Open a new savings account quickly in GSave Marketplace via UNOBank using UNOready by UNO.

Disclaimer: This post aims to educate and not to give financial advice. Investments have different risks, and it is up to the investor to do due diligence and make decisions regarding his money.

UNOBank is one of the digital banks in the Philippines today. Similar players like CIMB, Tonik, Seabank, and others are fast growing as they offer better interest rates than traditional banks. Many conventional banks are also trying to adapt to the digital wave, as more people now transact through cashless technologies.

UNOBank currently has its own app but they’ve also partnered with GCash through the GSave Marketplace. This will allow them to get a bigger reach due to the huge user base of GCash.

What is UNOready by UNO?

UNOready is UNOBank’s product inside GSave. The main thing that sets it apart from the other GSave products is you get to have daily earnings from your savings. Also, you can avail of high-yielding time deposits within UNO GSave.

Here is the comparison data for all GSave banks:

| Features | #MySaveUp by BPI | GSave by CIMB | EzySave+ by Maybank | UNOready by UNO |

| Minimum Monthly Average Daily Balance (ADB) | Php 3000 | None | None | None |

| Maximum Deposit Amount | Php 30000 | Php 100000 | None | None |

| Required Daily Balance for Interest | Php 5000 | None | None | None |

| Interest Rate per Annum | 0.0925% (Need to have Php 5000 ADB) | ~2% | 0.35% | 4.5% for above Php 5000; 3.5% for below Php 5000 |

| Required activity (need to use by limit) | 30 days | 60 days | None | 2 years |

What are the requirements to create an UNOready account?

The requirements for creating an account are:

- A Filipino Citizen

- At least 18 years old

- A Fully Verified GCash App user

- A resident with a valid PH mailing address

How do I create an UNOready by UNO savings account?

It’s pretty simple, as you don’t need to submit most of the needed documents. GSave merchants can leverage the know-your-customer (KYC) data of GCash to speed up registrations.

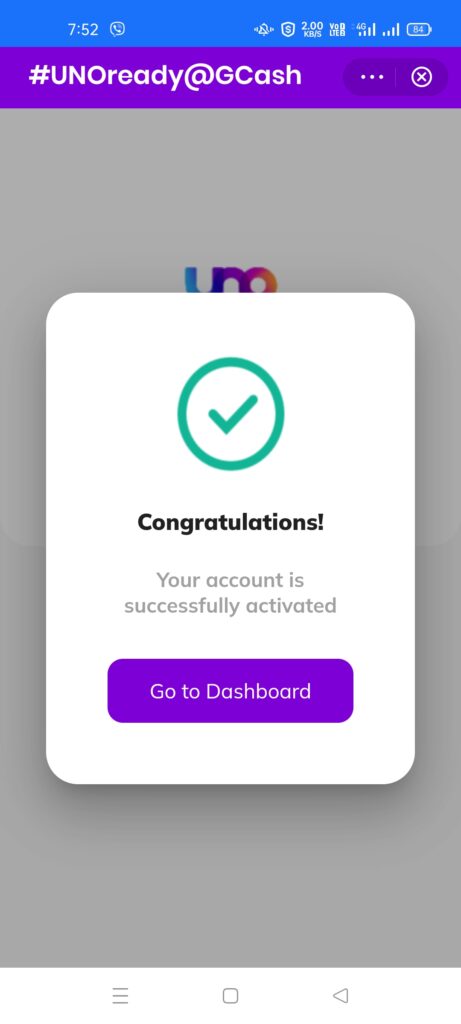

Registering a new account in UNOready by UNO

- Click on GSave from the GCash main page. Then from the GSave marketplace click on the UNOready by UNO button.

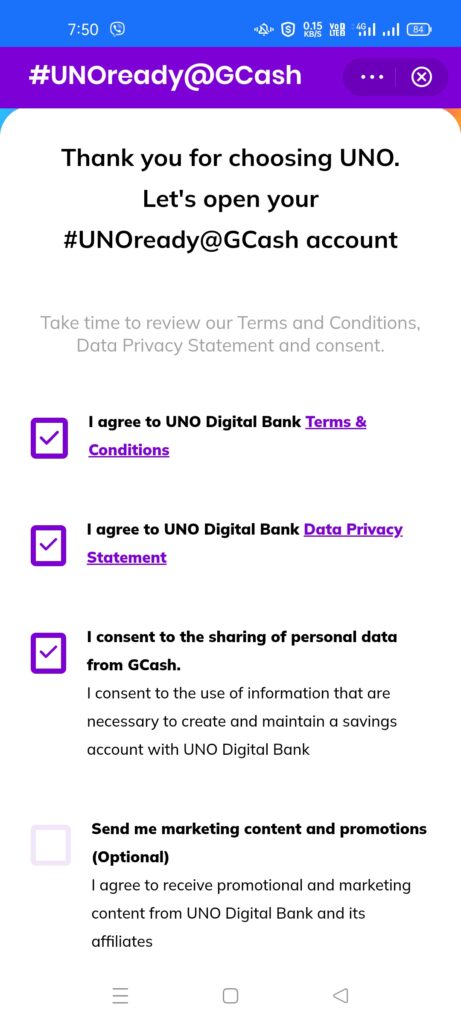

- Click on Apply Now in the prompt window. A declaration page will show up. Read the documents shared and click on Continue.

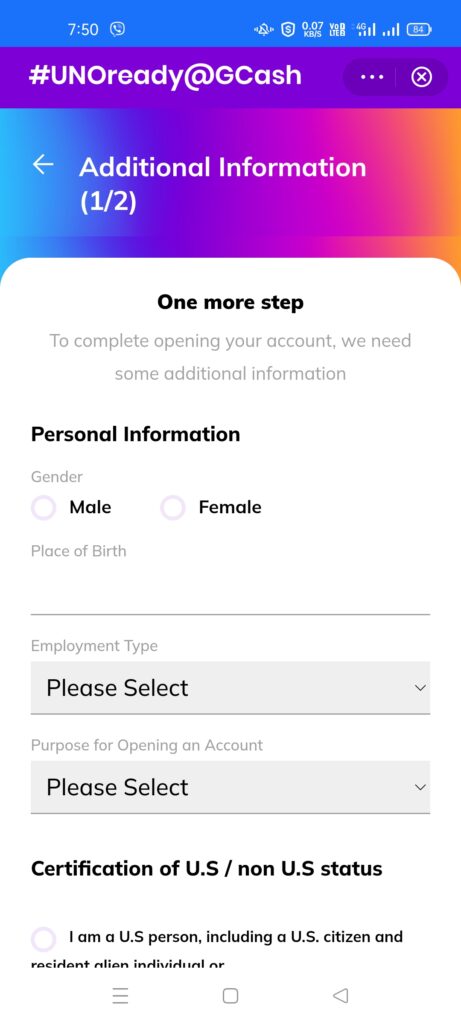

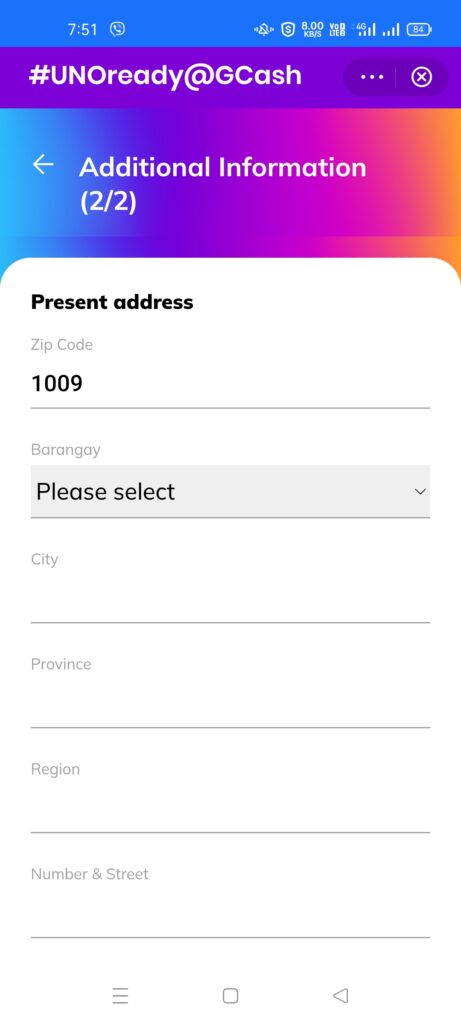

- Fill up the needed information in the two pages you need to accomplish and continue on until you see that the registration was a success.

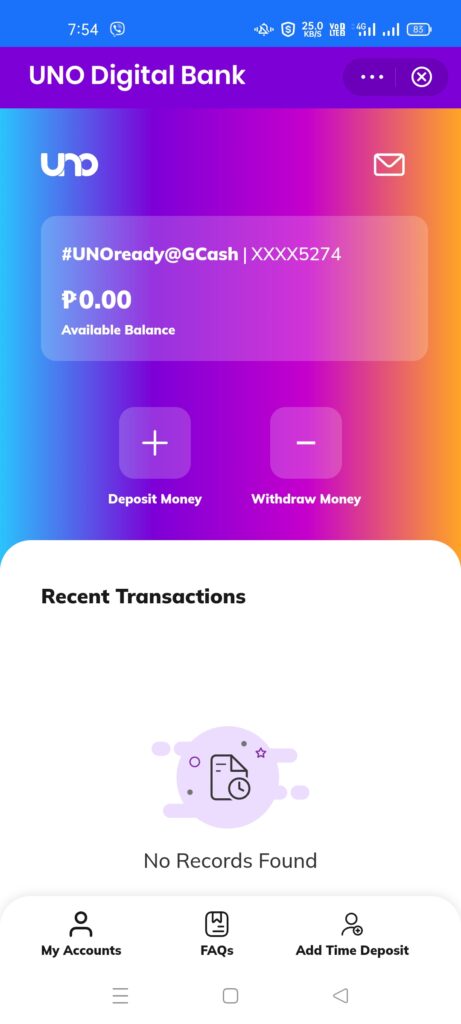

How do I deposit or withdraw from your UNOready account?

Moving funds in and out should be simple as with other GSave partners.

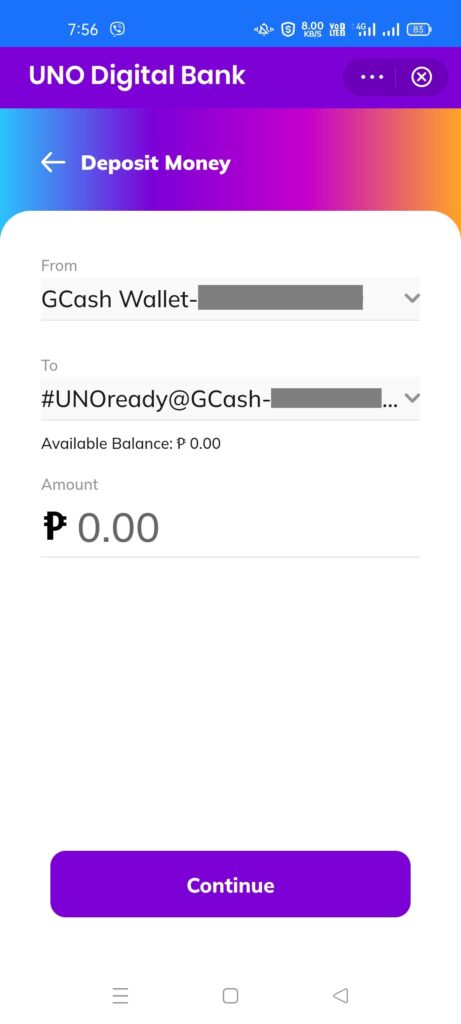

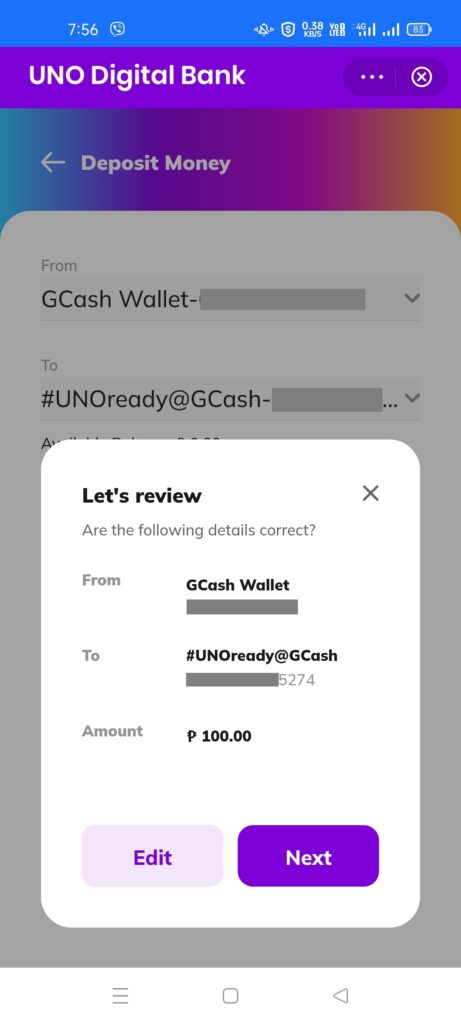

Depositing funds in your UNOready account

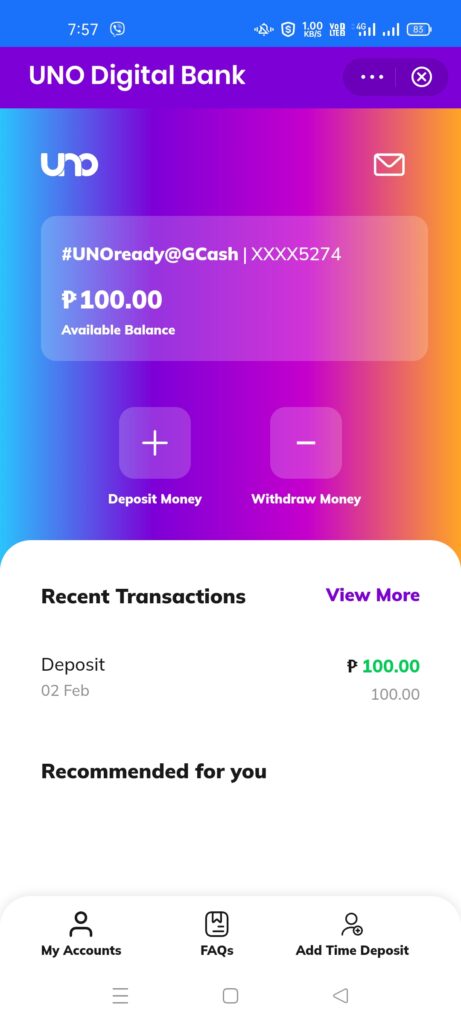

- From the UNOready main page, click on Deposit Money.

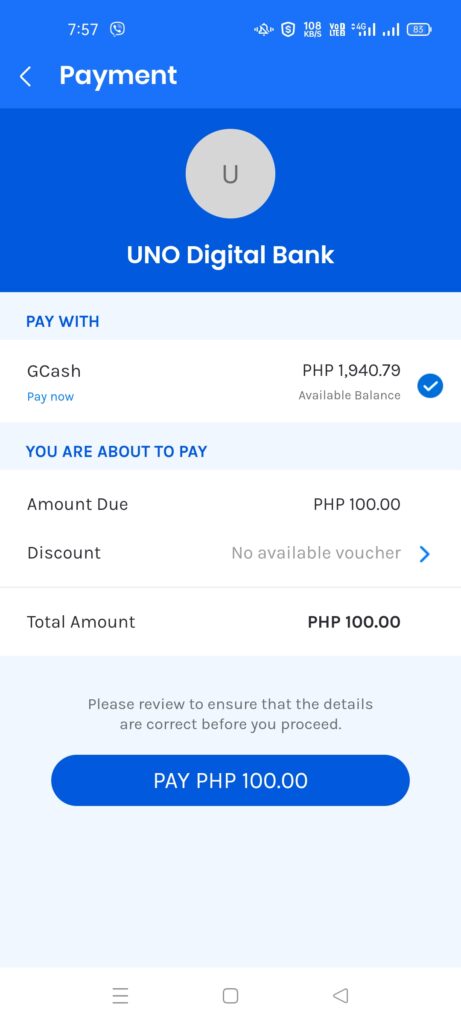

- On the next page, enter the amount you plan to deposit and click Next. The GCash payment page will appear and click Confirm.

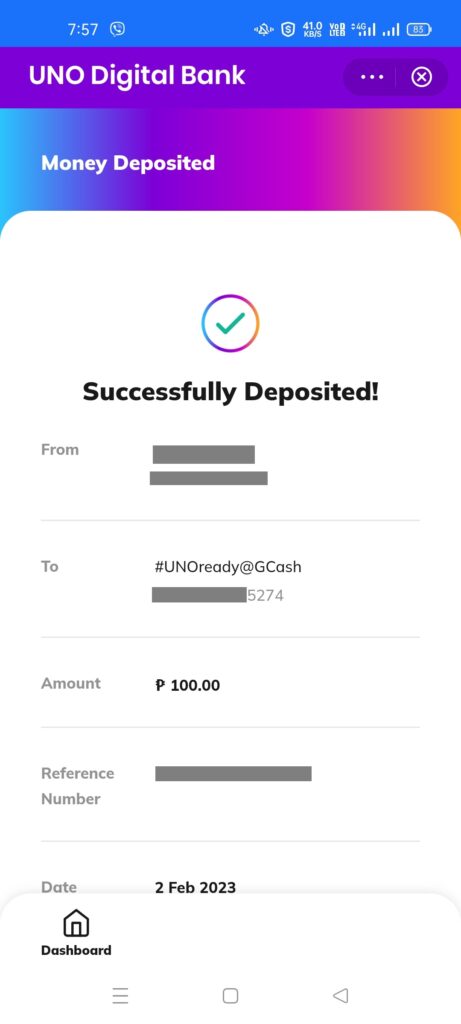

- Once you click Confirm, a success page will show and your funds should be deposited.

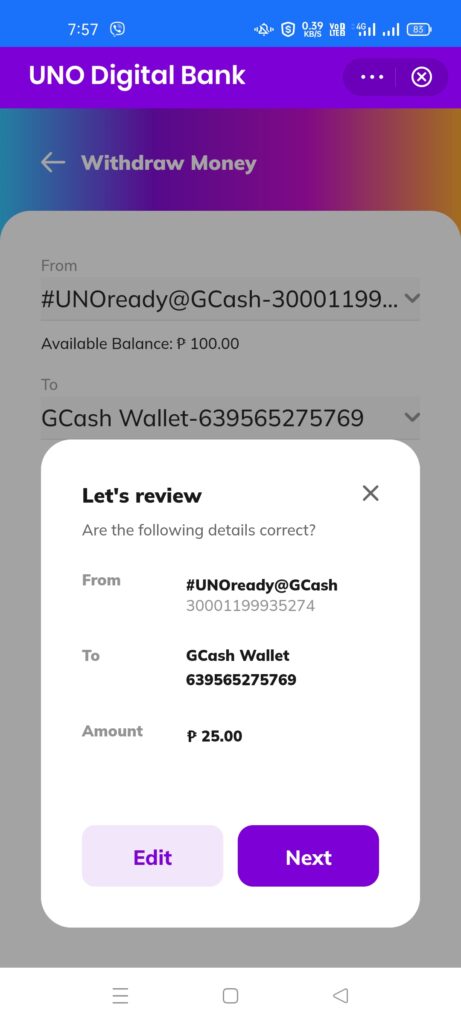

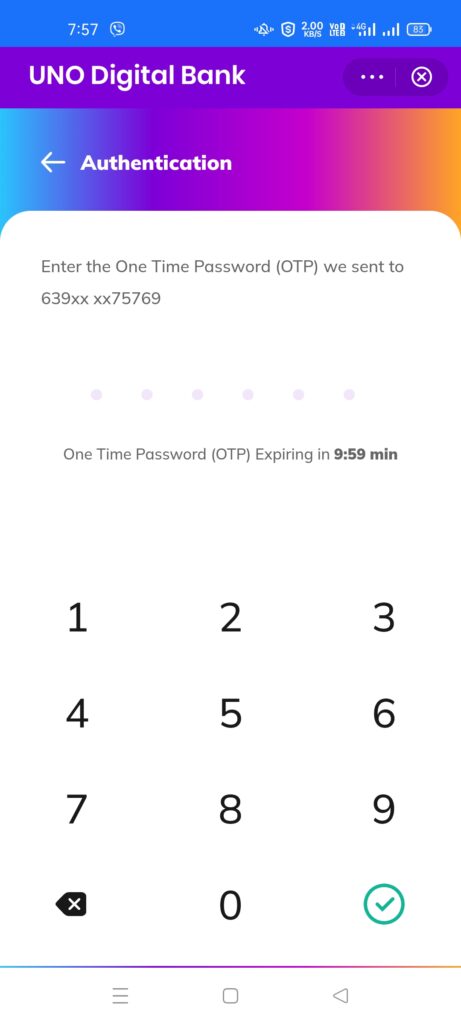

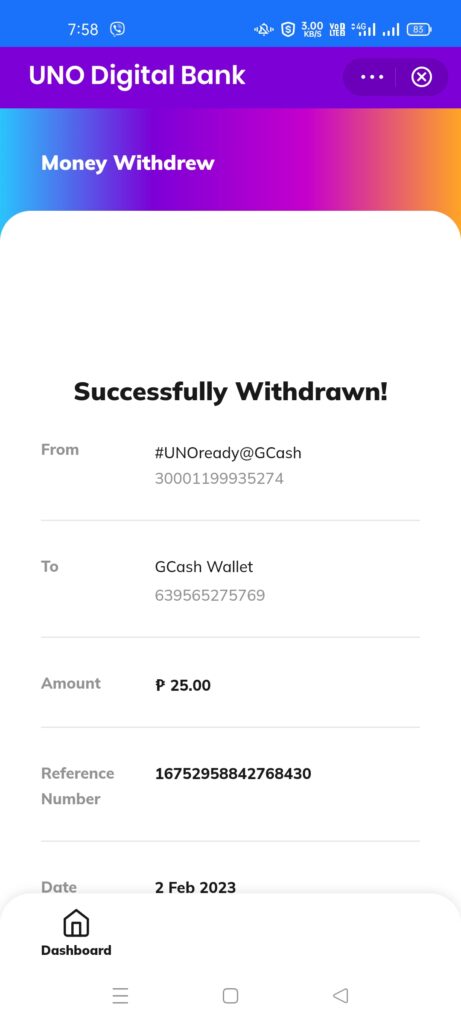

Withdrawing funds from your UNOready account

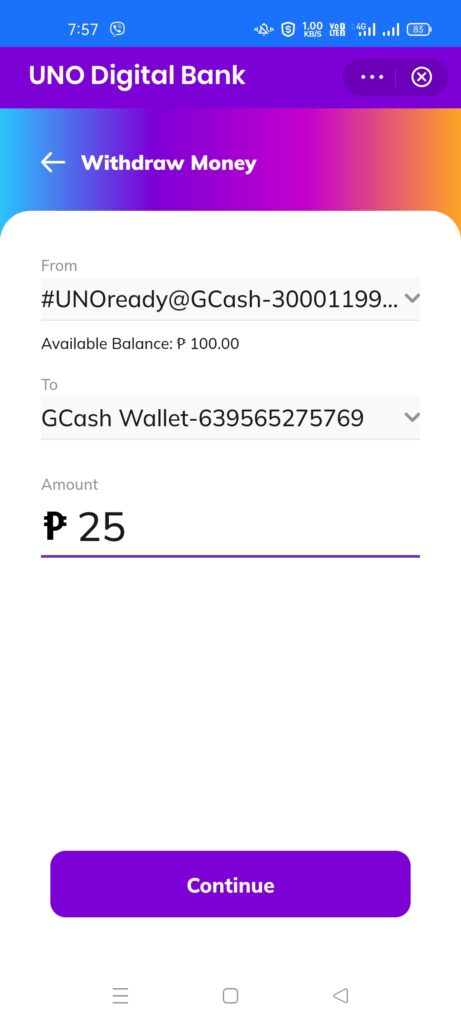

- From the UNOready main page, click on Withdraw Money.

- On the next page, enter the amount you plan to withdraw and click Next. The OTP page will show up. Enter your OTP and click on the check button.

- A success page will show and your funds should have been withdrawn.

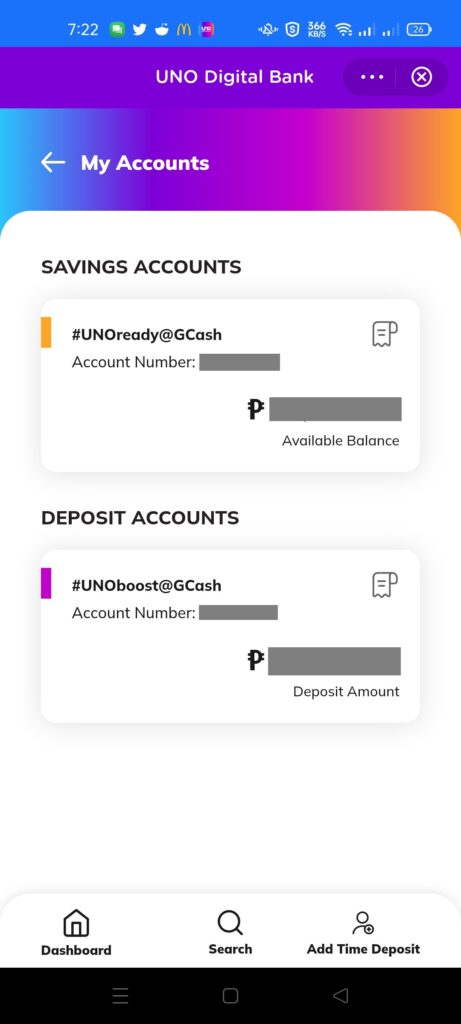

What are the Time Deposit Accounts in UNOready?

UNOBank also provides time deposit accounts and this feature distinguishes it from a lot of banks out there. You can open multiple accounts without the need to fill up forms, and you will be able to make use of them immediately.

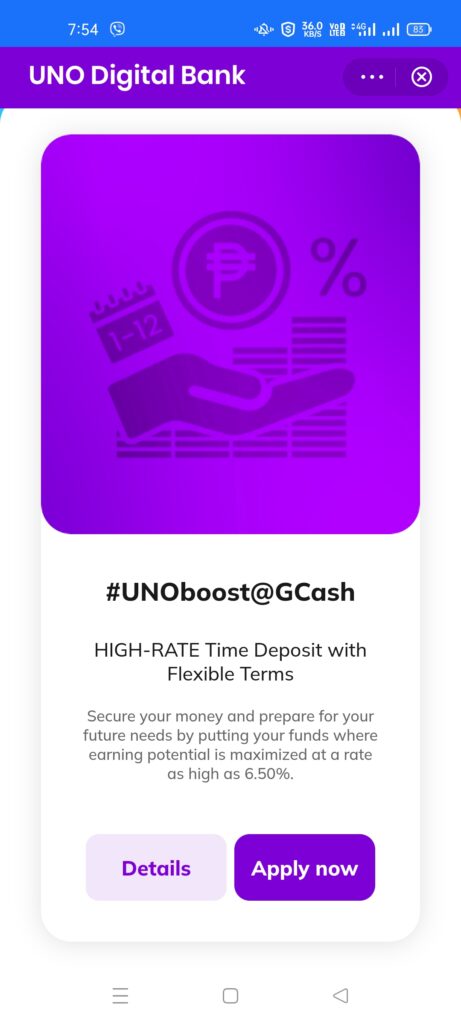

UNOboost is a time deposit feature where you can enjoy higher rates within the time the amount is in deposit. As this is a time deposit, you cannot withdraw from the account during the time it is locked. Some of its features are:

- Terms can start from 3 months to 12

- The rate is 6.5% per annum

- Payout is after you get your deposit back

- Limit of 5 placements

UNOearn is similar to UNOboost, but with some differences:

- Terms can start from 12 to 24 months

- The rate is 6.5% per annum

- Payout is monthly and credited to your savings account

- Limit of 5 placements

How do I avail of UNOboost or UNOearn?

You can click on the “Add Time Deposit” button from the UNOready page and select which product you like by swiping left/right on the selection page, then click on “Apply Now”. You then input the amount and the time you want to lock your funds and confirm.

You can also check out the mechanics by clicking on “Details” for each product.

What are the Deposit and Withdrawal Limits for UNOready by UNO?

These are the same as the GCash wallet limits, determined by your verification level.

Wallet and Transaction Limits

This also covers most of the limits of all cash-in channels, including over-the-counter, machine, online, Paypal, Payoneer, and remittances.

Additionally, the outgoing limit also applies to financial services like GSave, GInvest, and GInsure, as you are putting money into investments and/or insurance.

| Detail | Basic | Fully Verified | Fully Verified with Linked Accounts (GCash Plus) | Fully Verified Minor (GCash Jr) | Platinum ( enrolled in a Globe Platinum Plan) |

|---|---|---|---|---|---|

| Wallet Size | Php 10,000 | Php 100,000 | Php 500,000 | Php 50,000 | Php 1,000,000 |

| Daily Incoming Limit | N/A | N/A | N/A | N/A | N/A |

| Monthly Incoming Limit | Php 5,000 | Php 100,000 | Php 500,000 | Php 10,000 | Php 1,000,000 |

| Daily Outgoing Limit | N/A | Php 100,000 | Php 100,000 | Php 10,000 | Php 500,000 |

| Monthly Outgoing Limit | Php 5,000 | N/A | N/A | Php 10,000 | Php 1,000,000 |

| Yearly Outgoing Limit | N/A | N/A | N/A | Php 100,000 | N/A |

The linked accounts here pertain to BPI, UnionBank, and Payoneer accounts, with GSave and GInvest placements.

If you encounter GCash limit exceeded errors, you will need to wait for next month for your limits to reset.

Other Questions

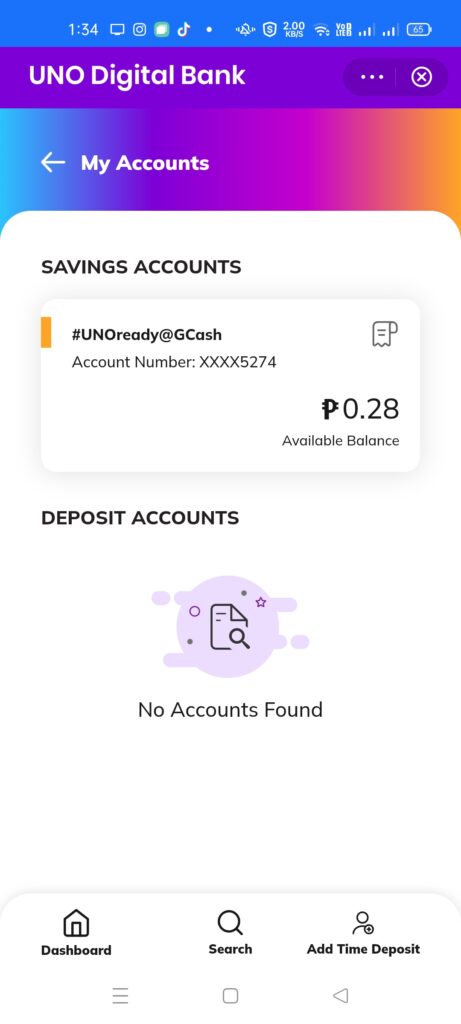

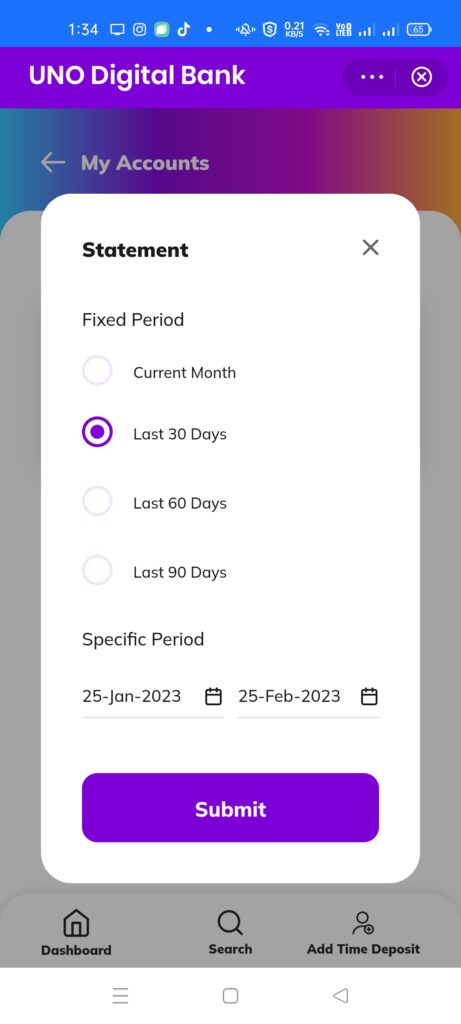

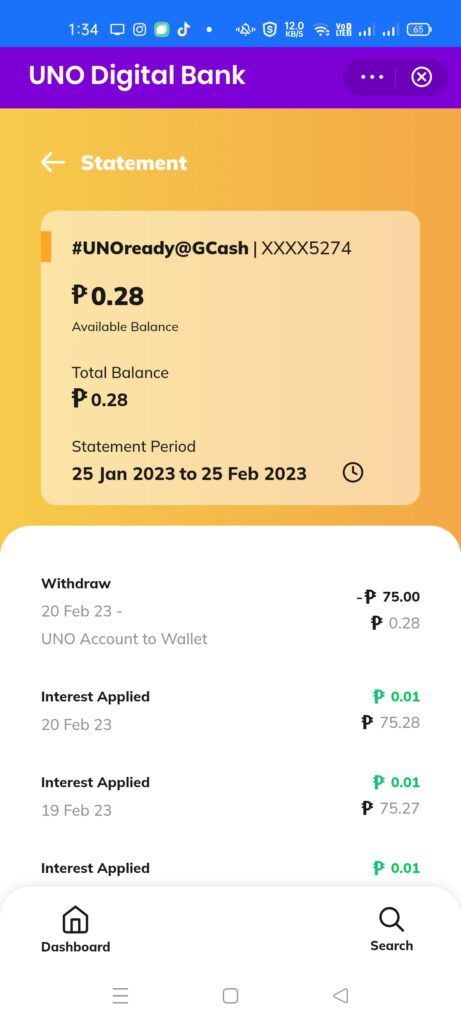

How can I check my Transaction History?

The Transaction History is easily seen under the UNOready page, but if you need to look back a bit further (up to 90 days), there is a transaction history button (the scroll icon) in the savings account box.

What will happen to my UNOready account if I lose or change my mobile number?

As your account is tied to your GCash number, when you lose your mobile number you will need to contact GCash Support first to resolve your mobile number issue. After this, if you transferred your GCash account to another number, you will also need to contact UNO to transfer your account to this number as well.

Can I have multiple UNOready accounts?

Yes, since you can create multiple GCash accounts as well. You can create an account for each GCash account you have.

Can I withdraw my Time Deposits earlier than my maturity date?

Yes, but you will incur charges if you do so. You can pre-terminate by going to the deposit account and clicking on the “Pre-terminate” button. You need to confirm via a one-time password.

The charges are:

- Documentary Stamp Tax Charge — PHP 1.50 for every PHP 200.00 of the principal amount

- For time deposits with tenure of less than 1 year, Charge = (Original Tenure in Days / Total Days in the Year) x (1.50 / 200) x Principal Amount

- Predetermination Penalty — 50% of gross interest earned if pre-terminated at the first half of the tenure but 25% if pre-terminated at the second half

Can I link my GSave UNO account to the UNO Bank app?

Yes, you need to download the app and then link your account by using the mobile number you are using with GCash. Once linked, you can also use the app with the tied account. You can also open time deposits with the app and it will reflect on the GCash one.

Summary

UNOready by UNO is another product within the GSave Marketplace. It’s another option for those who are looking to open another savings account and leverage the higher interest rates compared with conventional banks.

You can open either a savings account or a time deposit account. You can also link your accounts to the UNO Bank app.

Related Topics

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services: