GCash has made the QR code an integral part of its ecosystem. There are now more than 100,000 merchants using Scan to Pay as a method of payment.

Since GCash is partly Ayala-owned, all Ayala malls have a requirement for their merchants to accept GCash. Other malls like SM and Robinson’s also support cashless methods of payment that’s why you can readily see different QR standees on their cashier counters — GCash, Paymaya, GrabPay, and Alipay.

Even fast-food outlets like Mcdonald’s and Jollibee also support GCash QR payments now.

What is Scan to Pay or QR Payment?

Scan to Pay or QR Payment is the usage of QR (“Quick Response”) Codes to pay for goods and services. Majority of e-wallets, GCash included, have some sort of QR payment implemented into their apps.

What are the different types of Scan to Pay QR in GCash?

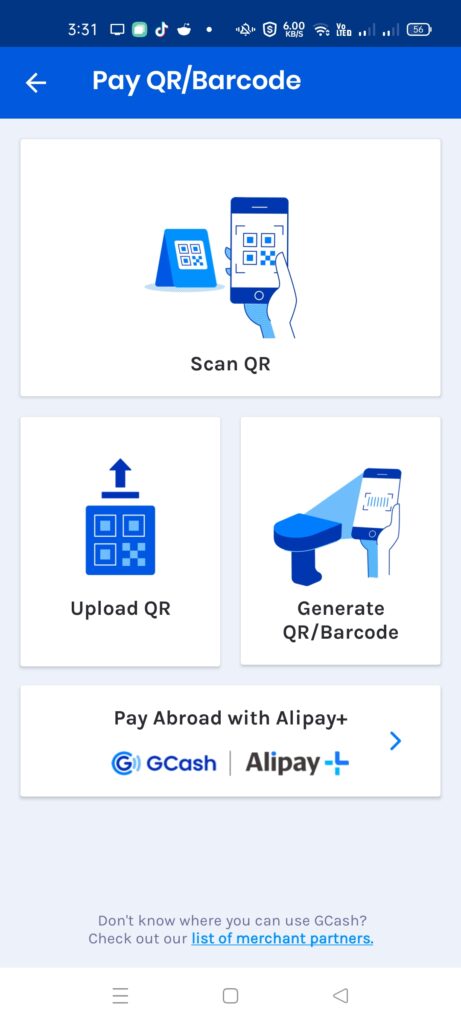

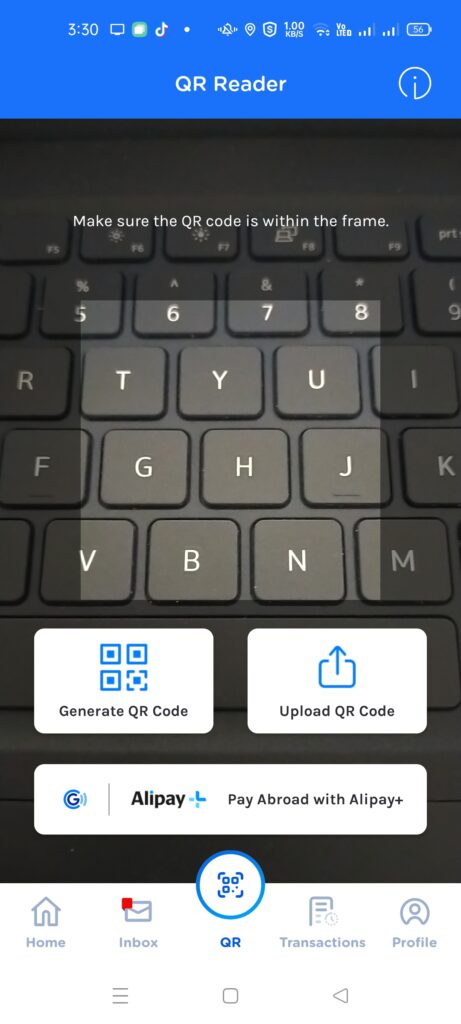

When we look at the payment options in the GCash app, there are two options — Scan QR Code and Generate QR Code. The difference lies in the way the QR is scanned.

Using Scan QR, the GCash user scans the QR Code, this means that the merchant holds the QR code. The vast majority of GCash merchants use this method since this is the simplest.

For Generate QR/Barcode, it’s the opposite. The GCash user generates the QR Code that the merchant scans. This means that the merchants need to have an actual scanner and be integrated with GCash to be able to use this method.

There are four features related to QRs:

- Scan QR

- Generate QR/Barcode

- Upload QR

- Pay Abroad with Alipay+

1. How does Scan QR Code work?

There are actually two types of Scan QR — Static and Dynamic. The GCash user basically needs to scan the merchant-presented QR Code, input the amount (if static), then confirm payment.

What is Static QR?

Static QR means the QR code does not change. This is the most common one since the QR Codes are printed on a piece of board or sticker. Usually, the QR code contains the GCash merchant information.

The user experience for Static QR is the simplest to implement but is actually slow, error-prone, and has reliability issues as a payment method for GCash.

It is the slowest method among all of the GCash options because the user needs to input the amount to be paid, then needs to confirm the payment which in total costs two steps.

It is prone to error because you are relying on the user to input the proper amount and this can cause misclicks. Oftentimes, the GCash reference number needs to be inputted or written down by the cashier and this adds to the error factor.

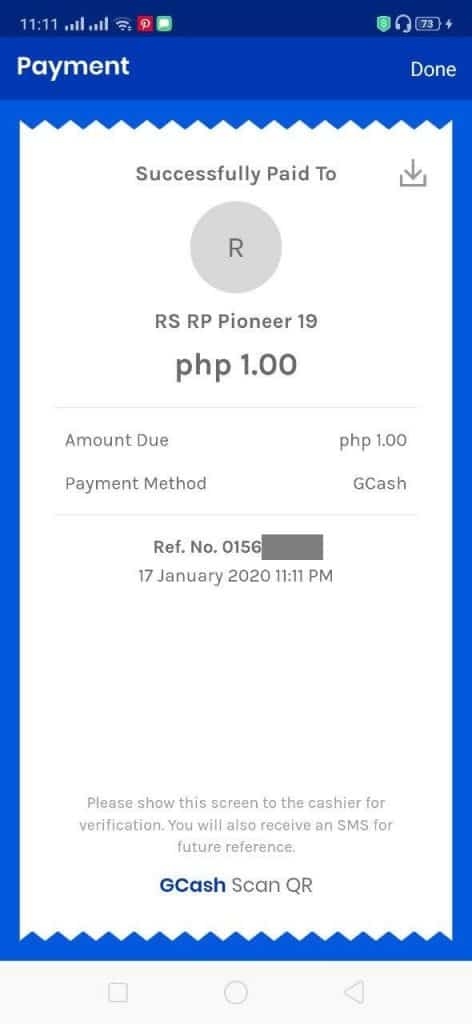

It is unreliable because the merchant only relies on the SMS received on his GCash phone to verify the payment. If there is no confirmation SMS and the cashier does not know how to follow up via text, then the only way is for the customer to wait in most cases.

There are also cases when the cashier does not have the phone with him or the phone hasn’t any power at all which also takes up the queue.

But even if this is the case, this is still the most widely used because it is the simplest to implement. And most of the time, the merchants know their way around this already as GCash has become mainstream.

What does “Alipay also Accepted” below the QR mean?

It means anyone with an Alipay app can pay by scanning the GCash QR code. Alipay is one of China’s main digital wallet apps. It means there is interoperability between GCash and Alipay.

This also means that GCash is tapping into the big Chinese market as well.

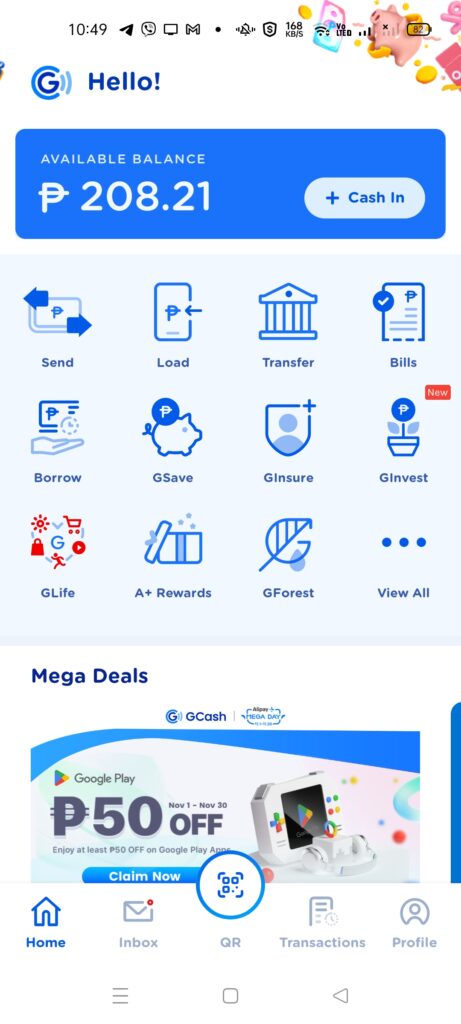

How do we pay via Static QR Scan to Pay?

From the GCash main page, we first select the QR button in the middle bottom of the screen, then use the camera to scan the code. After which we input the amount and verify the payment.

Where can I see the full Static QR merchant list?

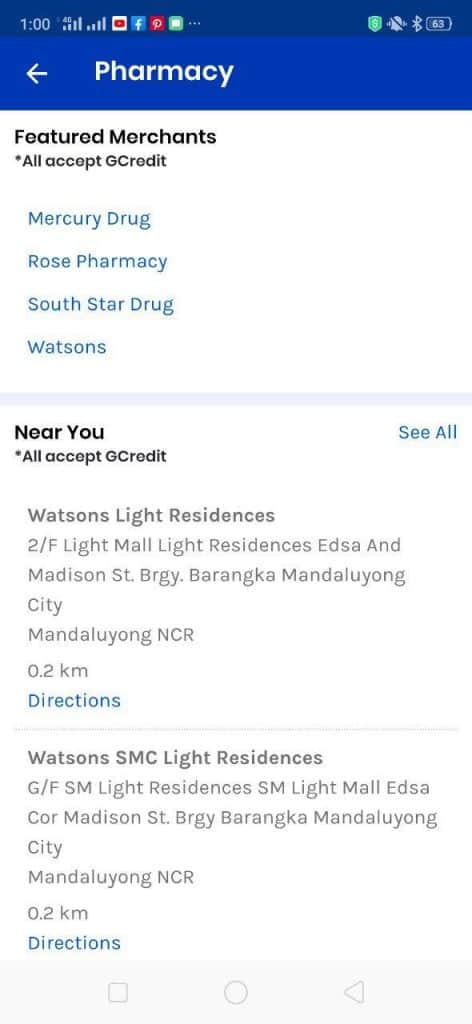

The full merchant list can be seen from the side menu in the GCash profile page. After clicking it you will see different categories (Pharmacies, Supermarket, Food, Retail, Convenience Stores, Transportation, Entertainment, Lifestyle, and Services).

When you click any of these, you will see the featured merchants and the full list for that category.

What is Dynamic QR?

Dynamic QR means the QR Code changes depending on the details included in the order. Usually, the amount is already included with the QR code, that’s why the code is always unique every time it is generated.

Because of this, the merchant needs an integration with GCash to be able to implement this. They need a way to be able to show the dynamic code on a screen.

Some notable Dynamic QR merchants include SM Department Stores (like SM Makati and SM Aura) and also all SM Hypermarkets / Supermarkets nationwide. Another is the Paymaya terminals in most stores like McDonald’s, Jollibee and others.

How do we pay for Dynamic QR?

The steps are similar to Scan Static QR above, but we just confirm the payment as the amount is included for confirmation. This makes the whole process faster and also eliminates the error factor from the user.

Also, the merchant would know the payment status right away, which also removes the unreliability of SMS notifications.

What are some issues with Scan QR?

For Static QR, the merchant is not integrated with GCash, which is why SMS notification is his only means of knowing whether the payment succeeded. This is why sometimes when there are issues with SMS sending merchants have no choice but to call the GCash hotline.

That is not the case with Dynamic QR, since the merchant can know immediately whether the payment succeeded or not and can process the refund or cancellation if needed.

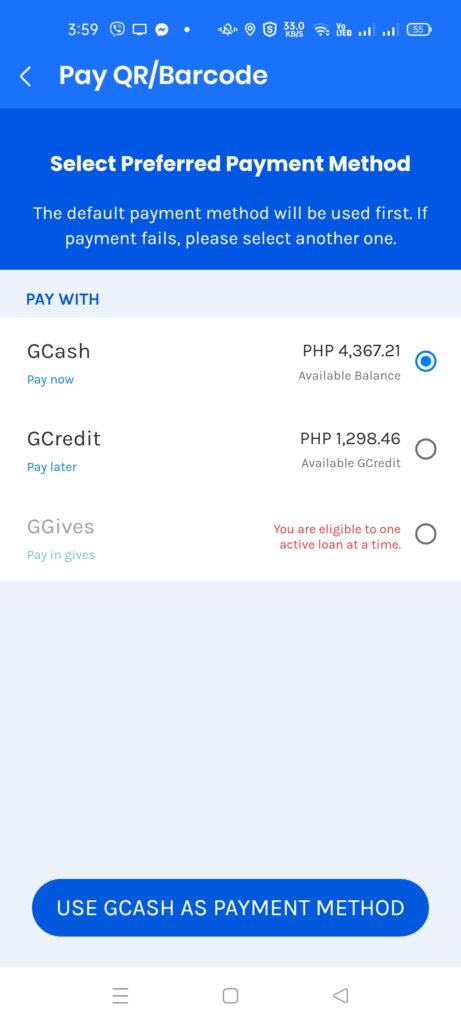

2. How does Generate QR Work?

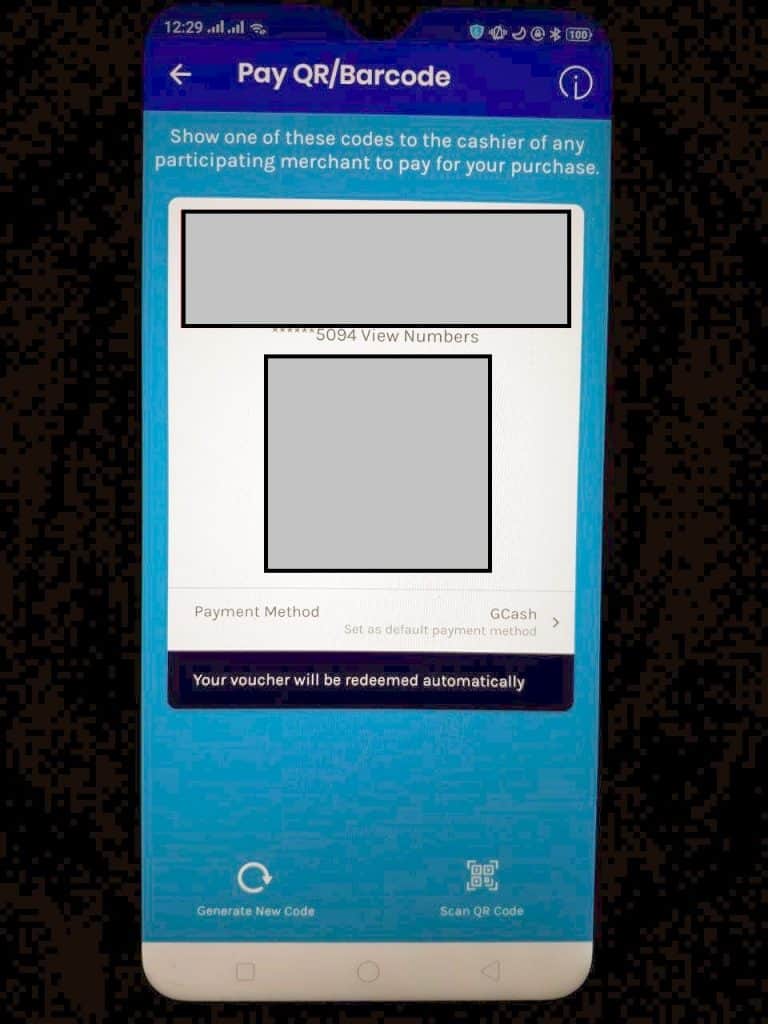

Generate QR means the GCash user generates the QR code themselves. The merchant will be scanning the generated code using their scanner.

This is the fastest mode of payment because the amount has already been inputted by the merchant. You only need to have your code scanned. The GCash user will receive a success page, and also an SMS notification.

Some Generate QR merchants are Puregold, Bonchon, BEEP, and Starbucks. In Puregold, Generate QR is termed as “GCash Barcode” Payment.

What are some common errors encountered with Generate QR?

The typical issue encountered is by far the “balance not enough” error. This is due to the fact that the GCash user cannot see his balance before paying.

3. What is Upload QR?

Upload QR is used to scan a saved QR code in your phone. This is useful for paying not through an actual store, but through chat channels.

For example, when I order my medicines from Mercury Drug viber chat, I use upload QR to pay for my order.

You can also use Upload QR to pay for personal QR codes to send money through GCash.

4. What is Pay Abroad with Alipay+?

Pay Abroad with Alipay+ allows the GCash user to use his GCash to pay for products and services abroad. Using the partnership with Alipay, GCash users can now pay merchants in South Korea, Japan, Singapore, and Malaysia currently.

Aside from the usage of GCash Mastercard in international ATMs, payments would allow more mainstream use by GCash users abroad.

Other Questions

How do vouchers work with Scan QR?

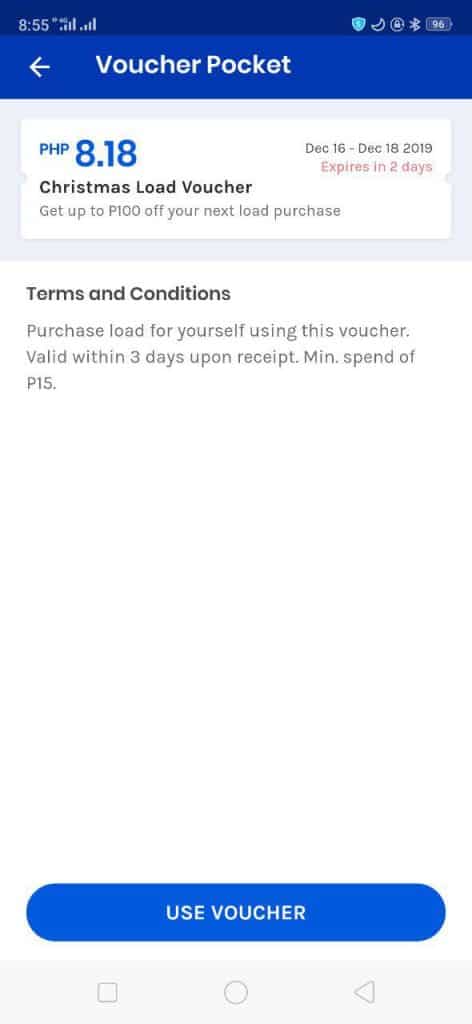

You need to check first in your Voucher Pocket what available vouchers you have. Then it would be better to check the conditions first before using the voucher.

For example, there are minimum purchase amounts or you can only use it with a specific merchant or you can only use it with a specific type of merchant (i.e., drug stores, food, etc).

To use the voucher, either click on the “Use” button in the voucher or select the voucher from the payment confirmation page.

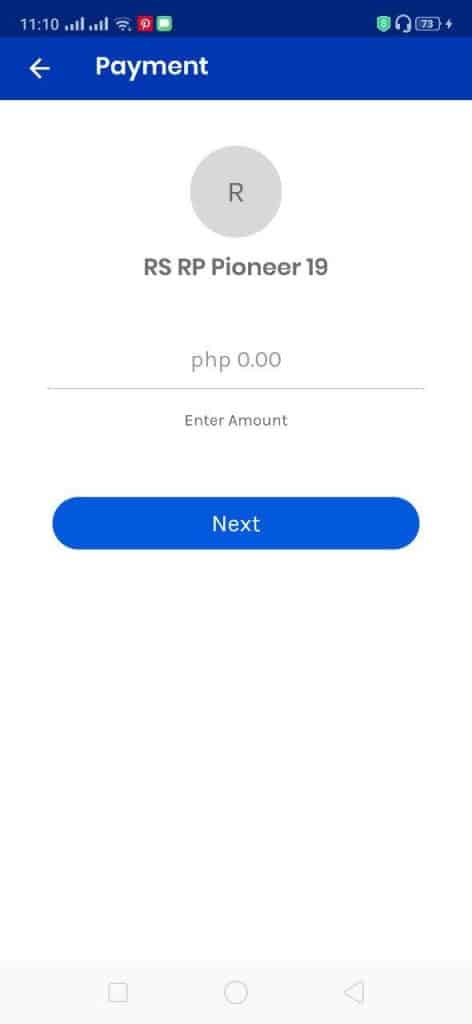

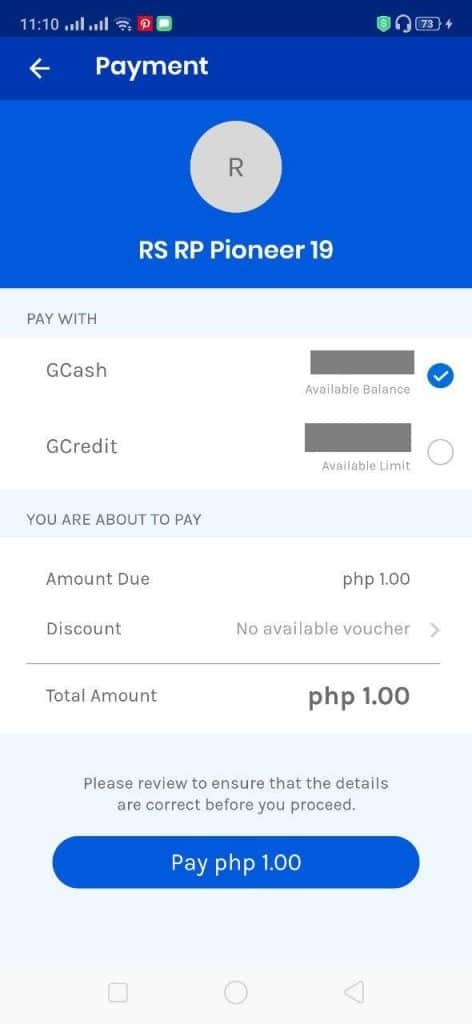

payment page

How do vouchers work in Generate QR?

Vouchers are automatically selected when you scan. There is no way manually to select which voucher you will be using for payment. It would be helpful to check first the conditions of the voucher you plan to use before paying.

Can you use the QR Codes of the other digital wallet apps?

No, the QR code formats are unique to each digital wallet app. Basically, a GCash QR code cannot be read by the Paymaya app, for example, and vice versa.

There is a BSP mandate to standardize QR code formats, but this only covers what type of QR it is — the actual content still cannot be read by other e-wallet apps currently.

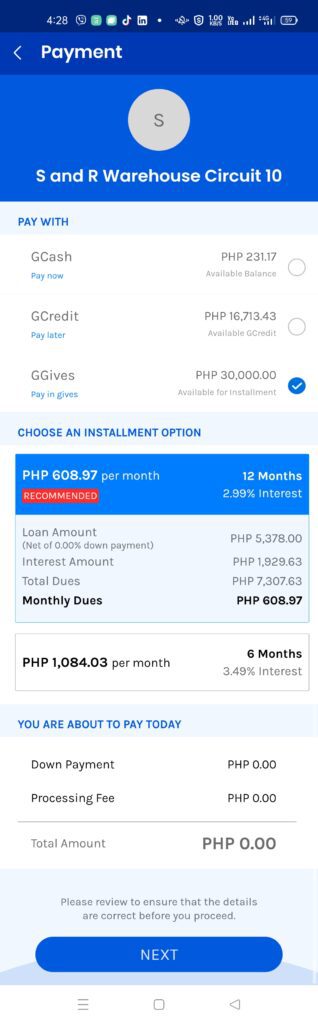

Can you use GCredit and GGives with both Scan to Pay and Generate QR modes of payment?

Yes, GCredit and GGives are both supported as payment options. You just need to select it right before the verify page for Scan QR. For Generate QR, it’s right on the generation page itself.

Does Scan to Pay contribute to GScore and GCash Forest points?

Yes, GScore gets a snapshot of your money habits, so this definitely takes it into account. As for GCash Forest EPs, payments unfortunately do not contribute to EP generation.

How do I apply as a GCash Scan to Pay merchant?

You can refer to what I’ve already posted here about applying for GCash acceptance and what to expect as a merchant partner.

You may also generate your own personal QR code, however you may also run into wallet limits, unlike GCash merchants.

Do you have a list of payment-integrated merchants?

You can take a look at this page for the list of integrations in GCash.

Summary

We talked about the different methods of payment in GCash — via Scan QR or Generate QR.

Scan QR in turn comprises Static QR and Dynamic QR. Static QR is the most common and what most of the GCash merchants use — this is where the QR code has a hard copy. Dynamic QR is a QR code that changes based on the payment information and needs a screen to display the QR code. Many payment aggregators have this payment method available.

Generate QR/Barcode has a GCash user creating a QR and having it scanned by a merchant. The payment experience is fast and is best for supermarkets like Puregold. Starbucks also offers this method as well as BEEP bus ticketing.

If you’d like to learn more about GCash, I created a how-to on the basics of GCash here.

Here are a couple of more links if you’re interested in other GCash articles:

- GScore and GCredit

- Cash in or Cash out

- GCash Scams

- Send Money

- GCash Forest

- GSave

- GInvest

- Book Movies

- Bank Transfer

- Cashing in with the Union Bank app

If you would like some tips on how to create a blog from scratch, I’ve created a resource page.

How do you like the article? Did I miss anything? Please add your comments and suggestions below!

Hi! I am just curious if I have to be fully verified in my gcash account to us the pay with qr code or it will be okay if I am just a basic user?

Pay qr is enabled for basic users

Hi! I just wanna ask if paying using qr code has an additional charges?

No extra charge for users in payments via QR code

Your payment of P159.00 to Google has been unsuccessful due to insufficient balance & remaining credit limit. Click here to top-up your wallet. https://gcashapp.page.link/55K8

Hi! We recently opened a donation drive. We opened a Gcash account so those who would like to donate can just send money to that Gcash account. Is there a way I can generate a QR code for that Gcash account so that I can share it to others to those who would like to donate?

You can try emailing iw**********@my**.xyz

Hi! Someone send me money thru gcash, but my balance is still 0. He told me to have a gcash voucher first to complete the transaction and for me to receive the money. Is it true or not?

not true. maybe he sent it to a wrong number or he is trying to scam you.

Hi, is there any way that I can use my GCredit in paying but using other other banks QRCode? For example, if the store is not a partner/certified merchant but they have a QRCode of Metrobank or any bank. Can I use that QRCode using my GCredit to pay?

No, there is no connectivity between QR codes of other banks

My friend wants to send me money but She isn’t verified. Is there other means that I can receive the money?

Unfortunately, no. Why not have her verify instead? It doesn’t take 5 minutes to do.

Is my gcash number and name revealed after paying thru qr code?

No, as the number and the name are personally identifiable info.

Hi! I’m just wondering is Gcash for business is only for QR codes? What if the customer doesn’t know the process of QR code and just wanted to express send (type in the number). Will our corporate name appear or the name of the representative will appear?

For business QRs you cannot do express send, you can only do payment. And for businesses, the amount for the day is settled into the bank account.

Can I generate my QR first at home before going to Puregold using home wifi so as to save on data? Thanks po.

nakasave po ang first 5-10 QRs for generate QR, no need for data; but if you are using globe no, data is nonmetered (or free) for any gcash feature (except those that call third party apps)

pwede bang gmtin yng cp number issued by gcash sa payment without qr code

Huh? What do you mean? Hindi naman iniissue ni GCash ang CP no… ang user ang nagreregister ng CP no sa GCash mismo

Hi! Pwede ba i-send sa ibang phone ang screenshot ng qr code ko at yun pa-scan nila for payment pero sa akin madebit

puwede. yung iba nga nagpprint at pinapamigay yung kopya eh.

Hello. How can I obtain gcash dynamic qr codes for business? Do I have to be a merchant account or contact globe gcash directly?

Dynamic codes should be directly implemented by a payment facilitator that has integrated with GCash. You can partner with an integrator for these kinds of POS solutions.

How to know the gcash number of the sender if they used qr barcode?

You can’t, unless you ask for it from the receiver itself

Hello, if I have 10 sub-merchants, after I register as a merchant with gcash, can I generate different static QR codes for these 10 sub-merchants? After each static QR code is successfully received, does gcash have a webhook to notify our own system?

Yes, but you need to integrate with GCash for this as the webhook solution isn’t standard with normal merchants. Better contact them via their email.

hi is there any way to received money from another country via gcash? someone told me to buy gift card first to codashop before they can transfer or transact to my gcash? is it true or they were bluffing?i dont know what codashop is haha

you can buy load or gift cards from codashop (www.codashop.com), and then provide the details to the recipient

Is the QR code I made to receive money can be used the same as to pay?

What do you mean? you can only create a QR code to receive money. There is no other QR code that pays you.

Does verification code sent to the registered number is required when using qr pay of cash?

No, because you are already logged in the app, so no need to verify any qr payment

Hi do you experience failed transaction to the groceries store but gcash deducted you the money? How to connect with gcash for tje complaint since their hotline didnt accept phone calls.

File a support ticket from within the app itself

For dynamic QR is there a way to choose the payment options?

Based on my experience, I noticed that the default option is GCash unlike when I generate the code where I’m prompted with the GCredit options.

I’m thinking do I need to tell the merchant GCredit instead of GCash?

This depends on the merchant if they normally allow GCredit, GGives — otherwise it’s Balance only