This post explains how to open a UnionBank account and link to your GCash as a cash-in channel with no fees.

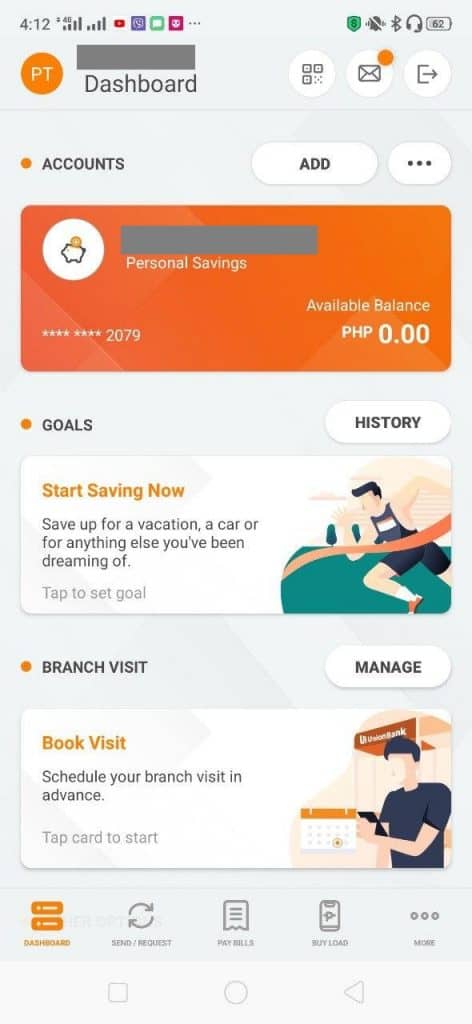

The UnionBank app is currently the most progressive banking app in my opinion. Compared with other banking apps, in terms of user-friendliness and a number of features, no one beats this for now.

This is also one of the few local banking apps that allow the opening of savings accounts within the app itself. The only other banking apps that enable this are digital banks like CIMB, Maya, Tonik, Seabank, and others.

Like GCash, they also utilize QR codes in payments and in transferring money between accounts.

The app is full-featured and has a lot of similarities with GCash in many ways. Here are some things you can do from within the app:

- Apply for a debit or credit card

- Pay using QR codes

- Deposit checks

- Transfer money using QR codes

- Schedule a bank visit

- Bank transfer

- Request payment

- Split bills

- Pay for bills

- Buy load

- Receive money

Setting up in UnionBank

How do I create a savings account in the UnionBank app?

You don’t need to go to the bank itself and queue. You just need to install the app (UnionBank Online Google Play / UnionBank Online iTunes App Store). Once installed, you will be greeted by their signature orange login screen.

If you already have an account, then you can either sign up with your existing account or log in if you’ve already signed up before. Otherwise, you can open a new account.

Creating a new account

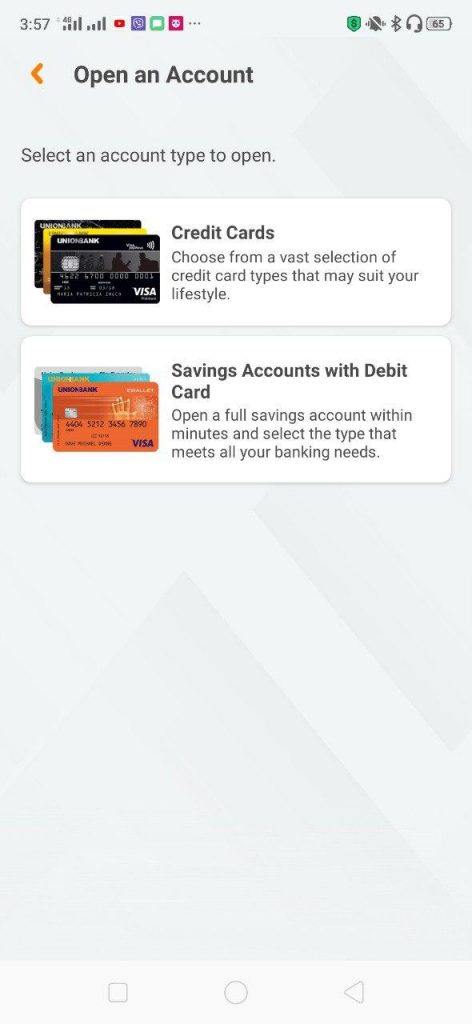

- From the login screen, click on the “Open an account” button.

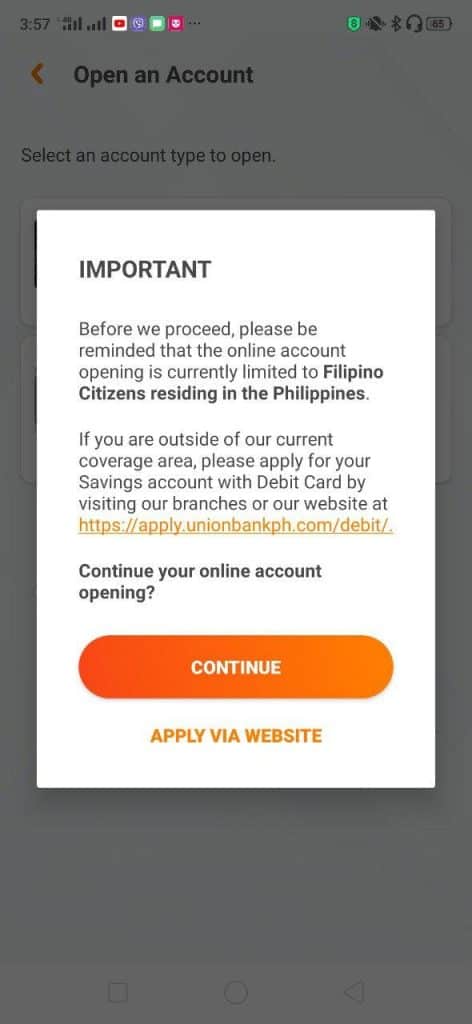

- Select an account type to open, in this case, click on the Savings Account with Debit Card. Afterward, you will encounter a disclaimer page. Just click on Continue.

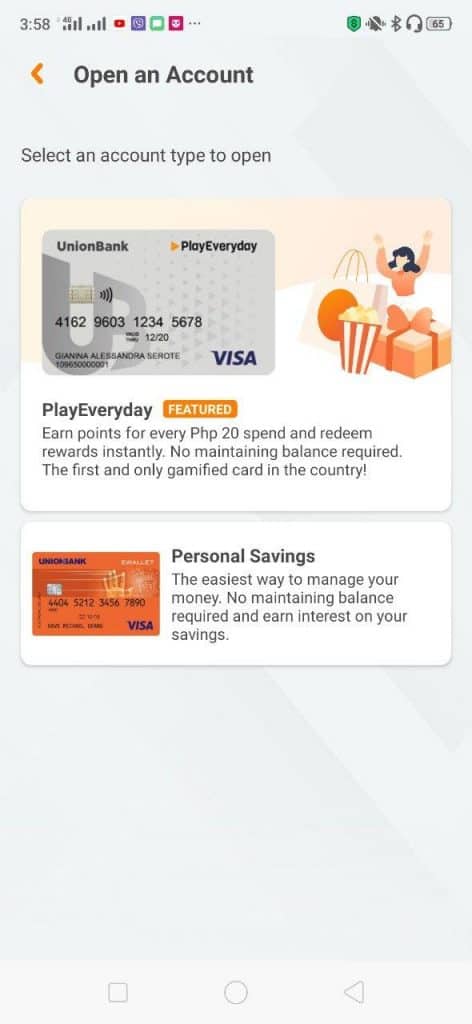

- Next, you need to select what type of Savings Account you want to open. I chose Personal Savings for this tutorial.

- You need to go through the terms and conditions again, before heading to the actual forms.

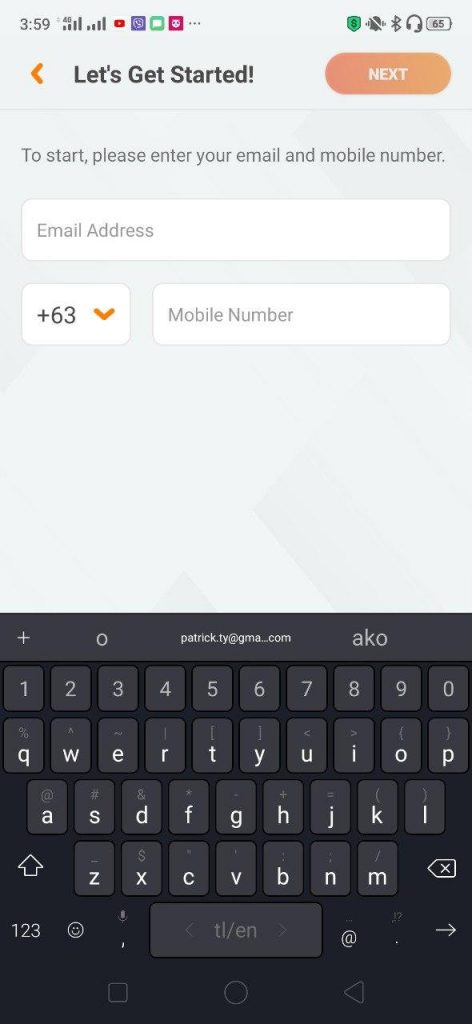

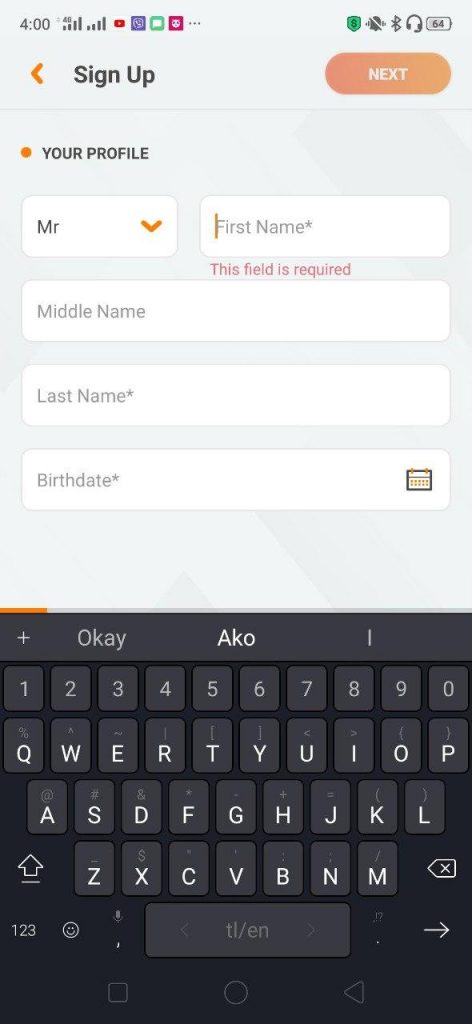

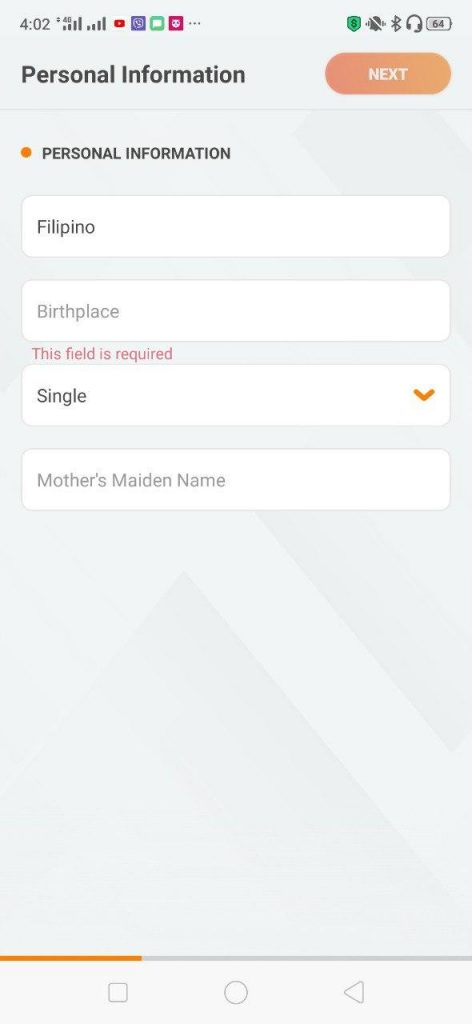

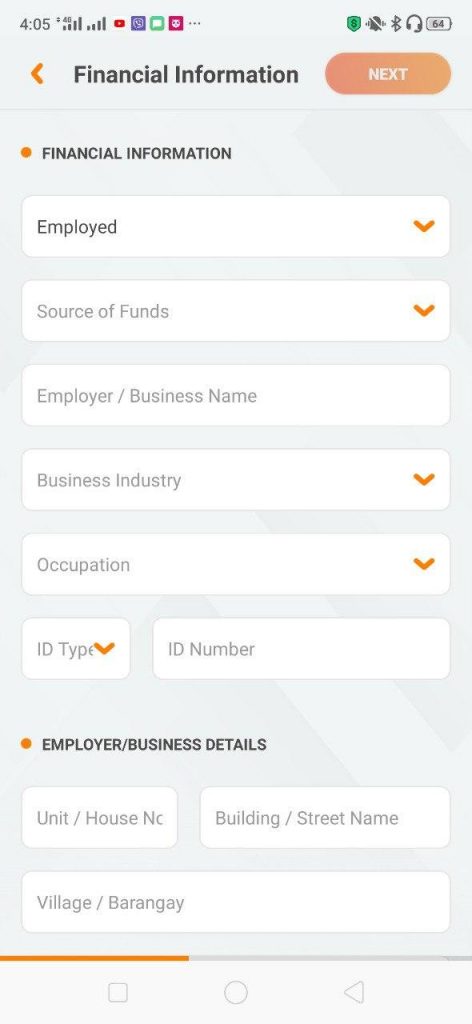

- The forms are straightforward but they are quite long, as these are subject to KYC (Know-Your-Customer) rules of the BSP.

- After you’ve completed the forms, you will need to send some pictures of the valid ID you are using as well as a selfie verification.

There were some skipped steps above because the app did not allow us to take screenshots — the skipped steps involved scanning the ID you will be presenting, and also the selfie verification.

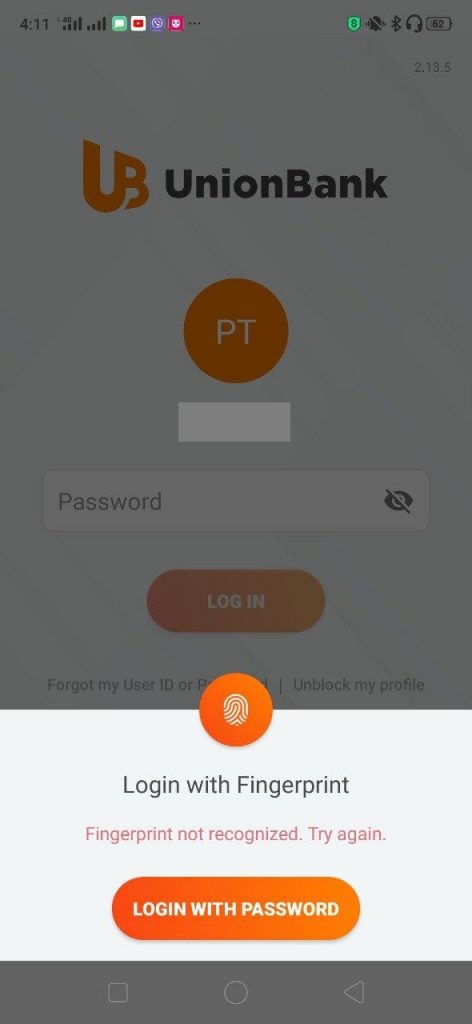

Once you’ve created the account, you will need to verify the email address you’ve put in, and then you can enable login with your fingerprint once you’ve enabled a trusted device. There would be lots of OTPs needed to set all of these up, so better to find a good area with reception.

All of these can be done in around 30 minutes and is actually easier than lining up in a branch and filing via the bank officer.

After doing this, you can now use all the other functions of the UnionBank app.

Cashing in GCash

How can I send money to other banks (like GCash) from the UnionBank app?

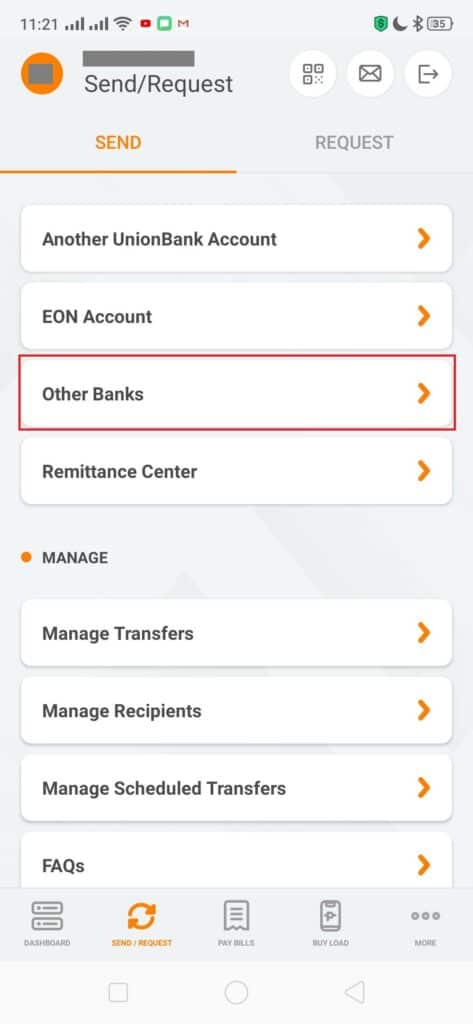

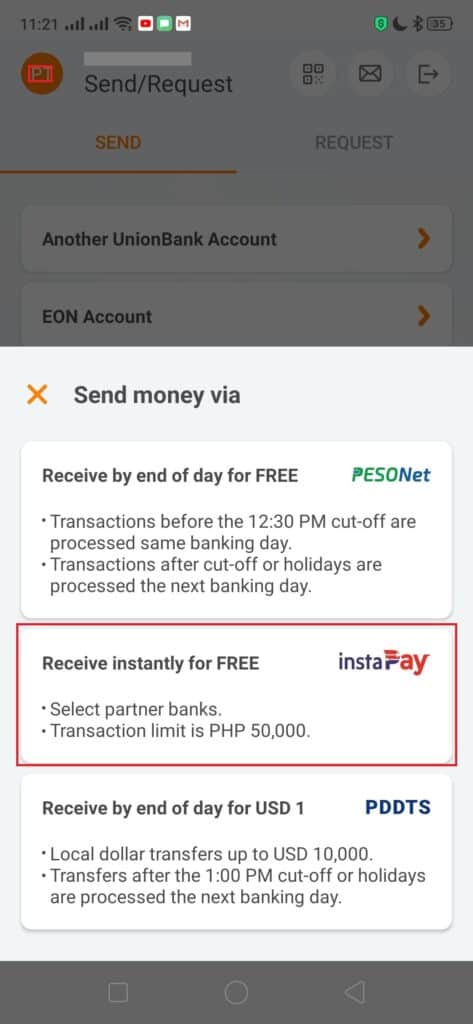

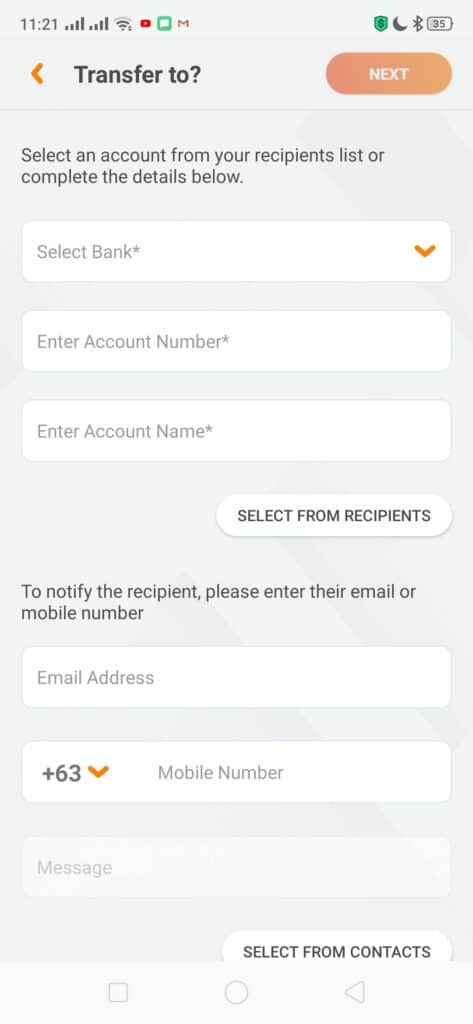

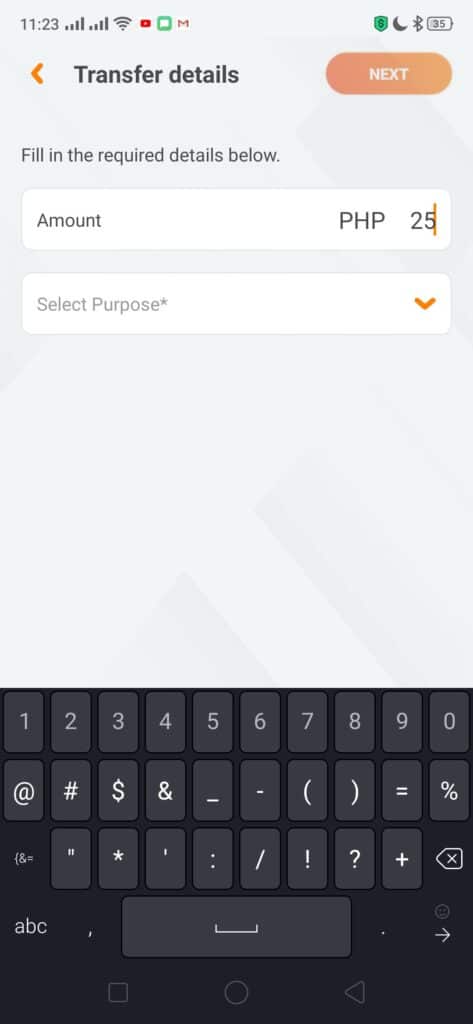

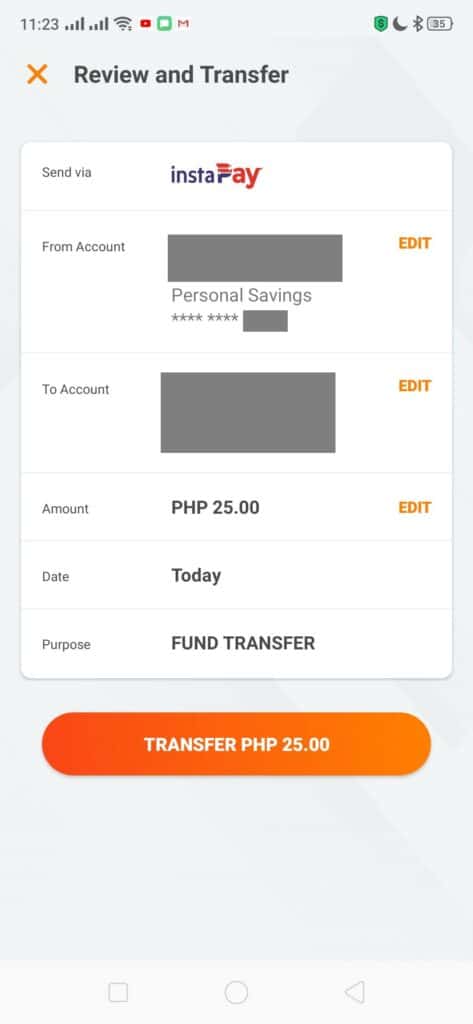

You can do this via the Send/Request button at the bottom of the main app page, then clicking on “Other Banks”. Unionbank supports both PesoNet and Instapay in sending.

As GCash, Maya, and DCPay (Coins.ph) also have Instapay, you can also send money to them and to any bank.

For other questions regarding Bank Transfers from UnionBank, they’ve also provided an FAQ.

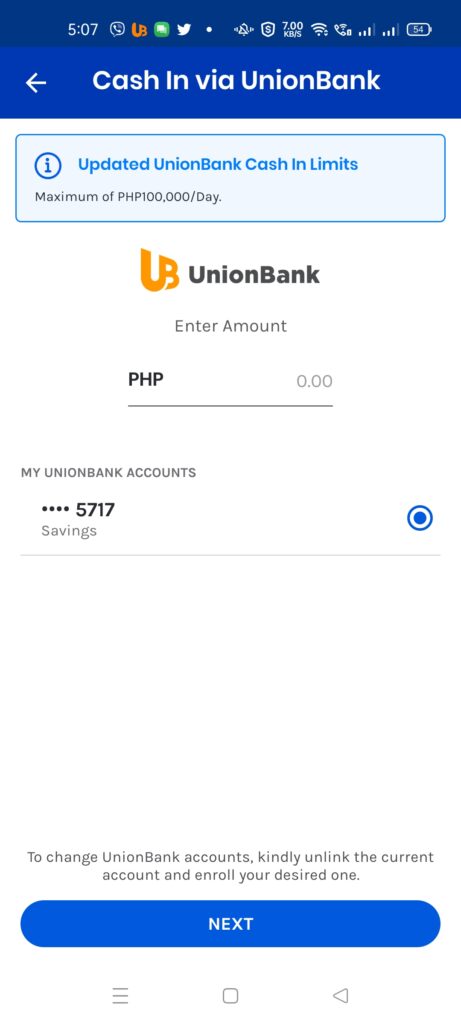

Are there limits in cashing in and transferring to and from GCash?

Yes, for GCash verified users, you are limited to Php 100,000 for cash in and out monthly. For UnionBank, they have a Php 10,000 transfer limit per day.

Unlocking Higher Account Limits

You can unlock higher limits by linking your BPI/UnionBank or your Payoneer account/s and utilizing either GSave or GInvest / GInsure with a Php 100 deposit or investment.

Once you do so, you will be able to unlock:

- A bigger wallet limit – Php 500,000 maximum

- Higher incoming limits – you will be able to receive up to Php 500,000 in your wallet and daily cash-ins have no limitations

- Higher outgoing limits – withdrawals will have no limitations per month, and you can withdraw up to Php 10,000 per day

You will be receiving an SMS informing you of the increased limits.

Take note that once you’ve unlinked all of your BPI/UnionBank/Payoneer accounts, the limits will revert back to what it was before.

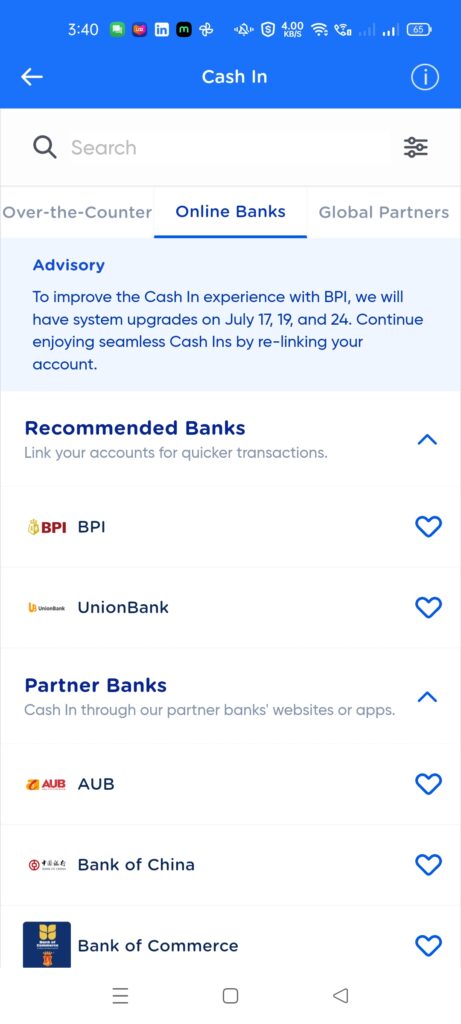

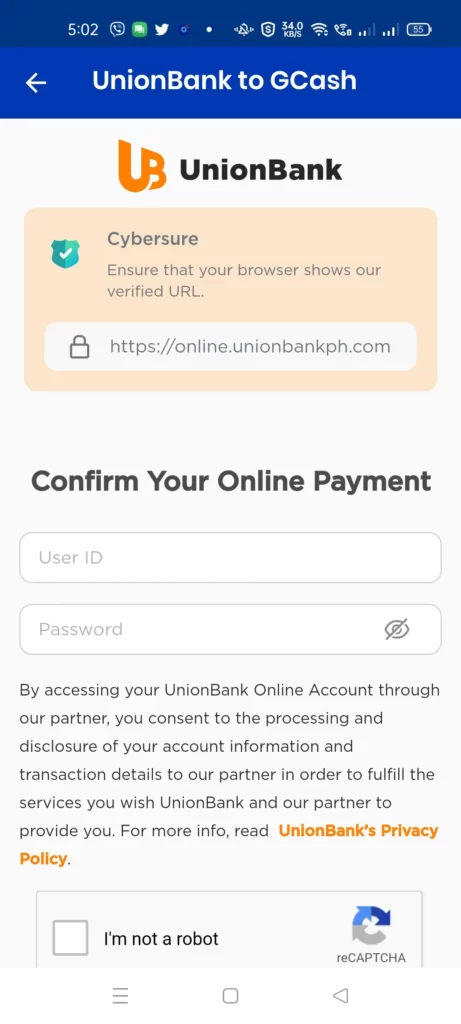

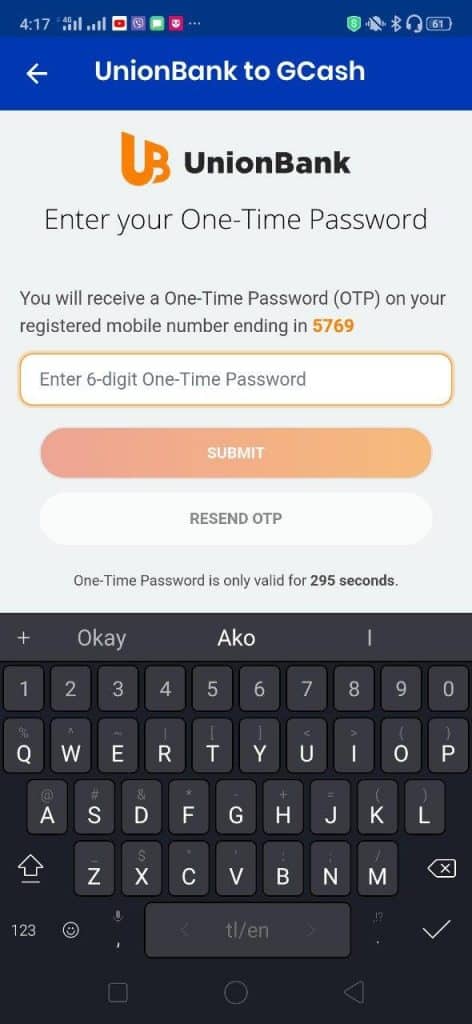

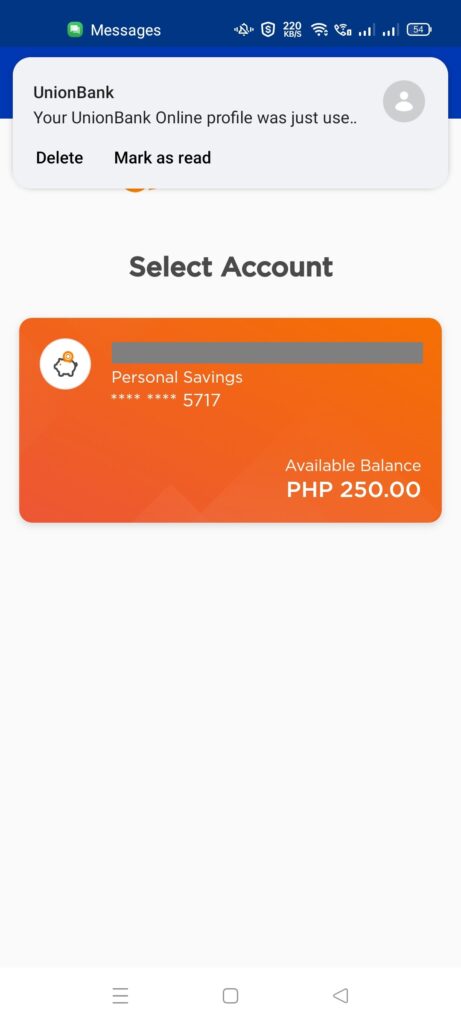

How do I register my UnionBank account to GCash for cash-in?

This is done in GCash by going to Cash In, selecting UnionBank under Partner Banks, and then inputting your username and password to link to the account.

Afterward, you can cash into your GCash easily. Take note that starting Oct 2, 2023, there will be a Php 5 fee when cashing in using UnionBank in GCash.

How do I transfer money to my UnionBank account from GCash?

You can use the GCash Bank Transfer feature since it uses Instapay. Take note that it costs Php 15 for Bank Transfers from GCash.

Summary

In this post, we showed you how to create an account in the UnionBank app and how to link it to GCash so that you can do cash-in similarly to BPI. You can also transfer to UnionBank via GCash Bank Transfer for free.

UnionBank is an app that has a lot of similarities with GCash which makes it the best banking app currently in my opinion.

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

Kuys is there possibility na ma automatic placement ang gcash mastercard sa fb ads? I keep searching until i found this site at ang galing sumagot sa concern.

*I have paypal account link by mastercard but decline when adding payment method. Ano po ma suggest mo kuys?

Puwedeng direct GCash ang pambayad sa FB ads.