This post explains the different ways you can get remittances using the GCash app.

Perhaps it is true that remittances are the lifeblood of our economy. In early 2022, according to the BSP, the total personal remittances from overseas Filipinos reached USD 2.9 billion. Additionally, every year the amount remitted by overseas Filipinos contributes a substantial part of our country’s GDP.

This is also why Filipinos are also one of the main markets of remittance services abroad, especially in the Middle East and in Hong Kong. Where there are Filipinos, there is also a big opportunity to make the process of remitting cheaper and more efficient. GCash recognizes this and has made receiving remittances a big part of its feature portfolio.

Compared with Paymaya and Coins.ph, GCash has support for more remittance partners in more countries. This makes it easier for GCash users to receive cash and then use it from within the app.

What remittance services does GCash have in the app?

There are two kinds of remittances in GCash currently — the pull and the push types.

Pull types require the recipient to claim the amount in the app. Examples of this are Moneygram and Western Union.

Push types directly remit to the recipient’s wallet. This is a quicker process, however, the sender should be sure of the recipient’s details to avoid sending it to the wrong person. Also, the wallet limit also is a factor in getting the amount. Examples of this are AlipayHK, GCash Remit, and others.

Pull Type Remittance

Pull types require the recipient to initiate the actual receiving of the money. Usually, this means they need to input some sort of reference number to be able to acquire the amount and put it into their wallet.

How do I receive a remittance using Moneygram or Western Union?

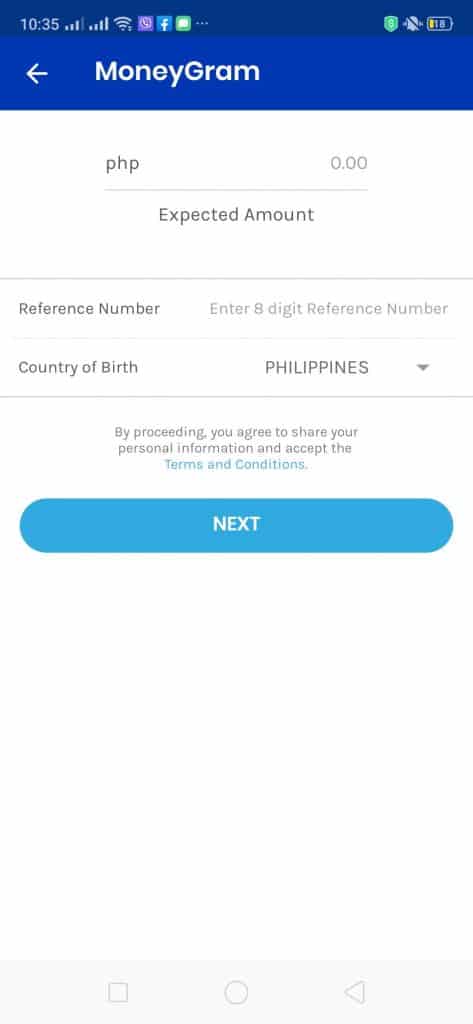

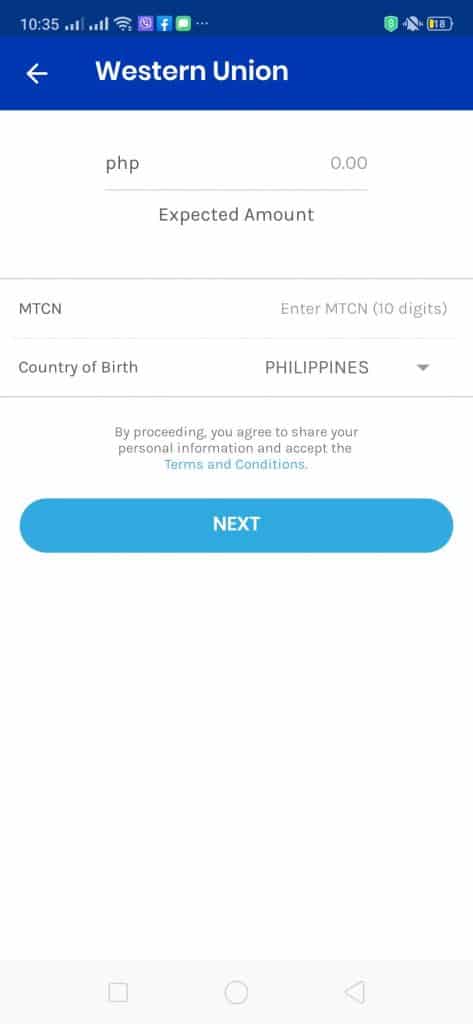

Before doing this, you should know the reference number and the exact amount of the remittance on-hand. If it isn’t inputted the exact same way, the remittance will fail. Here are the steps:

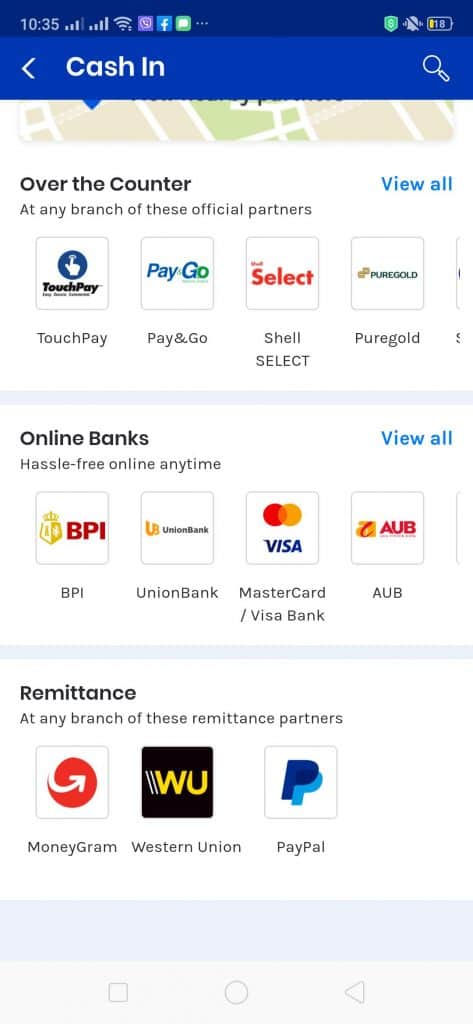

- In the GCash app, click on Cash In.

- On the Cash In page, scroll down to go to the Remittance Section.

- Select Moneygram or Western Union. Input the Expected Amount and the Reference Number or MTCN and click Next.

- For Western Union, your GCash registered name should match the beneficiary’s name stated by the sender.

- Confirm the details. You will be receiving an SMS regarding the transaction.

Is there a time limit for claiming my remittance?

For Moneygram, the expiration date is 1 year. After which if you try to claim your remittance, you will be subjected to a monthly service fee deducted from the remittance.

Similarly, Western Union money orders have technically no expiration dates, however, if you wait too long, you will not be getting the full amount due to service fees.

How do I send my remittance through Moneygram or Western Union?

You can do it two ways — one is via over-the-counter, and the other is via online remittance or app.

Here are the steps:

- You either need to go to a physical Moneygram or Western Union branch or log in to your account (online).

- Input the receiver information and the amount you plan to send. For online, you need to input the bank account or credit/debit card details from which you plan to send. Make sure that you know how much the actual amount the currency conversion yields into.

- For Western Union, you need to input the beneficiary’s name as stated in an official ID and the mobile number you are sending to — in this case, it should be your GCash registered name and mobile number respectively.

- Send the amount and the recipient can receive the money within the day.

What are the sending fees for Moneygram and Western Union?

Moneygram has a calculator to estimate the sending fees. For Western Union, it differs depending on the receiving option. You can check with the agent or on the website on the rates and fees before sending your money.

How many times can I input a reference number before locking it out? How do I claim my remittance if I was locked out?

You can only attempt to input a reference number three times per day. If you get it wrong thrice, you can try again 24 hours later. This is to prevent unauthorized transactions in your account.

What about Paypal? How can I transfer my funds in Paypal to my GCash account?

You will need to link your Paypal account to your GCash one. Once it’s linked, then it should be easy to transfer from your Paypal account.

Push Type Remittance

Push types don’t require recipient input. The amount is directly debited to the GCash account. For the next sections, I opted to separate the Push Type Remittances per company.

AlipayHK (Hong Kong)

AlipayHK is a cross-border payments app used mainly in Hong Kong. A couple of years ago a special remittance project by AlipayHK was created for Hong Kong-based domestic helpers. AlipayHK was the first in the world who utilized blockchain technology in processing cross-border remittances. You can download the AlipayHK app from your respective app store (Google Play/App Store).

What are the transaction fees for sending through AlipayHK?

There are no fees for the first monthly remittance. Subsequent remittances within the month will be charged an HKD 15 (around PHP 90) transaction fee.

How do I send my remittance using the app?

As I do not have visibility of the app (you need to be an HK resident to be able to create an account), I based the steps on the GCash help site:

- Log in to the AlipayHK App.

- Tap on “More”, then “Remittance”.

- On the Remittance page, tap “New Remittance” then under remittance destination, choose GCash.

- Enter the amount and the beneficiary’s information.

- The beneficiary’s name must match their GCash-registered name.

- The account number is the GCash-registered mobile number.

- Take note of the wallet limits of the recipient.

- Complete the transaction.

If you have other questions regarding the AlipayHK app, you can refer to their site FAQ page.

Softbank / GCash Remit (Japan)

GCash Remit is a partnership with Softbank via their subsidiary, SB Payment Service Corp. As the name goes, it only has one direction of remittance — from Japan to the Philippines. Basically, the site has a wallet that accepts bank account or Family Mart deposits and you can use that to send your remittance.

What are the transaction fees for GCash Remit?

The transaction fees are JPY 440 (~PHP 220) for amounts reaching JPY 10,000 (~PHP 5,000). For higher amounts, the fees can become JPY 700 (~PHP 350) for amounts reaching JPY 30,000 (~PHP 15,000). You can refer to the GCash Remit transaction fee tables for more information.

How do I send remittance?

You should first create an account on their site.

- Log into the gcash.jp site.

- Input your remittance amount and beneficiary.

- The beneficiary’s name must match their GCash-registered name.

- Take note of the wallet limits of the recipient.

- Choose GCash as the method of claiming the remittance.

- Enter the beneficiary’s mobile number.

- Enter the beneficiary’s information and reason for remittance.

- Agree with the terms of the remittance act. This is done as compliance with Japanese laws.

- Confirm the information you’ve inputted to process the remittance.

If you have any questions, you can also refer to the gcash.jp FAQ page.

EMQ Send (Taiwan/Hong Kong)

EMQ Send is a Fintech company based in Taiwan, that caters mostly to cross-border transactions. They have an app (Google Play/App Store) that is open to Taiwanese and Hong Kong residents.

What are the transaction fees for using EMQ Send?

The transaction fees are TWD 199 (~PHP 330) regardless of the amount. If you are in Hong Kong, the fees depend on which channel you used to send the remittance.

- Transaction fees are free if you transacted in Circle K.

- If you used JET Payment, the fee is HKD 20 (~PHP 125).

You can also refer to the EMQ Send fee table.

How do I send a remittance?

Here are the steps if you are sending via EMQSend in Taiwan:

- Open the EMQ Send app and click on Send.

- Enter the transfer amount and the country you are sending it to. Click Send Money to continue.

- Add a recipient and the GCash payout method.

- The recipient’s name should be the same as the GCash registered name of the recipient.

- Fund your pay-in amount in 7-Eleven or Hi-Life. You can also deposit it in EMQ’s SCSB Virtual Account in ATMs or in the bank itself.

- After payment, input the purpose of the remittance and the source of your funds as part of legal compliance.

- Verify the inputted information and click on Submit. EMQ will be reviewing and processing the remittance backend.

Here are the steps if you are sending via EMQSend in Hong Kong:

- Open the EMQ Send app and click on Send.

- Enter the transfer amount and the country you are sending it to. Click Send Money to continue.

- Add a recipient and the GCash payout method. The recipient’s name should be the same as the GCash registered name of the recipient.

- Fund your pay-in amount in Circle-K. You can also deposit it in EMQ’s account in any JetCo ATM.

- After payment, input the purpose of the remittance and the source of your funds as part of compliance.

- Verify the inputted information and click on Submit. EMQ will be reviewing and processing the remittance backend.

If you have other questions, you can refer to EMQ’s FAQ page.

Cross Remittance (Korea)

Cross Remittance is a global remittance service that serves different countries from a single remittance source in South Korea. You can also download the app (Google Play/Apple Store).

What are the transaction fees using Cross Remittance?

The minimum transaction fee is KRW 5,000 (~PHP 200) and goes on to 0.5% of the remittance amount. The minimum transaction amount is KRW 30,000 (~PHP 1200). Other details regarding the fees can be referenced from the Cross FAQ page.

How do I send a remittance?

You first need to fund your Cross Wallet before you can send your remittance. When you created your account, there was also a requirement to input a bank account. You need to use this to fund your Cross Wallet.

Here are the steps after you have funded your wallet:

- Log into the app, register a new recipient, then select Transfer Method with Cross Wallet.

- Input the recipient’s details, keep in mind the GCash registered name as well as the GCash registered mobile number.

- Enter your payment PIN to initiate the transfer.

For other information, you can refer to the Cross FAQ page.

Instant Cash (UAE)

Instant Cash is a UAE government-owned over-the-counter remittance company that has different agents in different locations across the country.

What are the transaction fees for Instant Cash?

There is a fixed charge of AED 15 (~PHP 200) for each remitted amount. You can use their calculator to check the conversion rates.

How do I send a remittance?

Here are the steps:

- You can use the locator to go to the nearest agent from you. Bring a valid ID card. Inform them that you plan to remit money to the Philippines.

- Fill out the form with the amount, beneficiary details, and mobile wallet option. Take note that the beneficiary name should be the same as the GCash registered name of the recipient and the target mobile wallet should be GCash with the recipient’s mobile number.

- Give the money and the remittance will be processed.

For more information, you can check out the Instant Cash FAQ page.

Wall Street (UAE)

Wall Street is one of the first remittance companies in the UAE. Now it is still going strong as a money transfer company because of the number of expatriates working in the country.

What are the transaction fees for Instant Cash?

Honestly, information is quite thin regarding fees, but from what I can gather, the fees are fixed at AED 15 (~PHP 200).

How do I send a remittance?

Here are the steps, but these are not 100% confirmed as you need to be at the store itself to be able to describe the process:

- Go to your nearest agent and bring a valid ID card. Inform them that you are doing a remittance to the Philippines.

- Fill out the form with the amount, beneficiary details, and mobile wallet option. Take note that the beneficiary name should be the same as the GCash registered name of the recipient and the target mobile wallet should be GCash with the recipient’s mobile number.

- Give the money and the remittance will be processed.

PayIt (UAE)

PayIt is a digital wallet in UAE (Google Play/App Store) and also has a feature for employers to pay their domestic helpers via cashless transactions. You can also remit money to mobile wallets in different countries.

What are the transaction fees for PayIt?

Currently, remittances to the Philippines are free.

How do I send a remittance?

You will need to register first in the app and this requires you to use your Emirate ID.

Here are the steps but these may not be accurate as I have no access to the app:

- Log in to the app. Then click on Transfer.

- Choose your country (Philippines).

- Choose a mobile wallet as a method of transfer.

- Enter the amount.

- Add beneficiary. Take note of the GCash mobile number and the registered name of the recipient.

- Click on Transfer.

You can also check out the PayIt FAQ page for more information.

Denarii Cash (UAE)

Denarii Cash is a money transfer app (Google Play/App Store) that aims to make remittances cheaper and easier. The CEO is also Filipino which is why it is OFW-centric — you can also use the app to pay bills and load back home.

What are the transaction fees for Denarii Cash?

The first remittance of the month is free as long as it is below USD 300 (~PHP 15,000). Subsequent transfers within the month have a USD 2.50 fee (~PHP 125).

How do I send a remittance?

You first need to create an account within the app and top up the wallet using your preferred channel (via kiosk, voucher, bank transfer, cash on delivery, or credit/debit card).

Here are the steps:

- Log into the app. On the home page, enter the amount and click on Send Money.

- Select the GCash transfer method.

- Add your beneficiary’s details (take note of GCash’s registered name and mobile number as well).

- Review the transaction details and tick the consent form.

- Proceed to payment.

You can also refer to the Denarii Cash how-to page.

Rocket Remit (Australia)

Rocket Remit is a remittance company in Australia that provides a simple way to send money without an app, and you only need the mobile number of the recipient.

What are the transaction fees for Rocket Remit?

The transaction fee is a fixed AUD 5 (~PHP 175).

How do I send a remittance?

You first need to register on the website. Then you will need to fund your account through bank channels (BPAY, POLi, ANZ). After funding your account, you can now then send money using any phone with SMS.

How to send money using your phone (via SMS):

- Compose the SMS with the proper keywords —

- PAY <recipient mobile number> <amount in AUD> <recipient’s first name> <recipient’s last name> <recipient’s address>

- Take note that the recipient’s mobile number is the GCash mobile number and the recipient’s name should follow the GCash registered name.

- Send the SMS to 0488-762-538 (0488-ROCKET)

- You will be receiving a confirmation code with an OTP.

- Reply with the OTP to authorize the sending.

- You will be receiving a reply receipt with a reference number. The payment will then be processed backend.

How to send money using the dashboard:

- Log in to the page, and from the dashboard, click on Pay.

- Input the recipient’s mobile number (GCash mobile number), amount to send (including the transaction fee), recipient’s name (GCash registered name), recipient’s address

- You will be receiving a confirmation code with an OTP.

- Reply with the OTP to authorize the sending.

- You will be receiving a reply receipt with a reference number. The payment will then be processed backend.

For more information about how to remit, you can refer to the Rocket Remit FAQ page.

Azimo (UK)

Azimo provides money transfers to many countries via an app (Google Play/App Store). It aims to make money transfers easy and stress-free.

What are the transaction fees for Azimo?

The first two transactions are free, then the subsequent ones are variable, depending on the amount, the destination, and the method of payment. You can always check the amount before sending it. But they guarantee that it’s always the best rate.

How do I send a remittance?

You need to install the app first or register using the site.

Here are the steps:

- Log into the app or the site.

- Choose Philippines, pick GCash/mobile wallet, and enter the recipient’s name (take note that this should follow the GCash registered name).

- Choose an amount and pay either with a debit/credit card or with a fund transfer.

- Check all transfer details and confirm payment.

You can also refer to the Azimo FAQ page.

To summarize, here is the list of remittance partners:

- AlipayHK – provides a way for Hongkong based Filipinos (usually domestic helpers) to remit to GCash quickly; uses blockchain technology

- Azimo – for UK remittances

- bWallet – for Bahrain remittances

- Cross – for South Korean remittances

- Denarii Cash – for UAE remittances

- EMQ Send – for Taiwanese remittances

- EEC Remit – for Taiwanese remittances

- GMoneyTrans – for Korean remittances

- Instant Cash – for UAE remittances

- MoneyGram

- Pacific Ace – Macau, Hongkong remittances

- PayIt – for UAE remittances

- Payoneer

- Paypal

- Remitly

- Rocket Remit – for Australia, New Zealand remittances

- SABB – for Saudi Arabia remittances

- SBI Remit – for Japanese remittances

- Siammali Remittance – for Brunei remittances

- Singtel Dash – for Singaporean remittances

- Softbank – for Japanese remittances

- Skrill

- Telcoin – for Canadian remittances

- Transfer Galaxy – for African remittances

- Wall Street – for UAE remittances

- Warba Bank – for Kuwaiti remittances

- Western Union

- WireBarley

Other Questions:

Can I receive a remittance without being Fully Verified?

No, you need to be Fully Verified to receive remittances and also to be able to receive the full amount due to wallet limits.

Does receiving the remittance incur a fee?

No, only the sender shoulders the processing fee of the remittance. The receiver does not need to pay any additional amount. This is similar to the padala remittance system we currently have.

What happens if the remittance exceeds my wallet limit?

You won’t be able to receive the remittance since the wallet limit is a system-wide limit. You can circumvent this by using a different GCash account to receive it (as we can have up to 5 separate accounts for the same user), or by unlocking a higher limit on your account.

Unlocking Higher Account Limits

You can unlock higher limits by linking your BPI/UnionBank or your Payoneer account/s and utilizing either GSave or GInvest / GInsure with a Php 100 deposit or investment.

Once you do so, you will be able to unlock:

- A bigger wallet limit – Php 500,000 maximum

- Higher incoming limits – you will be able to receive up to Php 500,000 in your wallet and daily cash-ins have no limitations

- Higher outgoing limits – withdrawals will have no limitations per month, and you can withdraw up to Php 10,000 per day

You will be receiving an SMS informing you of the increased limits.

Take note that once you’ve unlinked all of your BPI/UnionBank/Payoneer accounts, the limits will revert back to what it was before.

Summary

We talked about the various international remittance options of GCash. We can also see that GCash has the edge in terms of remittance support compared with other digital wallets like Paymaya and Coins.ph.

The supported remittance partners are:

- Moneygram

- Western Union

- AlipayHK

- GCash Remit

- Instant Cash

- Cross Remittance

- EMQ Send

- Wall Street Exchange

- PayIt

- Denarii Cash

- Rocket Remit

- Azimo

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

How much is the payment in converting dollar to peso. Is it really 2 thousand peso that I will pay for converting?

Anong gamit niyong remittance partner? Di naman siguro 2000 peso ang fee

TikTok