I am a top 1% GCash user and will share what it looks like.

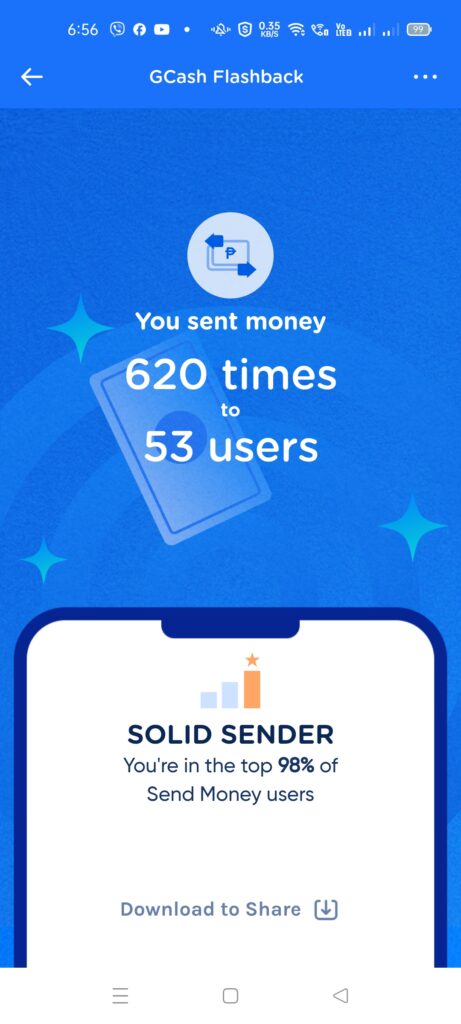

I know this because GCash also sends out your yearly stats at the end of the year, which is similar to what Spotify does. It’s called the GCash Flashback. It shows a summary of all the transactions you made the previous year.

What does a top one percenter GCash user look like?

I open and use my app every day. My daily transactions revolve around using GCash. Since I don’t have much cash, I usually pay as much as possible. I always have my GCash Visa card as a backup when stores suddenly don’t accept GCash payments.

I also don’t have access to credit cards due to what happened to me during the pandemic. I maxed out all my cards then and had to go into a payment schedule agreement with my card companies. I’m still paying monthly for them. My current source of credit is mainly GCredit, so I have an incentive to keep my GScore up.

I also have active loans using the app’s other loan products (GGives and GLoan). I also use other wealth management products like GInsure, GSave, and GFunds.

During paydays, all of my bills are paid through GCash. I fund my GCash account using bank cash-in.

I have GCash linked to my other apps, like Grab, Lalamove, Lazada, etc.

What is the GCash feature I always use?

It’s Send Money. I’m a breadwinner, and I use it to provide my wife’s allowance and pay for some of my family’s needs, like my son’s therapist or when I buy from the market. Many still use Send Money instead of applying for a business scan-to-pay.

I also give our helper her salary via GCash. She then sends it to her family in the province for their needs. Sari-sari stores that offer cash-in and cash-out services are makeshift remittance centers in the provinces.

Does being a GCash employee contribute to being a top 1% user?

Yes, because half my salary is sent via GCash. GCash employees eat their dog food. So if there’s an app downtime, it’s not only the outside users who get affected; we employees also get affected.

In the office cafeteria, we buy food using GCash only. Since the sellers don’t have cash, we are incentivized to make it work, or we won’t be able to buy food. This also applies to the Globe canteen in The Globe Tower.

I’ve also personally tried most of the features in the app. This is because we are encouraged to provide feedback for each of them.

Benefits of Using GCash

I find it beneficial to not always bring a lot of cash. Many vendors already have GCash accounts. The carwash, the drivers who ply using tricycles, our nearby bakery, and even our taho vendor all have GCash accounts.

Since I use many GCash features, my GScore is also high. This allows me to have a higher credit limit for all loan products in the app.

GCash has many wealth management features that make investing easier. You don’t need to install different apps when everything you need is there. I own stocks, crypto, insurance, savings accounts, and mutual funds.

Downsides of Using GCash

I’m reliant on my data connection, so I can’t log into the app when there’s a problem with the signal. This is also why I carry my GCash Visa card in my wallet. If the merchant has card acceptance, then I can at least pay using that.

Does this mean I don’t use other fintech apps?

No, using GCash means I’m also open to using other fintech apps. I have accounts with Maya, GoTyme, BPI, Union Bank, and others, and I’m not afraid to use them regularly.

Have I experienced being hacked?

No, because I’m naturally skeptical, I don’t fall into scams as quickly. I also follow best practices with security. I also work in the fintech industry, so I know first-hand how regulated it is. A lot of regulations revolve around account security and privacy.

Another benefit of working at GCash is that we regularly receive training on managing the security and privacy of all users. This training is required and naturally embedded in all our processes. GCash is also a big company that is under much scrutiny from regulators like BSP, NPC, PAGCOR, etc.

What are some issues you find with GCash?

I’ve used GCash for years and noticed it has steadily slowed down due to the bloat. You need to open the app in advance to pay merchants.

I would like to see a version of GCash that’s not bloated—a lite version. I want a faster app that I can use for simple transactions like Sending Money and making payments.

Another thing I noticed is the need to keep up with Google Play requirements. Currently, to upload an app to the Google Play Store, the target Android version should be 13 or higher. This makes it harder for people with lower versions to download and use the app.

GCash’s motto is “serving the underserved.” They can’t do that if they can’t reach people who don’t even have the means to upgrade their phones.

What are things you look forward to with GCash?

With their current trajectory, they’re in a position to push many positive changes in our country. The potential is there to make everything easier for all Filipinos. It isn’t even specific to finance anymore.

In five years, they can push many industries to digitalize. Digitalization brings about a lot of optimization and growth from the bottom up. Innovations will cover related technologies, and there is no limit.

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services: