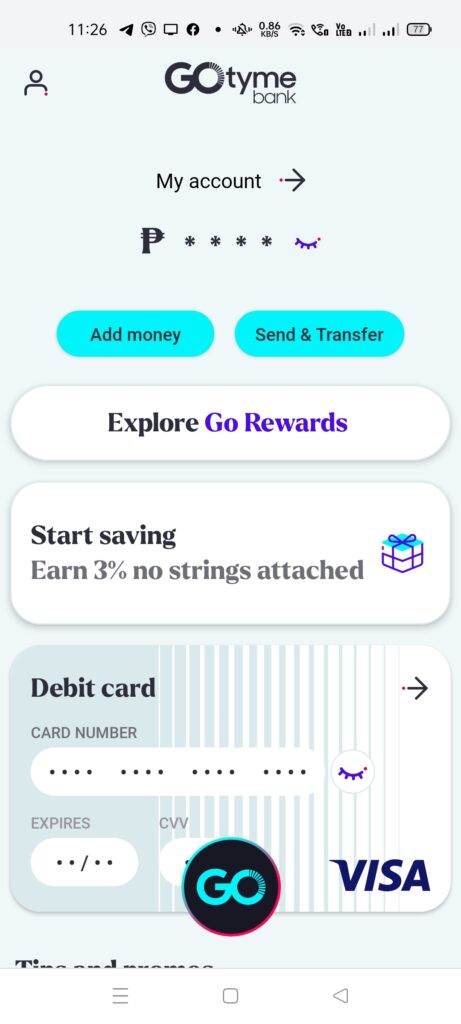

This post introduces GoTyme, a high deposit-yielding digital bank app with some nice features included.

Aside from GCash, there are currently a lot of different neo-banks and virtual wallets, with each having different ways to expand into the space. GoTyme is similar, and its sticky point is the pretty competitive deposit interest rate and usage of the Robinsons network of specialty stores, department stores, and supermarkets.

What is GoTyme Bank?

GoTyme is a digital bank that is partly owned by the Gokongwei Group, which also operates Robinsons Bank and everything related to Robinsons. The other owner is TymeBank, a banking platform based in South Africa.

They are definitely leveraging the extensive supermarket and retail network of Robinsons from which transactions can originate. Go Rewards, which is the rewards platform of Robinsons, is tied to GoTyme to give an incentive for users to switch. They have an ongoing promo that gives 3x the number of points when you use the GoTyme debit card in Robinsons stores.

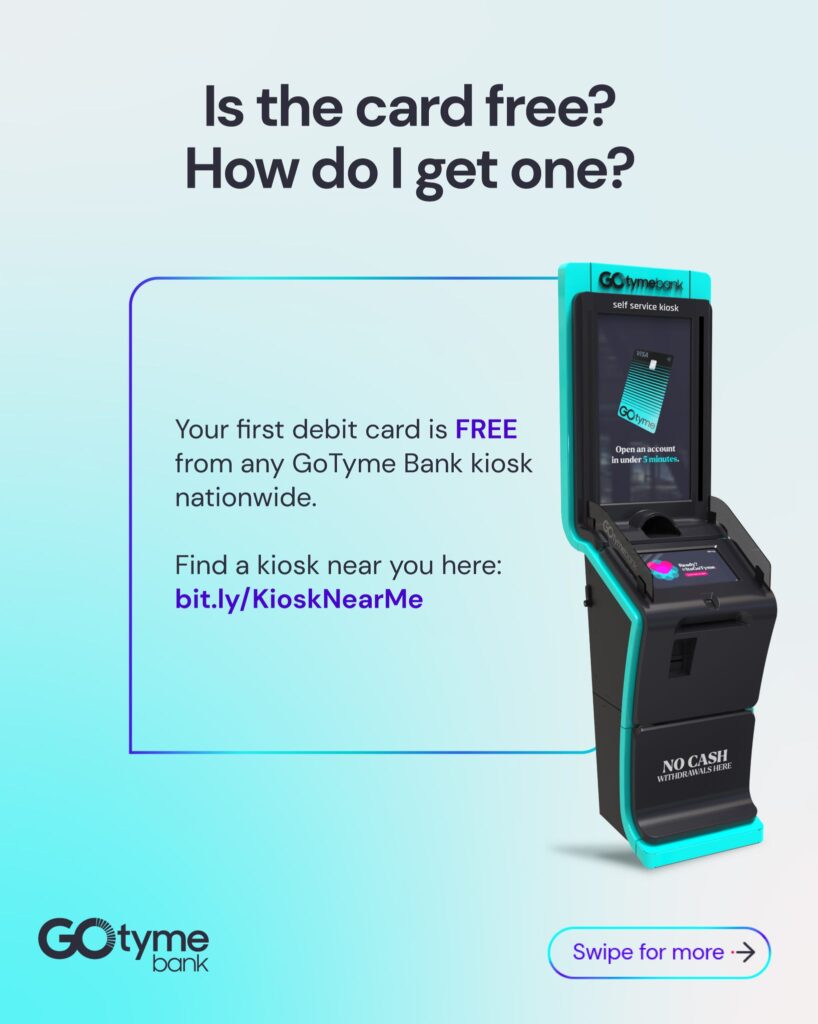

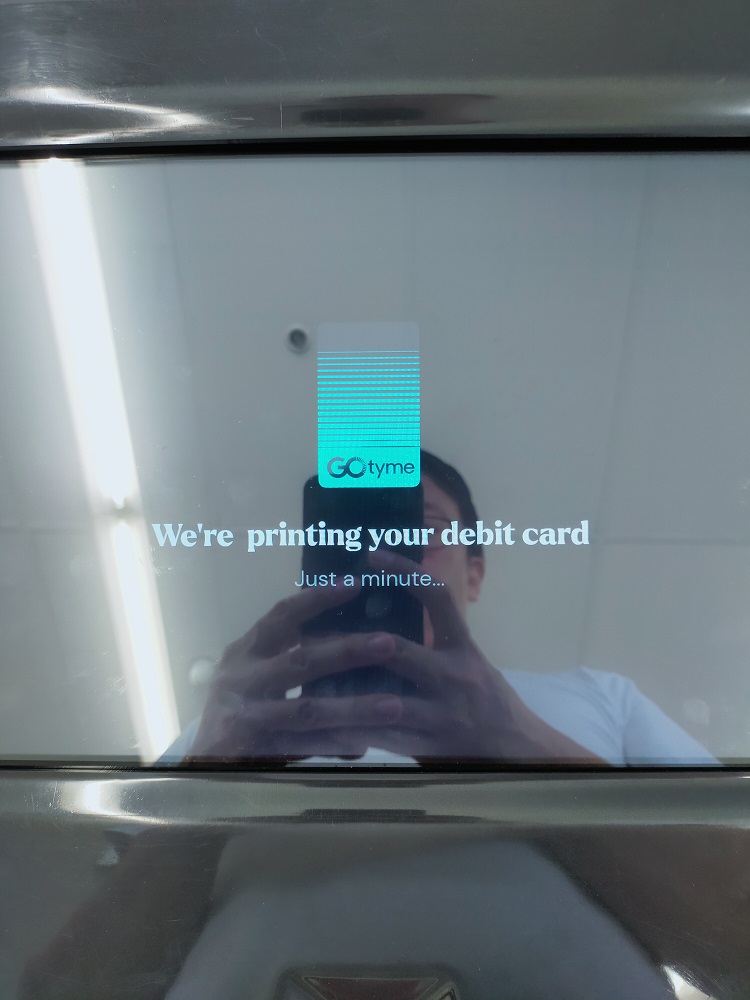

GoTyme does have QR codes for payment but is also leveraging debit cards. Normally banks acquire users by branch visits, but in this case, since GoTyme is mainly an app, it would be harder to apply for debit cards. Another pain point they are trying to solve is the issuance of these cards. You can now get the cards in a few minutes using their teal-colored, high-tech kiosks found in Robinsons stores.

Notable Features in GoTyme Bank

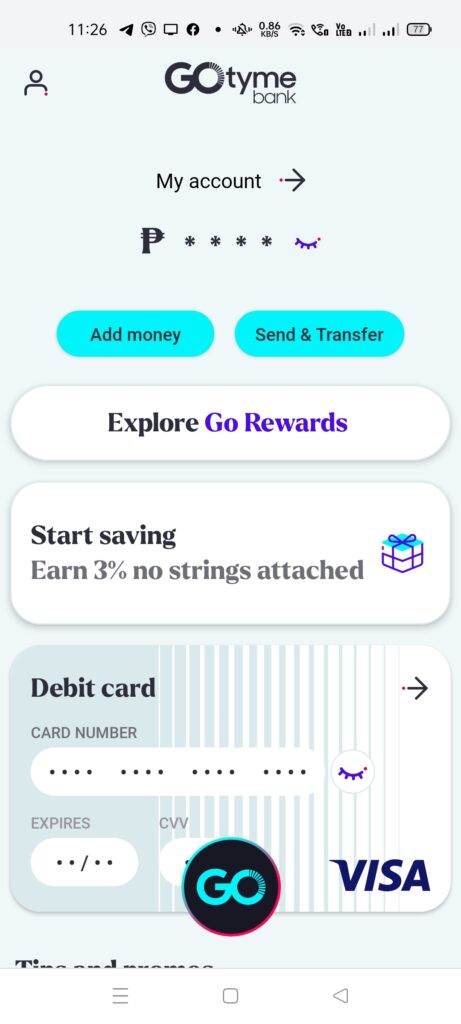

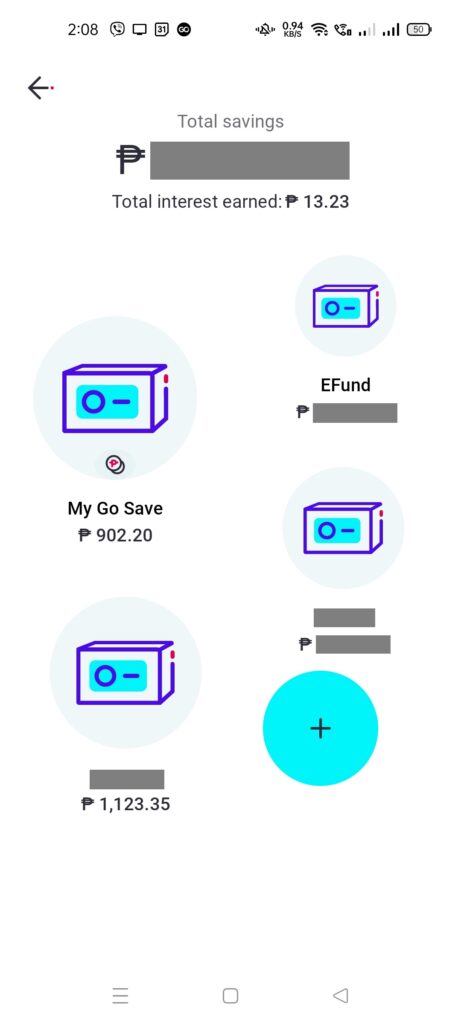

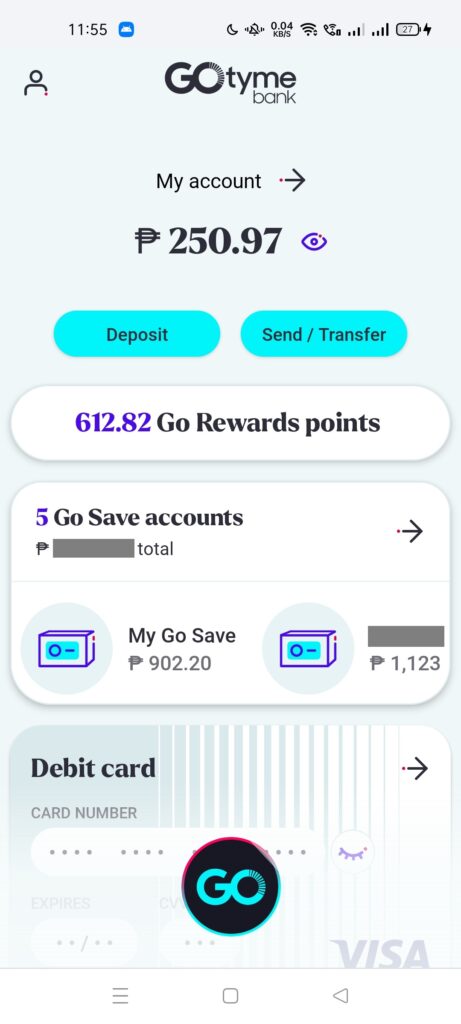

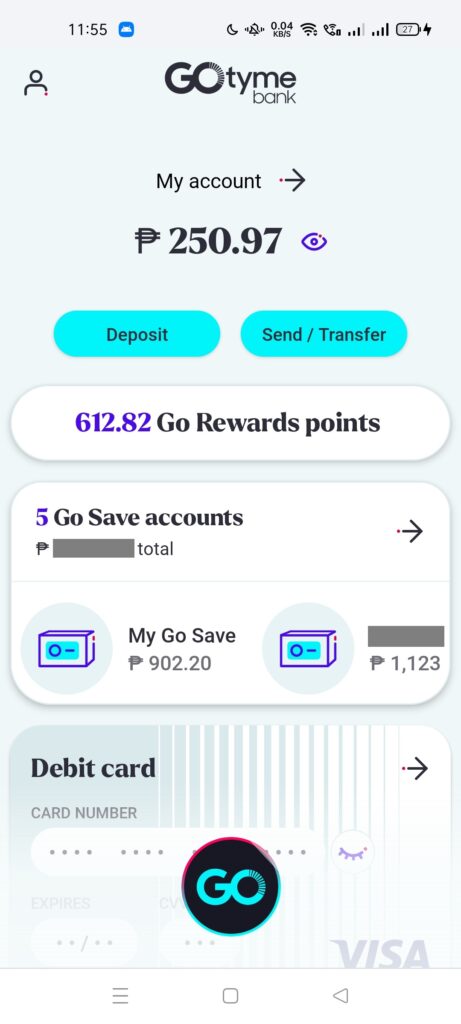

GoTyme is mainly a digital bank, and they offer a 5% interest rate for deposits per year, compounded per month. This is higher than a lot of other digital banks out there currently. Creating sub-accounts in GoTyme for different purposes is also easier than other banks. You can create up to 5 sub-accounts in your Go Save account, and you can set a savings target for each. You can also schedule automatic deposits and rounded-up deposits for loose change.

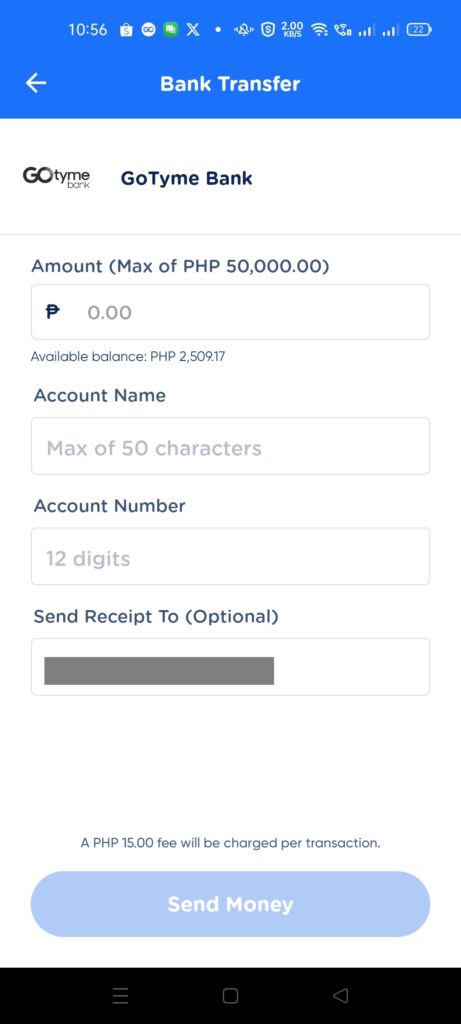

Other features they have currently are Buy Load, Pay Bills, Bank Transfers (3x free per week), and Pay QR through QRPH. You can also have your debit card virtually and in real life as the kiosks print your personal details on the debit card for free.

Another notable feature they have is the linking of your Go Rewards account to your GoTyme account. This allows you to gain Go Rewards points when you use your GoTyme debit card, and a multiplier if you use it in a Robinsons-owned store or any Robinsons partner. The Go Rewards points can be redeemed as a payment method.

Personally, the main reason why I use GoTyme is I do my groceries in a nearby Robinsons Supermarket and I sometimes top up in Caltex gas stations. The Robinsons ecosystem is pretty accessible as it covers a lot of industries. I also like that their GoSave product has a higher interest rate than other similar bank apps.

Here is a list of Go Rewards partners:

- Benefit

- Cle de Peau

- Caltex

- Daiso Japan

- Cebu Pacific

- Handyman

- Maxicare

- No Brand

- Pet Lovers Centre

- Robinsons Appliances

- Robinsons Bank

- Robinsons Dept Store

- Robinsons Easymart

- Robinsons Supermarket

- Rose Pharmacy

- Savers Appliances

- Security Bank

- Shiseido

- Shopwise

- Southstar Drug

- Super 50

- The Marketplace

- Toys R Us

- True Value

- Uncle John’s

How to Create a GoTyme Account

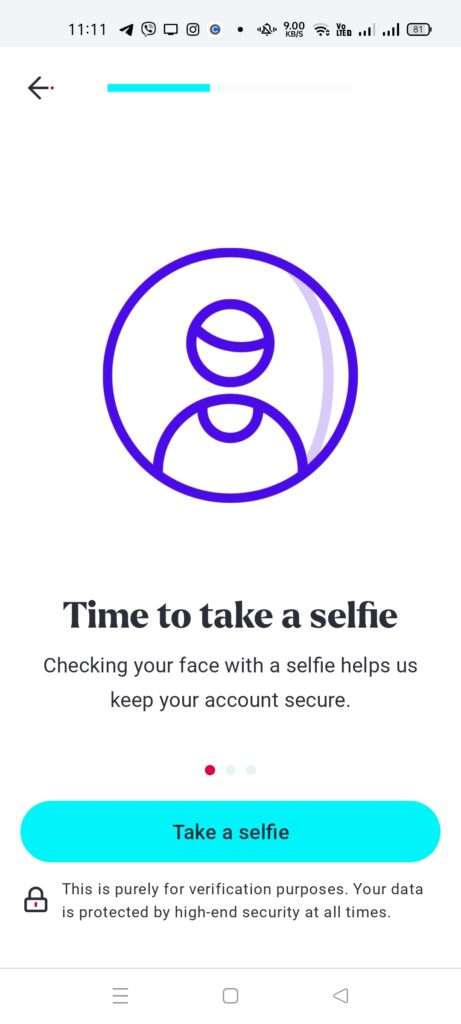

Creating an account starts with downloading the app and opening one. You will need to take a selfie, so it would be best to be prepared:

- From the start page, click on “Open an account”.

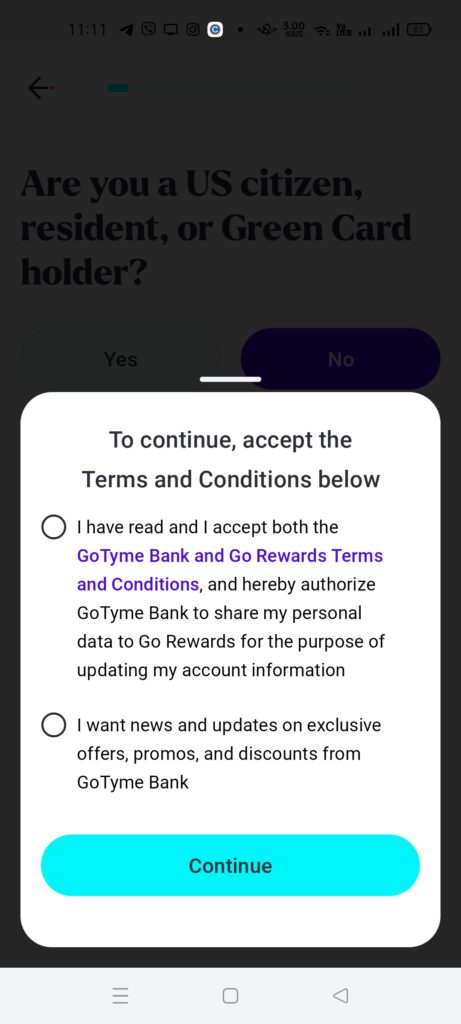

- Confirm that you are a Filipino citizen, not a US citizen, and accept the terms and conditions.

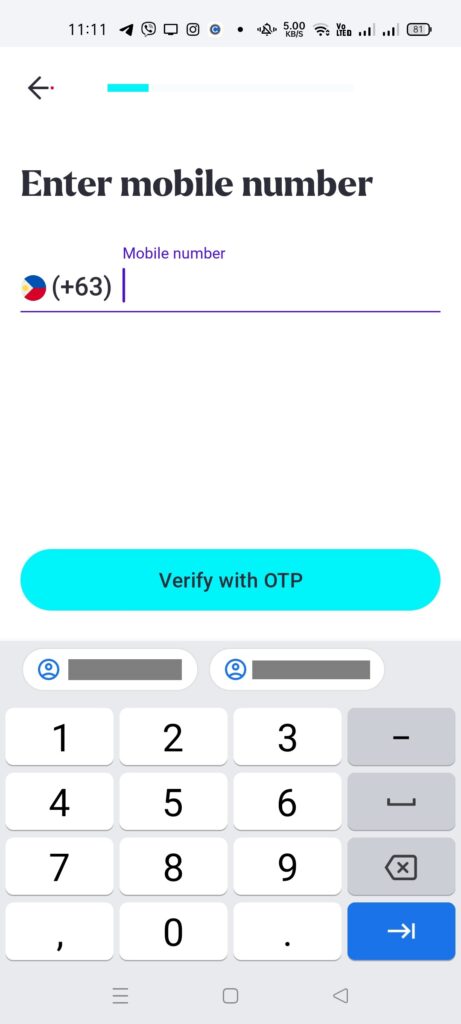

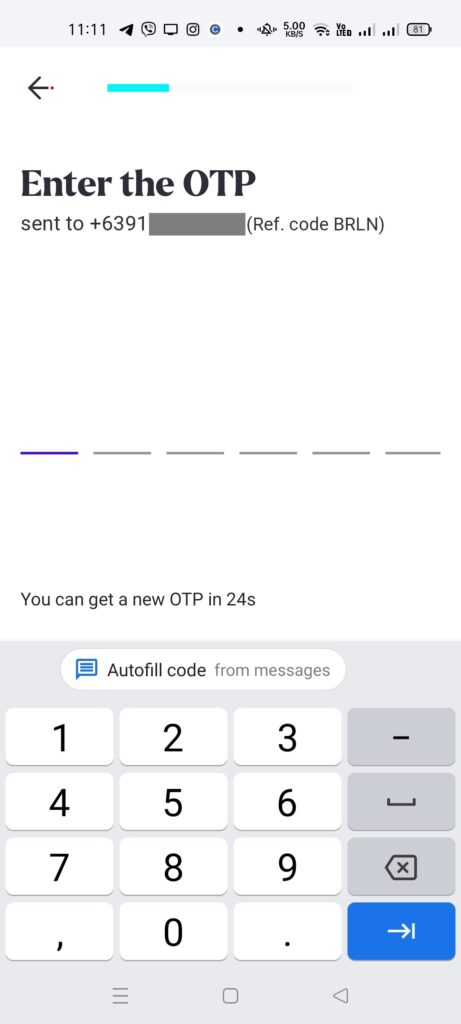

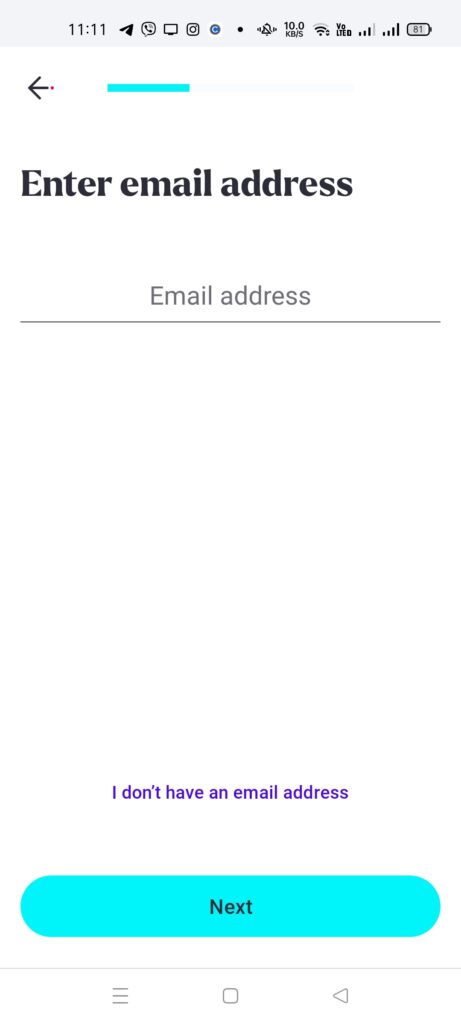

- Input the number you are using and confirm using OTP. Also, input your email address.

- The last part is you need to take a picture of your official ID and selfie and follow the directions.

- If you want to enable fingerprint authentication, you can do so.

How do I get a GoTyme Debit Card?

In the app, once you’ve opened an account, debit card creation is already included. If you need an actual card printed, you need to go to kiosks and have them printed in 5-10 minutes. There is always a person manning the kiosk to help users with this step.

How do I use the GoTyme Debit Card?

You can use the virtual card in online stores and internationally as it is a Visa card. If you use the card when paying in Robinsons-owned stores, you also get the Go Rewards multiplier benefit.

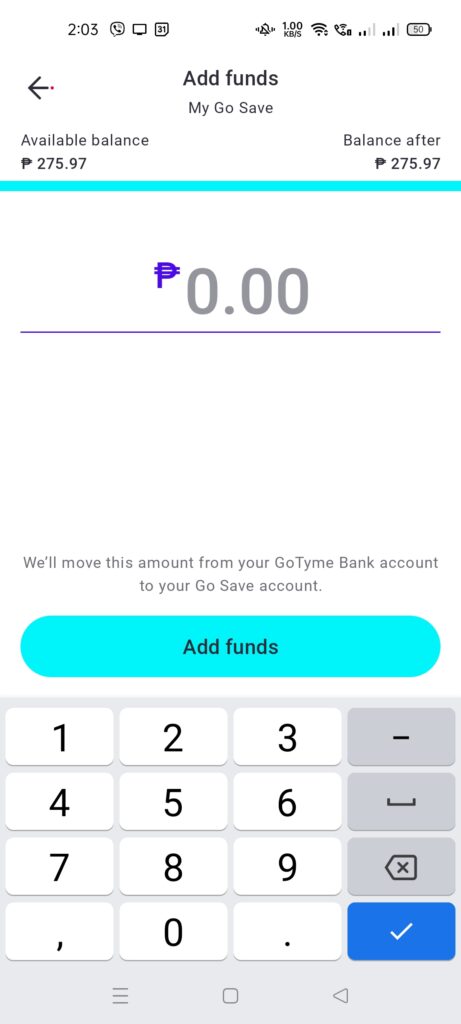

How to Deposit in GoSave on GoTyme

You can deposit directly using your wallet balance into GoSave. You can make up to 5 subdeposit accounts inside GoSave and the interest rate will apply to all of them.

To start you can click on “Start saving” and add funds from your wallet balance. Once done, you will be able to see your deposited amount in the “My Go Save” account. Afterward, you can open a subdeposit account easily, you just need to click on the plus sign on the GoSave page.

You will be able to see all of your subdeposit accounts from the main page afterward.

How to Use GoTyme with GCash

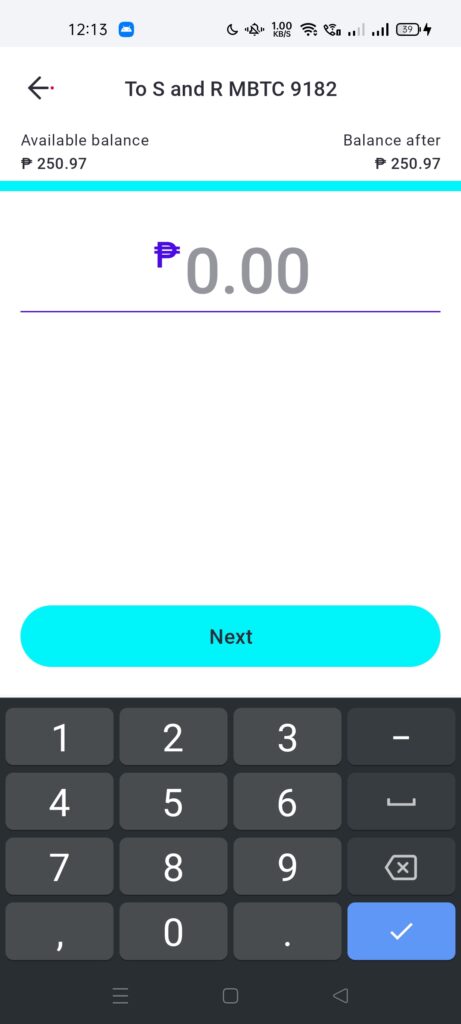

The beauty of digital wallets and banks is you can switch to different apps to maximize the benefits on a certain platform. In this case, one way we can leverage GoTyme’s strengths (Go Rewards multiplier and deposit interest rate) using GCash is via Bank Transfer.

We just need to send the funds to our GoTyme account from GCash, and from the GoTyme app you can use the debit card to earn points or put it into GoSave to earn interest.

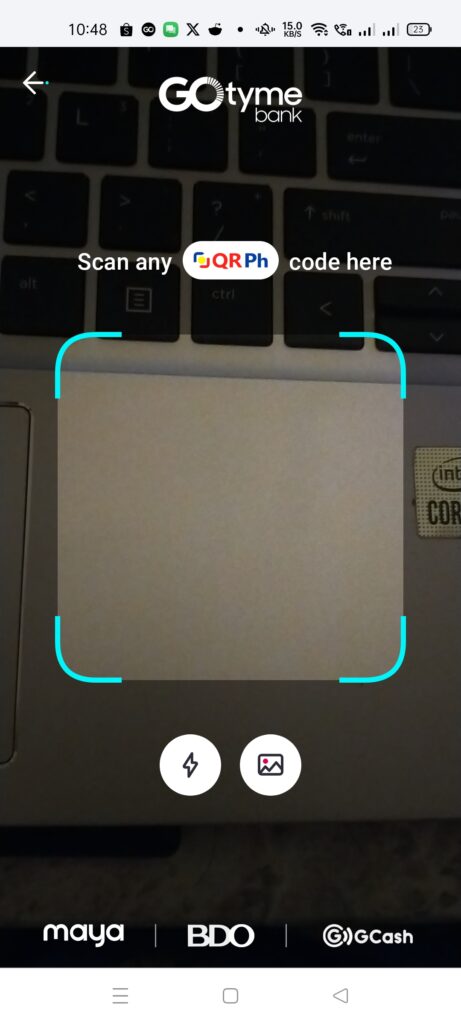

Another neat feature is you can utilize the QRPH network as you can scan a GCash QR using GoTyme’s QR scanner for payment and vice versa. Here is proof:

A limitation currently is personal or bank account QRs can’t be scanned in the meantime.

Other Questions

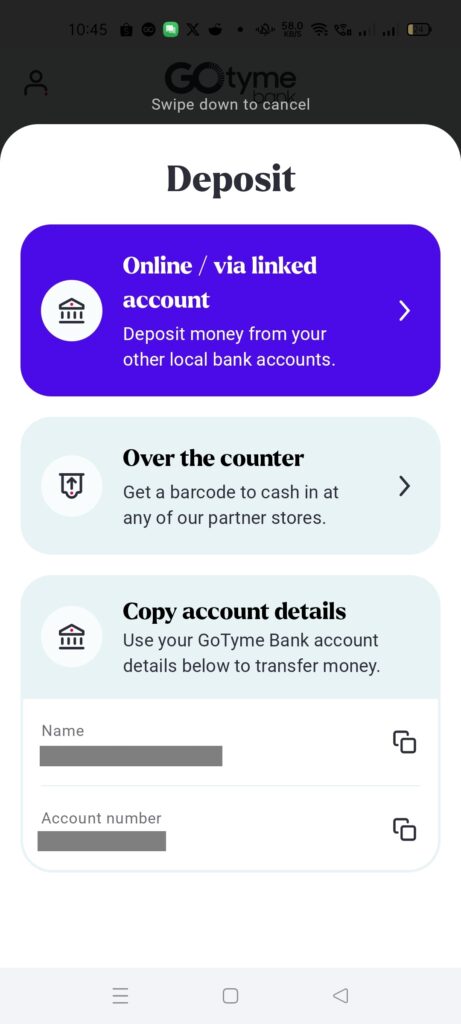

How do I cash in in GoTyme?

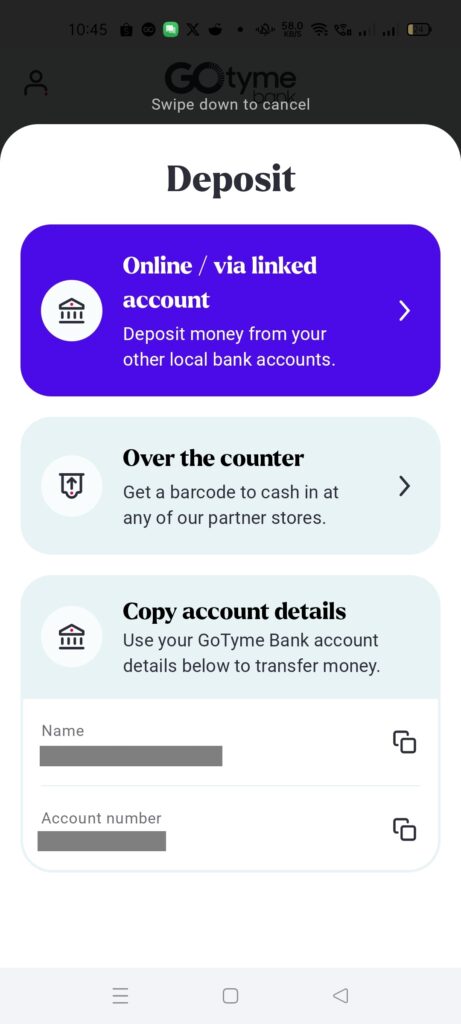

You can cash in via over-the-counter in Robinsons-owned stores, or you can also deposit using linked bank cash-in via BPI, UnionBank, ChinaBank, or RCBC.

Over-the-counter cash-in in GoTyme

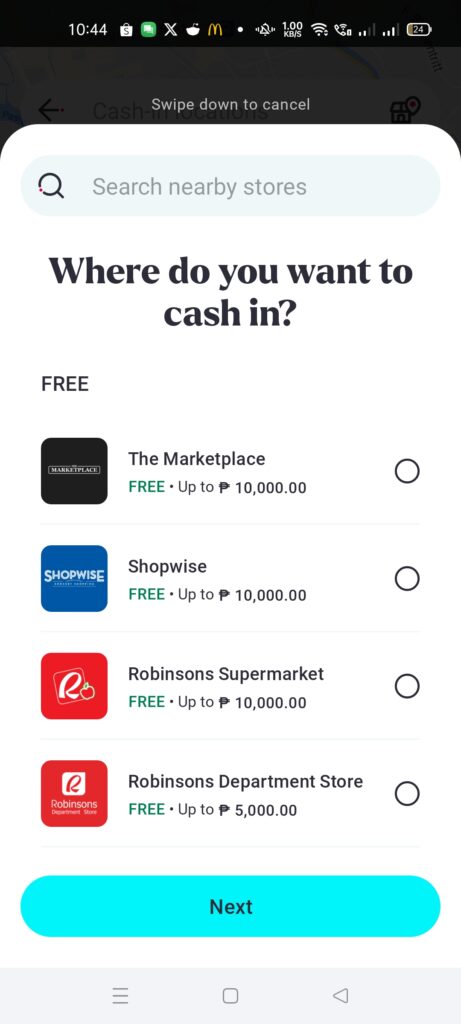

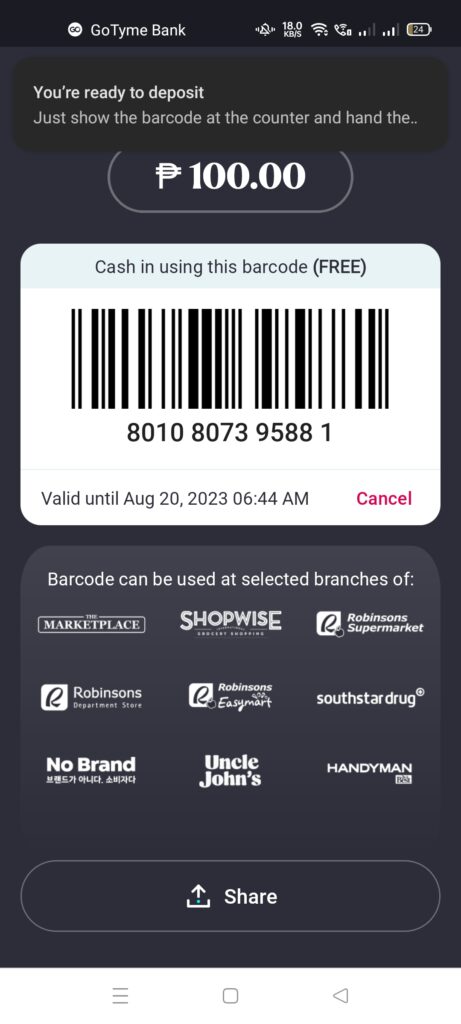

If you are cashing in OTC, you need to select the store you are planning to cash in and generate a barcode.

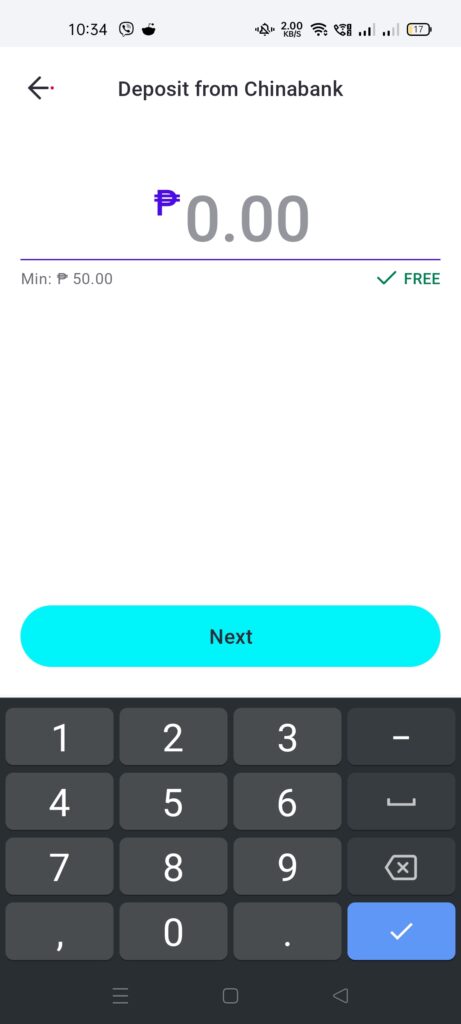

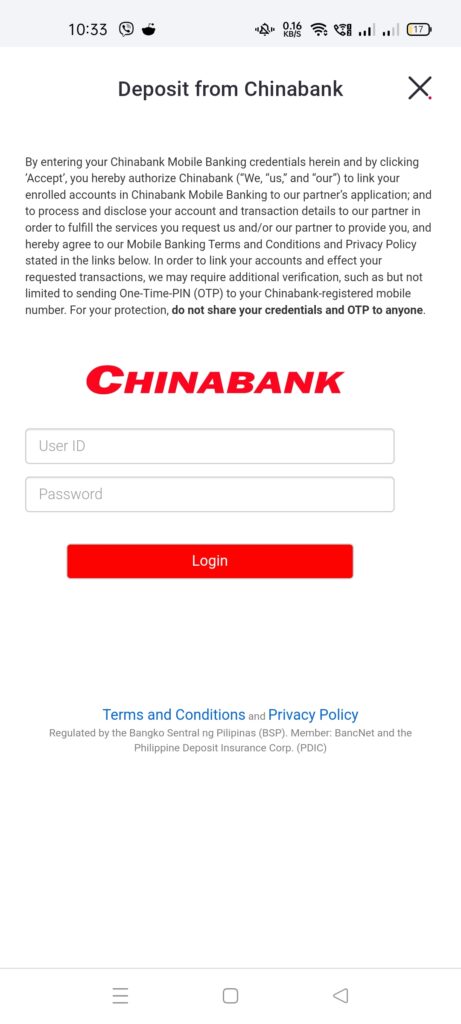

Bank Deposit Cash-in in GoTyme

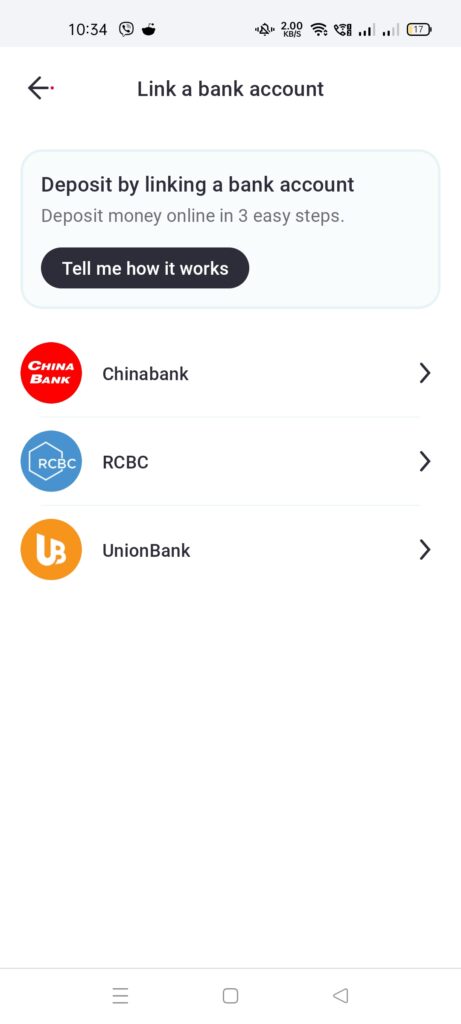

You can also cash in using supported bank integrations. Unfortunately, BPI Cash-in is now absent after a recent update. Linking a bank account requires you to have an account with that bank, and you should also have your username and password on hand. You would also need to input the OTP sent to the mobile number linked to that account.

When do I get my interest in Go Save?

The 5% interest is compounded monthly, on the first of every month. There is also a 20% withdrawal tax included.

Can I use the GoTyme Scan QR with QRPH codes?

Yes, you can use Maya, GCash, and other QRPH codes with the GoTyme QR scanner.

Summary

I talked about how GoTyme Bank is one of the fastest-growing digital banks as it is leveraging the huge Gokongwei portfolio of companies to support its growth. You can open an account in around 15 minutes and also have your debit card printed in any GoTyme kiosk located in Robinsons-owned stores.

You can leverage the higher Go Rewards point multiplier by transferring funds from GCash to GoTyme via Bank Transfer and then using the debit card to pay for your purchase.

Related Posts

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services: