We talk about some examples of easy, pain-free passive income investments in GCash in this post.

Disclaimer: This post aims to educate and not to give financial advice. Investments have different risks, and it is up to the investor to do due diligence and make decisions regarding his money.

Passive Income is an achievement many people strive for, including myself. In simple terms, passive income needs an investment of time or money to make money without actively maintaining it. Active income on the other hand needs you to spend a huge chunk of your time every day to maintain it.

The easiest way to achieve wealth is to have multiple sources of income, both active and passive together. Most of us try to focus on only one to two active sources of income at a time, via salary or a business.

Passive Income in GCash

Currently, the only way we can start having passive income in GCash is via investing money. The two available methods are GSave Savings and Dividend Investing.

GSave Savings

GCash is not a bank, but an e-wallet. Hence it can only partner with other online banks for GSave. Currently, there are 4 banks in the GSave Marketplace:

- GSave by CIMB

- #MySaveUp by BPI

- EzySave+ by Maybank

- #UNOready by UNO

Each bank has its own interest rates as long as you deposit an amount. Currently, in my experience, #UNOready is the best as it offers daily compounding at 4.25% p.a. and time deposits at 6.50% p.a.

A caveat though, as “per annum” means “per year” you need to take into account that it’s really small when divided monthly (and even more so daily) and you also need to factor in 12% VAT in your earnings.

Here is an example using #UNOready savings:

Savings = 10000

Annual Interest = 0.0425

Daily Interest = 0.0425/365 days = 0.000116

Gross Daily Interest = 1.16

Net Daily Interest with Taxes = 1.16*0.88 = 1.0208

Basically for every Php 10000 deposited you gain around Php 1 a day as interest.UNO has also a time deposit account available, and you can leverage the higher 6.50% interest but it is prorated on the number of months you want it locked.

For the other savings products, here are the corresponding details:

| Features | #MySaveUp by BPI | GSave by CIMB | EzySave+ by Maybank | UNOready by UNO |

| Minimum Monthly Average Daily Balance (ADB) | Php 3000 | None | None | None |

| Maximum Deposit Amount | Php 30000 | Php 100000 | None | None |

| Required Daily Balance for Interest | Php 5000 | None | None | None |

| Interest Rate per Annum | 0.0925% (Need to have Php 5000 ADB) | ~2% | 0.35% | 4.5% for above Php 5000; 3.5% for below Php 5000 |

| Required activity (need to use by limit) | 30 days | 60 days | None | 2 years |

Savings are generally safer than other investments as these are insured by PDIC. And you have also the benefit of being liquid, meaning you can use the cash when you need it. For investments that you can lock for a longer time in exchange for a higher interest, you can also choose dividend investing.

Dividend Investing

Dividend investing is a method of investing that is focused on mainly getting dividends. This is in contrast with most types of investments where you need to sell the investment to realize your gains.

The benefits you get with dividend investing include:

- Having passive income regularly

- Ability to compound gains by reinvesting the dividends

- No need to “time” the market to find the best time to sell

- Capital growth for some investments like stocks

Dividend investing works very well when you also practice peso cost averaging, as you can also reinvest dividends (also called DRIP, or dividend reinvestment plan).

Some dividend investments that you can delve into using GCash are:

- ATRAM Global Multi-Asset Income Fund in GFunds

- PAG-IBIG MP2 / SSS WISP Plus (via Pay Bills)

- Dividend Stocks in GStocks PH

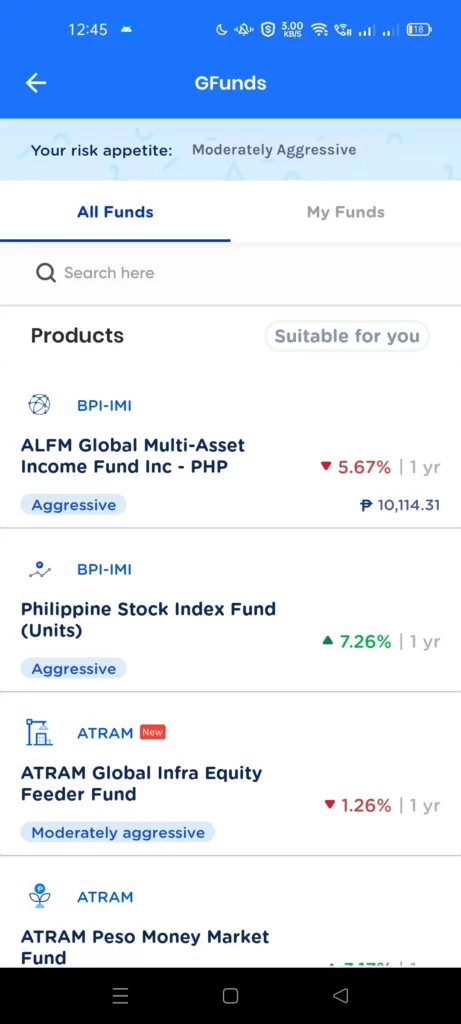

ATRAM Global Multi-Asset Income Fund in GFunds

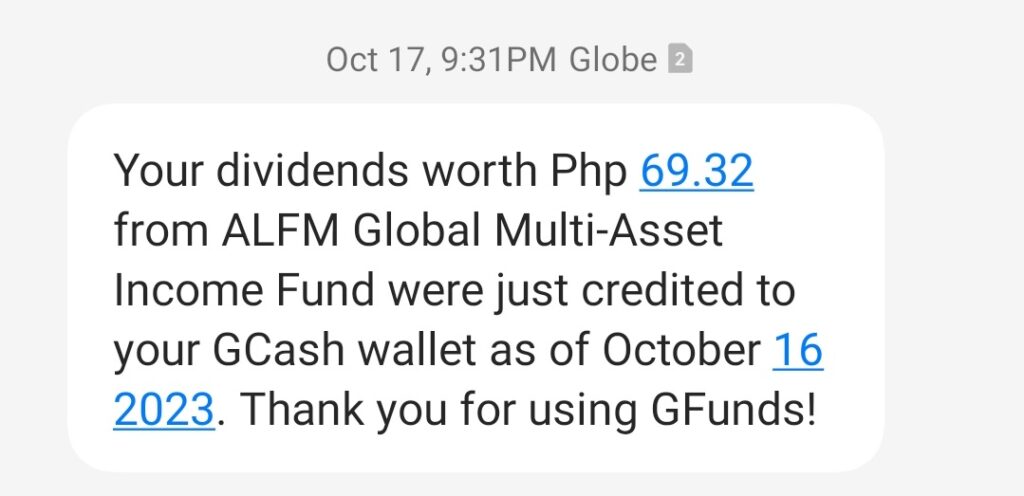

The simplest method here is investing in GFunds because you only need to opt into GCash. Buying more shares is easy as it can be done within GFunds as well. You will be receiving dividends monthly in your GCash account depending on the amount invested.

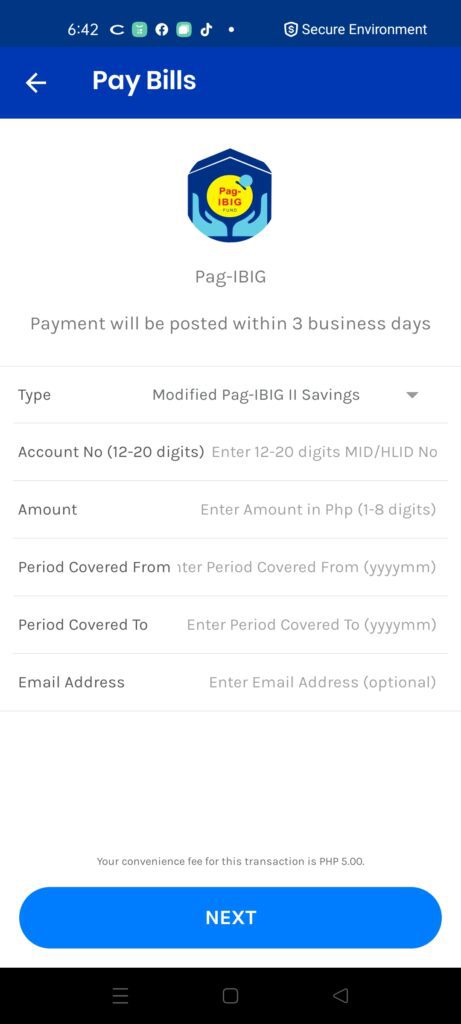

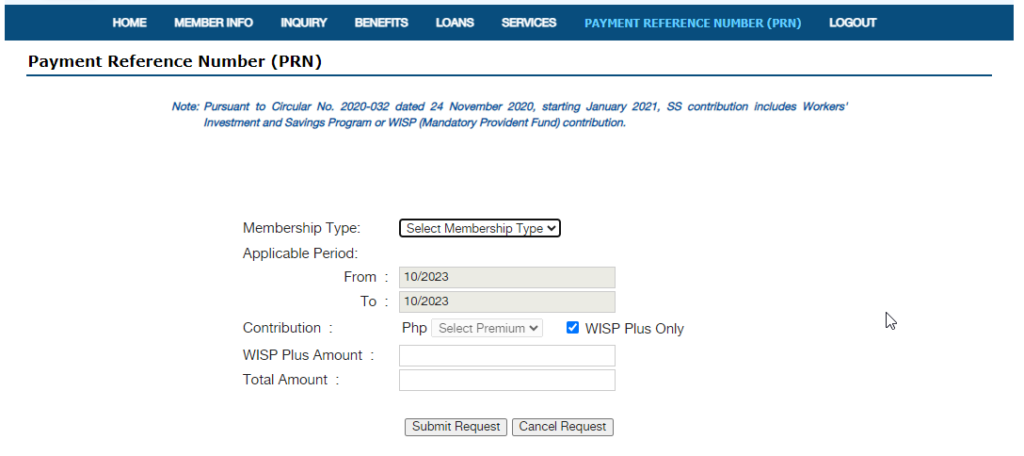

PAG-IBIG MP2 / SSS WISP Plus in GCash Pay Bills

PAG-IBIG MP2 and SSS WISP Plus are both government trust funds. You need to open these accounts using their respective websites. The earnings are both “locked” in 5 years — for MP2, you need to withdraw and reinvest after 5 years, while in WISP Plus you can keep the funds until retirement, but are withdrawable in full after 5 years.

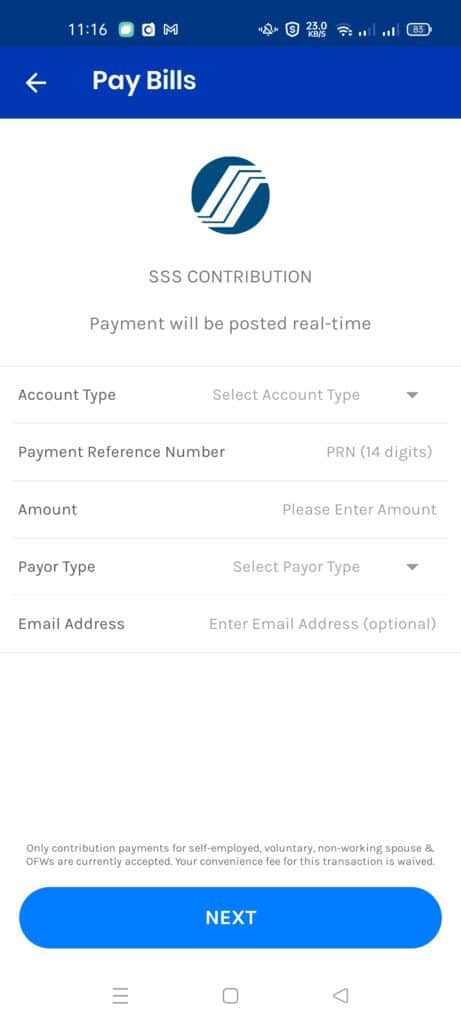

Buying more is also easy — in MP2, you just need your MP2 account number in GCash Pay Bills; in WISP Plus, you need to generate a PRN in the SSS portal and then pay it in GCash.

Last year, PAG-IBIG MP2 had a 7.03% dividend rate, while WISP had none as it just started in late 2022. But please take note that these rates are not representative of future gains.

Dividend Stocks in GStocks PH

Stock picking is generally harder as you need to research the viability of a stock. Also, a high dividend yield does not mean the stock is good value. However, you can buy blue chips and real-estate investment trusts (REITs) and practice peso cost averaging.

You should also take note of the ex-dates (dividend dates) so that you can reinvest your earnings into the same stocks. Another thing to note is that stocks in the PSE all have minimum lot sizes to purchase (10s, 100s, 1000s, etc) so investing regularly needs a higher amount to cover a minimum lot size. Topping up funds in GStocks PH is also not instant as it needs to clear the broker first before you can buy the stocks.

Buying stocks in GStocks PH is easier than other brokers as it is inside the GCash app already, and inputting forms is minimized as it uses your GCash account details to register you.

Summary

I talked about some ways of investing using GCash to get passive income. Passive income emphasizes little to no maintenance while putting in your time or money. The easiest ways are via GSave savings and dividend investing through GFunds, PAG-IBIG MP2/SSS WISP Plus, and GStocks PH.

The main driver of having the biggest gains from these types of investments is reinvesting earnings and doing peso cost averaging via scheduled investing.

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services: