I’ve seen a lot of guides about GCash users, but not so much about GCash merchants. Currently, there is no better time when e-commerce has a lower barrier for entry and everyone is delving into e-commerce due to the pandemic.

It’s a good thing that GCash allows you flexibility since as a digital wallet app, payment transfers can be easily managed due to it being cashless. This is an advantage for freelancers and online sellers.

GCash users (and other digital wallet users) are also a big market to tap for SMEs and corporations because of the increasing user base.

Setting up a Business with GCash

I’m thinking of setting up a business. What would I need to do?

Here is an in-depth guide for setting a business from the ground up. You need to do your due diligence.

As for government requirements, you will need to apply for a DTI Business Name, and your articles of incorporation from SEC if you are a partnership or corporation. Additionally, you will need to register for a barangay clearance, a business permit with your LGU, and ultimately a TIN with the BIR.

If you have employees, you would need to register with PAG-IBIG, Philhealth, and SSS as an employer as an additional requirement.

What are the benefits of going with GCash as a merchant?

As GCash is currently the most mainstream cashless app in the Philippines, you will be able to tap on the biggest slice of that pie. As of the first quarter of 2019, GCash has had more than 50,000 merchants. Now in 2021, there are definitely more than 100,000 active merchants with them.

And as GCash becomes integrated with payment partners like AUB, we should see a lot of potential for growth in this payments space. To add to this, the pandemic has made cashless payments a necessity as well.

As a merchant, if you need GCash acceptance in your website or with any online presence, you can partner with many Internet Payment Gateways (IPGs) that has GCash acceptance. You can refer to this list of IPGs integrated with GCash.

The main driver of acceptance is that as more and more merchants are integrated to GCash, the more that users will be using this app to pay. It becomes a positive feedback loop. As a business, the lesser friction we have for payments, the better focus we can provide to our products and services.

What are the types of merchants under GCash?

There are 4 types of merchants in GCash as mentioned in the site:

- Informal

- Online Seller

- Storefront Seller

- Online and Storefront Seller

Informal sellers have little to no requirements. Any GCash user can also be an informal seller. There is no need to register or anything, as the user/seller can already get a personal QR code using Send via QR. People won’t need to send money by manually inputting the contact number and/or amount when they need to pay for products or services anymore.

Online sellers as mentioned, only sell online. GCash has a partnership with Paynamics to enable payment links called Getpaid Payment Portal. This allows sellers to accept payments via sending links to buyers. This is similar to Paymongo or to Bux.ph, but in this case, GCash would be the only payment method available. Here is a comparison of the different payment link services accepting GCash.

As for storefront merchants, they can have their own QR codes generated, including a separate transaction wallet that is tied to their business itself. This allows them ease of use as any transaction using the codes will be settled to their bank account at the start of the next day.

Enterprises can also more use different modes of payment other than static QR as they have their own POS (point-of-sale) systems. If they have an online presence, they can also utilize GetPaid, or their own implementation of online payments.

What are the list of requirements for each type?

There are no requirements for informal sellers as the Send via QR function is free in the GCash app itself.

For online sellers, you would need to register in the GetPaid portal and onboard with Paynamics as their sub-merchant. This involves documents that need to be submitted while within the portal, depending on the type of merchant you are (sole proprietor, partnership, or corporation).

If you want your own QR codes as a storefront seller, you would need to apply as a merchant with GCash itself. They’ve streamlined the process as you can onboard yourself in their merchant portal. Once you’ve registered, you can submit documents and enroll your representatives and branches where the QR kits will be delivered.

What’s the difference between an enterprise wallet and a user wallet?

A user wallet is the one used in the GCash app. You can do normal GCash things with a user wallet like Send Money, Cash-in, Bank Transfer, Bills Payment, and others.

An enterprise wallet is used for those onboarded as a storefront merchant. This wallet acts as a wallet for all of the customer transaction amounts that happen in a day. Once settlement occurs the next business day, this wallet gets “swept” and automatically gets settled into the nominated bank account of the seller.

GCash Scan-to-Pay Merchants / Storefront Sellers

Typically, small and medium merchants go for using Scan-to-Pay or QR Payments because this is the simplest way to get GCash acceptance.

What do I get when I onboard with GCash as a Storefront Seller?

If you are an individual/professional merchant, you will get a kit that contains the GCash promotional materials as well as the QR code for display.

If you are onboarding as an enterprise merchant, aside from the kit, you will also be given feature phones for each branch you’ve onboarded. These phones will be able to receive SMS notifications when a GCash sale takes place.

Additionally, you can request access to the merchant online payment portal (this is different from the merchant onboarding portal), where you will be able to see transactions in real-time. You will also get a transaction report every day, training on how to use your GCash account, and a separate merchant support hotline for issue escalations.

How does Scan-to-pay payment work?

During payment, the GCash user scans your QR Code, and he also inputs the amount to pay. Once he confirms payment, both of you should be receiving an SMS notification.

For enterprise partners, there are also other modes of payment aside from the typical scan-to-pay but they would need system integration. I’ve also described these in detail in another post.

How does GCash settle to my account?

If you are a storefront merchant, the cash you receive goes to your GCash account directly. Keep in mind that this is subject to the monthly limits a verified account has (Php 100k for cash coming in and out). You can increase this limit to Php 500,000 if you link a bank cash-in into your account.

If you are a business entity, GCash will require you to nominate a bank account for settling all of the transactions that occurred. They will be “sweeping” your wallet, and then depositing this amount to your bank account. A usage report and a settlement report will be generated and that will be also be sent to your nominated official email address.

Are GCash transactions considered cash transactions?

Yes, they are considered as cash transactions (even if they are by definition “cashless”) and are exempt from withholding tax, unlike credit card payments.

If you paid via GCash Mastercard, it will also be considered as cash, as it is a debit card.

Does G-XChange / Mynt get a portion of every transaction?

G-XChange is the official operator of GCash. And as to gain revenue, they get a cut out of every purchase through any GCash payment channel. They call it the Merchant Discount Rate (MDR) and they get 2% of the transaction amount. This applies to both online and storefront sellers.

However, if you are an informal seller, there is no MDR for each transaction. You will be getting the whole amount as it is technically using Send Money.

Some enterprises negotiate a better rate with other conditions (like GCash only promotions, partner-related vouchers, etc).

Do I need to be online when accepting Scan-to-Pay payments?

No, however, you need to be under good network coverage to be able to receive SMS notifications.

What if I don’t like to use Scan-to-Pay? Are there other GCash payment alternatives?

Scan-to-pay is the simplest way to provide a GCash payment option to a merchant since you only need a QR code to be able to transact.

However, as enterprises grow, they will eventually attain the capacity to implement or acquire their own POS solution. A partnership with GCash is possible if they are willing to do some integrations (e.g., Generate QR needs each POS to have a scanner) or they can also opt to go through a GCash integrated third party.

As for online payments/e-commerce, merchants can also opt for integrating with payment gateways. Here is a list of companies with GCash payment integrations.

Can I integrate with a payment provider that is partnered with GCash?

Yes. GCash is partnered with different payment providers and banks (like AUB, BDO, and GHL). They each can provide different ways of payments like credit cards or other digital wallets like GrabPay or Coins.ph.

If you are an online seller, you can go with payment gateways that can cater to smaller merchants like Paymongo (which now supports Shopify), Magpie, and BUX.

What if I don’t receive any SMS notification for a GCash Scan-to-Pay transaction?

There is a way to check the transaction via SMS. You just need to send an SMS with this format to 2261 using the feature phone from GCash:

GCASHCHECK <GCASH REF NO> <GCASH DISPLAY NAME>

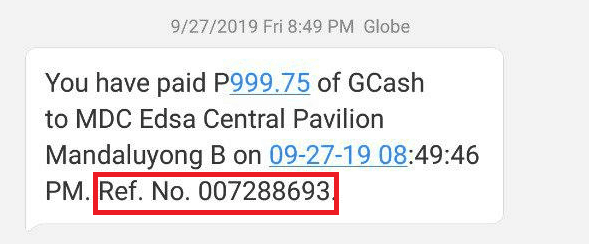

The GCash Reference Number is the transaction ID the GCash user received as proof of payment. The display name is the name displayed above the QR Code in the standee.

The GCash Reference No.

The Branch Display Name

So, in this case the message should be:

GCASHCHECK 007288693 MDC Robinsons Place Pioneer Mand D

Once you send it via the feature phone to 2261, you should receive the transaction status for that transaction.

You can also get a summary of GCash transactions so far in the day via SMS to 2261.

GCASHSUMMARY MDC Robinsons Place Pioneer Mand D

Is there an official GCash merchant list?

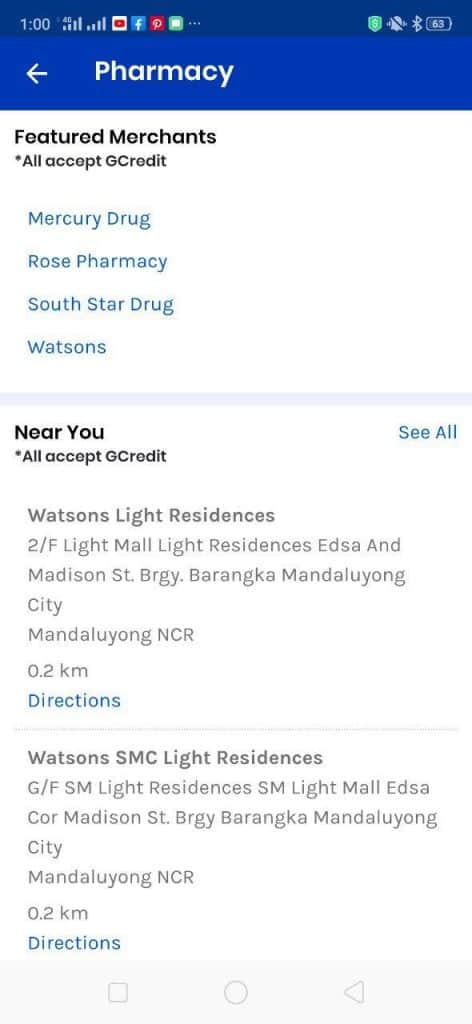

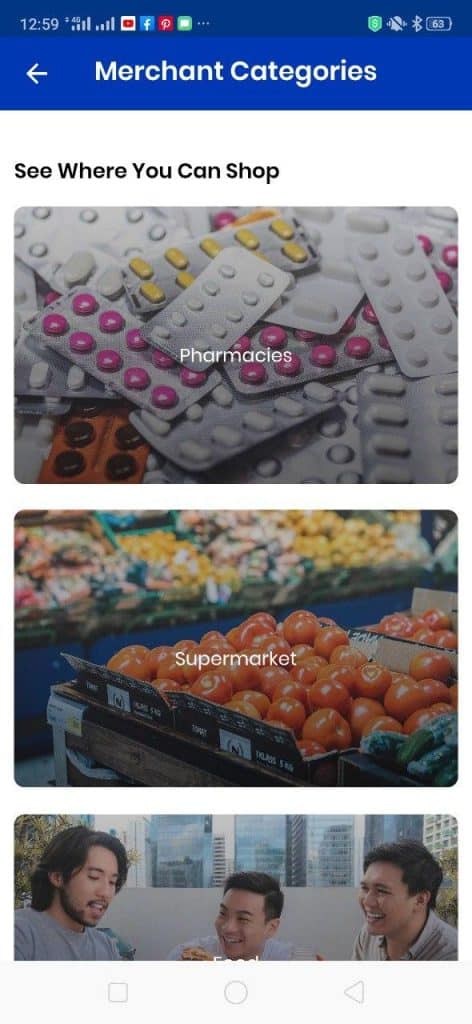

Yes, there is one in the GCash app itself. You need to open your sidebar, and the merchant list is just below the Voucher Pocket.

After clicking it you can see different categories (Pharmacies, Supermarket, Food, Retail, Convenience Stores, Transportation, Entertainment, Lifestyle, Services).

When you click any of these, you will see the full list for that specific category.

GCash Online Payments for Merchants / Online Sellers

I have an online business. Can I use GCash for online payments instead of using Scan-to-Pay?

Yes, you either use the GetPaid portal to accept payments or you can leverage GCash online payments with the other payment gateways/providers online. Here is a shortlist of payment providers that provide online payment functionality:

- 2C2P

- Adyen

- AltPayNet

- Asiapay

- Asia United Bank

- BUX.ph

- DragonPay

- eGHL

- Fucent Gateway

- IPay MyEG

- IPay88

- JazzyPay

- Magpie

- PayMongo

- Paynamics

- Paymaya

- Pilipinas Teleserv

- Synermaxx

- Traxion

- XendIt

What if I want to pay my employees via GCash?

There is also a disbursement solution for GCash. You can provide salaries and compensations using this option.

Do you have a copy of the Frontliner Guide for Merchants?

Yes. I was able to take a picture of this from a JRS Express branch as they support GCash Scan-to-Pay payments.

GLife Seller

GLife is a feature in GCash that allows you to have a mini-app from within the GCash app. This makes it easier for a seller to gain visibility and ease of payment as they are inside the GCash ecosystem already.

To be able to get into this, you can reach out to official GCash/GLife partners like:

Summary

I explained what GCash is from the point of view of the merchant. I discussed how to avail of it, and what distinguishes GCash payments from others. I also answered some frequently asked questions regarding setting up GCash as a merchant.

For posts or pages related to merchants, you can also check out:

- How to Setup your Personal QR Code

- Paymongo and GCash

- Bux.ph and GCash

- Comparison of Payment Links Services

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

I wish to be a merchant of gcash… how?

You need to complete the requirements I mentioned above and email it to iw**********@**nt.xyz.

Can I apply gcash merchant for individual in globe outlet or by email only?

You can do it by both, but I recommend you do it via email.

Both, but since we are in ecq, it would be better to do it by email.

Is there a maximum limit in merchant account for now we are having 100k limit in cash in and cash out basis?

If you are applying for individual merchant, the limit is still 100k. But if you are applying for business merchant (solo prop, partnership or enterprise), there is no limit.

How can i apply gcash merchant for individual business?

Please accomplish the form and send it to them.

sir how?? i send it the form and what email i should ?

thank you notice me

Meron pong nakasulat sa blog post. Yung email ito — IW**********@**nt.xyz. O kaya mag-apply gamit ang form na ito — https://www.gcash.com/payment-solutions/#contact-form

How to request a new QR code standee?

I think you can email me*************@**nt.xyz for that.

How much is the transaction fee if our company uses GCAsh facility for our clients to remit payment to our company?

For payments, typically it’s around 2% per txn. You can negotiate, but that’s the baseline.

After sending my application requirements via email, do they reply after how many days?

It depends, since we are in quarantine, it can still take a while.

Aside from transaction fee, what are the other fees if our business uses Gcash for payment?

Aside from the mdr/transaction fee, nothing else.

hello, thanks for this post.

in the requirements, https://www.gcash.com/wp-content/uploads/2020/05/GCash-Offline-Merchant-Application-Requirements.pdf

where can we get the following forms?

– Scan to Pay Application Form

– Branch Enrollment Form (BEF)

Both are provided by gcash once you sign up.

Hello i applied for individual scan to pay qr code. How would I know if they have confirmed my application form?

You can send a follow-up email to iw**********@**nt.xyz

Thank you very much!

I cannot open the link for the requirements. For your assistance please.

I edited the page a bit and refreshed some info. Regarding the link for the requirements, these are in PDF format.

We are interested to apply for GCash to be used for our online product selling as a Corporation type of business. Do we need to apply for a Globe line for us to receive all transactions via SMS? And lastly we have existing BDO POS merchant please guide us what’s the fastest way to have a corporate GCash facilities. Thanks

There is no need to apply for a Globe line as GCash provides the phones. You can course your inquiries through iw**********@**nt.xyz.

good day tanong ko lang po yung fee/charge po ba ng using qr code/scan to pay qr code is base sa tarnsaction daily/monthly? or fix po sya sa fee nya mothly kaht d masyado nagagamit? kakauha ko lang po kasi ng qrcode ko at wala po ako idea sa chrge or fee nya pag gnagamit yung scan to pay. slamat po

Kay merchant pinapataw ang fee, hindi sa GCash user. Kung merchant ka, ibig sabihin kada bayad sayo gamit scan to pay QR mo, may kaltas na yun dapat. Hindi siya daily/monthly. Per transaction siya.

ilang percent po? mag rereflect po ba yun agad or with in 24 hours pa po? salamat po

Dalawa po kasi ang sagot dito —

1. Kung nagregister kayo as business, 2% siya. Ginagawa ang kaltas per transaction. Halimbawa, Php 100 ang item, Php 98 po ang makukuha niyo pagkabayad. Pero di ito mapupunta sa GCash account mo, mapupunta ito sa bangko kung saan nakaregister ang GCash account mo.

2. Kung individual account ang ginawa mo, makukuha mo yung buong amount sa GCash wallet mo. Walang kaltas.

Paano po if online payment lang po yung ia-avail via checkout sa website nung business without the scan-to-pay qr? 2% pa din po ba yung transaction fee?

Kung online payment, mas magandang dumaan ka sa mga payment gateways like Dragonpay, 2C2P, Paymongo, Magpie, Asiapay. May corresponding fees rin sila kada isa.

This is a great help. Thanks.

Hello! I am Joice, HR of Lazy Bear Milk Tea. We want to apply as merchant. Where can I send the requirements needed?

Hi, please send it to IW**********@**nt.xyz.

Hi po, after po ng 3 working days. Makukuha na po yung Scan to pay QR Code? And okay lang po ba yun kung nag apply lang ako via form na naka direct for apply agad? Since Individual po yung inapplyan ko.

Di ko po alam kung 3 working days yun, unless sinabi nung nakausap niyo. Pag individual dapat mabilis lang ang proseso.

Hi po!

I am now conducting a study ’cause the management wants to apply for corporation.

