This post explores how we can best leverage bank cash-in methods on the GCash app.

As we go towards Week 4 of the Community Quarantine, I’m getting some comments about creating a tutorial for people with bank accounts. As we all know, it’s currently a bit troublesome to go for over-the-counter cash-in options because of the different schedules for each location.

So for many people, there is no choice but to move funds through bank accounts. I’ve written this guide for those who find this unclear.

How do I cash in using non-bank channels?

I have a post explaining everything about over-the-counter and self-service kiosks here.

Cashing in from Bank Channels

There are officially three ways to do this — we can either go through a bank integration, a debit card link or an Instapay send from a bank app. Take note that for the first two options, you cannot see your balance in the GCash app. I would recommend checking it beforehand before cashing in.

1. Cashing in using Online Banks (BPI / UnionBank)

There are currently two bank integrations within the GCash app. If we have either BPI or UnionBank bank accounts, then it should be easier to cash in because you don’t need to enter an OTP (one-time password) every time you want to.

BPI is one of the first bank integrations because of its ties with Ayala Corporation and Globe Telecom. For UnionBank, they are just that tech-savvy. They have a great emphasis on tech innovations and this makes them have the best banking app in my opinion.

How do I link my BPI account to GCash?

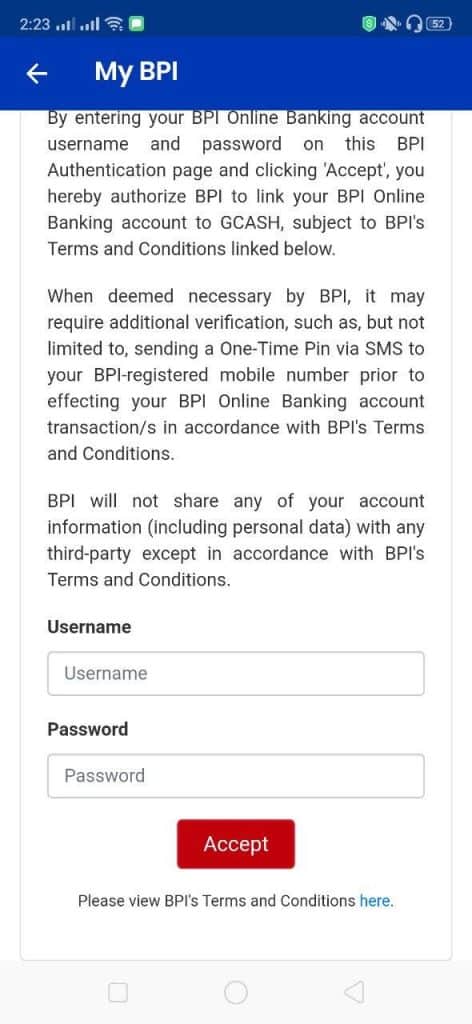

You should have an enrolled account in BPI ExpressOnline first. If you need some pointers about how to do that, you can refer to their guide. Once you have an enrolled account, linking it in GCash is just a matter of inputting your BPI account username and password.

Linking your BPI account to GCash

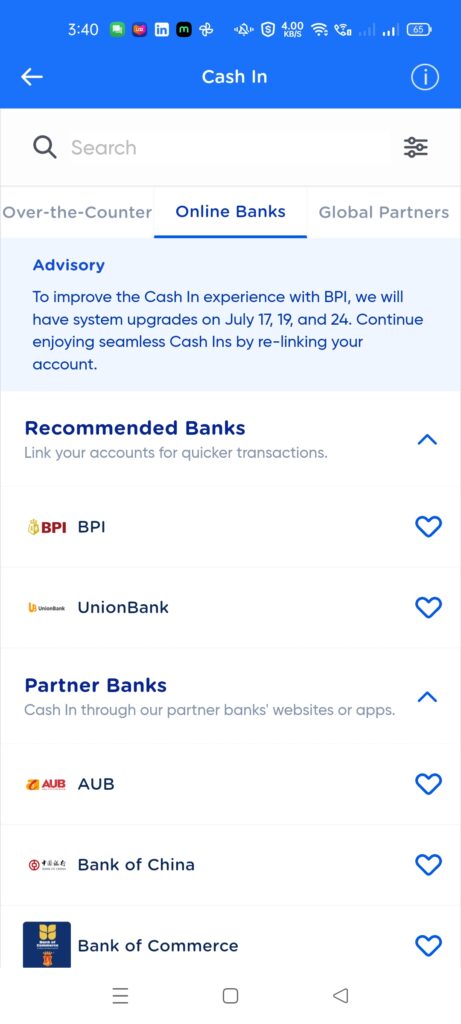

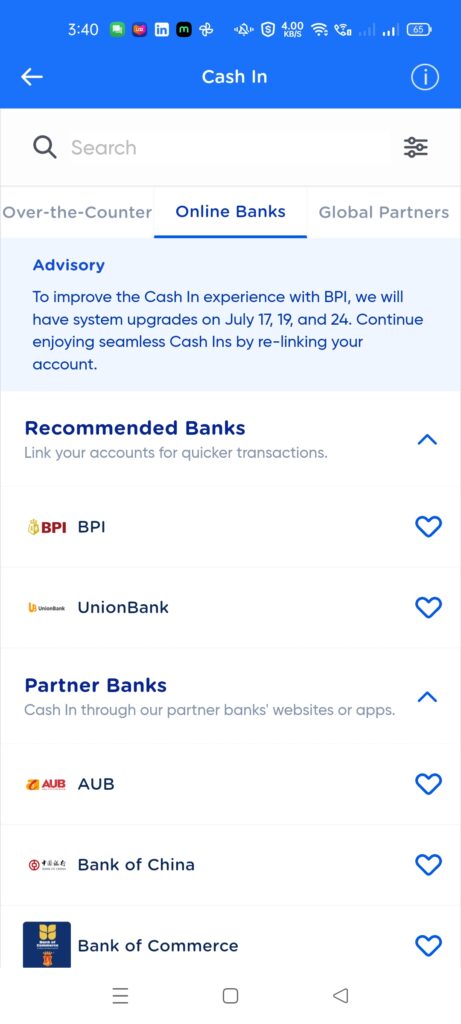

- From the main GCash page, click on the Cash In button.

- On the Cash In page, click on Online Banks, then click on BPI.

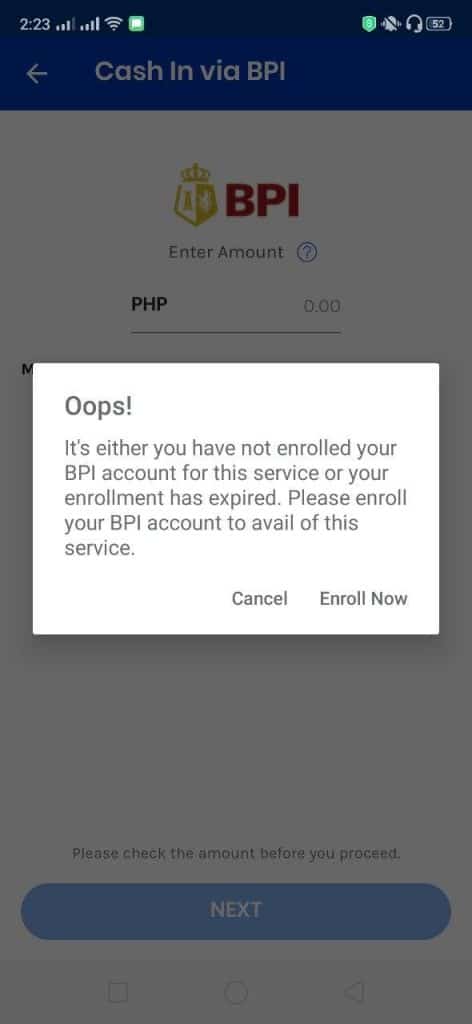

- You need to enroll in your account. A notice will display if you haven’t enrolled yet.

- Enter your BPI username and password on the opt-in page. You will need to confirm using OTP.

- Once done, you will see the BPI Registration Success page.

Can I also link the same BPI or UnionBank account to another GCash account?

Yes, you can link to different GCash accounts, but please take care not to link to any unauthorized account.

How do I create an account in UnionBank? How do I link it to my GCash account?

Creating an account is easy and even verification can be done within the UnionBank app.

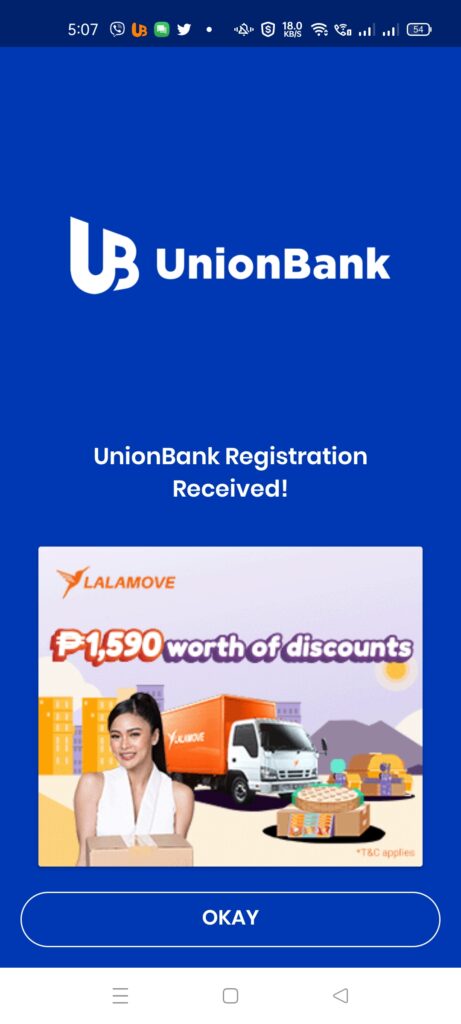

Linking your UnionBank account to GCash

- From the main GCash page, click on the Cash In button.

- On the Cash In page, click on Online Banks, then click on UnionBank.

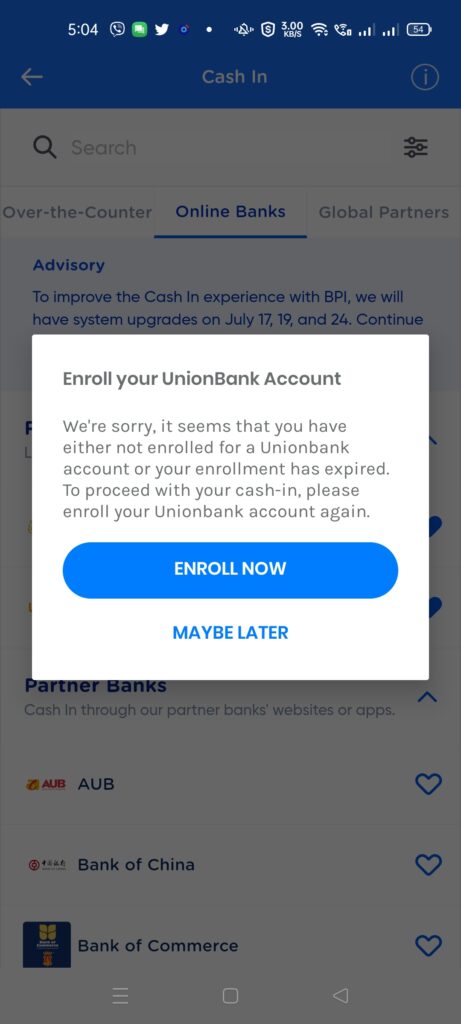

- You need to enroll in your account. A notice will display if you haven’t enrolled yet.

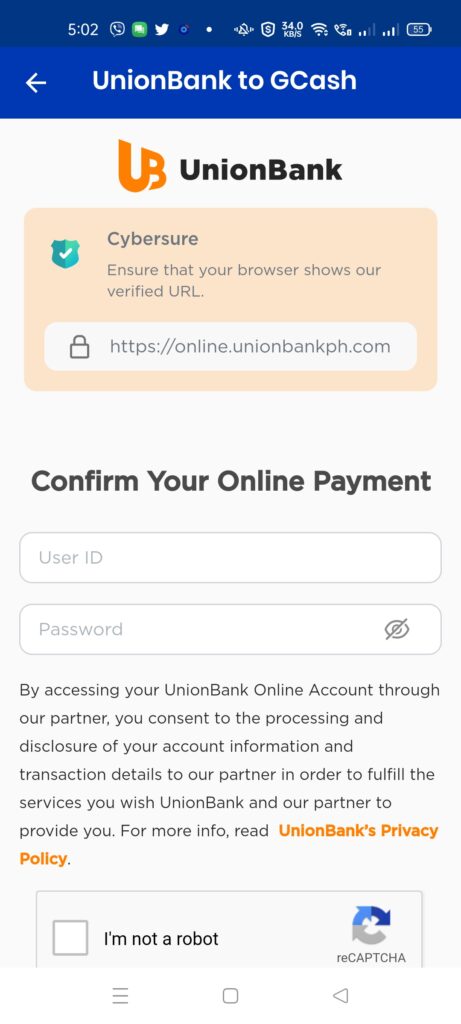

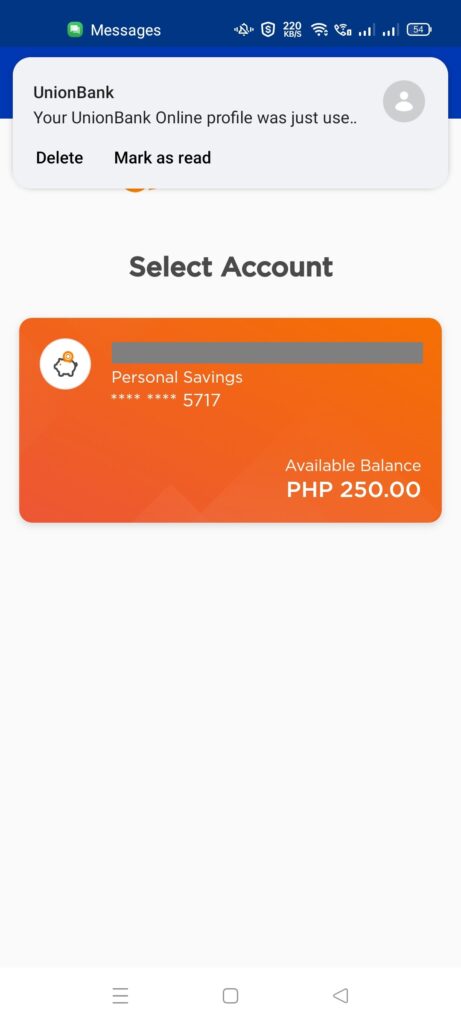

- Enter your UB username and password on the opt-in page. You will need to confirm using OTP.

- Once done, you will see the UB Registration Success page.

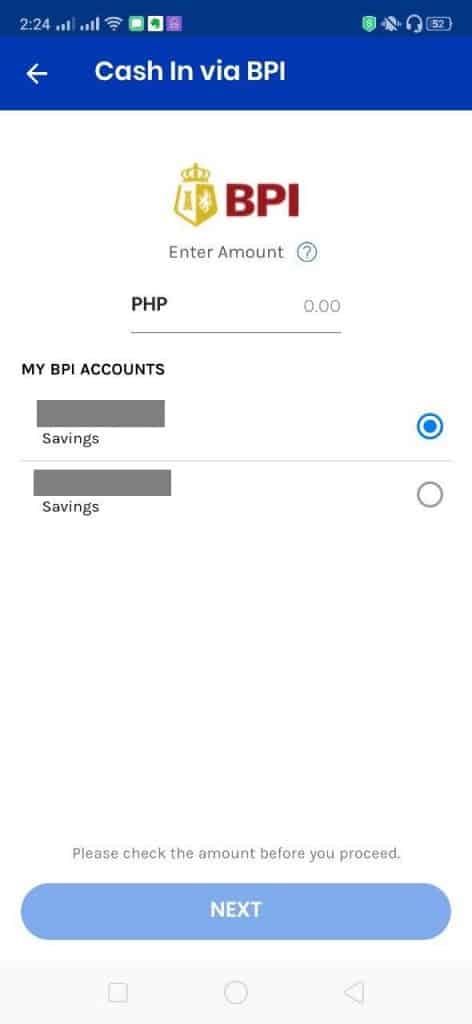

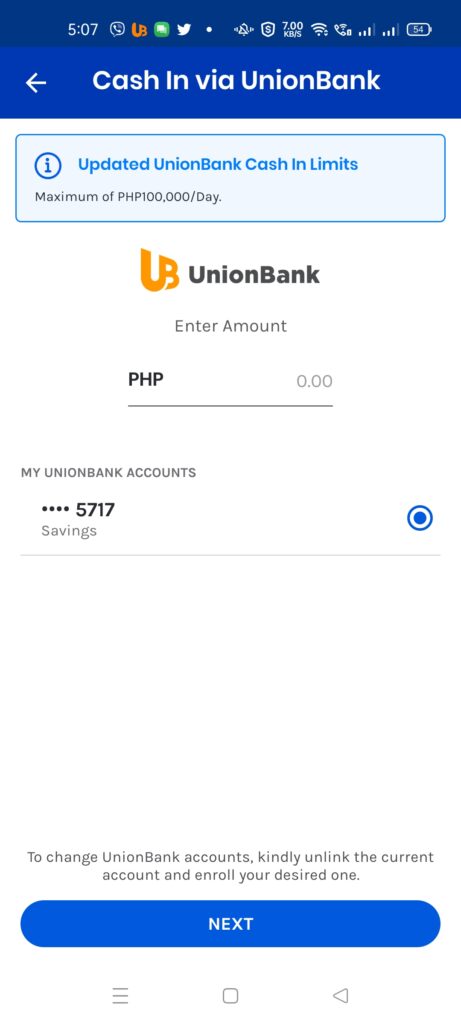

How do I cash in once I’ve linked either my BPI or UnionBank account?

You can either click on the BPI or the UnionBank options and you can cash in directly, without the need for an OTP.

Is there a cash-in limit?

Initially, for BPI, there is a per transaction limit of Php 10,000. But as you use it you will eventually unlock Php 50,000 per day. For UnionBank, the limit is Php 100,000 per day.

Also, keep in mind that a verified GCash account without upgrades has a cumulative limit of Php 100,000 per month.

Unlocking Higher Account Limits

You can unlock higher limits by linking your BPI/UnionBank or your Payoneer account/s and utilizing either GSave or GInvest / GInsure with a Php 100 deposit or investment.

Once you do so, you will be able to unlock:

- A bigger wallet limit – Php 500,000 maximum

- Higher incoming limits – you will be able to receive up to Php 500,000 in your wallet and daily cash-ins have no limitations

- Higher outgoing limits – withdrawals will have no limitations per month, and you can withdraw up to Php 10,000 per day

You will be receiving an SMS informing you of the increased limits.

Take note that once you’ve unlinked all of your BPI/UnionBank/Payoneer accounts, the limits will revert back to what it was before.

What do I do if I encounter an error?

You can try again later as sometimes there is downtime. But if the issue persists, then you can file a support ticket with GCash support.

2. Instapay Sending from Bank App

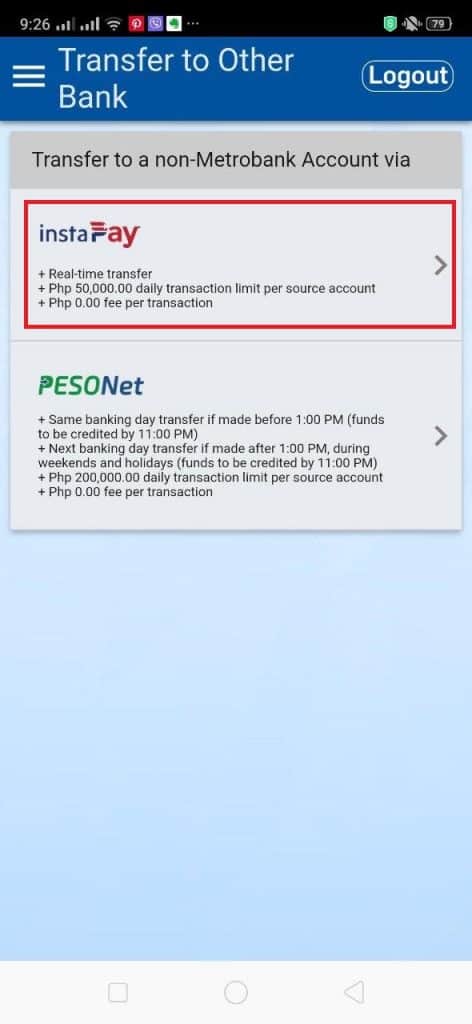

The second option is via Instapay sending using your bank app. You can use any banking app as long as it supports Instapay, not PESONet.

What’s the difference between PESONet and Instapay?

The main difference is the speed and the amount being transferred. Instapay has a Php 50,000 amount limit per transaction, but the speed you can send the amount is instant, hence the name.

PESONet has no set amount limit because it is used for volume transactions. Because of this, the clearing time is longer and can take up to a day to process.

For GCash, it currently only supports Instapay receiving from other banks.

Can I send to GCash from other digital wallets like Paymaya, Coins.ph, and GrabPay?

Yes, since most of them also receive Instapay transactions.

Are there any fees for using Instapay to send to my GCash wallet from the bank app?

Yes, but since we are all in quarantine, some banks have waived all fees.

Normally there are fees for the different banks. Here are the transaction fees for the different banks if you initiate a transfer using their individual apps:

Here are the InstaPay fees for most banks (as of Jan 24, 2025):

- AUB: Php 8

- BDO: Php 25

- BPI: Php 25

- Chinabank: Php 15

- Coins.ph (DCPay): Php 10

- East West: Php 10

- Landbank: Php 25

- Maybank: Php 10

- Metrobank: Php 25

- Maya: Php 15

- PBCom: Php 20

- PNB: 20

- PSBank: Php 15

- RCBC: Php 25

- Union Bank: Php 10

You can also refer to the BSP Instapay fees list if your preferred bank is not here.

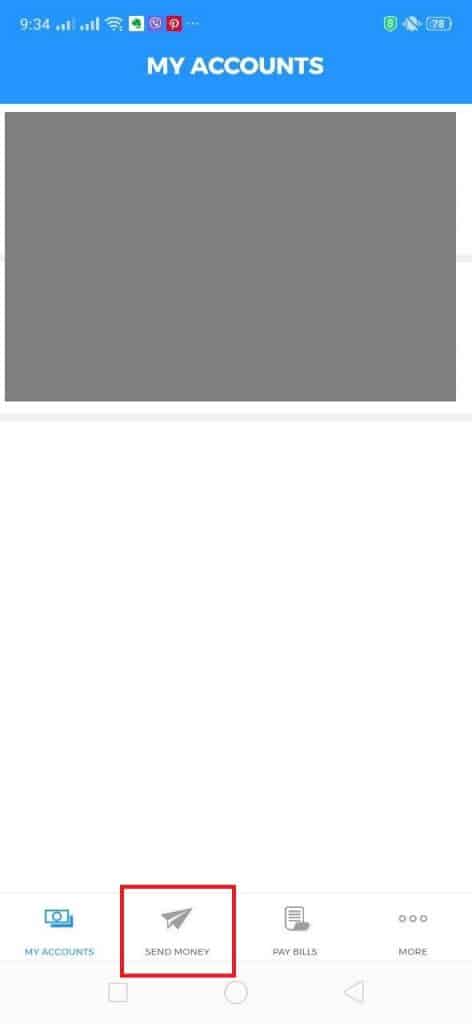

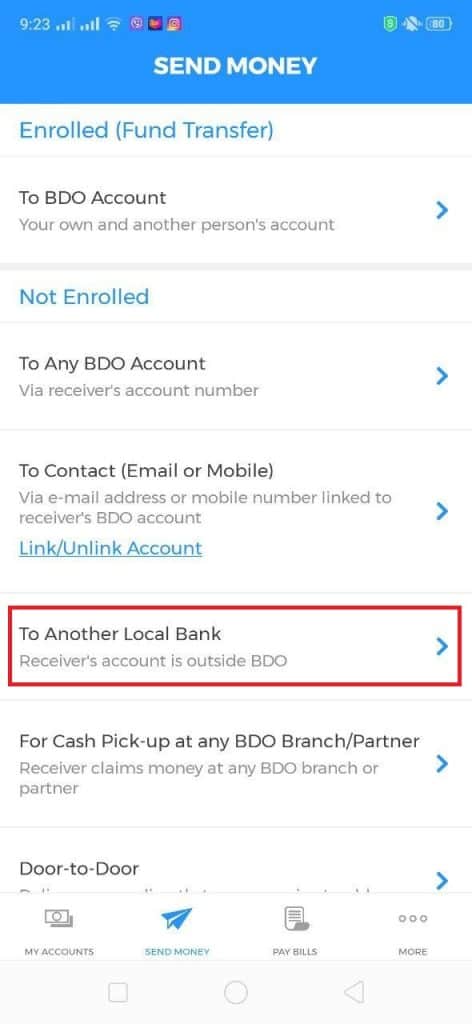

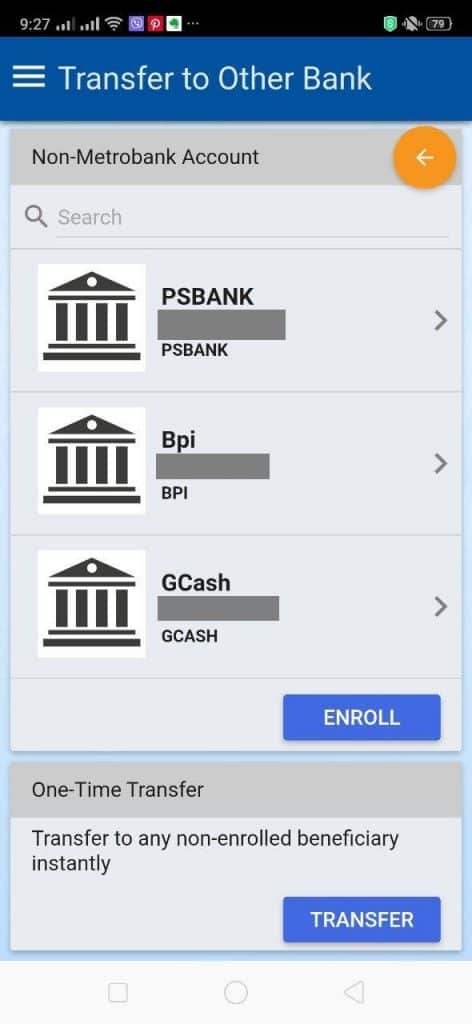

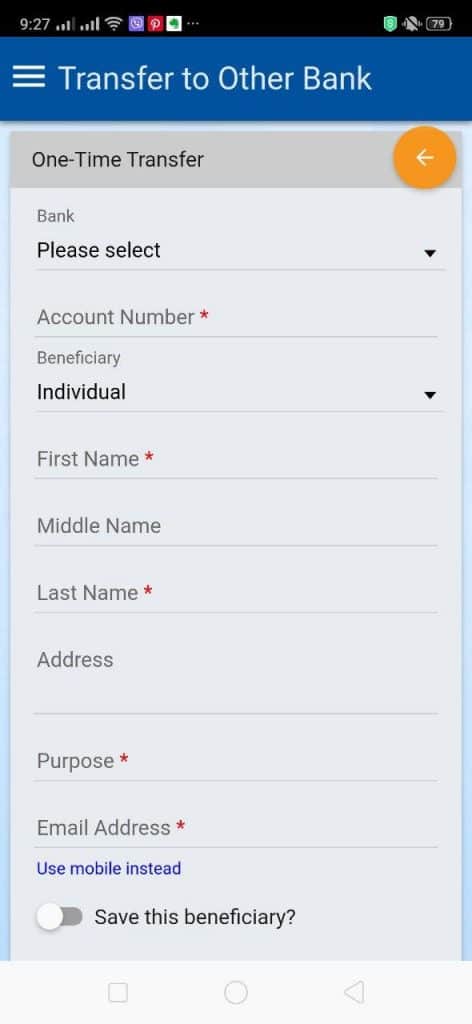

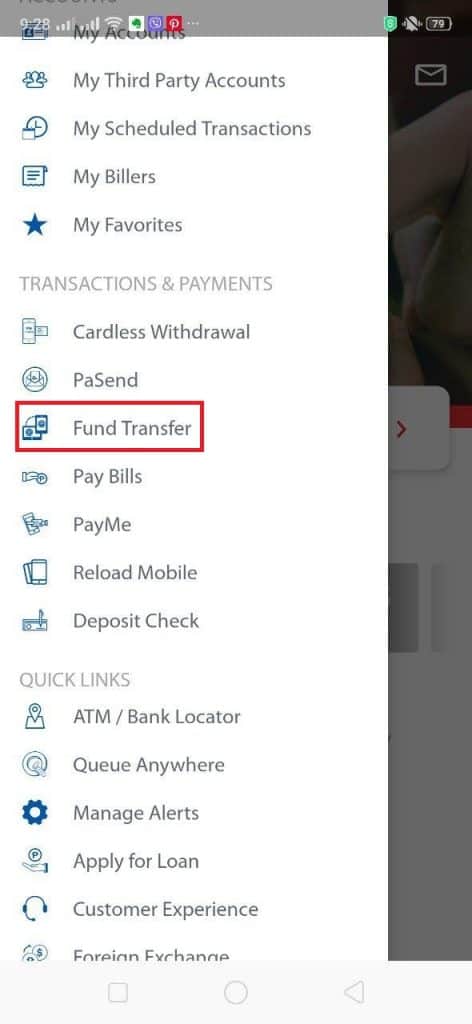

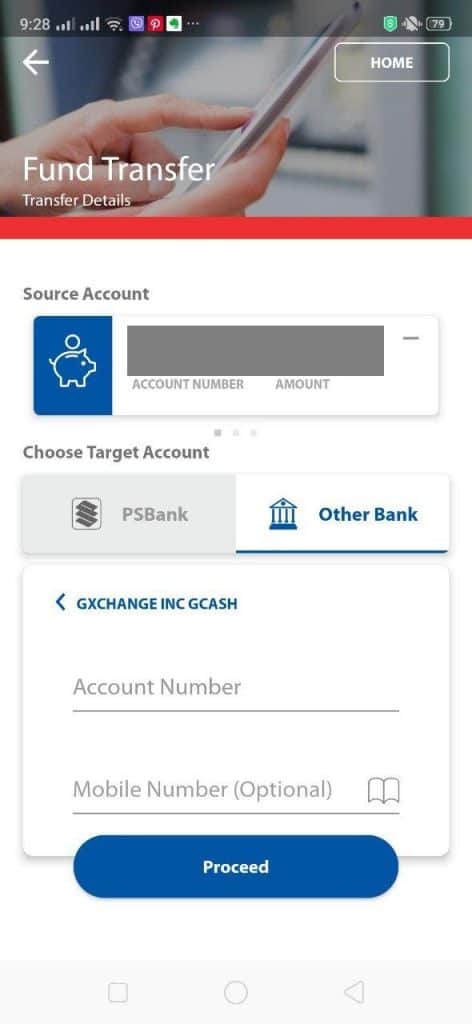

How do I initiate a bank transfer from my banking app to my GCash wallet?

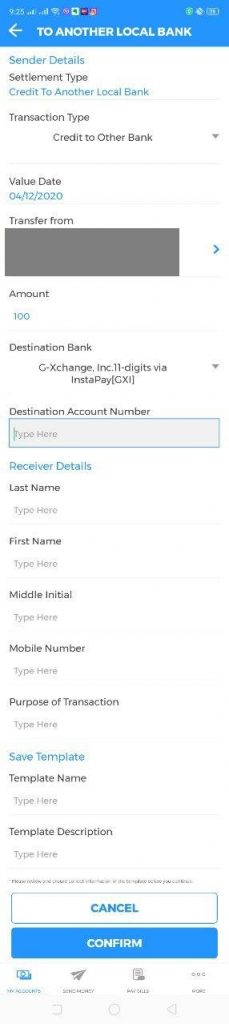

Generally, you need to find the Send to Bank option within the app and look for “G-XChange, Inc” or “GCash” in the options. The account number is your GCash mobile number, and the account name is your registered name.

As I have only BDO, Metrobank, and PSBank apps, I cannot add screenshots for the other banking apps. You can check out the steps for your specific banking app under the Online Banks section of the GCash Cash-In page.

BDO

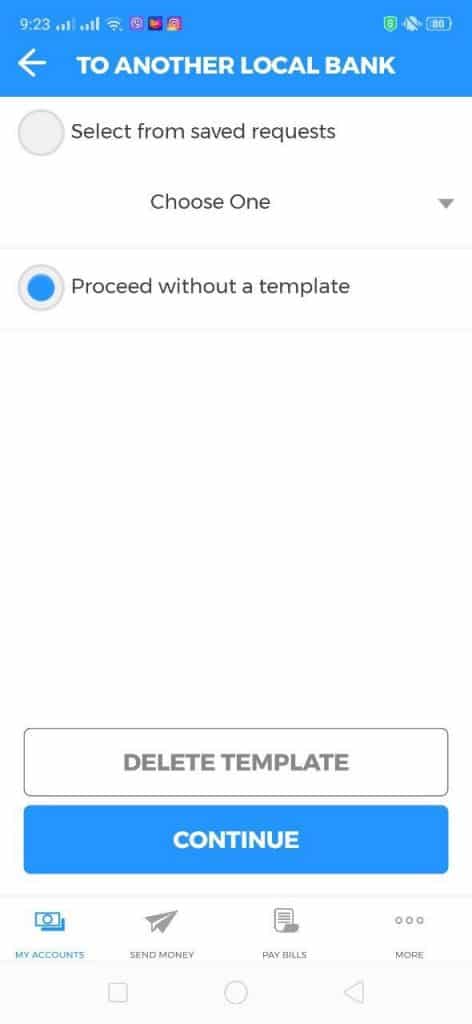

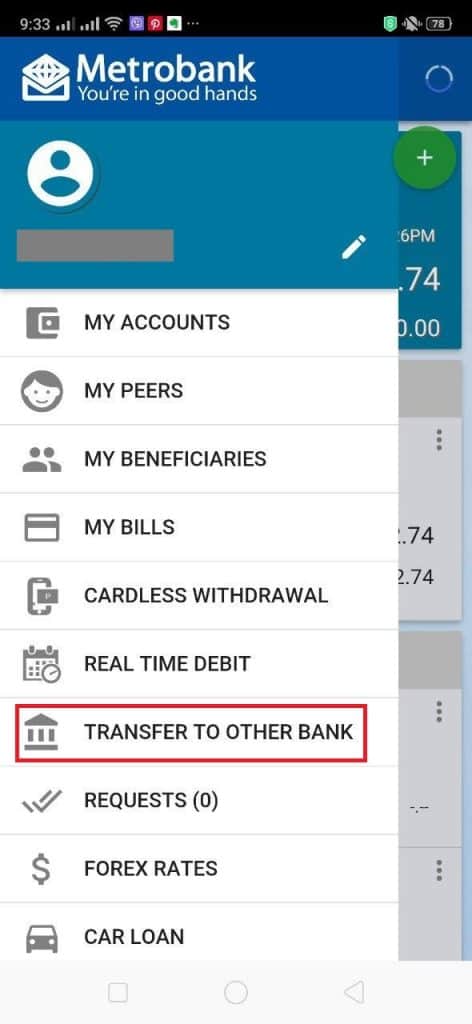

Metrobank

PSBank

Summary

I’ve talked about the three ways you can cash into your GCash account via bank channels. You can either use the BPI or UnionBank integration with GCash, enroll your debit card to GCash, or transfer via Instapay to GCash from your respective bank app or digital wallet.

Once you’ve cashed in, you may be looking for ways to use GCash. Here are some other posts I recommend:

- Paying for Food Delivery Apps (FoodPanda, GrabFood)

- Paying for Delivery Apps (GrabExpress, Lalamove)

- GCash x Codashop

- GCash and Streaming Apps (Netflix, Youtube Premium, etc)

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services: