One of the hard things to do while selling online is applying for different modes of payments. Not everyone gets to have a credit card or debit card payment option since we’re all used to cash payments.

However since we’ve all seen how digital wallet usage has grown during this pandemic, we can also see how it can be easier for merchants to offer different payment options and for buyers to be able to pay via the easiest way for them.

Paymongo is one of the first startups that has catered to this space. Other alternatives are Magpie, JustPay.To, and Bux. Basically they make it easier for both merchants and buyers by providing web links that offer different payment options to buyers, and a dashboard and easier settlements for merchants.

How does Paymongo work?

Paymongo is a payment gateway that is very SME friendly. Other payment gateways, they require you to have a landing page of some sort to be able to use their services. That means an online presence is required. This can mean an e-commerce site or something similar.

Paymongo provides payment links, instead of payment pages. What does this mean? When you need someone to pay, you can just log into the Paymongo dashboard and create a payment link. This link is one-time use only and has the details of the transaction embedded with it. What sets it apart is that when you access the link, it gives you lots of options on how to pay.

You can pay with credit/debit cards, digital wallets, or over-the-counter methods like 7-11 or Cebuana, etc. Once payment is done, you can confirm your payment right in the link itself. As for the merchant, he will be able to see whether the link he provided the buyer is already paid or not using his dashboard. It makes paying and receiving payments easier and less of a hassle.

Do I need to be onboarded as a GCash merchant?

No, being a GCash merchant is different from being onboarded as a Paymongo merchant. Being a GCash merchant means directly using GCash QR or other GCash payment methods while being onboarded with Paymongo means you will be using it as a payment gateway to provide multiple payment options, including GCash.

How is the payment settled with the merchant?

When you register with the service, they will also be asking for your bank details. The settlement is via bank transfer the next banking day. This again makes it easy for merchants as they can focus more on the everyday running of the business instead of handling finances in a big chunk of the day.

How about refunds?

Paymongo supports refunds, and the merchant can do so within the dashboard itself, under the Payments section.

What payment methods are supported by Paymongo?

Currently, they support credit/debit cards (Mastercard or Visa), GCash, GrabPay, Coins.ph, 7-11, Cebuana Lhuillier, M Lhuillier. The good thing is a merchant would not need to onboard with some or all of these payment facilities since Paymongo supports all those options out-of-the-box already.

This looks like something that can be automated. Does Paymongo have an API?

Yes, and they have an easy to digest documentation as well. They also have a sandbox environment to be able to test your integration with them.

I have an e-commerce store. Can Paymongo support my site?

Currently, they have a plugin for Shopify and WooCommerce. You will need to onboard as a merchant first in Paymongo to be able to use this. Otherwise, you can always build your own because of their API.

Keep in mind though that going through Shopify incurs fees for them as well. For the Basic subscription, they take away a 2% fee – this is on top of the fees taken by Paymongo. For other subscription levels, it can go down.

What is Paymongo’s cut of the purchase?

From their website, they state that they charge 3.5% + Php 15 for debit/credit cards, 2.9% for e-wallets (like GCash and GrabPay), and 1.5% for over-the-counter channels as well as Coins.ph. If you need a calculator, their pricing page explains further.

However, for the convenience, then it can be of value to you as a seller.

Does Paymongo support Bank Transfers as a payment method?

Currently no. But if you need that type of payment method, then you can go with bux.ph as they are partnered with UnionBank. They support BPI, UnionBank, and RCBC.

How do I sign up in Paymongo?

Signing up is free, you just need to input some personal details. Once your account is created, you can log in and see the dashboard. However initially, you can only do test transactions. To be able to do actual ones, you would need to go through verification.

How do I generate and use Paymongo links?

Once you’ve confirmed your email, you will be able to access the test environment of your account.

You will be able to see some options in the dashboard:

- Activate your account – this enables you to complete your KYC/KYB (Know Your Customer/Know Your Business) information and unlocks the live accounts once completed

- Links – contains the links you generate for payment

- Payments – lists the payments you’ve received using your links

- Payouts – shows the settled amounts to your bank account

- Developers – shares the API keys to those who want to extend the functionality of their Paymongo account

- Settings – allows you to change some information regarding your account

How to Generate Links

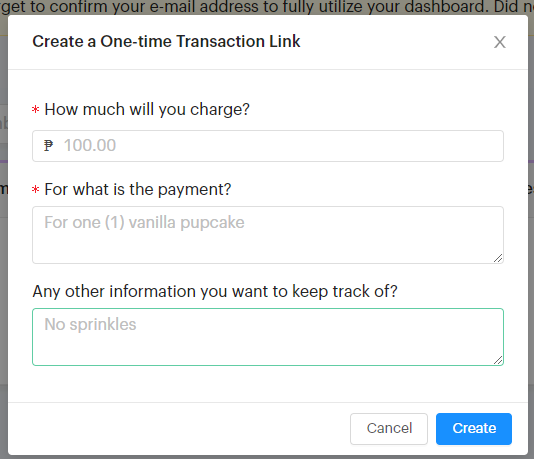

The main function used here are the links. You can generate one payment link per transaction. You cannot reuse links. Before you can create a link, you need to put in the details like how much and the reason you’re doing the payment.

Once the link is created, you can then copy this link and share this with your customer. The customer then will be seeing this page. Notice that you can select different payment methods — credit or debit cards, even over-the-counter ones like 7-11, Cebuana Lhuillier, and M Lhuillier, but the most compelling one is the GCash option.

When payment is done, you can see the details under the Payments section.

Usually, the settlement is done the next business day, via bank transfer to your account. You will be able to see the details using the Payouts section.

What’s the purpose of having an API?

Paymongo extends the functionality using an API which means you can create your own payment implementations and handle it programmatically instead of manually.

The API also handles webhooks, meaning you can make it so that Paymongo can notify you once a customer has paid, which makes it easier for you to chain event-driven rules if you need it.

You can refer to their documentation for more details.

Using GCash with Paymongo

Paying through Paymongo is straightforward. You just click on the GCash payment method and you will be seeing the GCash cashier page. You just need to input your mobile number, OTP and MPIN to confirm the transaction.

Can I link my GCash debit cards (AMEX, GCash Mastercard) with Paymongo?

Yes, but I would recommend that you use the straight GCash route because it is easier.

How do I fund my GCash wallet?

There are multiple ways to cash-in to fund your GCash balance. You can cash-in via online banking, and over-the-counter options.

Summary

I talked about how you can use Paymongo to accept different payment methods, especially GCash. I also provided some how-tos on how to create payment links and how payments and settlements are handled by the service.

An API is also available for Paymongo, as well as a Shopify integration. I think that Paymongo holds a lot of promise in making payments easier for both buyer and seller.

For posts or pages related to merchants, you can also check out:

- GCash for Merchants

- How to Setup your own QR Code

- Bux.ph and GCash

- Comparison of Payment Links Services

I have a new e-commerce site where you can buy some e-books here: GCR Prime

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services: