This post describes how to buy and sell US stocks using GStocks Global within the GCash app.

Disclaimer: This post aims to educate and not to give financial advice. Investments have different risks, and it is up to the investor to do due diligence and make decisions regarding his money.

What is GStocks Global?

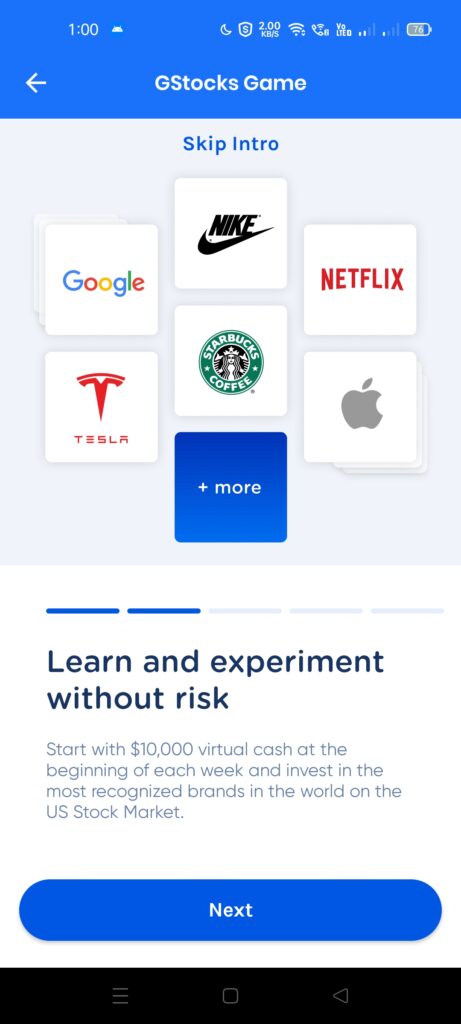

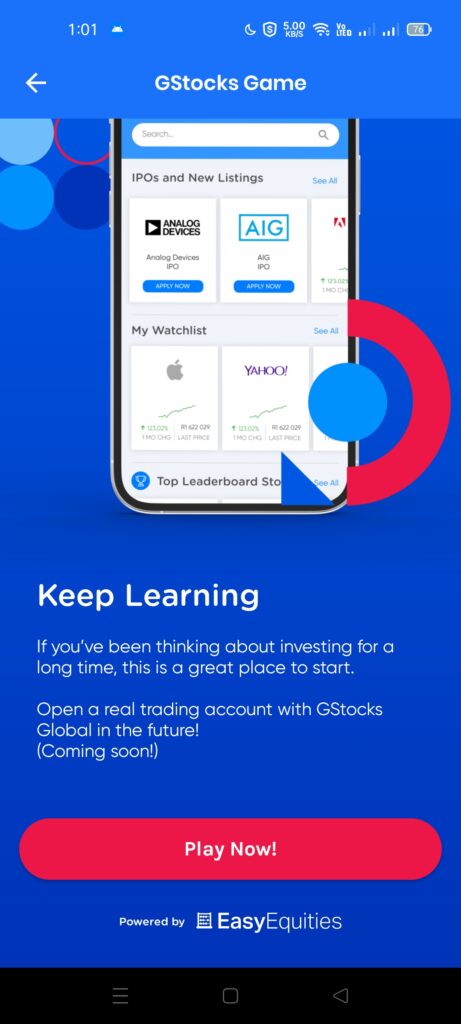

GStocks Global is the international counterpart of GStocks PH. It aims to offer a way to purchase and sell stocks and securities from overseas markets. Currently, it is focused on the US stock market through a partnership with EasyEquities, a broker based in South Africa.

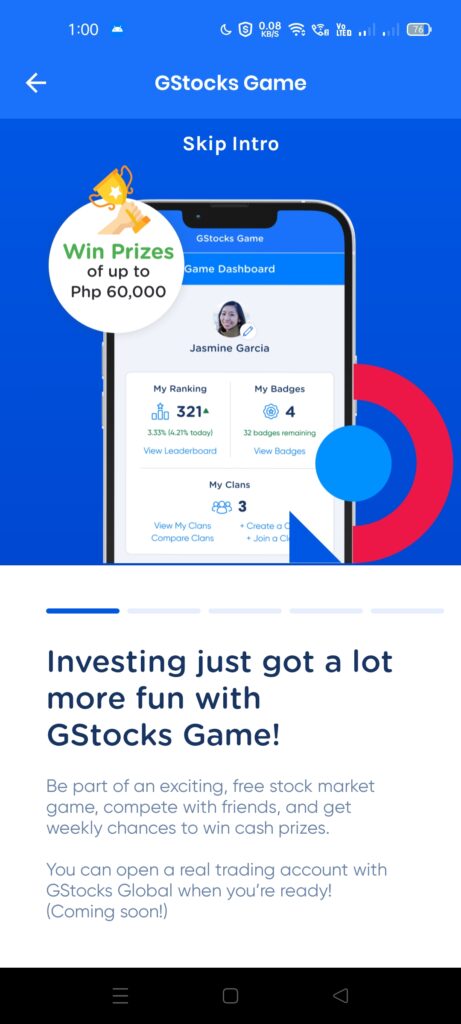

Currently, while waiting for regulatory approvals from the SEC, it has opened an investing game that provides prizes to the top 20 traders per week.

Please take note that the game has officially stopped on October 27, 2023.

What are the requirements to join the GStocks Game?

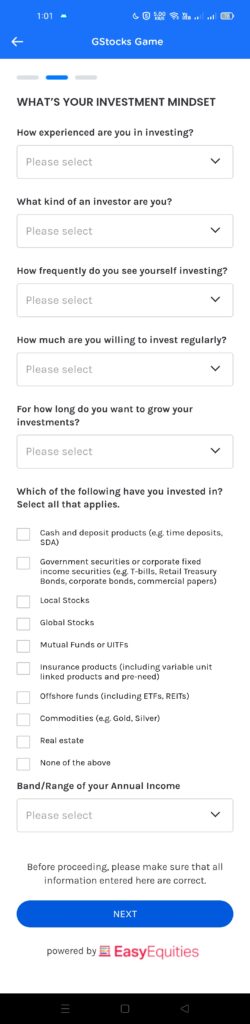

You need to be at least 18 years old and a Filipino citizen, and your GCash account should be Fully Verified. There is also a risk appetite assessment when you start investing under GInvest.

What are the mechanics of the GStocks Game?

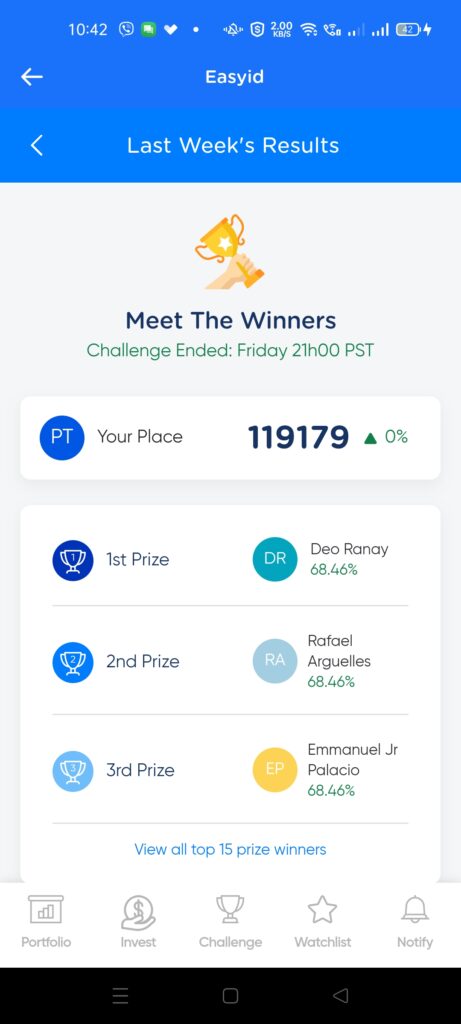

The game runs from Monday to Friday and resets every Saturday. Each week players are provided USD 10,000 as play money to invest in the US Stock Market. You need to buy stocks to be able to win the weekly prize. The one who has the most net asset value wins the game. The top 15 players will qualify for prizes.

The US Stock Market is open weekdays from 9:30 AM – 4:30 PM Eastern time, which is conveniently 12 hours behind PH time. So 9:30 AM EST is 9:30 PM in the Philippines. This is notably different from the local stock exchange which runs from 9:30 AM to 12:00 PM and 1:30 PM to 2:45 PM.

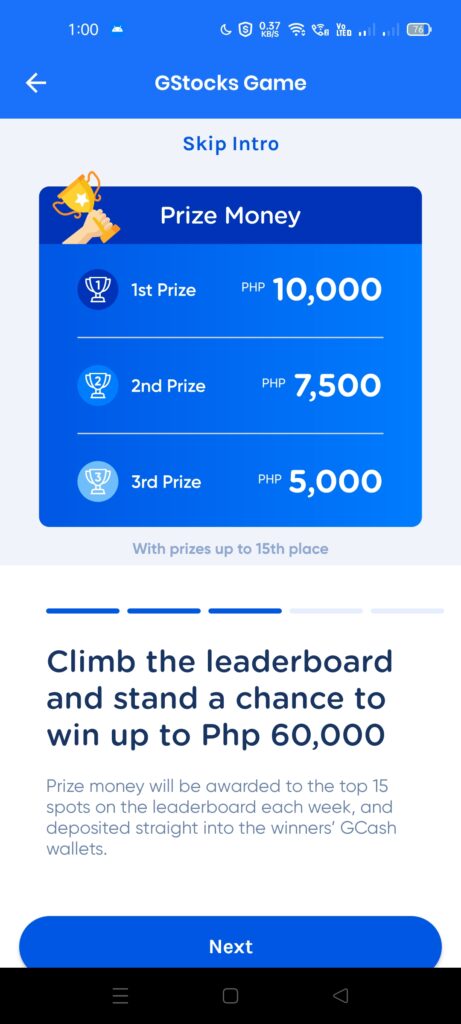

What are the prizes for the GStocks Game?

- First place – Php 10,000

- Second place – Php 7,500

- Third place – Php 5,000

- Fourth place – Php 4,000

- Fifth place – Php 3,500

- Sixth place – Php 3,000

- Seventh place – Php 2,500

- Eighth place – Php 2,000

- Ninth place – Php 1,500

- Tenth to Fifteenth places – Php 1,000

How do I register with GStocks Global?

You can see GStocks Global under GInvest on the GCash main page. You will first get a tutorial page to see an overview of what you can do with the game.

GStocks Global Registration

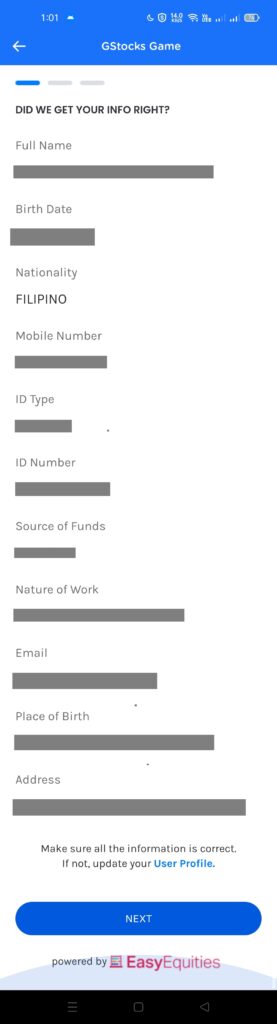

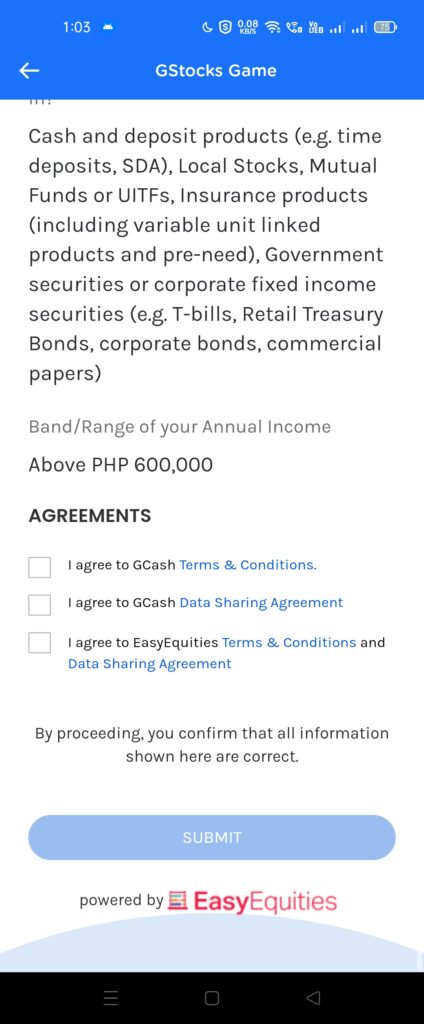

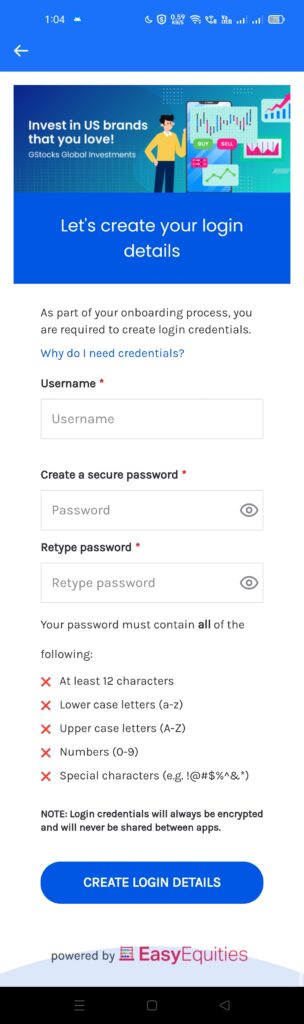

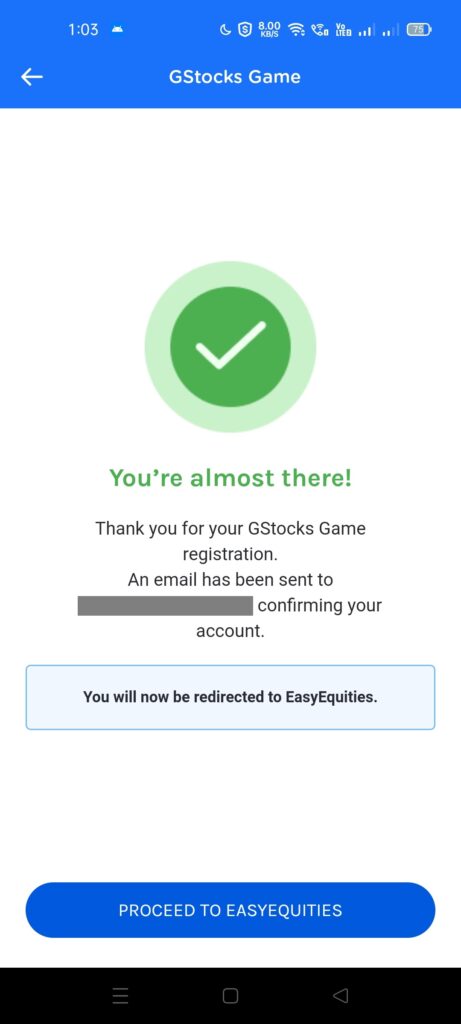

Once you click on Play Now, you will see the onboarding pages. Most of the hard work has already been done as they get your information from GCash KYC (Know-Your-Customer) when you did your verification.

How do I use GStocks Global?

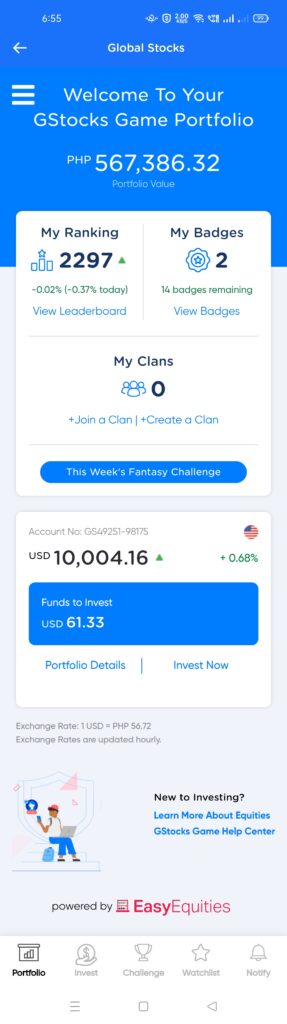

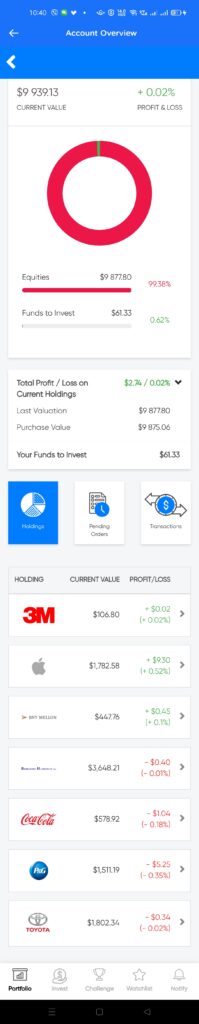

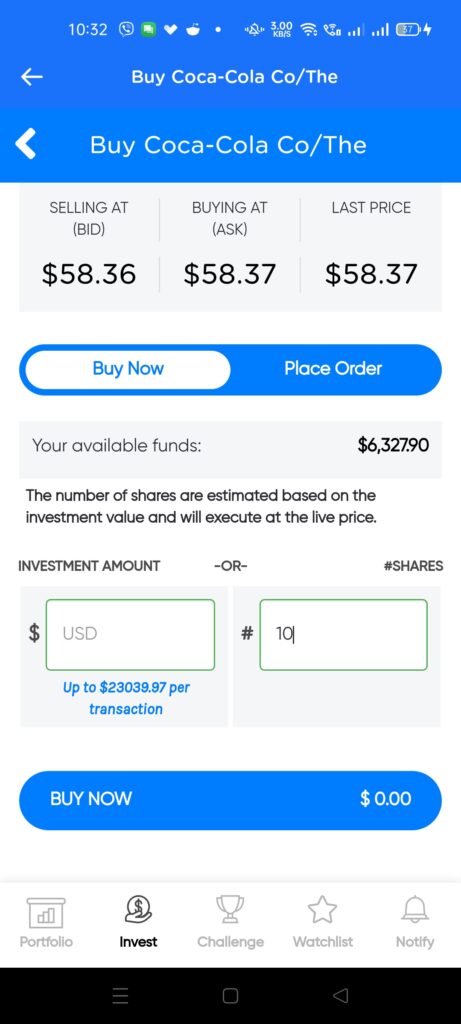

Once registration is done, you will be able to log in and go to the main/portfolio page. You will see that you have USD 10,000 (PHP 560,000) in play money to invest.

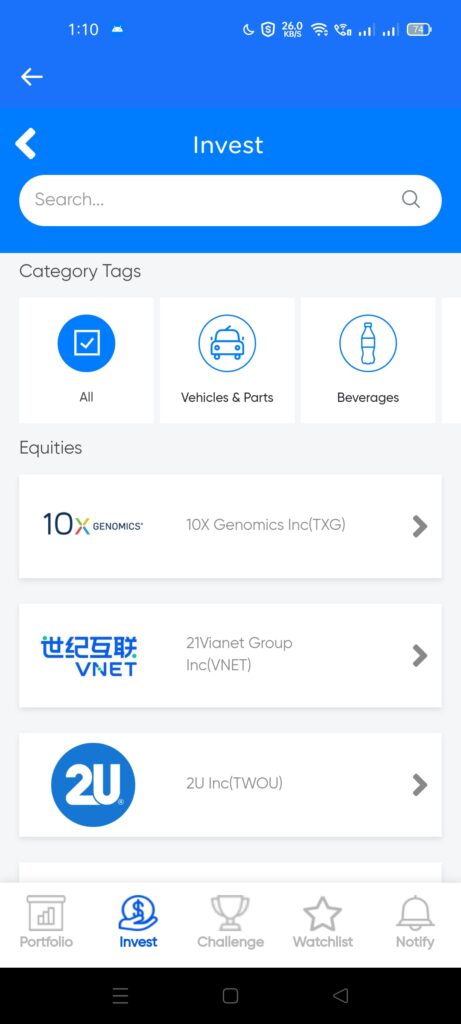

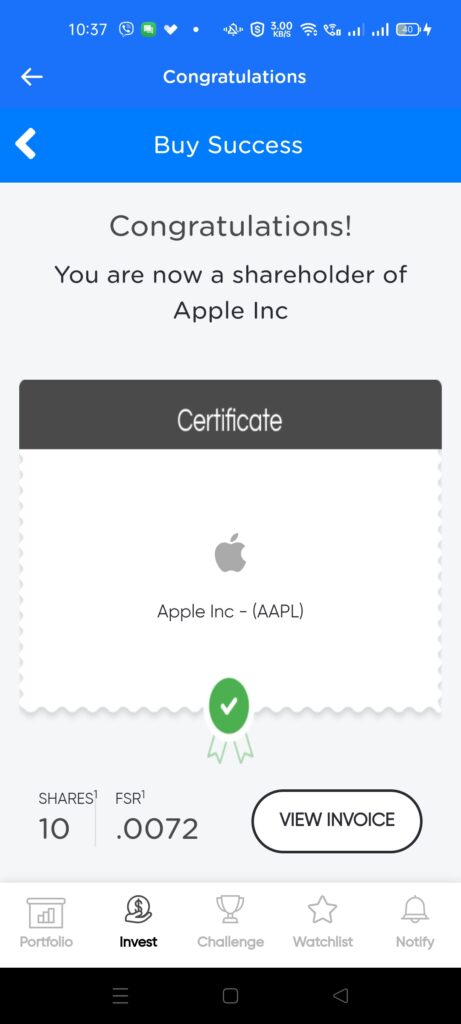

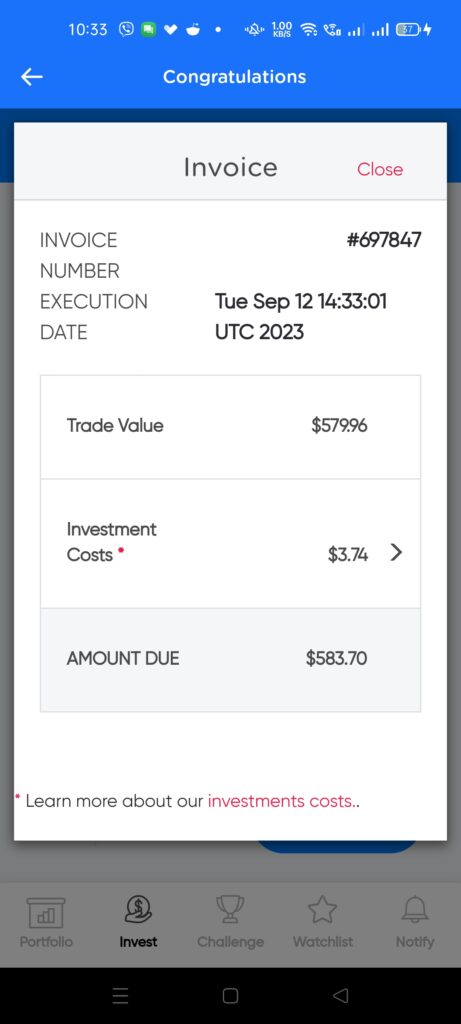

Invest

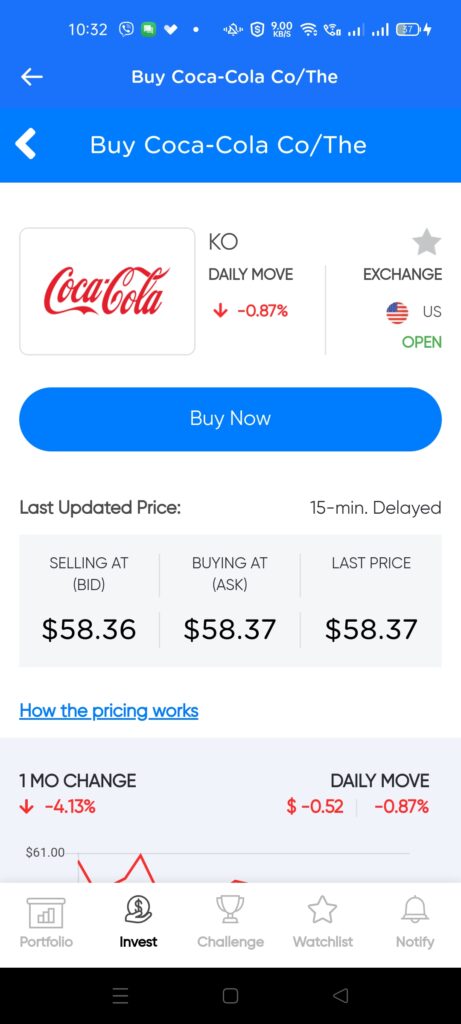

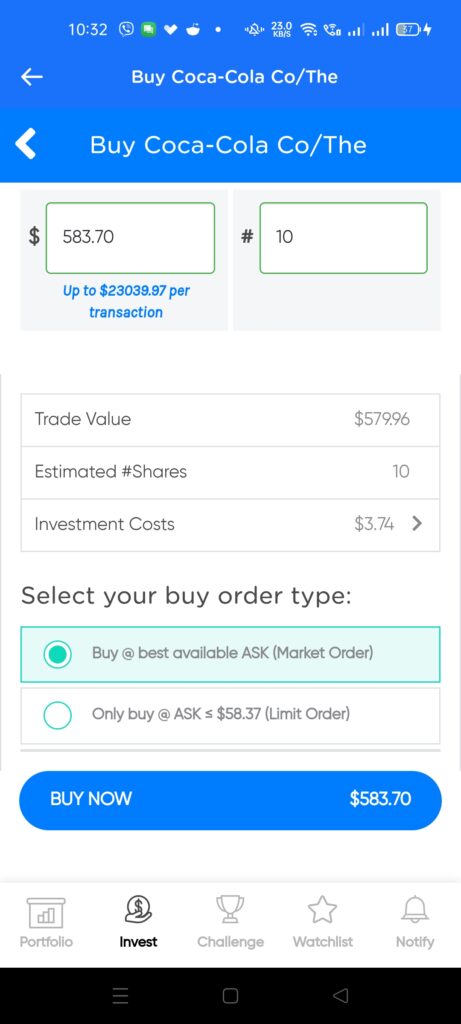

This is where you can buy the stocks that are available. Buying is straightforward, you can click on the company you want to invest in, then click Buy. You then need to input how many shares or how much in shares you want to buy. Likewise, you can Sell from your portfolio page.

Lastly, you select whether it’s a Market Order, meaning you are buying or selling it at its current market price, or Limit Order, meaning you want to buy or sell once it hits at or below a price point you’ve set. Typically you will want to buy or sell it via Market Order.

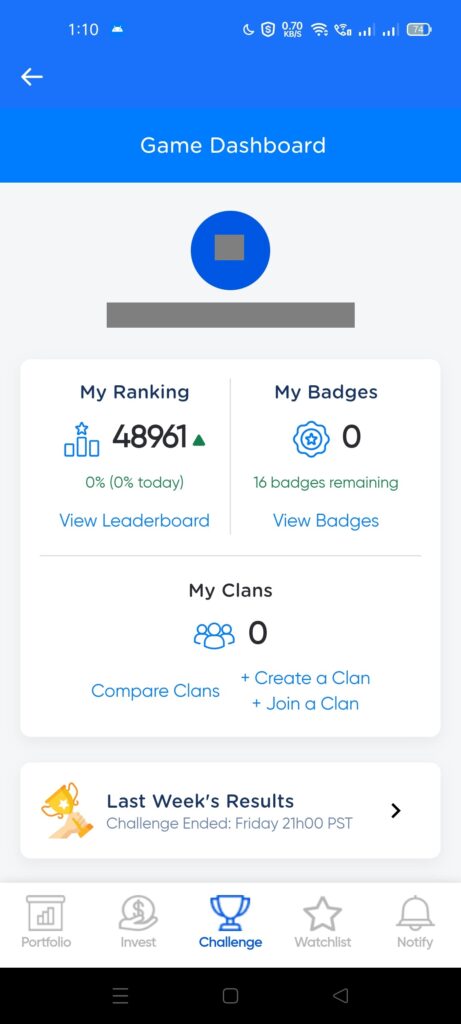

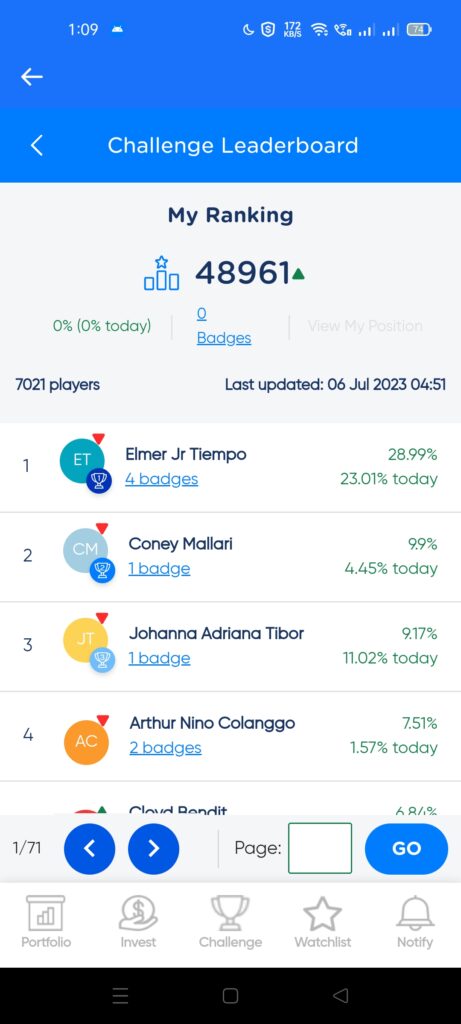

Challenge

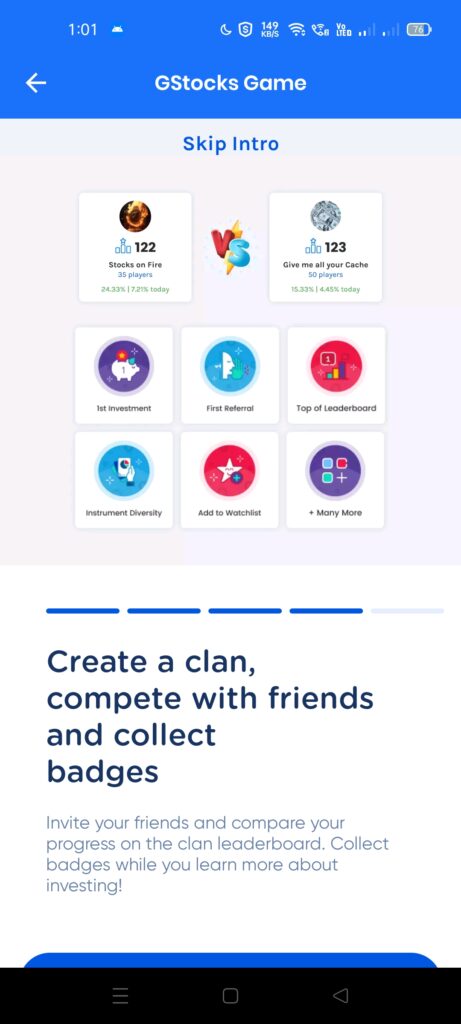

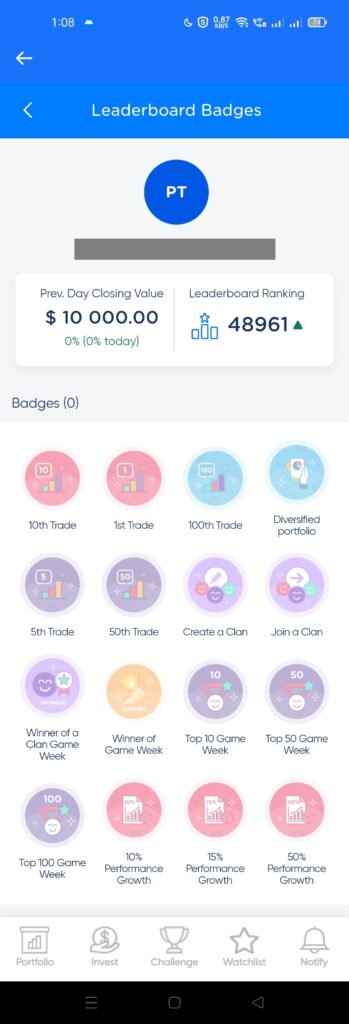

This section shows your ranking and the leaderboard for the weekly challenge. You can also see here the badges you’ve collected over the course of using GStocks. The badges don’t really provide any other benefit except for bragging rights.

Watchlist

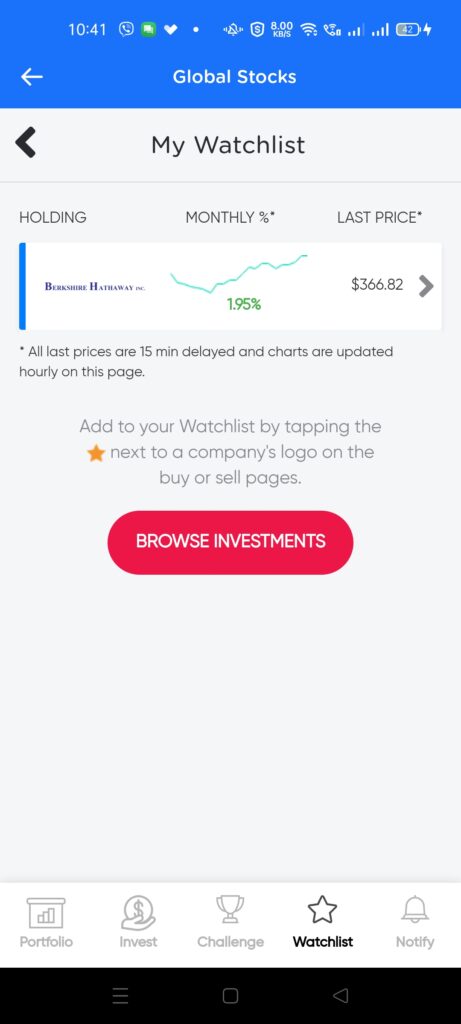

The watchlist shows the stocks you’ve saved to help you buy and sell. It also helps you make more informed decisions as you are able to see monthly percentage graphs as well as the last price.

Notify

This page shows any notifications while using the GStocks Game. This is mainly used for Limit Orders if you’ve availed of them.

Other Questions

What is the purpose of clans?

Basically this is an investing group. You will be able to compete within your clan, and also compete together against other clans as well.

What time does the US Stock Market open?

The US Stock Market opens from 9:30 AM to 4:00 PM EST, which is 12 hours behind the time in the Philippines, so in our case, it’s 9:30 PM to 4:00 AM. If you buy or sell at off-hours, it will book buy or sell on the next opening.

Summary

We talked about GStocks Global and how to buy and sell US stocks from the platform. Currently, it’s set up as a game due to ongoing regulatory applications. The game though allows you to win prizes by being in the top 15 pseudo-investors. This is a great way to have a feel for the platform until the actual app is released.

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

My winning money to Receive to gcash