Bank transfer is one of the most used features of GCash. This has become a feature that is almost a requirement for all fintech apps nowadays. From Maya to Coins.ph, to ShopeePay, to LazadaPay, all have a way to transfer funds between them.

A side effect of this is the fact that it has also become one of the only free ways to cash out in GCash — all you need to do is to transfer it to the bank where you already have an ATM, then withdraw from that ATM. There are other ways, but this is one of the most common ones.

BSP: InstaPay and PESONet

What makes Bank Transfers work?

This was made possible by a BSP initiative called the National Retail Payment System. This system provides a framework for easy retail payments and transfers. Under this framework is where they enable Automated Clearing Houses like PESONet and Instapay.

GCash utilizes Instapay to transfer funds between banks or other fintech apps.

What’s the difference between PESONet and Instapay?

The main difference is the speed and the amount being transferred. Instapay has a Php 50,000 amount limit per transaction, but the speed you can send the amount is instant, hence the name.

PESONet has no set amount limit because it is used for volume transactions. Because of this, the clearing time is longer and can take up to a day to process.

What is the transfer limit for GCash?

There are cash-in and cash-out limits of Php100,000 per month for Fully Verified users.

Unlocking Higher Account Limits

You can unlock higher limits by linking your BPI/UnionBank or your Payoneer account/s and utilizing either GSave or GInvest / GInsure with a Php 100 deposit or investment.

Once you do so, you will be able to unlock:

- A bigger wallet limit – Php 500,000 maximum

- Higher incoming limits – you will be able to receive up to Php 500,000 in your wallet and daily cash-ins have no limitations

- Higher outgoing limits – withdrawals will have no limitations per month, and you can withdraw up to Php 10,000 per day

You will be receiving an SMS informing you of the increased limits.

Take note that once you’ve unlinked all of your BPI/UnionBank/Payoneer accounts, the limits will revert back to what it was before.

GCash Bank Transfers

How does Bank Transfer work in GCash?

Sending from GCash to Bank Accounts using QR PH

As BSP is mandating QR PH for greater interoperability between financial institutions, you can now scan from GCash any Bank QR supporting QR PH using the “Scan to Bank” feature under Transfers or from the GCash QR scanner itself.

You do not need to know the account number or account name to transfer funds using this method.

Here are sample QRs supported by BPI, UnionBank, and PSBank. Notice the QR PH logo in the middle. Once scanned they will go to their respective transfer pages in the GCash app.

Normal Bank Transfer in GCash

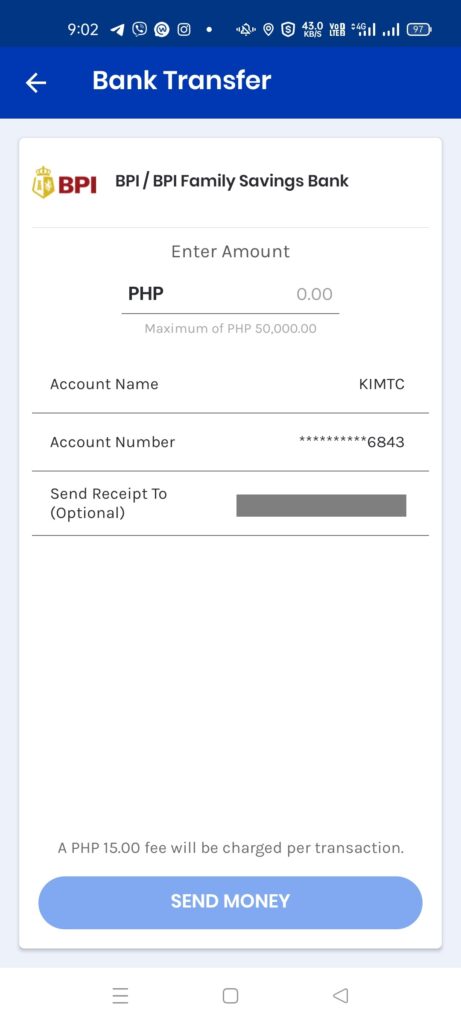

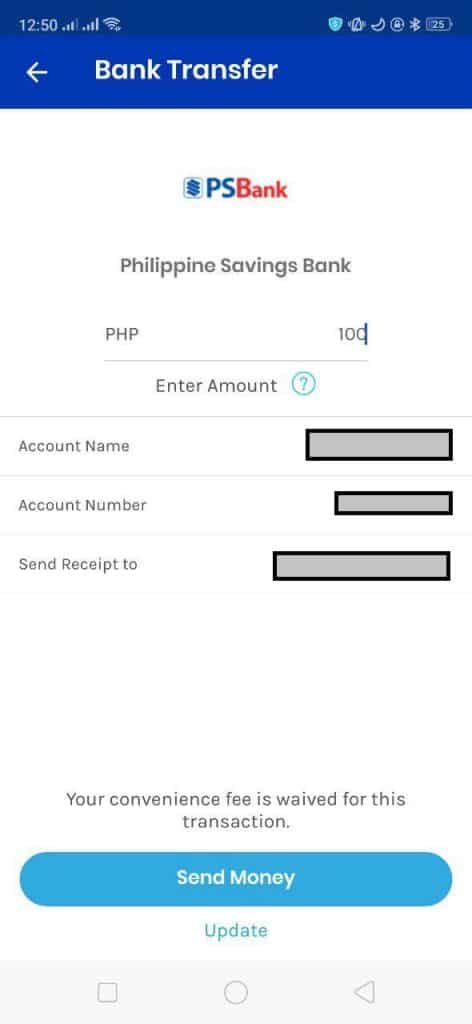

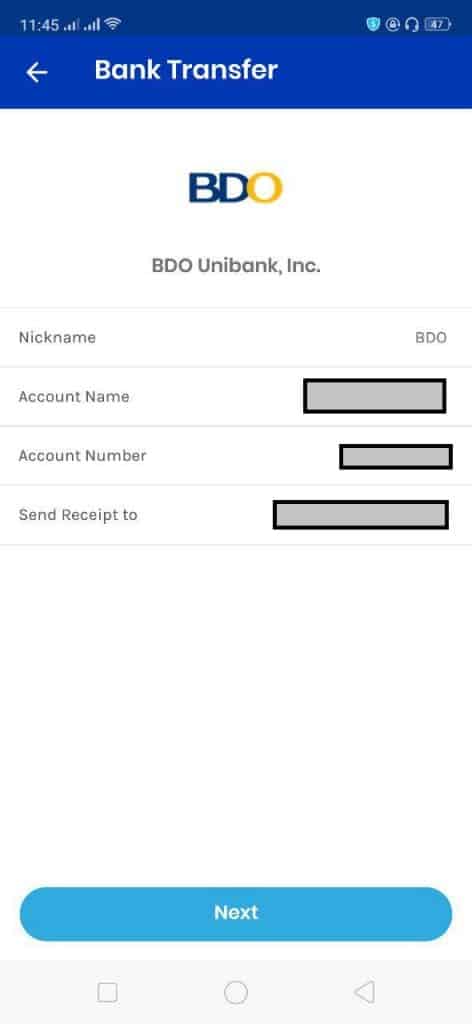

This is the normal bank transfer method in GCash, and this needs you to know the actual account name and number to proceed.

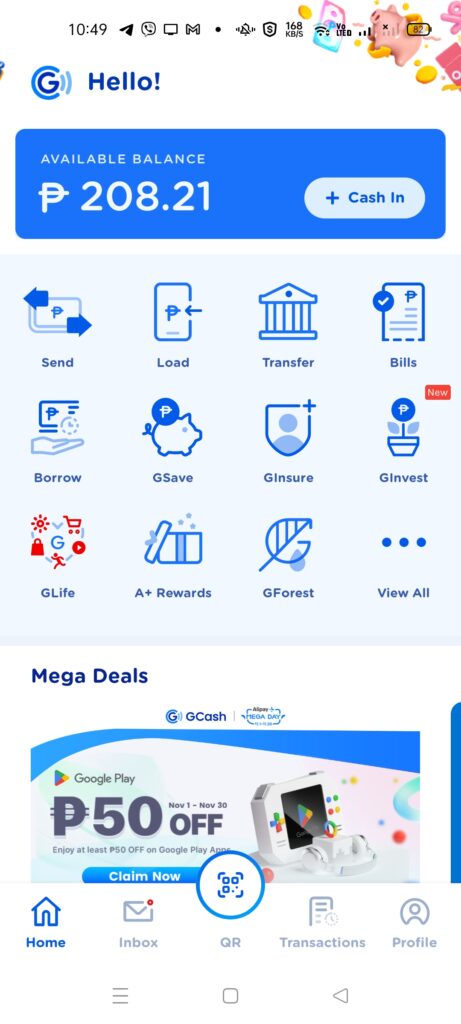

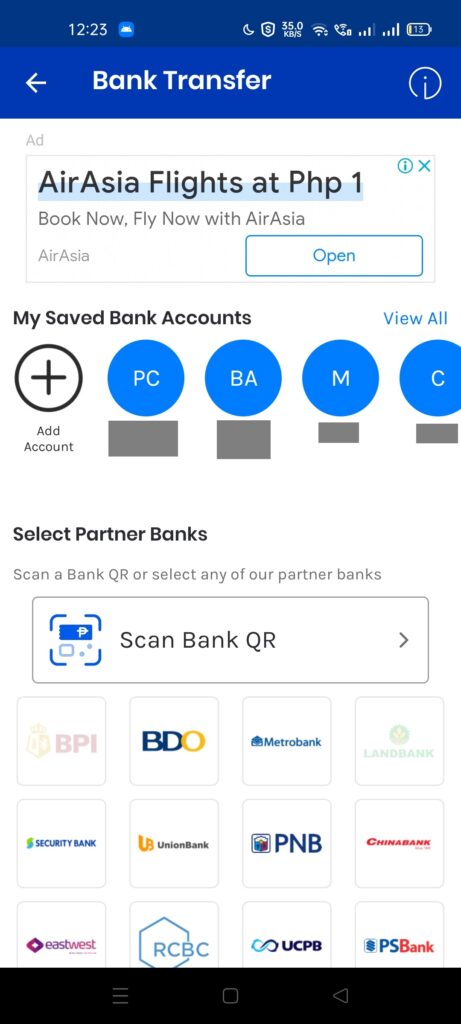

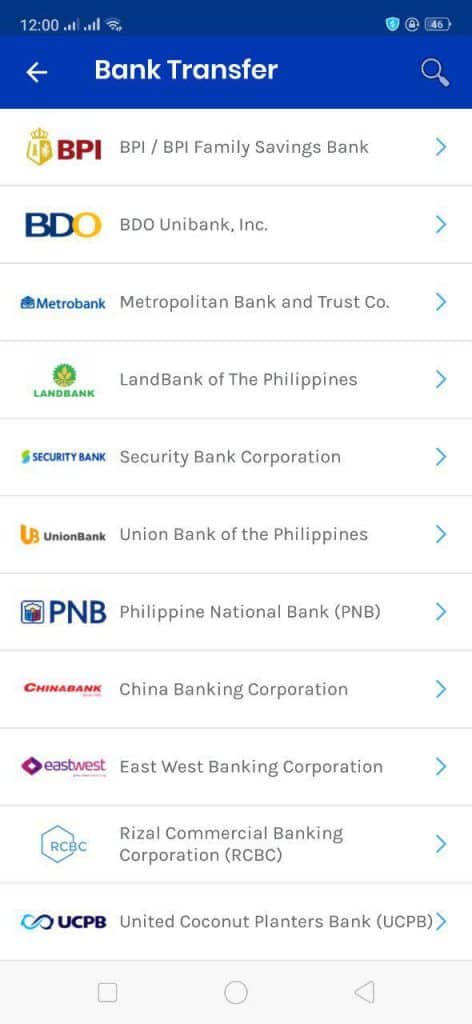

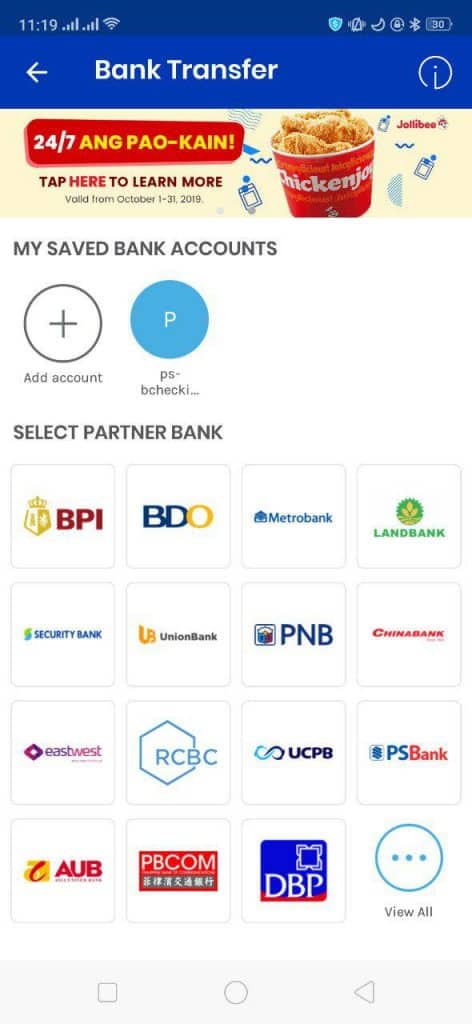

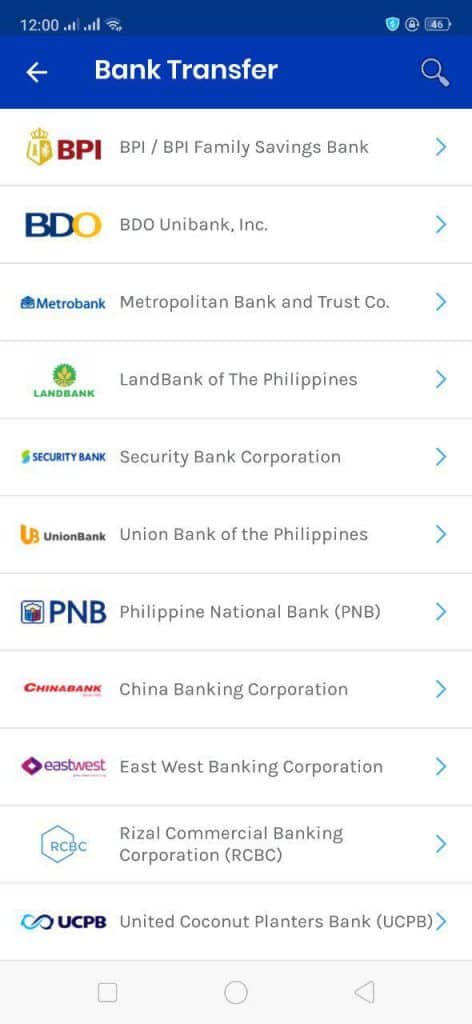

You need to click the Transfer button on the main page. On the next page, we can see some partner banks we can send funds. To see the whole list, we can click on “View All”.

You need the account name, account number, and amount to transfer funds. I recommend putting your email address in the “send receipt to” option so that you will have a record of the transaction.

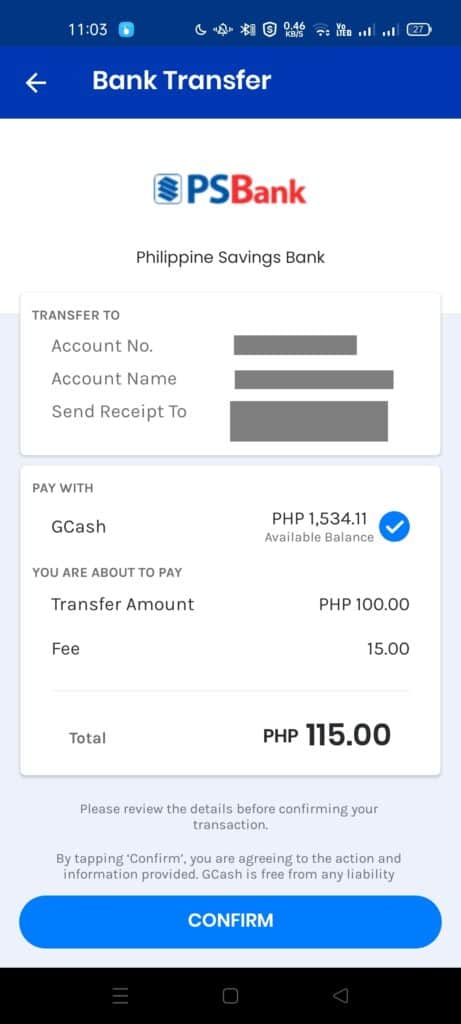

Is there a fee to use Bank Transfer?

Starting November 1, 2020, GCash will be charging Php 15 per transfer. This is due to Instapay charging banks and other institutions using its service.

Here are the InstaPay fees for most banks (as of Jan 24, 2025):

- AUB: Php 8

- BDO: Php 25

- BPI: Php 25

- Chinabank: Php 15

- Coins.ph (DCPay): Php 10

- East West: Php 10

- Landbank: Php 25

- Maybank: Php 10

- Metrobank: Php 25

- Maya: Php 15

- PBCom: Php 20

- PNB: 20

- PSBank: Php 15

- RCBC: Php 25

- Union Bank: Php 10

You can also refer to the BSP Instapay fees list if your preferred bank is not here.

How can I save bank details for use later?

You can also save bank details so that it’s easier to transfer the next time. There can be a maximum of 20 saved banks at any time.

Procedure for Saving Bank Details

- You need to click on the “Add Account” button under My Saved Bank Accounts.

- This brings up a bank list. In my example, I chose BDO.

- You need to save your account details and set a nickname for use next time.

- Once you’ve saved your bank, you will see it in the Saved Bank section.

How do you use your saved bank details?

You need to click your saved bank, then go through the bank transfer as normal. Since the details have been saved, you don’t need to input them — just the amount to be transferred is needed.

How do you do a scheduled transfer?

You first need to save your bank details. Once you plan to use your saved details, you can add a scheduled transfer (max of 5) to your saved details.

Procedure for scheduling bank transfers

- From the specific Bank Transfer page, click on the Add New Schedule under the Create Scheduled Transfers section.

- Select your period and amount then click Confirm.

- On the next page, check the settings you created and click on the Confirm button.

What do I do if I don’t receive the funds?

You should be able to receive it a little later (at most 24 hours). If after 24 hours you still haven’t received them, then it would be best to contact support.

Why does this happen? This is usually a connection issue. Since GCash transactions as a whole take up a lot of bandwidth, sometimes the backend servers cannot keep up.

Can Bank Transfers affect GScore and GForest?

GScore looks into your financial habits as a whole, so how you use Bank Transfers can potentially affect your GScore. Here is a blog post explaining more about raising your GScore.

Bank Transfer is one of the known Energy Point (EP) generators for GCash Forest. You can get around 130EP, but there is a minimum of Php100 before it triggers EP creation.

Can I use Bank Transfer and withdraw from my ATM account as a cash-out method?

Yes, and I recommend this option because it is cheaper than the alternatives.

Withdrawal via ATM using your GCash Mastercard has a fee depending on the ATM. Over-the-counter withdrawals have a Php 20 fee per Php 1000 withdrawn.

Can we send funds to GCash from other bank apps?

Yes, GCash can now accept transfers from InstaPay and PESONet. There may be transaction fees, depending on the bank.

You can also refer to the BSP settlement list for the fees.

How do we send funds to a Maya account?

There is a Paymaya selection in the bank list – meaning Paymaya supports receiving Instapay deposits. You need to input your account name and the account number, which is your mobile number tied to the Paymaya account.

Can we send the money back to GCash from Paymaya?

Yes, from Maya’s main page, you need to click on Bank Transfers, then input details like the account name and the account number (again, this is the mobile number tied to the GCash account). There are likely to have transfer fees, similar to GCash.

How about GCash transfer to Coins.ph?

Yes, there is also a Coins.ph selection in the bank list (under DCPay) which means Coins.ph supports InstaPay receiving as well. The account name and account number (again, mobile number) is needed.

Can we send funds from Coins.ph back to GCash?

Yes, Coins.ph supports sending via InstaPay. However, there is a fee included.

Coins.ph also supports free PESONet transfers to other banks but it takes more than a day to process them.

How about GCash to GrabPay transfers?

You can also send via InstaPay to GrabPay. The account number to be used is your mobile number linked to the Grab account.

Another way you can top up to Grab with GCash is via GCash Mastercard or AMEX. I used AMEX since I had that option in my GCash app. You just need to click on “Cash-in” on the GrabPay page.

Can we send funds from GrabPay to GCash?

For the opposite case (GrabPay to GCash), GrabPay can also do transfers to e-wallets through InstaPay.

From the GrabPay Wallet page, click on Transfer and you will see different ways of transferring funds. One of those is via e-wallets. Select GCash and input your credentials and you will be able to send via InstaPay as well.

Is there a way to send funds between banks for free?

You can refer to this page to find out how to send funds by skirting fees.

Summary

We’ve talked about how Bank Transfers work in GCash. GCash leverages Instapay to process these transactions. We also delved into how to transfer to and from other fintech apps like Maya, Coins.ph, GrabPay.

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

where to find the cid of amex virtual card? i only know my security code (ccv)

For Virtual Pay, there is no CID. We only have the CVV.

Very soon this site will be famous amid all blogging and site-building users, due to it’s good content

Hello, I’m a student, who’s doing a study and applying a testing technique for the bank transfer feature of GCash. Does it prompt invalid input of credentials or does it succeeds when a user inputs an incorrect account number?

As far as i know yes