Last Updated: Aug 26, 2023

This page lists all of the documented limits currently in GCash. For a list of GCash fees and alternatives to these fees, please see this page instead.

GCash Account-Related Limits

Wallet and Transaction Limits

This also covers most of the limits of all cash-in channels, including over-the-counter, machine, online, Paypal, Payoneer, and remittances.

Additionally, the outgoing limit also applies to financial services like GSave, GInvest, and GInsure, as you are putting money into investments and/or insurance.

| Detail | Basic | Fully Verified | Fully Verified with Linked Accounts (GCash Plus) | Fully Verified Minor (GCash Jr) | Platinum ( enrolled in a Globe Platinum Plan) |

|---|---|---|---|---|---|

| Wallet Size | Php 10,000 | Php 100,000 | Php 500,000 | Php 50,000 | Php 1,000,000 |

| Daily Incoming Limit | N/A | N/A | N/A | N/A | N/A |

| Monthly Incoming Limit | Php 5,000 | Php 100,000 | Php 500,000 | Php 10,000 | Php 1,000,000 |

| Daily Outgoing Limit | N/A | Php 100,000 | Php 100,000 | Php 10,000 | Php 500,000 |

| Monthly Outgoing Limit | Php 5,000 | N/A | N/A | Php 10,000 | Php 1,000,000 |

| Yearly Outgoing Limit | N/A | N/A | N/A | Php 100,000 | N/A |

The linked accounts here pertain to BPI, UnionBank, and Payoneer accounts, with GSave and GInvest placements.

If you encounter GCash limit exceeded errors, you will need to wait for next month for your limits to reset.

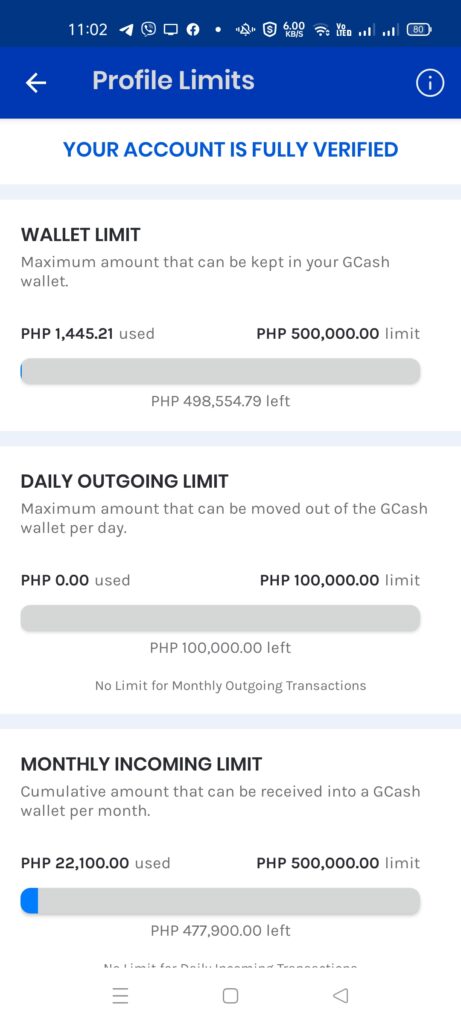

Profile Limits shown in GCash

These limits are shared across all alternate accounts you may have and can be seen under the Profile page. Unfortunately, you can’t see all of your accounts at once, but you only see the limit of the profile you are currently using:

Other Documented Limits

| Product | Limits | Value |

|---|---|---|

| Send Money – Padala | GCash Padala Send Limits | The minimum amount is Php 500, maximum is Php 5000 |

| Send Money – Padala | GCash Padala Nonclaim Limit | 15 days (after which it will return to sender) |

| GInvest – GFunds, GStocksPH | GInvest Limits | None for investing; applies outgoing limits (daily and monthly) for redeeming |

| Cash-in – BPI | BPI cash-in limit | Php 15,000 (for newly registered GCash users) Php 50,000 per day |

| Cash-in – UnionBank | UnionBank cash-in limit | Php 100,000 per day |

| GForest | GForest energy point limit duration | 3 days |

| GCredit | GCredit limits | Starts with Php 1,000, maximum of Php 10,000; depends on GScore |

| GSave – CIMB | Account limits (without upgrade) | Php 100,000 deposit limit 12-month account expiry |

| Send Money – Bank Transfer | Instapay limit | Php 10,000 per transfer if within first 2 weeks of first cash-in Php 50,000 per transfer afterward |

| General | Max number of GCash accounts per user | 5 accounts (5 mobile numbers per user) |

| General | MPIN lockout limit | 3 attempts then lock-out for 24 hours |

| Cash-in – Payoneer | Payoneer withdrawal limit | Php 100,000 every 30 days |

| Cash-in Paypal | Paypal minimum cash-in amount | Php 500 per transaction |

| Cash-in – UnionBank | UnionBank cash-in limit | Php 10,000 per day Php 100,000 per month (for Fully Verified accounts) Php 500,000 per month (for Fully Verified with Linked GSave/GInvest accounts) |

| GSave – BPI MySaveUp | BPI MySaveUp limits | Php 3,000 (Minimum Monthly Average Daily Balance) Php 30,000 (Maximum Deposit Amount) Php 5,000 (Required Daily Balance for Interest Accrual) 0.0925% Interest Rate per annum 30 days (Required Activity) |

| GSave – Maybank EzySave+ | EzySave+ limits | Php 100,000 Total Deposit (if not Fully Verified) Php 50,000 per day 0.35% Interest Rate per annum No Minimum Deposit No Maintaining Balance |

| GSave – UNOReady | UNOReady limits | 3.25% per annum for Deposits below Php 5000 4.25% per annum for Deposits above Php 5000 No Minimum Deposit No Maintaining Balance |

How to Unlock Higher Limits within the GCash app

You can unlock higher limits by doing the procedure below or by becoming a GCash Platinum user. Nonetheless, a higher limit is very useful especially if you are handling higher funds.

Unlocking Higher Account Limits

You can unlock higher limits by linking your BPI/UnionBank or your Payoneer account/s and utilizing either GSave or GInvest / GInsure with a Php 100 deposit or investment.

Once you do so, you will be able to unlock:

- A bigger wallet limit – Php 500,000 maximum

- Higher incoming limits – you will be able to receive up to Php 500,000 in your wallet and daily cash-ins have no limitations

- Higher outgoing limits – withdrawals will have no limitations per month, and you can withdraw up to Php 10,000 per day

You will be receiving an SMS informing you of the increased limits.

Take note that once you’ve unlinked all of your BPI/UnionBank/Payoneer accounts, the limits will revert back to what it was before.

GCash Over-the-Counter Cash-in Limits

For 7-11 cash-ins, there is a 1% fee of the total cash-in amount. For example, if you cash in Php 1000, the fee will be Php 10, and the total amount of Php 990 will be credited or added to your balance. This fee always comes first as it is a 7-11 collected fee.

GCash cash-in for partner outlets is free for the first Php 8000 per month. When the amount goes over the Php 8000 limit, it will incur a 2% fee. This limit refreshes every first day of the month.

For example: Today, you cashed in Php 7000. There is no fee since it is still below the Php 8000 limit. The next day, you cashed in Php 2500. Since you went over the limit, there is a fee included with the cash-in but only for the amount over the limit. The cash-in that has the fee applied is the amount over 8000 this month: Php 8000 - Php 7000 = Php 1000 Then we subtract from the amount you are cashing in: Php 2500 - Php 1000 = Php 1500 The fee is 2% of the amount. Php 1500 * 0.02 = Php 30 So the total cash-in with the fee would be: Php 2500 - Php 30 = Php 2470 Any later cash-ins for this month will have a 2% fee after this.

If you are cashing in 7-11, and you’ve exceeded the Php 8000 limit, the 1% fee goes first (7-11 fee), then the 2% goes after (GCash fee).

For example, if you are cashing in Php 1000 in 7-11 after exceeding the Php 8000 limit, the cash-in fee for 7-11 applies first: Php 1000 - Php 10 (1% of Php 1000) = Php 990 Afterwards, the 2% fee from GCash applies: Php 990 - Php 19.80 (2% of Php 990) = Php 970.20 The net cash-in amount is Php 970.20.

Once you are near the limit, you will receive a notification in your Inbox informing you of the charges once you go past the limit.

Please take note that this is only for manual cash-ins — remittances and bank cash-ins are not included.

If you want to know how to circumvent this fee, you can refer to my fees page to see alternative solutions.

Other Questions

Why do we have these limits?

These are regulations from the BSP as GCash is keen to prevent money laundering.

When do these limits reset?

These limits reset on the first day of every month. So if you hit your limit in the middle of the month, you are out of luck.