Explore the different secrets behind having alternate accounts in GCash.

GCash accounts are usually tied to only a mobile number. Once you create an account, you can then tie this account to a person via verification of KYC (Know-Your-Customer).

Now some questions you may have about this are: can I create multiple GCash accounts? And how does this work with GCash? Is this legal? Anyway, let’s dive into it and explore how we can use this to our advantage.

Can I have more than one GCash account?

Yes, because all your GCash accounts will be tied to a single user id. When you create a new account with GCash, your personal information initially is not linked to that account as long as you haven’t gone through full verification. However, once you do full verification, the new account will be linked to your main one.

In the Philippines, there are a lot of SIM cards that can be bought anywhere, unlike in other countries that tie up mobile numbers with their respective national IDs. Recently, due to the SIM Registration Law, there is more emphasis on maintaining your existing numbers as long as they are registered.

How many multiple accounts can I create?

According to the GCash Help Center, you can create up to 5 accounts. Linking of accounts to a certain user happens whenever you go through full verification; so in short, the account limit for a certain user should be 5 fully verified accounts.

If you go beyond this, customer support will be contacting you to choose only 5 accounts to maintain.

Should I also have my other accounts fully verified?

Verification is not mandatory. However, you cannot access a lot of features without going through verification. Here is a list of features you can access depending on verification level:

| Basic | Fully Verified |

|---|---|

| Offline Cash-in | All Basic Features |

| Pay Bills | Send Money |

| Buy Load | Request Money |

| Pay QR | Cash Out |

| Purchase GCash Card | Amex Virtual Pay |

| GlobeOne Linking | Linking a GCash Card |

| Book Movies | GSave |

| GCash Forest | Transact using GCash Card |

| ATM Withdrawals | |

| Send to Bank (Instapay) | |

| Online Bank Cash-in | |

| GCredit | |

| GInvest | |

| International Remittance | |

| Paypal Cash-in | |

| Payoneer Cash-in | |

| GInsure | |

| GLoan | |

| GGives | |

| GCash PO | |

| KKB | |

| Online Payments | |

| GLife |

What features can I share between accounts?

Here are the features you share between accounts, meaning there can be only one instance between all of the existing accounts:

Aside from the wallet balance, here are the features that are different between accounts — meaning there is a different instance per account.

- GForest

- GSave (includes all banks)

- GFunds

- GInsure

- GCash PO

- GLife

- GCash Card

- AMEX Virtual Pay

- GCrypto

- GStocks PH

- And others

An example is if you already have a GSave CIMB account created with your main GCash account, when you create another GCash account, you can create another CIMB account given you’ve provided a different email when you signed up.

The features that are shared usually are linked to a primary account. If you have any reason to transfer your primary account to an alternate one, you would need to request it from Help Support.

What are the benefits of having multiple accounts?

Having multiple accounts helps categorize your wallets. As in real life, we can have different wallets for different purposes, this can also be applicable to GCash accounts. You can have a different account for work and for paying bills.

Some features like GSave and GInvest help you categorize your savings and investments as well. Think of the benefits of having a different GSave savings account per GCash account.

Also, all of the things you do with your accounts count towards your singular GScore. This can help you avail of more GCredit, GGives, and GLoan amounts.

Can I verify another GCash account using the same ID I used when I verified the main one?

Yes, you can use any valid ID to verify your account. You will then be linked to the other accounts you have.

Can I make another GCash account using the same number?

No, because the main identifier of a GCash account is the mobile number, so this should be unique per account.

How do I switch between other GCash accounts?

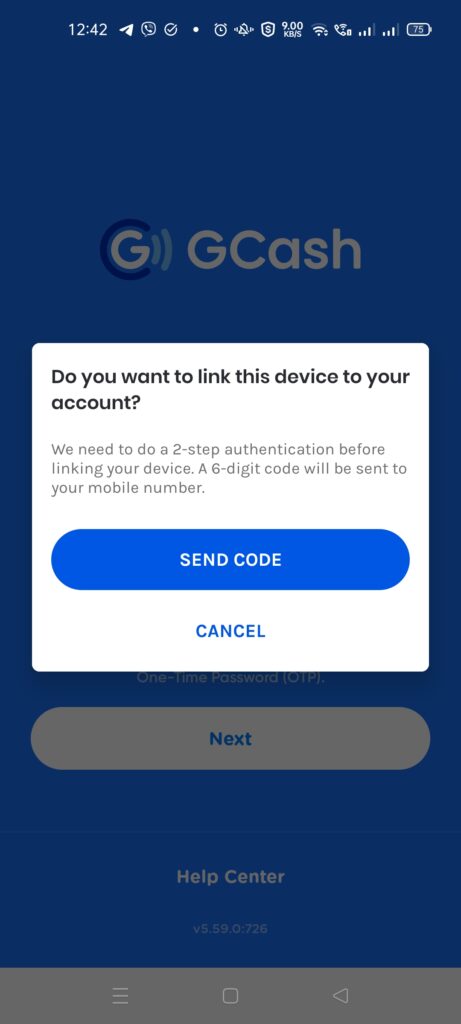

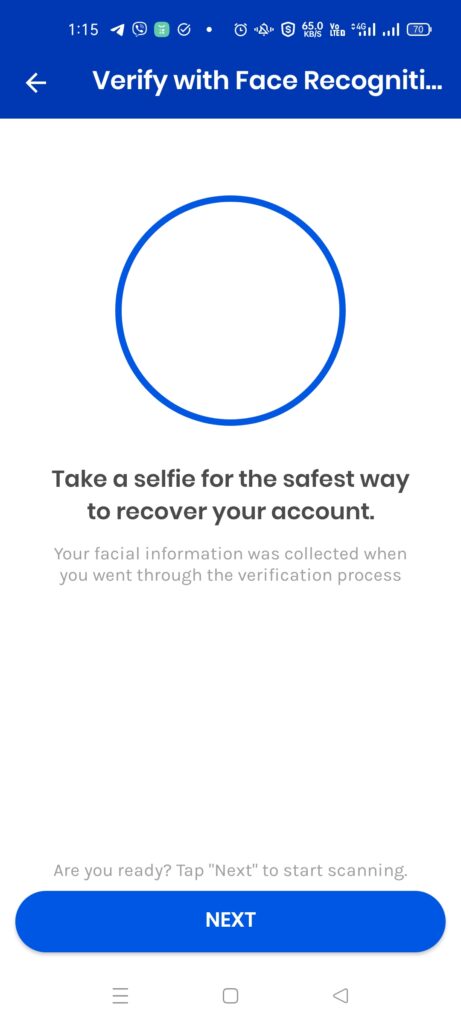

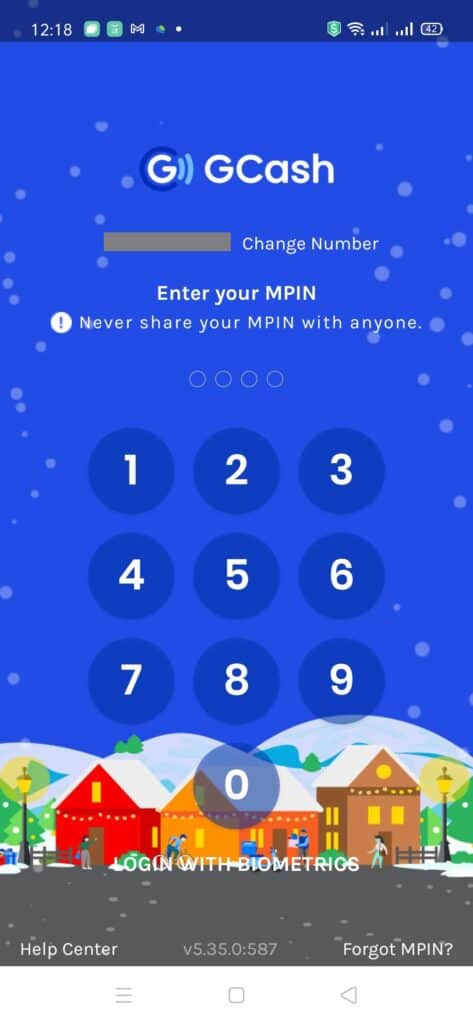

You can log out from GCash from your current device. Then from the login screen, click on the “Change Number” link to change to your alternate number. Take note that you need to enter the OTP sent to that number. A new feature called Double Authentication would eventually ask you to take a selfie to be able to switch to your other account on other mobile devices.

What is Double Authentication?

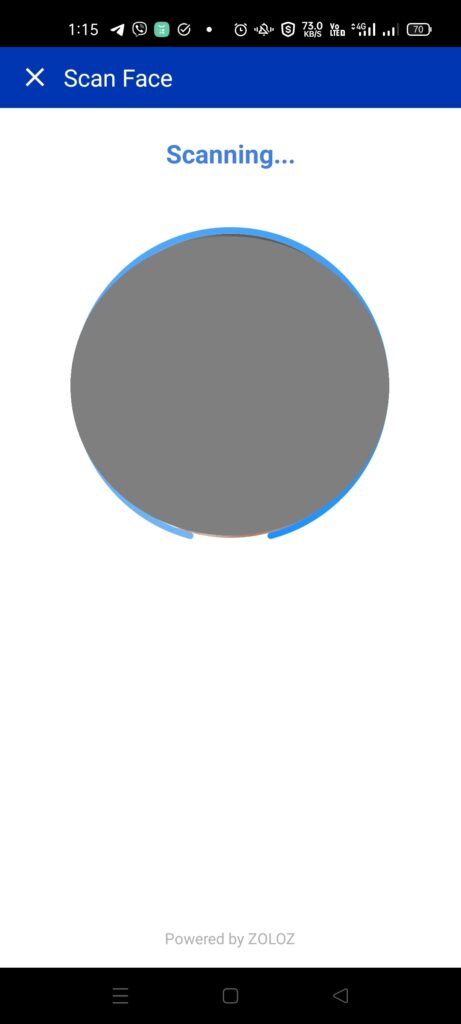

Double Authentication is a security feature in GCash that prevents account takeovers by getting your selfie and comparing it with the selfie you provided during verification.

This is a result of a glut of scams perpetuated in social media and SMS. Alongside the masking feature for Send Money, this heightens the account security for all users moving forward.

This facial recognition only triggers when you log in from a different phone you’ve used previously. If the recognition fails 5 times, you will not be able to access your account. You will need to file a ticket to Help Support to prove your identity.

This step goes between the input of OTP and MPIN during the changing number step.

How do I register another GCash account?

Similar to switching to another account, you need to log out from GCash, then from the login screen, change your number to your new mobile number. After inputting the OTP, the next screen should be a registration screen. You need to input your basic information and MPIN to finish the registration.

Other Questions

Is SIM Registration different from GCash Full Verification?

Yes. GCash Verification is for verifying your identity in the GCash platform only. SIM Registration is for verifying your identity with your SIM provider. GCash is not connected with any SIM providers directly.

I lost my phone and/or SIM. How can I get my account back?

You need to file a ticket to GCash Support to temporarily suspend your account. The support team will be validating your identity first.

Once done, you can either get a new SIM or have your existing SIM replaced. If you have a new SIM but the same number, you can submit a ticket to lift the suspension. If you have a new SIM and number totally (meaning a new GCash account), you need to request a transfer of funds to this new GCash account.

My verification is stuck in “Upgrade in Progress”. What should I do?

Verification typically takes 7 days to finish. If it’s beyond 7 days, you need to file a ticket with GCash Help Support. Regularly follow up using the same ticket, and not open a new one.

Can I link my BPI, UnionBank, PayPal, and Payoneer to multiple accounts?

Yes, you can link your accounts with all of your GCash accounts if you need it. Take note though that some accounts, like PayPal, are strict with linking.

Why do I have different GScore and GCredit amounts on my other accounts?

For some old accounts, there is no linking and merging done yet. As such, the “single-instance-between-accounts” rule is not necessarily followed. However, this policy will change as account merging can happen anytime.

This also applies to transaction limits — that is why for some old accounts, sending to your alternate account is a workaround for bypassing limits.

For new accounts, strict merging is done so that only one account (your main one) has the GScore, and GCredit linked. This also goes for any other loan products like GLoan and GGives.

A side-effect of this is if you ever lose your main account, you would need to request from GCash Support to transfer your GCredit and GScore to your new nominated number as your “main account”.

How can I delete my account?

You can request it in Help Support. They will be requiring you to settle all outstanding balances regarding your account and to send them an accomplished deletion form.

Take note though that due to data retention requirements of the BSP, the actual deletion can only be done after 5 years. Basically, your account will be inactive until that time.

If you change your mind, you can always activate it before the 5-year limit is up.

Can I sell my alternate account?

Definitely no, as this is tied to your identity. Any selling of accounts will open you to possible abuse as any bad actor can impersonate you and do illegal things. Also, you may be liable to legal proceedings once your account was used to defraud someone.

Can I create a new account when my alternate one was suspended?

This depends. If you suspended your account voluntarily, creating a new account should have no issues. However, if your account was suspended due to violations, you may need to resolve the violation first before you can verify the new account. Please reach out to Help Support to resolve any account issues.

If your account was suspended due to a police report or a similar sanction, you will not be allowed to verify yourself in any new account. Essentially you will be banned from the GCash platform itself.

Summary

We talked about the benefits of having multiple GCash accounts. There are certain features that are shared between accounts like GScore, GCredit, GLoan, and Transaction Limits.

However, if you have an old alternate account, there may be little to no restrictions in terms of sharing accounts. For new alternate accounts, account linking is now strictly done during full verification so it’s less likely for this to happen.

I have a new e-commerce site where you can buy some e-books here: GCR Prime

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

hi just to verify if i have 3 accnts and i have a credit limit of 500k it means all through that 3 accounts my total credit limit is only 500k?

i actually use my gcash account with investments

Yes, shared limit siya

Paano po mapalitan yung naka register na name sa gcash number ko kasi hindi ko po ma fully verified yung account ko kasi magkaiba yung name ng gcash ko at id na gamit ko para ma fully verified na yung gcash ko?

Di ba puwedeng palitan niyo yung name sa GCash niyo para parehas sa ID? Puwede niyo po siguro idaan sa manual verification by support ticket.

Hi. If I request for deletion of gcash account will it affect all my accounts if I made multiple gcash accounts?

No, it’s only for the account you requested deletion on

Meron po akong 3accounts sa gcash lahat po nag share limit . Ung dalawa po kasi gamit ng mga kapatid ko sa pag online sabong nila . Gusto ko po sanang ma delete ung multiple account ko . Paano po kaya?

Open a ticket with GCash Support in the app

Hi. I have a problem with my otp. Hindi po ako nakakatanggap ng otp even i tried na yung mga possible ways. Pero po pag nagcheck ako ng balance narerecieve ko po. I don’t know kung bakit hindi ako nakakarecieve ng otp code. Hindi ko na po ma access gcash ko. Magbabayad po sana ako sa gloan ko but it happened na d ko ma open gcash app ko. Anyone? if my alam po kayo possible ways kung san pwde magbayad ng gloan sana po matulungan nyu ako.

Kahit late mareceive wala rin ba? Baka need ito gawan ng support ticket

Ask lang po ako meron po ba limit ung name sa pag gawa ng gcash?meron po ako gcash# dati kaso nawawala ng anak ko yung sim nya.so gawa n nman ako ulit parang pang apat na to..tapos gsto ko gumawa ulit kaso di na ma fully verify

Puwede naman magpagawa ng bago, tapos ipadisable nalang yung mga hindi nagagamit

Puwede naman marami, pero papapiliin ka kung anong ititira niyo

Hello, i have 3 accounts po. Ung 2 nakalink na, pero ung new account ko hindi pa. My 2 accounts have 500,000 gcash limit yung bago 100,000 lang. Paano kaya yon?

Yung 500k na yun shared sa 2 accounts mo habang yung 1 di pa nakalink, so parang may extra 100k ka na hiwalay na limit.

Kung gusto mong malink lahat, ifile mo siya sa gcash support. Or probably malilink na siya.

i have two names like homer cyrus and i have already registered 5 accounts with it.

can i use the name homer only with same id but different email and number to create another 5 different account?

I don’t think so, as the IDs you can use to verify are limited

Very Flexible and Helpful… This Info is extremely Helpful

Hi ask ko lng po.hanggang kailan ba ang suspended ng gcash acount kc yung sa akin mhigit ISANG buwan KNA pina follow up yung ticket ko.at marami na rin akng nai submit na ducument na hinihinge pero last email SAKIN processing na yung acount pero HANGGANG ngayun Wala pa rin.pwede po ba akng gumawa nlng ng another gcash acount? Ma fully verified Kya?

Nasuspend ka ba dahil sa violation? Kung oo, need muna iresolve yun. Follow up po ng ticket o tumawag sa 2882 sa umaga.

Kapag suspended yung gcash mo pwede ba gumawa ng panibago?

Puwede, pero pag nagverify ka, pag nakita yung original account mo suspended, massuspend rin ang alternate account mo lalo na kung may violation ka. Unless pinasuspend mo siya in the first place.

Hi wanted to ask Kasi Yung GCash ko. Forgot MPIN ko na sya then Ng file Ako ticket after that. Diko na submit I a pang requirement due to family mourning that time. Tpos nag follow up Ako another ticket sabi suspended.. pwede paba ma lift Yun if ever mag Malaki apng halaga Yun panu kaya makukuha bago I pa delete Yung account?? Sobrang nag aalala na Po aq .sna Po ma replayan nyo Yung concern ko.. salamat

Puwede naman, basta maprove mo lang na sayo yung account na yun.

I have question about names with suffix.

What is it?

i have 2 accounts…ung first gcash account ko ay naavail ko na ung gcredit, ggives at gloan…possible po ba na maofferan ako ng another gcredit,gsave at gloan sa second gcash account ko?

No po kasi alam ni GCash na separate account mo yun (dahil nagverify ka rin doon)

Hello po, ID po and identity ni mommy yung ginamit sa pagverify ng gcash ko pero number ko po yun. Ngayon po nasa ibang bansa na sya kaya di na pwede mag-face scan. Need daw po yun after ko magregister ng sim ko. Di na po ako makapasok sa account ko, medyo malaki pa naman amount nun. Pwede po kaya na ibang ID nalang gamitin sa account ko?

Bakit pala mommy mo ang nagverify for you — ibig bang sabihin sa kanya yung account? Kung ganun, gawa ka ng sarili mong account, ipalogin mo mommy mo sa account niya (tulungan mo nalang sa MPIN), at ipalipat nalang niya sa account mo.

Bakit sakin ung isang gcash account ko submitted ticket lng ung lumalabas walang lumalabas kundi submit acount

Pwede ko pa poba makuha yung maintaining balance ko na 300 sa matagal ko ng gcash account na di ko na maopen, active pa naman yung number ko na yun and nasa akin pa tamad lang ako asikasuhin

Iforget MPIN niyo para makapasok kayo. Kung hindi, file kayo ng support ticket sa app rin.

hi, accidentally ako naka gawa ng gcash account using my tnt sim pero not verified pa sya, i already have 2 accounts, counted ba yun sa 5 na limit?

Kung di pa verified, hindi pa

Hi. Meron ako 2 gcash account at nagamit ko ang Gloan ko dun sa una kong account and after ko mafully paid yung Gloan ko nag try ako mag magloan ulet pero dun na sa pangalawa ko na gcash account pero sabi dun its available for pre-qualified users but my gscore is more qualified than my first account. I also decided to stop using the first account since I will be using one device from now on.

Ang alam ko isang account lang nabibigyan ng GLoan pag marami kang accounts. Need mong iraise sa support kung anong main account na gagamitin mo.

Pls pasagot po. Duplicate po gcash ko. Mag kaibang number po Sila pero iisa Ang information. Ask ko po, kapag na suspend po ba ung Isang number damay din pati Yung Isa?? Pls pasagot po

Hindi, yung isa lang

Hello po my main gcash account have reached its wallet limit which is 100k, then I make another gcash account with different number but with same name I already have it fully verified. Then when I log in to my main account again it goes back to zero again why does it happen?

Kahit gumawa ka ng bagong account shared wallet limit pa rin yun sa main account mo.

May 5 accounts na ako. Gusto ko sana mawala na yung 3 kasi hindi ko na rin nagagamit, wala na din yung sim sakin at nakalimutan ko na din yung mga MPIN ng tatlong yon. Ano kaya pwedi gawin kung ipapa disable ko yung 3 kong accounts?

Reach out to GCash Support to deactivate the other accounts

Pag may loan na sa ggives and gcredit sa una account pwede kapa ba mapagbigyan ng loan ni gcash sa isa mong account?

Sa main account mo lang magkakaroon ng ggives/gcredit