GFunds allows you to invest easily in mutual funds within GCash, with some funds having minimum amounts as low as Php 50.

Disclaimer: This post aims to educate and not to give financial advice. Investments have different risks, and it is up to the investor to do due diligence and make decisions regarding his money.

What is GFunds?

GFunds is a way for GCash users to invest their GCash wallet balance in mutual funds from partner providers. This is under the GInvest feature on the main page of the GCash app.

What is GInvest?

GInvest is now a suite of different financial products within GCash that caters to different types of investments — GFunds, GStocks Global, GStocks PH, and GCrypto. GFunds focuses on mutual funds, GStocks Global focuses on international equities, GStocks PH focuses on the Philippine Stock Exchange, and GCrypto focuses on cryptocurrencies.

GInvest provides ordinary Filipinos access to different investment vehicles, which normally are out of reach. It’s free, and the only thing you need is a GCash account.

GFunds Details

What are the current mutual funds supported by GFunds?

Here are the different funds we have available:

- ATRAM

- Peso Money Market Fund – a conservative fund that is mainly involved with time deposit placements in different banks

- Global Consumer Trends Feeder Fund – an aggressive fund that comprises shares of international consumer companies like Amazon, Alibaba, Shopee, Sony

- Global Technology Feeder Fund – an aggressive fund that delves into overseas tech stocks like Microsoft, Apple, Alphabet (Google), and Samsung

- Total Return Peso Bond Fund – a moderate fund that is a mix of government treasuries and corporate bonds

- Philippine Equity Smart Index Fund – an aggressive fund that tracks 30 companies (blue-chip ones) on the Philippine Stock Exchange Index (PSEi)

- Global Infra Equity Feeder Fund – a moderately aggressive fund that invests in global stocks related to infrastructure

- Global Health Care Feeder Fund – a moderately aggressive fund that involves global stocks related to healthcare, medicine, biotech

- Philippine Sustainable Development and Growth Fund – an aggressive fund that is into local stocks related to environmental and societal change

- Global Equity Opportunity Feeder Fund – an aggressive fund that invests in global securities in major and smaller emerging markets

- BPI

- Philippine Stock Index Fund – an aggressive fund that tracks the stocks comprising the PSEi, similar to ATRAM’s Philippine Equity Smart Index Fund

- ALFM Global Multi-Asset Income Fund – an aggressive fund that is a mix of global equities and fixed-income securities; this fund actually provides regular vesting of dividends

One nice thing about it is you only need to be Fully Verified to opt in. Anyone can now invest easily with just a few clicks inside the GCash app.

Another benefit is access to feeder funds (basically funds that also invest in funds), as most feeder funds out there require a large investment.

You only need Php 50 as an initial investment for some of the available funds. You can do the peso cost-averaging strategy and put in funds regularly.

How risky are GFunds?

GFunds are as risky as what you can endure. No investment is totally risk-free, and as a result, no investment is totally safe. This is why you should invest in a fund that fits your risk appetite and age. This is also why before opting into GFunds, there is a survey to determine your risk appetite before you can proceed.

How do I create a GFunds account?

The first thing is you should click on the GInvest button on the main page, then select GFunds from the page:

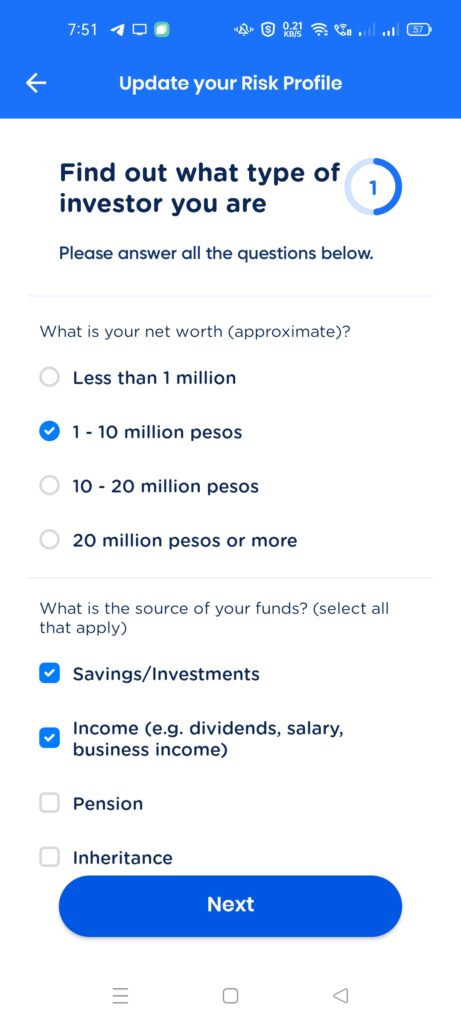

Getting your Risk Profile

You will need to take a questionnaire to be able to acquire your risk appetite. The results of this questionnaire will determine your risk appetite and GCash will be recommending you some investments depending on this appetite.

After knowing your risk appetite, we then can proceed to the GFunds main page.

How do I opt into a fund?

From the main page, you can click on Buy. You will proceed to a page where you can see details of each of the funds with the corresponding appetite and performance in a year. When you click on a fund, you will further see more data to help you decide if it’s a good buy.

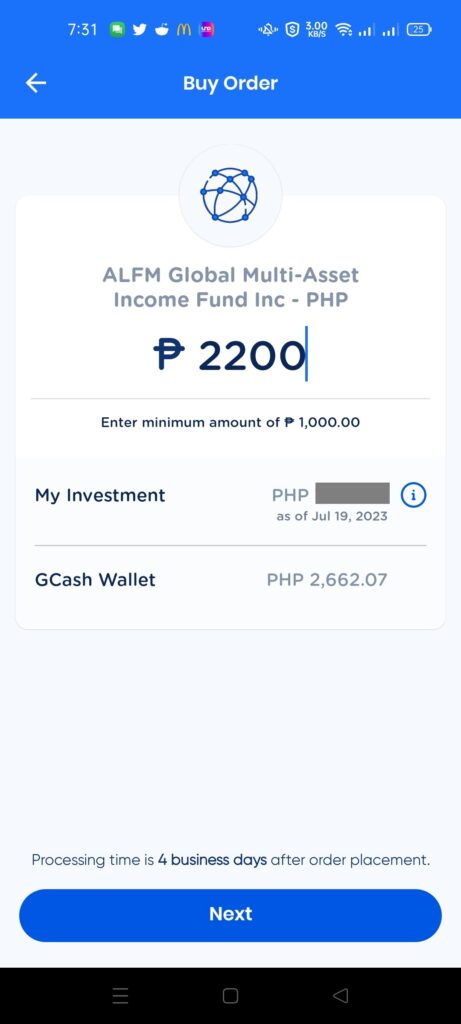

How do I buy shares of a fund?

You need to click on Buy to be able to go to the next page. You can then input your amount to buy, and confirm it. The transaction will be completed in around 3-5 days. You will be receiving an SMS as proof of subscription.

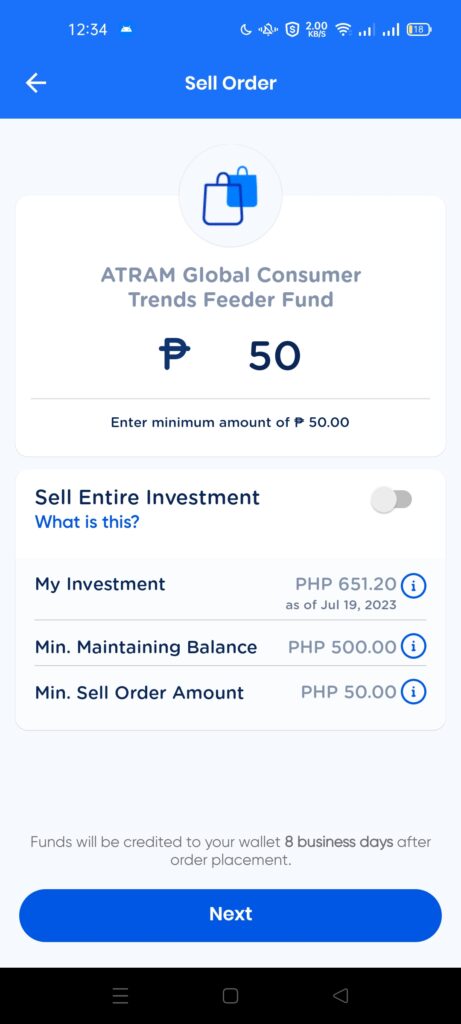

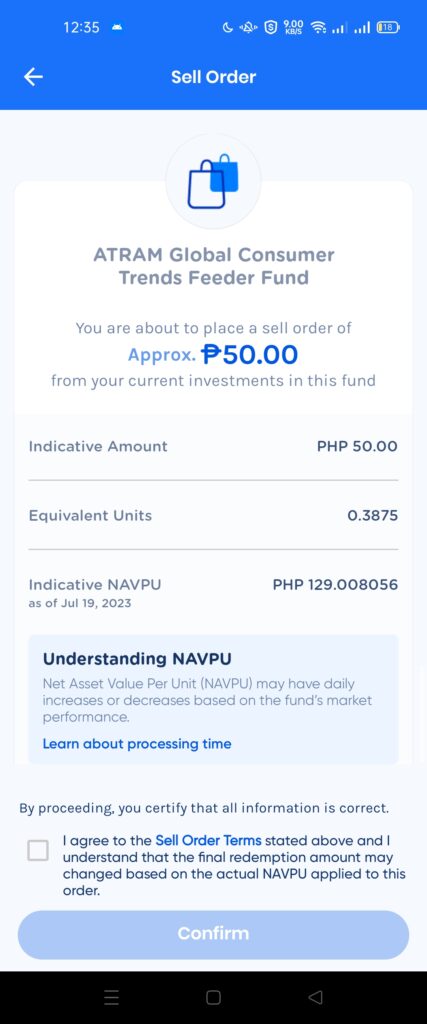

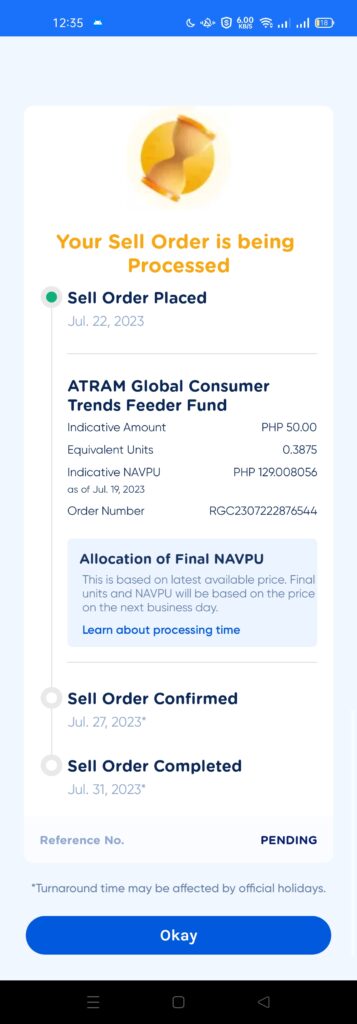

How do I sell shares of the fund?

You need to click Sell from the fund page. After inputting the amount you plan to sell, confirm your order. The confirmation page comes up and you will get an SMS notification. The transaction will be completed in 8 business days. Similar to subscribing, you will receive a notification when the transaction is complete.

How much are the minimum subscription and redemption amounts for GFunds?

Here is a table that describes such:

| Investment Fund | Minimum Subscription | Minimum Redemption |

|---|---|---|

| Peso Money Market Fund | Php 50 | Php 50 |

| Global Consumer Trends Feeder Fund | Php 1000 | – |

| Global Technology Feeder Fund | Php 1000 | – |

| Total Return Peso Bond Fund | Php 50 | Php 50 |

| Phil Equity Smart Index Fund | Php 50 | Php 50 |

| Global Multi-Asset Income Fund | Php 1000 | – |

| Philippine Stock Index Fund | Php 50 | Php 50 |

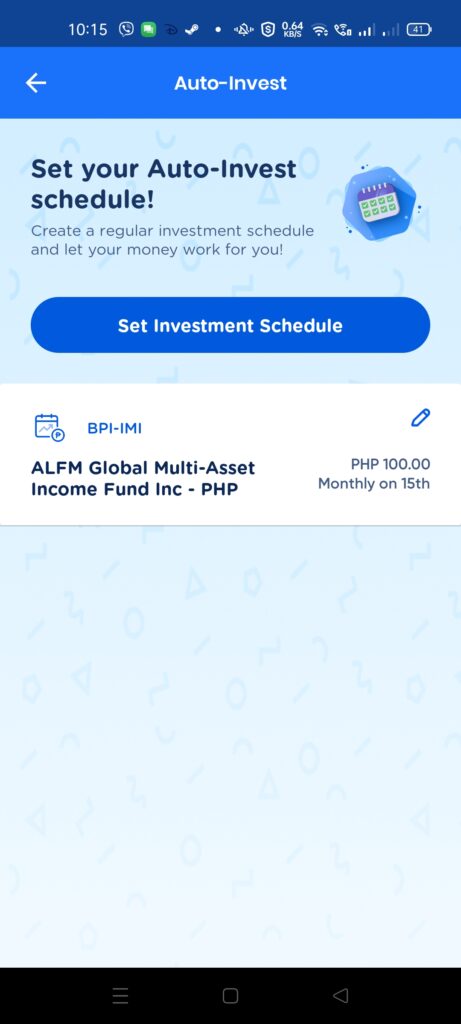

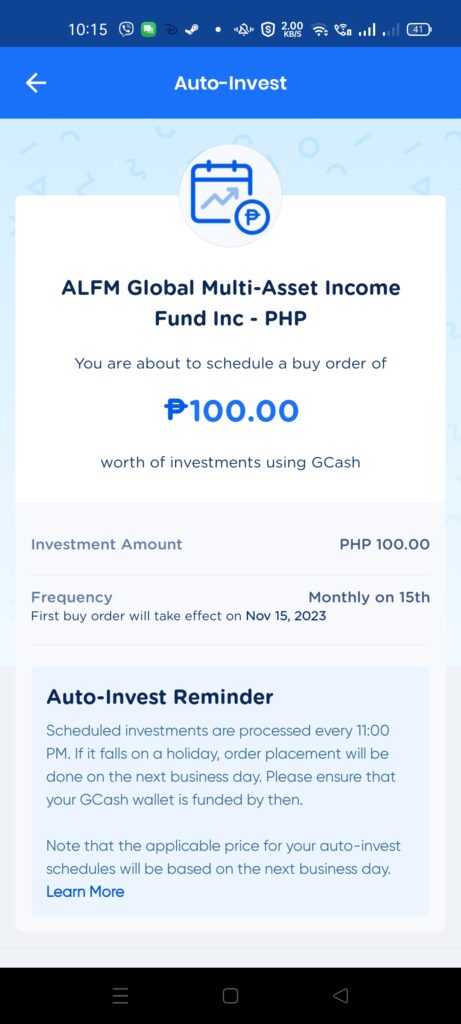

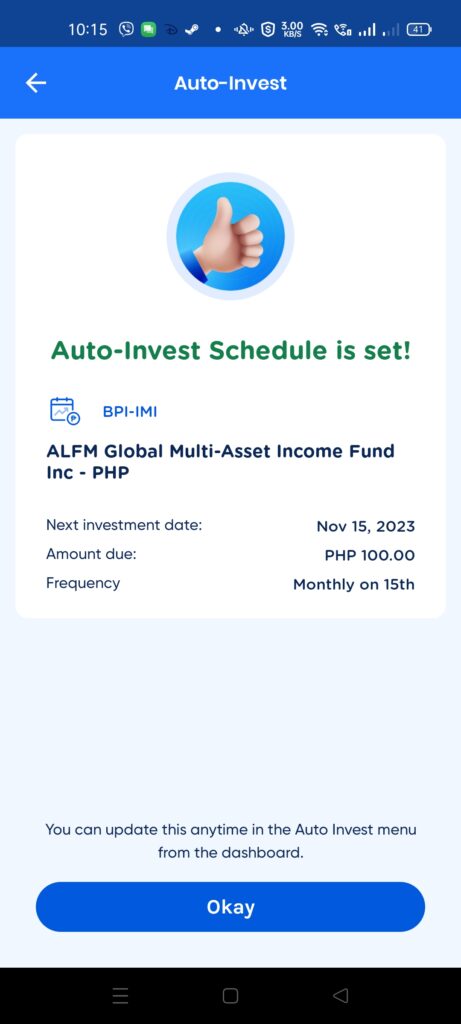

Enabling Auto-Invest Schedules

Auto-Invest is a new feature in GFunds. Previously it only reminded you to invest, but now you can actually set schedules to invest. This makes it easier to do peso cost averaging.

Availing is easy, just click on the Set your Auto-Invest schedule from the GFunds main page, then the Set Schedule button. The next pages are easy to follow, as they ask what funds you want to invest in, how much and how often.

Other Questions

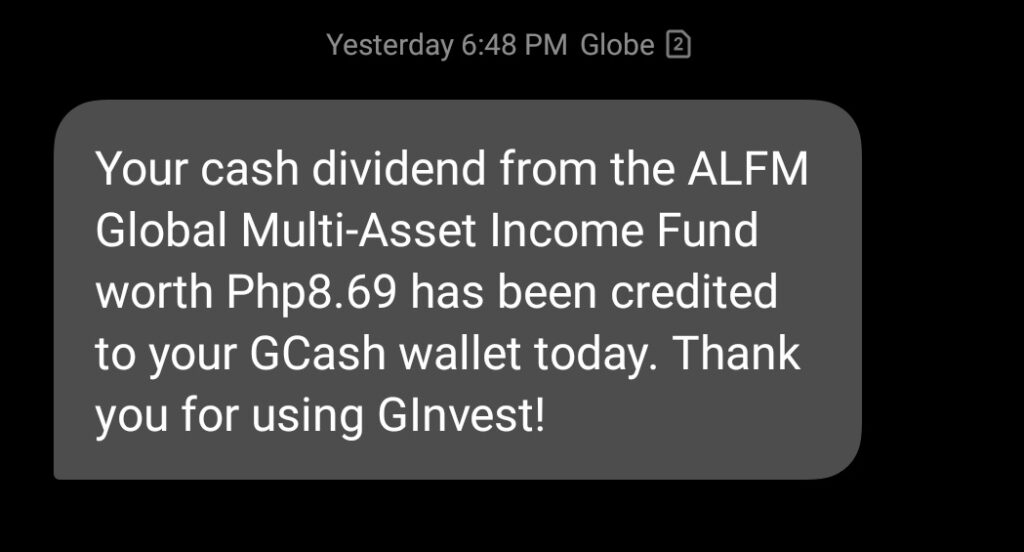

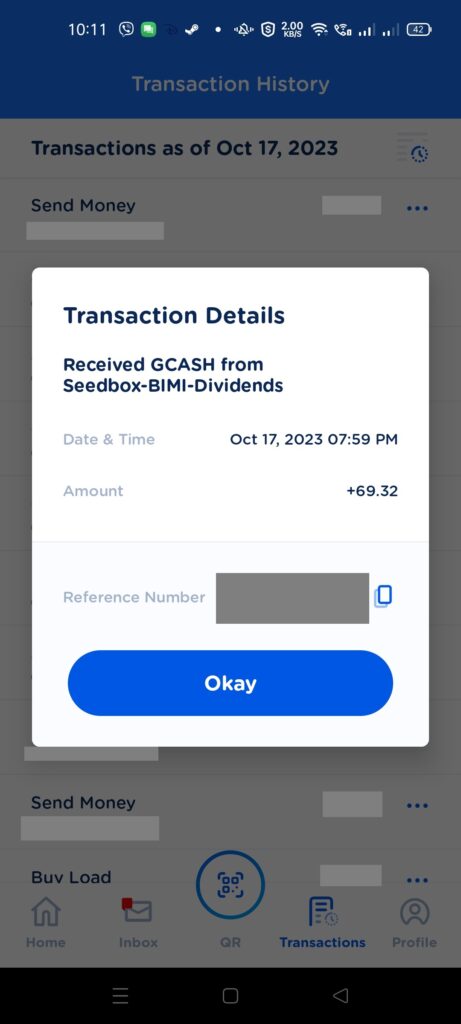

For the ALFM Global Multi-Asset Income Fund, how often do the dividends payout?

Dividends come monthly, usually on the 15th, and go straight to your GCash balance. You will be notified by SMS and will be receiving an email. Personally, I reinvest any dividends I get to it.

Is GFunds a safe investment?

No investment is truly safe. But remember that you should only invest according to your risk appetite.

When do I sell in GFunds?

You should have a plan when selling, and not sell when you feel like it. Investment should be governed by a set of rules you personally follow, and not based on your emotion. A recommendation is you sell when the time is ripe in the future.

What is the lock-in price for NAVPU when you buy or sell in GFunds?

When you buy or sell at a certain price, your order is pegged to that price until it gets fulfilled.

Are there transaction fees for subscribing/redeeming in GFunds?

No transaction fees.

What’s the difference between GFunds with GSave?

The main difference is GSave allows you to open savings accounts, while GFunds allows you to invest in mutual funds.

Another difference is the speed at which you can put in and pull out your money (liquidity). GSave withdrawal speed is instant because you are taking our funds out of your savings account.

However, for GFunds, this isn’t instant. It typically takes around 3-5 days to complete the transaction.

Which gives better interest – GSave or GFunds?

Currently, GSave gives interest for savings at 0.5%-6% annually, depending on the GSave product. Originally, GFunds had only a money market fund to invest in, and it had a year-to-date annual interest rate of around 0.63%. However, since they now provide other riskier funds to invest in and higher yields, it’s definitely worth a second look.

For example, in the Global Consumer Trends fund, the year-on-year return was 102.21%. For the Global Tech fund, it was 98.44%. For the Phil Equity Index Fund, it was 33.02%, and for the Peso Bond Fund, it was 10.96%. Again, these are historical data, do not think that it would hold the same for the future.

If you want relatively steady but low returns, then go for GSave accounts. If you want higher returns but with higher risk, then pick a more aggressive fund in GFunds.

Does using GFunds contribute to GScore? How about GForest?

GFunds and any GInvest product affect GScore positively because investing more and more means you become more creditworthy. So as long as you invest regularly, and make your investment grow, this will contribute to a positive GScore (and higher GCredit as well).

Unfortunately, GFunds does not give energy points to GCash Forest. There is no particularly green activity attributed to investing in mutual funds. Perhaps in the future, they can find a way to make investing in mutual funds greener.

Summary

We talked in length about the different basic types of investments and mainly about mutual funds. We talked about how mutual funds have different risks depending on the risk appetite of the investor. However, the best investment you can ever have is in yourself. With the knowledge you’ve gained, it pays a lot more since your earning power also scales.

We also talked about the difference between GSave and GFunds and that this is now an easy venue for everyone to invest in mutual funds

We also talked about how to opt into GFunds. We talked about how to subscribe and redeem funds from it.

For similar topics, you can also check out my other posts:

- Buying stocks in COL using GCash

- Buying stocks in GCash using GStocks PH

- Buying Bitcoin using GCash

- Buying altcoins in Binance P2P

I have a new e-commerce site where you can buy some e-books here: GCR Prime

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

It’s good I know now about gcash or ginvest.as you advised us we prefer to do gcash.pls advice me further on ginvest for one year only and how much will I get after a year if I invest 50k to ginvest.thanks so much.

No specific gains cause that depends on the market po. But for sure, tataas ang halaga niyan if you hold it for a year.

if ever i invest in Ginvest who will manage my investment? and is there any additional fees?

it’s basically a mutual fund, so a fund manager handles everyday buy and sells and naturally gets a cut of of the gains. you can read the details in the fund itself.

is there specific time frame to redeem ginvest i mean like after a year> or its redeemable anytime u want?

can i add investment weekly?

Redeemable and investable anymore

There’s no time frame, you can invest anytime and redeem anytime, but you should wait 3 days to receive your money after selling your investment

Ask lang po ano ang gagawin pag hindi maopen ang ginvest sa gcash account. Hindi ko kasi na open gusto ko Sana mag invest.. Please answer

What do you na di po maopen? Fully verified po kayo? Kung ayaw pa rin baka need niyo po magfile ng ticket sa Help Center sa app rin mismo.

As per data sang investment opportunities mas nag iinvest ng mga clients niyo sa Ginvest

Di po ako GCash or Atram kaya di ko rin masasagot ito.

Terrible interface. You subscribe to a fund, it transacts amd shows your balance. However, no way to drill down to units held in total, cost basis price, gain/loss, or even that time of last NAV update and closing price. This app was made for investors at all unless I’m missing something,

Terrible interface. You subscribe to a fund, it transacts amd shows your balance. However, no way to drill down to units held in total, cost basis price, gain/loss, or even that time of last NAV update and closing price. This app was NOT made for investors at all unless I’m missing something,

yeah, definitely this is more catered to beginners. and it seems it was not made for your type of audience.

If nagplace ako ng buy order for Day 1, anong NAVPU ang maaapply? NAVPU for Day 1 or NAVPU after 2-4 banking days? Salamat.

Normally for mutual funds, when you order, it buys with the NAVPU at the end of the day or when the market closes.

how bout sa sell order po, ganon din?

Mali pala ako, naconfirm na kung kelan mo siya binili yun ang illock in na price for buying or selling.

pag nagsubscribe ba ako, everyday ba sya makakaltas sa gcash ko or once a month lang? thanks

Kung ano lang ang ipapasok mo, yun lang ang mapupunta sa fund. Di siya automatic.

ok lang po bang maka pag invest s ginvest khit nasa abroad

Yes, basta may laman GCash mo puwede

Paano malalaman kung na credit na sa Gcash wallet yung naisell mo from GInvest? +

May text kang matatanggap.

Ilang percentage po ang redemption fees sa ginvest? Un subscription po nabanggit nyo na zero fee ang transactions

No fees sa lahat, subscribing at redeeming

will ginvest or gcash a whole be available even after 5 years? what will happen to our investment if gcash/ginvest goes down/away?

GInvest is powered by ATRAM, and ATRAM as a company has been here since 2009. Also, being a trust fund, it’s regulated by the BSP. So even if they go away, your funds won’t easily go with it.

Can someone please give an example of computation of how our investment (say P1000. 00) would become 1 or 3 years from now? I know there’s no specific gains or loss because it depends on market value but I want to know how it works.

for example, here are the gains posted for three years (not actual figures):

Year 1: 17%

Year 2: 15%

Year 3: 16%

then in the first year, Php 1000 * 1.17 = Php 1170

in the second year, Php 1170 * 1.15 = Php 1345

in the third year, Php 1345 * 1.16 = Php 1560

so basically after 3 years your 1k -> 1.5k if you did not put anything more and just left it to compound on its own

Matic po ba na de deduct sa balance mo?

Yes, pagkainput mo ng amount at pagconfirm ng transaction madededuct agad.

for example, here are the gains posted for three years (not actual figures):

Year 1: 17%

Year 2: 15%

Year 3: 16%

then in the first year, Php 1000 * 1.17 = Php 1170

in the second year, Php 1170 * 1.15 = Php 1345

in the third year, Php 1345 * 1.16 = Php 1560

so basically after 3 years your 1k -> 1.5k if you did not put anything more and just left it to compound on its own

sa computation pong ito..meaning..hindi mo nakukuha ang interest ng first and 2nd years?

Yup, kinukuha kasi dun ang puhunan sa mga susunod na taon

Yung sa 50.00 minimum investment nmn po sa Giinvest can someone give an example computation po? Para may idea lang po before mag invest. Thank you so much po sa makakasagot.

Sa investment Transaction History po, ano po ang purpose ng “Request Transaction” mentioning Email To, No. of Days?, From?, To?, Paki clarify po … Thanks

For downloading your own copy of the transaction history via email

Pardon my ignorance, I just started last month and I’m still skeptic.. Does investing in the ATRAM Global Technology Feeder Fund means I have to buy and sell on a daily basis just like in stocks trading? Or do I just put in money and just watch it earn or lose?

GInvest is meant to be a medium-long term investment and not to be dabbled on a daily basis.

Thanks! I can watch my meager investment grow bigger..

You mentioned the minimum investment amount for GInvest. Is there a set maximum investment amount also that we should know? Thanks.

I think it would depend on the wallet limits of your GCash account. Otherwise there is no limit.

para saan po ung buy and selling

Question lang po.

>Kapag nag BUY/Invest ako ng 1000pesos magkakaroon ba ako ng shares? Kung Oo, mababawasan ba ang shares ko kapag bumaba ang NAVPU?

Pag bumili ka ng 1000 pesos worth of shares, once nasa yo na yung shares, di siya magbabago. Yung price per share lang ang bumababa/tumataas. Kaya mas mainam na ibenta ang shares mo pag mas mahal na ang price ng per share niya, kumpara sa presyo ng shares mo noong binili mo siya.

ask ko lang po, mas better po ba na hayaan lang ang pera sa ginvest , tapos mag ko compund din po ba yung interest earned? mas profitable po ba ang ganitong set up? thanks!

Yeah, mas magandang iwanan mo nalang siya at dagdagan mo nalang every month for example. Habang palaki nang palaki ang top-up, palaki rin ang interest earned. Huwag ka rin magpull out pag nakita mong bumagsak, gawin mong incentive na makakabili ka ng mas maraming shares sa ganung pagkakataon.

Hi,

Bago sa GInvest, Ask ko lang kung pwede akong mag invest sa iba’t ibang funds ? Mas ok ba yun para sa beginner ? Any suggestion.

Thank you.

Puwede sa iba ibang funds, suggest ko pag-aralan mo muna isa isa para malaman mo anong pinakamaganda