 400.

Will I be charge if I only pay a fraction of my amount due plus the interest amount on my due date?

Basically, you will not be able to use GCredit until you’ve paid all of your dues. Also, GCredit will be deducting from your balance until you’ve done so.

Don’t worry though, the deduction happens at certain times of the day (mostly at night). GCredit will be sending an SMS before it deducts your balance.

Uhg my GScore is already 661, but I still have a credit limit of 1,000 😕😕😕😕😕 I use GCash every day. I invest every once in a while. I save every pay day. My heart aches so much seeing my credit limit not going up.

I don’t know how to help you regarding this. As far as I know, once GScore reaches a certain level you should be able to unlock a higher limit. Have you been paying off your GCredit bills?

In my experience, GScore updates every tuesday of the following week.

My current GScore is 560 with 2k GCredit and gets a steady 25 points every week.

Do i need to link a debit card to unlock my gcredit?

Not necessarily. You only need to keep on using your gcash app and make your gscore go up.

Oki thank you

How can i re-apply for my gcredit?

Re-apply? Once lang po nangyayari yun, pag umabot na ang GScore mo sa tamang value.

How to reactivate gcredit? Had it and used it before and stopped using it. Still have my gscore at 390 but need to reactivate gcredit for i haven’t used it in a while. Anyone

Better file a ticket to check. Did your GCredit get revoked due to unpaid dues?

how to use Ginvest?

Have a look — https://gcashresource.com/invest-money-ginvest-a-beginners-guide/

Very informative!

Pwede ba pagsamahin ang gcredit at yung balance pag sumobra yung babayaran mo sa limit ng gcredit?kunyare nag grocery ako worth 3500 pero yung gcredit ko is 3000 lang pwede ba ibawas sa regular balance ng gcash if meron or pwede i cash yung kulang?

Tanungin mo muna yung kahera kung puwede. For example, sa Puregold, puwedeng ganun.

Hi

I have a question what if i activate my GCredit but i don’t what to use it.

maccredit pa rin ba sakin yon at need ko pa rin po bang bayaran yun ? o hayaan ko lang sya na nakaactivate at magkukusa na syang malock?

because i accidentally activate my gcredit and i dont what it to use

thank you for the answer 🙂

You can just leave it alone. It will not incur any charges nor interest in any way. Malay mo kailanganin mo rin in the future, at least nandyan.

Thank you for the info. This is very informative indeed. I was able to unlock mine with Gscore of 438 and Gcredit of 10k. I was wondering at first if it has minimum amount due to settle but reading this my question has been answered. Thank you so much!!!

GCredit or fuse lending: may email ako last dec 2 till now wala kayong reply, tumawag ako hotline nyo pero hindi kayo sumasagot. Yung gcash ko na-hack nung dec 2 at ginamit at na-activate ang GCredit ko na 10K. Nagpadala na ako ng mga documents sa email nyo nung dec 2 at dec 4 till now walang reply…Sumagot naman kayo Gcredt or fuse lending. Tapos maniningil kayo sa transaction na hindi ko naman ginawa. Sumagot naman kayo sa landline nyo, then indicated sa site nyo 24 hours kayong open. Kung work from home naman kayo so mas dapat accessible kayo tru email pero till now wala pa din kayong sagot.. Kapag wala pa din akong nareceive na feedback sa inyo, lalapit na ako sa SEC or sa DTI..

Hindi po ito Fuse Lending. Blog lang po ito. Kung gusto niyo po submit kayo ng ticket sa help.gcash.com para masagot po ang reklamo mo.

Ask ko lang po kasi ung Gcredit ko ginamit ng bf ko then naghiwalay na kami last month lng then hindi nya na binayaran ung sa Gcredit ko until now. tapos tumatawag sakin ung sa gcash regarding sa unpaid bal ko. Eh hindi ko naman un napakinabangan saka sya nakakaalam ng mga ganun. Makukulong po ba ako kapag hindi ko un nabayaran? :'( need help po

Nope, babawasan niya yung balance mo hanggang mabayaran mo yung buong amount. Suggest bayaran mo na siya para puwede mo pa rin gamitin, sayang rin kasi ang GCredit malaking tulong pag gipit. Charge to experience nalang na wag magshare ng accounts sa iba lalo na sa mga SO’s kasi sakit ng ulo yan kung naging ex’s sila hehe.

Hello ask ko lang po. If magbabayad po ba ako ng gcredit ko 10 days after ng purchase need ko po ba icompute ang interest at idagdag dun sa ibabayad ko or pag nasend palang ang billing statement saka pwede mabayaran ang interest? Thanks.

Actually di agad nakikita ang interest, sa billing statement lang siya makikita. So kung nagbayad ka ng GCredit 10 days after, yung principal lang ang nabayaran mo. Yung interest nun makikita mo sa next billing statement pa.

Hi Good day!

I have a GCREDIT of 10,000 with just only 544 GScore. I don’t know if this will help you, but it’s effective for me though. These are the things that I did to Increase my GScore and has granted me the opportunity to have a 10k GCREDIT:

1. I linked 3 bank accounts in my Gcash

2. I opened a GSAVE account in CIMB

3. I save at least 500 every 15th payday

4. Pay my bills through GCASH or GCREDIT

5. Make sure to pay credit bills (gcredit) on time.

6. Use GCASH not only for load but for bank transfers as well. Though i would have liked it if there were no trans fee of 15 pesos everytime I transfer.

I hope these tips will help you grant your GCREDIT of 10k. and will unlock 30k GCREDIT as well. Have a nice day and God bless!

Pa help please panu po mg request nang refund from gcredit . I decide not to invest. Please help me

di naman investment si gcredit. utang po siya.

Hi kgabi po kac may nreceive kaming messages ngsasabi na nagbayad daw kami ng 1350 sa google para sa gcredit pwede po bang malaman para saan yon saka nacheck ko na din po balance ng gcash ko nabawasan na nga ng 1350 gusto ko sana sya irefund paano po ba ang gagawin ko?di naman po kc kami ngrequest ng gcredit bigla nalng ngnotify samen sa sms.slamat po.

Kung may GCredit ka at ginamit mo, dapat mabayaran mo siya bago ng due date. Kung hindi, babawasan niya ang wallet mo.

Panu makagawa ng gcredit

Basahin niyo po yung post

I’ve recently activated my Gcredit today with a Gscore of 379, na shock ako kasi 10,000 ang nakalagay, gulat din ung sister ko kasi nung na activate nya sakanya 400 ang score nya 1k lang ang nakalagay sa Gcredit. Sino po naka exprerince ng ganito?

Hi, gagamit ako ng shopee then mag top-up sana ako using gcredit kaso wala sa choices yung gcredit. Bakit ganun?

kasi top up siya sa shopee wallet, puwede lang gamitin sa direct payment ang gcredit

Hi. Does GCredit have annual fee? Thank you for the vet informative article btw. ☺️

No annual fees! Thanks for the review 🙂

Around 460 na unlock yung Gcredit ko. Tas tumaas sya hanggang 495 tas biglang baba ulit dahil nasaid ung Gcash ko. Nadeactivate siya as payment option. Tas pinataas ko na sya ulit 502 na. Nagtext na yung Gcash sakin na pede ko na daw ulit magamit pero hindi naman sya nagrereflect sa account ko. Hindi pa rin unlocked. Nag sumbit na ako ng ticket pero walang naitulong at walang explanation bakit ganon. Sabi need ko pa daw pataasin pa. E bakit sila nagtext na okay na ung gcredit ko ulit. Take note 2x this month nag text. Naranasan niyo din ba ito?

hello po. paid kona ang gcredit ko. medyo nalate lng ng ilang weeks. nakaenable naman siya bakit dina po siya nagaappear pag magpaypayment ka?

baka nakadisable sa tindahan na yun, kasi dapat kung nakaenable gagana siya

akin namn 200Gscore ko and 3K GC limit. kaso nga lang naging 1K nasa 500 nako tas bigla naman binawasan ni gcash ng around 15-30 yung score ko. ayun hanggang ngayun di na umaakyat GC limit ko hahaha. di ko alam kung anong nagawa ko sa gcash pati master card ko kinain di ko magamit 4months pa lang sakin di ko na makuha sa BPI ang husay ng gcash. tuwing mag rereport ako laging sasagot. merong akong illegal activities hahaha la na akong magawa hinahayaan ko na lang.

Hi,

I had an outstanding dues on my Gcredit that I failed to pay on time for some months and it incur me a high penalty. But fortunately I was able to pay it however I won’t be able to use it for the time being as my Gcredit was revoke because of my low Gcredit score. And to my shock, while I was under the impression that I have nothing to pay anymore I received a notice that I have to pay another interest rate plus a 600 pesos penalty when it’s not even a month when I paid it in full and that I have not use my Gcredit. Now I feel like I was being double charge. I would understand if it was only 200 pesos penalty, but 600!!! I think it’s very unfair. As of now, I’m still escalating this to GCash Customer service. Does anyone here who has the same experience as me?

Hello! We have the same case. Did you pay that 600 pesos and interest? I am currently escalating this to Gcash. I just want to know what happen after you contacted them? Thank youuu!!

My GScore is already 700+ but my limit is only 2900, is there a reason for lower limits?

No one really knows why some limits are still low. Anyway, consistency is key.

Unlocked my GCredit at around 350 GScore back in 2020 with a CL of 2,000. Used it consistently since then for bills, groceries and Ministop trips for the past 2 years. I am now sitting at a 703 GScore but my CL has not increased at all. Any tips?

I think GScore is looking for usage of as many GCash features as possible. So this includes GSave, GInvest, GLoan, GGives, GLife, etc.

mine is already 516 , but drpped to 460 even though i am using gcash in all of my transactions ,and it was stucked at 506 for so long already, still cannot use the gcredit feature 😔😔