A side-effect of the pandemic was the shift to online and cashless payments. Secondary to this is the boom of the gig economy as well as the proliferation of online shops.

As such, Filipino freelancers and entrepreneurs have started to see the value of using Paypal and Payoneer to collect payments, especially for overseas transactions.

What is Payoneer?

Payoneer is a way to receive payments in different currencies online. The main difference with Paypal is that for Paypal you need to manually send your account details to the sender. For Payoneer, it simulates a bank account so you can just set it up once and can receive payments automatically.

Currently, this is popular with freelancers using Upwork, Fiverr, Freelancer.com as well as from entrepreneurs leveraging sales from Amazon and other marketplaces.

What is a Payoneer Card?

Once you’ve received USD 100, you will be receiving a Payoneer card. This works as an international ATM card and you can withdraw your earnings from anywhere.

Can I link my Bank Account to my Payoneer Account?

Yes, this is another way of disbursement aside from cashing in with GCash. You can connect it with any local bank account under your name.

Linking Payoneer with GCash

There are two ways of linking Payoneer with GCash: linking an existing account and creating a new one within GCash.

Linking an Existing Account

Here are the steps:

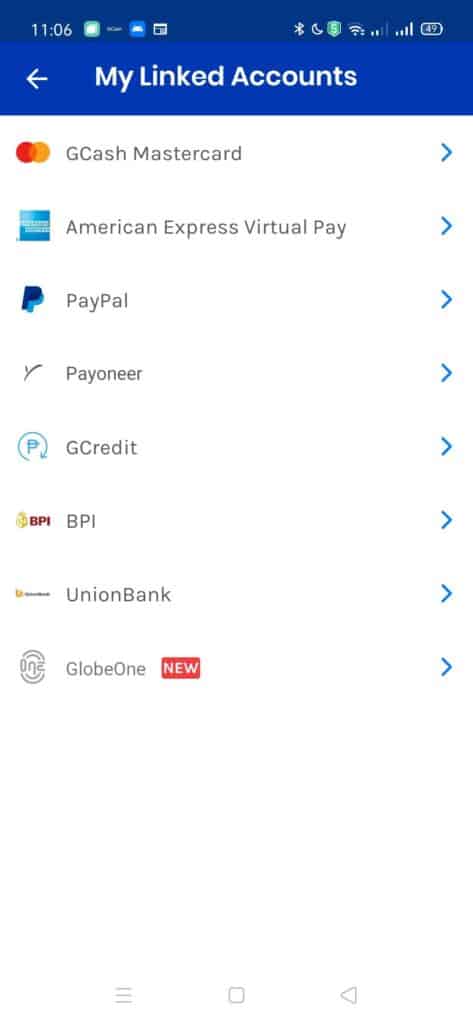

- Go to the sidebar and choose “My Linked Accounts”.

- Select Payoneer from the list.

- From the linking page, click on the Link Account button.

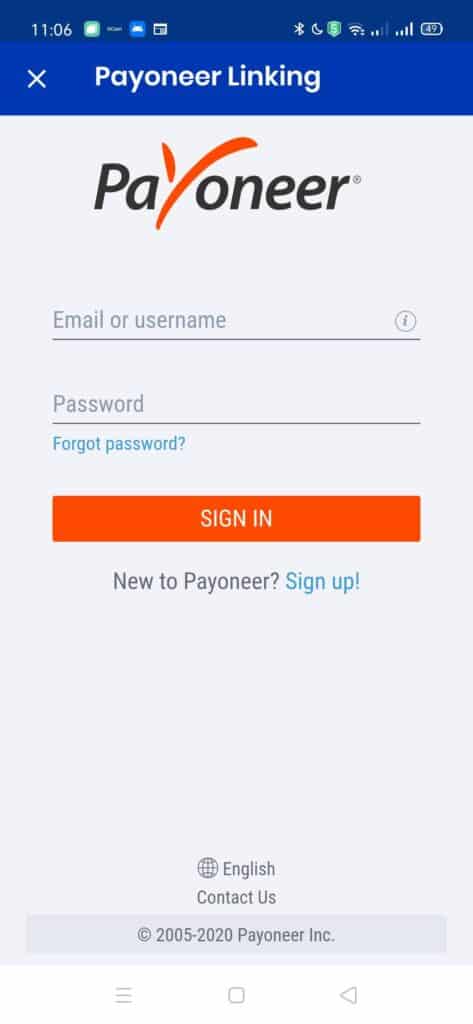

- Sign in from the Payoneer login page.

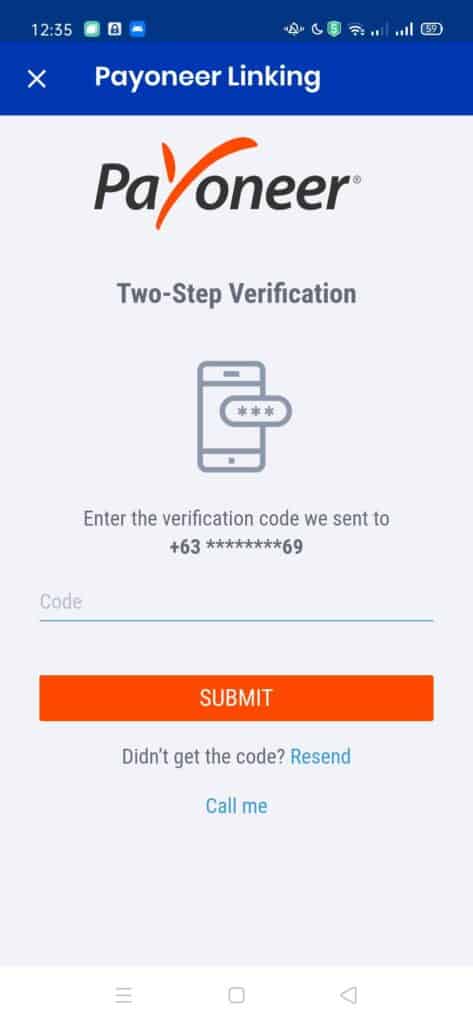

- Enter the one-time password received from the SMS.

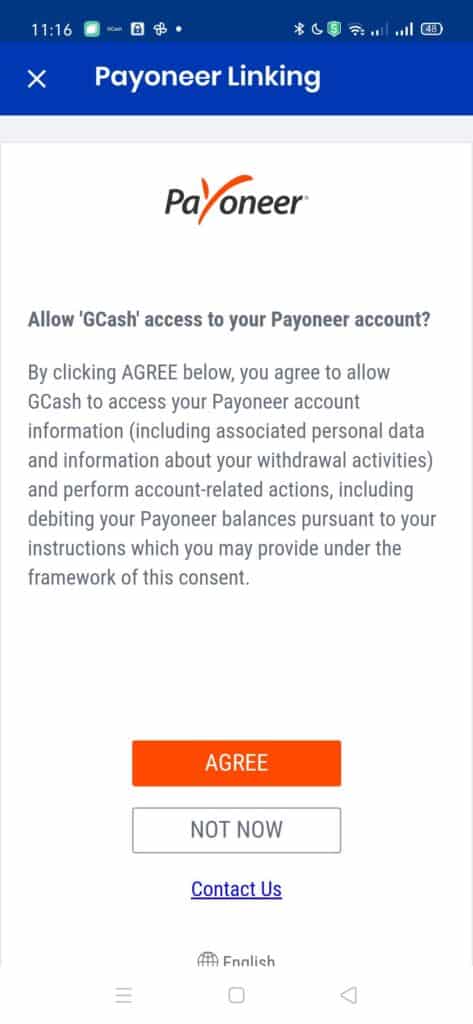

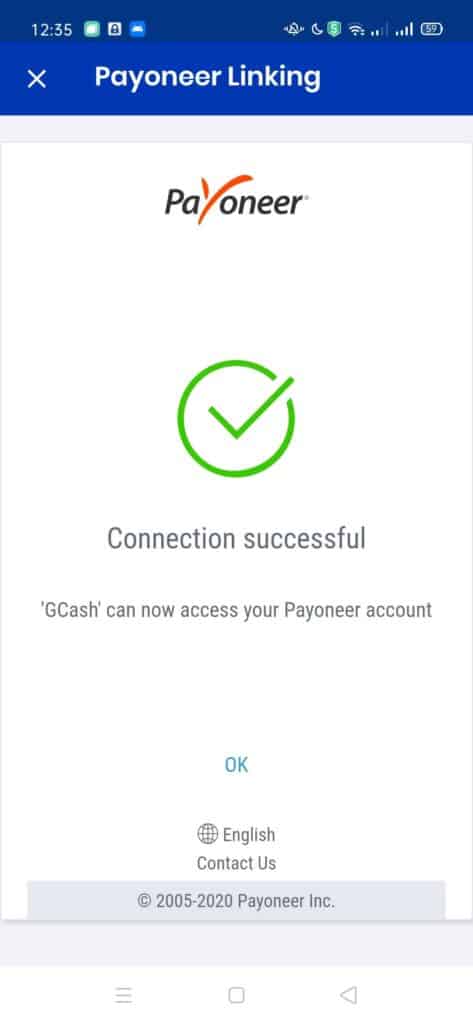

- Agree to allow GCash access to your account. The success page follows.

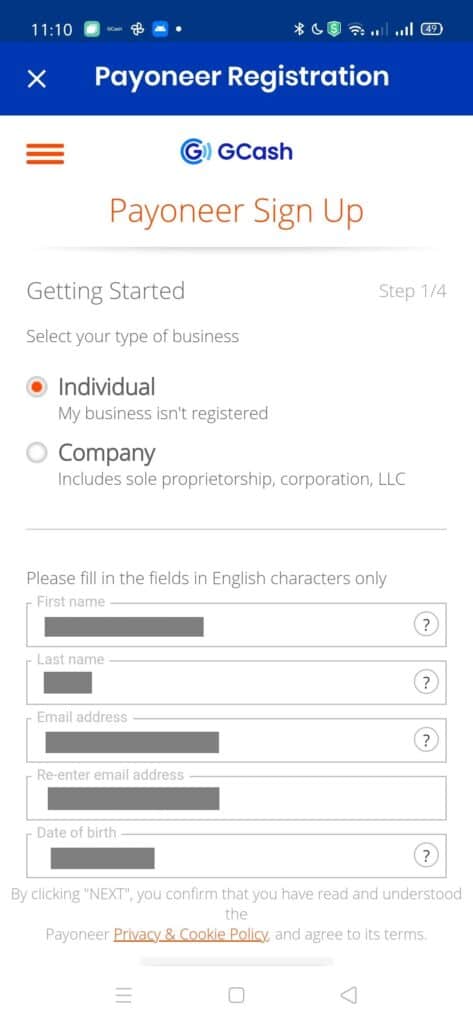

Creating a New Account

Here are the steps:

- Go to the sidebar and choose “My Linked Accounts”.

- Select Payoneer from the list.

- Click on Create Account.

- You can opt to Register with GCash or Create an account separately. I suggest you choose the first option.

- If you chose to use your GCash credentials, most of the fields have already been filled.

- You will also need ID details to sign up (e.g., Driver’s license, SSS ID, UMID, Passport).

- Under bank details, don’t forget to put in your account number in GCash.

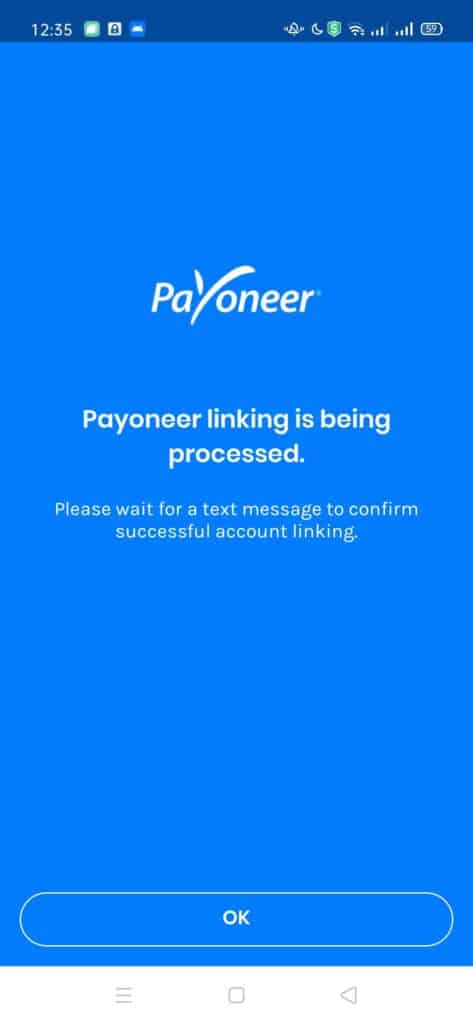

- Once registration is done, confirmation takes at most 3 days before your account is created and linked. Once confirmation is done, you will be receiving an email and an SMS.

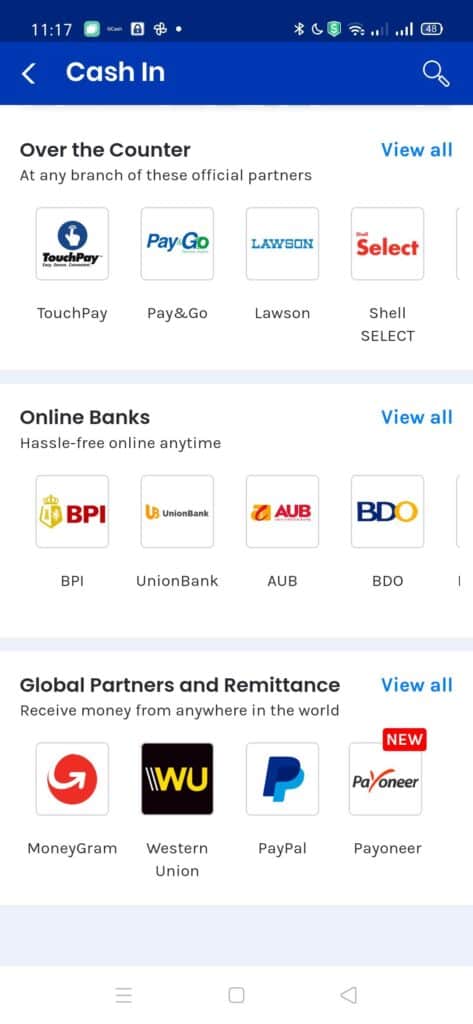

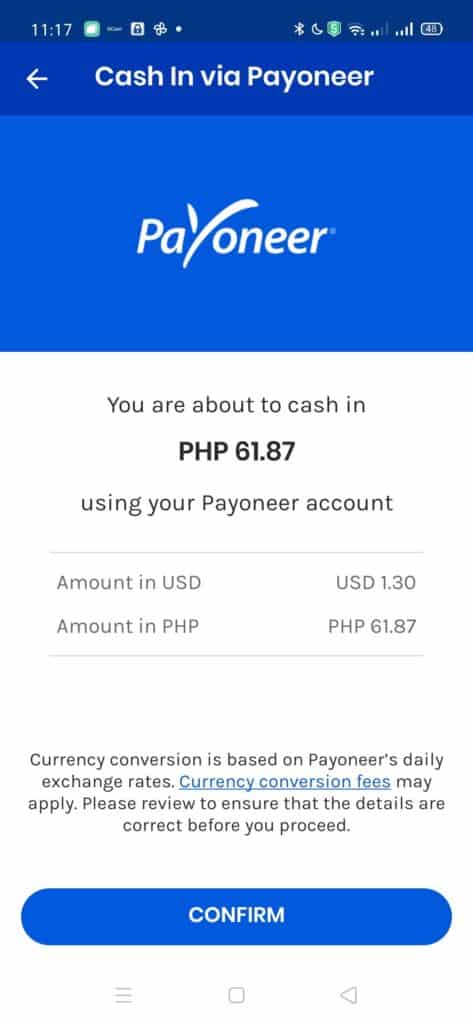

Cashing in using Payoneer

Cashing in using the Payoneer option is simple. You just need to select Payoneer in the cash-in options.

Here are the steps:

- Under Cash In, select Payoneer under Global Partners and Remittance.

- Select your available currency and input the amount you are planning to cash-in.

- Confirm you cash-in.

- Input the one-time password you’ve received.

Are there fees when cashing in using Payoneer?

Currently there are no fees. This is in contrast when transferring to a local bank account which has a 2% fee.

Is there a cash-in limit once I cash in using Payoneer?

The cash-in limit is the same as the wallet limit. Normally an individual wallet has a Php 100k limit unless you link a bank account, which extends the limit to Php 500k.

Unlocking Higher Account Limits

You can unlock higher limits by linking your BPI/UnionBank or your Payoneer account/s and utilizing either GSave or GInvest / GInsure with a Php 100 deposit or investment.

Once you do so, you will be able to unlock:

- A bigger wallet limit – Php 500,000 maximum

- Higher incoming limits – you will be able to receive up to Php 500,000 in your wallet and daily cash-ins have no limitations

- Higher outgoing limits – withdrawals will have no limitations per month, and you can withdraw up to Php 10,000 per day

You will be receiving an SMS informing you of the increased limits.

Take note that once you’ve unlinked all of your BPI/UnionBank/Payoneer accounts, the limits will revert back to what it was before.

Summary

GCash has partnered with Payoneer, a popular payment platform for entrepreneurs and freelancers online. Payoneer allows anyone to receive any amount from any currency and have it transferred to any local bank with some fees.

You can now link your existing Payoneer account or create a new one from within the GCash app. Once linked, you can cash-in from any of the supported currencies without any fees.

If you are interested in similar posts, you can check these out:

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

Hello! I recently used my GCASH AMEX for purchasing an iPad from Apple Store Philippines. My card is already been charged. But yesterday, Apple emailed me that my card cannot be authorized and the payment is not yet released to Apple although I was already charged.