This post aims to teach how to buy and sell crypto assets using GCrypto in GCash.

Disclaimer: This post aims to educate and not to give financial advice. Investments have different risks, and it is up to the investor to do due diligence and make decisions regarding his money.

The Current State of Cryptocurrencies

I’ve talked about cryptocurrencies like Bitcoin before. And I’ve always argued that cryptocurrencies have a place in one’s portfolio. As long as the coin/token has utility it has the potential to become valuable in the future.

I’m not talking about the tokens that rely on hype to shoot their value up to the moon. I mean we should buy coins or tokens that have stood the test of time and have valid use cases for everyday use. There is an argument that the safest cryptocurrencies to invest in are Bitcoin and Ethereum only.

With the boom of decentralized finance last 2022, it seems that there were ways to invest your assets into different investment smart contracts, with higher yields than your normal digital bank rates. Unfortunately, this boom did not last long, as there were more scams than proper products that launched during that time. And this ultimately resulted in the bear market we are still experiencing today.

Unfortunately at the end of the day, because of the big learning curve and how easy it is for bad actors to scam people out of their money, these make many new crypto investors go away.

Now as a newbie crypto investor, it is better to stick to the “blue chips”, or the top 10 cryptocurrencies by market cap. But the best practice still is to research thoroughly any crypto you plan to invest in.

Currently, at the end of 2023, there are multiple Bitcoin ETF applications in the US SEC and if these get approved, institutional money will come in and buy Bitcoin in droves, and this will drive the price higher, kicking off a bull market.

What is GCrypto?

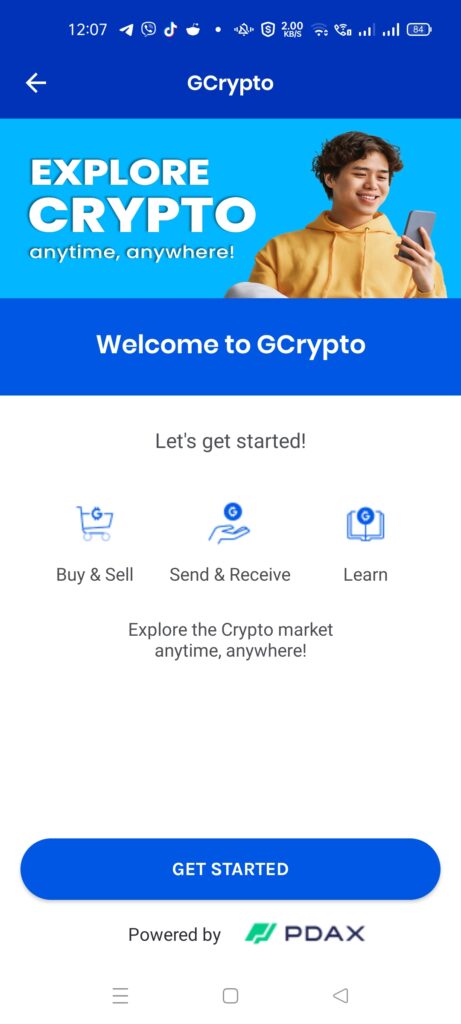

GCrypto is a cryptocurrency trading product built into GCash. It allows you to buy and sell supported coins/tokens and build up your portfolio from within GCash itself.

GCash has partnered with PDAX to push for this GCrypto product. I had written a post before about how to buy and sell coins in PDAX and now since they’ve partnered directly, it makes onboarding users and handling transactions easier.

My recommendation on using GCrypto is you can use this to buy and sell crypto assets, but you should have your separate crypto wallet (like Metamask or a hardware wallet like a Ledger or a Trezor) and transfer the assets you plan to hold for the long term there.

What are the requirements for opening a GCrypto account?

You need to be at least 18 years of age, have fully verified with GCash, and have an active email account.

How to create a GCrypto account?

Registering in GCrypto

- Select GCrypto from the GInvest page on the GCash main screen.

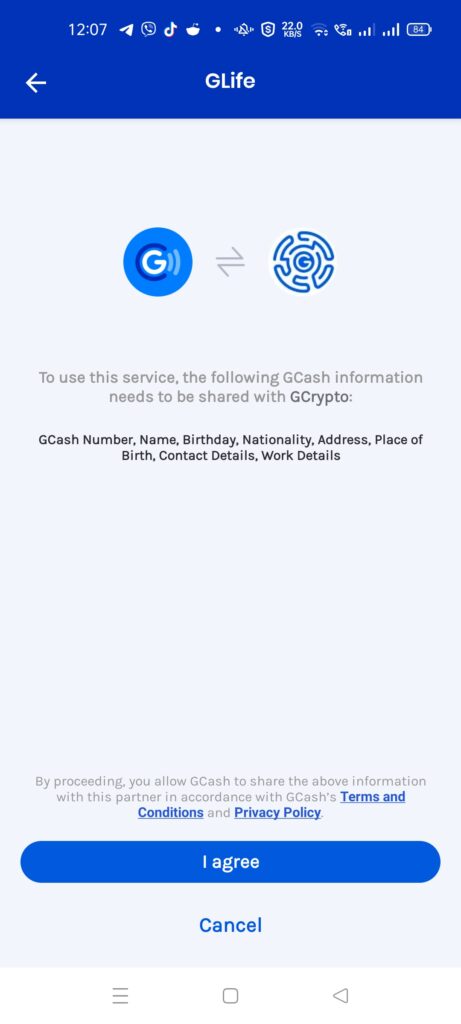

- On the opt-in page, click on Agree. Once you’re eligible to open a GCrypto account, you will be able to click on “Get Started”.

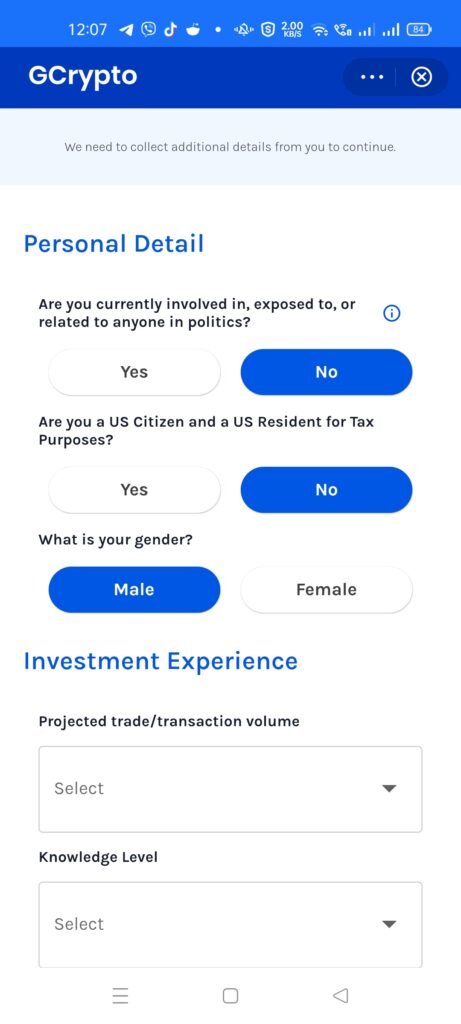

- The registration page is short as you only need to input some details and investment experience.

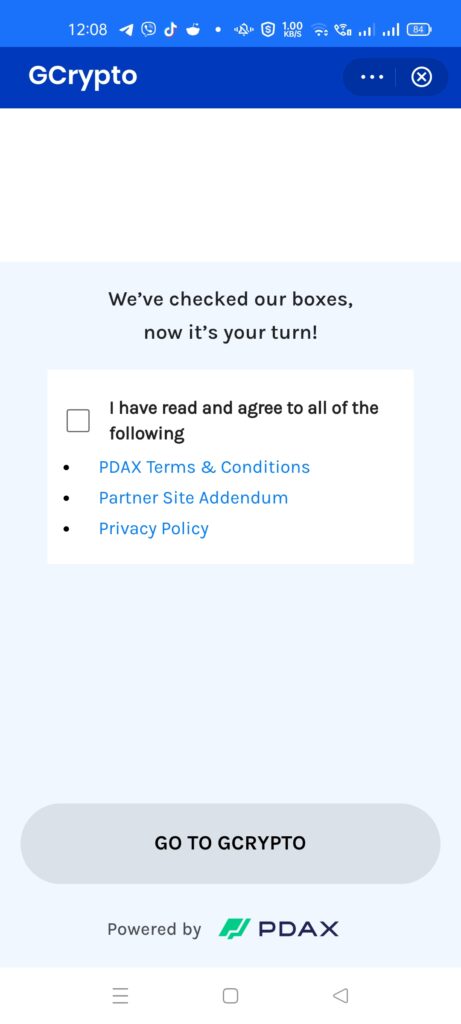

- The last page is the Terms and Conditions page which you need to agree with to proceed.

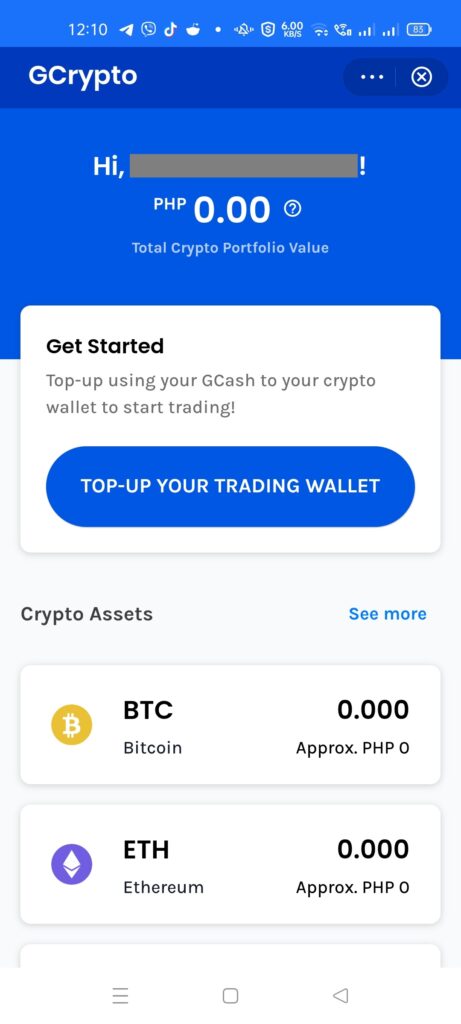

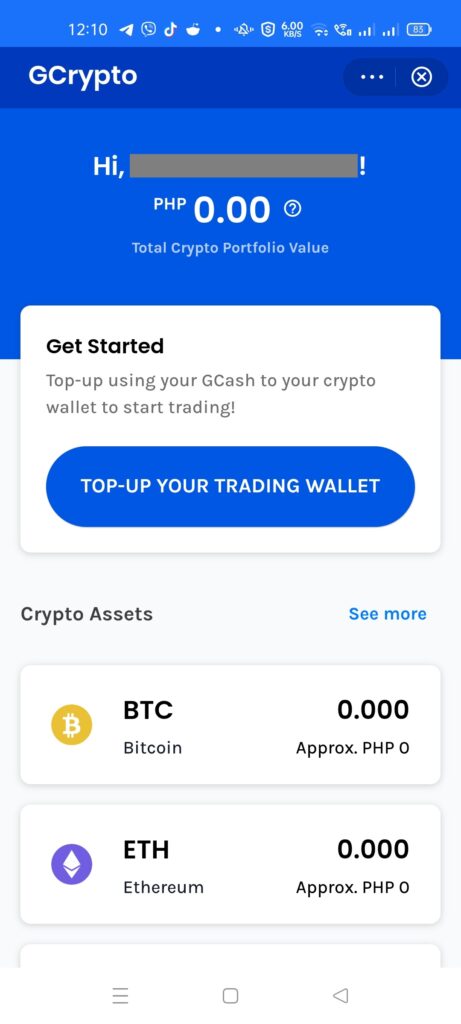

- Once done, you will be able to see the GCrypto main page.

How do I top-up or withdraw my GCrypto wallet?

