One of the troubles of investing is finding a vehicle that has an acceptable return but is not risky. The rule is there would be safe investments but with meager returns. Conversely, there are risky investments with sky-high returns.

An example of a really safe investment is deposit products. CIMB and ING were digital banks that provided higher rates on this end with 4% per annum sometimes in a single month. But looking at this from a monthly rate perspective, 4% / 12 months is just 0.33% per month. That’s still pretty low. Even now when you look at the offerings of digital banks they don’t provide this rate anymore.

Think about it. The inflation rate in the Philippines (at the time of this article) is currently at around 6% per month. This means that the peso is losing value at roughly this amount a month. Why is it losing value?

One reason is the war in Ukraine causing a cascade of events contributing to higher costs of production. Another reason is that banks around the world kept printing money during the pandemic to keep things afloat to pay creditors and for other earmarked funds. And this printing, while keeping economies afloat, also makes all of our existing money lose value little by little in general.

Additionally, during the pandemic stimulus packages gave money to people who are mostly unemployed so that they could spend. However, since many people are unemployed, there wasn’t much production, which caused things to become more expensive, and in turn, fed inflation. In the Philippines, we’ve already enacted a couple of stimulus laws (Bayanihan to Heal as One Act, and Bayanihan Act 2).

Actually, the US right now is in a state of hyperinflation because they also printed a lot of money to fund their own stimulus packages, as with a lot of countries. Again, this is something that will cause a worldwide depression in the near future, but to fight that, we must always think of investing our extra funds while we can.

I’ve digressed a bit, but this should put us on our toes to always strive to grow our wealth for the future.

What is the Pag-IBIG MP2 Savings Program?

The Modified Pag-IBIG2 (MP2) Savings Program is a 5-year maturity savings product that offers high dividends. This is different from the Regular Pag-IBIG fund. The dividends are paid out yearly, but you can opt not to receive the dividends and have them compound with the accumulated savings you already have.

Some advantages of MP2 are:

- The minimum investment amount is Php 500. There is no maximum.

- The dividends are tax-free.

- There are no penalties if you miss a payment.

- You can open multiple MP2 accounts.

The minimum amount is Php 500 for the whole five years. That’s how lenient and flexible it is. But I would suggest taking advantage of it by putting in money when you have some extra. Or you can also have your employer automatically put in an amount every payday. Nothing beats paying yourself first.

Who can avail of the PAG-IBIG MP2 Savings Program?

Any active Pag-IBIGmember can avail of this as long as he has at least 1 contribution within the last 6 months.

How big are the dividends in PAG-IBIG MP2?

Historically, the range is around 4-8% per annum, so most likely around 5-6% on average. If you are looking for an investment that is safe and beats inflation, then you can choose this investment.

How risky is this investment? Is my money guaranteed?

The dividends mostly come from the proceeds of the Pag-IBIG fund, which is generally safe as these are tied to housing loans in the whole country. There is also a part invested in government securities and corporate bonds. The risk is small as the money is guaranteed by the government.

How do I get my dividends?

When you enroll, you get to choose whether you want to get your dividends every year or have it compound with the amount you’ve put in so far.

If you choose to get your dividends every year, you will need to go to a Pag-IBIG office, accomplish and submit this form, and have your dividends credited to your bank account.

How do I get my money after the 5-year maturity?

You will need to go to a Pag-IBIG office, accomplish and submit this claim form, to be able to get a receipt. This receipt will tell you when you should come back to get your check, which is around 3-4 weeks.

You can also claim your money before maturity, but only with certain conditions:

- Retirement

- Total disability

- Termination from service due to health concerns

- Death / critical illness of a family member or yourself

- Permanent departure from the country

You can also claim your money without these conditions before maturity, but you will only get half of your dividends if you opt for the yearly claim. If you opted for compounding your dividends with your savings, you won’t be able to claim the dividends.

How can I see my PAG-IBIG MP2 Savings contributions?

If you’ve applied for a virtual Pag-IBIG account, you will be able to see your contributions in the portal.

Can I invest in PAG-IBIG MP2 Savings again after maturity?

Yes, some people even recommend putting the whole amount into it as a lump sum and waiting for another 5 years to mature. It can become a nice nest egg for retirement.

You can open multiple MP2 accounts at the same time. However, you also would need to pay for the savings of those accounts as well.

What happens when I don’t get my money after maturity?

The money will keep on earning dividends, but not through MP2, only the regular savings dividend rate. After 2 years, it will not earn dividends anymore.

How do I enroll in the MP2 Savings Program?

You can either go to a Pag-IBIG office or enroll online. I would suggest you do it online, as it’s really easy — you can finish within 5 minutes.

An advantage though of going to a Pag-IBIG office to enroll is that you can process other requests like auto-credit of dividends to your bank account.

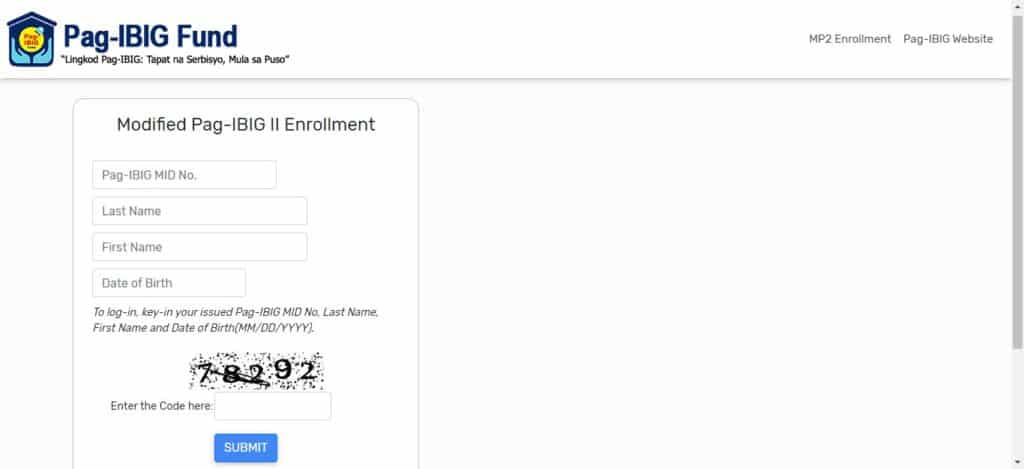

You would need to prepare your MID (member ID) beforehand. Here are the steps for enrolling online:

- Go to the PAG-IBIG online site, and fill out the online form.

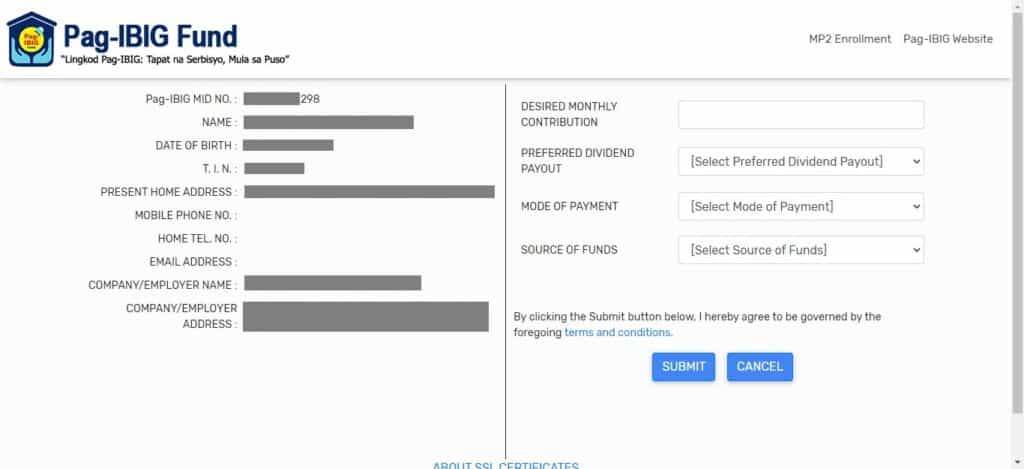

- You would be able to see your details, and you can input your desired monthly contribution, preferred dividend payout, mode of payment, and source of funds.

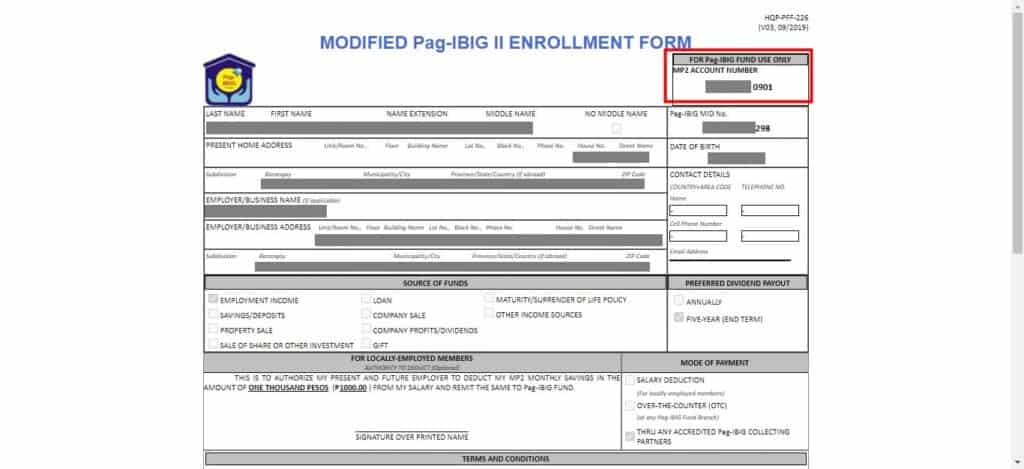

- Once submitted, you will be downloading an enrollment PDF form with all of the info you entered. The important thing to note here is the MP2 Account Number as you need this to be able to add to your investment.

- That’s it, you’re already enrolled, and you can put in your contribution immediately.

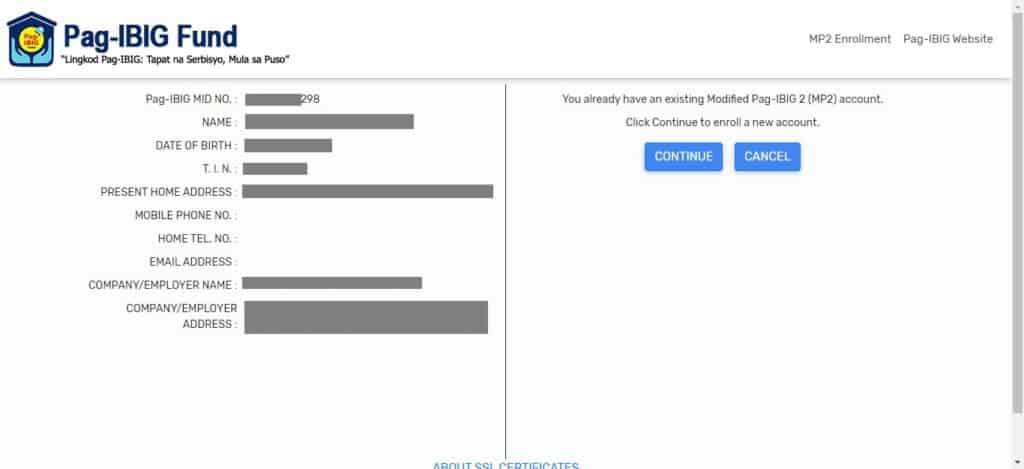

How can I enroll in the program again?

You can redo step #1 above, and it will ask you for confirmation if you will be enrolling in another account.

How do I pay for my PAG-IBIG MP2 contribution using GCash?

There are two ways to use GCash, one is the simplest, which is via the Pag-IBIG biller in the GCash app, and the other is paying directly on the Virtual Pag-IBIG site.

Paying your PAG-IBIG MP2 Savings via GCash Pay Bills

Using GCash, you just need to open the Pag-IBIG biller and pay for your contribution.

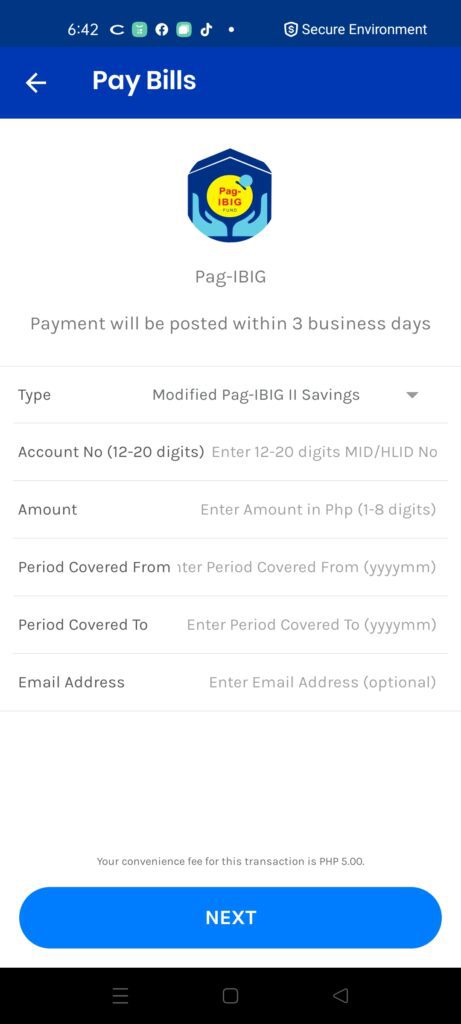

- From the GCash main page, Click on Bills and search for Pag-IBIG.

- Select “Modified Pag-IBIG II Savings” in the dropdown. As for Account No, put in your MP2 Account No. Take note that you shouldn’t put in your MID.

- The “Period Covered” from and to fields are not really used with MP2, so I recommend that you put in the current date as these are required.

- Confirm your payment. Take note that there is a Php 5 convenience fee.

Paying Pag-IBIG MP2 via the Virtual Pag-IBIG portal using GCash

You can also pay from inside the Virtual Pag-IBIG site, as long as you have an account.

Here are the steps:

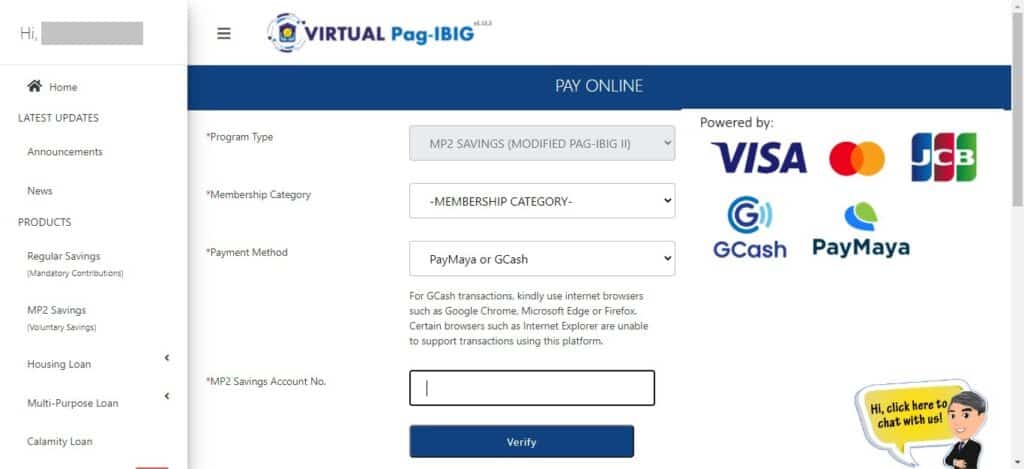

- Log into the Virtual Pag-IBIG portal.

- On the left panel, click on “Pay Online” and “MP2 Savings”.

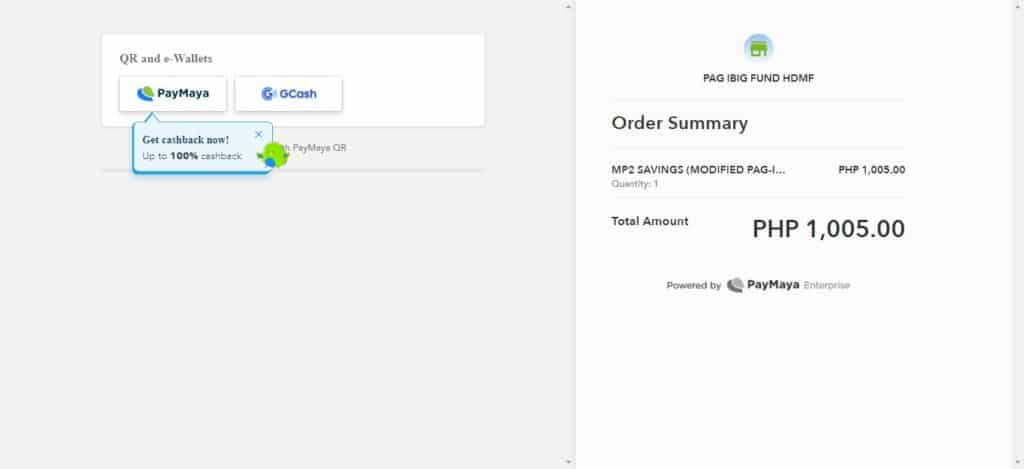

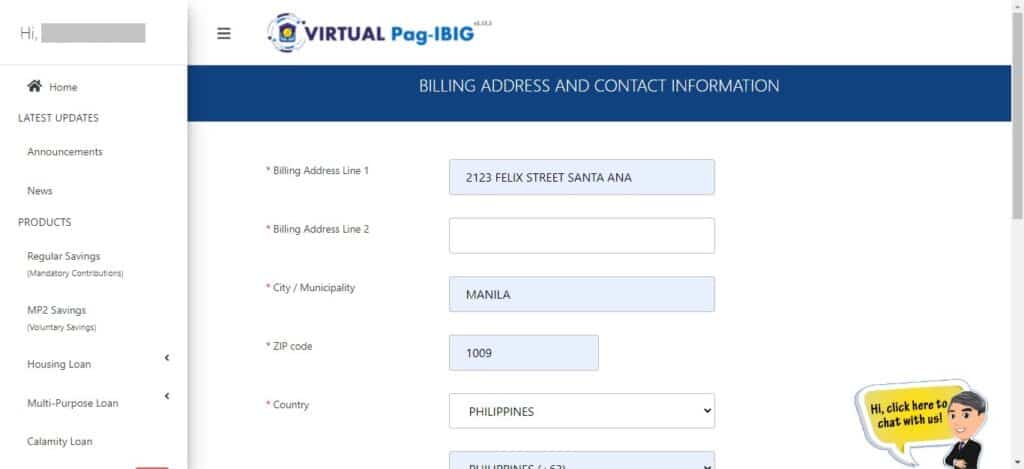

- Input the proper information including the MP2 account number, then you’ll be redirected to a Paymaya landing page.

- Choose GCash and go through payment. Take note that there’s a Php 5 fee included.

Other Questions

Is having a Virtual Pag-IBIG account required to be able to invest in MP2 Savings?

No, you just need a MID — meaning if you’ve been paying your contributions either voluntarily or via salary deductions, you can invest in MP2.

Do you need to add on your MP2 Savings investment every month?

No, beyond the first Php 500, the additional investments are optional. But of course, if you want bigger dividends, you should make it a habit. Your investment will not change if you don’t put in any amount.

Is there a limit on how much you can add to your MP2 Savings using GCash?

GCash has a Php 100k limit monthly for transactions. But if you link any bank account or Payoneer to your account, it will expand to Php 500k.

Unlocking Higher Account Limits

You can unlock higher limits by linking your BPI/UnionBank or your Payoneer account/s and utilizing either GSave or GInvest / GInsure with a Php 100 deposit or investment.

Once you do so, you will be able to unlock:

- A bigger wallet limit – Php 500,000 maximum

- Higher incoming limits – you will be able to receive up to Php 500,000 in your wallet and daily cash-ins have no limitations

- Higher outgoing limits – withdrawals will have no limitations per month, and you can withdraw up to Php 10,000 per day

You will be receiving an SMS informing you of the increased limits.

Take note that once you’ve unlinked all of your BPI/UnionBank/Payoneer accounts, the limits will revert back to what it was before.

Summary

I wrote about the benefits of having investments to beat inflation — especially nowadays when we have high inflation due to the stimulus packages while in this pandemic. The Pag-IBIG MP2 Savings account offers yearly dividends to holders for up to a period of 5 years. Another advantage is the dividends are tax-free and guaranteed by the government.

I described how to create an MP2 account on the Pag-IBIG site, and how to put in your initial investment via GCash. Hopefully, this would make it easier for everyone to start putting their money into these kinds of investment vehicles.

For other investment-related posts, you can check out:

- Guide to GInvest

- How to invest in COLFinancial using GCash

- How to put money into your Binance account

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

I PAID MY MP2 CONTRIBUTION TODAY 09/24/2022 WHICH IS SATURDAY I CANNOT SEE THAT IT IS REFLECTING ON MY PAG-IBIG WEBSITE SHOULD I WAIT UP UNTIL MONDAY TO FRIDAY TO CHECK IF IT’S ALREADY REFLECTING.

Yes, minsan matagal siyang makita