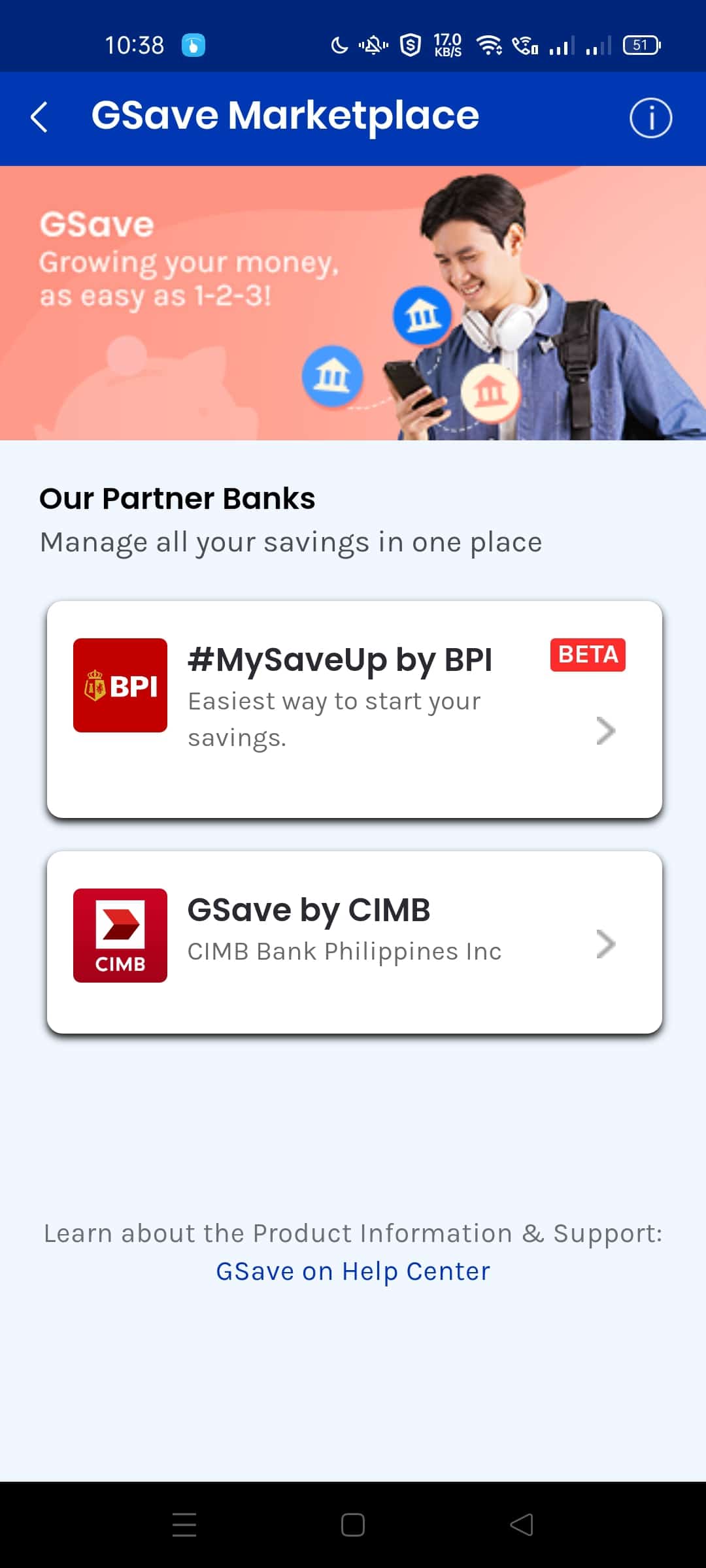

GSave now is a marketplace. I’ve updated the old GSave post to reflect the changes, but there is also a need for a new post that explains how to create and use the new MySaveUp by BPI savings account.

What is MySaveUp by BPI?

GCash wants users to have multiple choices for opening up savings accounts in GSave. BPI has put its hat in the ring with MySaveUp. It works similarly with GSave by CIMB, but with a few differences:

| Features | #MySaveUp by BPI | GSave by CIMB | EzySave+ by Maybank | UNOready by UNO |

| Minimum Monthly Average Daily Balance (ADB) | Php 3000 | None | None | None |

| Maximum Deposit Amount | Php 30000 | Php 100000 | None | None |

| Required Daily Balance for Interest | Php 5000 | None | None | None |

| Interest Rate per Annum | 0.0925% (Need to have Php 5000 ADB) | ~2% | 0.35% | 4.5% for above Php 5000; 3.5% for below Php 5000 |

| Required activity (need to use by limit) | 30 days | 60 days | None | 2 years |

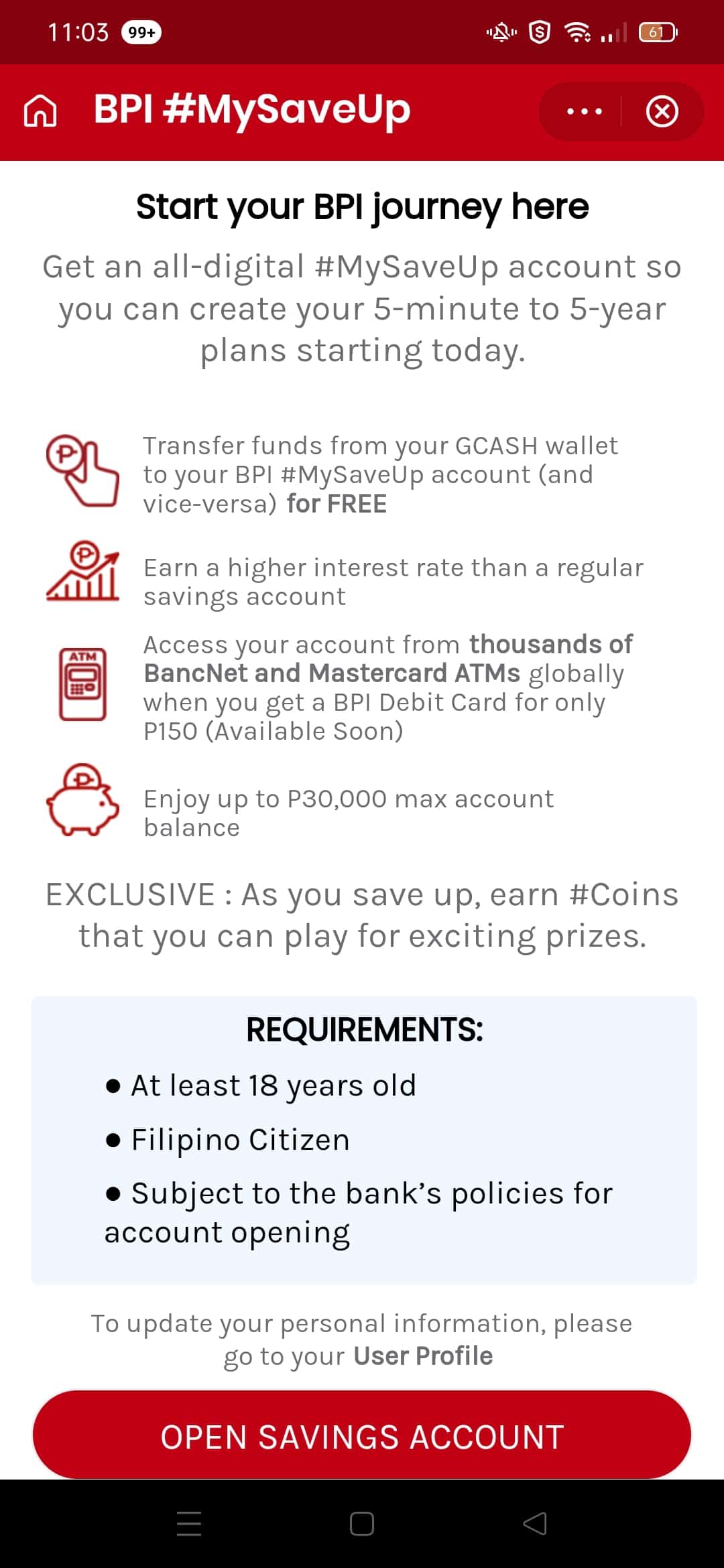

What are the requirements to create a MySaveUp by BPI account?

The requirements are:

- Need to be Fully Verified

- Age is at least 10 years old

- Should be a Filipino citizen

In terms of documents and other information, because they can leverage the know-your-customer (KYC) information of the user, you don’t need to send other requirements, like IDs.

How do I create a MySaveUp by BPI account?

Opting in is easy as you just need to input a few forms — the heavy lifting has already been done via GCash verification and/or by an existing BPI account.

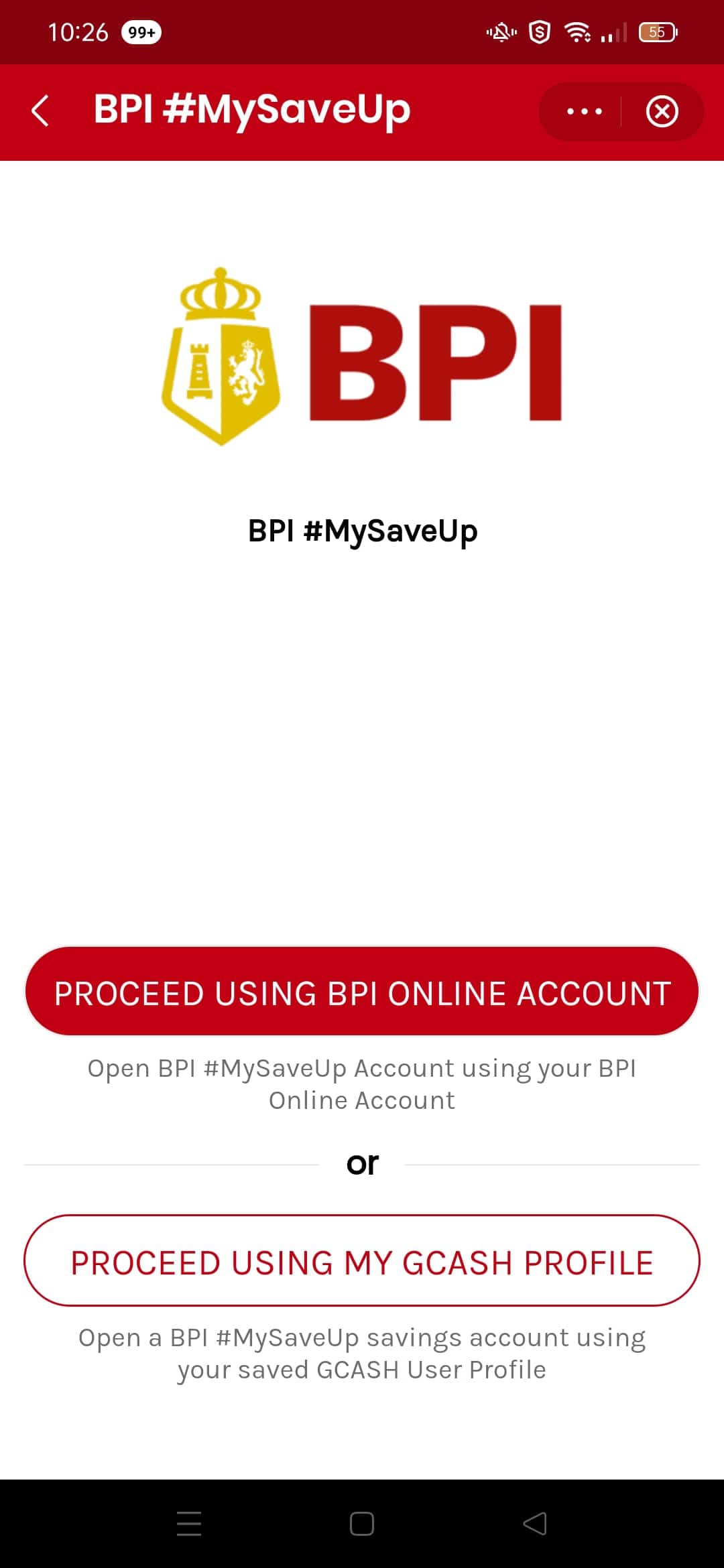

There are two ways of creating a MySaveUp by BPI account:

- Linking your existing BPI Online account

- Creating a new one using your GCash information

Linking your existing BPI Online account

If you don’t have an existing BPI Online account, you can refer to my post about BPI Online cash-in. It has steps for creating a BPI Online account from scratch, as well as linking it to GCash as a cash-in method. You can also see the MySaveUp account in your own BPI Online account and it allows you to move funds to your other accounts if needed.

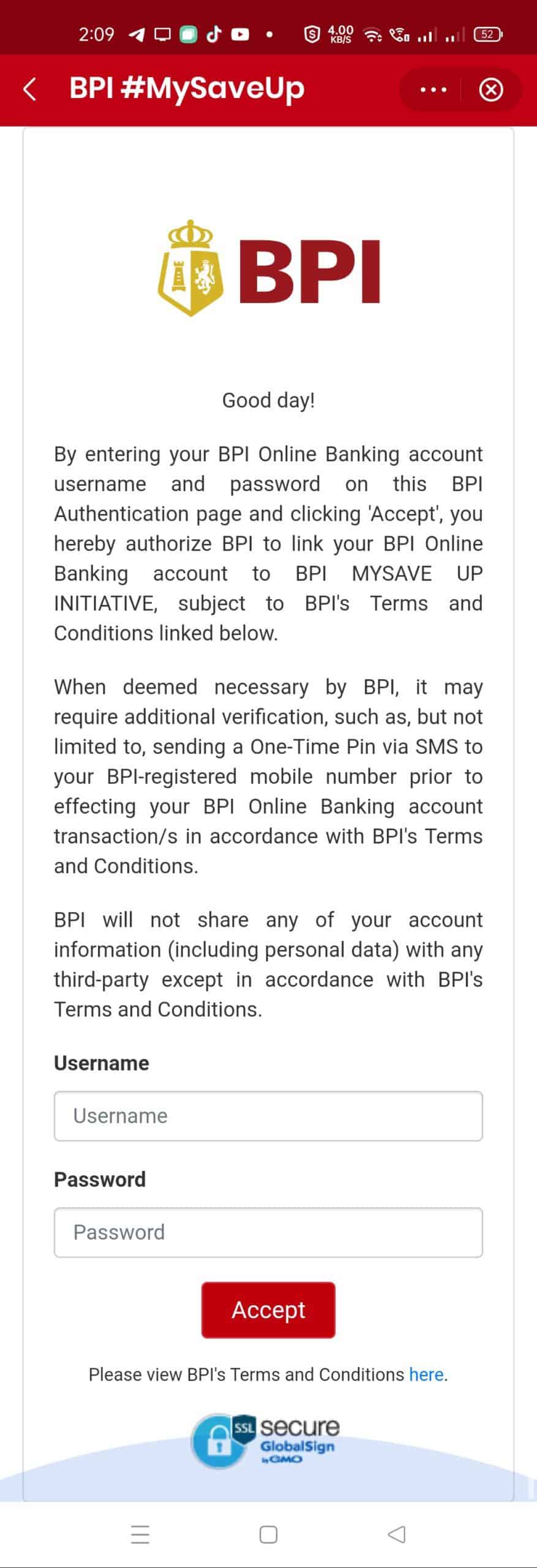

If you already have a BPI Online account, then the linking is easier as you only need to input your username and password.

Linking your BPI Online Account

- Go to GSave Marketplace and click on #MySaveUp by BPI.

- Review the requirements and click on “Open Savings Account”.

- On the next page, click on “Proceed Using BPI Online Account”.

- Input your username and password and click “Accept” on the login page.

- An acknowledgment page will show and you can then use your account.

Creating a MySaveUp by BPI Account by GCash Profile

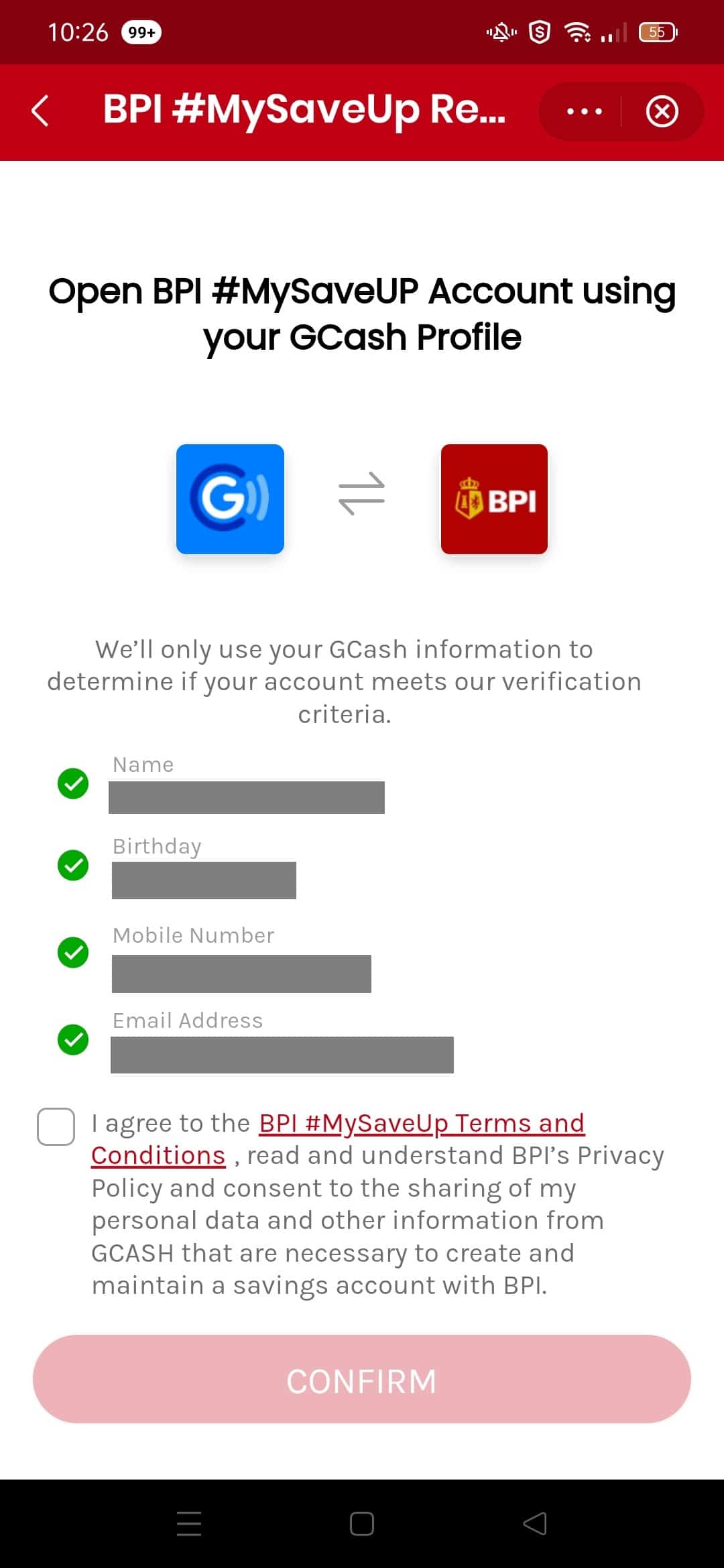

You can also create an account using your GCash information, and it is easier to do than many online apps. The heavy lifting is done by your GCash Know-Your-Customer information, due to being Fully Verified.

Creating a MySaveUp by BPI Account via GCash Profile

- Go to GSave Marketplace and click on #MySaveUp by BPI.

- Review the requirements and click on “Open Savings Account”.

- On the next page, click on “Proceed Using My GCash Profile”.

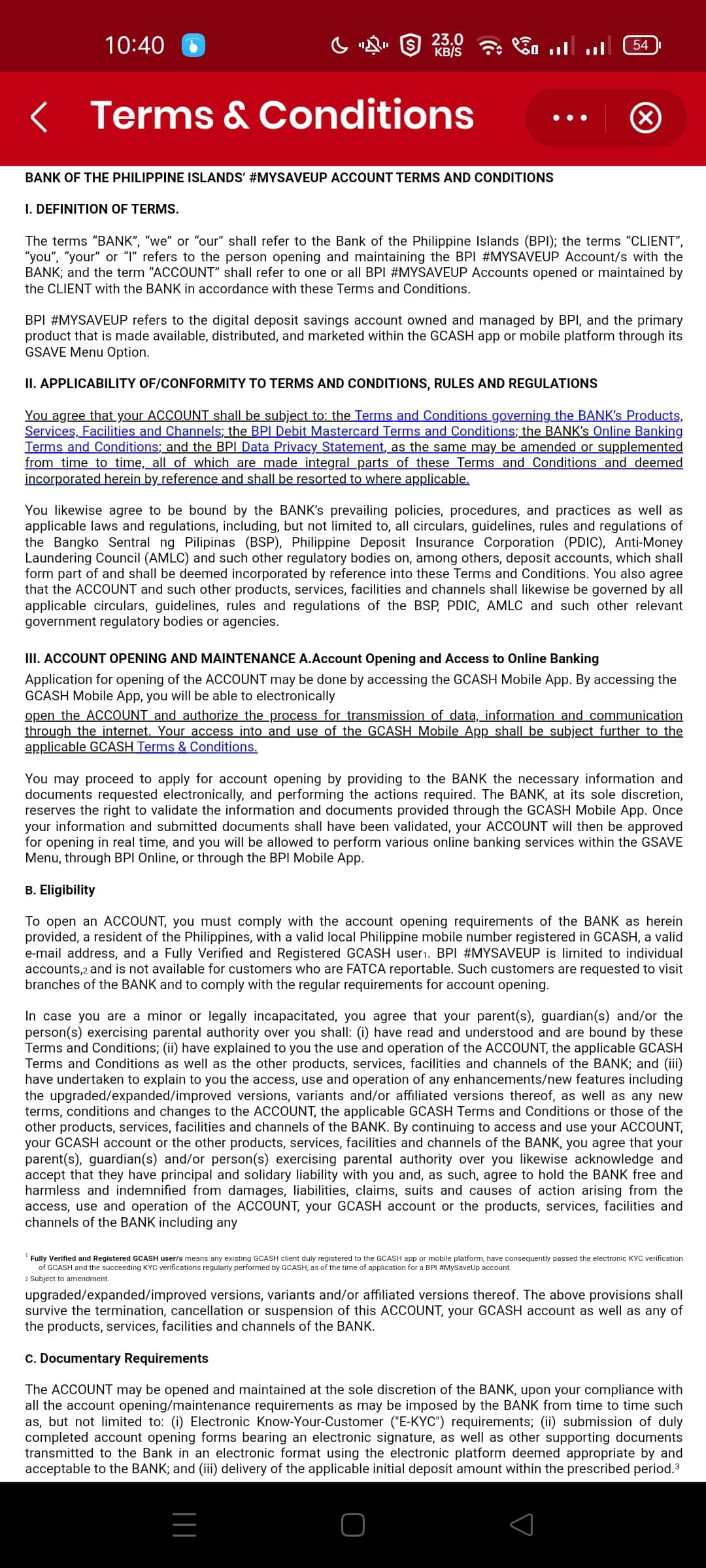

- Confirm your GCash information and click on the Terms and Conditions checkbox.

- While on the Terms and Conditions page, you can click on the back button to go back to the previous screen.

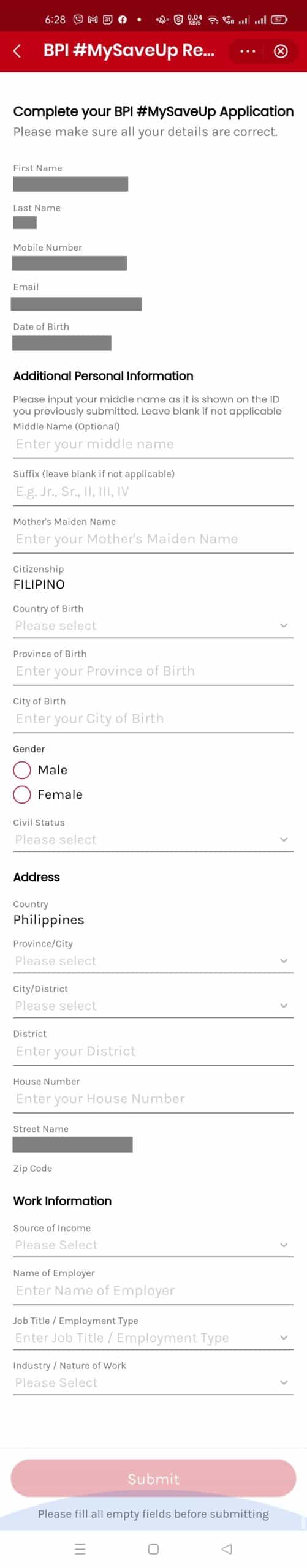

- You need to input more information as this is part of the Know-Your-Customer BSP requirements for opening a bank account. Click on Submit after filling out the form.

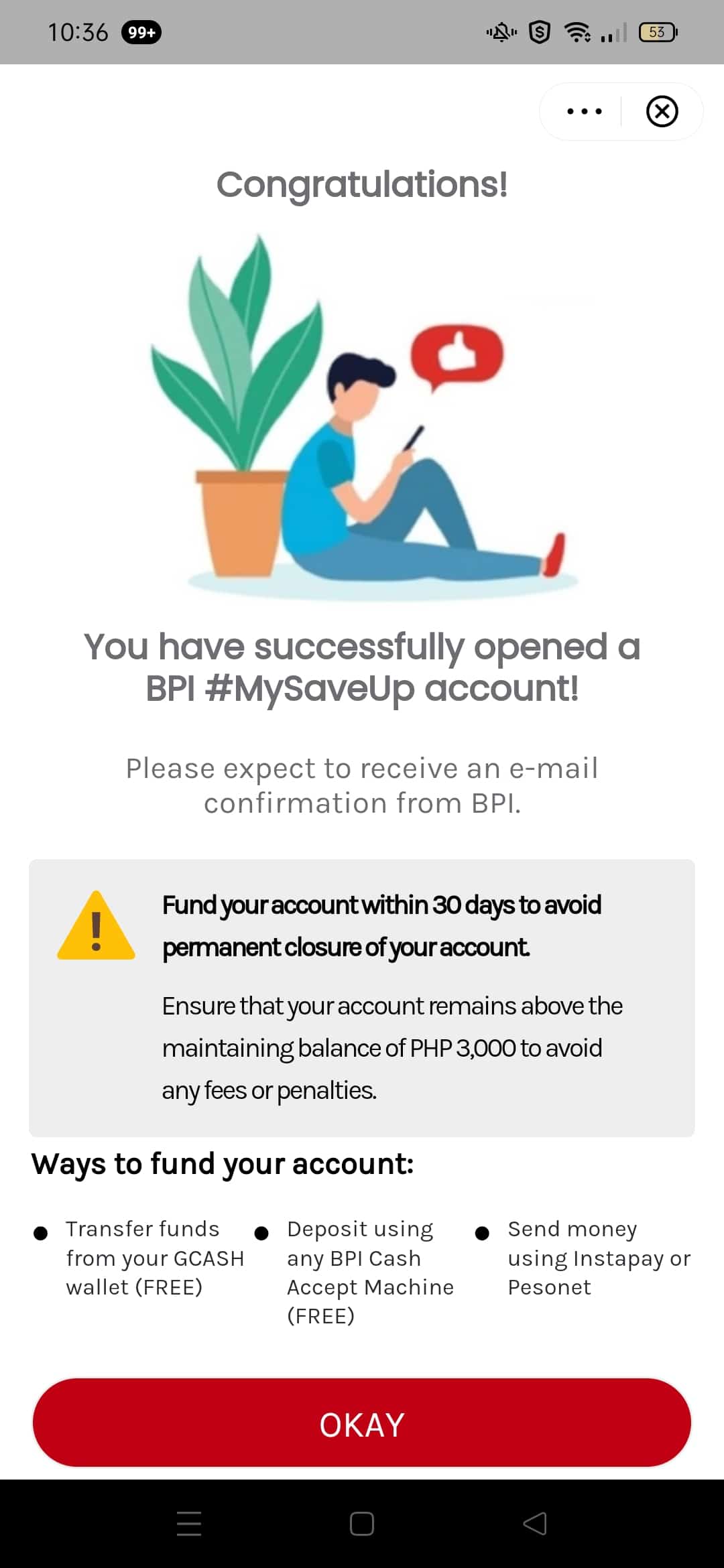

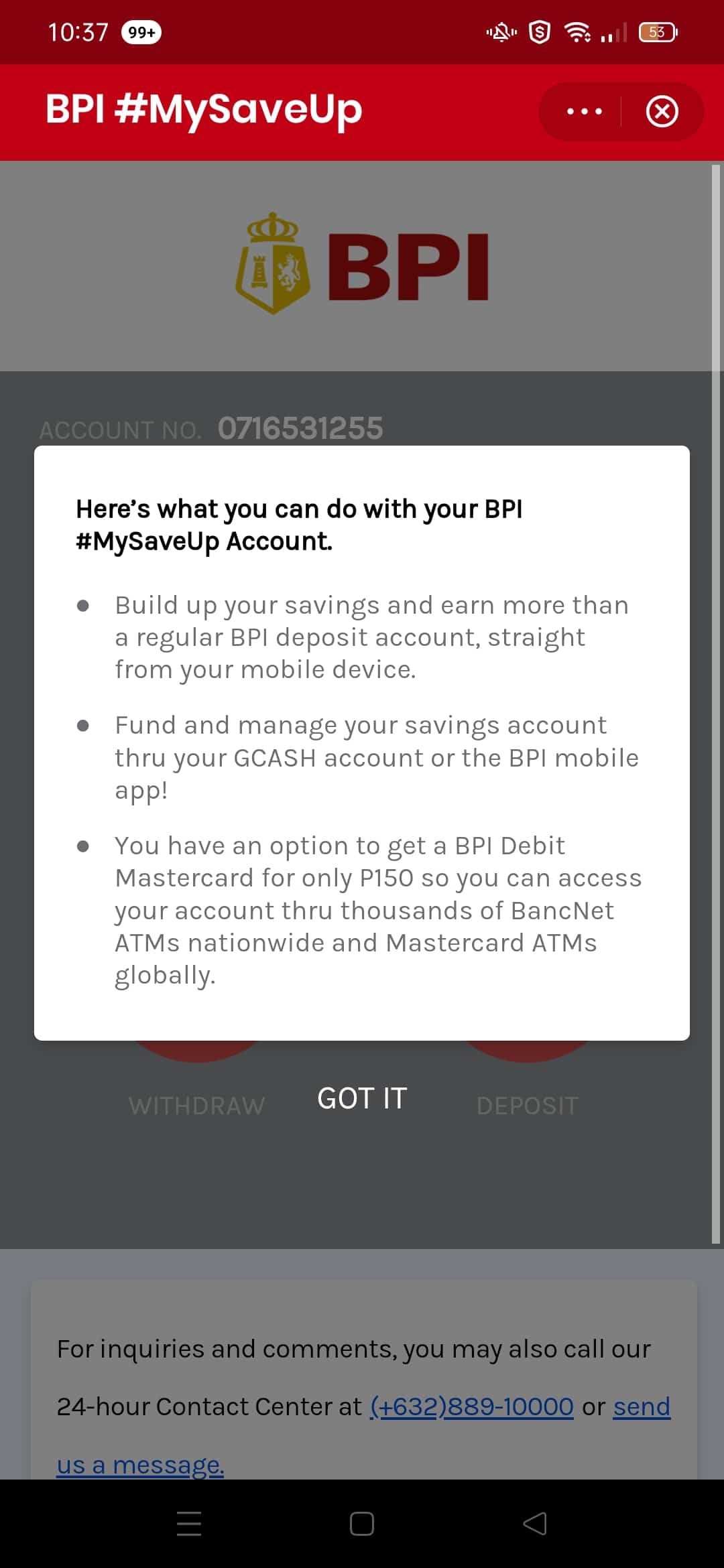

- Once approved, you’ll be seeing the Congratulations page.

- You can now use your account. You need to fund your account within 30 days to prevent closure.

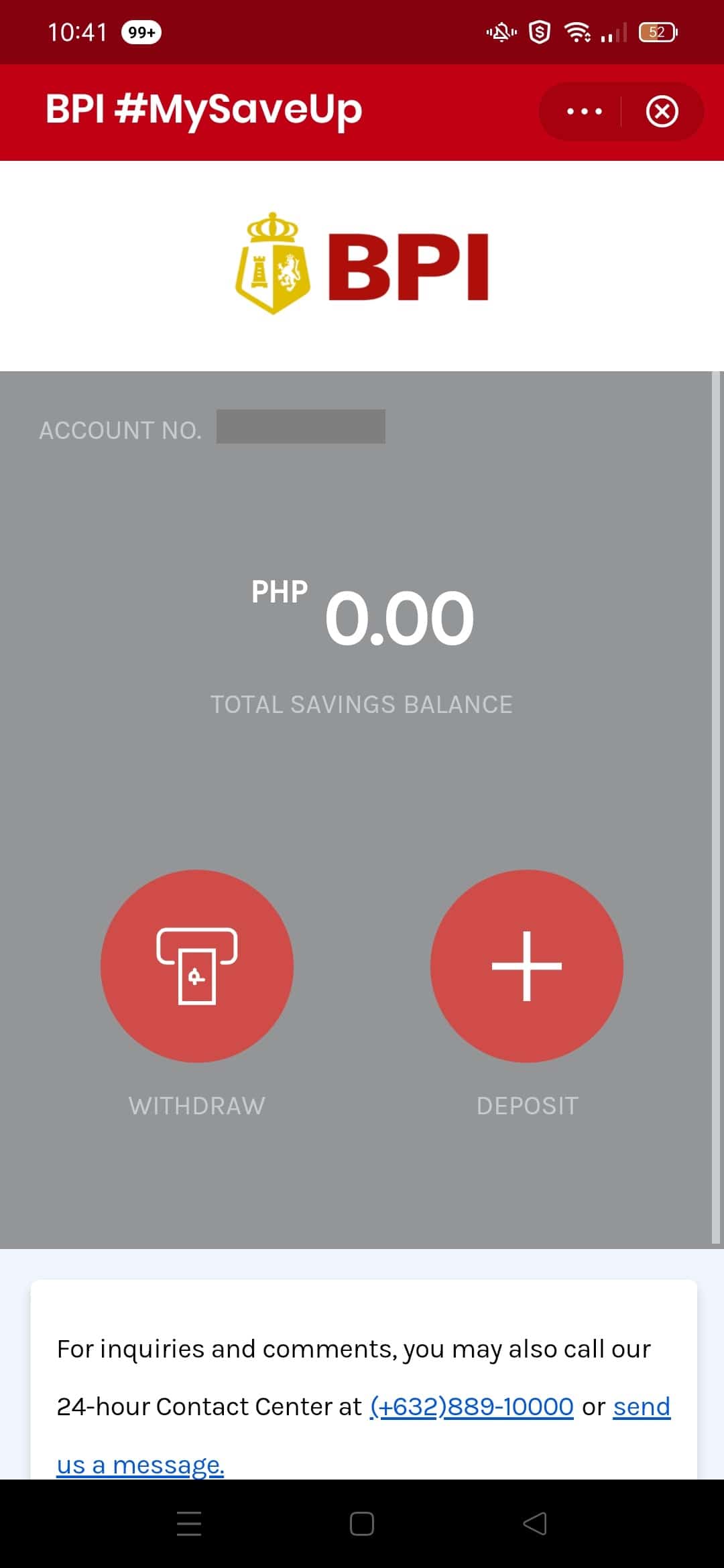

How do I deposit and withdraw using my MySaveUp by BPI account?

Deposit and Withdrawing funds are the same as in GSave by CIMB.

Making a deposit in MySaveUp by BPI

- Click on the “Make a Deposit” button and you will go to a deposit screen.

- Choose any amount, then you need to confirm the amount to be deposited. You will receive an SMS for a successful deposit.

Withdrawing funds in MySaveUp by BPI

- Click on the “Withdraw Funds” button and you will go to a similar screen with Deposit.

- Input the amount to withdraw and you will need to confirm the withdrawal amount.

- With withdrawals, there is always an OTP confirmation included.

- Similarly, you will receive an SMS for a successful withdrawal.

Other Questions

Why can’t I create a MySaveUp by BPI account?

There may be some requirements that you are not eligible or you may have issues with credit or loan companies. As the message is pretty vague, as an alternative, you can open with other digital banks like UnionBank or similar.

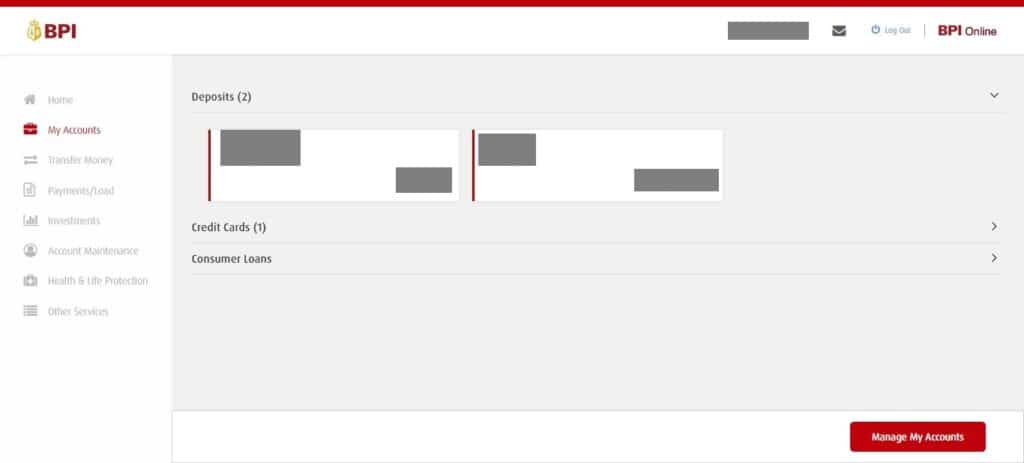

How can I see my MySaveUp by BPI account in BPI Online?

Yes, you only need to modify your account settings via the browser. After this, you can transfer funds easily to and from your MySaveUp account.

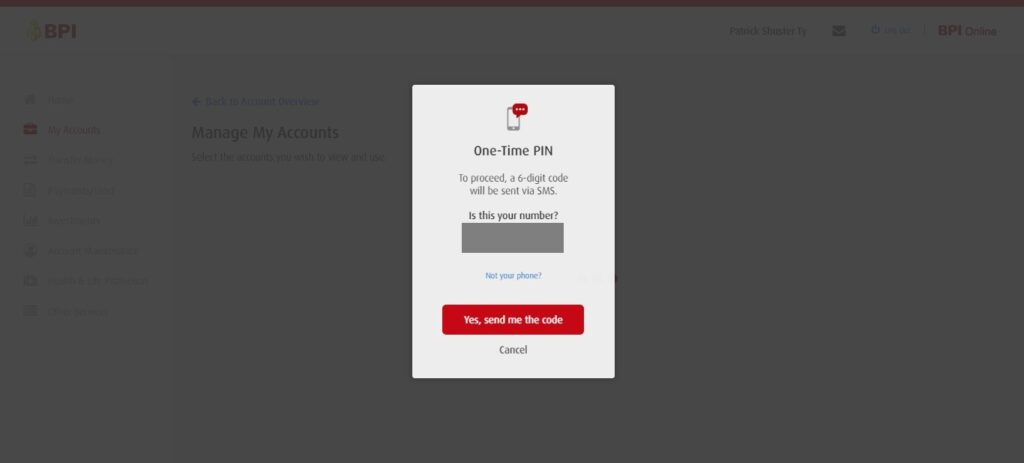

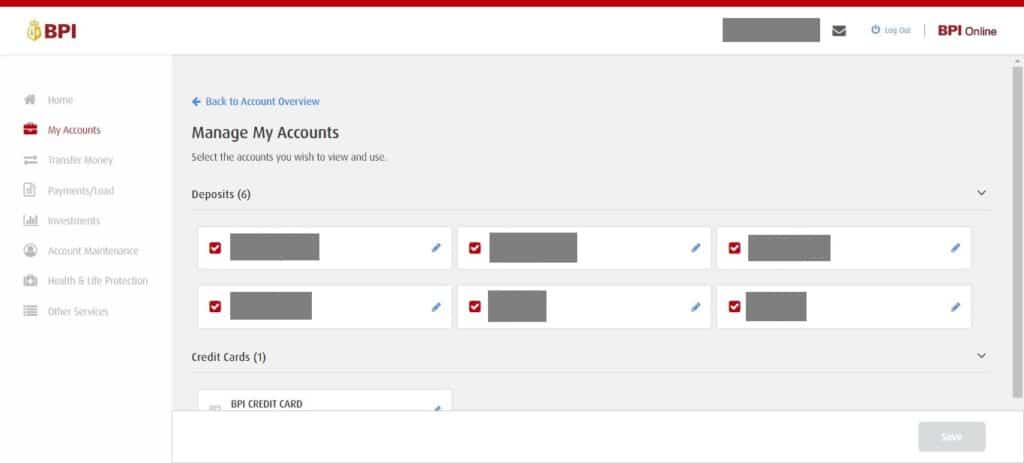

Enabling MySaveUp in BPI Mobile app

- Log into your BPI Online account using a browser.

- Click on My Accounts then click on the Manage My Accounts button at the lower right.

- Complete the one-time password (OTP).

- Once the OTP is completed, select/deselect the accounts you need to display in the mobile app. Then click Save.

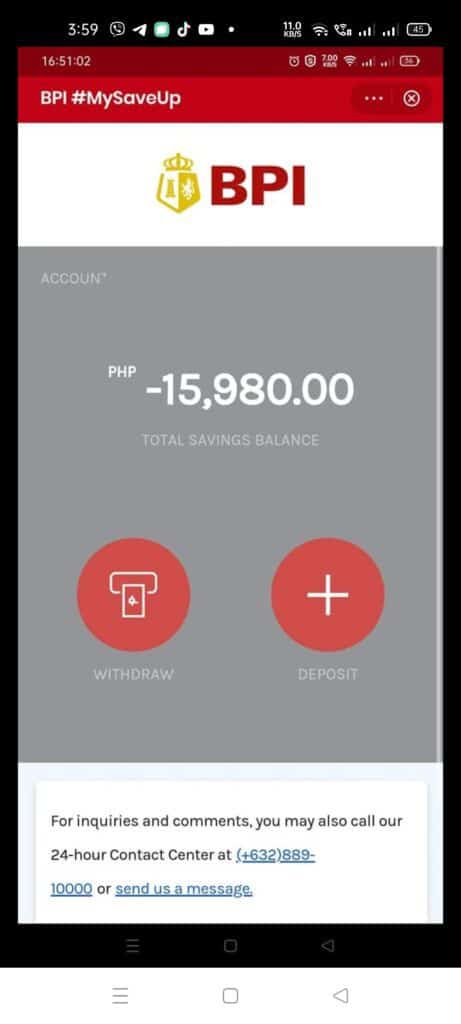

Why am I seeing negative balances in my MySaveUp by BPI account?

This is an issue with BPI. You will need to wait for the next day for this to be fixed on its own.

Summary

MySaveUp by BPI is a savings product included with the new relaunch of GSave Marketplace. You can open a BPI savings account by using your existing BPI Mobile credentials or by using your GCash profile. Deposits and withdrawals are the same as GSave by CIMB.

Related Topics

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

Hi. Is the BPI Save up a PESONET accredited? Thank you.

I know they can send and receive PESONet

How do I close bpi mysave account?

You probably need to contact BPI support

I sent money from international to gcash gsave bpi but money hasn’t arrive yet

How did you send the money? Via SWIFT Bank Wire Transfer ba?

i sent more than 30 thousand money to my gcash bpi upsave? And the maximum is 30k deposit only in bpi saveup. From my bank in middle east.