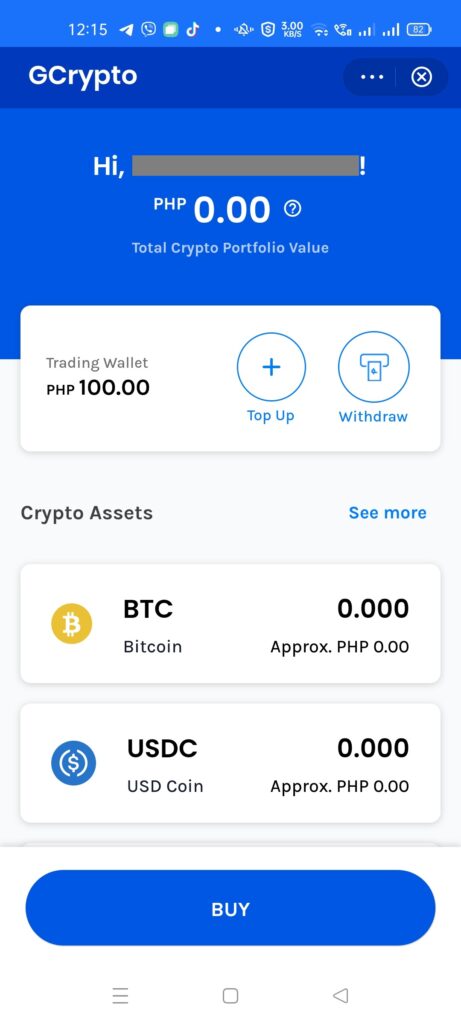

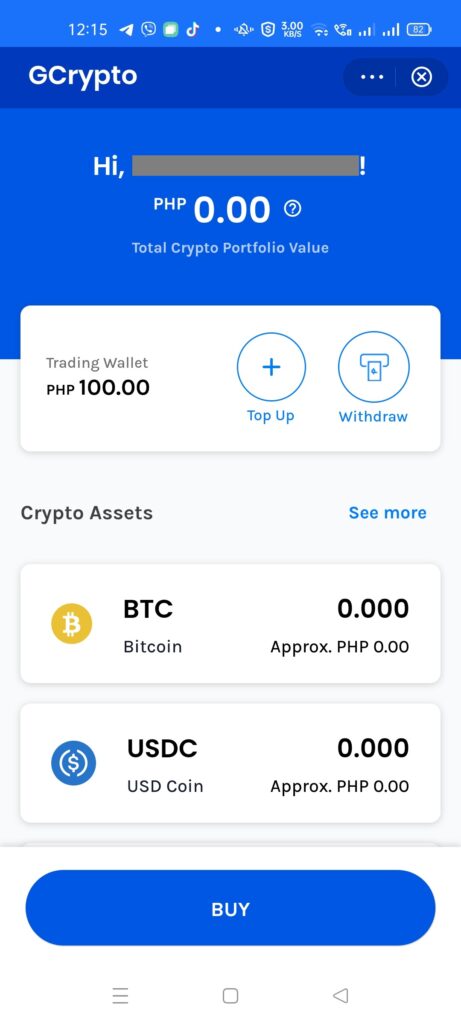

GCrypto works as an exchange, so you first need to top-up funds to be able to buy your crypto assets. Unlike GStocks and GFunds though, you can top-up and withdraw your funds immediately.

Topping up your GCrypto Wallet

- From the GCrypto main page, click on “Top-Up Your Trading Wallet”.

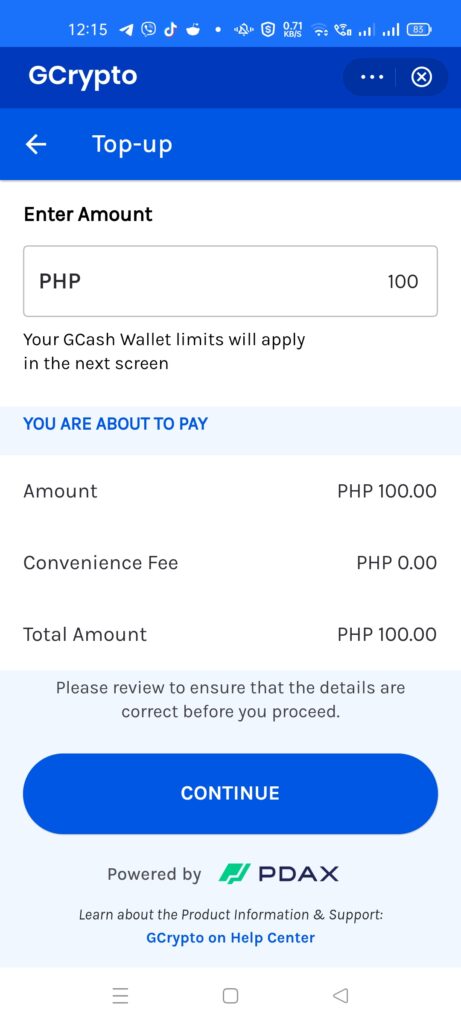

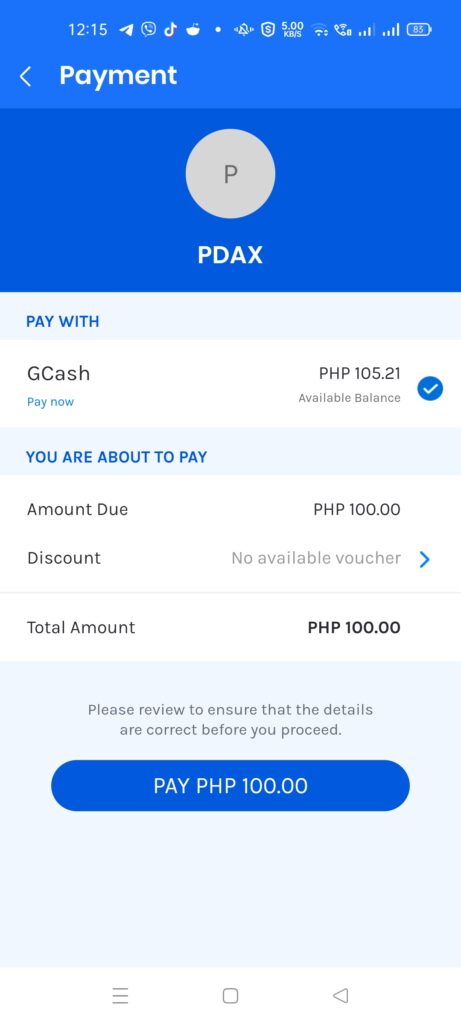

- On the top-up page, enter your amount and click continue. This will lead you to the payment page where you need to confirm.

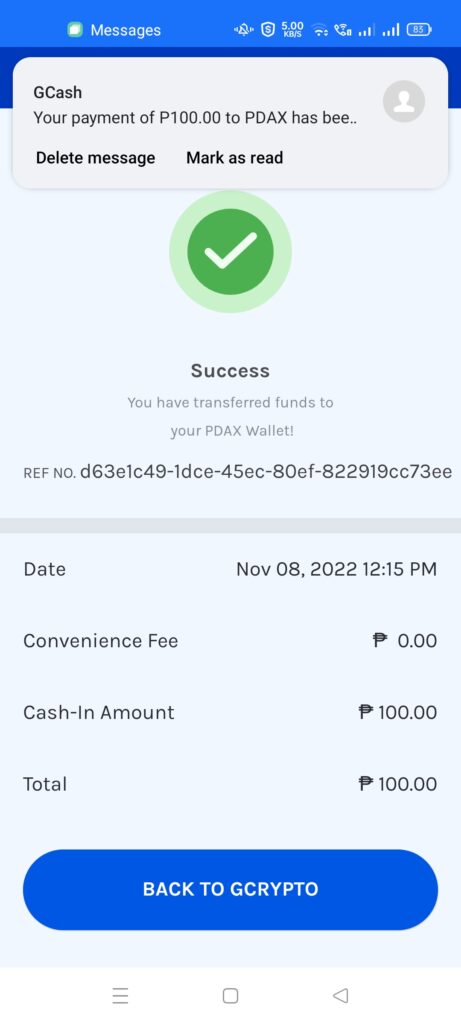

- Once confirmed, your trading wallet will be officially topped up.

Withdrawing from your GCrypto Wallet

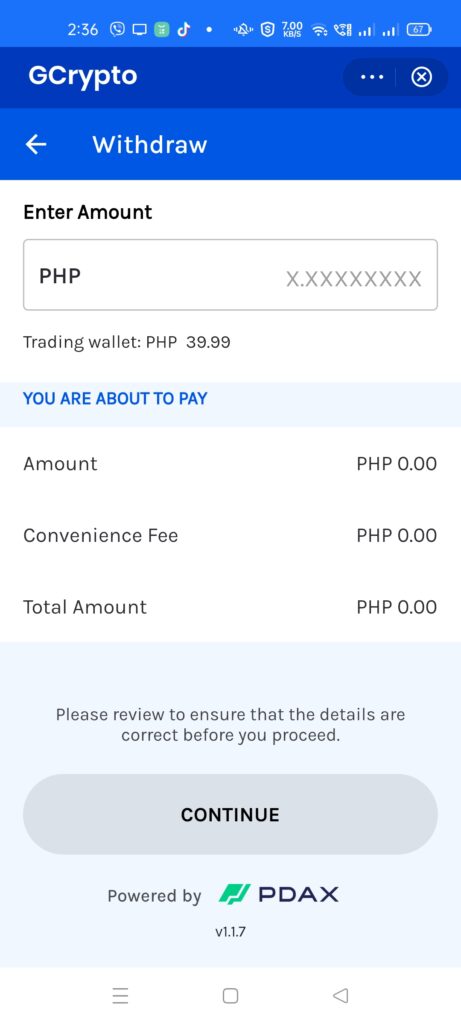

- From the GCrypto main page, click on Withdraw.

- On the Withdraw page, enter the amount to be withdrawn and click Continue.

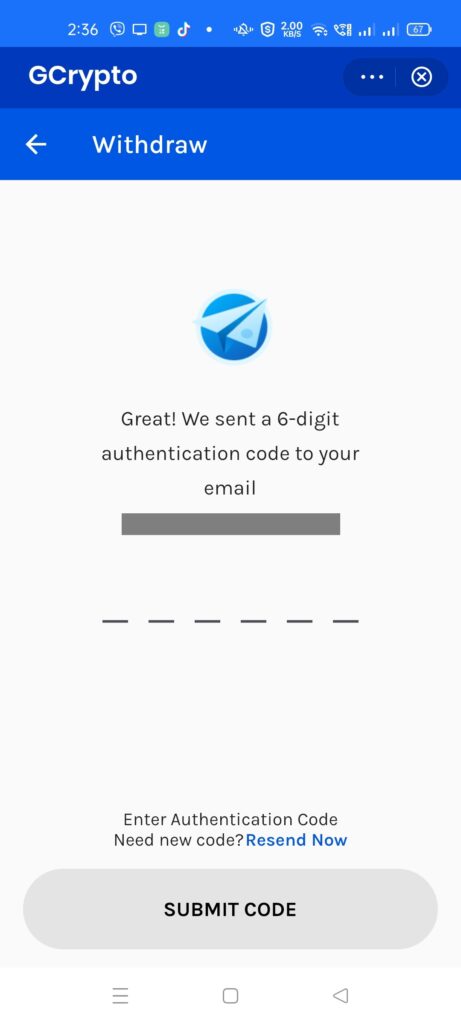

- You will be receiving an OTP in your email. Enter the 6-digit number and click on Submit Code.

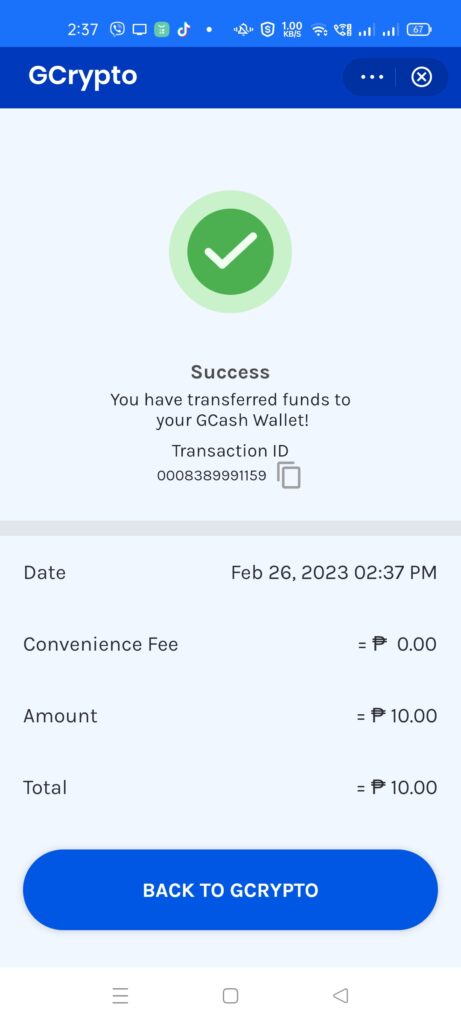

- Once a withdrawal is successful, you will see a success page.

Wallet and Transaction Limits

This also covers most of the limits of all cash-in channels, including over-the-counter, machine, online, Paypal, Payoneer, and remittances.

Additionally, the outgoing limit also applies to financial services like GSave, GInvest, and GInsure, as you are putting money into investments and/or insurance.

| Detail | Basic | Fully Verified | Fully Verified with Linked Accounts (GCash Plus) | Fully Verified Minor (GCash Jr) | Platinum ( enrolled in a Globe Platinum Plan) |

|---|---|---|---|---|---|

| Wallet Size | Php 10,000 | Php 100,000 | Php 500,000 | Php 50,000 | Php 1,000,000 |

| Daily Incoming Limit | N/A | N/A | N/A | N/A | N/A |

| Monthly Incoming Limit | Php 5,000 | Php 100,000 | Php 500,000 | Php 10,000 | Php 1,000,000 |

| Daily Outgoing Limit | N/A | Php 100,000 | Php 100,000 | Php 10,000 | Php 500,000 |

| Monthly Outgoing Limit | Php 5,000 | N/A | N/A | Php 10,000 | Php 1,000,000 |

| Yearly Outgoing Limit | N/A | N/A | N/A | Php 100,000 | N/A |

The linked accounts here pertain to BPI, UnionBank, and Payoneer accounts, with GSave and GInvest placements.

If you encounter GCash limit exceeded errors, you will need to wait for next month for your limits to reset.

How do I buy or sell crypto assets in GCrypto?

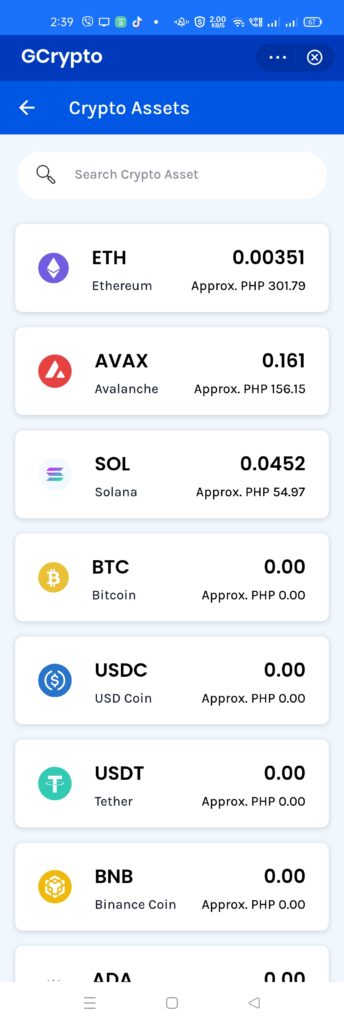

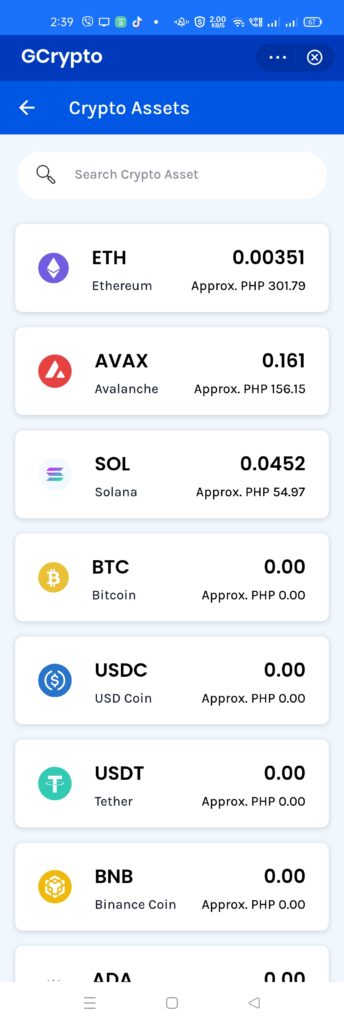

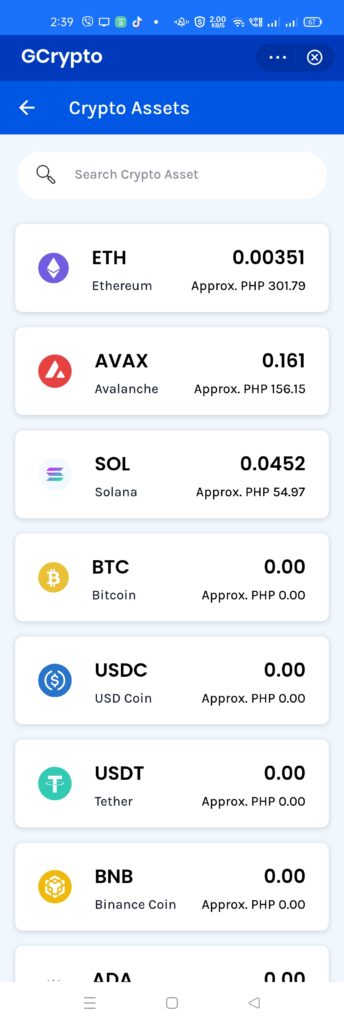

In GCrypto, each crypto asset also has its wallet. After topping up, you can now easily buy or sell supported cryptocurrencies within GCrypto as you have a crypto wallet for each asset.

GCrypto/PDAX supported crypto assets

To explain in a nutshell, the difference between “coin” and “token” is that coins are the main units of information in a blockchain. Any transaction or information is tracked by coins. Tokens, on the other hand, are real-world applications that are used on top of a blockchain, and they are supported by the coins in that chain.

Tokens are created so that projects don’t need to build a new blockchain from scratch to keep track of transactions and information. They can just ride on existing blockchains.

In the table below, if the crypto asset has the same name as the blockchain, it is a coin of that blockchain. Otherwise, it’s a token.

| Crypto Asset | Blockchain | Short Description |

|---|---|---|

| Ethereum (ETH) | Ethereum | The pioneer for blockchains that run smart contracts; a lot of tokens use this as the backbone of their decentralized apps (dApps) |

| Bitcoin (BTC) | Bitcoin | The pioneer for all crypto assets; its coin is used mainly as a store of value (like virtual gold) and is the most well-known and mainstream asset |

| Solana (SOL) | Solana | An alternative to Ethereum and is known for very high-speed transactions |

| Avalanche (AVAX) | Avalanche | An alternative to Ethereum and is known for speed and security; also has dApps in its blockchain |

| USD Coin (USDC) | Ethereum | A mainstream USD stablecoin token in Ethereum; USD stablecoins peg their value to the US Dollar |

| Tether (USDT) | Ethereum | The biggest USD stablecoin token by market value; hosted in Ethereum |

| Binance Coin (BNB) | BNB | A coin that is tied with Binance, the largest centralized cryptocurrency exchange; also known for its speed and also has dApps in its blockchain |

| Cardano (ADA) | Cardano | An alternative to Ethereum and seeks to improve on Ethereum’s issues |

| Polkadot (DOT) | Polkadot | A blockchain that allows other blockchains to talk with each other |

| Litecoin (LTC) | Litecoin | An original fork (“copy that diverged from”) of Bitcoin, and is generally cheaper and faster than Bitcoin |

| Uniswap (UNI) | Ethereum | A decentralized finance (de-fi) platform mainly used as an exchange; you can “swap” tokens with other tokens in the ETH blockchain |

| Polygon (MATIC) | Ethereum | A scaling solution to ETH, which allows the creation of sidechains to make transactions in ETH cheaper and faster |

| Chainlink (LINK) | Ethereum | Implements oracles, or systems that track data outside of the blockchain; examples are financial data, sports data, etc |

| Stellar (XLM) | Stellar | A blockchain that is known for very, very low fees and is good for micropayments |

| Bitcoin Cash (BCH) | Bitcoin Cash | A fork of Bitcoin itself when there was a disagreement about handling how transactions were validated; still works mostly similarly to Bitcoin but is not as popular |

| Axie Infinity (AXS) | Ronin | The Ronin sidechain is built on top of ETH to easily support the Axie Infinity game |

| AAVE | Ethereum | This is a de-fi platform for lending and borrowing assets in the ETH platform |

| The Graph (GRT) | Ethereum | Allows to get data across multiple projects in the ETH blockchain and makes them available easily |

| Basic Attention Token (BAT) | Ethereum | Aims to democratize attention sharing and distribute advertising money efficiently across readers and publishers |

| Enjin (ENJ) | Ethereum | Makes management of virtual goods easier; known for making non-fungible tokens (NFTs) and game-related goods and collectibles |

| Sushiswap (SUSHI) | Ethereum | Another popular decentralized exchange; this fork of Uniswap has different features from its parent |

| Smooth Love Potion (SLP) | Ronin | The in-game currency of the Axie Infinity game; allows you to breed Axies which is a core part of the game itself |

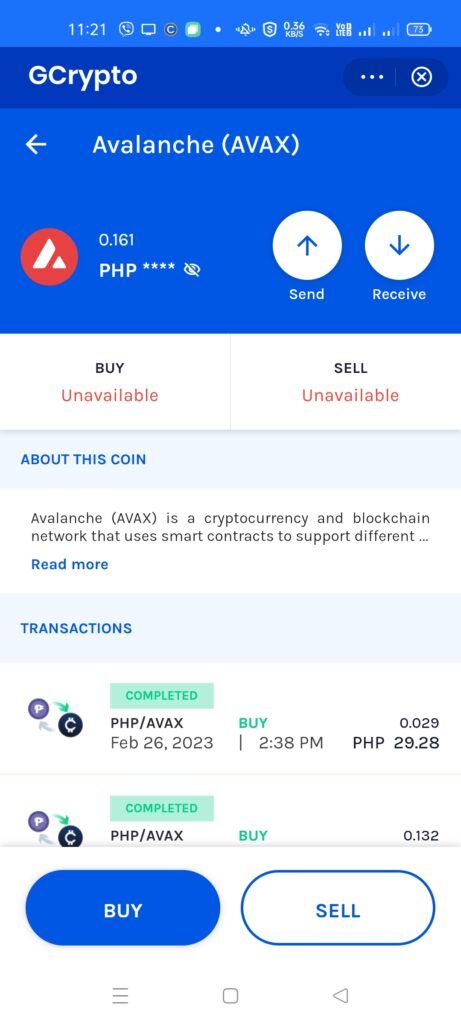

Buying a crypto asset in GCrypto

- From the GCrypto main page, look for the asset you plan to buy and click on it.

- From the asset page, click on Buy at the bottom. You will be taken to the Buy page.

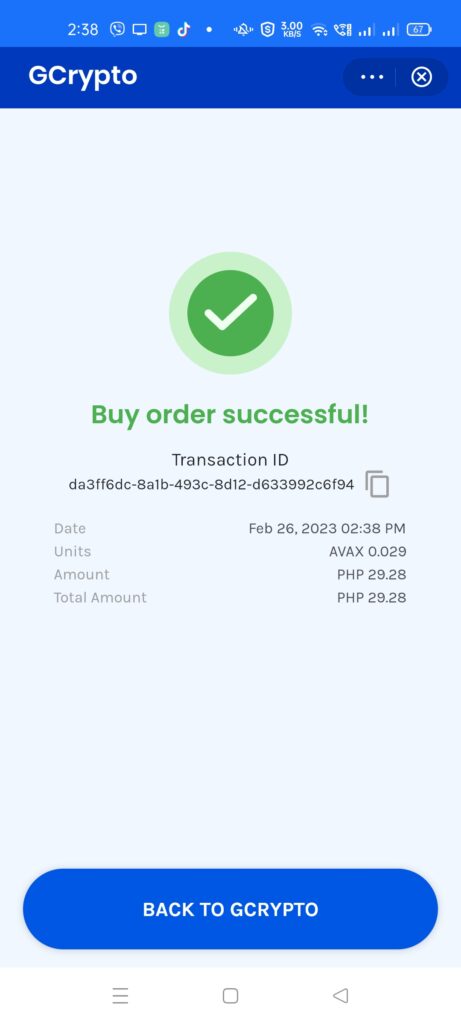

- On the Buy page, input either the peso amount or the AVAX amount you are planning to buy. Click on the Get Quote button to get the quoted price. Take note that this price is held for 10 seconds only. If you take too long, you will need to get another quote. Click on the Buy button.

- You will see that your Buy Order is successful. When you go back to the GCrypto main page your assets will update.

Selling a crypto asset in GCrypto

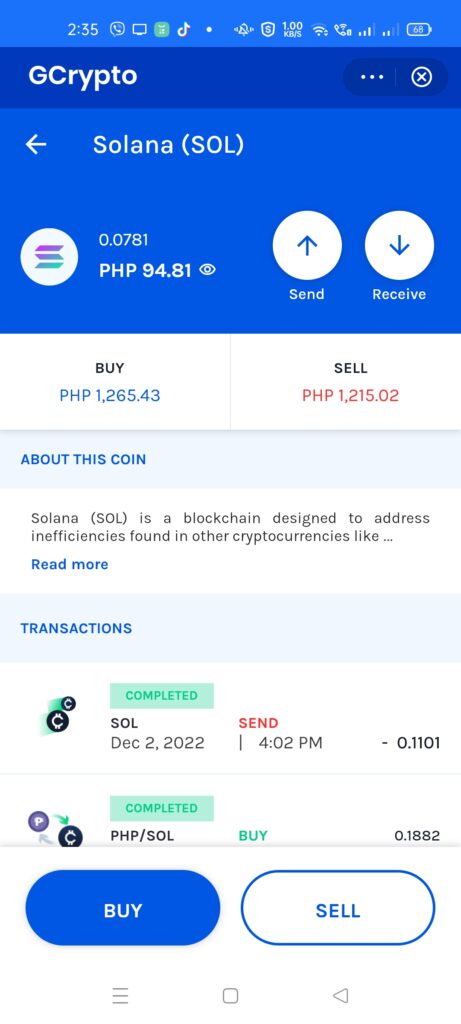

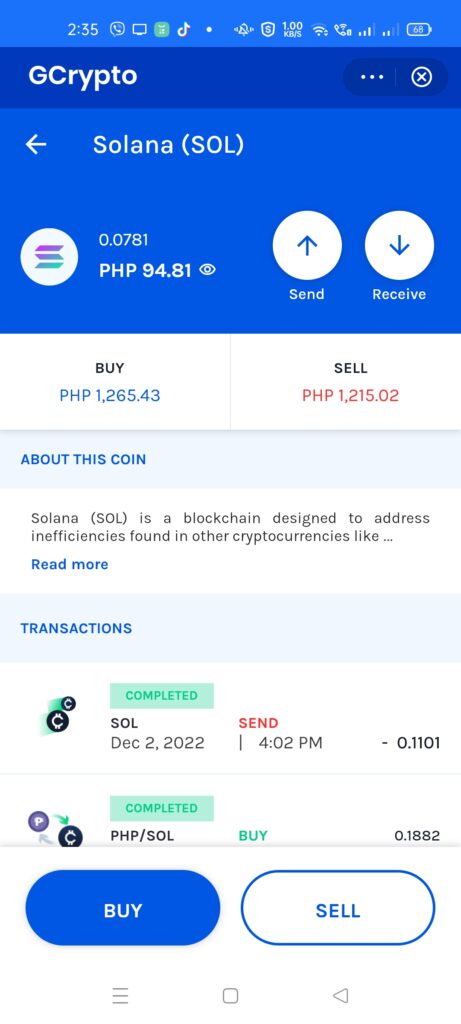

- From the GCrypto main page, look for the asset you plan to sell and click on it.

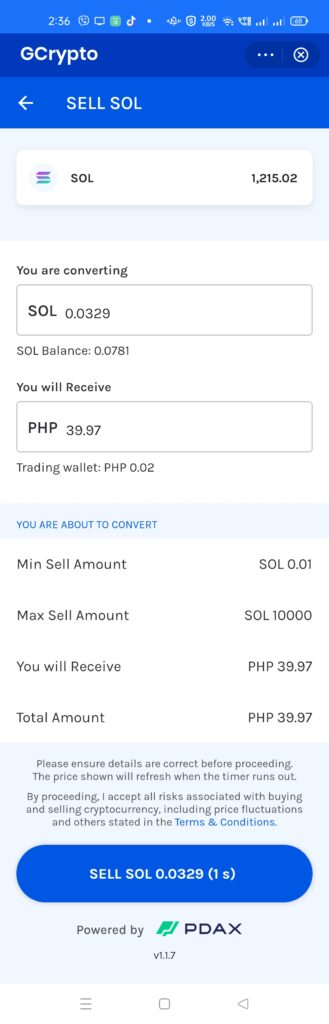

- From the asset page, click on Sell at the bottom. You will be taken to the Sell page.

- On the Sell page, input either the peso amount or the AVAX amount you are planning to sell. Click on the Get Quote button to get the quoted price. Take note that this price is held for 10 seconds only. If you take too long, you will need to get another quote. Click on the Sell button.

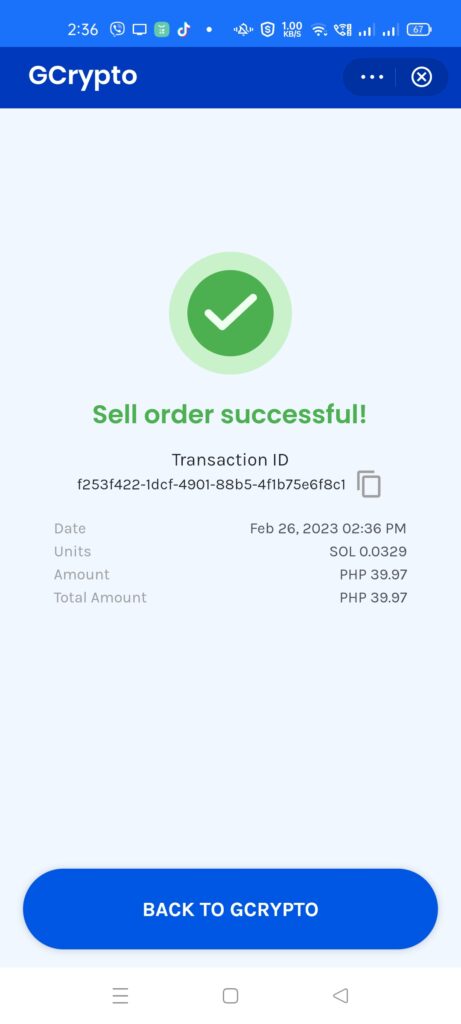

- You will see that your Sell Order is successful. When you go back to the GCrypto main page your assets will update.

How do I send or receive crypto assets in GCrypto?

In GCrypto, as each crypto asset also has its wallet, you can also send and receive assets in their designated wallets.

Take note that sending and receiving crypto assets has its risks:

- You need to get the destination address right, as there’s no way to get it back once you get it wrong.

- You also need to make sure you’re using the proper blockchain to send or receive assets.

- You should take into account the transaction fees as they can eat into your asset value. Ethereum is notorious for having high transaction fees.

- Lastly, transaction time differs greatly between blockchains. One of the slowest blockchains currently is Bitcoin as a transaction can take 1-1.5 hrs to validate. Ethereum transactions take 15 seconds to 5 minutes to complete.

Sending crypto assets to another wallet from GCrypto

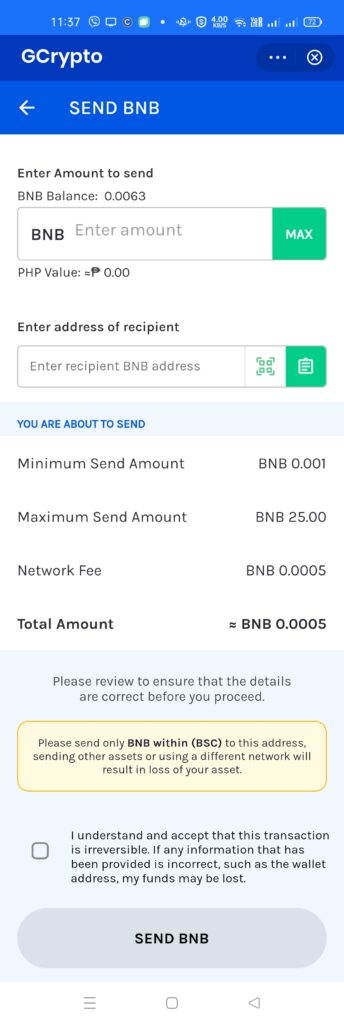

- Go to the crypto asset page from within GCrypto. Click on the Send button.

- On the next page, input the amount of crypto asset you are planning to send. It has a corresponding PHP Value below the field.

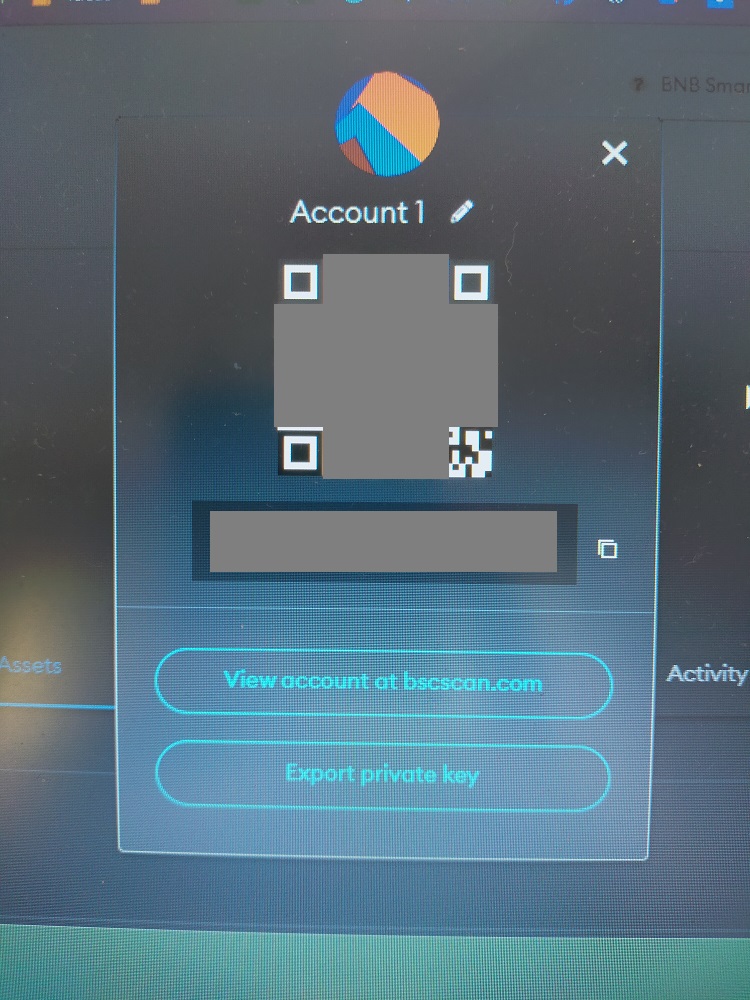

- Enter the address of the recipient, better use the scanner to scan the QR code of the address to minimize mistakes.

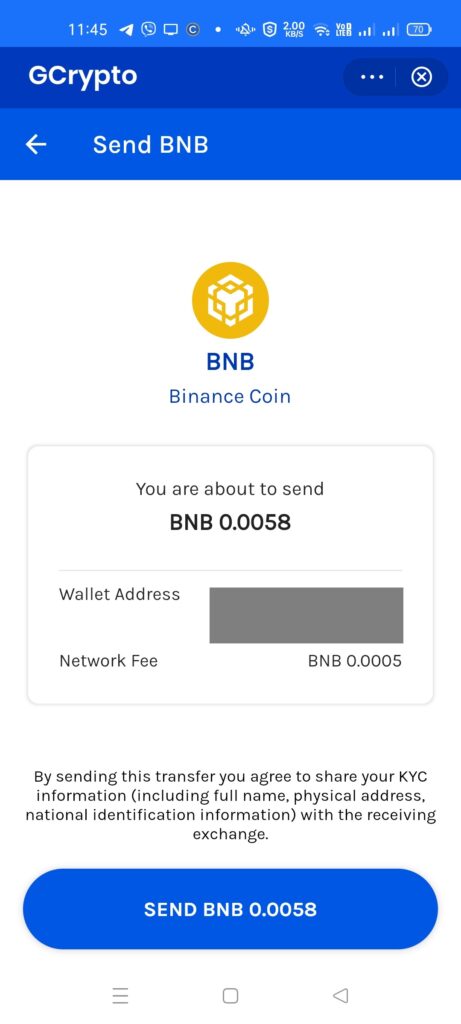

- Tick on the disclaimer and click Send. On the next page, review the data and confirm.

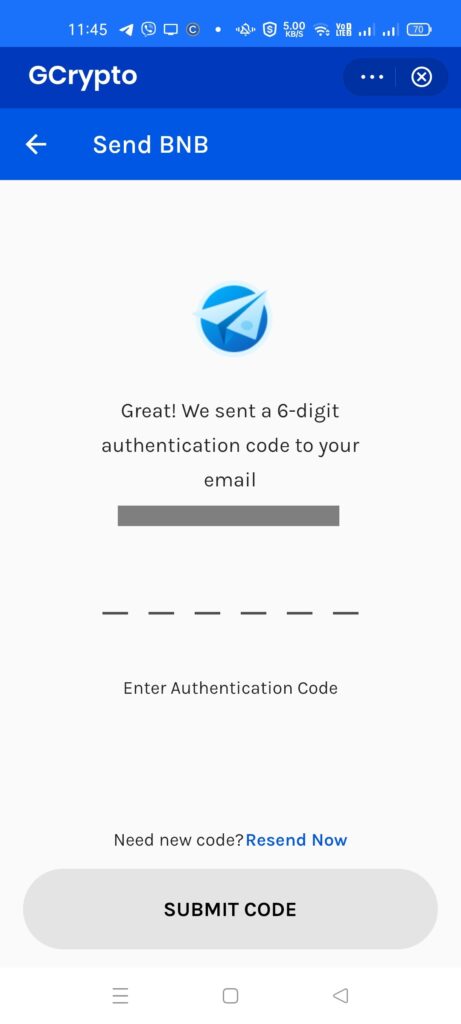

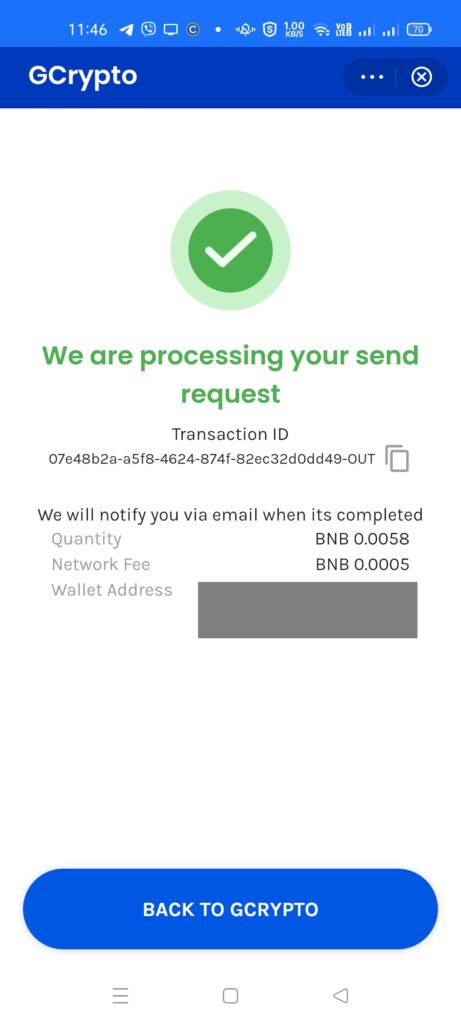

- As the last step, you will need to doubly confirm by inputting the OTP from your email address. Once done, the sending should succeed.

Receiving crypto assets in GCrypto

Receiving is easier as you only need the QR code or the address to receive assets. Take note that the sending leg of the transaction needs more effort and care. Once the transfer is done, you can wait for the assets to arrive in your specific crypto asset wallet.

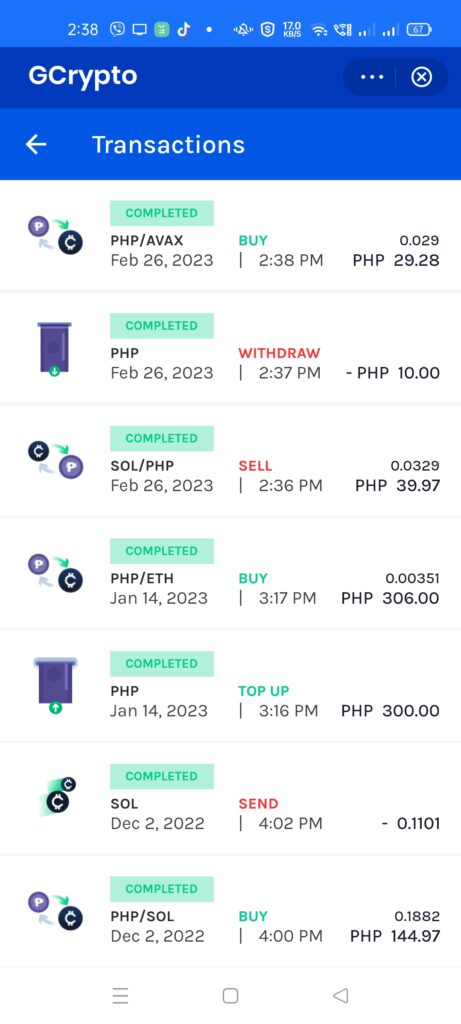

How can I check my Transaction History in GCrypto?

You can check all your transactions, even send and receive ones in the Transaction History. It’s at the bottom part of the GCrypto main page.

Other Questions

How do I solve the white screen issue when opening my GCrypto?

You may need to clear your cache or data and restart your GCash app. This would make your app forget settings, however, it also allows you to refresh the GCrypto app within GCash.

Where can I learn more about crypto assets and currencies?

It can be a stretch to digest for a newcomer, but there are resources online that make this easier. You can use LearnCrypto or Binance Academy to help you get started.

Can I open multiple accounts in GCrypto?

Yes, if you have multiple accounts, you can open a GCrypto account for each of them.

Summary

I talked about the different features of GCrypto and how you can top-up and withdraw from your wallet, as well as buy, sell, send, and receive crypto assets from their respective wallets.

Related Topics

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services: