This post describes how to use GCash Padala in sending money to non-GCash users.

Remittances are still one of the most used ways of sending money to people here. Especially for OFWs, despite the existence of digital solutions. I understand that not everyone can create their own bank accounts and not everywhere can we get good connectivity. I agree that there is also a sense of concreteness when you can get actual cash from the remittance center.

To be able to cater to this need, GCash is leveraging bill payment partners and GCash Partner Outlets with their new product, GCash Padala.

What is GCash Padala?

This is a service provided for GCash users to send money to non-GCash users. The requirement is the sender needs to have a GCash account.

An advantage of this is the fact that the sender does not need to queue in padala centers to send money. Another is the fact that you can send GCash Padala from anywhere in the world, even if you are an OFW.

How do I send a GCash Padala?

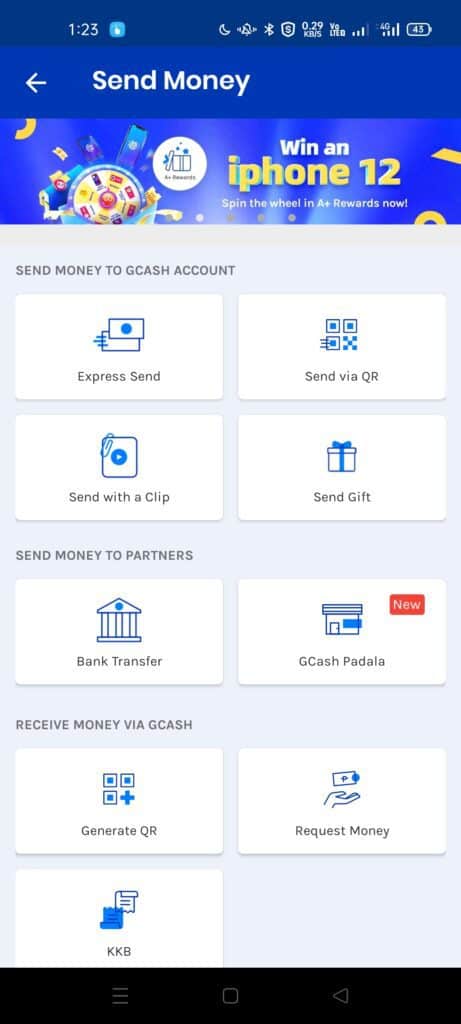

- From the GCash main page, click on Send Money.

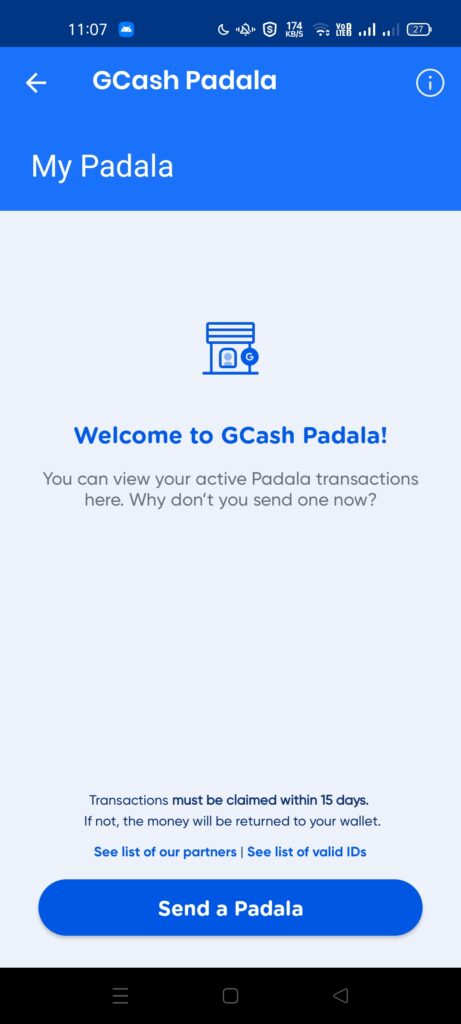

- Click on GCash Padala from the Send Money page. You will be redirected to the My Padala page. Click on Send a Padala.

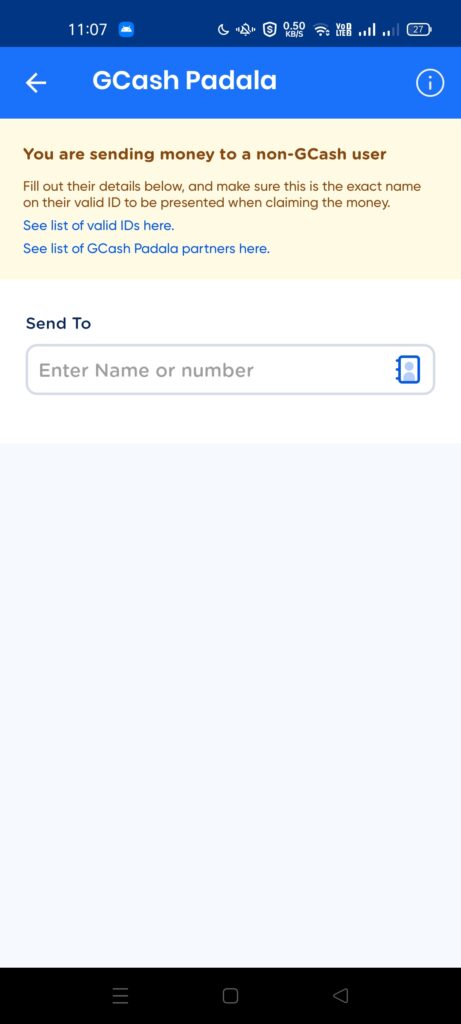

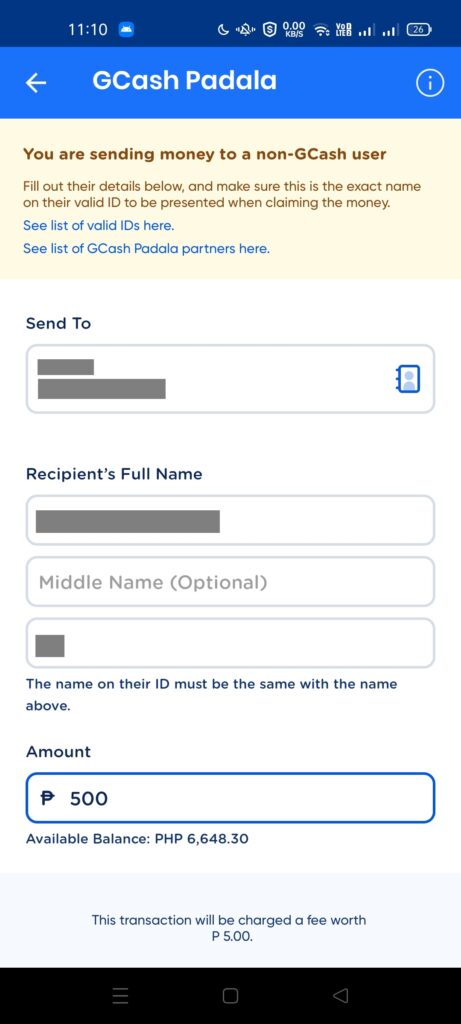

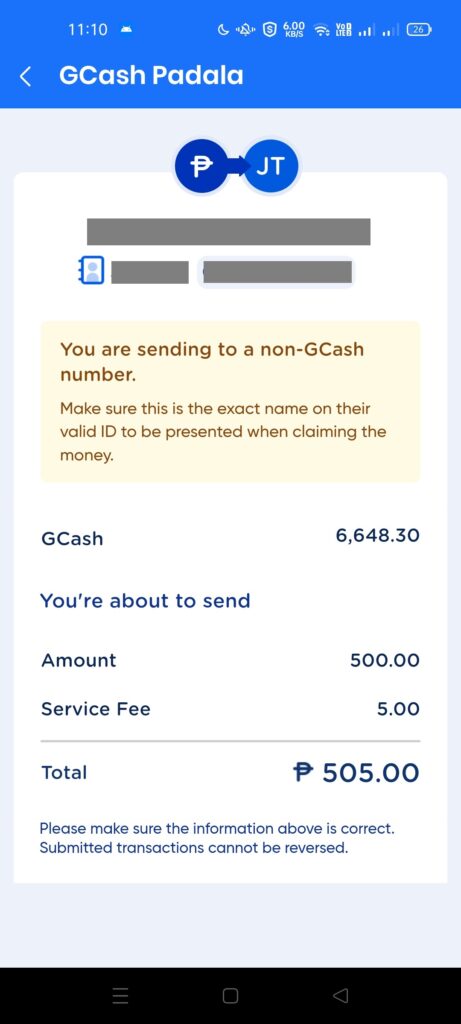

- Input the recipient’s number. It should be a non-GCash number. Enter the recipient’s full name. This should match the ID that the recipient will be showing the Padala agent. Lastly, enter the amount to send. The minimum is Php 500.

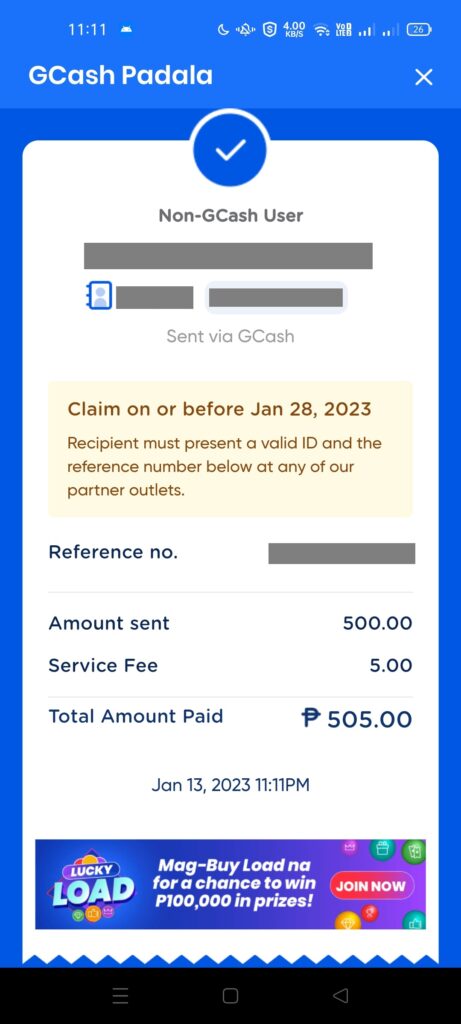

- Confirm the details. Once confirmed, you will be receiving an Inbox message that you’ve sent your amount to the recipient for claiming.

How do I claim a GCash Padala?

