Learn how to buy stocks in COLFinancial using GCash, and learn about basic stock investing while doing so.

Stock Trading and Mutual Funds are some of the investments the typical Filipino has no deep knowledge of. Usually when we talk about assets, typically what people think about are the tangible ones like jewelry, cash, and real estate. But often overlooked are some of the intangible ones like stocks, bonds, securities, or patents.

Stock investing does seem complicated to the typical Filipino, but this shouldn’t be. We should help provide people the knowledge on how to be able to earn more. With tools now online, it is easier than ever to start investing.

Basics of Stock Trading / Investing

Since this is a guide on how to invest in COLFinancial using GCash, then as a first step, let’s do some introductions first.

What are stocks?

Stocks are units or shares of ownership in a company. If you buy shares of stock, then you become a part-owner of the company. You can buy these shares at a stock market, in the case of the Philippines, it is locally managed by the PSE (Philippine Stock Exchange), and through multiple accredited brokers (like CitisecOnline or AB Capital).

For GStocks Global, they have partnered with Easy Equities to be able to buy and sell US stocks.

Why would I need to invest in stocks?

Investing in stocks can be a way of making money without spending a lot of time or effort to start. Some investments require you to spend either time or money to start and maintain it. For stocks, generally, you only need to put money and you will be able to reap the benefits later on.

Generally, investing in the stock market has bigger gains than traditional investments like time deposits or government bonds and securities. However, bigger gains also mean bigger risks so when investing here you should consider not touching the investment for a long time. Generally, if you look at the stock price of a company for a long enough period (usually in terms of decades), it gives a better return on your investment.

Stocks have non-fixed prices, depending on what is happening in the company (or in the market as a whole). It is in these differences in price that traders look to invest in. When you buy low and sell high, then you can make a profit.

How do you make money in stocks?

There are generally two ways — when your stock value appreciates, or when you earn dividends from your stocks. Dividends are a type of revenue some companies share with their shareholders. These dividends are from profits the company gained while doing business.

When is the best time to invest in stocks?

Generally, the best time to buy is during a recession. The best time to sell is when the market is bullish. But because we as beginners don’t know what the best time is, one recommendation is to invest some money at a set time period, via cost averaging — meaning buying stocks at regular periods at a set price.

This also applies when selling your shares as well. You can also do that by reverse cost averaging. This works for people who need some money at regular intervals.

Is it hard to invest in the stock market?

It is hard because there is a lot of information to take into account. However, as with many things, if you put in the work to learn, you can lessen your mistakes.

The act of investing is simple enough that doing so can be done anywhere with an Internet connection. COLFinancial is one such platform to invest in. Another is GStocks PH. Other alternatives can be FAMI (First Metro) and Phil Stocks. GStocks Global is currently hosting a game where you can win prizes.

If you need pointers on how to invest, you can first take a look at the SmartPinoyInvestor beginner’s guide. There are also a lot of books related to this subject. You can look into The Intelligent Investor by Benjamin Graham, who was Warren Buffett’s mentor. This book is more than 70 years old, and the principles described here still hold true today.

What are some good stocks to buy?

An easy pick is a stock that serves a public need and would stick around for a long time. Part of being an investor is doing your research to find the best stocks that fit your investment appetite.

An example is if you want consistent dividends, then perhaps you can invest in REIT (real estate investment trust) stocks as these are focused on providing dividends taken from the rental income of big property owners.

Where can I look up stocks available in the market?

You can look it up from inside the platform you are using (like COLFinancial or in GStocks PH) but you can also use the PSE Lookup Tool to find companies you may be interested in investing in.

For GStocks Global, there is a built-in tool to check out the different US stocks you can purchase.

What are some considerations when buying or selling stocks in the stock market?

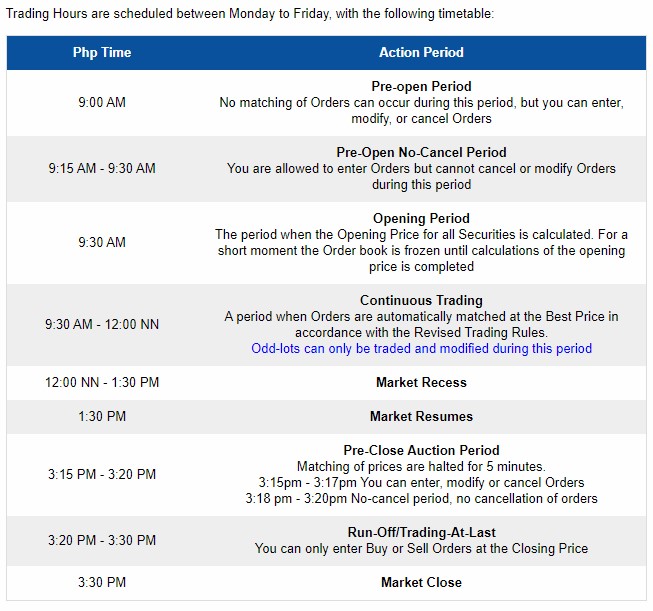

Buying and selling stocks take time to process, as the local stock market is only open on weekdays from 9:30-12:00 PM and from 1:00-2:30 PM. Aside from that, topping up your account wallet also is not instant as you need to wait 1 banking day for it to be processed.

For GStocks Global, this follows the US Stock Market trading hours, which are 9:30 PM – 4:00 AM Philippine time.

Another consideration is that when buying stocks, you cannot buy just 1 unit of stock. There are lots (or groups) of stock and these are the minimum units you can buy. Some stocks you can buy by lots of 10, others 100, and there are other lot sizes available.

In contrast, for the US stock market, you are able to buy single shares.

Creating your COLFinancial Account

As this guide is about COLFinancial and GCash, I’ve compiled some how-tos below:

How do I create an account with COLFinancial?

There are three types of accounts with COL:

- COL Starter – minimum investment is Php 1,000

- COL Plus – minimum investment is Php 25,000

- COL Premium – minimum investment is Php 1,000,000

As a beginner, I would recommend a COL Plus account. I find that the minimum investment for a COL Starter is not enough to buy shares even for a single company most of the time. Typically, when you purchase stocks, it is divided by lots. Each lot can have different sizes, for example, 5, 10, 100, or 1000 depending on the share price.

For example, PLDT (stock abbreviation TEL) has a price of around Php 1,200 per share currently but is being sold with a lot size of 5. So that means buying this stock can reach Php 6,000 in just a single transaction.

However, if you are not comfortable with the amount, then COL Starter is fine. You can find other cheaper stocks to test the waters.

What are the requirements to open an account?

Here are the requirements for creating one:

- TIN

- One valid government-issued ID

- SSS/GSIS/CRN (UMID) Numbers

- Bank Account Details (for Withdrawals)

- Selfie with your ID

- Specimen Signatures with your ID

After collecting your requirements, you can sign up in this portal. You will also need to sign some documents.

I don’t have a TIN (Tax Identification Number). How do I get one?

Unfortunately, the online portal for getting one is not working. So you would need to process it at a BIR RDO (Revenue District Office) near you.

The requirements listed depend on what type of taxpayer you are. If you are unemployed, you can apply with Form 1904. If you are self-employed, apply with Form 1901. You would also need PHP 500 as a processing fee.

How do I fund my account?

After creating an account, the next step is to fund it. There are several ways of funding your account, but most of them involve paying bills via your preferred channel (like banks or over-the-counter options). Since we have GCash, we can use pay bills to fund your account.

There is a Php 20 transaction fee, and you need to wait for your payment to be successful. Once your payment is accepted, you will be receiving your login details at your registered email address.

Buying Stocks Using Your COLFinancial Account

How do I use my account as a beginner?

You will need to research first what stocks you plan to buy. You can use this tool to check out the stock codes for companies in the stock market. Find out your risk appetite, and seek out the fundamentals of companies you admire.

Once you’re ready, you need to log in to your account and you will be able to see this screen.

The main tabs of note are Quotes, Trade and Research.

Under Quotes, you can check out specific stock info and put it into your watch list. If you want to buy or sell stocks or look at your portfolio, click on Trade. As for Research, you can find out some tips and research outputs from COLFinancial analysts regarding company-specific information or general market trends.

Explore and tinker around as you get used to the interface.

How do I buy or sell shares of a stock?

You’ve done your research. Now, how do you buy shares? Here are the Steps:

First, you need to do your buying during trading hours. Basically, you can only trade at certain hours every weekday. Here is the schedule:

Next, check your portfolio under Trade > Portfolio to check if your funds came in.

Third, you need to get the price of the stock you are planning to buy, click on the Quotes tab, and enter the stock code of the shares you are planning to buy.

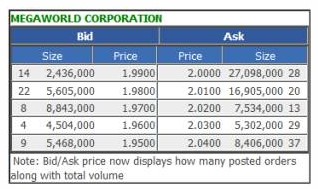

Here is what a quote looks like. Bid means these are the buyers and Ask are the sellers.

For this example, the first row under Bid means that there are 14 buyers buying at 1.99. The first row under Ask has 28 sellers selling at 2.00. Buyers would always want lower prices, and sellers would always want higher prices.

Fourth, you can put in your buying price near or at the cheapest ask price. You can do this by going to the Trade tab, and clicking “Enter Order”. Input your Order details and enter your password. Your order will then be posted.

Once your order is fulfilled, you will be seeing your shares under Trade > Portfolio. If you want to sell your shares, the process is similar, you just need to post a sell order instead.

Other Questions

Can I buy or sell mutual funds in COLFinancial?

You can click on the “Mutual Funds” tab to check out their selection. You can also buy or sell anytime, without any exit or entry fees.

Can I top up the funds in my account?

Yes, you can use GCash or other payment or billing channels to top up your account anytime.

How do I withdraw my funds?

Under the Trade > Portfolio, you can click on the “Withdrawal Request” link. You will then need to input the amount you are going to withdraw and whether you prefer it to be deposited to the bank account you enrolled. Take note that this isn’t instant and would likely take a few days to be processed.

What’s a surefire way of earning via stock investing?

You should have the discipline to stick to a strategy for both putting in and pulling out funds. An example of a strategy of putting in funds is via peso averaging, where you put in a set amount of funds regularly. An example of an exit strategy is selling at a ceiling price and selling also by peso averaging.

Once you remove the emotional element in investing, that’s when you become a better investor.

Summary

We talked about some stock trading basics, then moved into how to create a COLFinancial account, fund it using GCash and buy your first stocks.

Please take note that stocks are generally volatile investments and it is recommended you do a good deal of research before investing. Also, it is better to buy and hold stocks for a long time if you are not a day trader.

If you are the enterprising type, here are some links that you might be interested in:

- Buy Local Stocks via GStocks PH

- Bitcoin and GCash

- Paying for Facebook Ads using GCash

- Linking Paypal to GCash

After reading about what GCash is, here are the main GCash features:

Fund Transfers:

Cashing In/Out:

Payments:

New Services:

Thanks learn a lot from this

Planning to invest

ano po ba recommend niyo kapag hindi naman daytime trader?

puwede pa rin naman sa COL kahit di daytime trader or you can also check with alternatives like PhilStocks, First Metro, AAA