Here’s my question po sana masagot po to include in my study

1. What are the benefits can we get when we apply?

2. Diba its 1.58% fee per transaction na? Then, may nabasa po ako sa comment na yung transaction fee hindi mapupunta sa GCash account kundi mapupunta sa bank kung saan inapply ang GCash, does means samin sa merchant pa din po ba yun o dun na sa bank?

3. What Merchant Discount Rate (MDR) mean?

4. Are we going to gain an income po ba if we apply or its just an payment solution for us?

Thank You hope to get an answer from you as soon as possible hehe

1. Benefits po – dagdag kayo sa merchant list, may daily reporting at settlement sa bank niyo. May feature phone rin para sa frontliners niyo. At separate support hotline.

2. Sa cash in po yan, payments po ito. 2 percent po ito.

3. Yan po ang cut ni gcash per transaction kasi siya ang ginamit na payment method.

4. This is a payment method po. Ang makukuha niyo dito ay yung access to gcash users kasi sila ang may pinakamaraming users ng digital wallet sa Pilipinas. So may gain rin ito sa income, kasi mas malaking market ang matatap compared to just plain cash.

An another concern po

Yung transaction fee po ba sa QR code lang binabawas? pano po kung isa na kami sa mga merchant and our customer will pay us via selecting our name in the merchant list may fee pa din po ba?

Once nagtransact via QR po dun lang may kaltas. Basta company (single prop, partnership or corporate) po ang pagkaonboard. Pero kung individual seller lamang, wala pong kaltas.

Yung 1.58% fee per transaction po ba hindi mapupunta kay GCash? May nabasa po ako sa comment na dun mapupunta kung saan niregister ang GCash account, Ibig sabihin po nun yun na po yung parang magiging income ni GCash?

Ang alam ko po 2% yung transaction fee ni GCash. And yes, dito po nakukuha ni GCash as income niya. Saan niyo po nakuha yung 1.58% na value?

Hi po, until now wala pa po akong narereceive na feedback sa Gmail acc ko regarding sa nirequest kong QR Code. Individual po inapplyan ko. Lagpas 3 working days na po gaya nong sinabi sa website nong nag fill up ako ng form. 3 days process. Til now wala pa.

Well, we’re still under the pandemic, hence everything is subjected to delays. I suggest you call or email for an update.

HI , nagrequest po ako nong Monday for my own QR code. Individual. I haven’t received any feedback. Sabi kasi 3 working days eh. Till now wala pa.

Puwede pong itanong natin sa kanila. Baka nahirapan sila dahil sa mecq.

Hello. My questions are directly related to a Sole Proprietorship.

1. How about the Send Money option? Since may feature fon, are we given a new number as a new gcash account? Can we receive payments thru send money (to my new number) from our customers? Magkano naman ang charge? Is send money (to my new number) treated the same as a QR payment?

2. Paano kung may expenses kami and we need to send money out (to gcash din) , may transaction limit ba for this?

Sole Proprietorship is different from Individual accounts.

1. Basically once you have an enterprise account, the wallet is different from the user type of wallet. Hindi na puwedeng mag SendMoney soon sa account na yun. Individual accounts on the other hand, is still tied to your wallet, kaya puwedeng mag SendMoney. The QR code for just basically sending money to your particular wallet without inputting the details.

2. For enterprise accounts, it works differently. Basically Kung ano man ang laman ng wallet mo, dinedeposit as account mo every day. Hindi siya user wallet.

Hi, Sole Proprietorship rin po yung GetPaid Gcash account namin. How many days does it take po to transfer funds? yung isang tinransfer ko almost 2 days na Pending parin. And yung kahapon na tinransfer ko sa user (personal) Gcash account wallet ko, di paarin na tatransfer. I would like to know the estimated days of transferring funds to another Gcash/bank.

I see. Now, I get it. Magka iba pala sila. Please keep this up. We need this. We’ve been heavily researching this ecq season for our procedures in our business and walang kwenta si GCASH HELP. D sinasagot ng maayos mga queeries namin and maraming info dito na wala wa website nila. So, more questions: pwede ma transafer yung sim ng feature fon to an android device? May real time monitoring sa account of the amounts na pumapasok?

You could use that sim card, but the feature phone mainly relies on sms and ussd for transactions. Kaya medyo di rin cost effective palitan pa yung phone.

For real time monitoring, ask for dashboard access. May ganung option for merchant accounts.

I see. So, kung may sim, meron ding number? Pwede rin po bang mabayaran kami using the number thru SendMoney from our customers? Pwede rin mag cash in thru the number? If pwede mag cash in, mag a apply din ba yung 8k limit sa cash in, above 8k may 2% charge na?

Sa individual/professional accounts lang po yan. Pag enterprise di applicable ang mga sinabi mo.

For corporation po what will be the difference of the eWallet and how does it works?

Iba po ang wallet ng enterprise sa user wallet. Ang enterprise wallet basically nag-iipon lang siya nung mga binayad ng customers. At the start of the next day, sinisweep yun kasi diretso settle sa bank account.

Ang user wallet, yan yung ginagamit natin sa gcash. Nakikita sa app ang mga puwedeng gawin using this wallet.

1. What is the difference between the wallet of corporation and for individual?. And, How does it work?

2. Dun po ba mapupunta lahat ng transaction?

3. Paano po namin makuha yung sales per day? saan po wiwithdrawhin?

Thank You

Pag wallet ng enterprise iniipon lang niya yung mga bayad ng customers.

Next day, may settlement na nangyayari, meaning sinisweep yung laman ng wallet at dinedeposit lahat ng laman nito sa naenroll mong bank account.

Since nasa bank account niyo na, puwedeng withdraw anytime.

Pwede po kaya kami magapply for GCash Kiosk? Where customer to cash in and cash out?

Sa payments lang po kasi ito. Di kasama ang cash in and cash out.

Pero may mga partners sila like Posible na nagpprovide ng ganitong service.

Hi po were planning kasi na magapply as corporation sa GCash ang business po namin convenience store then gusto po sana namin na pwede mamili si customer thru online same thing with the payment, then ideliver sa kanila, pwede po ba yun?

Puwede naman, pero ayaw mo bang dumaan sa mga payment gateway like dragonpay, asiapay, paymongo, etc?

Kasi ang problema kasi dito pag online payments need pa magdevelop ng software para magconnect sa gcash. Pero pag sa payment gateway, gawa na siya.

Pano po kung may website yung store namin where they can place their order, then nasa mode of payment si GCash? pero as corporation pa rin kami

Online payments po gusto niyo, pag ganun, mas maganda po siguro dumaan kayo sa mga payment gateways like Dragonpay, Asiapay, Paymongo, etc.

Hi po were planning kasi na magapply as corporation sa GCash ang business po namin convenience store then gusto po sana namin na pwede mamili si customer thru online the pay using their GCash, then ideliver sa kanila, pwede po ba yun?

Online po gusto niyo, pag ganun, mas maganda po siguro dumaan kayo sa mga payment gateways like Dragonpay, Asiapay, Paymongo, etc.

Question: Pano kung may Payment App na that comes with QR Scan Capability and we would like to integrate with GCASH, what are the steps and is this considered as Online Payments? And do we have to be an Individual Merchant or do we need to apply as For Enterprise?

Yes, they call that “offline integration”. If you want to integrate, I would suggest you do so with payment aggregators already integrated with gcash.

But since you mentioned you have an app, you can also apply as a payment facilitator as well. Basically ikaw ang dadaanan ng ibang merchants para makaprocess ng payments.

Pano po kung one of merchant na kami, ilang working days bago mapunta samin yung payment ni customer, pwede po ba yun na within the day mareceived na? Convenience store po and business namin

Usually ang settlement next day for enterprise accounts

Hi po

ano po ba difference ng biller sa merchant?

Merchant is for purchasing goods, usually one-time only. Biller is for paying for a subscription or a recurring payment.

Hi, po sir we are a cable and internet provider in mindanao po. okay lang po ba mag apply kami as merchant enterprise? kesa as biller? no clear information po kasi kung pano mag apply as biller sa Gcash.

Better apply muna, tapos pag nacontact ka na, saka mo itanong siguro kung papaano.

Hi

The reference number. Is that generated by Gcash or the merchant? How can the merchant identify what item or service the transaction was for?

The reference number is generated by gcash. Both merchant and gcash user can use that number in support tickets.

hi po. qualified po amba ang magapply ng individual kung sari sari store po yung negosyo?thanks

Puwede po, ang kailangan lang naman ay gcash account para makaapply.

As a merchant can I get details of for what and who has made the payment on the receipt?

If you’ve onboarded as an enterprise merchant you will be getting txn reports everyday in your nominated email address.

Paano po pag bills payment lang po. Pag probinsya po kasi di masyado gumagamit ang mga tao ng gcash mas gusto nila magbayad dun mismo sa utility branch. Gusto ko sana apply as individual/freelance po ba applicable? Paano po yun pag issue ng reciept nun keleangan po ba register kay BIR

Ang pagiging merchant dito ay hindi kasama ang bills pay. Ibang usapan yun. Kung gusto mo ng ganyang business, search mo ang Posible.net.

Gusto ko po sana bills payment business dto samin pano po yun tas yun pag issue ng reciept kelangan po ba register kay BIR?

Kung di namang umaabot 20k per month ang kita mo kahit hindi ok lang.

Nag request po ako nong monday for my own QR code, till now wala pa. Any follow up po?

Follow up niyo po with them. Di po kasi ako official support.

Hi, we had already enrolled a globe number for our GCash pero as an individual account. Is it possible to use the same number to apply it as a Merchant partner. We intend to ise it for our church and we’re wanting a QR code to be used in all transactions. Please advise me how to do it. Appreciate much your response. Thanks

God bless,

Madz

I would suggest you email iw**********@**nt.xyz with your questions. I think they can suggest an alternative instead of the usual enterprise onboarding.

Hi, matagal po ba talaga bago ma-isend or bago ka mabigyan ng iyong request QR Code? Nagrequest po ako Aug 5, wala pa din akong narereceived na QR Code.

Di ko rin po alam. Baka natagalan rin dahil sa quarantine. Puwede pong ifollow-up sa GCash mismo.

How long is the onboarding/activation turnaround time?

I don’t know. Better follow-up with them regarding this.

Hello, kapag Individual Merchant po, meron po kayong blog na Steps on how to set up Gcash Online Payment Portal sa iyong online store? From the application to the integration in to your online store website…

Actually that’s a pretty good idea. Nag-iisip rin ako na magtayo ng sariling tindahan online. Why not document the effort diba?

What if succesfull yung payment ni customer sa digital pay(gcash Bdo terminal)pero hindi na press ni cashier yung green button para lumabas yung receipt and found out later na hindi nag register sa terminal yung customer payment.will still be credited since naging succesfull naman sa guest yung payment nya? Or babalik sa kanya yung binayad nya?

Nope, ang pagdebit sa account mo nangyari na. Mangyayari dyan since di nakaprint ng resibo, di siya settled sa end ni merchant. Next day di magiging balanse ang settled amounts with the merchant at mafflag yun sa side nila BDO. Ngayon, mas mainam na ireport mo agad para mabalik ang pera mo nang mas mabilis.

Hello po, kapag ang business (corporation) po ba namin ay may dalawang branch, dalawang application for merchant/enterprise din po?

For a hotel business po ba kapag may online reservation po need pa dumaan sa payment portal like dragonpay etc para makareceive ng payment? di applicable po dito ang scan to pay? thank you.

for business with multiple branches, isang onboarding lang, pero kailangang ideclare ng branches para mabigyan rin sila ng qr codes.

pag online payment naman, no choice kundi dumaan sa mga payment gateways like dragonpay. iba ang scan to pay sa online payment (example ay lazada, di siya gumagamit ng qr code pagbayad).

may fee po ba kapag nag apply ng qr code for store?

Walang application fee for QR codes

Hi po! sa application po for merchant wla po sa choices dun pra madeclare na dalawa yung branch ng company. pano po yun?

Pagcontact sayo doon mo sabihin na may mga branch ang company niyo.

Hi, based sa requirements ng sole proprietorship, kailangan po ng implementing agreement (based on this link from GCash https://drive.google.com/file/d/1i3eZ7BcLLJUVjWntyp46s6qSNbmIAA3V/view ). Saan po makukuha itong implementing agreement or paano ito ginagawa?

I think agreement ito with GCash, basically it’s a contract with them

I have a qr merchant code.

My question is, is there a limit of number of scan per day?

No limit of course

Hello po. We are currently doing a feasibility study at kasama po ang Gcash sa mga transactions namin. May mga questions lang po ako regarding sa charges sa Gcash.

Sole Proprietorship po yung Business po namin.

1. Kapag po nagapply kami yung gcash poba mismo yung maglalagay ng cash balance sa account namin sa gcash?

2. Pano po kapag may nagpaload po ng gcash samin. example po 1,000. 1000 din po ba makakaltas sa balance namin or may additional pa po?

3. Paano po naapply yung Merchant Discount? Example po, kapag po ba may 1000 nagbayad/load saamin yung makakaltas lang po sa balance namin is 1000 less 2% nung 1000?

1. Kapag po nagapply kami yung gcash poba mismo yung maglalagay ng cash balance sa account namin sa gcash?

-> Pag merchant wallet, walang laman yun — malalagyan yun ng laman ng mga nagbabayad. at nililipat ang laman nun kada araw sa bank account niyo.

2. Pano po kapag may nagpaload po ng gcash samin. example po 1,000. 1000 din po ba makakaltas sa balance namin or may additional pa po?

-> Hindi kagaya ng normal GCash wallet ang merchant wallet. Hindi mo siya maccontrol gamit ng GCash app.

3. Paano po naapply yung Merchant Discount? Example po, kapag po ba may 1000 nagbayad/load saamin yung makakaltas lang po sa balance namin is 1000 less 2% nung 1000?

-> Ang settlement kada araw (pag lipat ng pera sa bangko) nakakaltas na ang 2%. Meron ring report na sinesend sa inyo sa email na nakasaad lahat ng detalye nun.

Good day. inquire ko lang po before we apply for merchant under the corporation po, is the 2% transaction fee deducted from the merchant? meaning the payment received is less than the original payment given. paano po kung 15,000 yung due sana, so 14,700 nalang makokolecta ni merchant? tama po bah?

yes galing sa merchant tapos sa settlement nakakaltas na yung 2%

Hi, I just want to ask since we’re applying the corporation as a Biller.

1. Is the Transaction Fee different from the MDR?

MDR is taken from the merchant (and is invisible to the user), the transaction fee on the other hand, is taken from the user and is noted in the biller itself.

hello, Once we applied Gcash for business, business name na po ba namin ang mag a-appear sa gcash kapag magbabayad ang clients samin?

Yes, specifically yung Trade Name – which I think ay nasa form

Hi, Sole Proprietorship rin po yung GetPaid Gcash account namin. How many days does it take po to transfer funds? yung isang tinransfer ko almost 2 days na Pending parin. And yung kahapon na tinransfer ko sa user (personal) Gcash account wallet ko, di paarin na tatransfer. I would like to know the estimated days of transferring funds to another Gcash/bank.

di ko po maintindihan. walang transfer na nangyayari from merchant wallet to user wallet dapat.

pag merchant account kasi automatic settlement siya sa bangko na naset ninyo.

wala ring settlement na nangyayari sa weekend kasi wala rin pong bangko.

tanong ko lang po sana kung ang merchant qr ay pwede rin tumanggap ng gcredit payment. salamat po.

Yes po basta merchant QR

do you know how long does the merchant receives the payment in their bank account? first time may nagbayad sa akin using gcredit. 2 days na hindi pa din pumapasok sa bank account ko yung payment.

Dapat po invisible sa merchant kung GCredit o hindi ang pagbayad sa kanya. Kung may concerns kayo, raise niyo po sa merchant support email.

Hi.

We linked our BDO acct as we open for Merchant for Corporation, however our Boss want to change it into Union Bank (a newly opened one) for us to monitor and manage it properly.

What is the procedure to change it po?

Thank you in advance!

I think you need to email merchant support to change your settlement bank.

Hello, thanks for the info.

Do you have any contact numbers for Gcash Merchant Corporation Application? My company applying for this service, more than 2 weeks na wala pa ding update sa application. Nagsubmit lang after that, no confirmation arrived. Yung Account executive na naghandle walang ka-reply reply.

Hope you have any idea. Thanks in advance!

how did you apply? did you use the website?

Using Gcash Business Website and may nagemail sa amin, they sent all the requirements and application form via google form. It’s been 3 weeks since we have submitted the requirements pero wala akong nakakausap na account executive.

Wala pa rin ba po?

Hi we are a private company and the line of business is water utilities. We would like to avail the services of gcash for water bill payment of our customer. What are the requirements?

Thank you.

You can reach out to en********************@**nt.xyz

What is the cost to us? It mentions a Merchant Discount Rate (MDR) of 2%. Is this the amount we have to pay GCash for payments received thru their platform?

yes 2% of successful transactions are taken once settled

Hello po! gusto namin mag accept ng gcash payment pero hindi talaga kaya yung may 2% transaction fee. wholesale kami and kung kada payment is 1,ooo so 2o agad bawas.. is there any way na walang 2%?

Personal QR siguro muna kung wala talagang way.

1.what are the other benefits that gcash can give to us aside for the above mention.

2. how can you defend the 2% mdr to merchant if this service can offer only convience and security?

3. what are the strategies should apply so that the merchant can get the service?

1. You can provide customers more flexibility to buy via GCredit, GGives if needed. Also, you are opening yourself to a big segment of transactions brought about by e-money, not just cash.

2. The MDR is the only way how GCash is going to gain from the transaction — there’s no membership fee or subscription. Think of it as flexibility as the “fee” is on a per use basis. Besides, if you also accept debit/credit cards, they actually charge a bigger MDR than 2%.

3. No strategies needed; as long as you have complete requirements you can already be onboarded.

What are the charges or fees if I open a corporate account of Gcash? Are payments made to my Gcash corporate account being charged a service fee?

Yes there’s a fee. It’s called the merchant discount rate.