Let us deep-dive into the different Send Money choices we have for GCash. As we all know, Send Money is the cornerstone of the GCash app. You cannot have a digital wallet without some sort of fund transfer between users.

If it boils down to it, we all need to transfer money in one way or the other – the only difference between payments and sending money is that payments usually come with a receipt and a record of the transaction. But essentially both are types of fund transfer.

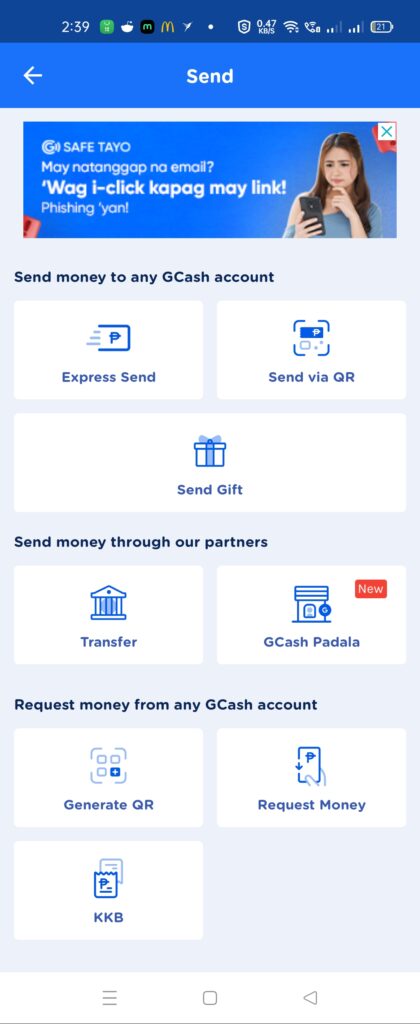

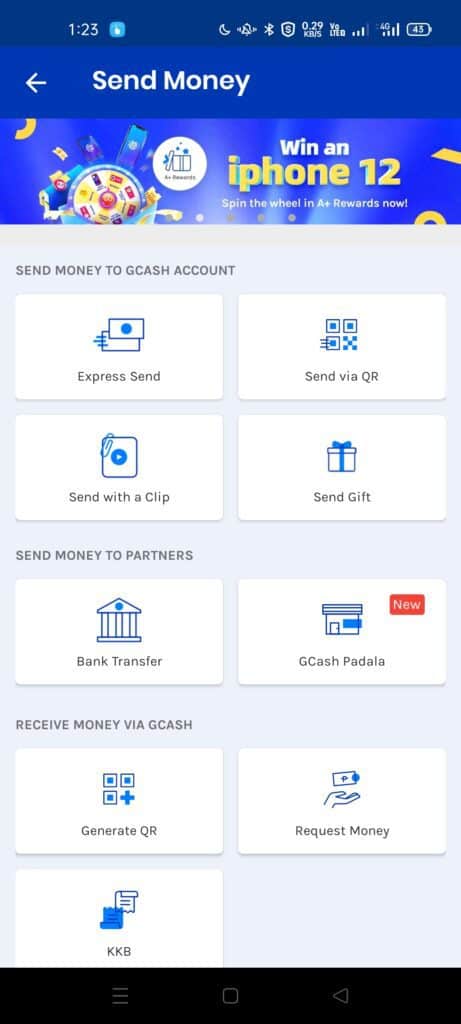

What are the different Send Money options in the GCash app?

In the GCash app, there are currently nine sending options. Let’s delve into each:

- Express Send

- Send via QR

- Send Gift/Pamasko/Ang Pao

- Transfer

- GCash Padala

- Generate QR

- Request Money

- KKB

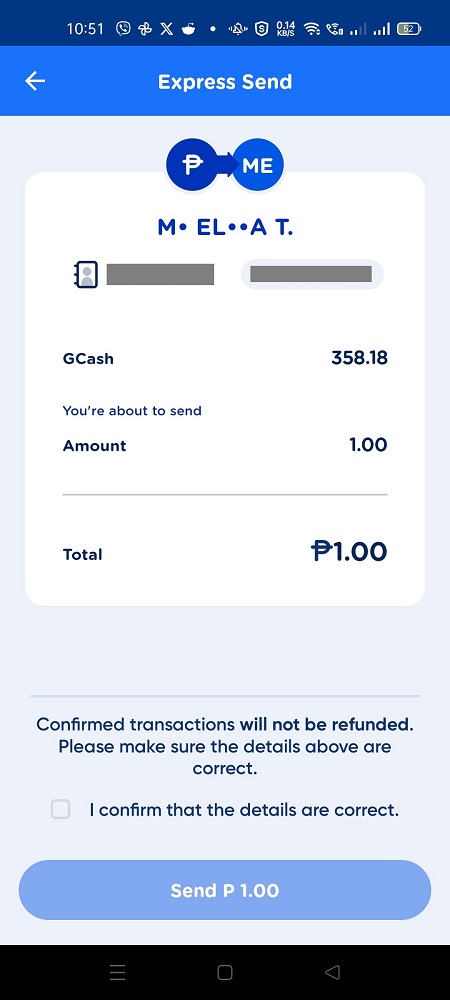

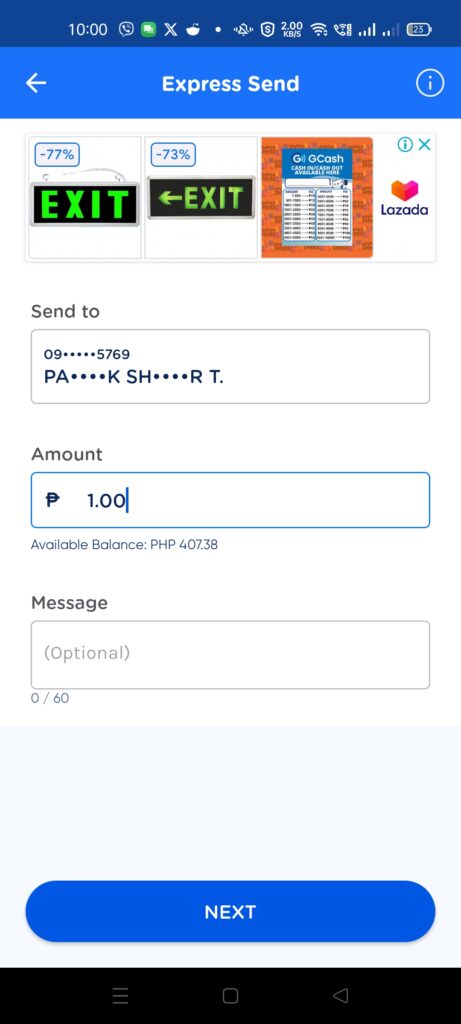

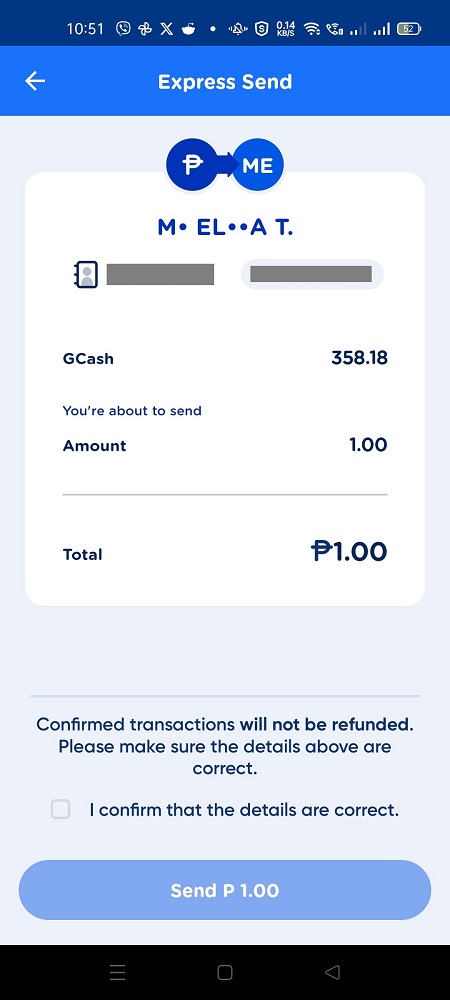

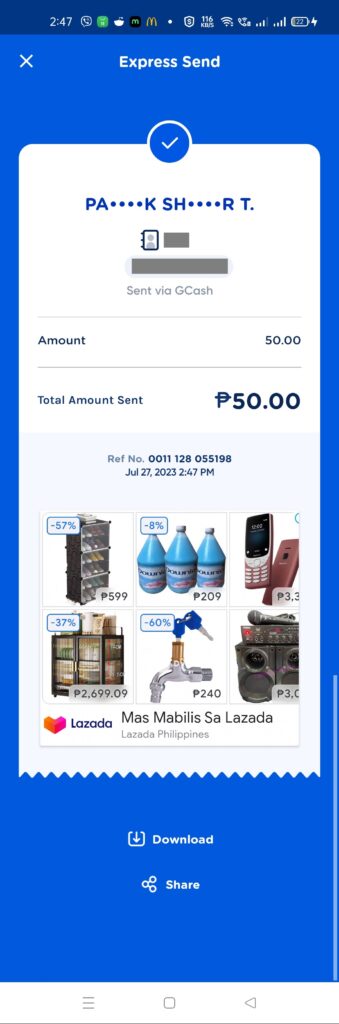

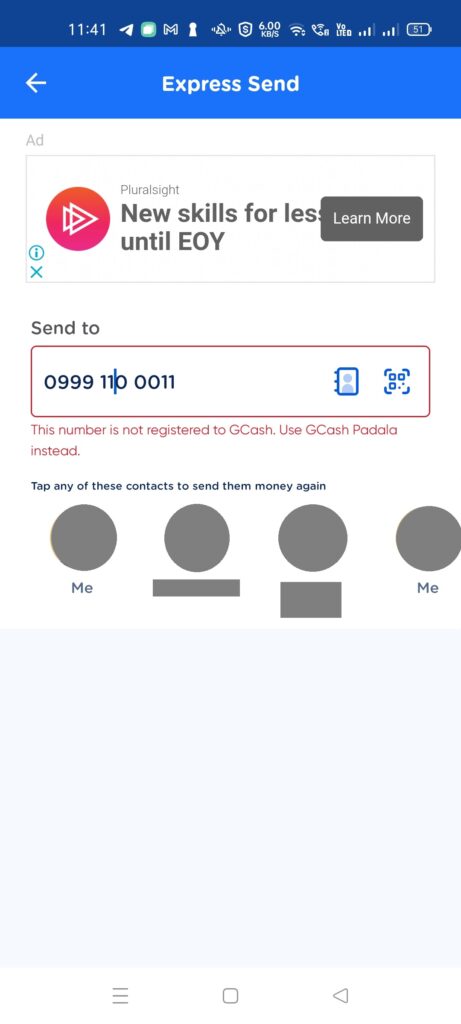

1. What is Express Send?

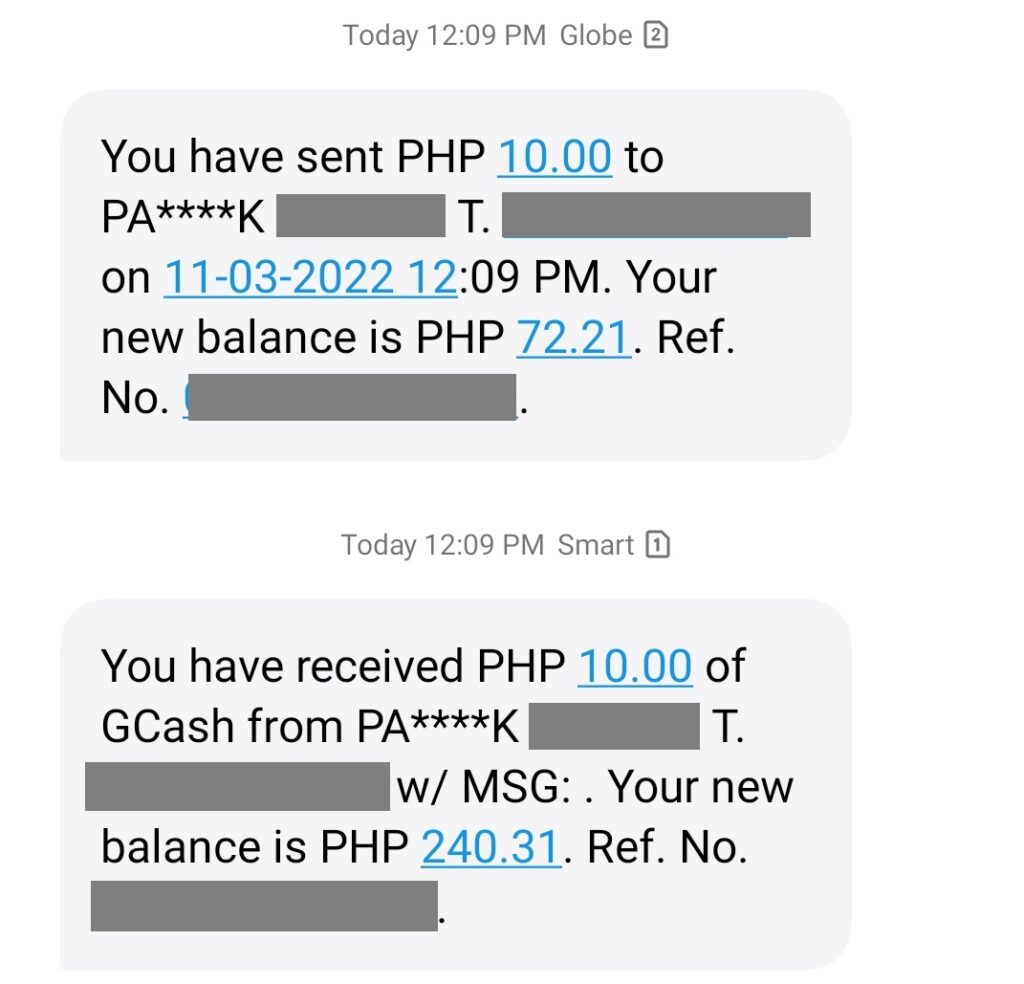

Express Send is the bread and butter of GCash. Basically, you can just send money to any GCash user as long as you know their mobile number. You can also add an optional message to be sent to the recipient. The recipient’s name is obfuscated to protect his privacy as we’ve got a lot of scams proliferating using actual names and numbers.

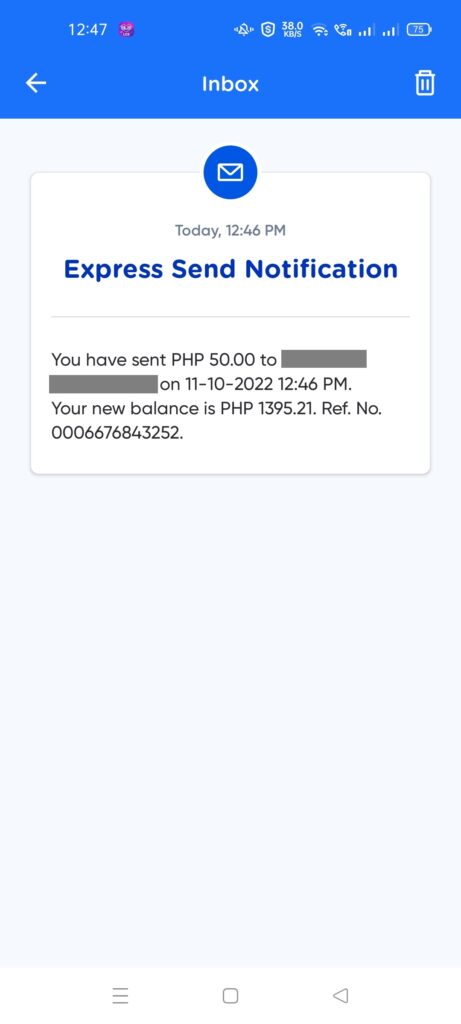

Currently, sending the notification is via GCash Inbox. Sending notifications will be in the Inbox while receiving notifications will still be via SMS.

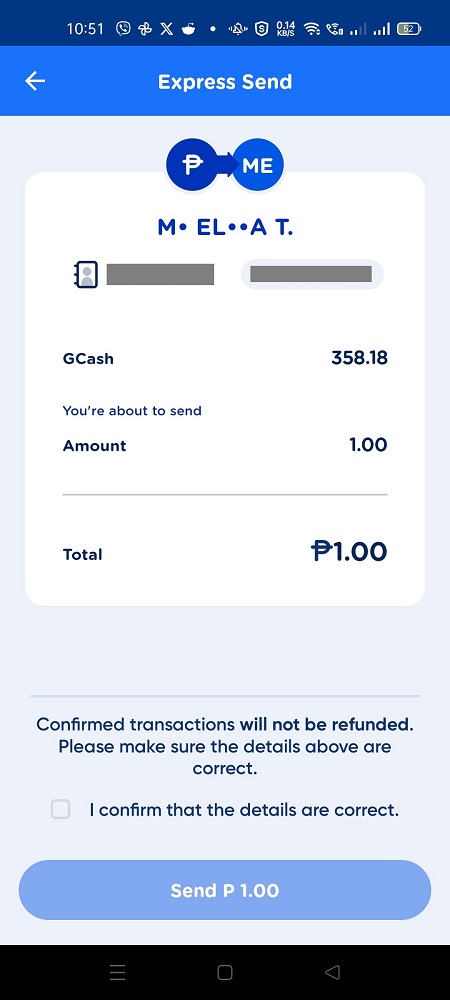

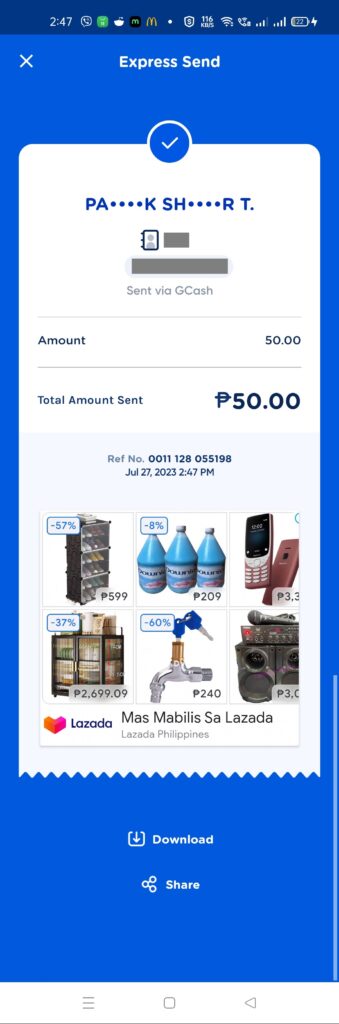

Unlike Send with a Clip and Send Gift, any sent cash using Express Send cannot be undone. It can only be returned by the receiver directly sending it back. Also, sending bigger amounts (Php 1k above) may trigger an OTP from the sender to make sure that he is the one sending.

How to do Express Send in GCash

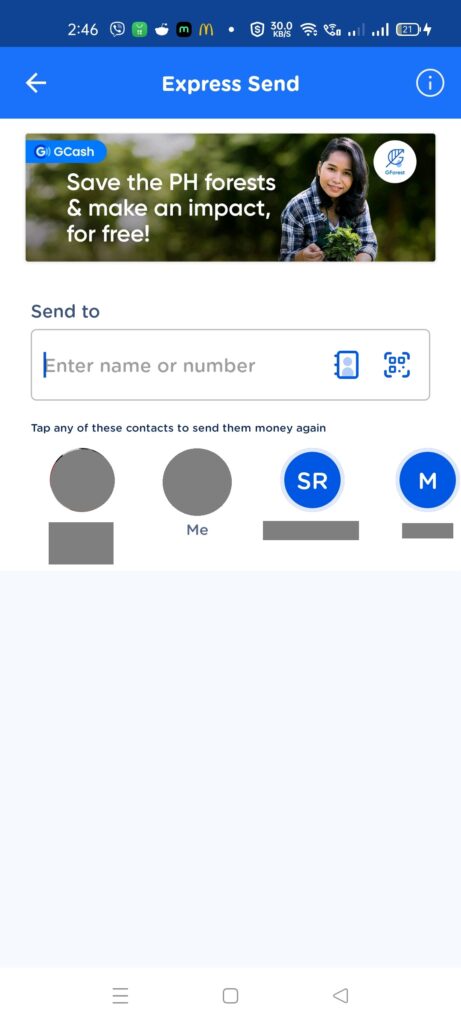

- From the main page, click on the Send button. Once in the Send screen, select Express Send.

- Input the recipient’s number, amount, and message if applicable. Confirm the sending by clicking the checkbox. You can also select any of the previous numbers you’ve sent some money.

- The recipient would be receiving a notification SMS as he receives the money. The sender would also receive a notification in his Inbox.

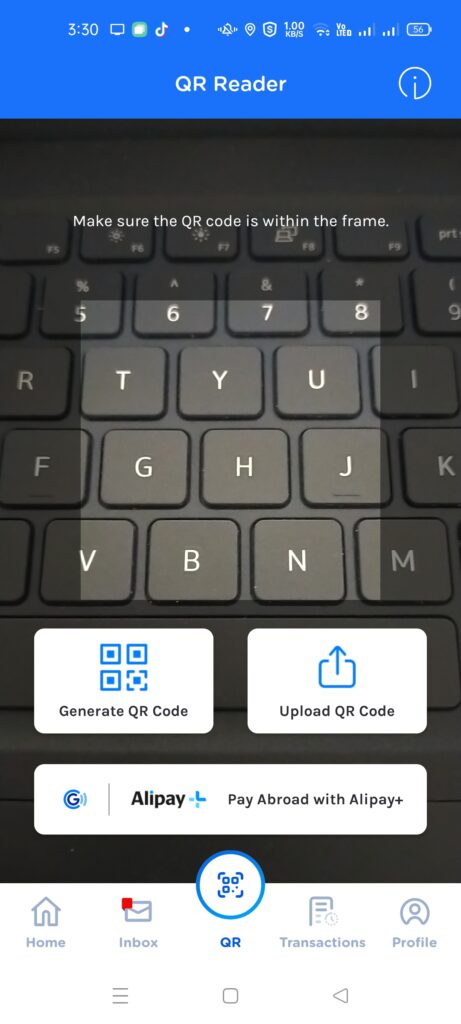

2. What is Send via QR?

This is the counterpart of Receive via QR, where you can generate your own QR code and save or print it — which makes payments easy for those who need to regularly receive money. There are more details about Receive via QR below.

Send via QR allows you to scan the generated QR code. You can also use this to scan any GCash QR Code, including payment QR Codes.

How to Send via QR in GCash

- The receiver needs to show his Generated QR code.

- The sender then scans the code using the QR scanner in the GCash app.

- If the receiver QR code is not customized, the seller inputs the amount and confirms the sending.

- The recipient should receive an SMS that sending is successful.

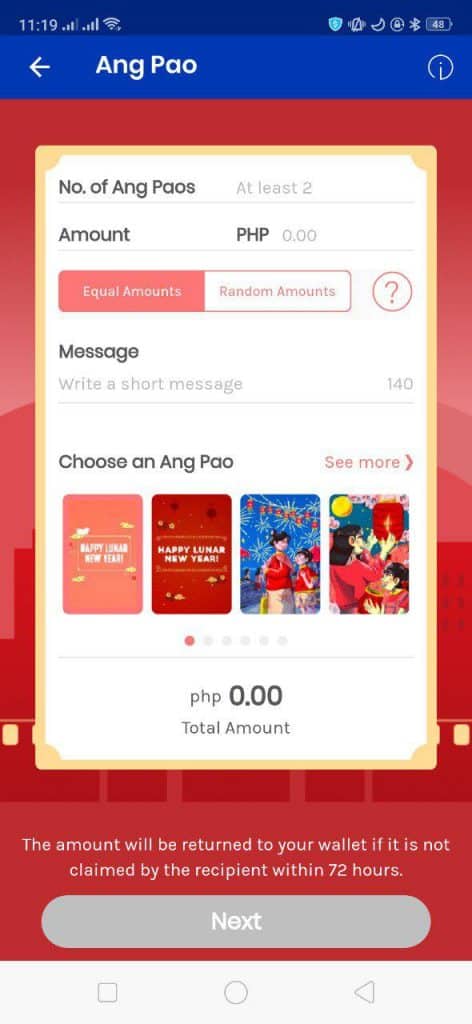

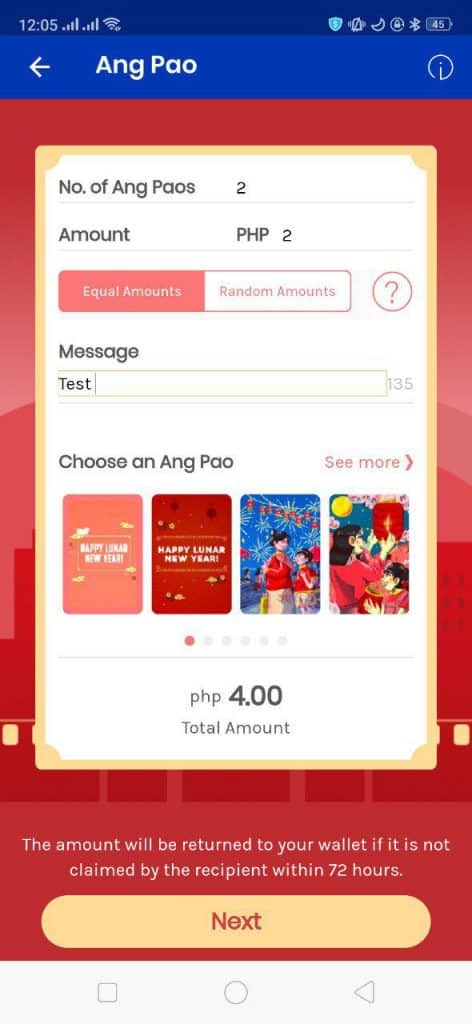

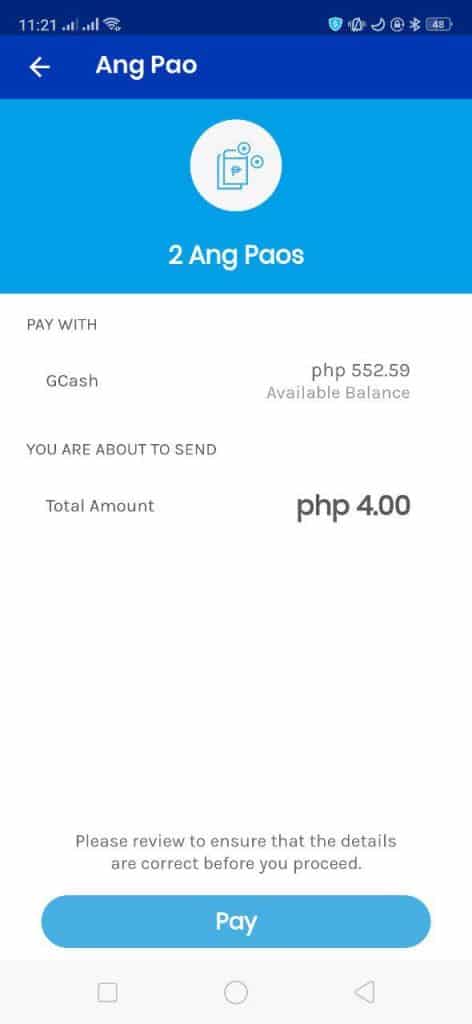

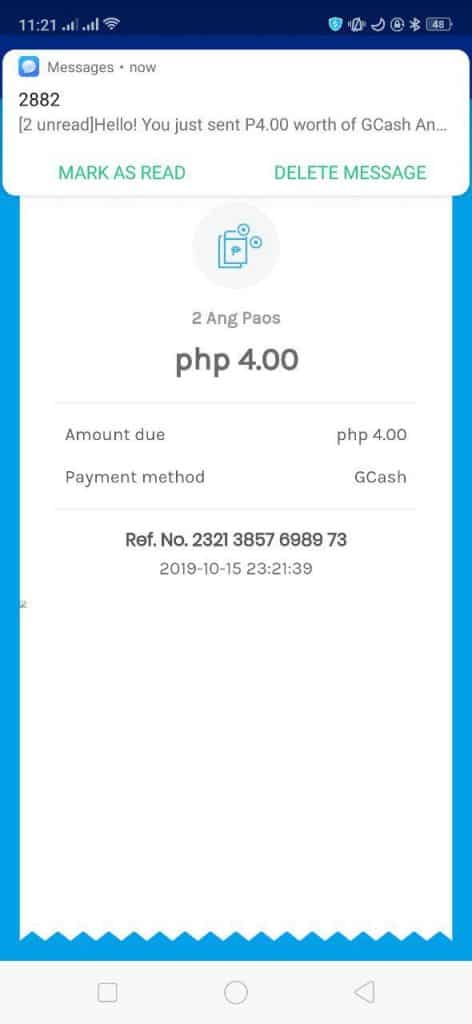

3. What is Send Gift/Pamasko/Ang Pao?

Send Gift/Pamasko/Ang Pao is the GCash equivalent of giving those little red envelopes on special occasions. This is very useful when you need to give at least 2 people a cash gift. The maximum number of people you can give to is 10.

You can set the amount type to “Equal Amounts”, meaning any amount inputted is multiplied by how many people you will be giving; or you can set it to “Random Amounts” where you let GCash determine the share of each gift. The equal amount of sending is pretty useful, even if you aren’t really sending a cash gift.

Take note that any Gifts/Ang Paos unclaimed will return to the GCash wallet after 3 days.

How to Sending Gift/Pamasko/Ang Pao in GCash

- From the main page, click on the Send button. Once in the Send screen, select Send Gift/Ang Pao.

- Input the details for the recipient — no of recipients, amount per person, and message.

- Confirm sending. The recipient would receive an SMS and a message in the Inbox. Click on the message to confirm receipt.

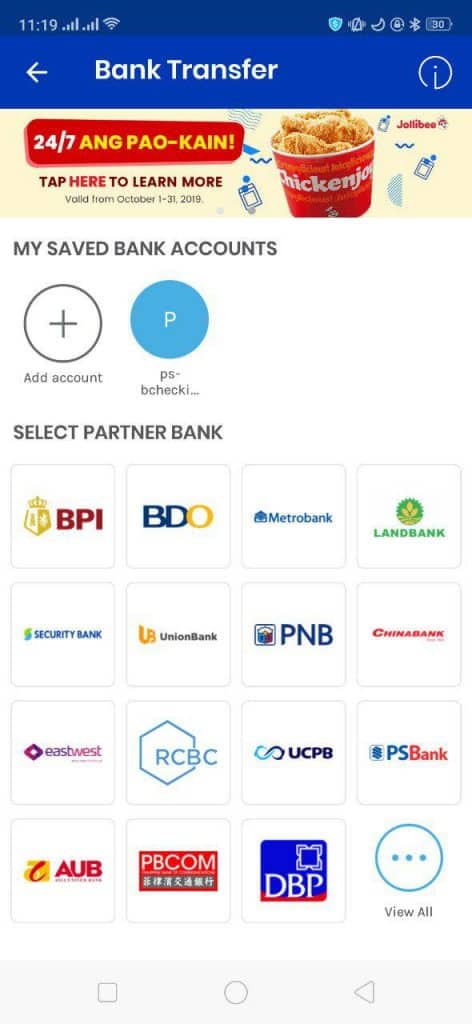

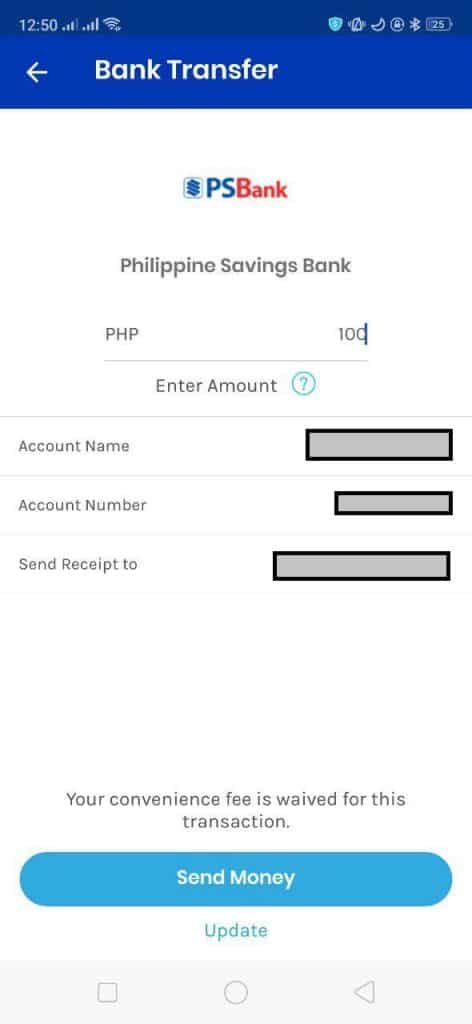

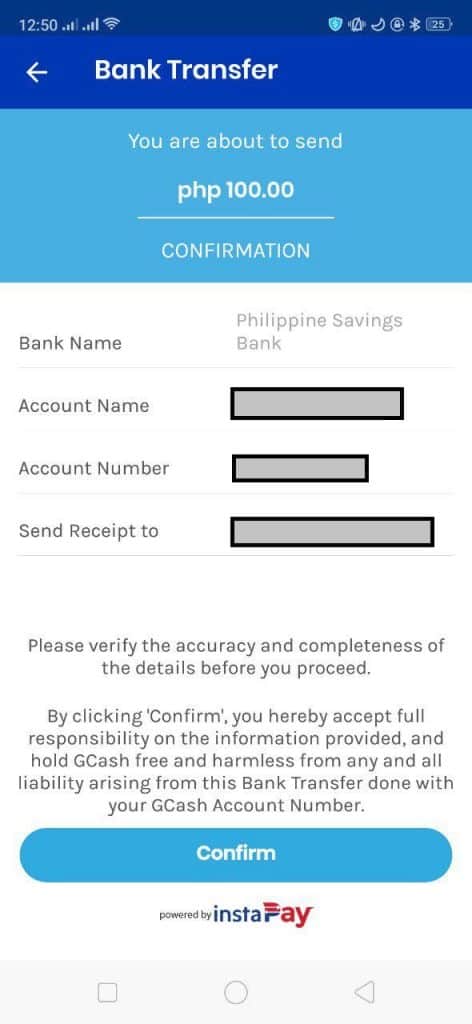

5. What is Transfer?

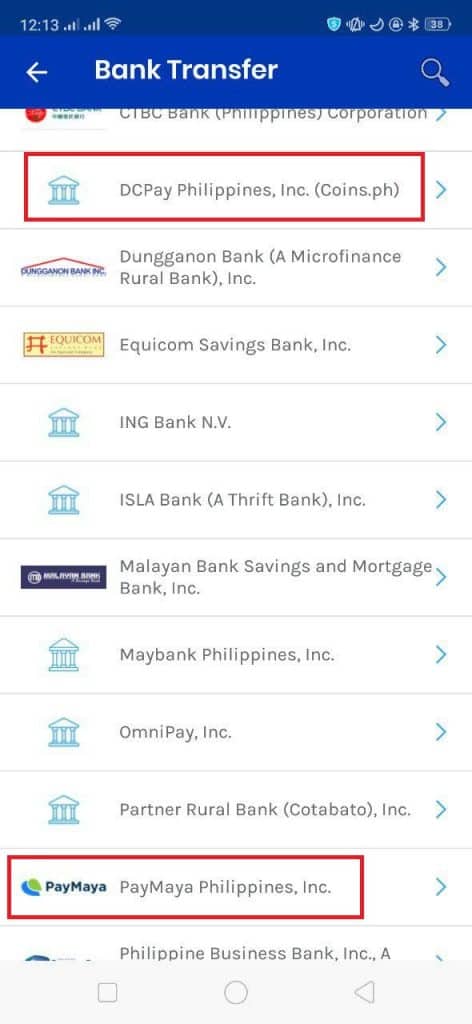

This feature allows you to use the power of Instapay to transfer from GCash to another bank. This service has a Php 15 fee involved. You can also save your bank details for easy access next time. One new feature is to be able to scan Bank QR codes to automatically send using Instapay to a particular bank account.

Same as Express Send, once you’ve sent funds to any bank, you cannot undo it. So we need to take care when entering the account number and name.

How long would the Bank Transfer take?

The transfer should be instant. Any delays or nonreceipt of funds are usually settled the day after.

Can I also save bank details and schedule a transfer?

Yes, you can save bank details and add up to 5 scheduled transfers with a saved bank.

Are there any transaction limits?

Yes, it still follows the Fully Verified incoming limits (Php 100k total) for the month. If you want to increase this, then you should link a bank account to your GCash (like BPI or Union Bank), since your wallet limits will be increased to Php 500k per month if you do this.

How to Transfer to Bank in GCash

- From the main page, click on the Send button. Once in the Send screen, select Send via Bank, then select partner bank to send funds to.

- Input your account details and confirm sending.

- Instapay sending occurs almost instantaneously. You will also be receiving an SMS.

Alongside most banks, other e-Wallets like Coins.ph (DCPay Philippines, Inc.), GrabPay, and Maya are also part of the growing bank list. You can send funds to those accounts from GCash.

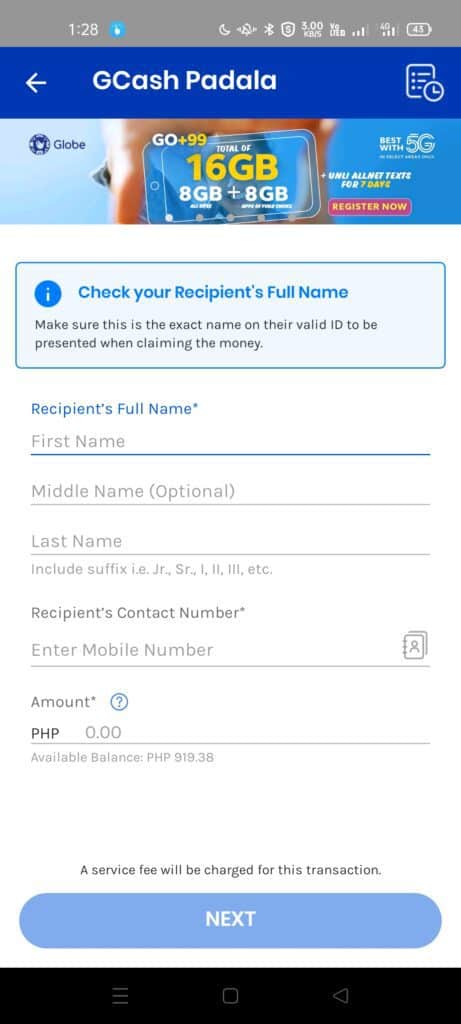

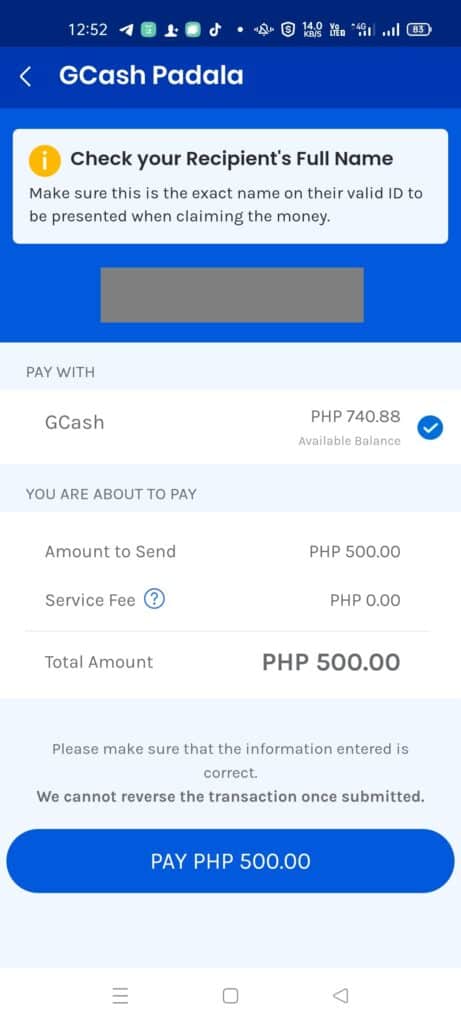

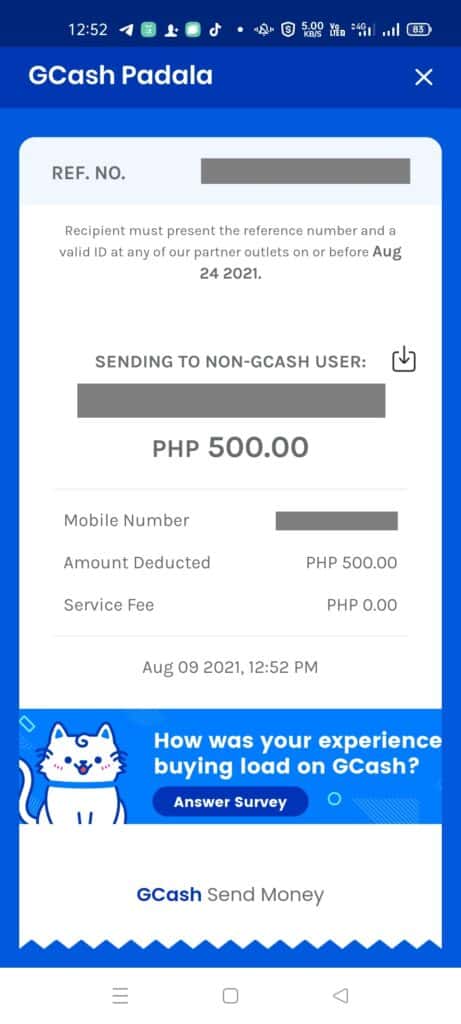

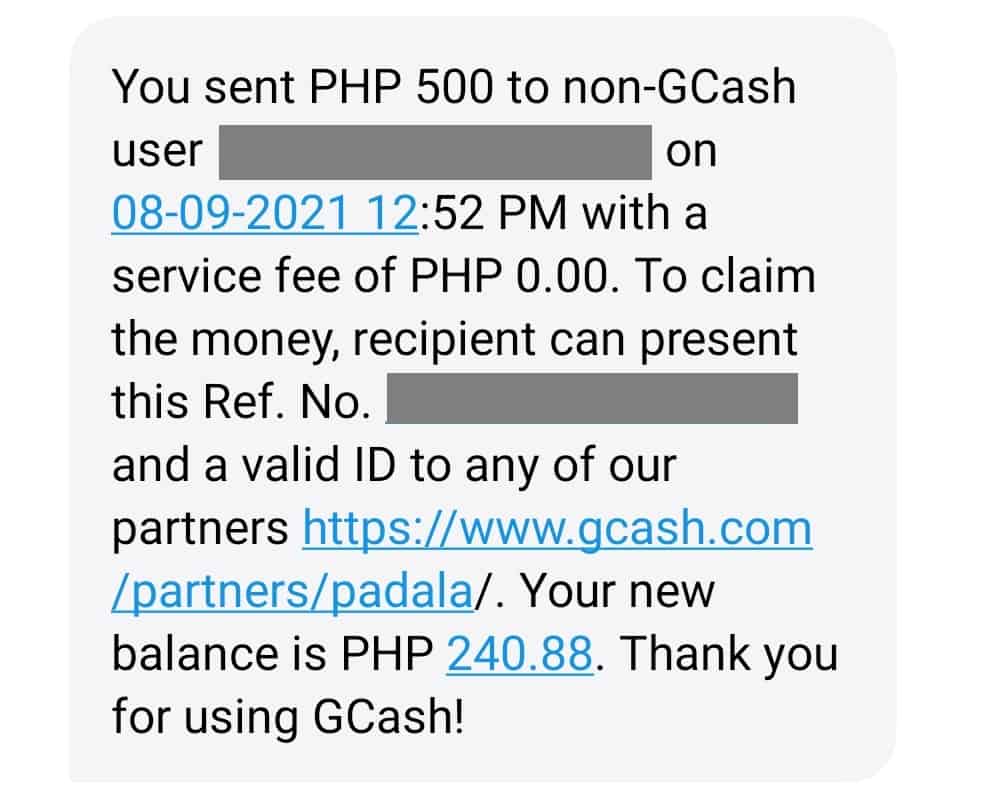

6. What is GCash Padala?

GCash Padala allows you to send funds to non-GCash users. The receiver needs to claim the funds from a GCash Partner Outlet. There are fees for claiming the funds, but this bridges the gap to cater to users that don’t use GCash.

How to do GCash Padala in GCash

- From the main page, click on the Send button. Once in the Send screen, select GCash Padala.

- Input the recipient’s details and confirm sending. The exact name on the valid ID that will be presented should be the same as the details entered.

- Once confirmed, you will be receiving an SMS that you’ve sent your amount to the recipient.

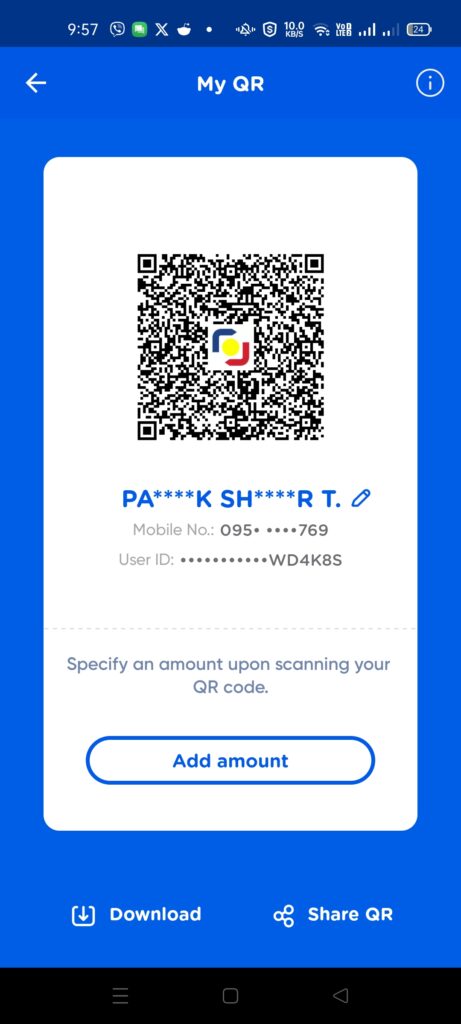

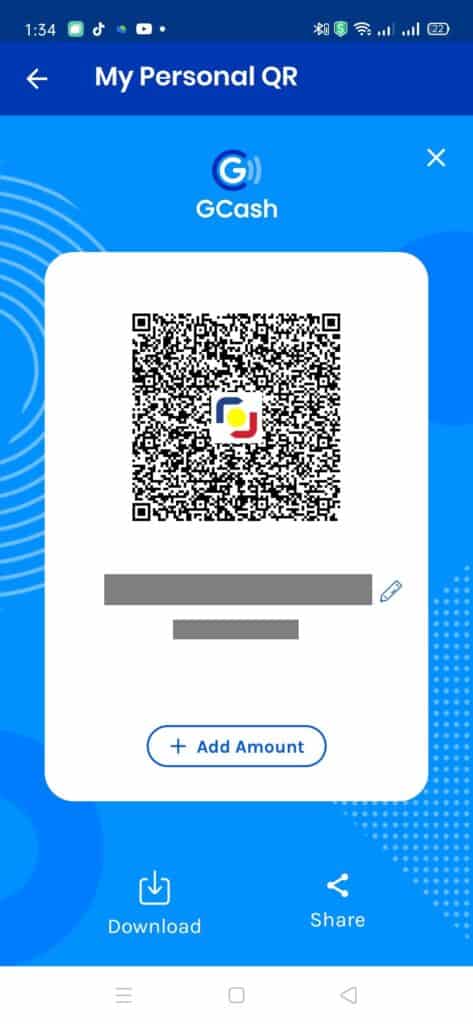

7. What is Generate QR?

Generate QR/Receive via QR is a way to send money without inputting the recipient’s number. The recipient of the money can just generate and send his QR code for the sender to scan. This is the counterpart of the Send via QR feature.

How to Generate QR in GCash

- From the main page, click on the Send button. Once in the Send screen, select Generate QR.

- To send funds, the sender then scans the code using the QR scanner in the GCash app.

- If the receiver QR code is not customized, the seller inputs the amount and confirms the sending.

- The recipient should receive an SMS that sending is successful.

Can I generate and save QRs beforehand?

Yes, you can customize your QR code to accept a fixed amount or add a nickname to the code. You can also save and share the code.

8. What is Request Money?

Request Money allows you to take the initiative and request money from the sender. The sender would only need to acknowledge and confirm the payment.

If you receive an amount regularly, this would be useful as you only need to repeat the same request every time.

How to Request Money in GCash

- From the main page, click on the Send button. Once in the Send screen, select Request Money. On the request page, click on the New Request.

- In the new request, input the requestee’s number, amount, and note.

- Confirm the request, and it will show up on the list page.

How to authorize the Request Money on the side of the sender

- You will see a message in-app about a request to send. Once inside Request Money, you will be seeing the request under the “Requests Received” tab.

- Click on the request details and pay or decline the payment.

- Confirm the payment and it will get logged into the list page.

9. What is KKB?

KKB or Split Bill is a way to share payments from within the GCash app. If used correctly, you can make splitting checks/bills easier as there is a certain procedure to it. This is basically a less complicated version of doing Receive Money from different people.

Once the facilitator sets the amount, GCash would be requesting money from all of his companions at the same time. The companions would only need to confirm the payment.

You can also add a group, which makes this even easier for you and your regular companions. You can also choose to split evenly or split by item.

Other Questions

Why is my recipient’s name during Express Send obscured?

This is to deter scammers from getting your details in the SMS inbox. Privacy is maintained for the sender as well as the receiver.

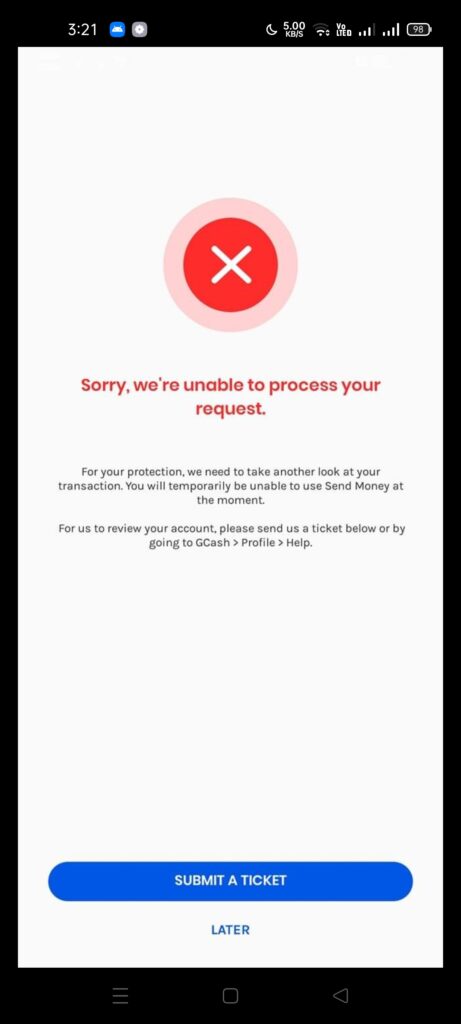

Why am I receiving an “unable to process request” error during Express Send?

The transaction has been flagged as risky and there is a need to recheck it. You can try to send it again until it succeeds. If the error persists, you may need to file a ticket to Support.

Do I need to be Fully Verified to be able to use Send Money?

Yes. Basic Verified Users do not have the Send Money feature enabled.

Is Send Money free to use?

Yes. GCash only charges fees when cash comes in and leaves the GCash ecosystem. This is why there are many different fees when you cash out or when you pay bills in any way.

Are there sending limits?

A Fully Verified account has a limit of Php 100k transactions incoming and outgoing monthly — meaning you can only do a combination of Send Money and payments amounting to Php 100k in a month.

However, if you follow the conditions of getting a higher cash-in, you will be able to unlock the Php 500k wallet limit. In this case, the sending limit would also be Php 500k.

Unlocking Higher Account Limits

You can unlock higher limits by linking your BPI/UnionBank or your Payoneer account/s and utilizing either GSave or GInvest / GInsure with a Php 100 deposit or investment.

Once you do so, you will be able to unlock:

- A bigger wallet limit – Php 500,000 maximum

- Higher incoming limits – you will be able to receive up to Php 500,000 in your wallet and daily cash-ins have no limitations

- Higher outgoing limits – withdrawals will have no limitations per month, and you can withdraw up to Php 10,000 per day

You will be receiving an SMS informing you of the increased limits.

Take note that once you’ve unlinked all of your BPI/UnionBank/Payoneer accounts, the limits will revert back to what it was before.

What if I’ve sent the money to the wrong account?

Unfortunately, GCash Support can only help you if the mobile number of the receiver of the money differs only by one digit. Otherwise, the only option you have is to request the receiver to return the funds you have sent.

This is also applicable to Bank Transfers. Once funds are sent, there is no getting them back.

So a reminder is to please take note of the mobile or the account number before sending it. This is why there is a confirmation screen on every Send Money option. Also, if you send money to a certain person regularly, it is better to assign him/her a picture to see on the confirmation screen.

Can you send money to a non-GCash user?

Currently, you can only send funds through GCash Padala for non-GCash users.

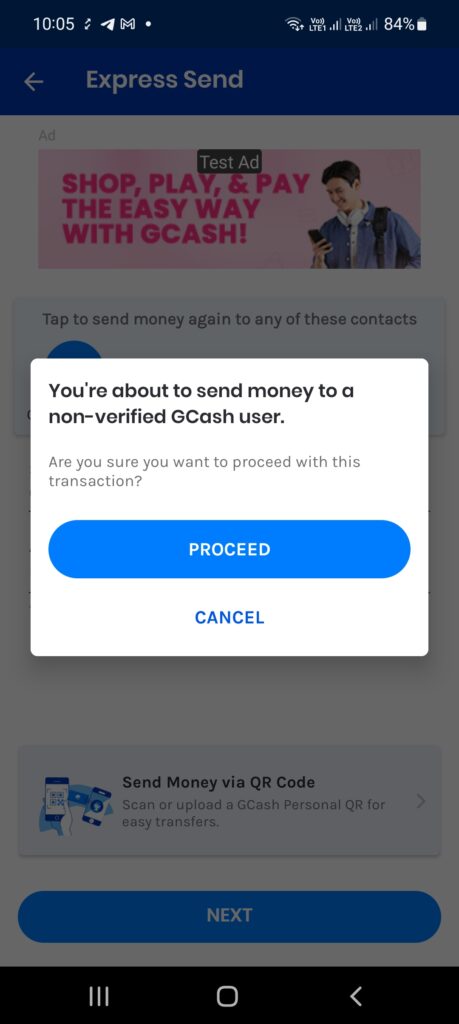

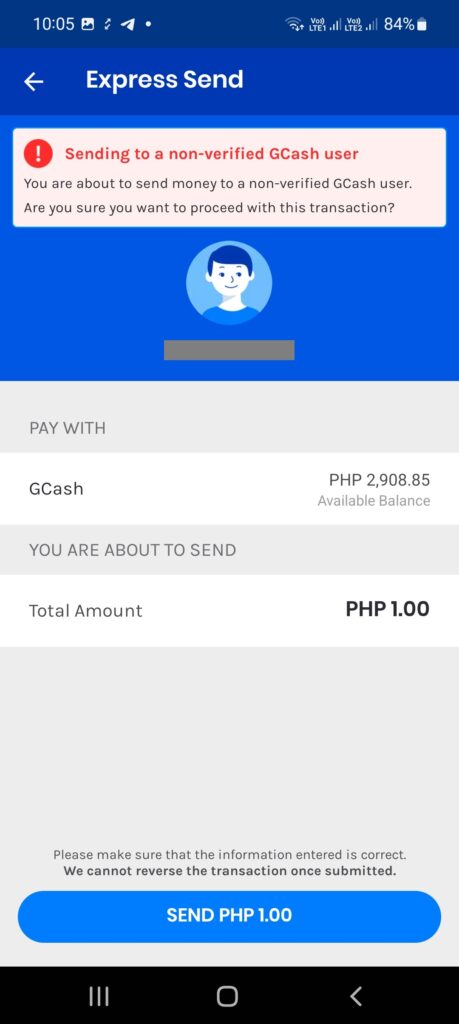

Can you send money to a nonverified GCash user?

You can send money to a nonverified user, but GCash will be confirming if you want to proceed with the transfer. This is to prevent scams and other untoward incidents.

Does sending money increase GScore? How about GCash Forest Energy Points?

Yes, sending money may contribute to a positive GScore. However, it doesn’t add that much transactional value compared to GSave or GFunds.

Send Money also does not add to GCash Forest EPs.

Summary

We talked about the different Send Money options in the GCash app. Additionally, we also explained all of the small distinctions between Express Send, Send with a Clip, Send Gift/Pamasko/Ang Pao, Send/Receive via QR, GCash Padala, and Bank Transfer.

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

How cleam my money to new gcash

Kung may access ka sa luma, lipat mo lang sa bago using Send Money. Pag wala ka nang access, idaan niyo sa GCash Support, pero need niyo iprove na sa inyo yung bagong account.