Cryptocurrency is such a hot topic lately. It seems like the Wild West from where we are sitting. From Tesla investing billions in BTC, De-Fi (Decentralized Finance) reaching billions of US dollars in locked-in value, and NFTs (nonfungible tokens) suddenly becoming a buzzword as millions of US dollars exchange hands buying digital art — it’s easy to get FOMO (fear of missing out), but as with everything worth investing in, we should put in the research before getting out feet wet.

I’ve already explained how Bitcoin (BTC) works, but there is an even wider world out there because of altcoins. This is beside the fact the BTC has been hitting all-time highs lately.

What are altcoins?

Altcoins are other cryptocurrencies that are basically not Bitcoin. The main difference is that the main use of Bitcoin is using blockchain technology to create a store of value (or money), other altcoins have different uses of blockchain aside from using it as a money ledger.

There are hundreds of altcoins out there, and it would be better to consider them as different companies. You don’t need to invest in all of them, it is much better to pick and choose which projects or altcoins are worth your time and money.

Ethereum, the main altcoin

Ethereum (ETH) today is the main altcoin and current #2 in market cap. ETH’s main use of blockchain technology is to create decentralized applications. Depending on the application, you can enforce smart contracts between parties using the blockchain.

This is also the reason why decentralized finance (De-Fi) using ETH is gaining so much ground right now. You can lend or borrow cryptocurrencies easily, and you can gain high investment gains just by using the platform and tokens, without even needing a traditional middleman.

Nonfungible tokens (NFTs) also are being sold using the ETH platform. NFTs are basically the opposite of currency. Currency is meant to be fungible — not unique to each other which makes it easy to divide units of it. Because of this, trade becomes easier. NFTs on the other hand, are unique per unit. This property makes it valuable because there is only one copy of it.

Examples of NFTs sold are digital art, recordings, music, and other creative works. It can also be attributed to land titles, collectibles, and other one-of-a-kind things. The very first Tweet has also turned into an NFT.

As the bulk of De-Fi and NFTs currently utilize the ETH blockchain, you need to pay transaction fees in enabling and implementing any smart contracts around these products. Due to high demand lately, this has led to incredibly high transaction fees.

As the usage of the blockchain increases, the fees also increase. I personally tried to transfer some ETH from my Coins.ph wallet to Binance (another centralized exchange) but the transaction fees needed was almost as much as I wanted to send.

But even for BTC, sometimes the fees can get high as transactions bog down the blockchain.

How can we lessen transaction fees?

One way we can lessen it is by buying it directly at the exchange or at the platform you are planning to use it. Another way is to schedule your transactions when demand is low. We can also look into other altcoins that provide similar functionality and invest in them.

What is Binance?

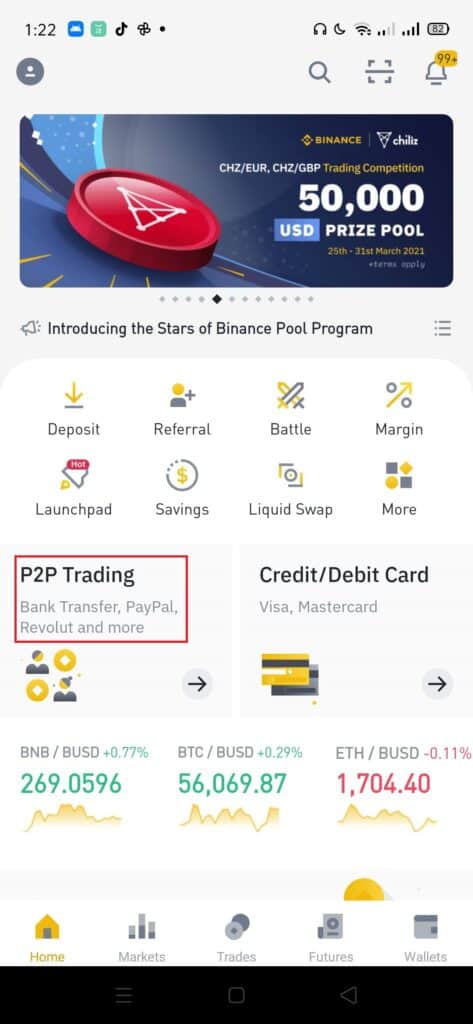

For this post, I will be buying directly from Binance. Binance is one of the most popular cryptocurrency exchanges. They are popular because they not only support lots of cryptocurrencies but also provides many ways for your cryptocurrencies to earn.

What can we do with Binance?

In Binance you can trade for your cryptocurrencies (basically selling one to buy another). You can also avail of investment opportunities such as Futures or Margins Trading.

They have their own smart contract blockchain (using the Binance Smart Chain) that handles staking, deposits, and De-Fi (liquid swapping, crypto loans), and others. This is underrated because it is cheaper than ETH and is all inside their platform. If we go through ETH, we would need to spend so much on gas fees just to set up the same.

It also has a learning portal for newcomers to cryptocurrencies in topics such as investing in blockchains and how to use the platform.

Anyway, if you are interested in signing up, I have a referral link. The good thing about taking this referral is that any trade you do on the platform, both of us will be getting a commission of 10% in the trade.

So for example, you buy 0.001 BTC, you and I will both get 0.0001 BTC extra. This also applies to selling.

How can we buy cryptocurrencies in Binance using GCash?

There are mainly two ways — one is via credit/debit card, the other is via P2P trading.

Via Credit/Debit Card

You can try with your GCash debit cards and also with your personal credit cards. However, when I tried personally with my GCash Mastercard, the transaction failed.

Nonetheless, the procedure is pretty simple. You just need to put in the amount you are planning to spend, select the cryptocurrency you are planning to buy, and input the card details. Once confirmed, your cryptocurrency is directly deposited to your spot wallet.

Via P2P Trading

P2P means peer-to-peer and it basically means you are buying a specific cryptocurrency from a seller with Binance as the middleman in charge of escrow. You can pay the seller with whatever payment method he accepts. Most of the time this means a bank deposit, or it can be e-wallets like GCash, Paymaya, and Coins.ph.

Here is the procedure:

- From the main page of the Binance app, click on P2P Trading.

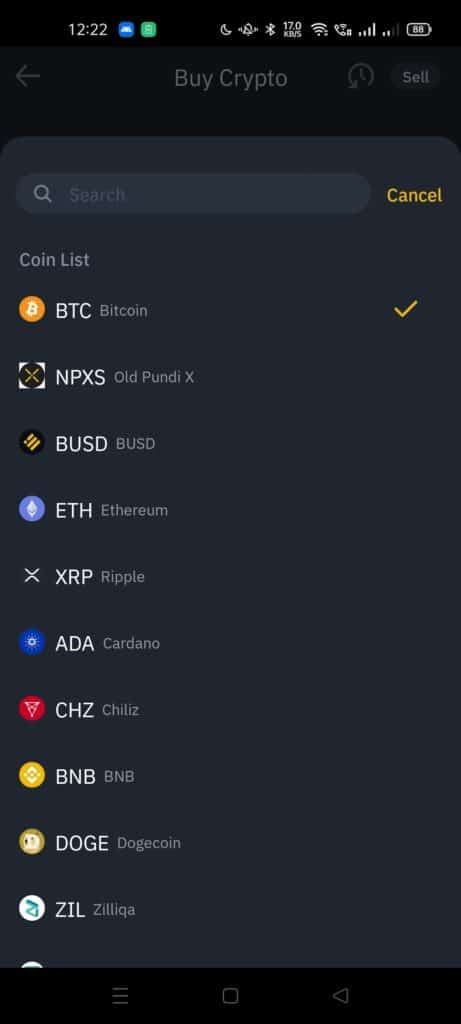

- From the P2P page, change your fiat currency setting to PHP and select the cryptocurrency you are planning to buy. Select the seller you plan to buy from, taking into account that the GCash payment method should be supported.

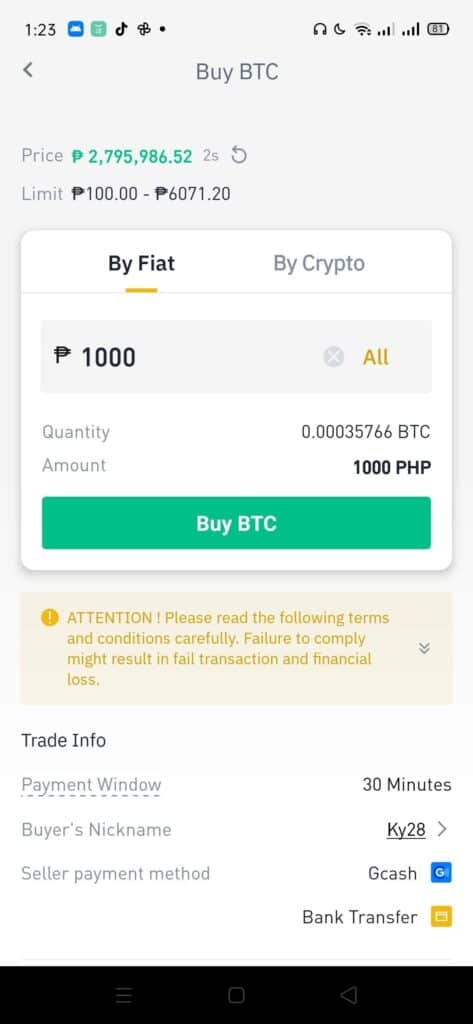

- From the buy cryptocurrency page, input the amount you are planning to buy and click on “Buy”.

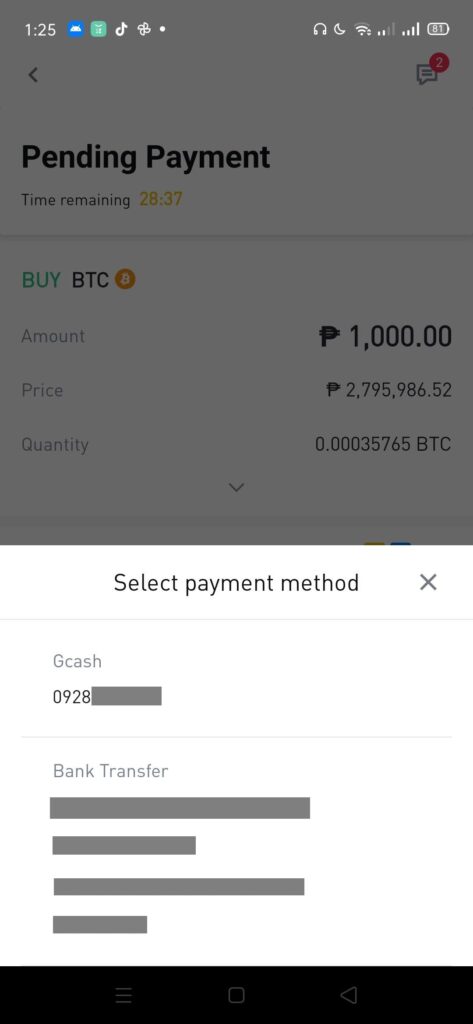

- From the Pending Payment page, select GCash as your payment method. Take note that you can chat with the seller using the chat option on the top right-hand corner.

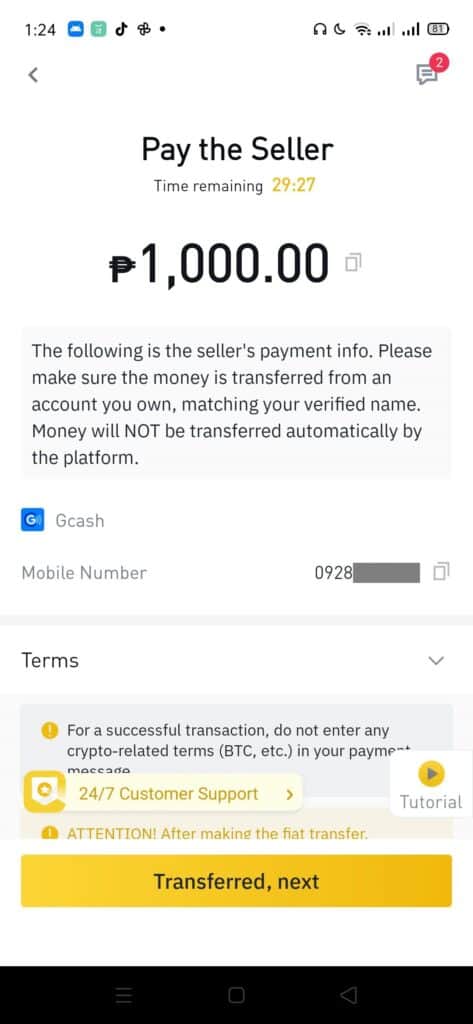

- You need to pay the seller by sending money from your GCash to the number specified in the payment details. Once done, click on “Transferred, next”.

- On the next page, it’s the seller’s turn to check whether you’ve transferred the money in order to release the cryptocurrency. You can still chat with the seller using the chat option on the top right-hand corner.

- Once your cryptocurrency has been released, it will go to your spot wallet. You can now use your cryptocurrency to exchange or to invest in the Binance platform.

Click on P2P Trading

Select your cryptocurrency to buy, and the seller; take note of the GCash payment method

Select amount to buy

Select GCash as the payment option

You will be prompted to pay the seller

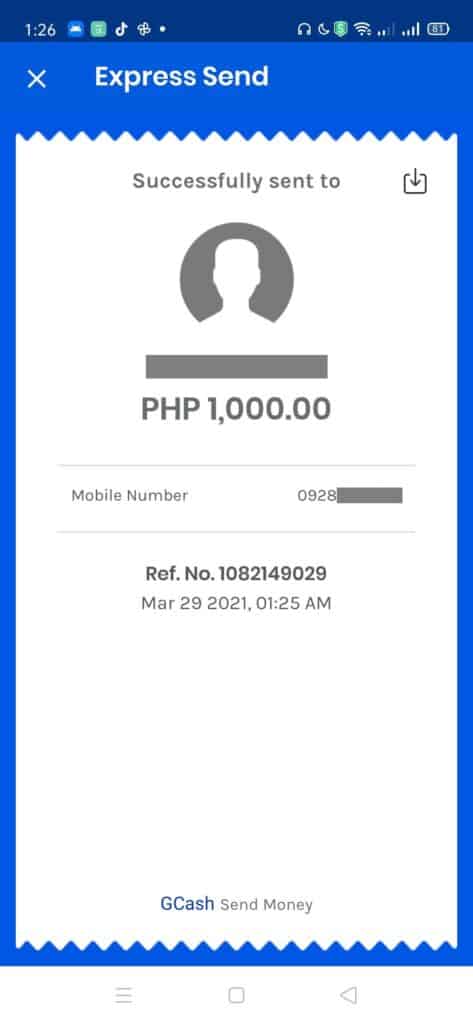

Go to your GCash and send money to the indicated number

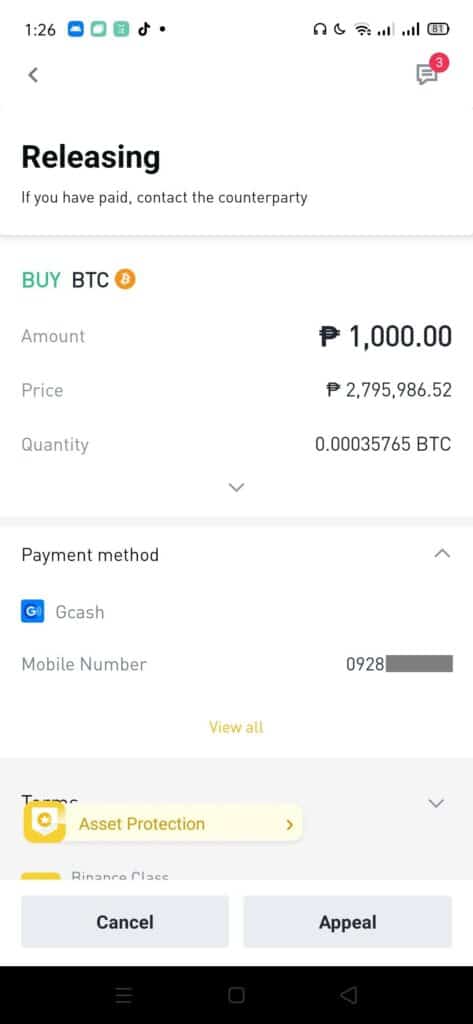

Once done, acknowledge the payment and wait for releasing

Once release is done, order is completed, you should have received your cryptocurrency

Is P2P Trading safe?

Yes, because of the existence of Binance as escrow agent — meaning that it does not release the cryptocurrency to the seller unless proof of payment has been acknowledged by both sides. Also, you can see how many trades was successful on the seller’s side as a sort of vetting.

Other Questions

Do we need to be verified in Binance to be able to buy cryptocurrency?

Yes, however, the KYC (know-your-customer) process is pretty quick — you just need a valid ID. Personally, I used my driver’s license.

However, you can only verify one account. If you create alternate accounts, it would be able to flag you as a duplicate user.

How do we turn our cryptocurrency back into money in GCash?

You would need to send the cryptocurrency into an exchange that supports conversion to Philippine peso. Some popular exchanges are Coins.ph and PDAX.

If the cryptocurrency is not supported by the exchange, you would need to convert your cryptocurrency first into one that is supported. An example could be converting to the common ones like BTC, ETH, or XRP in Binance then sending the cryptocurrency to a local exchange like Coins.ph or PDAX.

Once the cryptocurrency is successfully sent, you can then convert to peso, then send to GCash via Instapay transfer.

Some things to note are that there are fees for transferring cryptocurrency and that sending to Instapay isn’t free, so you need to plan your withdrawal.

Summary

I talked about how to convert your GCash balance to any cryptocurrency in the Binance platform. You can either buy it using the credit/debit card route or use the Binance peer-to-peer escrow feature.

For other investment related GCash posts, you can check out:

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

Can i buy coins in Celsius using my gcash account..ty

I tried, but the only way is to buy from Binance, then transfer specific coins to Celsius