This guide aims to explain how GCash works as simple as possible. It goes through the most common features and answers any questions you might have as a beginner.

What is GCash?

GCash is a digital wallet that holds your money, plain and simple. Each amount in the wallet has an equivalent amount of peso in real life. You put your money into it, and the cash being digital makes it easy to do transactions with it, empowering the user.

Introduction to Digital Wallets

Before we go through our guide, let’s talk first about digital wallets. What are digital wallets?

Think about your real-life wallet. You most likely have your cash there. You would also have your debit or credit cards.

Now think of your smartphone. With all of the wonders of apps in recent years, we have started to see the multitude of uses a smartphone can do. We don’t even leave the house without it. So why not combine the two together? Eventually, someone did, and the digital wallet is born.

Power of Digital Wallets

We have seen in recent years how financial technology evolved as a natural application of the power of the Internet. With the gradual improvement of our network connectivity, we can leverage the power of our always-on data connection to power our financial transactions via the Internet.

A case in point is China. It has embraced the digital wallet to the fullest, and most of the transactions are via the app, and cash is becoming increasingly rare. The effect is dramatic because so many applications can only come from innovation via technology. One can be online e-commerce, and another can be QR-based transactions.

For example, in a lot of restaurants in China, you can just sit down at a table and scan the QR code on it. Your app will open that restaurant’s web page and will lead you to its online menu. You can order what you want and also pay right there on the spot. The waiter will just serve you your order at your table, without you even standing up. How cool is that?

Another is the universality of their platform. You can go to the grocery, take a taxi, or rent a bike using an app. You can get loans, buy train tickets, buy street food, donate to street performers, and if your phone battery gets low, you can even rent power banks via an app.

Now here in the Philippines, we currently have those types of applications used by a handful of digital wallets too, even though they are at an early stage. GCash leads this pack and right now it’s at the top in terms of market penetration.

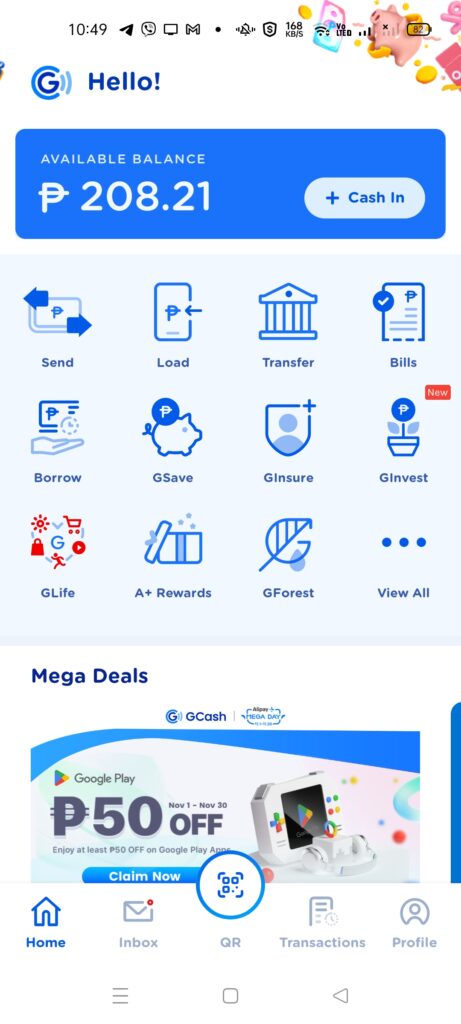

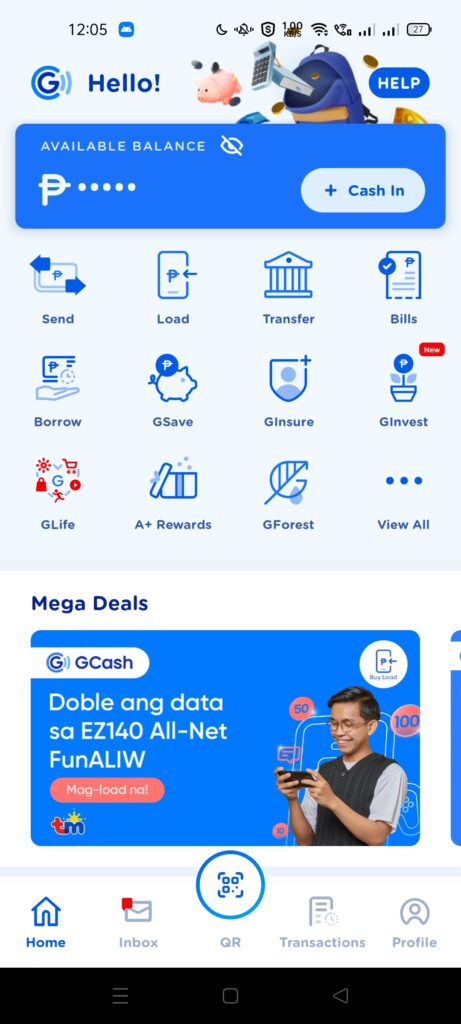

What can I do with GCash?

Here are some things you can do with GCash:

- pay your bills

- buy load

- buy things in real life and in the Internet

- send money to other GCash users in a variety of ways

- plant a tree

- receive remittances

- invest your money

- open a savings account and save money

- buy gaming-related currency

- ask for money from other GCash users

- transfer money to the bank

- support NGOs

- pay your tuition

- get a line of credit

- split your payments with other GCash users

- pay your taxes and dues to the government

- buy an insurance product

- be a gateway app for other merchants

- get a cash loan

- pay in installments

- open your own cash-in, padala, buy load, pay bills business

- invest in local and global wealth funds

- buy cryptocurrency

- invest in local stocks

- open a savings account with a partner bank

- find a job

The feature list keeps increasing as time goes by.

What can I expect from this guide?

For this primer, I’m going to describe how to install and verify your GCash account and explain the most used features in your GCash app, which include:

- Cash-in

- Cash-out

- Buy Load

- Pay Bills

- Send Money

- Payments via QR Code

How do I install GCash?

It’s as simple as searching for and installing GCash in your app store. Here is a screenshot from the Google Play Store and the iTunes App Store:

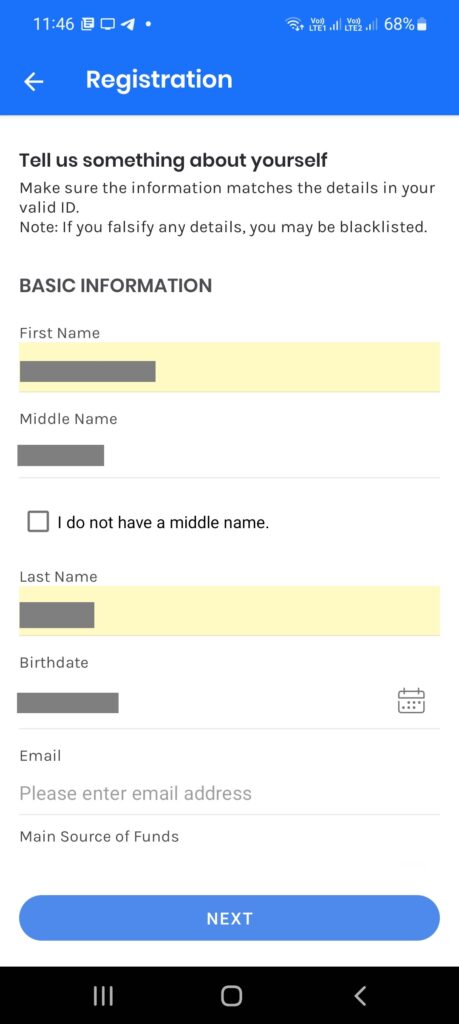

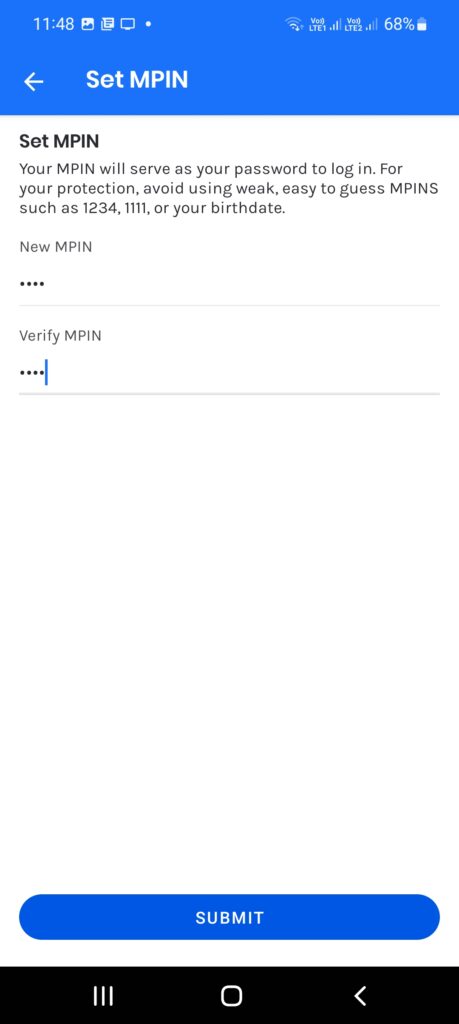

After installing, you need to register. GCash will ask for some basic information, your 4-digit MPIN, and verify with OTP (one-time-password) via SMS. After this, you can now log into the app.

Do I need to be a Globe subscriber to register?

No, GCash has been open to all networks since 2018. You can use any mobile number to register.

Do I need to be online to use GCash?

Yes, you need a data connection to use GCash.

Can GCash be used overseas?

Yes, since GCash uses the Internet to do its transactions. But if you have a PH number, you can activate your roaming function and transact even when abroad. Make sure your address is verified by going through full verification.

For GCash Overseas, you can also create an account using your foreign SIM, but features are limited compared to a normal GCash account.

As for cash-in options in your country, there are many partnerships with different remittance providers where you can directly cash into the app.

For withdrawals, you can use your GCash Card with any international ATM as a debit card. Once you withdraw you automatically get the local currency converted from your GCash balance with very good rates (one of the best), but with a Php 150 withdrawal fee included.

You can now pay using GCash Pay via QR in Alipay+ merchants abroad. Currently, the supported countries are:

- Australia

- Austria

- Belgium

- Bulgaria

- Cambodia

- China

- Croatia

- Cyprus (Republic of Cyprus)

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hong Kong

- Hungary

- Iceland

- Ireland

- Italy

- Japan

- Laos

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Macao

- Malaysia

- Malta

- Mongolia

- Nepal

- Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Qatar

- Romania

- San Marino

- Singapore (Must be a Filipino GCash user)

- Slovakia

- Slovenia

- South Korea

- Spain

- Sweden

- Switzerland

- Thailand

- Turkey

- United Arab Emirates

- United Kingdom

- United States of America

Does GCash have a maintaining balance?

No. However, GCash has a dormancy fee of Php 50. This amount will be taken from your GCash balance. This only happens when you don’t use your account for six months. Do not worry though, GCash will be reminding you of this a few days before via SMS.

If you do not have an existing balance when the trigger happens, then your GCash account will be automatically closed. You will need to create a new one.

What is my GCash account number?

This is the mobile number used when you created your account. This is the same as your GCash number.

Can my GCash number be changed?

No, but you can create a new one and have customer support transfer your old balance to the new one. This is important for cases when you lose your SIM.

Can I create multiple GCash accounts?

Yes, you can have up to 5 fully verified accounts. But you also need to have 5 different mobile numbers for each of those accounts. If you exceed 5, you will be asked which accounts you plan to use as the others will be disabled. However even if you have multiple accounts, they are still covered by the same transaction limits.

Can I use GCash as a minor?

Yes, once you verify yourself as a minor with parental consent, the version of GCash you will be able to access is the GCash Jr version. GCash Jr has more limited features and limits and is focused mainly on minors.

Can GCash accept dollars?

No, it can only accept Philippine pesos. If you use your GCash Card in international ATMs or pay for your purchases with Alipay+ abroad, it will be converted to pesos first.

What are some misconceptions about GCash?

I’ve written an in-depth post about that here.

Is GCash secure?

Yes. But there is no such thing as foolproof security as typically the weakest link is the user himself. Usually, the smallest mistake often revolves around getting conned by online scams and phishing sites. It is said that social engineering can compromise any security system.

In the case of GCash, the keys to an individual account are the MPIN. GCash has also implemented a biometrics validation method to help you log in without inputting the MPIN. You just need to turn it on from the settings screen.

GCash has also implemented the DoubleSafe feature, which requires a selfie if you are logging in from a new phone or if you are resetting your MPIN. You need to be Fully Verified to use this though as it is during the verification period that your selfie information is taken.

Let us not share our MPIN with anyone as this 4-digit number is the key to your kingdom. This bears saying that we should not share our MPINs with anyone, especially in any phishing attempts in FB Messenger, clicking links in text blasts, or email scams. Sharing accounts also increases the chances that anyone can break into your account.

Take note that phishing scams always take advantage of fear and urgency to make you click links or input your details.

Also, remember that GCash employees do not ask for your MPIN. More often than not it is the scammers that impersonate GCash employees.

GCash employs two-factor authentication

GCash has implemented OTP (one-time password) validation for most transactions that are connected to account or card linking, cashing in, cashing out, sending big amounts to other accounts, or online payments. You will need to validate any via SMS or email for any OTP validation. This serves as a type of two-factor authentication — meaning you need to do two things to prove that you are the owner of the account.

Again in setting MPINs, the weakest link is usually the person himself. Oftentimes people set the MPIN to 1111 or to their birthdays. Or we share our scan to pay vouchers or GCredit with strangers.

The best defense is vigilance. One good practice is to set a proper MPIN and not to share our account information with anyone, not even GCash support.

Why didn’t I receive an OTP when I entered my number during log-in?

When no OTP arrives during log-in, first check if the entered number is correct. Otherwise, it may be because there is congestion in the network or there is little network reception — better wait for a few minutes or find a better spot with a signal.

Government Regulation and the AMLA

We have a lot of government regulation (through the BSP) regarding digital money as it is easy to move and manipulate. Wallets are required to have an identity associated with them.

The BSP mandates that digital wallets should undergo KYC (Know-Your-Customer) and KYM (Know-Your-Merchant), meaning that there should be user or merchant information included with wallet creation. This is mainly to counteract criminal acts and enforce the AMLA (Anti Money Laundering Act).

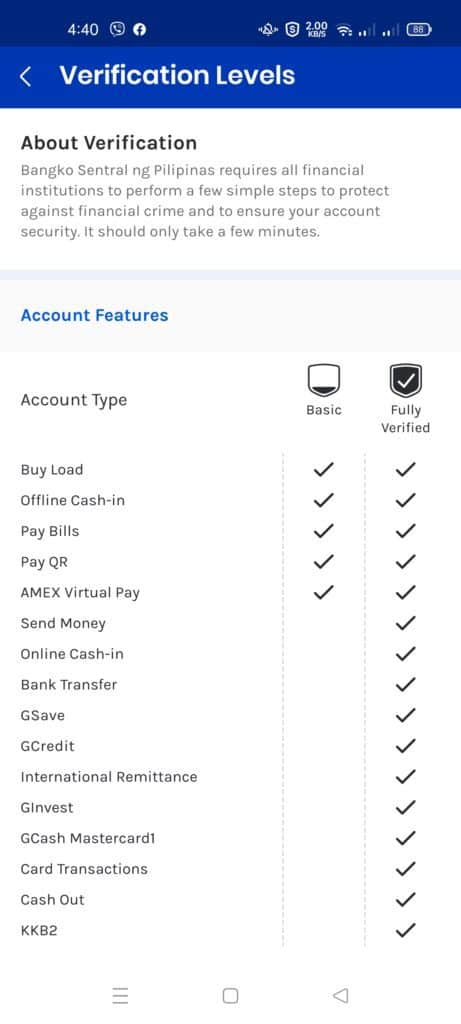

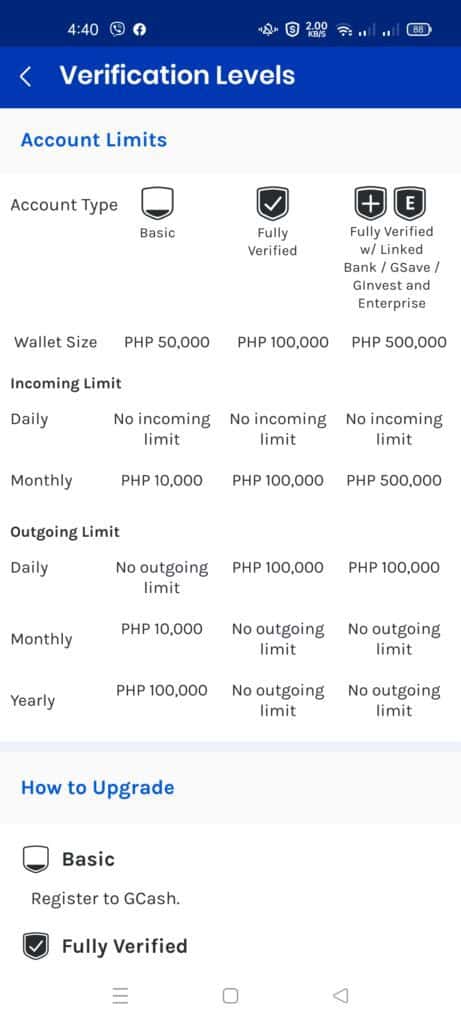

Everyone starts as a Basic User

Since so much hinges on having KYC information, GCash has mandated verification, and enforced feature locking depending on the amount of information each user shares. We all start out as Basic users.

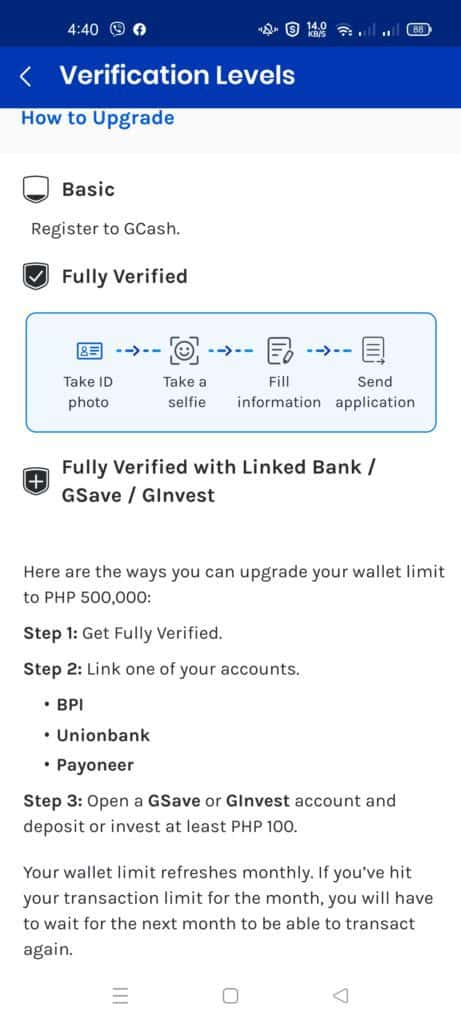

Then as we go into Fully Verified, we unlock all features and higher account limits. Take note that transaction limits are reset monthly.

You can check your current limits under Profile Limits on the Profile page.

If you want a higher overall limit (GCash Plus), you can link either a BPI, UnionBank, and/or Payoneer account to your GCash account, and put Php 100 into your GSave or GInvest account. If you receive your compensations/salaries via GCash, your limit will also be higher.

Expanded Feature List per Level of Verification

This is the complete list of features supported per verification level.

| Basic | Fully Verified |

|---|---|

| Offline Cash-in | All Basic Features |

| Pay Bills | Send Money |

| Buy Load | Request Money |

| Pay QR | Cash Out |

| Purchase GCash Card | Amex Virtual Pay |

| GlobeOne Linking | Linking a GCash Card |

| GCash Forest | GSave |

| Transact using GCash Card | |

| ATM Withdrawals | |

| Send to Bank (Instapay) | |

| Online Bank Cash-in | |

| GCredit | |

| GInvest | |

| International Remittance | |

| Paypal Cash-in | |

| Payoneer Cash-in | |

| GInsure | |

| GLoan | |

| GGives | |

| GCash PO | |

| KKB | |

| Online Payments | |

| GLife |

Unlocking Higher Account Limits

You can unlock higher limits by linking your BPI/UnionBank or your Payoneer account/s and utilizing either GSave or GInvest / GInsure with a Php 100 deposit or investment.

Once you do so, you will be able to unlock:

- A bigger wallet limit – Php 500,000 maximum

- Higher incoming limits – you will be able to receive up to Php 500,000 in your wallet and daily cash-ins have no limitations

- Higher outgoing limits – withdrawals will have no limitations per month, and you can withdraw up to Php 10,000 per day

You will be receiving an SMS informing you of the increased limits.

Take note that once you’ve unlinked all of your BPI/UnionBank/Payoneer accounts, the limits will revert back to what it was before.

How do I get verified?

There are two levels of verification – Basic User and Fully Verified.

It used to be tedious to have yourself verified as the process was very manual. But not anymore. Everything is automatic. You first need to click “Verify Now” from the Profile page after reading some explainers.

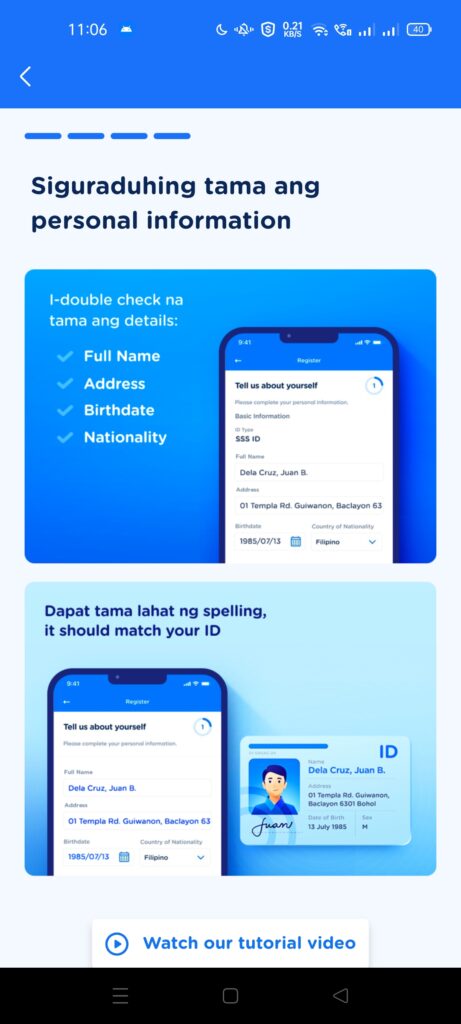

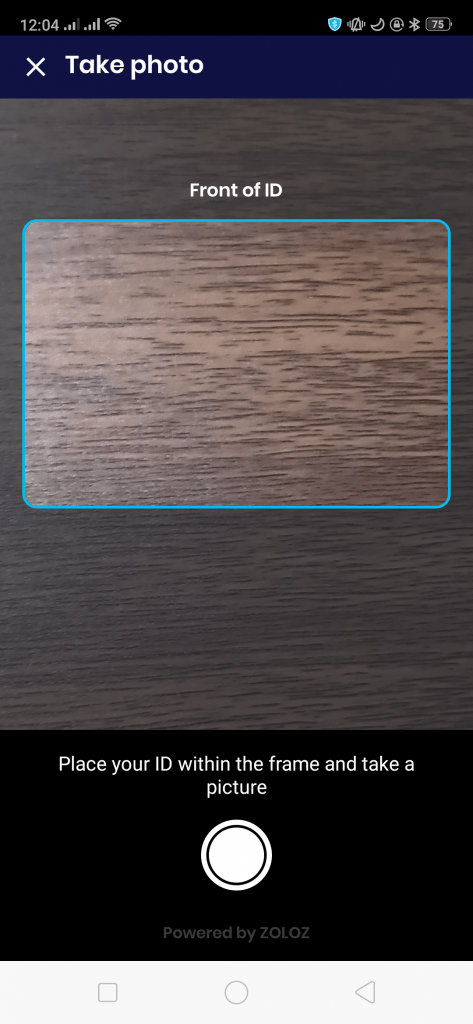

Since a recent update, you need to take a selfie in the app itself, take a picture of a valid ID, and input some more information (the app auto-populates some of the fields from the ID you took a photo of, so it takes a lot of the hassle off). You only need one valid ID.

The process is automated; you will get validation after 2-5 days. But sometimes you will be able to get it quicker. If you don’t get it after 5 days, better file a support ticket.

What valid IDs are accepted for verification?

Here are the listed valid IDs:

For GCash verification and for receiving GCash Padala, you would need a valid ID from this list:

- UMID

- Driver’s License

- SSS ID

- Passport

- Phil Postal ID

- PRC ID

- Pag-IBIG ID

- Philsys / ePhilID

- Alien Certificate of Registration (ACR) – if you are a foreign national

- Student ID, Birth Certificate – if you are a minor, and applying for GCash JR

If you don’t have an ID from this list, you need to file a Help Support ticket to help in your verification.

What if I don’t have an accepted ID?

You’ll need to undergo manual verification via a support ticket. You can either call 2882 or file a ticket on the help support site or in the Help Center in your app. They will likely ask you for an alternative ID. You can also go to any Villarica branch to fill out the verification form as an alternative.

What do I do if my SIM Card gets lost?

You should report your account first to GCash to lock it down and secure it. Then, you need to replace the SIM card with the provider. Once you have your replacement SIM card, you can then contact support and unlock your account.

If your SIM card cannot be replaced, then it would be better to buy a new one instead. You would need to create a new GCash account with that number and verify yourself. You can then contact support and transfer your balance to your new account.

Cashing in: How do I put money into my account?

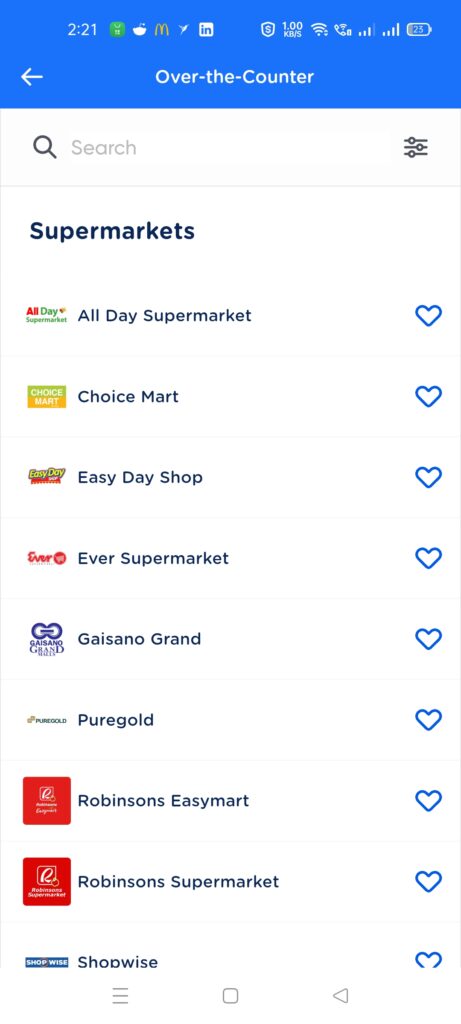

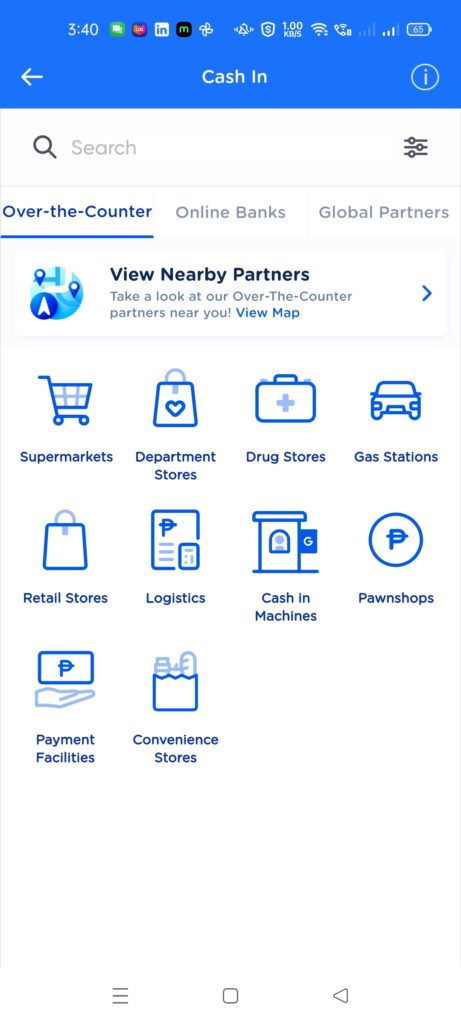

Now that we have installed and verified our GCash account let’s dive into our cash-in options to put money into our account. There are three main ways: Over-the-counter, Online Banking, and Remittance.

1. Cashing in Over-the-Counter

1.1 Are there cash-in fees?

For 7-11 cash-ins, there is a 1% fee of the total cash-in amount. For example, if you cash in Php 1000, the fee will be Php 10, and the total amount of Php 990 will be credited or added to your balance. This fee always comes first as it is a 7-11 collected fee.

GCash cash-in for partner outlets is free for the first Php 8000 per month. When the amount goes over the Php 8000 limit, it will incur a 2% fee. This limit refreshes every first day of the month.

For example: Today, you cashed in Php 7000. There is no fee since it is still below the Php 8000 limit. The next day, you cashed in Php 2500. Since you went over the limit, there is a fee included with the cash-in but only for the amount over the limit. The cash-in that has the fee applied is the amount over 8000 this month: Php 8000 - Php 7000 = Php 1000 Then we subtract from the amount you are cashing in: Php 2500 - Php 1000 = Php 1500 The fee is 2% of the amount. Php 1500 * 0.02 = Php 30 So the total cash-in with the fee would be: Php 2500 - Php 30 = Php 2470 Any later cash-ins for this month will have a 2% fee after this.

If you are cashing in 7-11, and you’ve exceeded the Php 8000 limit, the 1% fee goes first (7-11 fee), then the 2% goes after (GCash fee).

For example, if you are cashing in Php 1000 in 7-11 after exceeding the Php 8000 limit, the cash-in fee for 7-11 applies first: Php 1000 - Php 10 (1% of Php 1000) = Php 990 Afterwards, the 2% fee from GCash applies: Php 990 - Php 19.80 (2% of Php 990) = Php 970.20 The net cash-in amount is Php 970.20.

Once you are near the limit, you will receive a notification in your Inbox informing you of the charges once you go past the limit.

Please take note that this is only for manual cash-ins — remittances and bank cash-ins are not included.

If you want to know how to circumvent this fee, you can refer to my fees page to see alternative solutions.

1.2 How do I cash in Via Machine?

If you need a quick infusion of cash, the fastest way is using machine cash-in (from TouchPay, and Pay and Go/eTap machines), if there is one nearby. Sometimes, you may see cash-in machines in different convenience stores, gas stations, or malls. These are easy to use; you just need to insert your cash, enter your GCash number, and you will be able to receive the amount in your GCash wallet.

1.3 How do I cash in via the Payment Center?

You can also go through the manual/over-the-counter route, meaning cashing in a payment center. You will need to go to one of the listed stores in your app, fill out a form, and show a valid ID before they can process the cash-in request.

1.4 How do I cash in via 7-11?

You can also cash in via 7-11 via the Cliqq kiosk. You must enter the amount to be cashed in, get the printed slip, and pay at the counter. You can also use the Cliqq app to generate a code for cash-in to be paid for.

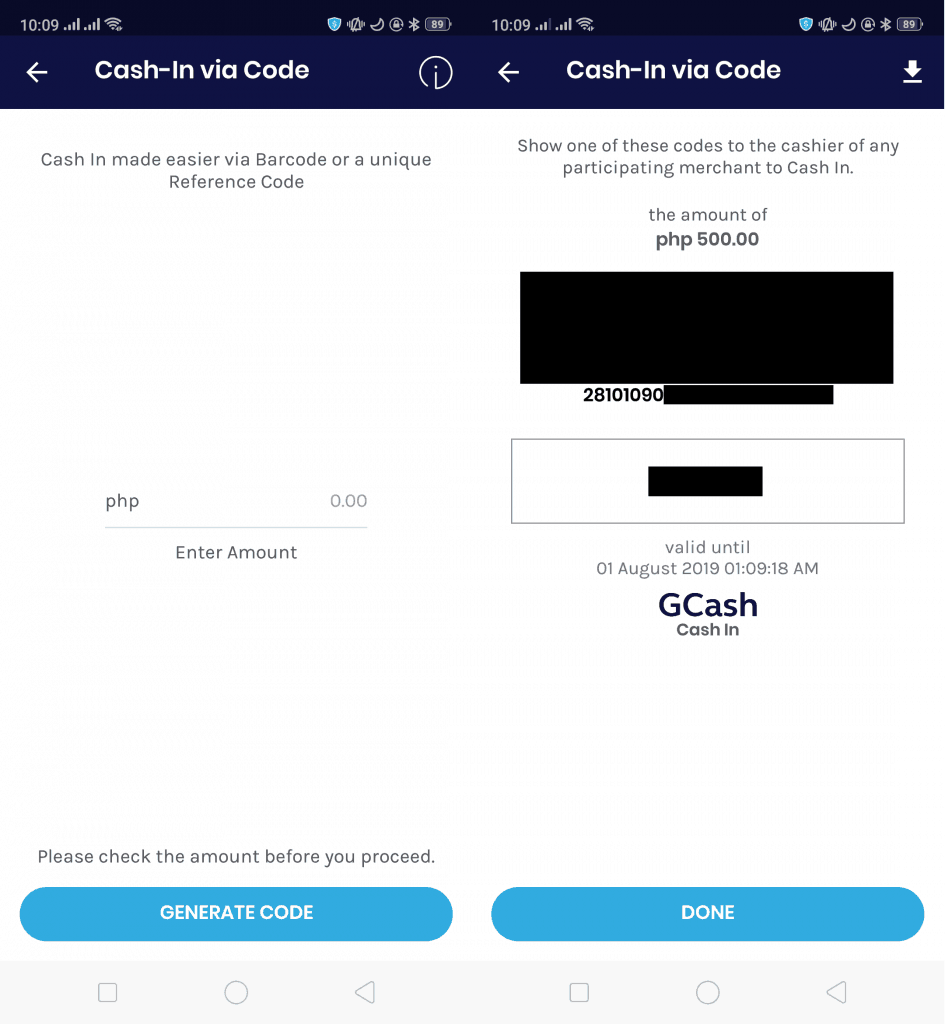

1.5 How Do I Cash in via Generic Barcode?

The second easiest cash-in option is the use of a generic barcode. Previously, this was a manual process as you needed to complete some forms.

Now, you can cash in from the cashier and it’s really quick – enter the amount, generate the barcode, and have it scanned at the cashier with the payment.

Here are some partners that use Generate Barcode for cashing in — check your app for an updated listing:

- Puregold

- Savemore

- SM Hypermarket

- SM Supermarket

- Tambunting Pawnshop

- SM

- Bayad Center

- ExpressPay

- True Money

- LBC Express

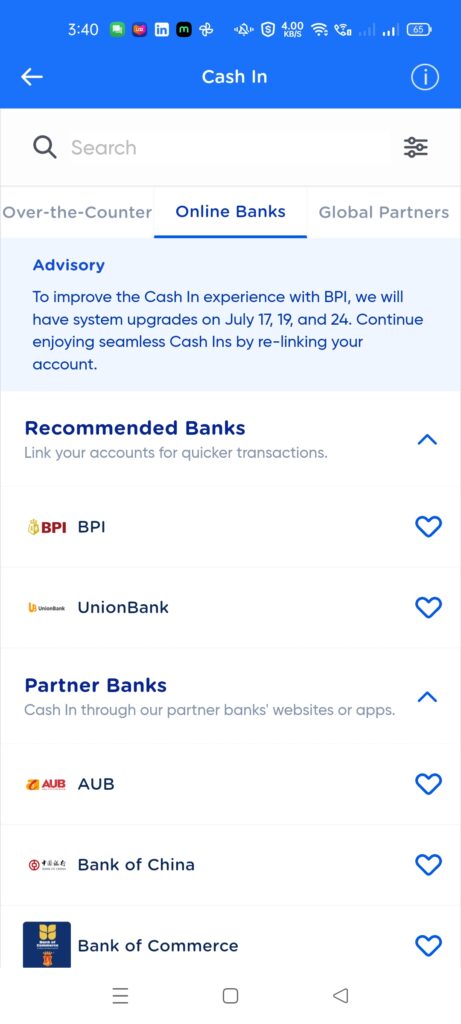

2. Cash in via Online Banking

If you’re like me and lazy not to get off my seat to line up and cash in using the options mentioned above, I can opt to go with the online banking route instead, like BPI and UnionBank. This option is for those with banking accounts and those with their online banking accounts enabled.

2.1 How do I cash in via other banks?

Each bank in the list also has an equivalent bank app for online banking. We can also use these bank apps to transfer to GCash via external bank account transfer (InstaPay or PESONet), using GCash as the receiving bank. Take note, though, that typically doing so includes fees depending on the bank app you are using.

Here are the transaction fees for the different banks if you initiate an InstaPay or PESONet transfer to GCash (G-XChange) using their apps:

Here are the InstaPay fees for most banks (as of Jan 24, 2025):

- AUB: Php 8

- BDO: Php 25

- BPI: Php 25

- Chinabank: Php 15

- Coins.ph (DCPay): Php 10

- East West: Php 10

- Landbank: Php 25

- Maybank: Php 10

- Metrobank: Php 25

- Maya: Php 15

- PBCom: Php 20

- PNB: 20

- PSBank: Php 15

- RCBC: Php 25

- Union Bank: Php 10

You can also refer to the BSP Instapay fees list if your preferred bank is not here.

3. Cash-in via Remittance

If you are abroad, you can remit with GCash partners and cash in directly to your GCash account. Paired with a PH SIM with roaming, you can transact as long as you have roaming data.

Here are some of the various GCash remittance and bank partners all over the world:

- AlipayHK – provides a way for Hongkong based Filipinos (usually domestic helpers) to remit to GCash quickly; uses blockchain technology

- Azimo – for UK remittances

- bWallet – for Bahrain remittances

- Cross – for South Korean remittances

- Denarii Cash – for UAE remittances

- EMQ Send – for Taiwanese remittances

- EEC Remit – for Taiwanese remittances

- GMoneyTrans – for Korean remittances

- Instant Cash – for UAE remittances

- MoneyGram

- Pacific Ace – Macau, Hongkong remittances

- PayIt – for UAE remittances

- Payoneer

- Paypal

- Remitly

- Rocket Remit – for Australia, New Zealand remittances

- SABB – for Saudi Arabia remittances

- SBI Remit – for Japanese remittances

- Siammali Remittance – for Brunei remittances

- Singtel Dash – for Singaporean remittances

- Softbank – for Japanese remittances

- Skrill

- Telcoin – for Canadian remittances

- Transfer Galaxy – for African remittances

- Wall Street – for UAE remittances

- Warba Bank – for Kuwaiti remittances

- Western Union

- WireBarley

As for Western Union and Moneygram remittances, you wouldn’t need to go out and line up in the outlets to cash in. You only need the reference number; the cash goes straight to your wallet.

For PayPal, you need to link your account first, but once done, the cash can be debited directly to your wallet. This is also the case for Payoneer accounts.

Cashing Out: How do I get my money out?

Cashing out has two main options: one is via the GCash Card, and the other is via Partner Outlet, which is over-the-counter. You can also use the Bank Transfers feature in the app to move money out of your GCash wallet.

1. Cashing out via GCash Card

The GCash Card is a debit card, and it can be used for withdrawal in all ATMs nationwide (and internationally) because it currently uses the Visa scheme. There is a fee of 10-18 pesos locally per withdrawal. For international ATMs, there is a fee of 150 pesos.

What I like about using it internationally is you can get the local currency immediately (at a very good forex rate), as it converts the pesos you have in your GCash account to that currency.

You can also use the card to purchase in stores and online shops.

1.1 How do I get a GCash Card?

The easiest way to get one is by ordering it in-app. The card costs PHP 210 (PHP 150 for the card, PHP 60 for the delivery fee), and you need to buy it from the GCash Card page inside the app. You need to enter your address and other details to pay for the card.

The expected delivery time is around 10 working days. For more details, you can check out my GCash Card how-to post.

2. Cashing out via Partner Outlet

When cashing out using this option, you need to go to the supported cash-out outlets below, fill out a form, and show a valid ID. There may be some fees when cashing out with some partners. Once they have processed the cash-out, you will receive an SMS requesting your MPIN as confirmation. Once done, you will be able to claim your cash. Note that money out with over-the-counter outlets and GCash Pera Outlets have a 2% fee.

The downside of this process is it’s manual. Another issue is if the outlet has a problem with Internet connectivity, they cannot process your request.

3. Cashing out via Bank Transfers

This option is not officially cash-out since we are technically sending money, but I can consider this as cash-out because we can still move funds via this method. You can then withdraw using your bank ATM.

GCash has implemented Instapay transfers, which makes it easy to transfer to any bank under Bancnet. You can transfer the amount to your bank and withdraw it via the bank’s ATM. There is a Php 15 fee for using this service.

This is convenient because you would not need to go to different banks to withdraw and deposit. You can also cash in using your debit card and then transfer to another bank without fees, within the app. You can even transfer to your Paymaya, Coins.ph, or GrabPay account if you need to.

Sending from GCash to Bank Accounts using QR PH

As BSP is mandating QR PH for greater interoperability between financial institutions, you can now scan from GCash any Bank QR supporting QR PH using the “Scan to Bank” feature under Transfers or from the GCash QR scanner itself.

You do not need to know the account number or account name to transfer funds using this method.

Here are sample QRs supported by BPI, UnionBank, and PSBank. Notice the QR PH logo in the middle. Once scanned they will go to their respective transfer pages in the GCash app.

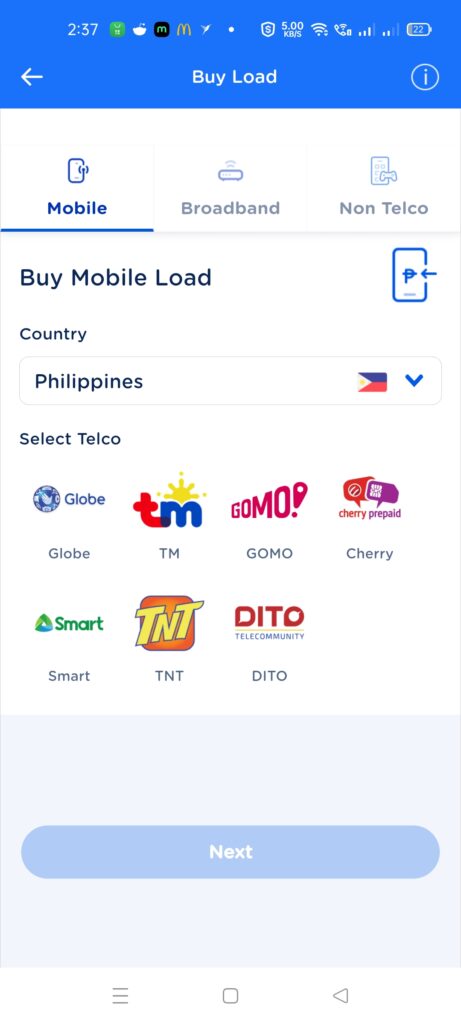

How do I buy load?

Buy Load is one of the main uses of GCash and shows its roots as part of Globe Telecom. What’s different from other load providers is that you can not only buy a load or a data package for your SIM, but also some other prepaid subscriptions not related to your phone – like game credits, broadband wifi, Cignal, and Sky TV subscriptions, and even health insurance (Maxicare).

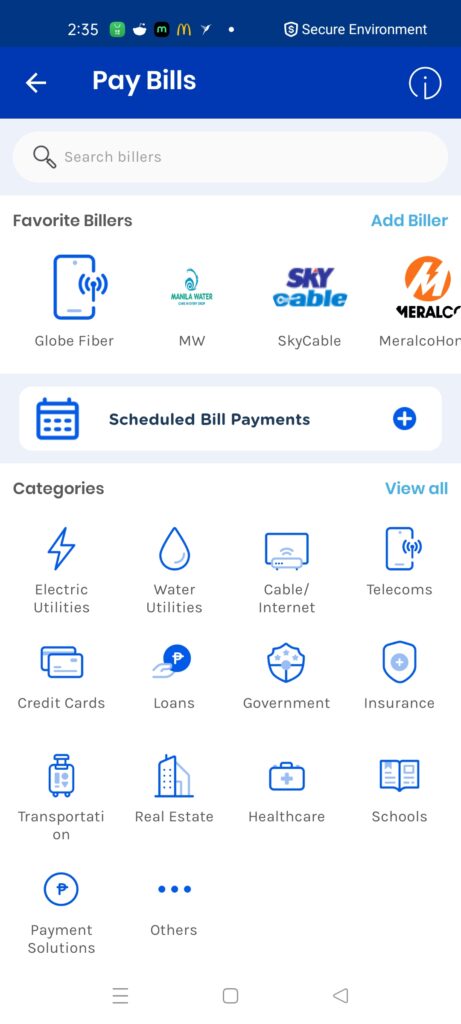

How do I pay bills?

I’m grateful for this feature since I don’t need to go to any bank or payment center to pay any bill I have. I can just do it all in the app. The list of billers is quite long and extensively covers all utilities. It handily beats any banking or digital wallet app with the number of billers it supports.

Additionally, you can see government billers like NBI, SSS, PAG-IBIG, schools, and airlines (PAL, CebuPac, AirAsia) on their list. There’s also a section called GCash for Good that includes NGOs and other donation-centric billers.

I pay for my electricity, water bills, phone bills, ISP, landline, credit card, and rent through the app. A minor annoyance is some of the billers might have convenience fees included, but if I think about it, the convenience is worth every peso, since you don’t need to get out of the house anyway.

Some billers also support payment via GCredit, which helps, especially when funds are low. There is also a Bill Protect Insurance for some billers, which continues the payment for 36 months after something happens to the insured.

How do I send money to another user?

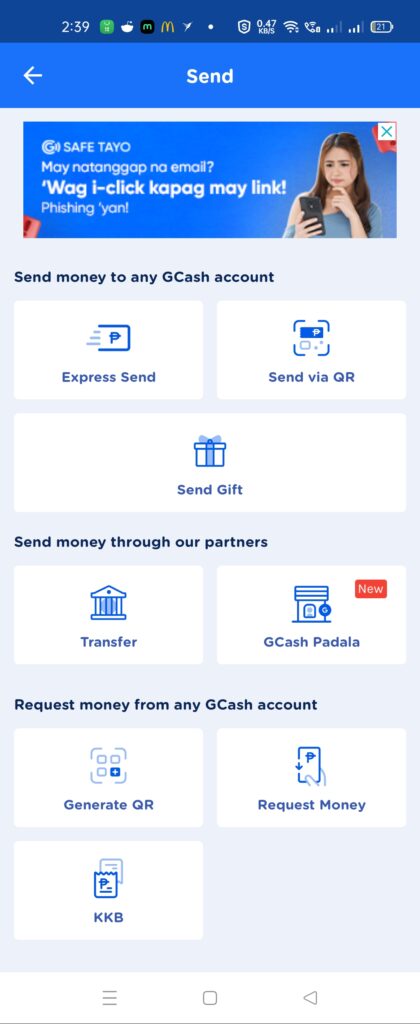

One of the fundamental features of GCash is sending money since we all need to pay people and share what we have as well. Fortunately, for GCash, we have different options – Express Send, Send Gift, Send via QR, Padala, KKB, and Bank Transfers.

A reminder: before sending money, we should be sure about the recipient’s subscribed number since we can mistakenly send it to another person by mistake. If you made that kind of mistake, GCash Support can only help you if:

- The receiver is not a GCash user

- One digit of the subscriber number is wrong, and the receiver has not used or withdrawn the money.

GCash Support will also ask for a lot of details regarding the transaction, so best to be careful. It’s even more difficult to dispute for Bank Transfers as it is considered a deposit. Remember that an ounce of prevention is worth a pound of cure.

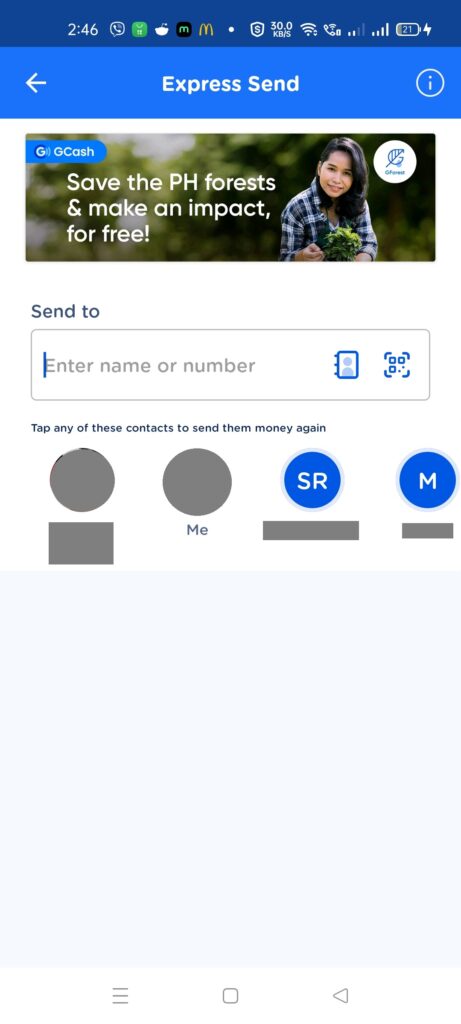

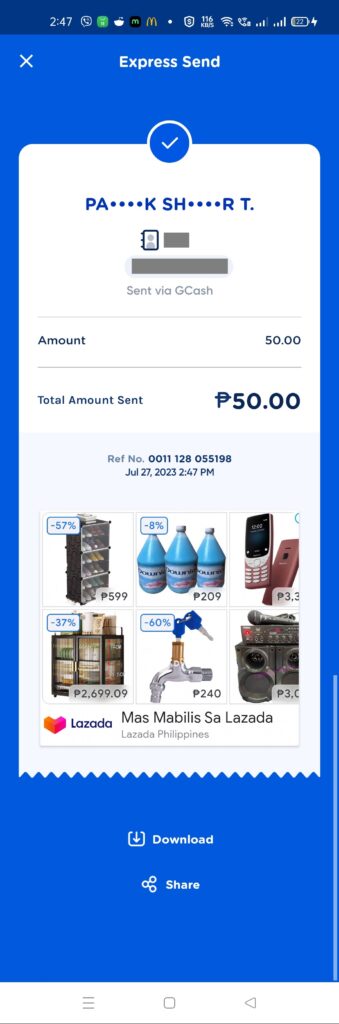

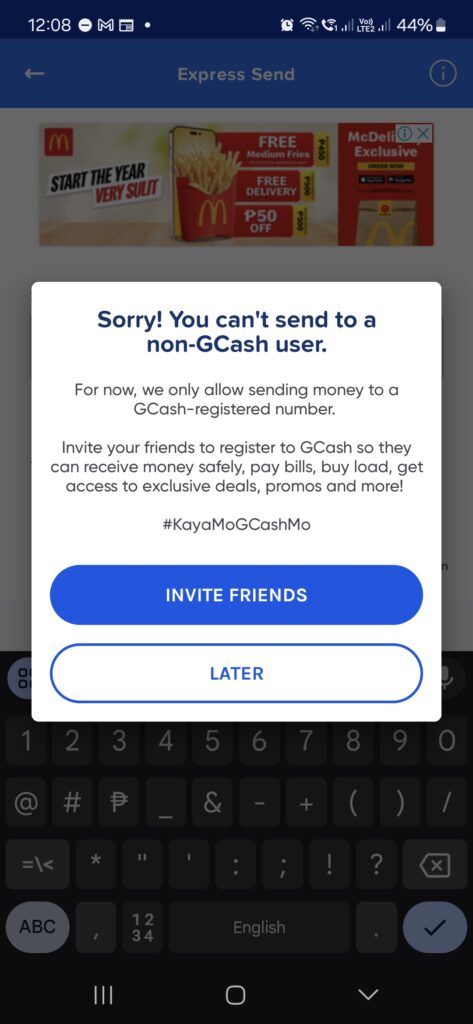

1. Express Send

This is the bread and butter of GCash. You can send an amount to another GCash user directly. The recipient’s name is now obscured, but if you send it to someone in your phonebook, you can see their full name.

If you want to send money to someone who does not have a GCash account, you need to use GCash Padala.

Another big change is the sender will not be receiving an SMS anymore, and the sending receipt can be seen in the Inbox. The receiver will still be receiving an SMS as usual.

2. Send Gift / Ang Pao / Pamasko

The red packet or Ang Pao is the Chinese cash gift for special occasions – a token of luck, life, and happiness. During Christmastime, this transforms into Pamasko. Nevertheless, our main practical feature for this is the option for multiple recipients of Send Money.

This is useful if you need to give multiple people the same amount of money. Sometimes, you may also want to randomize the cash amount of your gifts between multiple people.

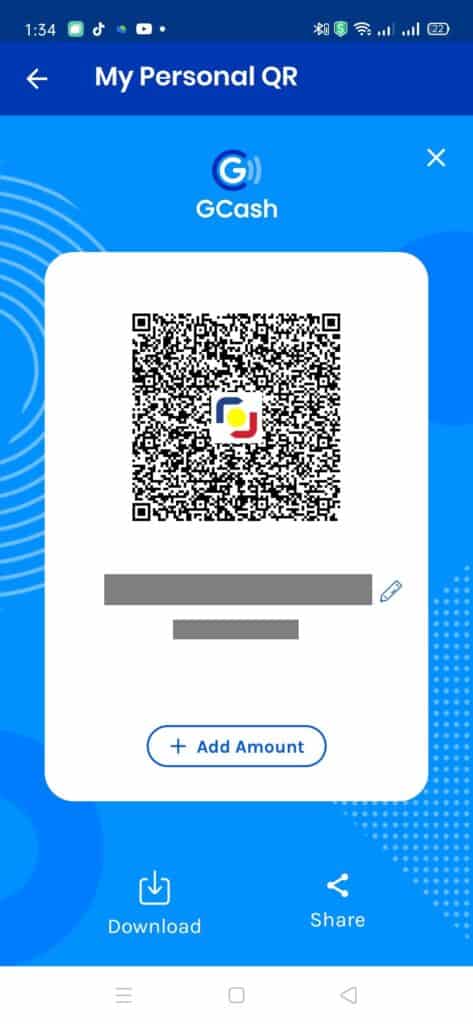

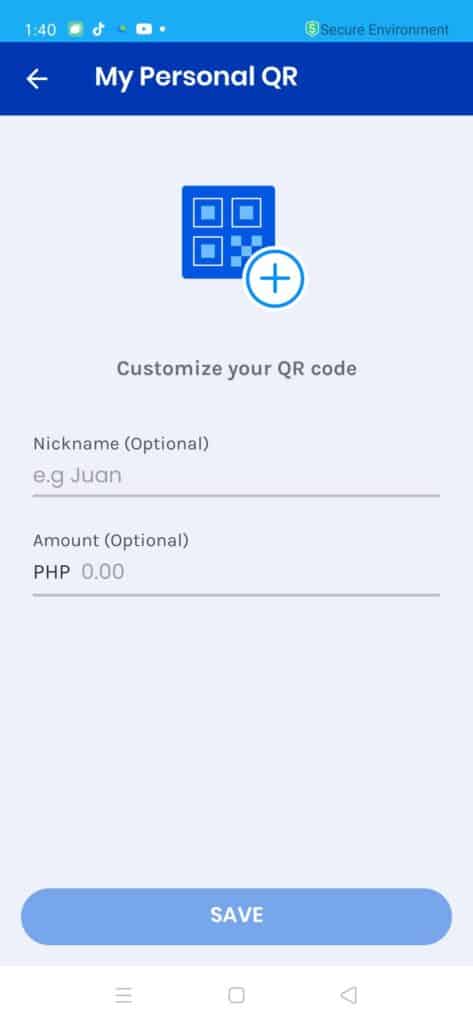

3. Send via QR Code / Generate QR

You can also generate a personalized QR Code and share it. The advantage is that you don’t need to dictate or send your GCash number to others. You can also set an amount for the QR code. This is incredibly useful for merchant sellers as they don’t need to request their QR code anymore.

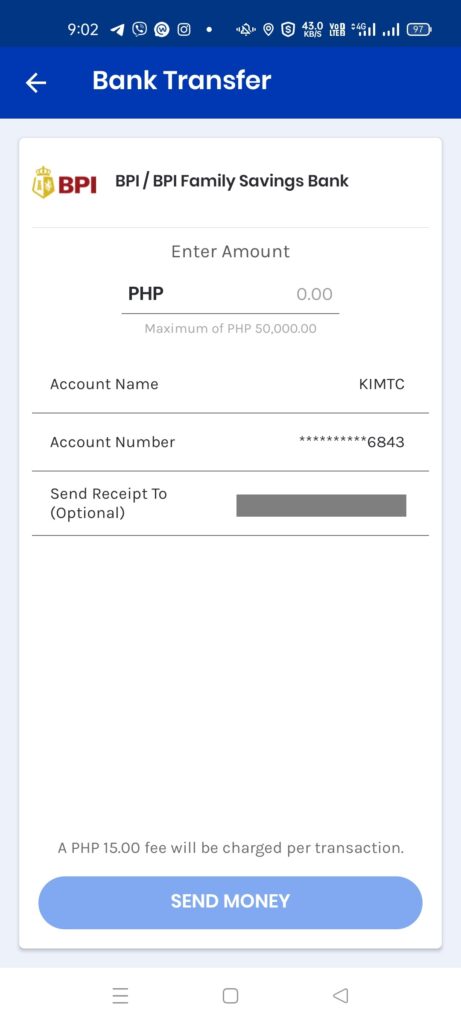

4. Bank Transfers

Bank Transfers earn another mention here since you can also deposit to all Bancnet partner bank accounts (even GrabPay, Maya, and Coins.ph). GCash will be charging Php 15 per transfer.

However, if you are a new GCash user, you can only transfer up to Php 20,000 per day, but as you use Bank Transfer, the limit goes up gradually until Php 50,000 per day is reached.

7. Request Money

Request Money allows the recipient to take the initiative and ask the sender for the amount instead. This makes it easier for the sender as they only need to confirm the transaction. This is also useful for those who need money regularly, like allowances.

The sender would just need to confirm the transaction and the amount is debited from his balance.

8. GCash Padala

You can send money to non-GCash users. This works with GCash partner outlets as a “padala” type of remittance. You need to input the number of the recipient, and the recipient needs to show the SMS and his ID to the GCash partner outlet to claim his money.

How do I pay merchants via QR Code?

A digital wallet won’t have much use if you can’t pay with the cash you have. Payments are the most recognizable since every GCash merchant usually also has a QR code. GCash utilizes these payment codes in two ways – from the point of view of the user and from the merchant. We can also pay via GCredit and GGives, if the feature is available, and we can also add vouchers if they are available.

1. Scan to pay via Merchant Presented QR Code (Scan QR Code)

Scan QR Code is the most common payment method available to merchants. The procedure is simple – the GCash user scans the QR code standee. He then enters the amount and confirms payment. As proof of payment, both the GCash user and the merchant receive an SMS.

The downside of this is the slow pace because the user still needs to input the amount, which adds time and is prone to error. Also, the merchant needs to wait for the SMS notification to arrive to be able to confirm the payment. There are times when the SMS doesn’t come in time, which definitely adds to the time in the queue.

There is also a different type of Scan QR Code, which is the dynamically generated QR code. The merchant has a device or a screen that shows the QR code, and the GCash user simply scans that and confirms payment in the GCash app to proceed.

This also supports Pay Abroad with Alipay+ merchants. You can scan Alipay+ merchant QRs from different countries for payment! The supported countries include Japan, Singapore, Malaysia, and South Korea.

2. Scan to pay via Customer Presented QR Code (Generate Code)

In contrast to Scan QR Code, Generate Code is definitely a speed upgrade. The GCash user first generates a QR Code and then the cashier scans it. The GCash user is deducted and receives an SMS. Since the merchant is integrated with GCash, there is no need to wait for SMS notifications to confirm payment.

Because of this, the merchant receives a response almost instantly – letting him know if the transaction was a success or not. This is faster since the amount is already inputted by the cashier itself and there is no manual step for the GCash user to do. In addition, any applicable voucher is automatically included in the purchase.

The downside is the GCash user should know how much his wallet contains before initiating the payment. Sometimes the amount to pay can exceed his wallet and he would get the “balance not enough” error.

For this particular method, some merchants have adopted – some examples are BEEP, Puregold, Bonchon, Alfamart, and Starbucks.

3. Pay Abroad with Alipay+ (Generate Code)

This is similar to the Generate Code above, but this is mainly for international Alipay+ merchants.

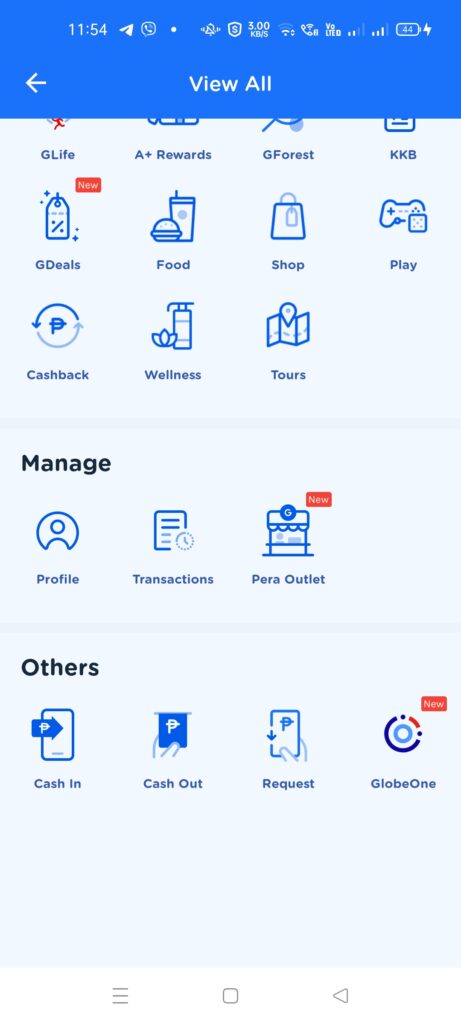

Other features

There are definitely other useful features in the GCash app, like:

- GScore – a credit scoring system based on GCash usage behavior

- GCredit – credit that a GCash user can use based on his GScore

- GForest – a rewards system that enables you to collect points that allow you to plant an actual tree

- GSave – a tie-up with online banks that allows you to create a savings account

- GFunds– a marketplace that allows you to invest your money in mutual funds

- GInsure – a marketplace for insurance products

- GLife – a showcase of different partner mini-apps within GCash

- GLoan – quick cash loans based on GScore

- GGives – paying for big purchases in installment

- GCrypto – allows you to invest in cryptocurrencies

- GStocks PH – allows you to invest in our local stock exchange

- GLife – an e-commerce solution within GCash

Summary

I discussed what GCash was and how it can make our everyday tasks easier. I walked you through the app installation, user verification, and some other need-to-knows.

Then I walked through the most common features of GCash – Cash-in, Cash-out, Buy Load, Pay Bills, Send Money, and QR Payments as a primer on how to get started with cashless wallets.

You can download GCash here (for Android) and here (for IOS).

Everytime i use GCash Amex as a payment method. this error pop up:

There appears to be a problem with the card you are trying to use. Please use a different card or check with your bank to make sure your card is enabled for international transactions

You may need to have some amount in your wallet to link it. Otherwise you can file a ticket in help.gcash.com.

Unable to process my transaction to pay maritime industry authority because when I put my contact number then when I press confirmation it says ‘contact number is invalid’

Baka kulang po ang number na nilagay niyo? O baka nag-aabang siya ng ibang format ng contact no (+63 sa harap, etc).

Wala po akong natatanggap na rebates every time I use buy load since yesterday.

Baka nakaquota ka na for the month. May limit ng ilang beses ka lang makakuha ng rebates every month.

Pwede po ba kuhanan ng Gcash Account ang business?

Puwedeng mag-apply for enterprise account. Direkta sa bangko ang perang ibabayad sa business/enterprise account.

HELLO. I would like to know if it is feasible for a small cooperative to ink a deal with GCash in crediting amounts to individual member accounts instead of using our own ATM machine which most of the time is out of order. How is that possible? Will the coop spend a big amount in the deal? Thank you.

Hello po, I know GCash also has payroll/disbursement services. You should check https://www.gcash.com/business

Hello. I understand there is an 8,000 cash in limit Free every month. My question is how to know date of cycle? What day will this free 8,000 cash in renew? Thank you

The first day of the next month

Does my gcash has an expiry

It has 6 months dormancy, meaning you need to use it within 6 months.

I need help po, kung papano gamitin si gcash for business. Like paede ka mag accept nang payment for water,electric bills and other payments. Please help.

Yes, puwede ka mag-apply as GCash PO. Nasa app po siya

HI! can a rural bank send money transfers to it’s clients via Gcash? Please tell us how to do it and the cost that goes with it. We are planning to send funds to our clients via Gcash and we need your guidance with this. Thank you.

If you plan to do so, then perhaps there’s a need to make use of the disbursement facilities offered by GCash. Please email en********************@**nt.xyz

How can I redeem rewards from my last 3months money transfers? And when will be the earliest date to receive it?

I think wala namang rewards sa GCash for money transfers

Hi,

I have been paying for my Prime Water bills for two years now via GCash, and there was never a service fee for each transaction. However, on my Jan and Feb 2022 bills, I noticed an extra charge of P5 for each payment. What has happened? Please enlighten me, thank you.

Depende po yan sa usapan ng biller with the payment processor. Minsan nagdadagdag talaga nang walang pasabi. Isipin nalang po natin na ok na yan kesa sa pupunta pa sa Bayad Center para magsettle.

I have been sending somebody money in the Philippines from New Zealand I’m being told they tell me that they have been hacked can you please confirm this?

You should confirm with the recipient — maybe he was scammed and his account was compromised as a result. Otherwise, the recipient should be the one who should report to GCash Support so that he still has a chance to get his money back.

Section “Cash-in via Remittance” above should also list WorldRemit.com.

Is GCash compatible with NFC payments? If not the app, can you use tap to pay with the issued card?

GCash is not compatible with NFC, only QR codes

Hi, I was loading my Gcash yesterday thru BPIonline. The transaction pushed thru with BPI with email on the successful transaction at 5pm. The load did not reflect on my gcash until now. How can I get it back?

You can call BPI support hotline with your issue