GSave has now a new bank in its marketplace: Maybank. This post focuses on how to use EzySave by Maybank.

Disclaimer: This post aims to educate and not to give financial advice. Investments have different risks, and it is up to the investor to do due diligence and make decisions regarding his money.

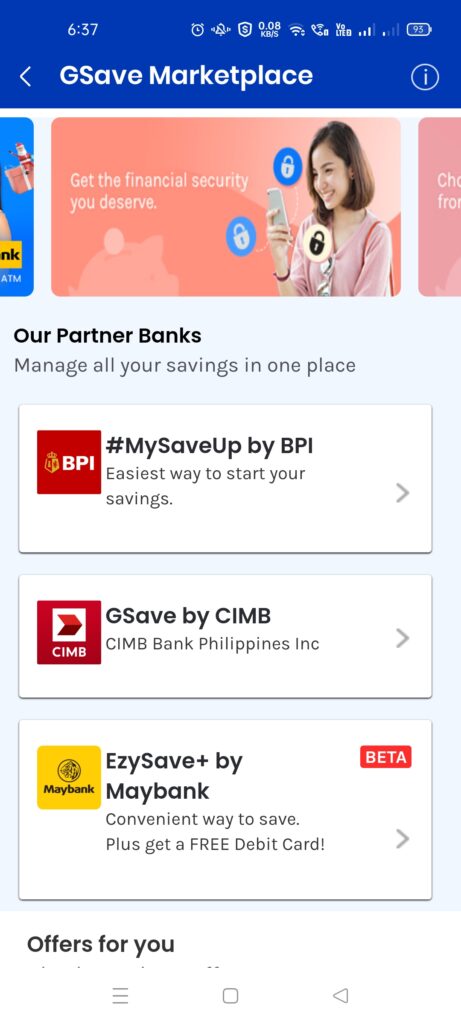

GSave being a marketplace, now not only provides GSave by CIMB and #MySaveUp by BPI but also EzySave+ by Maybank. This post comprehensively explains how to create and use the new EzySave+ by Maybank.

What is EzySave+ by Maybank?

GCash wants users to have multiple choices for opening up savings accounts in GSave. EzySave+ is another option in a growing selection in GSave Marketplace. It works similarly with GSave by CIMB, but with a few differences:

| Features | #MySaveUp by BPI | GSave by CIMB | EzySave+ by Maybank | UNOready by UNO |

| Minimum Monthly Average Daily Balance (ADB) | Php 3000 | None | None | None |

| Maximum Deposit Amount | Php 30000 | Php 100000 | None | None |

| Required Daily Balance for Interest | Php 5000 | None | None | None |

| Interest Rate per Annum | 0.0925% (Need to have Php 5000 ADB) | ~2% | 0.35% | 4.5% for above Php 5000; 3.5% for below Php 5000 |

| Required activity (need to use by limit) | 30 days | 60 days | None | 2 years |

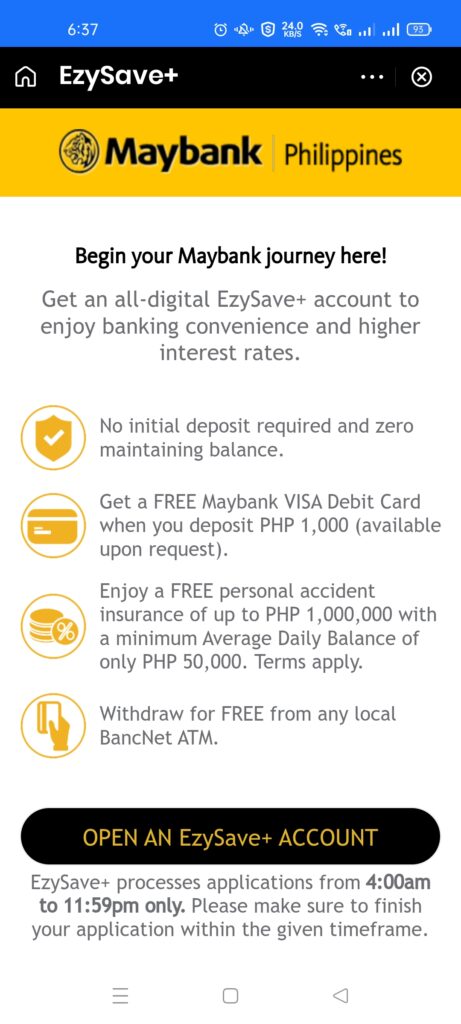

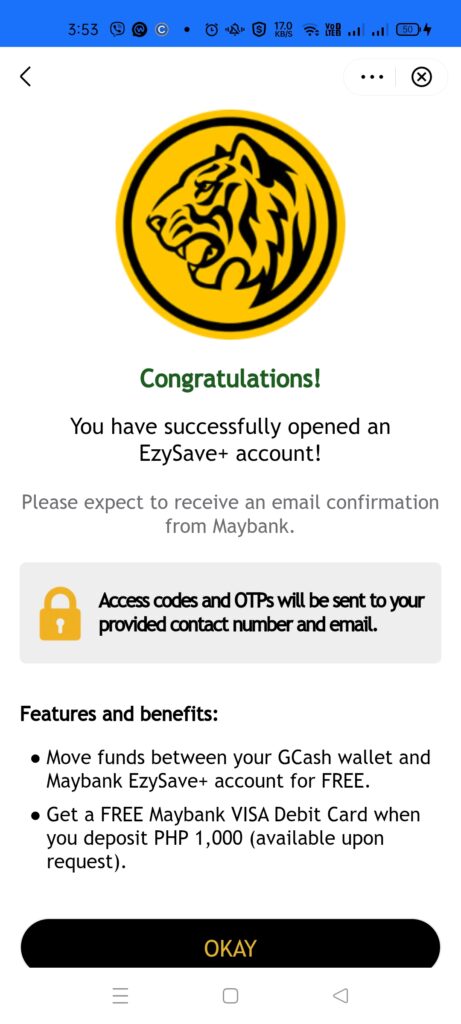

Other differentiators are the free Visa debit card once you reach Php 1,000, and free personal accident insurance with an ADB of Php 50,000. The insurance coverage is 2x of your previous month’s ADB up to Php1,000,000.

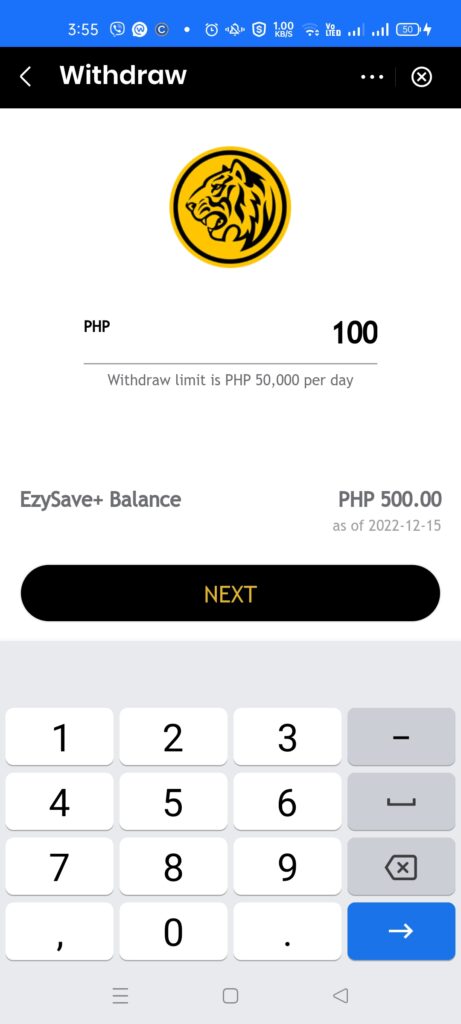

There is also a daily withdrawal limit of Php 50,000.

What are the requirements to create an EzySave+ by Maybank account?

The requirements are:

- Need to be Fully Verified

- Age is at least 18 years old

- Should be a Filipino citizen

In terms of documents and other information, because they can leverage the know-your-customer (KYC) information of the user, you don’t need to send other requirements, like IDs.

How do I create an EzySave+ by Maybank account?

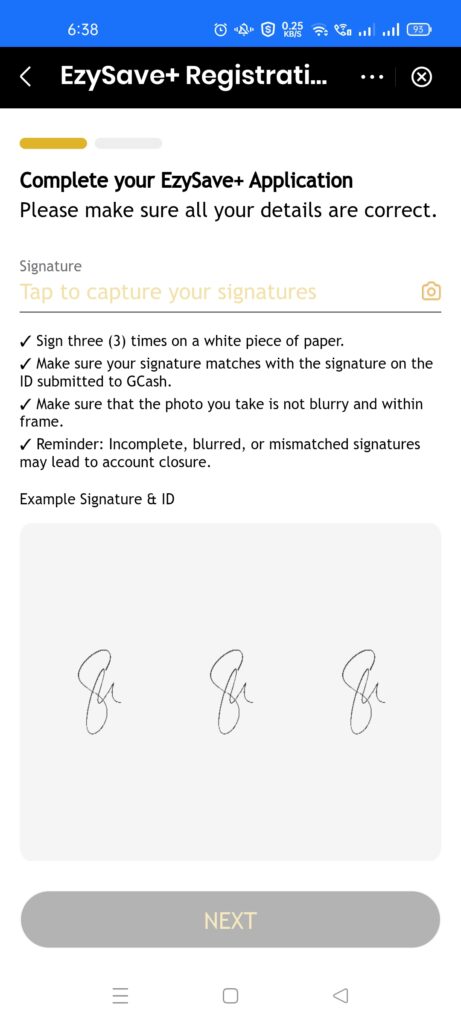

Opting in is easy as you only need to input a few forms — the heavy lifting has already been done via GCash verification. You need to be Fully Verified first. Additionally, they require a picture of your 3 specimen signatures on a piece of paper.

Creating an EzySave+ by Maybank account

- Go to GSave Marketplace and click on the “EzySave+ by Maybank” button.

- Review the requirements and click on “Open An EzySave+ Account”.

- On the next page, upload your specimen signature photo by clicking on the camera button under Signature.

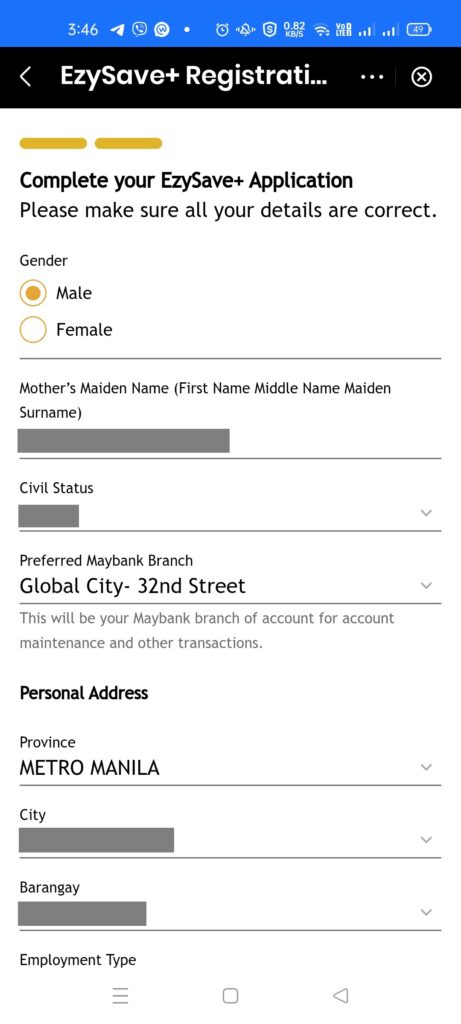

- Add your other details to the application form.

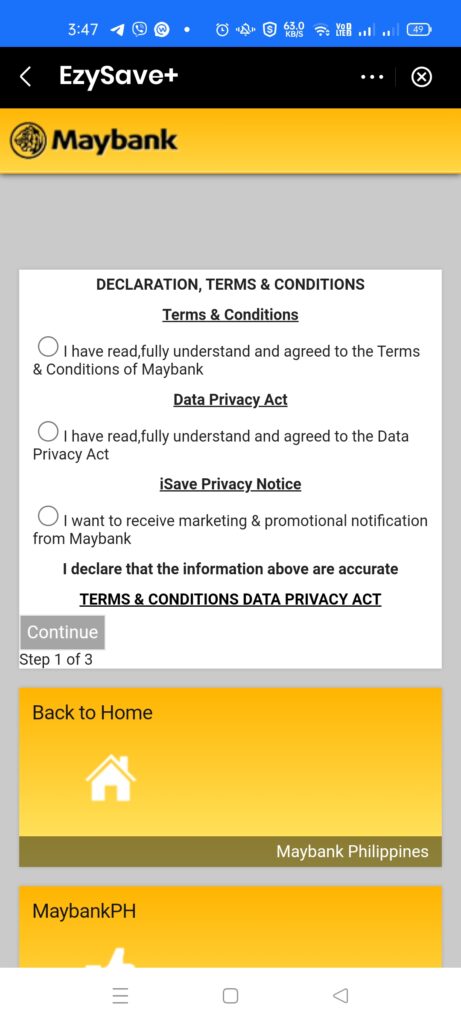

- While on the Terms and Conditions page, don’t forget to read first the T&Cs before ticking all of the circles. Click on Continue.

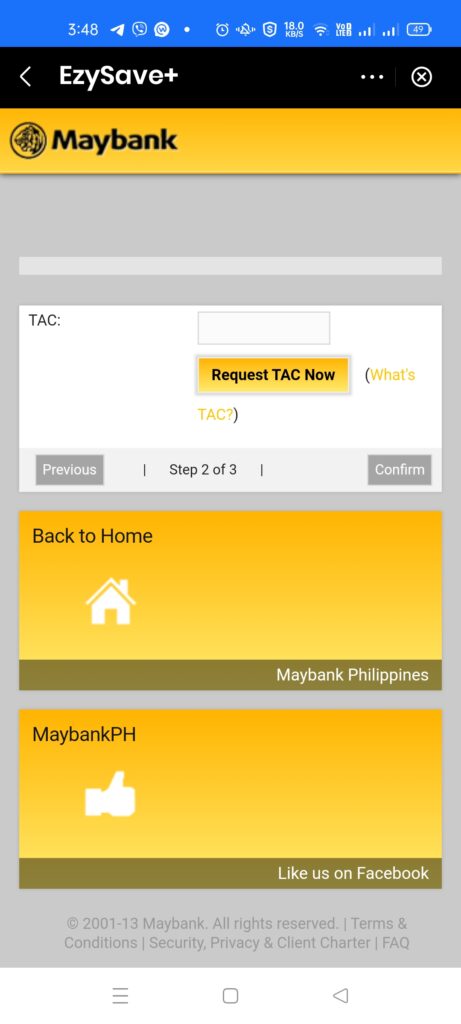

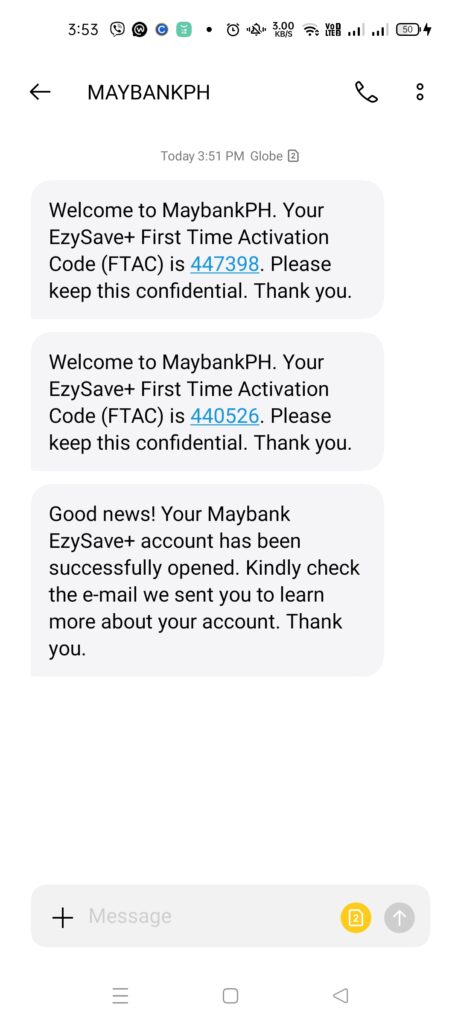

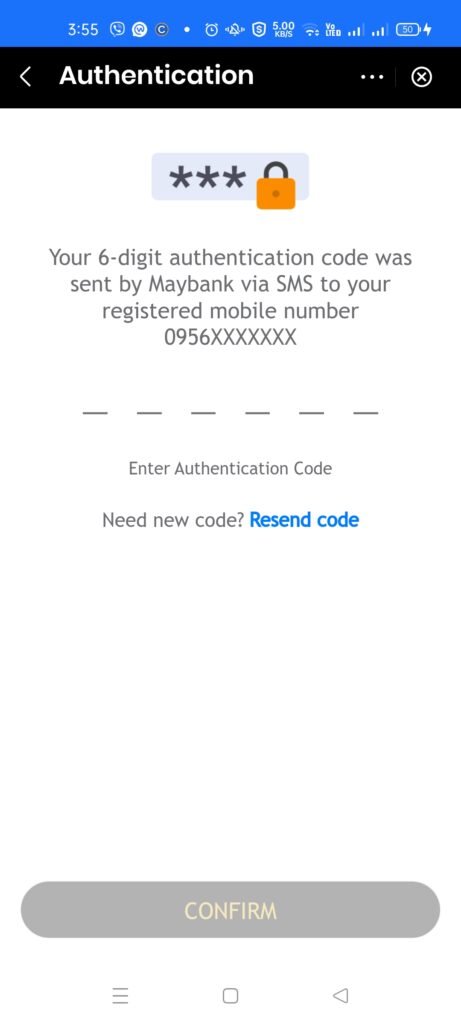

- You need to input the TAC which is a type of one-time-password. They will send it to the current GCash mobile number you are using. Click on confirm after inputting the TAC.

- You will see the Congratulations page. You can now use your account.

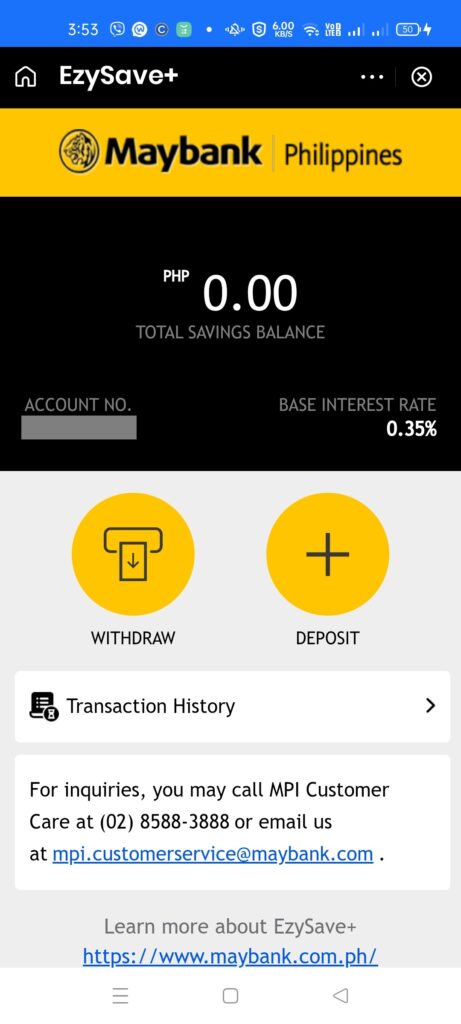

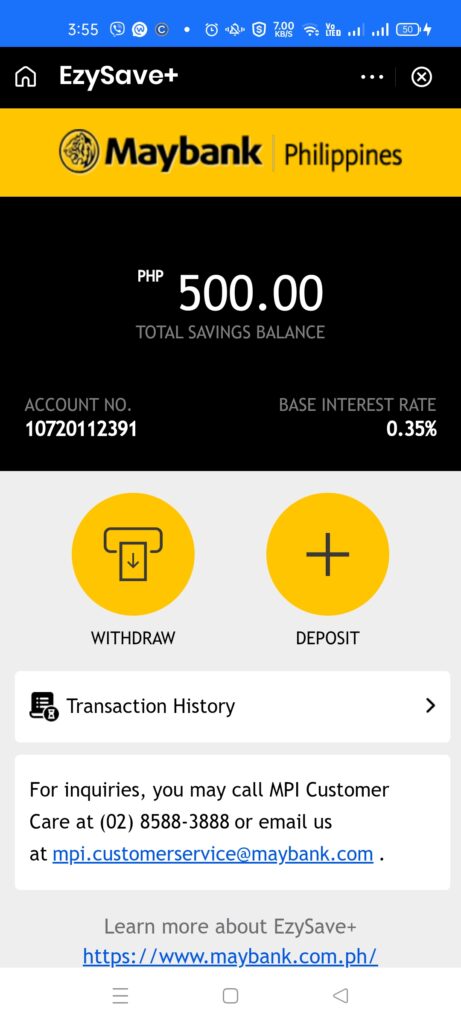

How do I deposit and withdraw using my EzySave+ by Maybank account?

Deposit and Withdrawing funds are the same as in any GSave partner.

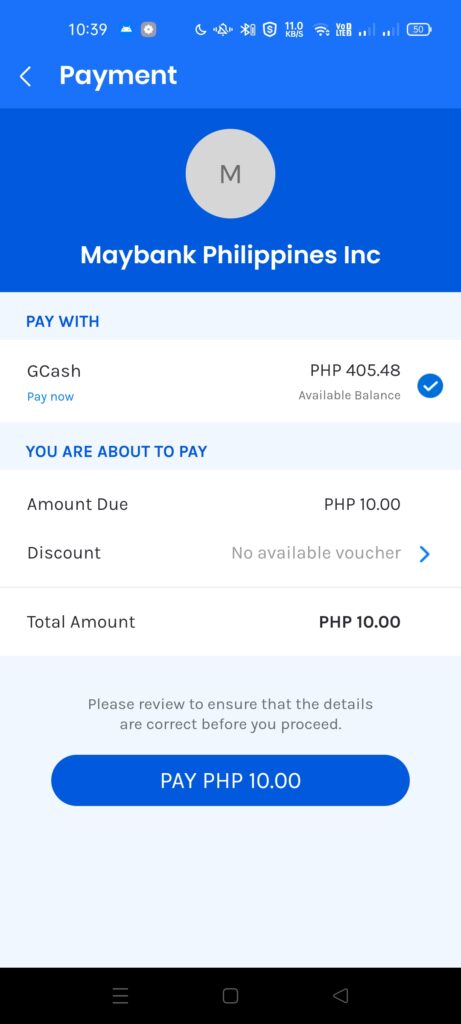

Making a deposit in EzySave+ by Maybank

- Click on the “Deposit” button and you will go to a deposit screen.

- Choose any amount, then you need to confirm the amount to be deposited. Once confirmed, you will receive an SMS for a successful deposit and the new balance will reflect on the main page.

Withdrawing funds in EzySave+ by Maybank

- Click on the “Withdraw” button and you will go to a similar screen with Deposit.

- Input the amount to withdraw and you will need to confirm the withdrawal amount.

- With withdrawals, there is always an OTP confirmation included.

- Similarly, you will receive an SMS for a successful withdrawal. Afterward, it will reflect on the main page.

Other Questions

How do I avail of the free Maybank debit card?

You may call Maybank’s Customer Care at (02) 8588 3888 to request your Maybank Visa Debit Card. A requirement is a minimum initial deposit of Php1,000.00.

Your debit card will be delivered to you within 7-10 business days for Metro Manila and 15-20 business days for other areas.

Summary

EzySave+ by Maybank is a savings product added to GSave Marketplace alongside CIMB and BPI. You can easily open a Maybank savings account within 10 minutes. Deposits and withdrawals are the same as GSave by CIMB.

Related Topics

I have a new e-commerce site where you can buy some e-books here: GCR Prime

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services: