Learn about the different ways of cashing in and out in GCash.

Cashing in and out is definitely an important feature of any digital wallet – no matter what, you would need to convert to and from physical money.

A lot of the things mentioned here can be seen from the GCash Support site, but I’ve summarized and added some more things in this post to be more helpful.

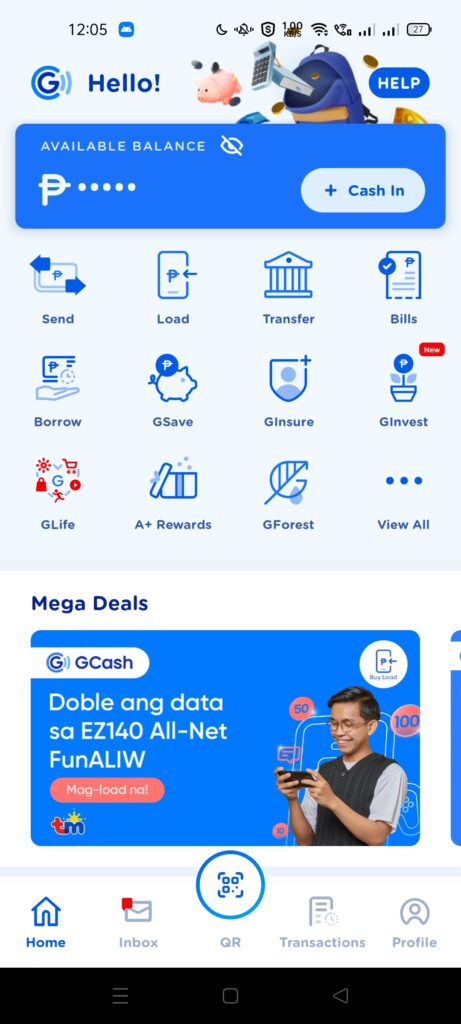

How do I cash in the GCash app?

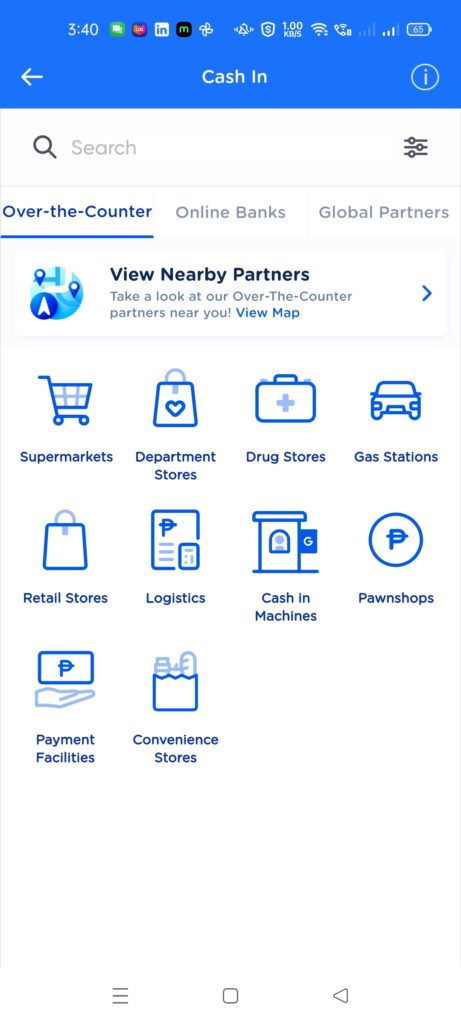

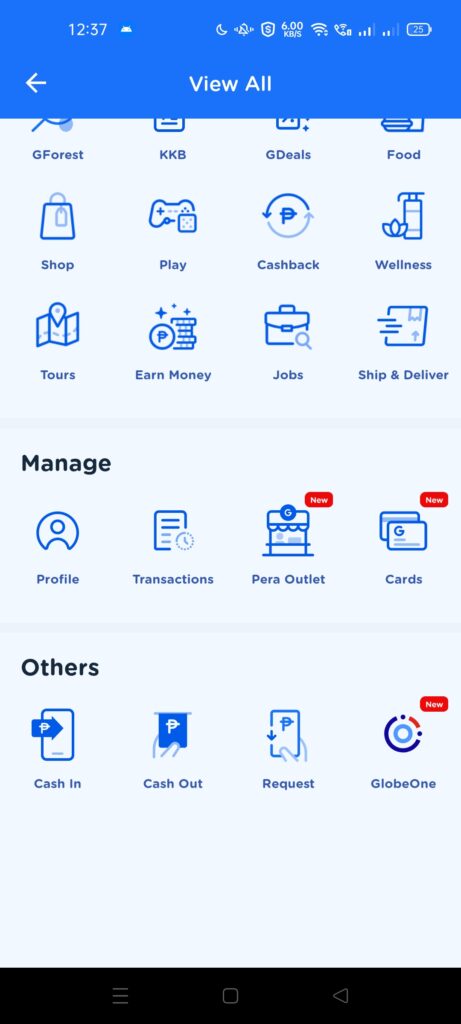

In the app, click on Cash-in and you will see different options. You can go either through Over-the-Counter, Online Banking, or Global Partners channels.

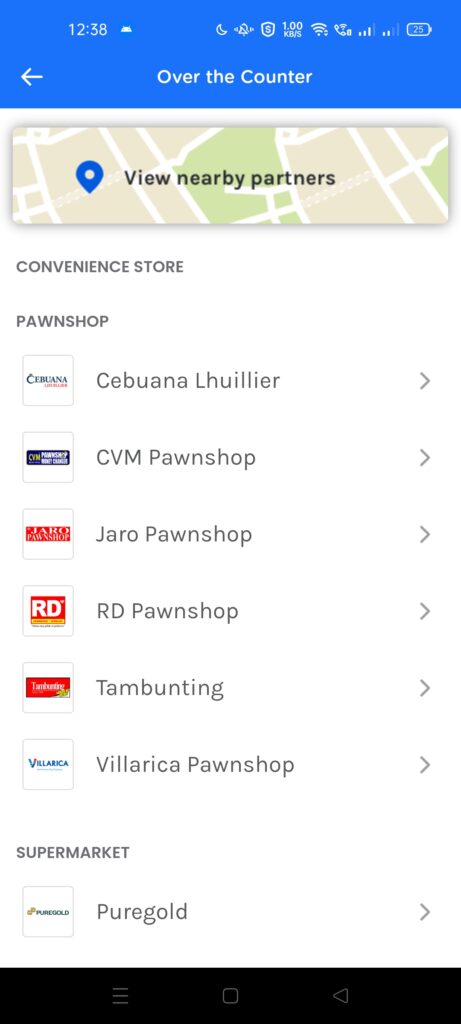

How to cash in via the Over-the-Counter channel

- Machine Cash-in: You can look for cash-in kiosks like TouchPay and Pay and Go to cash-in.

- Supermarket: This option is via Generic Barcode cash-in — you would need to show the generated code to a cashier. Here are some partners that use this method:

- Bayad Center

- ExpressPay

- Jaro Pawnshop

- Ministop

- No Brand

- Puregold

- Robinson’s Department Store

- Robinson’s EasyMart

- Robinson’s Supermarket

- Savemore

- Shopwise

- SM Department Store

- SM Hypermarket

- SM Supermarket

- Tambunting

- The Marketplace

- TrueMoney

- Waltermart

- 7-11: You will need to use the Cliqq kiosk to be able to cash-in

- Department Stores / Pawnshops / Payment Facilities / Logistics: You need to go to the actual store, fill out a form, and have your cash-in processed.

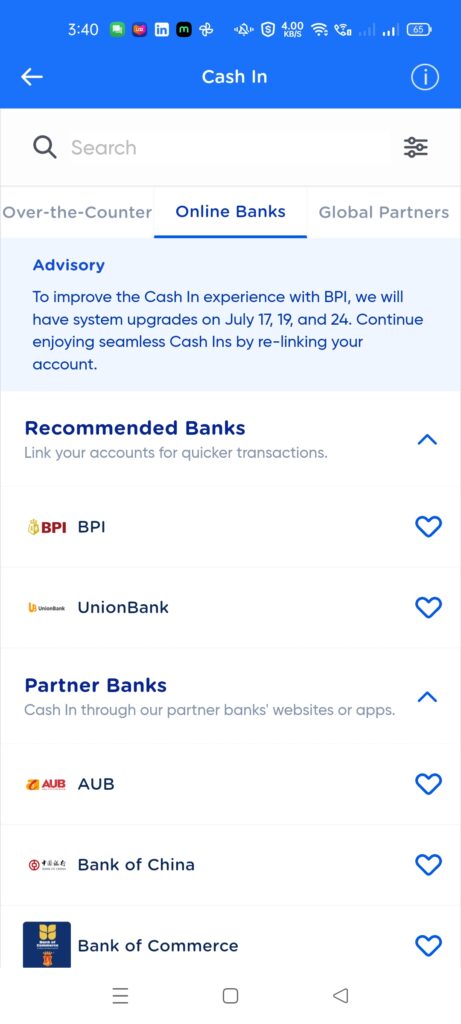

How to cash in via the Online Banking channel

- BPI: You need to link your account before you can cash-in

- UnionBank: You will need to enroll your UB account before you can cash-in

For other banks, you will need to use Instapay or PESONet within their specific banking or online apps; usually, this also includes a fee per transfer.

Here are the InstaPay fees for most banks (as of Jan 24, 2025):

- AUB: Php 8

- BDO: Php 25

- BPI: Php 25

- Chinabank: Php 15

- Coins.ph (DCPay): Php 10

- East West: Php 10

- Landbank: Php 25

- Maybank: Php 10

- Metrobank: Php 25

- Maya: Php 15

- PBCom: Php 20

- PNB: 20

- PSBank: Php 15

- RCBC: Php 25

- Union Bank: Php 10

You can also refer to the BSP Instapay fees list if your preferred bank is not here.

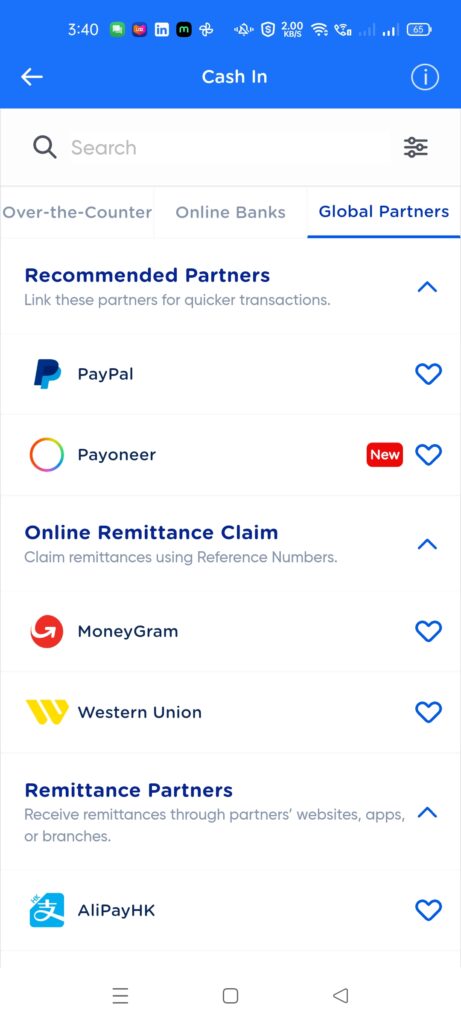

How to Cash in via the Global Partners Channel

- MoneyGram / Western Union: You will need the reference number or MTCN to be able to cash-in

- Paypal: You will need to link your account first, and will need to convert any currency to PHP beforehand in Paypal to be able to cash-in

- Payoneer: You need to first link your account, or create a new account then cash-in is possible

- Other Remittance Push Channels: Amount is directly transferred to your GCash wallet

What are the limits for cash-in and cash-out?

For Fully Verified users, there is a hard limit of Php 100,000 for both cash-in and cash-out. Unfortunately, once you experience this limit, there is no choice but to wait for the next month to reset limits.

If you have multiple GCash accounts via different mobile numbers, you share this limit between all accounts as well.

Unlocking Higher Account Limits

You can unlock higher limits by linking your BPI/UnionBank or your Payoneer account/s and utilizing either GSave or GInvest / GInsure with a Php 100 deposit or investment.

Once you do so, you will be able to unlock:

- A bigger wallet limit – Php 500,000 maximum

- Higher incoming limits – you will be able to receive up to Php 500,000 in your wallet and daily cash-ins have no limitations

- Higher outgoing limits – withdrawals will have no limitations per month, and you can withdraw up to Php 10,000 per day

You will be receiving an SMS informing you of the increased limits.

Take note that once you’ve unlinked all of your BPI/UnionBank/Payoneer accounts, the limits will revert back to what it was before.

What can I do if I cashed into a wrong number?

If the recipient is not a GCash user, then it would be easier to return the money.

However, if the recipient is an existing GCash user, then it becomes more difficult because if the user already withdrew or used the amount, generally there is no way to get it back.

Take note that a support ticket request can only be accommodated if the Send Money recipient has only one digit wrong. Otherwise, the request cannot be granted.

A support ticket with the following information is required:

- GCash Mobile Number

- Correct Recipient Number

- Wrong Recipient Number

- Amount

- Date and Time of Transaction

- Transaction ID

- Screenshots of the Transaction Confirmation

This is similar to Send Money. It is better to double-check the recipient before cashing into their account.

What do I do if I don’t receive any money in the app after cashing in?

For cash-in, confirm the cash-in details as the sender may have sent it to a different recipient. This is especially true of remittances from Paypal, Western Union, or MoneyGram. If it’s not via remittance, then it would be better to file a ticket.

Are there fees for cashing in?

For 7-11 cash-ins, there is a 1% fee of the total cash-in amount. For example, if you cash in Php 1000, the fee will be Php 10, and the total amount of Php 990 will be credited or added to your balance. This fee always comes first as it is a 7-11 collected fee.

GCash cash-in for partner outlets is free for the first Php 8000 per month. When the amount goes over the Php 8000 limit, it will incur a 2% fee. This limit refreshes every first day of the month.

For example: Today, you cashed in Php 7000. There is no fee since it is still below the Php 8000 limit. The next day, you cashed in Php 2500. Since you went over the limit, there is a fee included with the cash-in but only for the amount over the limit. The cash-in that has the fee applied is the amount over 8000 this month: Php 8000 - Php 7000 = Php 1000 Then we subtract from the amount you are cashing in: Php 2500 - Php 1000 = Php 1500 The fee is 2% of the amount. Php 1500 * 0.02 = Php 30 So the total cash-in with the fee would be: Php 2500 - Php 30 = Php 2470 Any later cash-ins for this month will have a 2% fee after this.

If you are cashing in 7-11, and you’ve exceeded the Php 8000 limit, the 1% fee goes first (7-11 fee), then the 2% goes after (GCash fee).

For example, if you are cashing in Php 1000 in 7-11 after exceeding the Php 8000 limit, the cash-in fee for 7-11 applies first: Php 1000 - Php 10 (1% of Php 1000) = Php 990 Afterwards, the 2% fee from GCash applies: Php 990 - Php 19.80 (2% of Php 990) = Php 970.20 The net cash-in amount is Php 970.20.

Once you are near the limit, you will receive a notification in your Inbox informing you of the charges once you go past the limit.

Please take note that this is only for manual cash-ins — remittances and bank cash-ins are not included.

If you want to know how to circumvent this fee, you can refer to my fees page to see alternative solutions.

Where can I cash in or cash out?

You can utilize the “View nearby” functionality within the app to conveniently locate nearby stores.

How do I cash out in the GCash app?

In the app, you need to click on Show More and scroll down to see the Cash-out button. There are two main options for cashing out — it’s either through Over-the-Counter or via ATM (GCash Cards).

If you want a free cash-out option, you can also transfer your funds to your bank via Bank Transfer and then use your bank’s ATM to withdraw the amount.

How to cash out via an Over-the-Counter channel

All of the options mentioned above need you to go to the actual store since you will need to fill out forms and receive your cash.

How to cash out via ATM Withdrawal

You will first need to have a GCash Card linked to your account. You can use any ATM to withdraw your money.

You can get your GCash Card by ordering it online, picking it up from Robinson’s Supermarket, or buying it from convenience stores (ex., 7-11, Ministop, All Day, etc).

What do I do if I don’t receive any money after cashing out via ATM?

I recommend that you always take a screenshot for transactions with big amounts — be it cash-in or cash-out.

For ATM non-dispense issues, you will need to file a ticket or email su*****@***sh.com with this information:

- Details of your concern

- Your name

- Your mobile number

- Date and time of transaction

- Amount

- Bank/ATM

- Location

- Screenshot of the (if available)

What fees are there for cashing out?

This chart explains the charges for each cash-out option:

| Cash-out Channel | Charges |

| ATM Withdrawal (via GCash Card) | Php 20 per withdrawal |

| ATM Withdrawal Abroad (via GCash Card) | Php 150 per withdrawal |

| GCash Partner Outlets (Villarica, Tambunting, Palawan Pawnshop, Puregold, Bayad Center, ExpressPay SM, Robinson’s) | Php 20 per Php 1000 withdrawn |

| Bank Transfer from GCash app to personal bank account then withdraw using bank ATM | No fees |

Summary

We talked about the different cash-in and cash-out options using the GCash app. We also tackled the different questions surrounding this.

Cash-in can be via Over-the-Counter, Online Banking, or Remittance. Cash-out can be via Over-the-Counter, ATM, or Bank Transfer.

Cash-in for partner outlets excluding 7-11 has 2% fees over the Php 8000 threshold amount. Cash-out has different fees depending on the channel you are planning to use, but generally, you need to pay Php 20 per Php 1000 for most channels. For 7-11, there is a 1% fee for cash-ins.

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

Thank you so much.

The tutorial is very helpful. I understand fully all about GCash.

God bless you.

I think there’s some mistake on cashing-out via Gcash mastercard info. On other article it says that cash-out via Gcash mastercard rate is Php. 20.00 per withdrawal.

Good catch. I’ve updated the post.

Hello po, gusto ko po sana padalahan mama ko sa gcash ng pang gastos nila sa probinsya. Malayo cla sa bayan at may dementia tatay ko dadalawa lang sila. Problema naka Basic account lang ho ang nanay ko walang ID na magamit pang validate. Gusto ko sana padalhan isang bigayan ng 50k para sa monthly na nila (bayad ng ilaw, tubig, internet). Pwede po ba un? di ko kc ma asikaso dhil nasa abroad ako magkaiba ang oras namin.

Since 50k ang montly limit/wallet size limit ng basic account. Pwede ko po ba sila padalhan ng 50k isang bigayan. Nalito kc ako sa 10k daily limit. Pwede bang isang bigayan 50k o kelangan talaga limang beses, limang araw ako magpadala tig 10k.

Yeah, 10k lang siya per day, so 5 beses mo kailangang gawin. Bakit di mo nalang ipadaan sa support ticket ang verification ng nanay mo para maging fully verified? Problema rin kasi ang daily transaction limit for outgoing is 5k. Pag malaki ang kailangang bayarang limitado rin ang puwedeng paglabas ng pera.

Almost 3days n po d p rn nafully verified ung gcash account ng asawa ko ngsubmit n dn kmi ng ticket,,,pno po b un,pwde po b nmin macashout un over the counter kht d p fully verified…tnx po

Di puwede magcash out pag di fully verified. Follow up niyo po yung ticket araw-araw.

Thank you very much for sharing this. May you continue to be blessed.