Insurance is really something that’s overlooked these days. Usually, for the layperson, they don’t really see the usefulness of insurance unless they’ve met the insurable event (like a death in the family or critical illnesses, etc).

I’ve talked before about how GInsure makes insurance easy as everything you need is already in the GCash app. You don’t need to fill out forms and you just need to pay for the insurance you need.

In this blog post, we’re going to talk about GInsure Bill Protect. This allows an insured person to be able to pay for their bills even if something happens to them, for a small amount extra of what they’re paying for the bill every month.

How does GInsure Bill Protect Work?

Basically, it’s life insurance, but the insurer helps you pay a bill when something happens to you. You will only need to pay for the premium once you’ve paid the bill monthly.

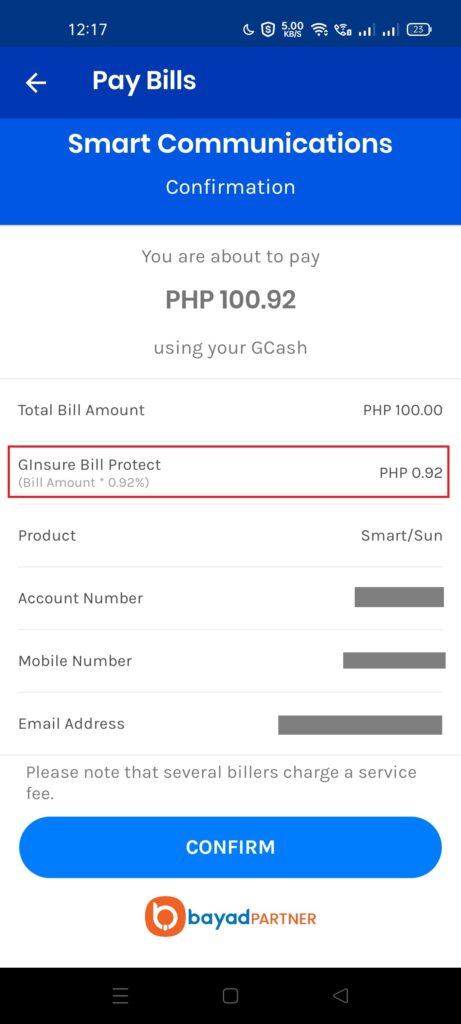

The amount is less than 1% of the total amount you’ve paid. Once you’ve paid the premium, you are insured for this particular bill for 30 days from the time you’ve paid for it.

Who will be insured?

The insured is the GCash user paying the bill. Even if you’re paying for another person’s bill, you are the one insured as you own the GCash account.

What is the benefit?

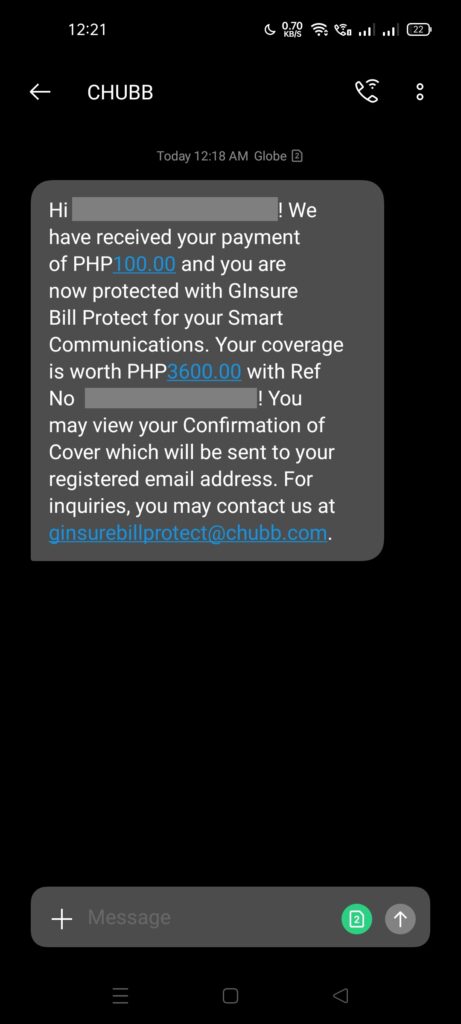

The insurance covers the insured for 36 times the bill amount when you are unable to earn and pay for your bills due to accidental death or permanent disablement.

Who are the beneficiaries?

The benefit is payable to the insured in case of permanent disablement but in case of death the beneficiary falls into an order of precedence — your spouse, then children, then parents, then siblings.

Can I enroll in multiple GInsure Bill Protect policies?

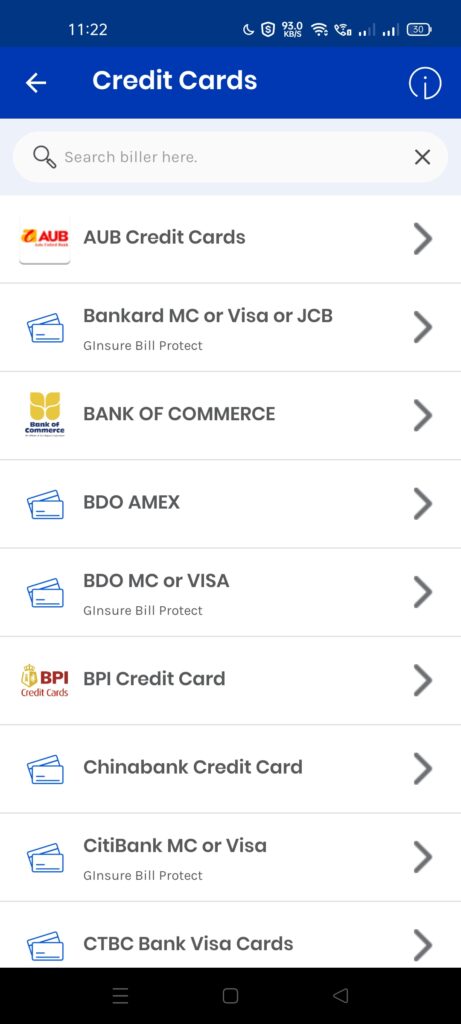

Yes, as long as it’s covered. You will be able to see if Bill Protect covers a specific bill in the biller list.

How do I avail of GInsure Bill Protect?

For certain bills, you will be able to see the option to enroll in Bill Protect. It’s in the bottom part of the biller.

Once you’ve entered the amount, it will automatically be included on the confirmation page. Once you’ve paid for the biller, you will also be receiving an SMS that informs you of your coverage.

How do I file a claim?

You need to first collect the requirements for filing:

- Valid ID of the Insured (GCash User) or of the Beneficiary of the GCash User

- Birth & Death Certificates of the Insured

- Proof of Relationship to Beneficiary

- Attending Physician’s Report

- Original Copy of Police Report

- Notarized Affidavit of Witness

- Autopsy Report or Medico-Legal Statement

After which you can submit them to the Chubb Claims website. Business hours are Monday-Friday, 8:30 AM – 5:30 PM.

Other Questions

Why does GInsure Bill Protect does not appear in my saved biller?

Currently, it only works with the normal, unsaved billers. The GInsure Bill Protect option will not show up when you pay using your saved biller.

Can I use GCredit to pay for both biller and GInsure Bill Protect?

Yes, as long as GCredit is also enabled for the biller.

Why is my biller not yet included in the GInsure Bill Protect list?

It seems that this offering is being offered in phases. Hopefully, we will be able to see most if not all of the billers covered eventually.

Summary

We talked about GInsure Bill Protect and how it helps the GCash user pay for the biller in times of great need. Basically, you can have your bill covered for 36 times the amount, with a premium of less than 1% of the amount you paid for it.

This helps provide a security blanket for the ordinary GCash user that cannot normally enroll in an insurance policy.

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services: