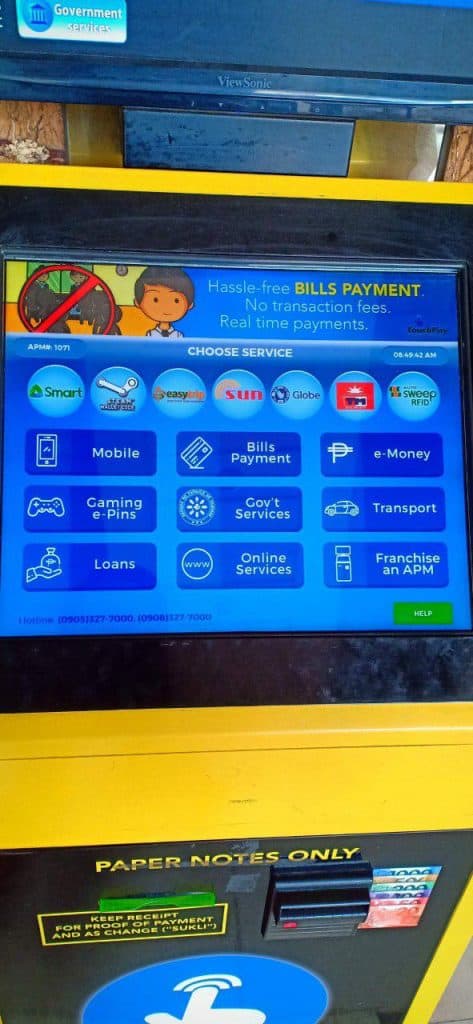

This post explains how to use TouchPay and Pay&Go machines to top up in GCash.

Cash-in machines have been becoming common, and I’ve seen them being used in malls, convenience stores, and some high-traffic areas.

I recommend using it when you see one as it makes transactions easier. You can pay bills and do transactions using the machine without letting you queue in person in Bayad Centers and other similar locations.

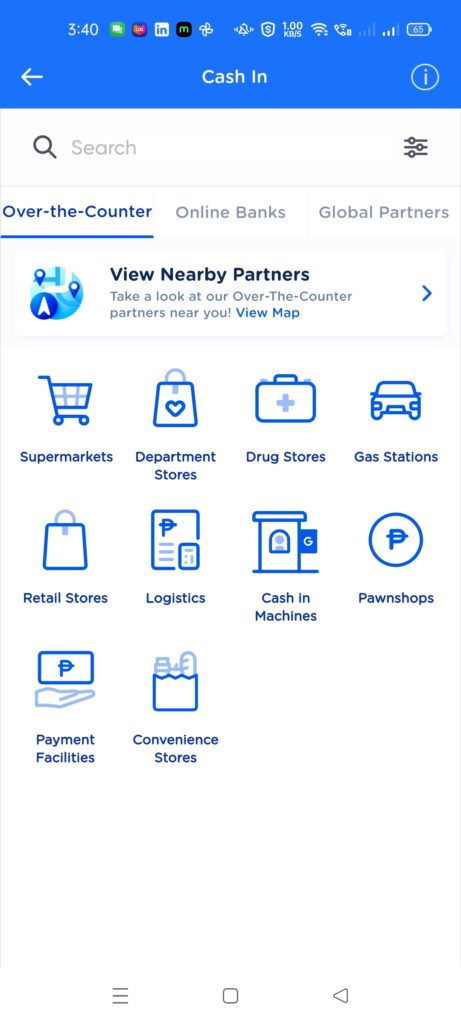

You can search for nearby cash-in points using the “View Nearby Partners” function in the GCash app. However, I usually find Partner Outlets most of the time, rather than cash-in machines.

During my search, I’ve since located some TouchPay and Pay&Go machines, but I’ve not found any Shell Select exclusive machines. I usually spot them in conspicuous areas in convenience stores or in malls.

TouchPay has the most number of machines, according to research. I’ve also only found TouchPay machines in the Shell Select stores I visited. For Pay&Go machines, I usually find them in Uncle John’s convenience stores and Robinson’s malls and supermarkets.

How to Use TouchPay to Cash-in in GCash

I found this in the lobby of Flair Towers in Mandaluyong. It seems really convenient to have this near where you live:

From the main menu, I clicked on the “e-Money” button:

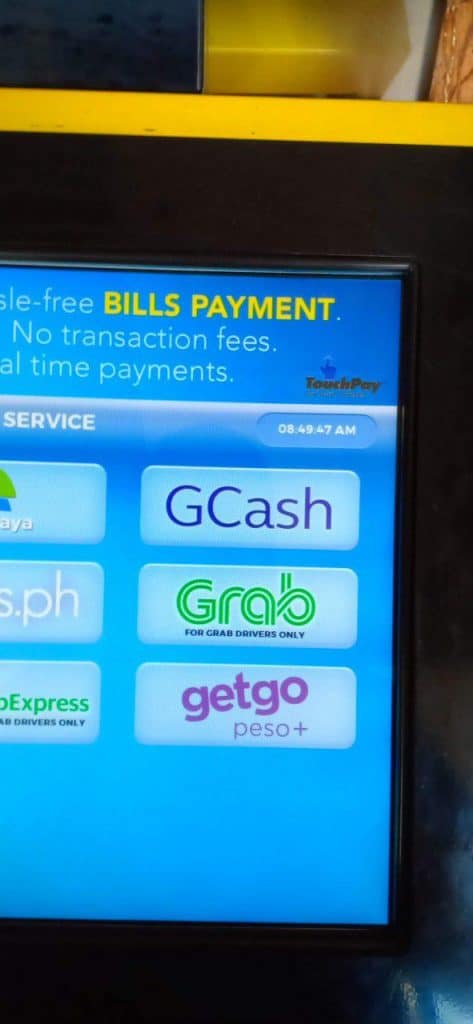

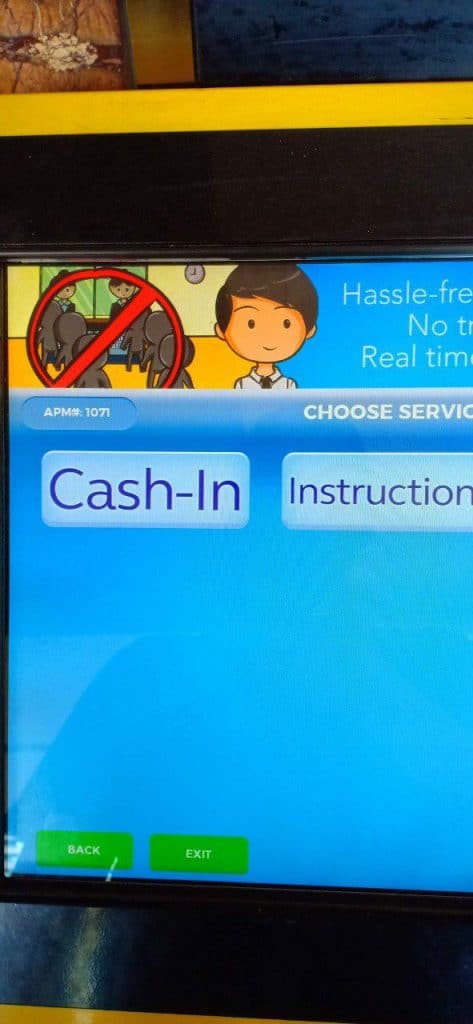

Next, I clicked on “GCash” and then “Cash-In”:

After selecting, we will see a disclaimer that there is no change for cashing in.

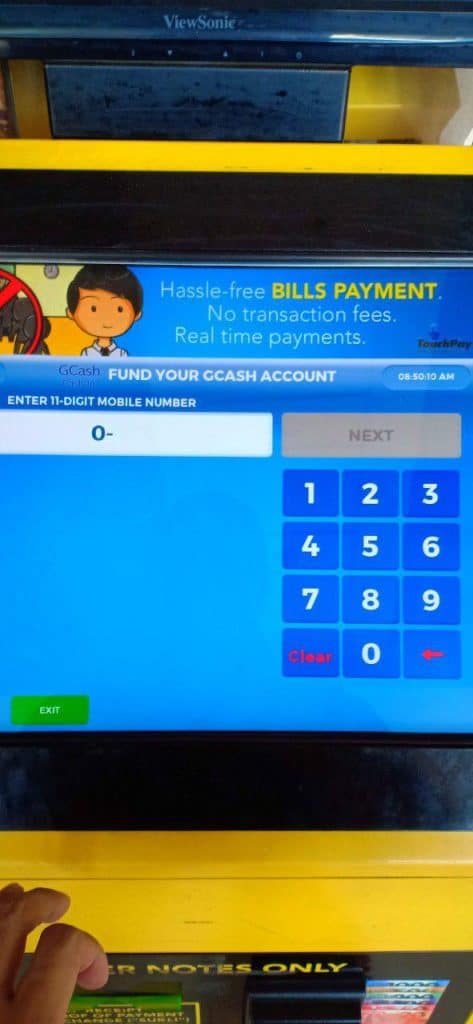

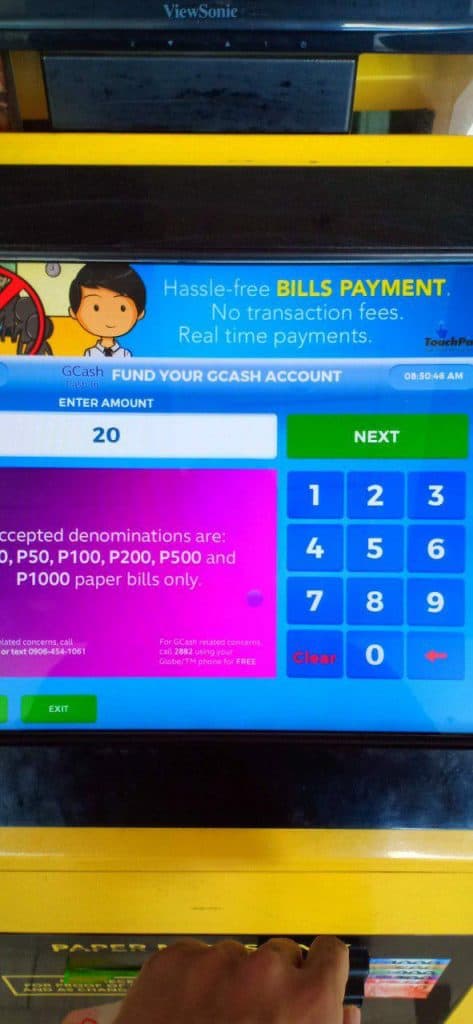

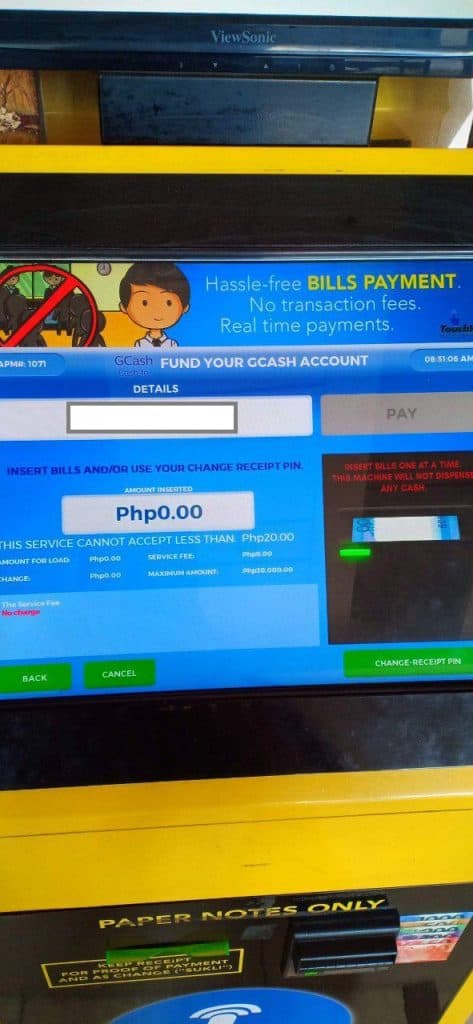

Next, we enter the GCash number and also the amount to be cashed in.

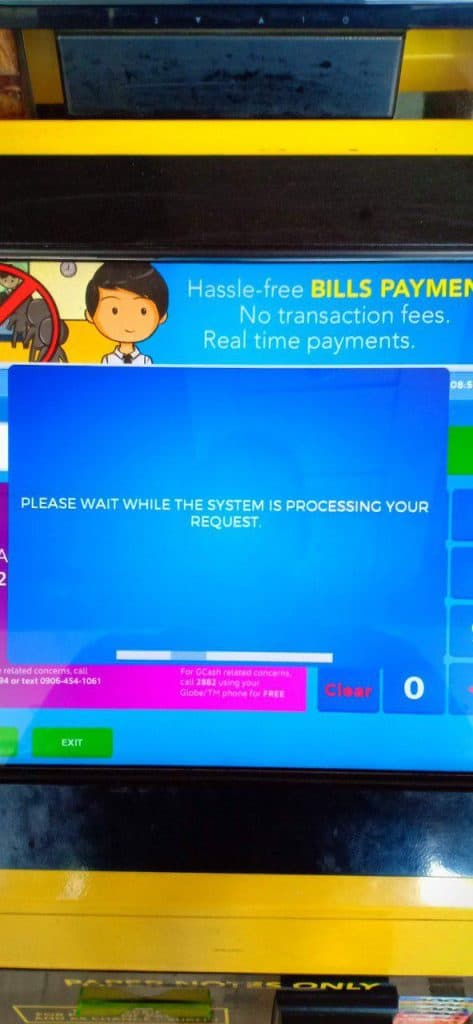

The processing page would display as well as the final confirmation page:

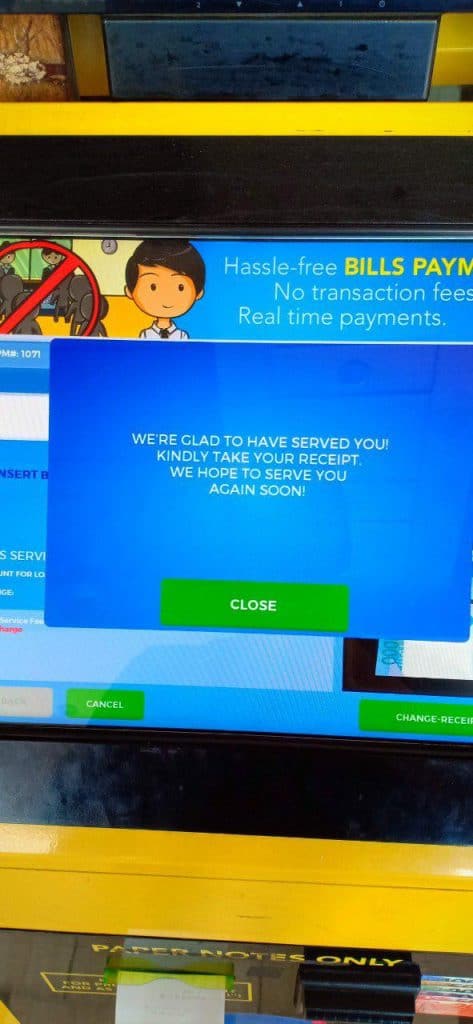

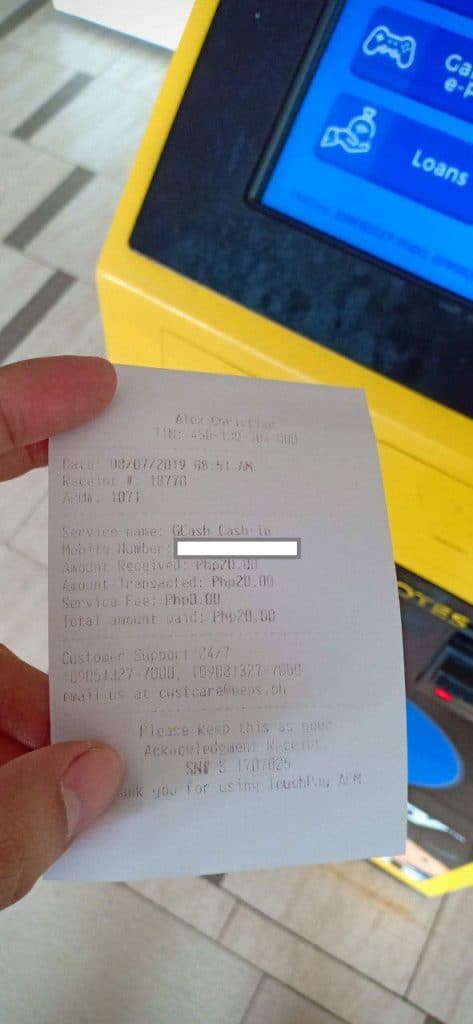

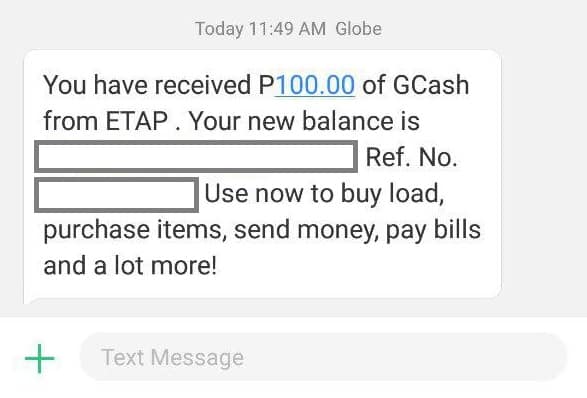

You will be able to see the cash-in success page. You will be receiving a paper receipt as well as an SMS confirmation:

Overall, using TouchPay was fairly intuitive and the step-by-step transitions were easy to understand.

How to Use Pay&Go Machines to Cash-in in GCash

I found this machine in an Uncle John’s convenience store near San Miguel Avenue, Ortigas, Pasig.

Pay&Go machines focus on cash-in services and the first screen makes you choose between GCash and Maya cash-in. Click on GCash Cash-in to proceed.

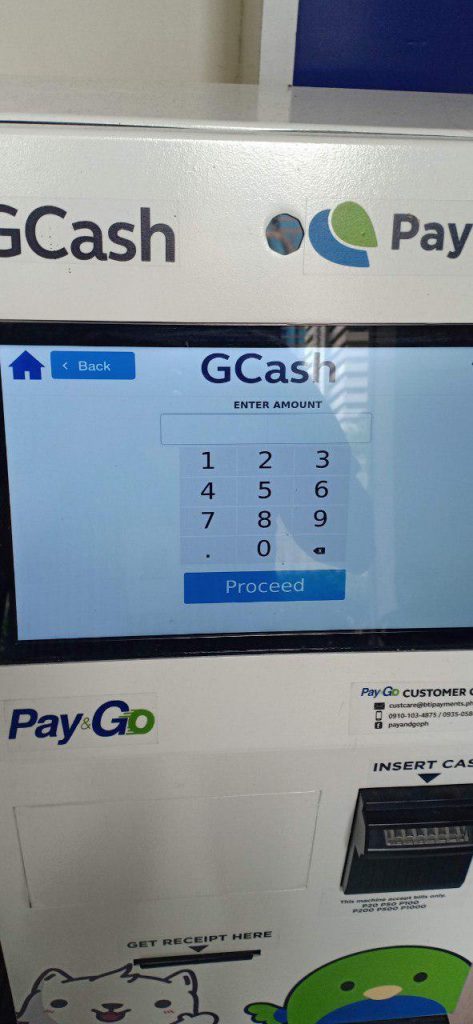

On the next screen, the machine asked for the cash-in recipient number and the amount for cash-in. Then the next screen asks where the SMS notification will go to.

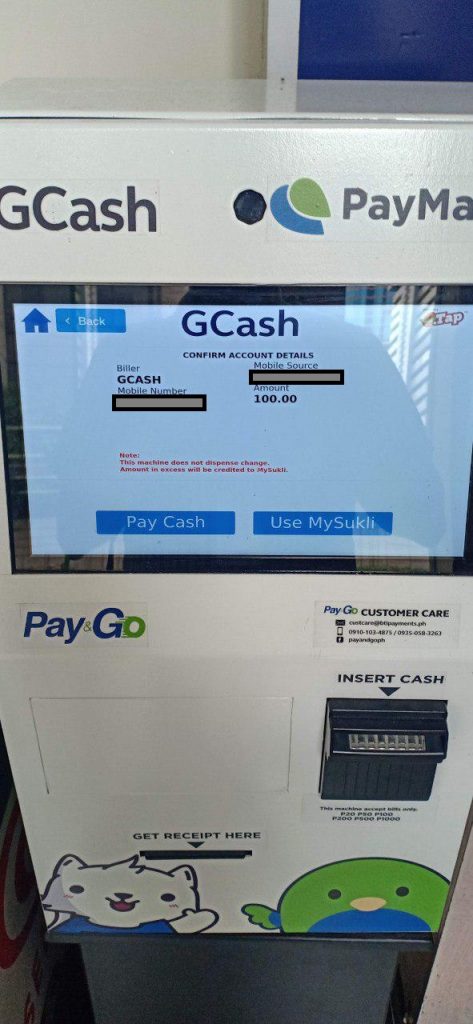

Once on the confirmation screen, check the details before clicking Pay Cash. Insert the bills into the machine.

After inserting the cash, you need to confirm the amount after by pressing “Done” on the second screen.

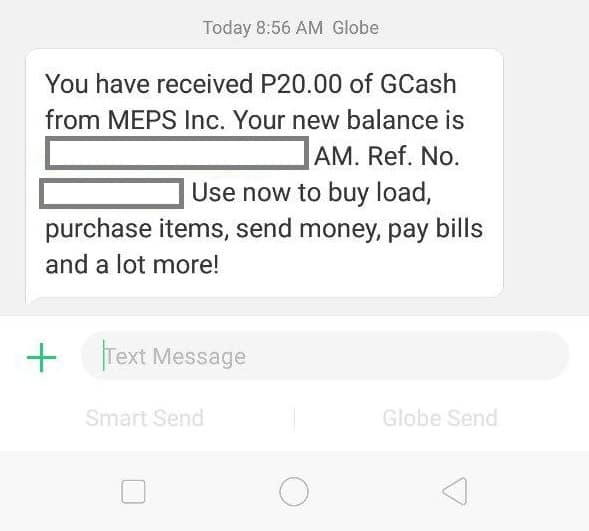

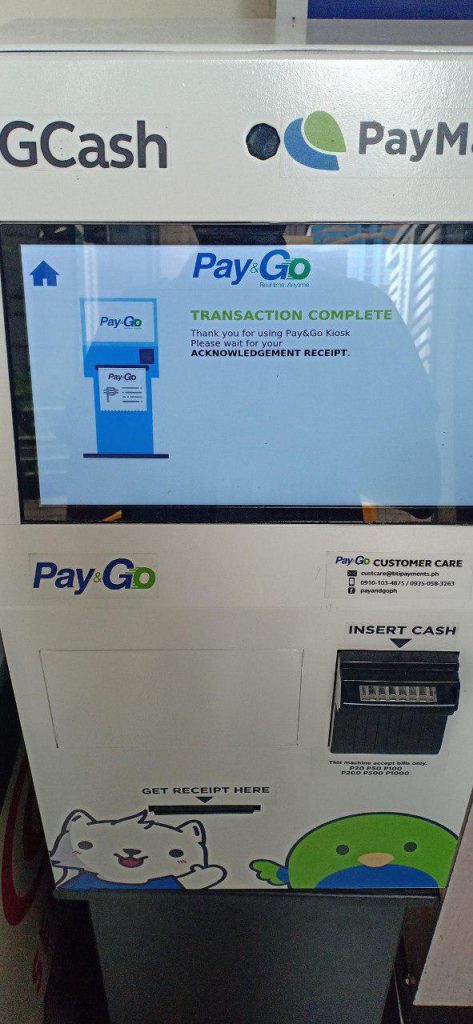

The confirmation page will show the transaction details. I wasn’t able to get a paper receipt, but I received an SMS regarding the successful cash-in.

Overall, using the Pay & Go machine was also intuitive and it was simple enough to operate as well.

Other Questions

Do GCash cash-ins have a fee?

Yes, machine cash-ins are considered over-the-counter cash-ins.

For 7-11 cash-ins, there is a 1% fee of the total cash-in amount. For example, if you cash in Php 1000, the fee will be Php 10, and the total amount of Php 990 will be credited or added to your balance. This fee always comes first as it is a 7-11 collected fee.

GCash cash-in for partner outlets is free for the first Php 8000 per month. When the amount goes over the Php 8000 limit, it will incur a 2% fee. This limit refreshes every first day of the month.

For example: Today, you cashed in Php 7000. There is no fee since it is still below the Php 8000 limit. The next day, you cashed in Php 2500. Since you went over the limit, there is a fee included with the cash-in but only for the amount over the limit. The cash-in that has the fee applied is the amount over 8000 this month: Php 8000 - Php 7000 = Php 1000 Then we subtract from the amount you are cashing in: Php 2500 - Php 1000 = Php 1500 The fee is 2% of the amount. Php 1500 * 0.02 = Php 30 So the total cash-in with the fee would be: Php 2500 - Php 30 = Php 2470 Any later cash-ins for this month will have a 2% fee after this.

If you are cashing in 7-11, and you’ve exceeded the Php 8000 limit, the 1% fee goes first (7-11 fee), then the 2% goes after (GCash fee).

For example, if you are cashing in Php 1000 in 7-11 after exceeding the Php 8000 limit, the cash-in fee for 7-11 applies first: Php 1000 - Php 10 (1% of Php 1000) = Php 990 Afterwards, the 2% fee from GCash applies: Php 990 - Php 19.80 (2% of Php 990) = Php 970.20 The net cash-in amount is Php 970.20.

Once you are near the limit, you will receive a notification in your Inbox informing you of the charges once you go past the limit.

Please take note that this is only for manual cash-ins — remittances and bank cash-ins are not included.

If you want to know how to circumvent this fee, you can refer to my fees page to see alternative solutions.

What to do if the cash-in in GCash failed?

It is better to contact the support number indicated on the cash-in slip as they generally answer more quickly than GCash Support.

Summary

I talked about a step-by-step guide on how to cash in using TouchPay and Pay&Go machines in GCash. I wasn’t able to locate a Shell Select machine because all of the Shell Select branches I went to had TouchPay as their machines. These machines have been increasing and they are stationed in high-visibility areas like convenience stores, supermarkets, and malls.

The GCash cash-in process was intuitive for both machines, and I think it would not take long for people to get used to the machines as they are used to ATMs.

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

How ta avail kiosk machine?

What do you mean? You want to transact to a kiosk, or do you want to be a kiosk provider?

what will happen when you cash in through touchpay then failed to put the listed amount, will it still go through or your money maybe lost in limbo

If you don’t put in any amount, the cash-in won’t go through, and you won’t get any receipt as well.

Hi, I tried to pay using a Touch Pay in Market! Market!, BGC. For some reson, the funds were not credited to my Gcash account. The machine was able to give me a receipt. Can you let me know how to proceed? Thank you

Call the support no in the ticket, rather than GCash.