You can pay your SSS PRNs for contributions and loan payments using GCash easily.

One of the ways GCash makes life easier is by integrating with government services such as PAG-IBIG and SSS. You can get disbursements using your GCash account, and you can pay your loans and contributions using the Pay Bills feature.

My wife was able to get her maternity benefit in a week by applying for a disbursement account and by filing the benefit from within the SSS portal — all without going to any SSS branch. It’s pretty convenient.

A prerequisite of all of this is you should have an online account with SSS. Registering is easy, you just need to have either your SSS number or CRN number (from your UMID) on hand.

Setting GCash as a Disbursement Account

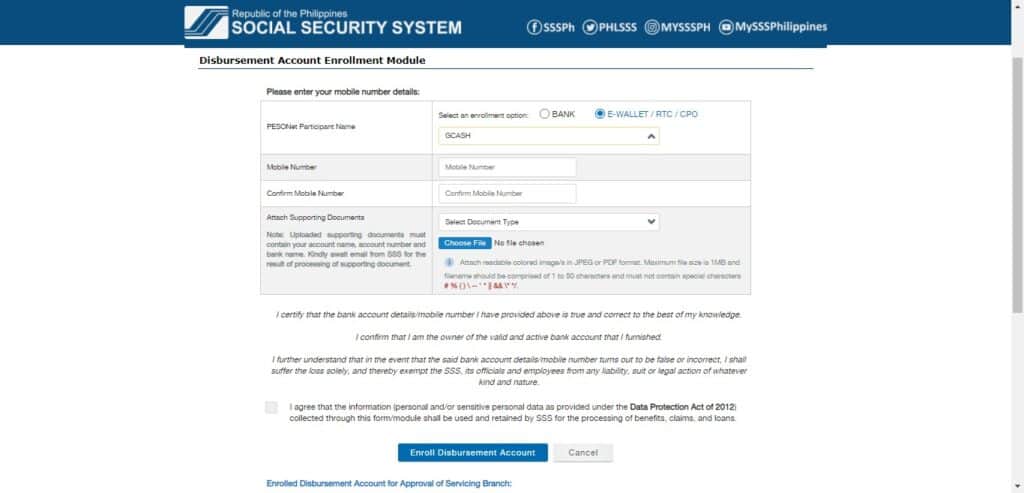

For the Disbursement Account Enrollment Module, you are basically setting up the account that will be receiving all disbursements from SSS. This can be any benefit or any loan proceeds you’ve applied for.

You can actually set it to any bank with PESONet. But if you don’t have any bank available, you can use your GCash account instead. You can set multiple different disbursement accounts if needed.

Setting SSS Disbursement Account to GCash

- Log into your SSS account.

- Under E-SERVICES, select “Disbursement Account Enrollment Module”.

- Under PESONet Participant Name, select E-Wallet and choose GCash from the dropdown menu.

- Enter your GCash number and confirm your GCash number.

- Attach a screenshot of your GCash profile page that includes your name and number.

- Click on the checkbox before clicking on the “Enroll Disbursement Account”.

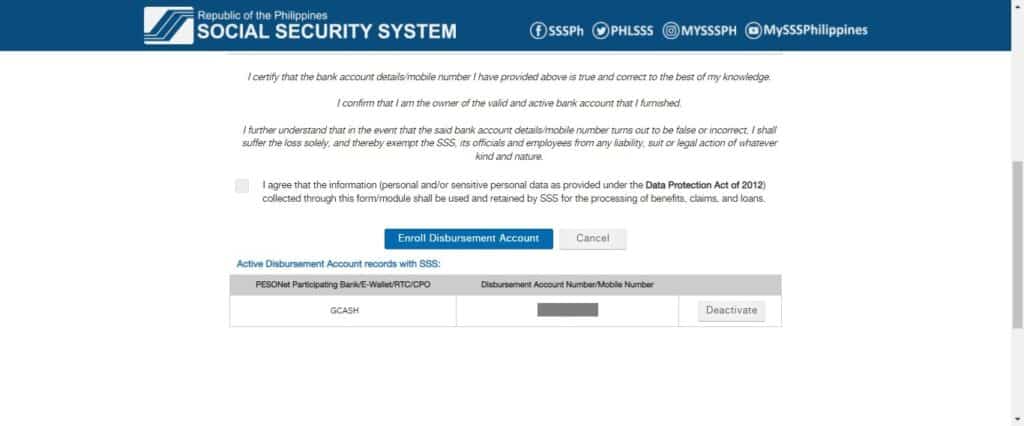

- Wait for a few days and you will be able to see it reflected on the page. You will also be receiving an email once the account has been activated.

Once enrolled, you will also see this account when you apply for benefits or loans from SSS. Take note that in getting the loan you may hit your transaction and balance limits in GCash. You can increase your limits.

Paying volunteer or OFW contributions in GCash

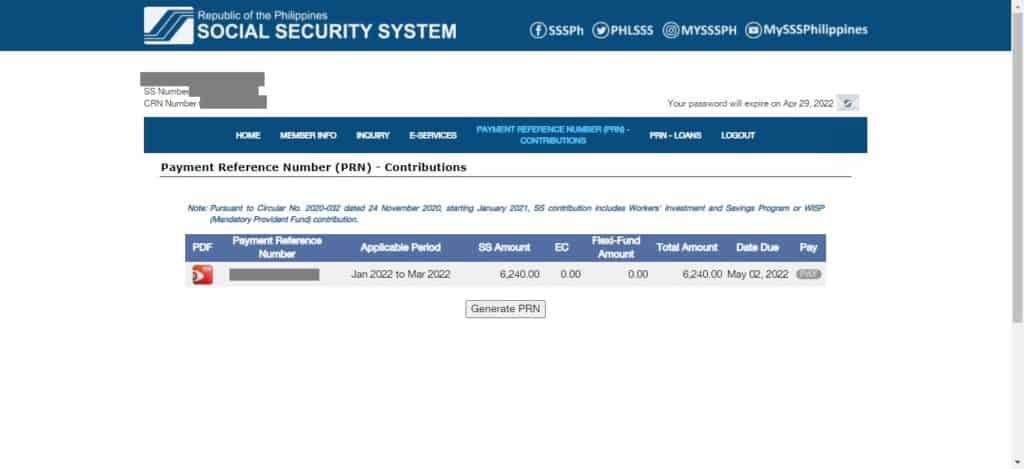

Employed members are spared from doing this as their employers can do this for them. But for voluntary or OFW members, you would need to generate a Payment Reference Number (PRN) first before you can pay using GCash.

How do I generate a PRN for contributions on the SSS portal?

Generating a PRN in the SSS Portal

- From the main page of the portal, select ” PAYMENT REFERENCE NUMBER (PRN) CONTRIBUTIONS”.

- Click on Generate PRN.

- Enter your Membership Type, Applicable Period, and Contribution. The Total Amount will be automatically generated. Once submitted, take note of the PRN.

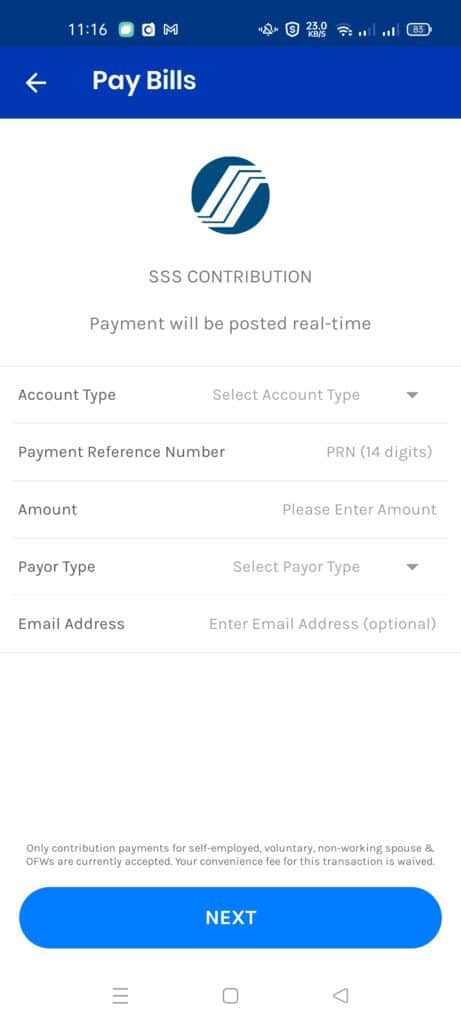

- In the GCash app, under Pay Bills, look for “SSS-Contributions” and enter the details from the PRN that you applied for in the SSS portal. Once paid, it takes a few minutes to reflect in the SSS portal.

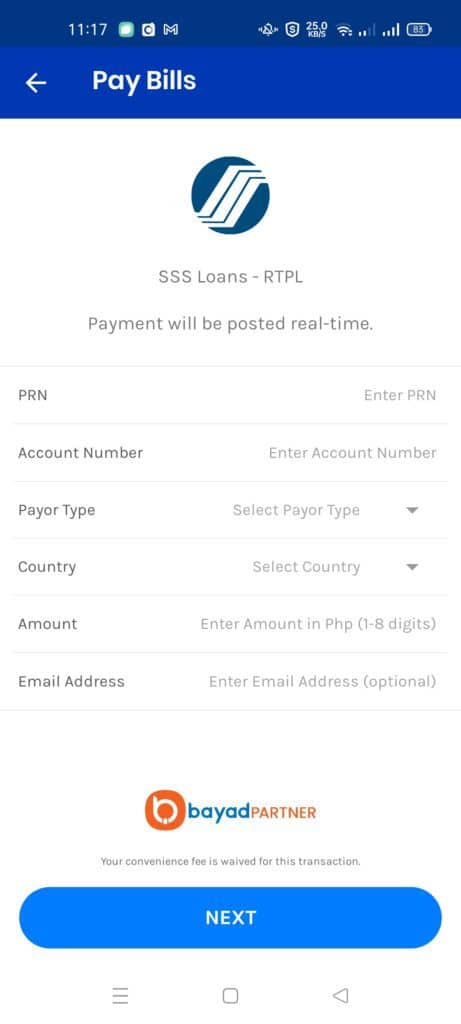

Paying Real-Time Processing of Loans (RTPL) in GCash

For loan payments, your PRNs should be sent to your email within the first 7 days of the month. You can also check out your PRNs from within the SSS portal.

From the email or from the SSS portal, you can get your PRN details, and then you can input this into the GCash biller. Once paid, it takes a few minutes to reflect in the SSS portal.

Other Questions

I can’t create an online account on the SSS portal. What should I do?

You can resolve this by going to your local SSS branch personally.

Can you reuse a PRN in paying a contribution or a loan?

No, a PRN is for one-time use only. If you want to add to your contribution or loan payment, you need to generate a new one from the SSS portal.

Does the PRN have an expiry date?

Yes, the PRN expires 5 days after generation for loans. For contributions, the expiration date is at the end of the quarter. You can generate a new one from the SSS portal.

Can I overpay or underpay using my PRN?

No, you can only pay the exact amount issued with the PRN.

Can you pay employer PRN using GCash?

No, but you can use the UnionBank app to input employer PRN. You can send your funds to your UB account from GCash and pay the SSS biller from there.

Can I get a salary loan when I’m unemployed?

Yes, as long as you have the requisite number of contributions — you need 36 monthly contributions for a single-month salary loan and 72 monthly contributions for a 2-month salary loan.

The loan amount is the average of the last 12 monthly contributions for a single-month loan, while for 2-month loans, it is twice the average of the last 12 monthly contributions.

I need a bank as a disbursement account. What options do I have?

If you need an actual bank account, you can always open one without going to any branch for certain banks like UnionBank, ING, or Tonik.

Summary

You can set up your GCash as your disbursement account in the SSS portal. This makes it easy for people who don’t have time to open a bank account. Additionally, you can also pay your contribution and loan PRNs via GCash Pay Bills.

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

Thank you so much this will help a lot to all of us..Thank You So Much Gcash..