GInsure offers affordable insurance products within GCash and makes insurance accessible to all of its users.

Disclaimer: This post aims to educate and not to give financial advice. Investments have different risks, and it is up to the investor to do due diligence and make decisions regarding his money.

GCash now has a built-in insurance marketplace, the first of its kind in the Philippines. In its pursuit of being an all-around lifestyle app, just like Alipay, they’ve also delved into selling insurance products. This is quite timely since we’ve all needed some kind of support, especially during the pandemic.

A benefit of this is we can do this without going to a separate app or site to manage or purchase these insurance products as it’s all being handled by GInsure.

What is the difference between investment and insurance?

Investment is something that grows in value over time when you give either your time and/or money to it. Insurance is something you are paying for that takes into account any bad thing that may happen that would cost you significant amounts of money.

An investment is an activity you have control over, as you actively select where you put your effort and your money. However, when an emergency happens, you would often need to draw from your investments if you have no other funds to take away from.

For insurance, you will need to pay an amount called a premium to cover you during a specific event you want protection from. An example can be disability insurance, which protects you from being disabled, or car insurance, which protects your car from damage due to accidents.

This premium enables you to have a security blanket in case this event actually happens. The good thing about this is you won’t need to take from your investments to pay for such emergencies. The only caveat is that you need to pay for the premium while being insured. Generally, the higher the premium, the better and more favorable the coverages are.

Another insurance example for employed individuals is HMO insurance, which is a type of medical insurance provided as a benefit to employees. The premiums are generally covered by the company or partly subsidized, but the benefit is to help employees (and sometimes their dependents) with medical emergencies and check-ups.

The distinction between insurance and investment is sometimes not explained well by those that sell insurance products, hoping to make a quick buck from the commission of the insurance product purchase. Oftentimes insurance products can have investment components (like Variable Universal Life Insurance or VULs), but the buyer should keep in mind that he is purchasing insurance first and hence the payment of premiums naturally take precedence over the “growing” of the investment component.

What are the requirements to enroll in GInsure?

You need to be Fully Verified to be able to use GInsure. The main requirements are already handled by KYC (know-your-customer) policies in the GCash app.

Basically, you only need one valid ID to be able to buy an insurance product in GCash. This goes a long way in providing financial services to the people that really need them.

Subscribing to GInsure Products

The very first provider was Singlife, but there have been more products added since it was introduced, depending on the category:

- Health (Singlife)

- Lifestyle

- Pet Insurance (Malayan, Standard)

- Phone Insurance (Etiqa, Igloo)

- Online Shopping Insurance (Igloo)

- Goals

- VULs (Singlife)

- Personal Accident (FPG, Singlife, Cebuana Lhuillier, Sunlife, Generali)

- Vehicle (Kwik.insure, FPG, BPIMS, Standard)

- Property (FPG)

- Travel (Malayan, Standard)

- Business (Malayan)

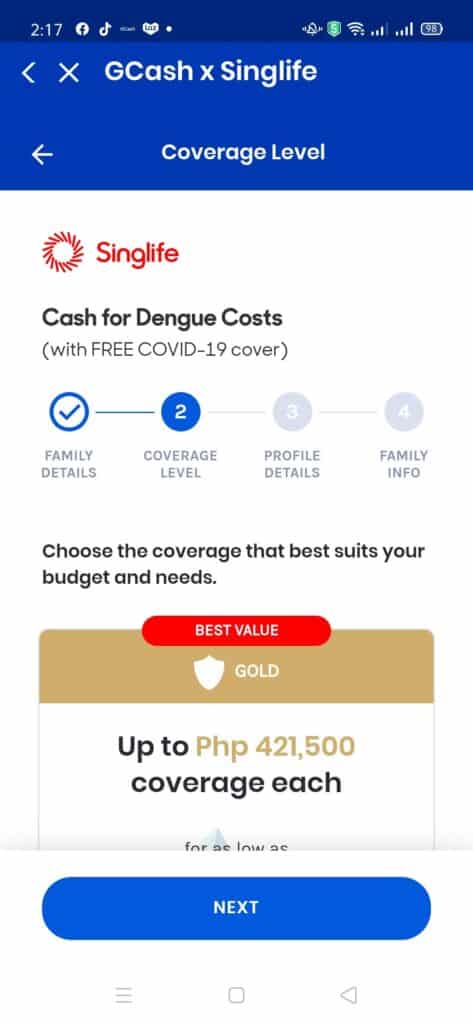

As an example of how to avail, here is the step-by-step guide for Singlife:

Singlife

Singlife is a life insurance company partly owned by Singapore Life Private Ltd, Aboitiz Equity Ventures (a local conglomerate), and a Singaporean investment company Di-Firm.

They specialize in offering digital insurance products, which are cheap, accessible, and customizable because they leverage technology in providing their products. They also offer them in their app (which removes middlemen) and in-app partnerships like GCash.

Singlife is the first partner for GInsure, hence we can see Singlife products within the marketplace.

What are the products by Singlife in GInsure?

There are multiple products offered by Singlife, not limited to:

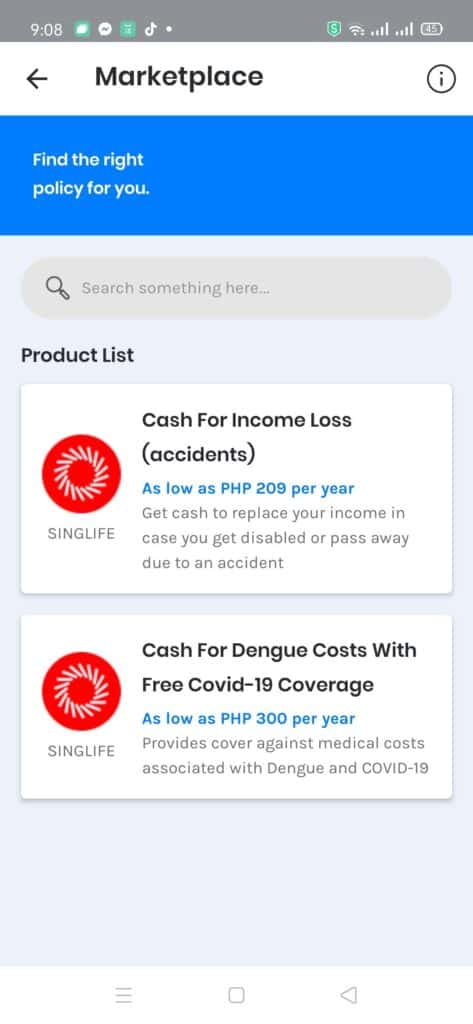

- Cash for Income Loss (Accidents)

- Cash for Dengue Costs with Free COVID-19 Cover – provides COVID-19 test allowance, confinement allowance, and medical cost reimbursement for severe cases

- 3-in-1 Protection Plan – protection against accidents, dengue, and COVID-19

- Cash for Medical Costs – hospitalization insurance

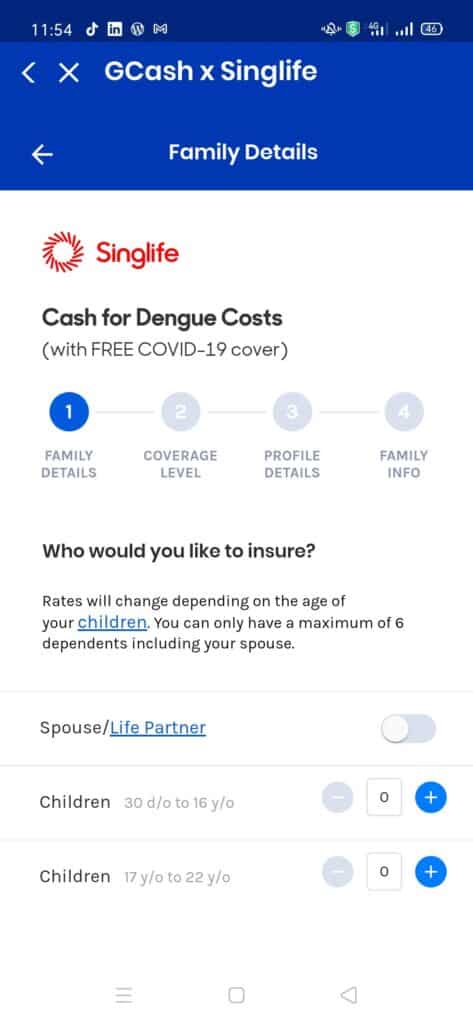

There are typically 3 levels of coverage. The cheapest is bronze and works its way to silver, then to gold. A higher level of coverage means you get more benefits, but you also need to pay a higher premium. You can also include your family in the coverage with additional premiums if you need to.

What are some considerations before buying a Singlife insurance product?

Here are some things I took note of before buying a plan for my family:

- You can include a Life Partner in your plan, which covers those who are not married but have kids or have been together for years.

- Check for a preexisting conditions clause – one of my family members was not included because of diabetes. Also, children below a certain age have a higher premium for certain products.

- The premium is taken from your GCash wallet, so keep in mind to fund your wallet if you wish to continue your coverage the following year. Don’t worry, you will receive a notification before your scheduled auto-debit.

- If you change your mind, you can apply for a full refund within 15 days of purchase. Additionally, before claims, you will need to wait for 15 days for coverage to begin.

How do I buy a Singlife Product?

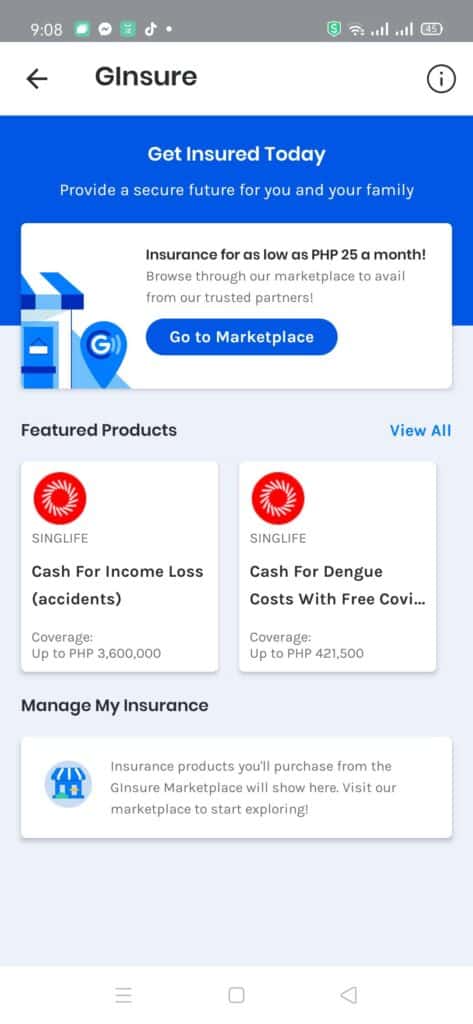

- From the main menu, click on the GInsure button.

- Once inside GInsure, either select a featured product from that page or click on “Go to Marketplace” and click a product from the list.

- You will be able to see the details of the product (Benefits, Premium, Family, Not Covered). Once everything is clear, click on “Buy Now”.

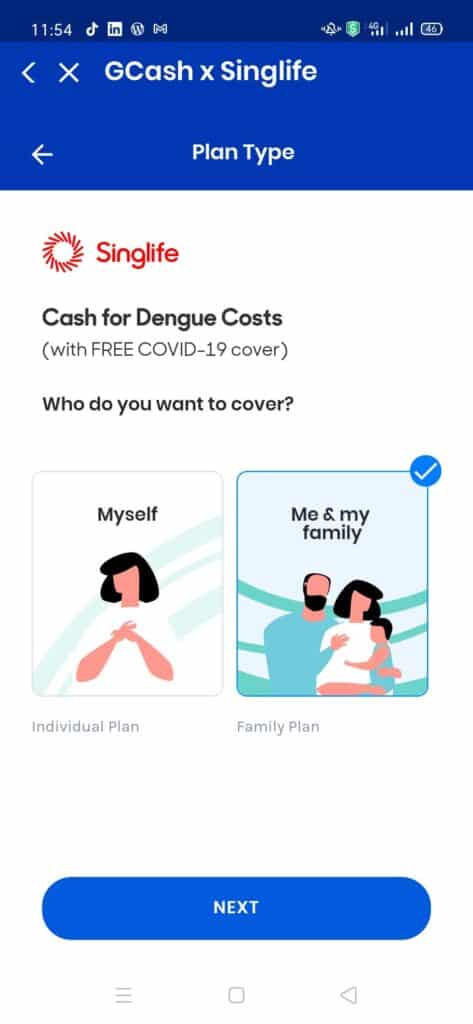

- Click the Plan Type you want (for Myself, or for Me & my family).

- If you selected “For Myself”, then you can choose your coverage level. Otherwise, you need to enter how many family members you want to join and select the coverage level for them.

- Confirm your profile details (basically this is already provided by GCash verification).

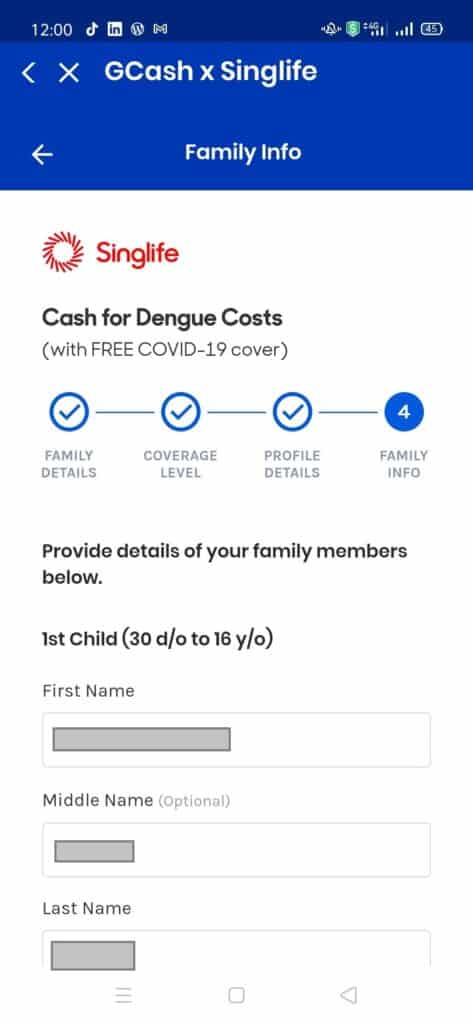

- If you have family members, enter their details.

- Review the details you’ve set, tick the Declarations, and click “Confirm and Pay”.

- Pay for the premium.

SMS Insure

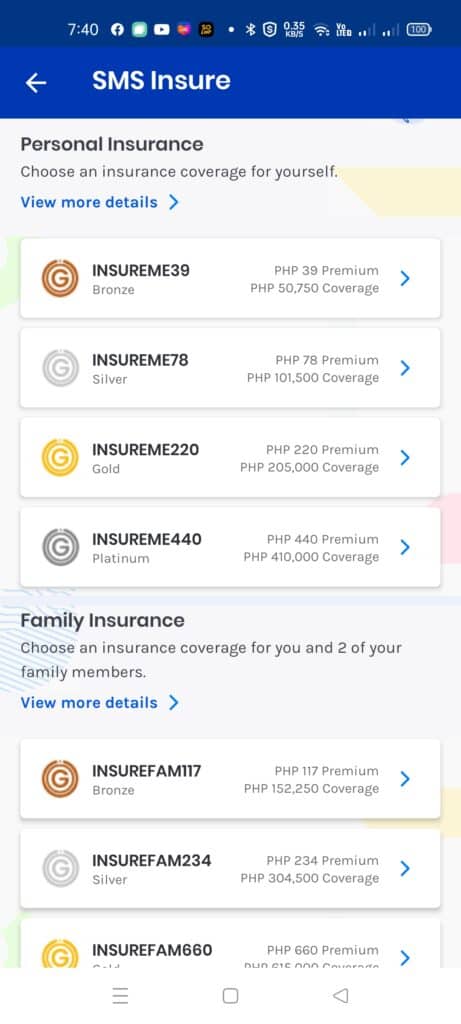

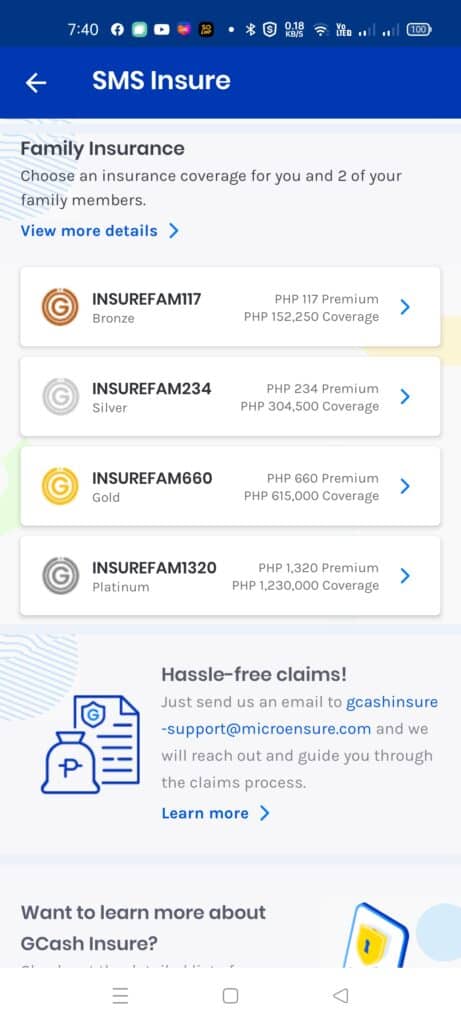

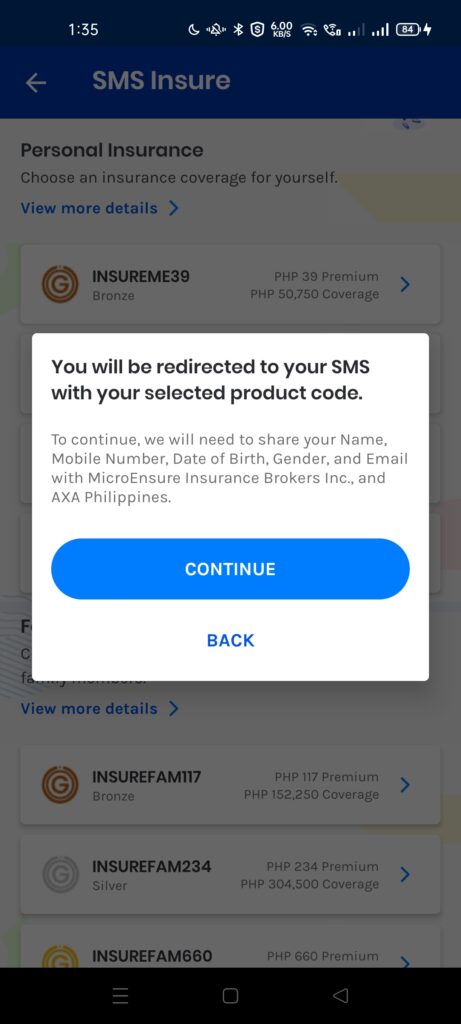

GCash has also its own insurance product, named SMS Insure. It’s a partnership with Microensure and underwritten by AXA. Basically, it allows you to apply for annual term insurance using SMS, paid monthly.

What are the SMSInsure product details?

All of the products offer a term coverage of 1 year. For personal insurance, the insured is the GCash user; for family insurance, it includes the user as well as 2 family members. Coverage includes each person insured.

Before claims, you need to wait for 15 days for coverage to begin.

| Product | Monthly Premium | Term Life / Personal Accident Coverage | Hospital Cash Coverage |

|---|---|---|---|

| INSUREME39 | Php 39 | Php 25,000 | Php 750 (Php 250 x max 3 days confined) |

| INSUREME78 | Php 78 | Php 50,000 | Php 1,500 (Php 250 x max 6 days confined) |

| INSUREME220 | Php 220 | Php 100,000 | Php 5,000 (Php 250 x max 20 days confined) |

| INSUREME440 | Php 440 | Php 200,000 | Php 10,000 (Php 250 x max 40 days confined) |

| INSUREFAM117 | Php 117 | Php 25,000 | Php 750 (Php 250 x max 3 days confined) |

| INSUREFAM234 | Php 234 | Php 50,000 | Php 1,500 (Php 250 x max 6 days confined) |

| INSUREFAM660 | Php 660 | Php 100,000 | Php 5,000 (Php 250 x max 20 days confined) |

| INSUREFAM1320 | Php 1320 | Php 200,000 | Php 10,000 (Php 250 x max 40 days confined) |

Is COVID-19 covered in these products?

Yes, they are covered for both death and hospitalization benefits.

How do I avail of the SMSInsure product?

You can just click on the product, and it will redirect to your SMS with the keyword and number already populated.

How to File a Claim from GInsure

Filing a Claim in Singlife

Claiming is easy as you don’t need to go anywhere. You can submit all the requirements within the GCash app.

Here are the steps:

- Within the GInsure page, click on “Manage my Insurance”.

- Click “File a claim” and then input the details.

- Upload your supporting documents, then click Next.

How long do I wait before I get the benefit?

For medical test allowances, generally, you will be getting your reimbursement in your GCash wallet within 24 hours of filing a claim. For confinement allowances, it can take up to 3 days.

How to File a Claim in SMSInsure

You can send an email to gc*****************@*********re.com. You need to include the details of your insurance as well as any supporting documents for assessment. It can take a few days for processing.

Other Questions

Will I be getting a copy of the policy?

Yes, within a day you will be getting an e-policy within the GCash app, as well as a confirmation email with the contract attached.

Can I use GCredit to pay for my insurance?

No, currently you can only use your balance.

Are there other insurance products in GCash aside from GInsure?

Yes, there is a Cebuana Insurance mini-app under GLife and you can buy personal accident insurance for only Php 10.

Summary

We talked about GInsure, the insurance marketplace within the GCash ecosystem. This allows anyone to avail of, and manage insurance products from within the GCash app. We talked about how to avail of a product and also the conditions surrounding it. Everything is within the GCash app, including payments and claims, making it really easy to use.

Related Topics

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

The info provided has been very useful for me to decide and choose well which insurance I plan to avail/buy

Hi, I just want to clarify if I did not used the insurance, will I be getting back the total money I paid monthly?

No, I don’t think you understand what insurance is. You are paying for the off chance that something happens to you and if that’s the case, you won’t be leaving behind your family without a bit of financial support. It’s not something like an investment where you get returns.

I think i have not read on how long are we going to pay?

Currently, the contracts are renewed yearly. So you can choose not to renew. Kind of like a subscription.

Until when is the coverage?

when you start your payment, the coverage is until the next year after that.

How can my family file a claim in case of my death? Or will I need to give them my GCash password?

Your family can initiate a claim via an email to he**@******fe.com or by calling 82993737

Hello. Does life partner also include partners of the same gender?

The rules doesn’t really say anything about gender so most likely it is allowed.

Hi, nag avail po kame ng INSUREFAM1320 Php 1320 last Aug 8. Magaavail po ba ulit kami at magbabayad ng Php 1320 ngayong September 8? Bale monthly po ba o 1 year na po yung binayad naming Php 1320?

Mukhang 1 year yan

bago lng po ako nag apply, within 1yr lng po ba ang validity? so after paying po ng 1 yr sa GInsure tapos di ko na po i-contine, wala na rin po ba ang benefits?

Yes, per year lang ang validity/term niya currently.

What if I purchase GCash x Singlife (GInsure – Cash for Income Loss) and I continue to pay monthly until such time I reached my retirement age, can I refund all the payment I made from the start of my purchase availment?

I don’t think you understand how insurance works — you are paying for the security blanket if something happens to you. If nothing happens, you can’t refund the insurance back.

I suddenly got an email from CHUBB PH . I did not apply for this insurance. May I know why is this and am I suppoed to be paying this?

Maybe you mistakenly clicked the bill protect — they provide insurance based on that