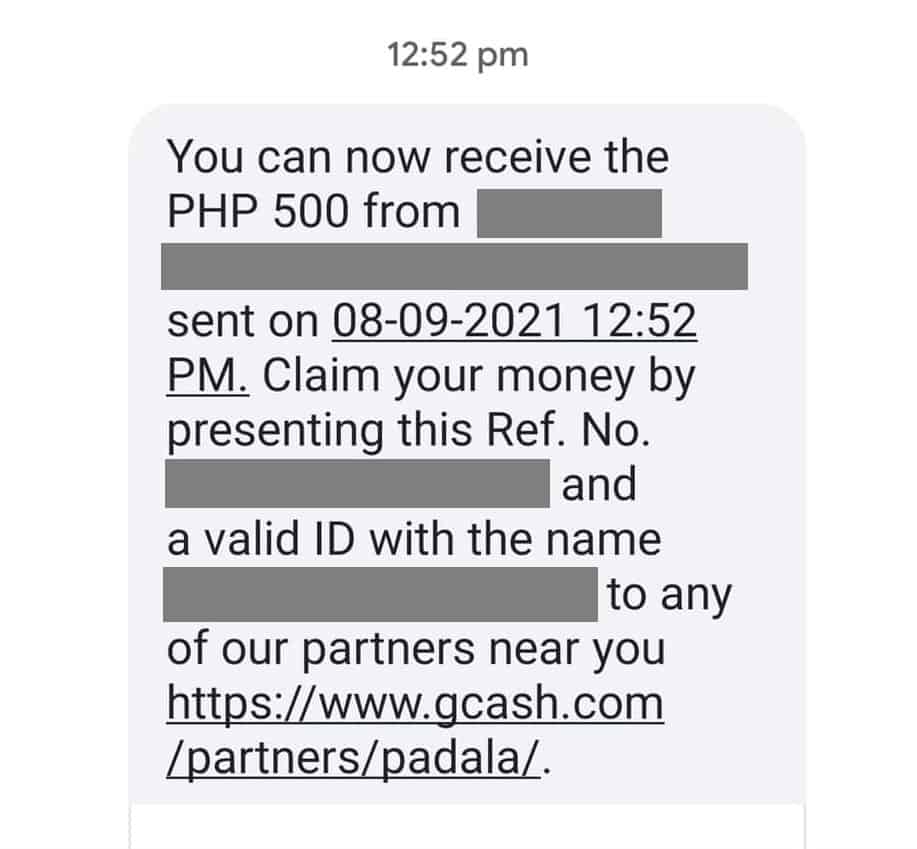

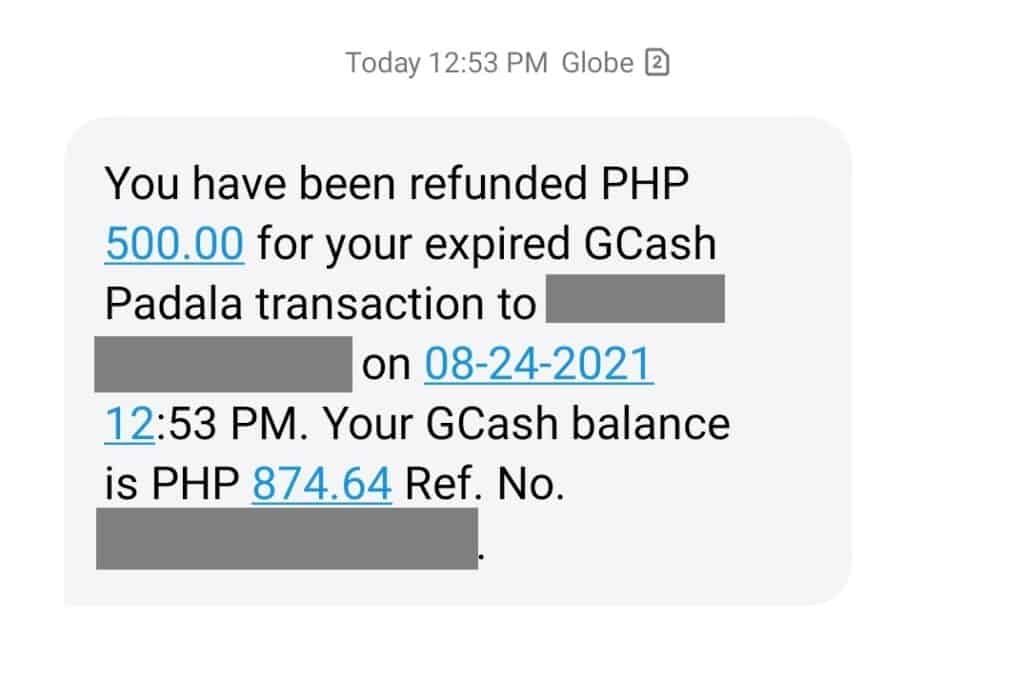

You need to go to any Padala-supported agent and bring an ID with the exact name the sender inputted. Once there, show the SMS you received and your ID for confirmation of identity. Once received, the sender would also be notified via SMS. If no claims happen after 15 days, the amount will be refunded to the sender.

Is there a way where I do not need to go to the GCash Padala agent anymore?

Yes, you can install GCash on your phone, and accept the Padala as Express Send instead.

What if the recipient already has a GCash account?

GCash would be able to detect if the recipient is a GCash account holder and would let you know once you’ve inputted the number.

How much are the fees for GCash Padala?

For the minimum amount of Php 500, the fee would be Php 5 fixed. Higher than Php 500, and it takes 1.5% of the total fee sent. The maximum amount that can be sent is Php 5000 per transaction. You can always split higher amounts into multiple transactions. This is shouldered by the sender.

What is the list of valid IDs can I use to claim my GCash Padala?

For GCash verification and for receiving GCash Padala, you would need a valid ID from this list:

- UMID

- Driver’s License

- SSS ID

- Passport

- Phil Postal ID

- PRC ID

- Pag-IBIG ID

- Philsys / ePhilID

- Alien Certificate of Registration (ACR) – if you are a foreign national

- Student ID, Birth Certificate – if you are a minor, and applying for GCash JR

If you don’t have an ID from this list, you need to file a Help Support ticket to help in your verification.

What are the GCash Padala supported agents?

You can search for it on the GCash site itself. Typically GCash Partner Outlets can also process the padala for the receiver.

Summary

We talked about how GCash Padala works. GCash Padala is a way to send money from a GCash user to a non-GCash user. It only requires an ID on the side of the non-GCash user. The remittance fees are shouldered by the sender.

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services: