CTPL Insurance stands for “Compulsory Third-Party Liability Insurance” and is used for protection in times of vehicular accidents. It covers bodily injury and death for third parties, meaning this doesn’t include the driver nor the passengers of the insured vehicle.

This type of insurance is mandated by the Land Transportation Office (LTO) for all vehicle registrations and registration renewals.

What is the difference between CTPL and Comprehensive Car Insurance?

The CTPL insurance only covers third-party liability, meaning injuries or death of non-passengers. Comprehensive insurance covers a lot more, depending on the coverage you want to include.

Usually, this includes personal bodily harm to the driver and passengers, loss and/or damage to your vehicle, and robbery.

You can also opt for add-ons to the policy like Acts of God (protection during times of calamities), repair, legal assistance (in cases when accidents bring you to court), and road assistance (free towing, and basic maintenance during breakdown)

As Comprehensive Insurance covers more scenarios, it is understandable that the premiums are also more expensive. The price range for comprehensive insurance covers range from Php 8000 to as high as Php 50000, depending on the model and the year the car was bought. Also, if the price is high enough, you can also negotiate payment terms.

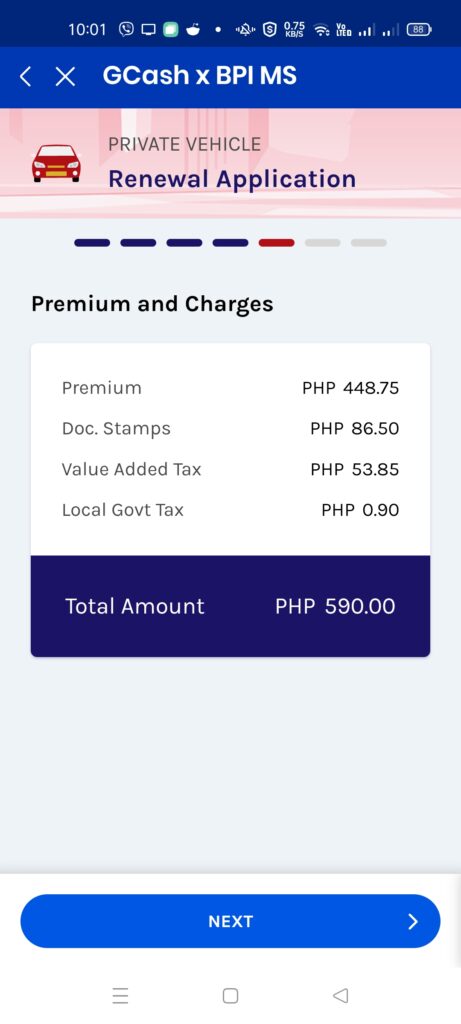

For CTPL insurance coverage, the price range costs less than Php 1000 typically.

How do I Renew my Car Registration in LTO?

You first need to collect the requirements beforehand, before going to the LTO branch closest to you:

- CTPL Insurance – you can get this from GInsure, as noted by this guide

- Personal TIN Number – no need to bring ID as long as you know your number

- Original Copy of Certificate of Emission Compliance – you should take your car to an emissions testing center to have it inspected

- Accomplished Motor Vehicle Inspection Report (MVIR) – this is also either taken from the emissions testing center or from the LTO office

- Photocopy of the Certificate of Registration

- Original Receipt used for renewal the previous year

- A Registered Account in the Land Transportation Management System Portal (LTMS) – this was required of me when I renewed my registration last year

LTO Registration Renewal Steps

- Acquire CTPL Insurance to get the Certificate of Cover.

- Have your car inspected at an LTO-accredited emissions testing center. They can help you complete the Certificate of Emission Compliance as well as the MVIR.

- Proceed to the nearest LTO satellite or branch office to submit the requirements and get a queue number. Take note that depending on the location of the office, this may take a couple of hours. For some satellite offices though, this may take less than an hour. Do your research beforehand.

- Once called, pay for the registration at the cashier. This may cost around Php 2000-4000 pesos depending on the vehicle. Take note of any penalties from late renewals as well.

- Once paid, you will receive the new Official Receipt. You may receive the new sticker, but depending on availability, you may receive only the receipt.

LTO Renewal Schedules

The deadline for renewing your registration typically depends on the last digit of your plate number. Starting with 1, which corresponds to January, it goes until 0 which corresponds to October. However, there are some advisories that extend the deadline for some plates.

There is also a week component to the deadline which is determined by the second to last digit in your plate number.

- 1,2,3 – 1st week

- 4,5,6 – 2nd week

- 7,8 – 3rd week

- 9,0 – 4th week

But generally, when the deadline is extended, this scheme is generally not followed anymore.

How to buy CTPL Insurance in GCash

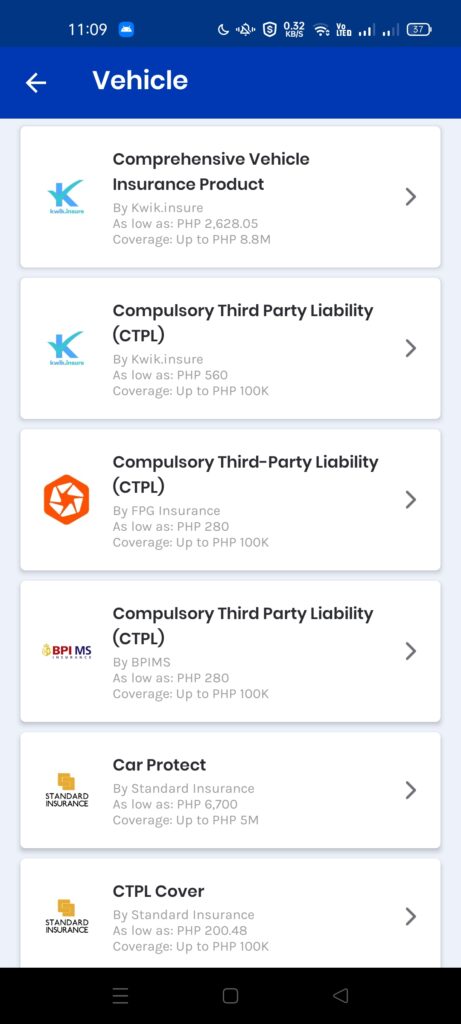

GInsure products have been growing steadily these past few months, and there are now car-related insurance products being sold on the platform. Under the vehicle category, here are some examples:

In my case, I chose BPI MS because my car has been covered by them for a few years now. You would need a copy of the Certificate of Registration to be able to input your vehicle information in the form. This is similar to the other CTPL insurance products in the category.

Buying a BPI MS CTPL Insurance via GInsure in GCash

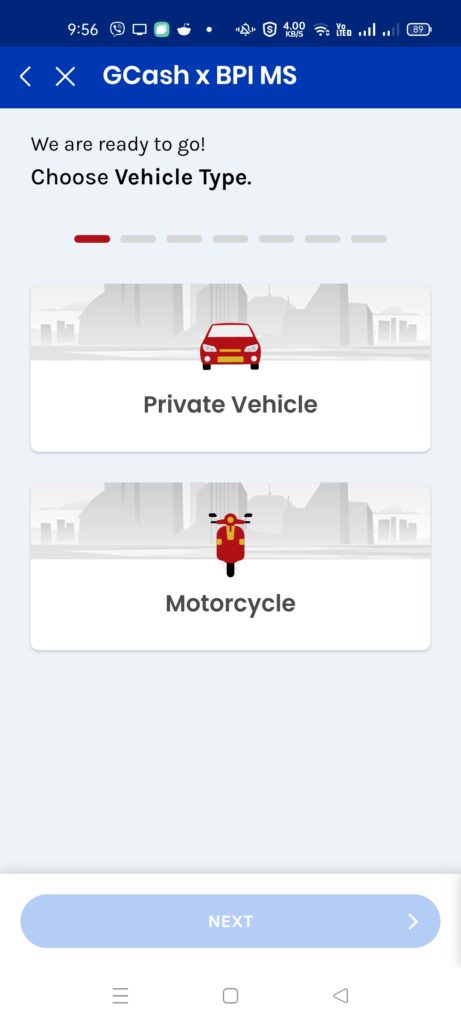

- Go to the GCash main page and click on GInsure. From the GInsure page, click on the Vehicles category.

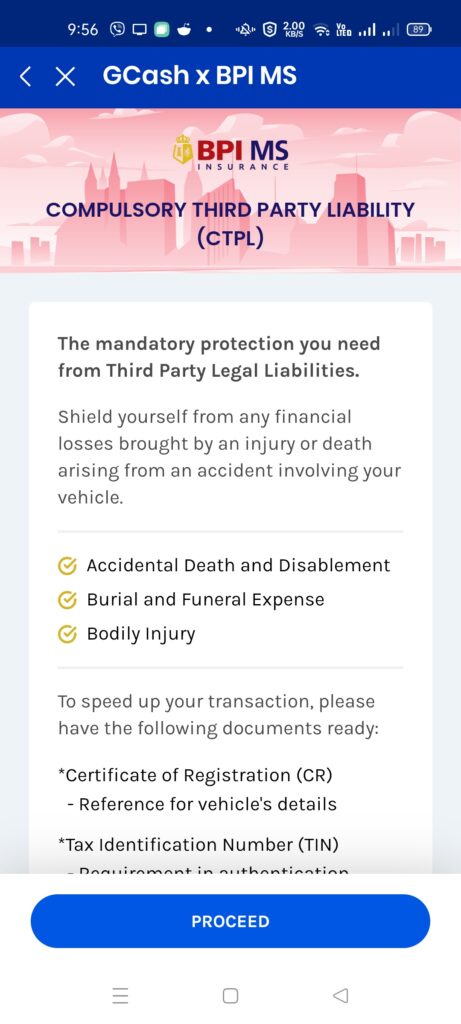

- Click on the Compulsory Third-Party Liability card of BPI MS.

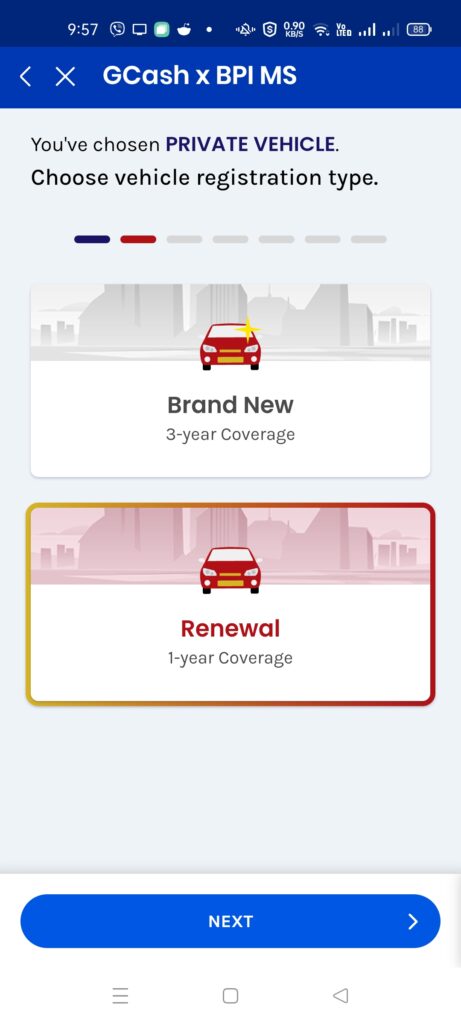

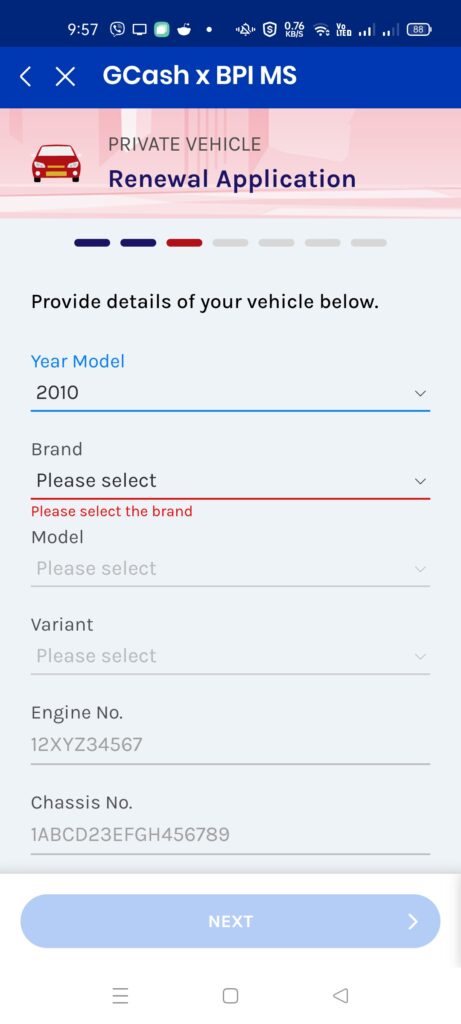

- Choose your Vehicle Type, Registration Type, and Vehicle Details (from the Certificate of Registration).

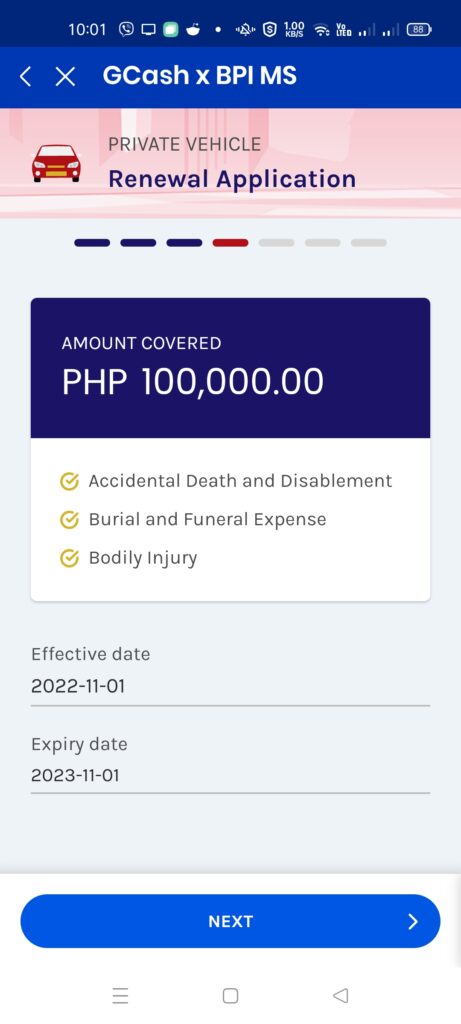

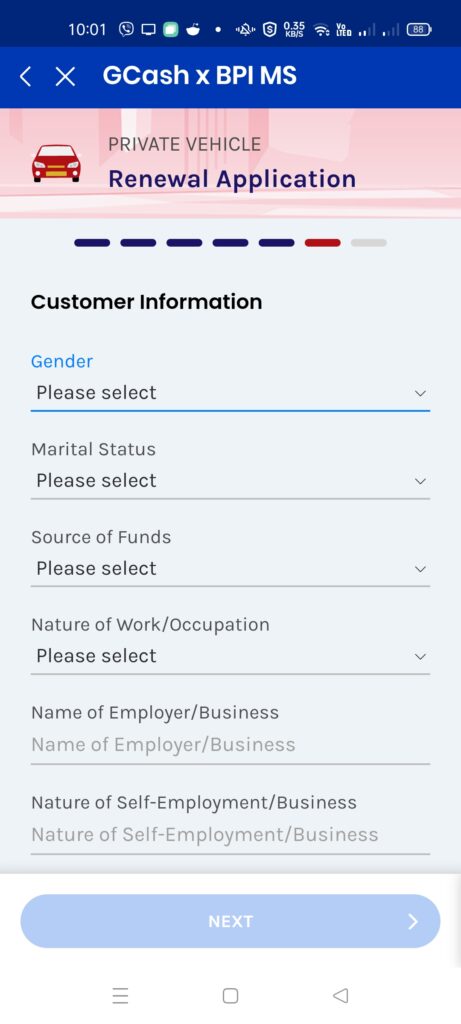

- Check the Coverage, Amount to Pay and Input your Personal Details.

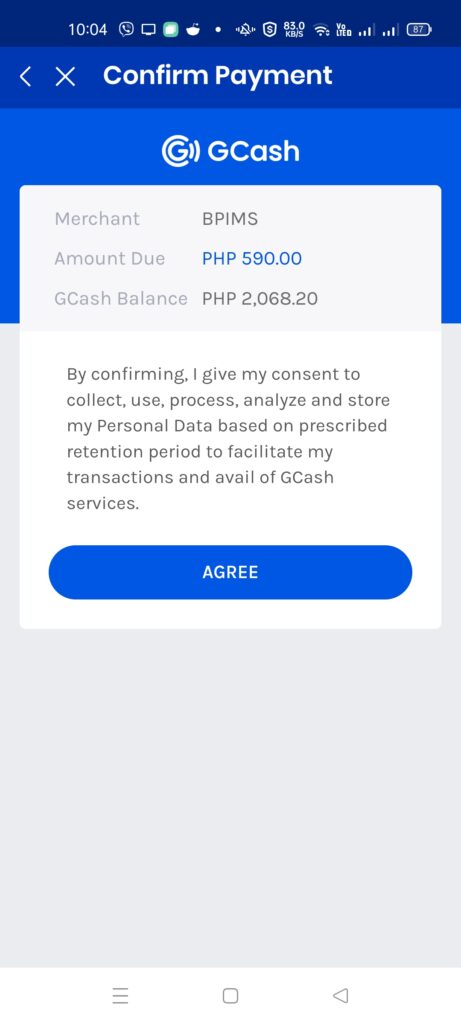

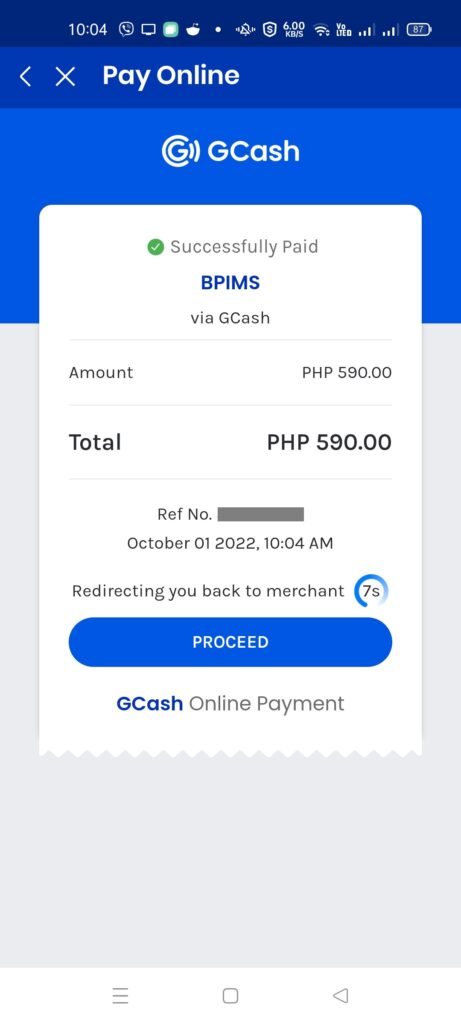

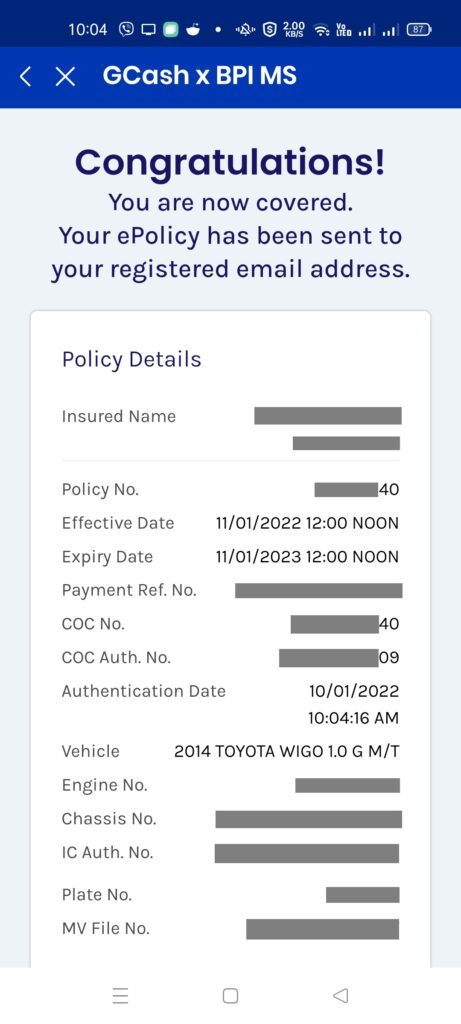

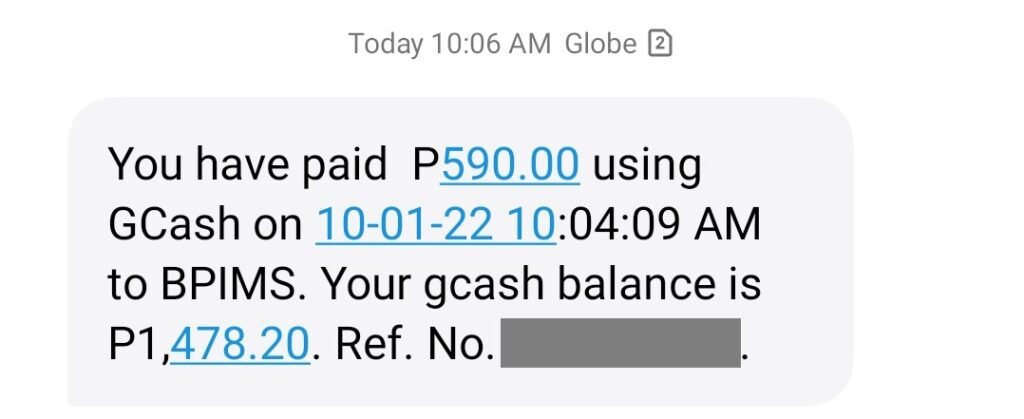

- Pay for the Insurance. You will be receiving a copy of the CTPL in your email. You will also be receiving an SMS about the purchase.

- Print the CTPL Certificate of Cover as this is a requirement for the renewal itself.

How to Renew your CTPL Insurance in GCash

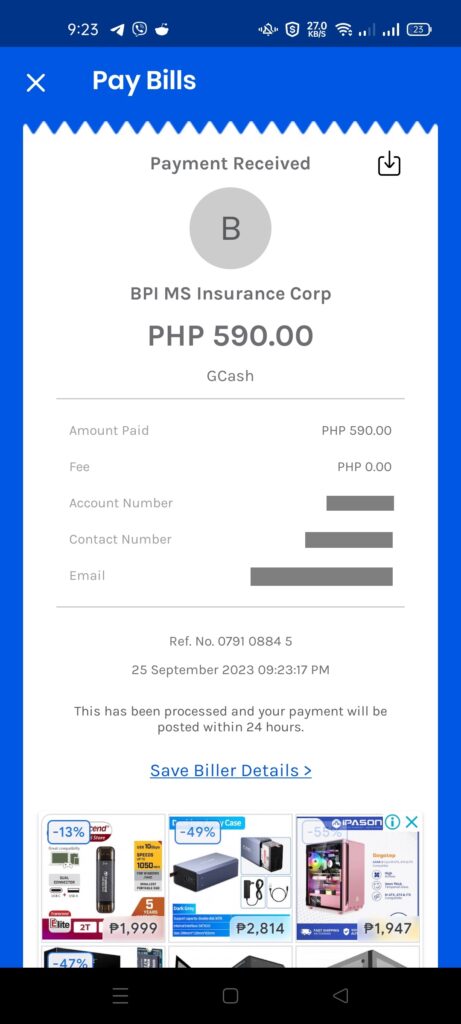

You can typically pay for insurance premiums from the Pay Bills section of GCash. In our example, since we are using BPI MS, there is the same biller in Pay Bills. You only need to input the policy number and amount.

Also, when you are up for renewal, typically the insurance representatives will contact you once the deadline is near.

Summary

The CTPL (Compulsory Third-Party Liability) Insurance is a requirement for renewing a vehicle’s registration. I’ve talked about the process of registration renewal as well as the how-to about getting a CTPL Insurance right from GInsure.

This makes it easier for vehicle owners as they only need to go through car inspection to be able to complete the requirements.

Related Topics

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

The system says something went wrong please submit a ticket please fix i really need may gcash for every day use thanyou so much

Please file a support ticket from within the GCash app